Market Overview:

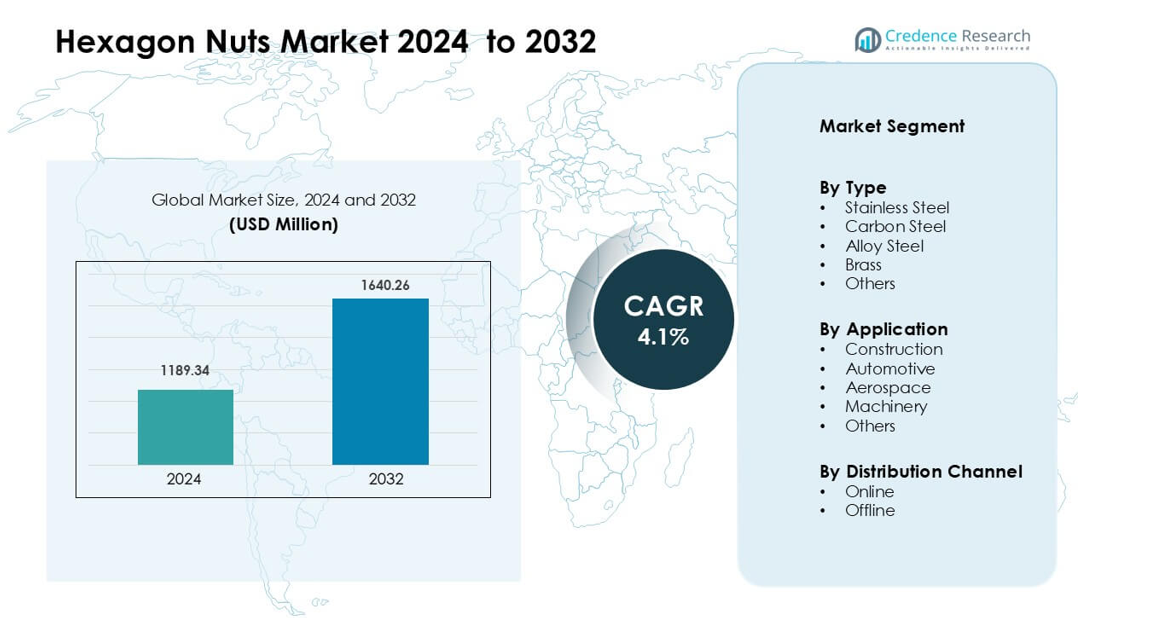

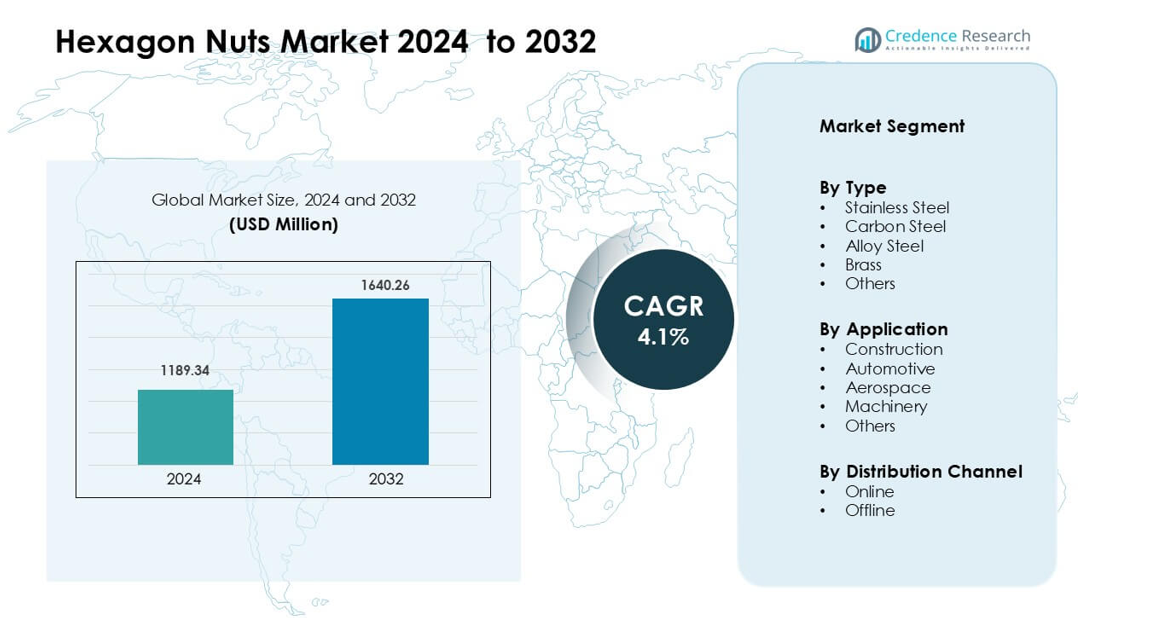

Hexagon Nuts Market was valued at USD 1189.34 million in 2024 and is anticipated to reach USD 1640.26 million by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hexagon Nuts Market Size 2024 |

USD 1189.34 million |

| Hexagon Nuts Market, CAGR |

4.1% |

| Hexagon Nuts Market Size 2032 |

USD 1640.26 million |

The Hexagon Nuts Market is shaped by major players including Bossard Group, Penn Engineering, Nucor Corporation, LISI Group, Würth Group, Fastenal Company, Arconic Inc., Illinois Tool Works Inc., Stanley Black & Decker Inc., and Bulten AB. These companies compete through advanced manufacturing, broad material options, and strong global distribution networks. They focus on high-strength carbon steel, stainless steel, and alloy steel nuts that meet strict industrial standards across construction, automotive, aerospace, and machinery applications. Asia Pacific leads the market with about 34% share, driven by large-scale manufacturing, rapid infrastructure expansion, and strong regional supply capabilities.

Market Insights

- Hexagon Nuts Market was valued at USD 1189.34 million in 2024 and is anticipated to reach USD 1640.26 million by 2032, growing at a CAGR of 4.1% during the forecast period.

- Construction remains the top application with 46% share because builders rely on high-strength fastening for heavy loads and structural safety.

- Stainless steel leads the type segment with 41% share as buyers prefer corrosion resistance and long service life.

- Top players such as Bossard Group and Penn Engineering compete through durable materials, wide portfolios, and global distribution, while smaller firms face margin pressure due to high product standardization.

- Asia Pacific holds the largest regional share at 34%, driven by strong manufacturing, rapid urban growth, and high-volume construction demand, while North America and Europe maintain stable consumption through automotive, machinery, and industrial upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Stainless steel hexagon nuts lead this segment with about 41% share in 2024. Buyers prefer stainless steel due to strong corrosion resistance, long service life, and stable performance in outdoor and high-moisture settings. Construction firms and industrial plants use stainless grades to reduce maintenance and prevent joint failure. Carbon steel records steady demand because manufacturers value its strength and lower cost for general hardware needs. Alloy steel grows in heavy-duty uses, while brass and other metals serve electrical, plumbing, and decorative applications where conductivity or appearance matters.

- For instance, Arnold Umform technik is a leading supplier of innovative fastening technology, focusing on complex, cold-formed parts and intelligent fasteners.

By Application

Construction dominates this segment with nearly 46% share in 2024. Contractors rely on hexagon nuts for structural fastening, concrete anchors, and steel framework joints that require high load-bearing strength. Growth in residential and commercial projects boosts consumption across developing regions. Automotive producers adopt hex nuts for engine mounts, chassis parts, and suspension systems due to precision fit and vibration resistance. Aerospace, machinery, and other sectors maintain stable demand as equipment makers seek reliable fastening for rotating parts and safety-critical assemblies.

- For instance, Sterling Tools Ltd (STL), India’s second-largest automotive fastener manufacturer, has a production capacity of 48,000 tonnes per annum, and a major share of its fasteners (including hex nuts) are sold into OEMs across passenger and commercial vehicles.

By Distribution Channel

Offline channels hold the largest share with around 67% in 2024. Industrial buyers prefer physical distributors because they offer bulk supply, verified quality checks, and immediate availability for urgent maintenance needs. Hardware retailers and authorized dealers support sales through technical guidance and assured standards compliance. Online channels expand quickly as buyers shift to digital procurement for faster comparison, wider SKU access, and easier contract purchasing. E-commerce platforms gain traction among small workshops and distributors seeking streamlined ordering and lower sourcing time.

Key Growth Drivers

Rising Construction and Infrastructure Expansion

Global construction investment continues to surge as countries upgrade bridges, rail systems, buildings, and industrial zones. This expansion raises the need for durable fastening solutions that support heavy loads and long-term stability. Hexagon nuts benefit from this trend because builders prefer predictable torque strength, corrosion resistance, and compatibility with standard bolts. Government-backed smart city plans and housing programs increase procurement across residential and commercial projects. Large contractors also standardize stainless steel and carbon steel nuts to maintain uniform safety levels across high-rise structures. Infrastructure upgrades in Asia and the Middle East strengthen demand, while renovation activities in Europe sustain ongoing consumption. The broad use of hex nuts in beams, columns, anchors, and formwork systems keeps this market on a steady growth path.

- For instance, SFS Group AG reported CHF 3,039 million in sales in 2024, with a significant portion coming from its fastening systems business serving large infrastructure and construction accounts.

Strong Automotive and Machinery Production Growth

Automakers and machinery manufacturers increase adoption of hexagon nuts due to rising vehicle output and expanding automation. Automotive plants use precision-grade nuts in engines, suspension systems, braking assemblies, and chassis joints where vibration resistance and torque reliability are essential. Machinery producers rely on high-strength alloy and carbon steel variants that support rotating shafts, gear housings, conveyor assemblies, and industrial robots. The shift toward electric vehicles also boosts demand for lightweight fastening systems that support battery modules and thermal enclosures. Manufacturing expansions in China, India, and Eastern Europe reinforce supply-chain stability and increase bulk procurement rates. As companies automate assembly lines, they prefer standardized hex nuts that work seamlessly with robotic fastening tools and torque-controlled systems, strengthening long-term market growth.

- For instance, Sundram Fasteners Ltd secured a US$ 250 million contract from a global automaker for EV sub-assemblies; the deal involves supplying 1.5 million transmission sub-assemblies per year.

Growing Demand for Corrosion-Resistant Fasteners

End-users across marine, chemical processing, renewable energy, and outdoor equipment markets increasingly adopt corrosion-resistant hexagon nuts. Stainless steel and coated variants gain attention because these fasteners retain strength despite exposure to moisture, saltwater, chemicals, or temperature swings. Offshore wind projects require high-durability fastening to support turbine towers, nacelles, and anchoring systems, driving procurement of corrosion-resistant nuts. Chemical plants and water treatment facilities also standardize stainless steel grades to avoid joint failure and reduce maintenance costs. Rising safety regulations encourage buyers to replace traditional carbon steel with advanced alloys and protective coatings. As companies prioritize long asset life and lower lifecycle costs, corrosion-resistant hex nuts become a strategic choice in harsh operating environments.

Key Trend & Opportunity

Expansion of Digital Procurement Platforms

Online procurement platforms create new opportunities as industrial buyers shift toward faster, transparent, and cost-efficient sourcing. E-commerce channels offer broader SKU availability, real-time pricing, and direct access to global suppliers. Small workshops and mid-sized manufacturers adopt online purchasing to lower search time and compare multiple quality grades, finishes, and certifications. Digital procurement reduces supply delays and offers better stock visibility for bulk buyers. Marketplaces also integrate technical datasheets and installation guides, helping customers make informed choices. Subscription-based ordering and automated replenishment tools support maintenance teams that need consistent access to fastening products. The rise of B2B marketplaces in Asia and Europe strengthens cross-border sales and enables suppliers to reach customers who traditionally relied on local distributors.

- For instance, Bay Supply, a B2B vertical marketplace focused on fastening products, supports over 2,000 identified fastener categories and allows buyers to generate RFQs that are auto-populated with part specifications, greatly reducing manual effort.

Growth of High-Strength and Lightweight Fastener Innovations

Innovation in materials and coatings creates new opportunities as industries seek stronger and lighter fastening solutions. Alloy steel hexagon nuts gain traction in heavy machinery and automotive assemblies because these products enhance fatigue resistance and support higher torque loads. Manufacturers introduce new coatings such as zinc-nickel, ceramic, and epoxy layers to improve corrosion resistance and extend service life. The shift toward lightweight vehicles increases demand for aluminum and hybrid-metal fasteners. Aerospace suppliers also experiment with advanced alloys that match strict weight-to-strength requirements. Vendors who invest in R&D benefit from rising demand for customized nuts designed for robotic tightening, high-temperature performance, and renewable energy structures. This innovation cycle strengthens market competitiveness and expands application potential.

- For instance, Bossard has developed a line of high-strength all-metal lock nuts (DIN 980 V) with property class 8, made from carbon steel, with dimensions like M10 (17 mm across flats) and prevailing-torque performance.

Key Challenge

Volatile Raw Material Prices and Supply Chain Pressures

Hexagon nuts manufacturers face challenges due to fluctuating prices of steel, alloys, zinc, and other key inputs. Global supply disruptions, energy cost spikes, and geopolitical issues raise production expenses and reduce profit margins. Smaller manufacturers struggle to maintain stable output when raw materials become scarce or costly, affecting order fulfilment. Transportation delays and port congestion also impact lead times for bulk shipments. Buyers often push for low-cost procurement, limiting the ability of suppliers to pass on price increases. These pressures force manufacturers to optimize sourcing strategies, but unpredictability in material availability continues to pose significant risks across major regions.

Intense Competition and Product Standardization

The hexagon nuts market experiences strong competition because many global and regional producers offer similar standardized products. This high level of uniformity limits differentiation and results in price-driven bidding, especially in construction and machinery sectors. Suppliers must maintain strict compliance with ISO, DIN, and ASTM standards, leaving little room for premium pricing. Smaller firms struggle to compete against large players with advanced automation, higher production capacity, and established distribution networks. As buyers compare suppliers mainly on cost and delivery time, manufacturers face pressure to reduce prices while maintaining quality. This competitive environment restricts margins and demands continuous operational efficiency improvements.

Regional Analysis

North America

North America leads the Hexagon Nuts Market with about 32% share in 2024. Demand rises as construction, automotive, and machinery projects scale across the U.S. and Canada. Manufacturers prefer stainless steel and carbon steel nuts for their strong durability and stable torque performance. The region benefits from advanced production technology, strict safety rules, and steady infrastructure spending. Automotive plants increase procurement as EV assembly expands. Distributors maintain strong supply networks that support fast delivery and reliable stock availability. Industrial upgrades across energy, manufacturing, and transportation continue to strengthen long-term demand.

Europe

Europe holds roughly 27% share in 2024, supported by strong engineering standards and mature industrial sectors. Germany, France, and the U.K. drive usage across machinery, automotive systems, and structural components. Buyers rely on stainless steel and alloy fasteners to meet strict corrosion-resistance and performance requirements. The region’s focus on renewable energy, rail expansion, and manufacturing automation increases procurement volumes. EU regulations promote the use of certified fastening products, strengthening demand for high-precision nuts. Steady upgrades in aerospace and heavy equipment also contribute to stable long-term growth across major European markets.

Asia Pacific

Asia Pacific dominates global growth momentum and accounts for about 34% share in 2024. China, India, Japan, and South Korea drive large-scale consumption across construction, automotive production, and industrial machinery. Local manufacturers supply cost-competitive stainless steel, carbon steel, and alloy variants, supporting strong export activity. Infrastructure expansion, urban development, and rising manufacturing output boost regional demand. Automotive plants adopt precision-grade nuts for engines, EV platforms, and assembly lines. Fast industrialization and strong distribution networks make Asia Pacific the fastest-growing regional market with significant long-term potential.

Latin America

Latin America holds nearly 4% share in 2024, with demand centered in Brazil, Mexico, and Argentina. Growth improves as construction projects, mining activities, and machinery upgrades expand. Buyers prefer carbon steel and stainless steel nuts due to good strength and cost balance. Automotive plants in Mexico increase procurement as regional manufacturing grows. Import-dependent supply chains create moderate cost pressure, but expanding distributor networks support wider product access. Public infrastructure spending provides steady opportunities across commercial, industrial, and utility-scale projects, helping the region maintain a stable growth outlook.

Middle East & Africa

The Middle East & Africa region accounts for about 3% share in 2024. Demand strengthens as governments invest in large construction developments, energy plants, and industrial zones. Stainless steel nuts gain preference due to strong corrosion resistance in high-temperature and high-salinity environments. Gulf countries lead adoption for oil, gas, and infrastructure installations. Africa’s machinery and mining sectors support additional growth. Import flows remain important, but expanding local distributors improve availability. Gradual industrial expansion and ongoing megaprojects help sustain long-term market demand across major countries in the region.

Market Segmentations:

By Type

- Stainless Steel

- Carbon Steel

- Alloy Steel

- Brass

- Others

By Application

- Construction

- Automotive

- Aerospace

- Machinery

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hexagon Nuts Market features strong participation from global fastener manufacturers and established industrial suppliers. Leading companies such as Bossard Group, Penn Engineering, Nucor Corporation, LISI Group, Würth Group, Fastenal Company, Arconic Inc., Illinois Tool Works Inc., Stanley Black & Decker Inc., and Bulten AB compete through wide product portfolios, precision-engineered fasteners, and strong distribution capabilities. Market leaders focus on high-strength stainless steel, carbon steel, and alloy steel nuts designed for construction, automotive, aerospace, and machinery applications. Many players invest in automated production, heat-treatment technology, and corrosion-resistant coatings to enhance performance and meet global standards. Distributors strengthen their competitive edge by expanding inventory depth, improving delivery speed, and offering technical support for industrial buyers. Strategic moves such as mergers, regional expansion, and digital sales platforms help companies maintain market presence, while rising demand for certified, high-durability fasteners continues to push innovation and product differentiation across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bossard Group

- Penn Engineering

- Nucor Corporation

- LISI Group

- Würth Group

- Fastenal Company

- Arconic Inc.

- Illinois Tool Works Inc.

- Stanley Black & Decker Inc.

- Bulten AB

Recent Developments

- In September 2025, Arconic commissioned a major expansion of high-purity aluminum output at its Davenport Works plant, boosting supply of advanced aluminum materials used in aerospace and defense components, including feedstock for high-performance fasteners and hex-style hardware.

- In January 2025, Bossard completed the acquisition of German fastener distributor Ferdinand Gross Group, expanding its range and regional coverage for mechanical fasteners, including hexagon nuts, in Central Europe

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as global construction and infrastructure projects expand.

- Automotive and EV manufacturing growth will increase the need for precision fasteners.

- Adoption of corrosion-resistant stainless steel and coated variants will accelerate.

- Manufacturers will invest more in automated production and quality-control systems.

- Digital procurement platforms will streamline sourcing and widen supplier reach.

- Renewable energy installations will boost consumption of high-strength fastening solutions.

- Lightweight and high-performance alloy nuts will gain traction in aerospace and machinery.

- Sustainability requirements will encourage the use of recyclable and eco-friendly materials.

- Supply chains will become more regionalized to reduce lead times and import risks.

- Competition will intensify as global and regional players expand product portfolios.