Market Overview

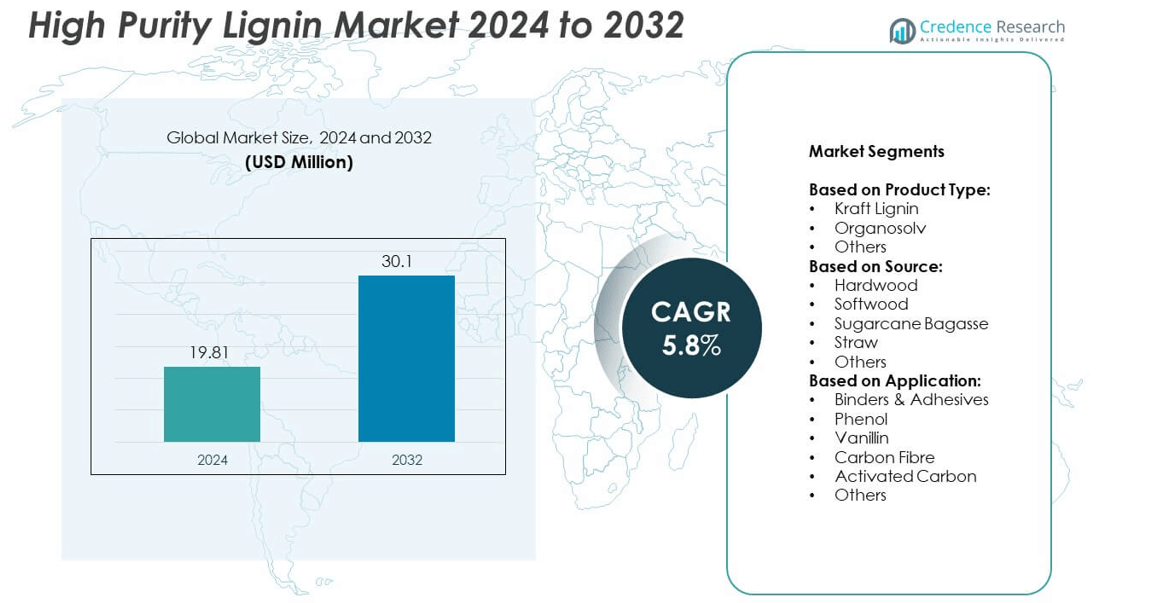

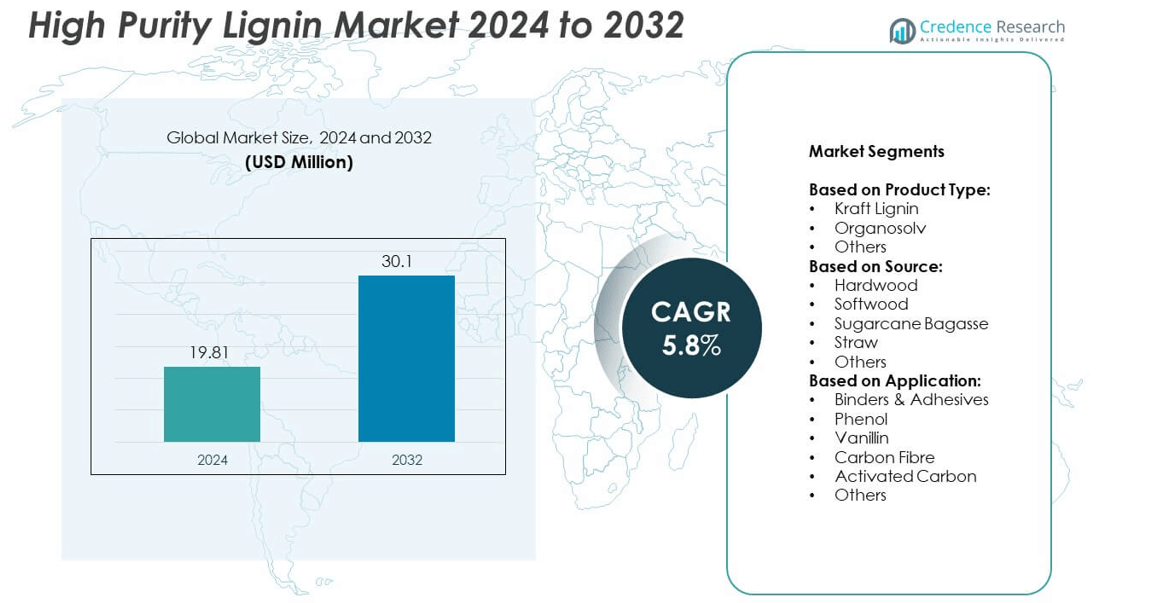

The High Purity Lignin Market size was valued at USD 19.81 million in 2024 and is expected to reach USD 30.1 million by 2032, growing at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Purity Lignin Market Size 2024 |

USD 19.81 million |

| High Purity Lignin Market, CAGR |

5.8% |

| High Purity Lignin Market Size 2032 |

USD 30.1 million |

High Purity Lignin market grows due to rising demand for bio-based materials, government incentives for green chemistry, and expansion of biorefinery projects. Industries adopt lignin for resins, adhesives, carbon fibers, and phenolic substitutes to reduce dependence on petrochemicals. Advancements in fractionation and purification technologies improve product quality and scalability. Collaborations between producers and research institutes accelerate development of high-value applications. Growing focus on circular economy models and sustainability targets strengthens lignin adoption across automotive, construction, and specialty chemical sectors globally.

North America leads the High Purity Lignin market driven by strong biorefinery infrastructure and demand from automotive and chemical sectors. Europe follows with robust regulatory support for bio-based materials and advanced lignin technologies. Asia Pacific shows rapid growth with rising industrialization and expanding pulp and paper production. Key players such as Green Value S.A., Metsa Group, Domtar Corporation, and Ingevity Corporation focus on capacity expansion, product innovation, and partnerships to strengthen their regional presence and address growing global demand.

Market Insights

- The High Purity Lignin market was valued at USD 19.81 million in 2024 and is expected to reach USD 30.1 million by 2032, growing at a CAGR of 5.8% during the forecast period.

- Rising demand for bio-based materials and regulatory push for sustainable solutions are key drivers shaping market growth.

- Commercialization of lignin-based carbon fibers, vanillin, and phenolic substitutes is expanding opportunities across automotive, chemical, and construction sectors.

- Leading players focus on R&D collaborations, process optimization, and capacity expansion to strengthen their competitive position globally.

- High production costs, variability in feedstock quality, and lack of global standardization remain major restraints for wider adoption.

- North America leads growth with strong biorefinery infrastructure, while Europe benefits from regulatory support and Asia Pacific experiences rapid industrial demand.

- Growing interest in circular economy models, rising investment in biorefinery projects, and development of specialty applications are expected to drive future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Bio-Based and Sustainable Materials

High Purity Lignin market benefits from increasing focus on sustainable and eco-friendly materials. Industries prefer lignin as a renewable alternative to fossil-based raw materials. It supports production of bio-based resins, carbon fibers, and adhesives. Governments promote adoption through incentives for green chemistry and low-carbon processes. The shift toward circular economy models drives research in value-added lignin applications. Growing corporate sustainability targets encourage replacement of synthetic chemicals with lignin solutions. This momentum strengthens its role in multiple industrial value chains.

- For instance, Tensile strength ~ 1.0 ± 0.1 GPa for fibers made from high molecular-weight (MW) corn stover lignin fractions.

Expanding Use in Advanced Composites and Specialty Chemicals

Demand for high-performance composites and specialty chemicals drives High Purity Lignin market growth. Lignin offers unique structural and thermal properties that enhance product performance. It enables cost-effective production of lightweight composites for automotive and aerospace sectors. Chemical manufacturers use lignin to develop dispersants, binders, and surfactants with improved environmental profiles. It contributes to reducing dependency on petroleum-derived ingredients. Research partnerships between chemical producers and research institutes expand commercial opportunities. Rising adoption across multiple industries fuels market penetration.

- For instance, VITO’s LignoValue pilot plant in Belgium, operational since 2022, is designed for the continuous conversion of lignin into bio-aromatics, its capacity is to produce over 100 kg daily, not a cumulative total since 2022

Supportive Government Policies and Funding for Biorefineries

Government policies promoting renewable feedstock utilization boost High Purity Lignin market development. Many countries provide grants and funding for biorefinery projects and biomass valorization. It ensures continuous development of lignin extraction and purification technologies. Regulatory pressure to reduce greenhouse gas emissions accelerates lignin adoption in industrial applications. Public-private collaborations promote pilot projects to scale lignin production capacity. National strategies for bioeconomy growth strengthen lignin demand across Europe, North America, and Asia. Supportive frameworks reduce risk for new market entrants.

Technological Advancements in Fractionation and Purification

Innovation in fractionation and purification techniques enhances High Purity Lignin market efficiency. Advanced processes yield lignin with improved purity, consistency, and functional properties. It enables manufacturers to meet strict quality requirements for specialty applications. Companies invest in proprietary technologies to optimize process economics and scalability. New separation methods reduce energy consumption and minimize waste generation. Commercialization of high-value lignin derivatives creates new revenue streams. Continuous improvement in processing technologies increases industrial adoption rates.

Market Trends

Growing Commercialization of Lignin-Based Value-Added Products

High Purity Lignin market is witnessing strong growth with commercialization of lignin-based carbon fibers, resins, and phenolic substitutes. Industries focus on developing scalable production processes to meet rising demand. It supports the manufacturing of lightweight and cost-efficient materials for automotive and aerospace. Chemical producers integrate lignin into dispersants, adhesives, and polymer blends to enhance performance. Companies launch new product grades tailored for high-value applications. Expanding product portfolios strengthen lignin’s position in specialty chemical markets. Demand for functionalized lignin continues to rise globally.

- For instance, Washington State University researchers extracted up to 93% lignin yield with up to 98% purity from wheat straw using a new extraction method.

Integration into Bio-Refinery and Circular Economy Models

High Purity Lignin market aligns with integrated biorefinery concepts focusing on complete biomass utilization. Biorefineries extract lignin alongside bioethanol and other co-products to maximize economic returns. It plays a key role in reducing waste streams and achieving carbon neutrality goals. Market participants invest in closed-loop systems to support circular economy objectives. The trend increases availability of high-purity lignin for industrial applications. Governments encourage biorefinery adoption through funding and renewable energy mandates. This integration strengthens supply chain stability and market competitiveness.

- For instance, the article “Carbon fibers from higher MW lignin fractions” (SV Kanhere et al., 2024) showed tensile strength of 1.0 ± 0.1 GPa and reduced stabilization time to 9 hours using corn-stover lignin.

Collboration Between Industry and Research Institutions

ollaborative initiatives between producers, research institutes, and end users shape High Purity Lignin market evolution. Partnerships accelerate development of advanced purification methods and new applications. It enables faster commercialization of high-value derivatives and improved cost-efficiency. Pilot-scale projects help validate performance in real-world applications. Joint ventures focus on scaling production facilities to meet industrial demand. Knowledge-sharing platforms promote innovation and standardization of quality parameters. Growing collaboration creates a pipeline of innovative lignin-based solutions.

Rising Investment in Sustainable Manufacturing Technologies

Technology upgrades drive efficiency and competitiveness in High Purity Lignin market. Companies adopt energy-efficient separation and fractionation systems to lower operational costs. It improves product consistency and reduces environmental footprint. Continuous process optimization supports large-scale commercialization efforts. Manufacturers expand capacity in key regions to address growing demand. Adoption of digital monitoring and process control ensures higher yield and quality. Investments in green technologies position producers as leaders in the bio-based materials sector.

Market Challenges Analysis

High Production Costs and Limited Commercial Scale

High Purity Lignin market faces challenges due to high production costs and limited commercial-scale facilities. Current fractionation and purification processes require significant capital investment. It increases the overall cost of lignin-based products compared to conventional petrochemical alternatives. Limited economies of scale restrict price competitiveness and slow adoption in cost-sensitive industries. Variability in feedstock quality creates additional hurdles for consistent product performance. Producers struggle to balance process optimization with affordability. Scaling up production remains a priority for market participants to expand adoption.

Technical Barriers and Lack of Standardization

Technical limitations and absence of global standards hinder High Purity Lignin market growth. Performance consistency varies across regions due to different raw material sources and processing technologies. It leads to difficulties in meeting uniform quality requirements for end-use sectors. Limited awareness among end users slows acceptance in automotive, construction, and chemical industries. Lack of standardized testing methods complicates benchmarking of product grades. Research efforts focus on addressing purity, reactivity, and compatibility issues. Overcoming these barriers is essential to unlock full market potential.

Market Opportunities

Expansion into High-Value Industrial Applications

High Purity Lignin market holds strong potential in high-value applications such as carbon fibers, engineered plastics, and advanced coatings. Industries seek bio-based alternatives to reduce dependence on petroleum-derived raw materials. It enables production of lightweight composites for automotive, aerospace, and construction sectors. Growing demand for sustainable binders and dispersants creates new revenue streams. Chemical companies explore lignin-derived vanillin, antioxidants, and performance additives for specialty chemical markets. Development of tailored lignin grades supports customized solutions for different end-use industries. This expansion is expected to boost market penetration in premium segments.

Rising Focus on Green Energy and Bio-Based Economy

Transition toward a bio-based economy creates attractive opportunities for High Purity Lignin market participants. Governments support biomass valorization and encourage lignin utilization in energy and material sectors. It plays a role in developing renewable fuels, bioplastics, and sustainable packaging solutions. Integration into biorefineries ensures continuous supply of high-purity feedstock for commercial use. Growing corporate commitments to carbon neutrality increase demand for eco-friendly raw materials. Partnerships with research institutes accelerate innovation in process efficiency and product development. These factors position lignin as a key contributor to the global green energy transition.

Market Segmentation Analysis:

By Product Type:

kraft lignin, organosolv, and others. Kraft lignin dominates demand due to its large-scale availability from paper and pulp mills. It is widely used in dispersants, resins, and fuel applications because of its consistent quality. Organosolv lignin is gaining traction for high-value applications requiring high purity and low sulfur content. Specialty chemical producers prefer organosolv lignin for carbon fibers, phenolic resins, and advanced composites. The “others” category includes soda lignin and emerging extraction methods that offer niche opportunities. Expanding production technologies are expected to improve availability and cost efficiency across all product types.

- For instance, ALPHA-fractionated corn-stover lignin (CS20K fraction) produced carbon fibers of about 12 ± 1 µm diameter, tensile strength 1.0 ± 0.1 GPa and electrical resistivity 49 ± 6 μΩ·m.

By Source:

High Purity Lignin market is divided into hardwood, softwood, sugarcane bagasse, straw, and others. Hardwood and softwood remain primary feedstocks due to established supply chains and reliable lignin yield. It provides uniform quality that supports consistent end-use performance. Sugarcane bagasse and straw gain interest in regions with strong agro-industrial output, offering alternative feedstock options. Using agricultural residues aligns with sustainability goals and reduces waste generation. The “others” segment includes specialty biomass sources that cater to region-specific availability. Diversification of feedstocks helps reduce supply risk and ensures steady market growth.

- For instance, Stora Enso’s mill in Sunila, Finland, formerly produced high-quality kraft lignin using Valmet’s LignoBoost technology, production has ceased. The plant, which had a capacity of 50,000 tonnes per year, started commercial operation in 2015.

By Application:

High Purity Lignin market covers binders and adhesives, phenol, vanillin, carbon fiber, activated carbon, and others. Binders and adhesives account for a major share due to their use in wood panels and composites. It offers cost-effective and bio-based replacement for petroleum-derived binders. Phenol and vanillin applications benefit from lignin’s ability to serve as a sustainable feedstock for specialty chemicals. Carbon fiber production represents a growing segment driven by demand for lightweight materials in automotive and aerospace. Activated carbon applications leverage lignin’s carbon-rich nature to produce high-surface-area adsorbents. The “others” category includes dispersants, antioxidants, and specialty additives for high-performance markets.

Segments:

Based on Product Type:

- Kraft Lignin

- Organosolv

- Others

Based on Source:

- Hardwood

- Softwood

- Sugarcane Bagasse

- Straw

- Others

Based on Application:

- Binders & Adhesives

- Phenol

- Vanillin

- Carbon Fibre

- Activated Carbon

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the High Purity Lignin market, accounting for 36% of global revenue. Strong presence of pulp and paper industries and advanced biorefinery infrastructure support growth. It benefits from significant R&D investment in lignin-based carbon fibers, adhesives, and bio-based phenols. Automotive and aerospace sectors drive demand for lightweight composites, encouraging use of high-purity lignin as a cost-effective material. Supportive policies promoting bio-based chemicals and carbon footprint reduction strengthen market expansion. Partnerships between research institutes and industrial players enhance product development and commercialization. Rising focus on sustainable sourcing and circular economy models continues to drive market adoption across the region.

Europe

Europe represents a significant share of the High Purity Lignin market with 31% of global demand. The region benefits from strong government backing for green chemistry and renewable material adoption. It has a well-established biorefinery network that enables consistent lignin supply. Automotive and construction industries lead consumption, using lignin-derived resins and binders in composites and panels. Regulatory pressure to reduce greenhouse gas emissions and fossil fuel dependency supports lignin integration into industrial applications. Continuous innovation in fractionation technologies in Scandinavian and Western European countries improves product quality and competitiveness. Growing collaborations under EU-funded bioeconomy projects accelerate commercialization of new lignin-based solutions.

Asia Pacific

Asia Pacific accounts for 23% of the High Purity Lignin market, driven by rapid industrialization and growing bio-based chemical demand. China, Japan, and India invest in developing lignin valorization technologies to support domestic industries. It gains traction in automotive, construction, and packaging sectors seeking sustainable alternatives to petroleum-based materials. Expanding paper and pulp capacity across China and Southeast Asia increases feedstock availability. Government initiatives promoting renewable materials encourage large-scale production and export opportunities. Research collaborations between academic institutions and chemical producers contribute to technological progress. Rising awareness of environmental sustainability drives new lignin applications across emerging economies.

Latin America

Latin America contributes 6% of the High Purity Lignin market, supported by abundant agricultural residues such as sugarcane bagasse and straw. Brazil leads the regional market with a strong bioethanol industry that generates significant lignin feedstock. It creates opportunities for developing high-purity lignin for adhesives, resins, and specialty chemical production. Regional players invest in biorefinery projects to convert agro-waste into value-added products. Government programs supporting bio-based energy and materials strengthen market penetration. Collaborative projects with international firms help improve process technology and product quality. Growing demand from construction and packaging industries is likely to enhance lignin utilization.

Middle East and Africa

Middle East and Africa hold 4% share of the High Purity Lignin market, with growth supported by increasing interest in biomass utilization and diversification of raw materials. South Africa and GCC countries focus on establishing pilot biorefinery projects to reduce dependency on imports. It creates potential for producing lignin-based fuels and performance chemicals. Limited industrial infrastructure currently restricts large-scale production, but rising investment in renewable energy initiatives offers growth prospects. Regional governments encourage private sector participation through incentives and funding for bio-based projects. Expanding construction sector and rising awareness of sustainable materials drive demand. Continued technology transfer from developed markets is expected to accelerate adoption in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The High Purity Lignin market features a competitive landscape with leading players including Green Value S.A., Metsa Group, Domtar Corporation, Ingevity Corporation, Alberta Pacific, Stora Enso Oyj, Suzano SA, Sigma Aldrich, West Fraser, and Liquid Lignin Company. These companies focus on developing advanced lignin extraction and purification technologies to deliver consistent quality and meet industrial specifications. Strategic investments in biorefinery infrastructure and process optimization allow them to scale production and improve cost efficiency. Many players emphasize partnerships with research institutions to accelerate product development and commercialize new lignin-based applications. Expanding product portfolios targeting carbon fibers, resins, vanillin, and activated carbon segments strengthen their market presence. Sustainability commitments and regulatory compliance drive innovation in bio-based solutions and position them as preferred suppliers for industries seeking low-carbon alternatives. Regional expansions and capacity upgrades support improved supply chain reliability, while joint ventures and collaborations help penetrate emerging markets. Competition remains driven by technological capability, product purity, and ability to offer tailored solutions for diverse end users across automotive, construction, chemical, and energy sectors. This competitive environment is expected to intensify with increasing demand for renewable materials and circular economy solutions.

Recent Developments

- In 2023, Metsä Group, in collaboration with ANDRITZ and Dow, announced a project to develop a new modified lignin product, Metsä LigO™, at a demo plant in Äänekoski. The plant’s construction began in summer 2024, with the goal of being ready for test use in late 2025.

- In 2023, Domtar Corporation reopened its converted mill in Kingsport, Tennessee, to produce 100% recycled containerboard, a sustainable packaging material. The company has also made broader sustainability commitments that it is pursuing beyond 2025.

- In 2023, Stora Enso Oyj collaborating with Valmet to develop next-generation lignin products and processes, enhancing lignin quality for applications like sustainable battery technologies; operating largest kraft lignin production using LignoBoost technology in Finland.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bio-based materials will drive steady growth in multiple industries.

- Adoption of lignin-based carbon fibers will expand in automotive and aerospace sectors.

- Biorefineries will scale production capacity to improve cost efficiency and supply stability.

- Technological advances will enhance purity levels and functional properties of lignin.

- Collaboration between research institutes and manufacturers will accelerate product innovation.

- Regulatory pressure to cut carbon emissions will support wider lignin integration.

- New applications in vanillin, phenolic resins, and activated carbon will boost market diversity.

- Emerging economies will invest in lignin valorization to support local industries.

- Companies will focus on standardization and quality benchmarking for global adoption.

- Sustainability commitments will position lignin as a key component of the circular economy.