Market Overview

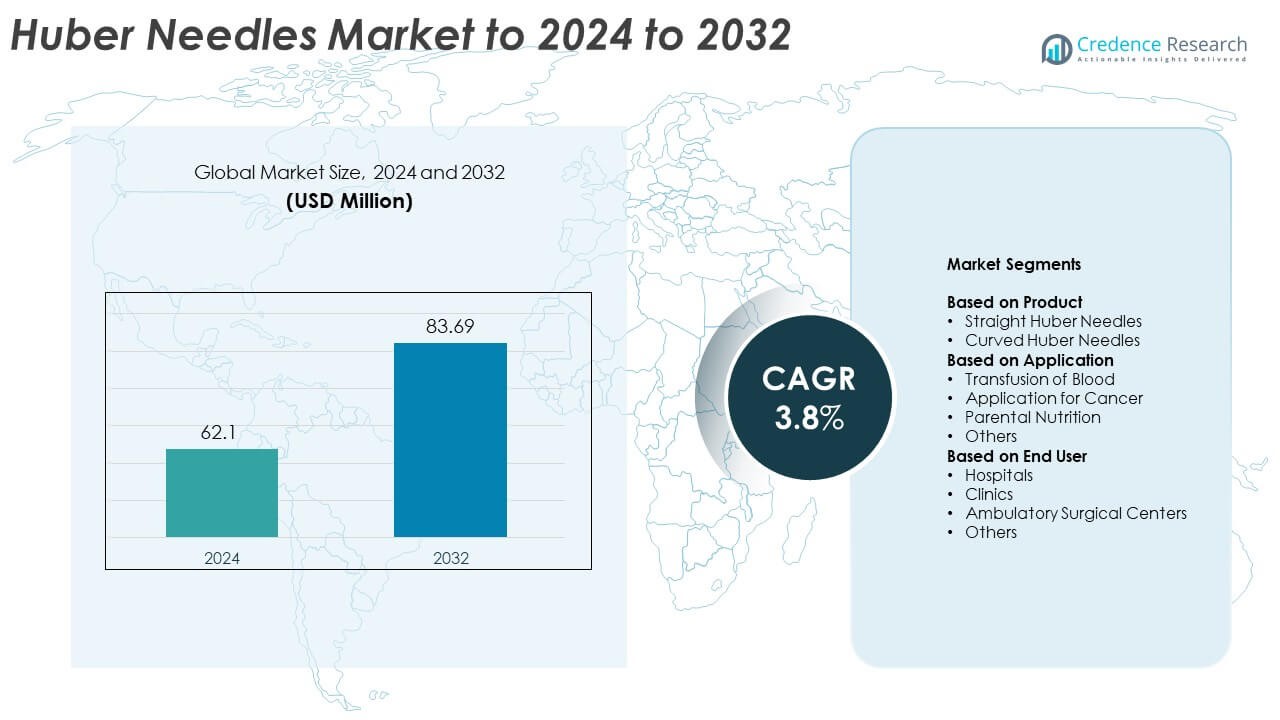

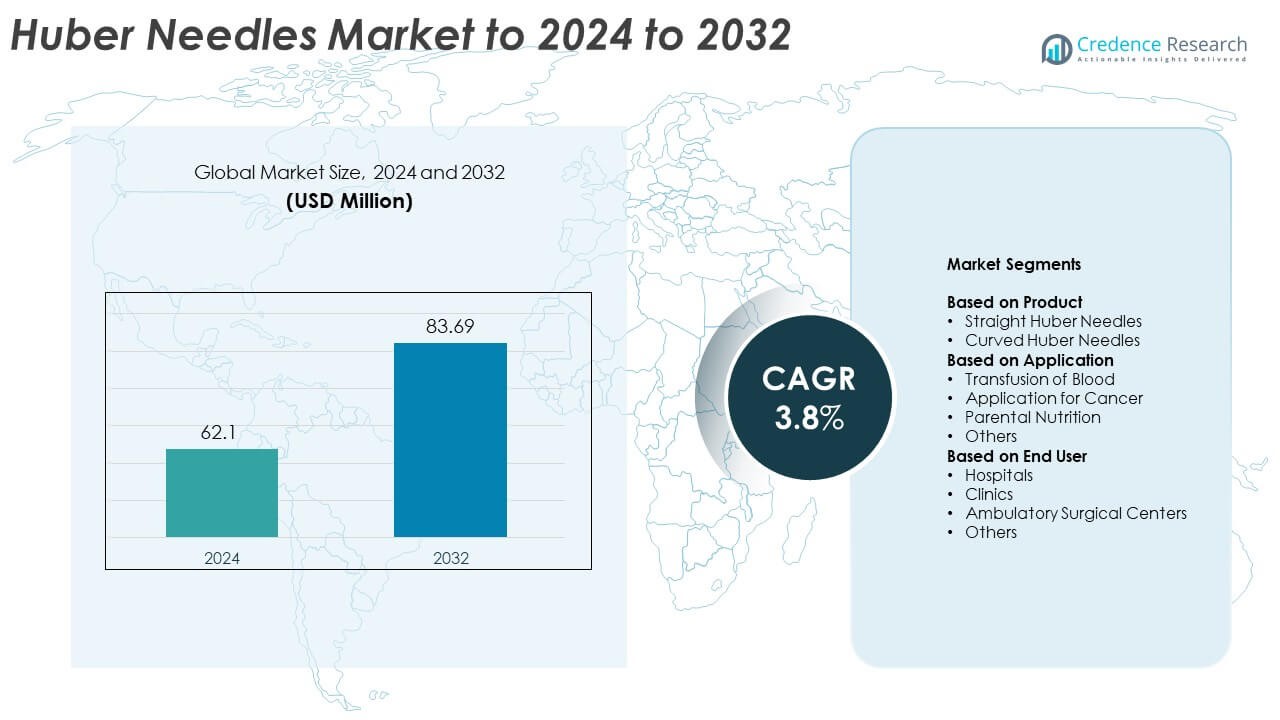

Huber Needles Market size was valued USD 62.1 million in 2024 and is anticipated to reach USD 83.69 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Huber Needles Market Size 2024 |

USD 62.1 Million |

| Huber Needles Market, CAGR |

3.8% |

| Huber Needles Market Size 2032 |

USD 83.69 Million |

The huber needles market includes major players such as Mekon, InfuSystem, Exelint International Co., Smiths Medical Inc. (ICU Medical Inc), Medline Industries, B. Braun Medical Inc., and Becton, Dickinson and Company, each expanding product portfolios focused on safe, non-coring vascular access. These companies strengthened their positions through improved ergonomic designs, enhanced safety mechanisms, and wider distribution across hospitals and infusion centers. North America emerged as the leading region in 2024 with 38% share, supported by high adoption of implanted ports for oncology and chronic-care therapies, followed by Europe with 29% share and Asia Pacific with 23% share.

Market Insights

- The huber needles market reached USD 62.1 million in 2024 and is projected to hit USD 83.69 million by 2032 at a 8% CAGR, supported by stable infusion therapy demand across clinical settings.

- Market growth is driven by rising adoption of implanted ports in oncology and chronic-disease care, with straight huber needles holding about 58% share due to broad compatibility and safer access.

- Key trends include wider use of safety-engineered, non-coring designs and growing demand from home-infusion and outpatient chemotherapy programs across major healthcare networks.

- Competition strengthened as leading manufacturers enhanced sterility assurance, improved ergonomic needle geometry, and expanded distribution to hospitals, which held about 49% share as the dominant end-user segment.

- Regionally, North America led with 38% share, followed by Europe at 29%, and Asia Pacific at 23%, while blood transfusion applications remained the largest segment with nearly 42% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Straight Huber needles led the product segment in 2024 with about 58% share, driven by wide use in routine vascular access and consistent demand across oncology and infusion centers. Healthcare teams preferred straight variants because they support stable insertion angles, reduce access complications, and fit most implanted port designs. Curved Huber needles grew at a steady pace as specialty centers used them for difficult anatomical positions and long-duration infusions, but straight formats maintained dominance due to broader compatibility and lower handling complexity.

- For instance, Jiangsu Caina Medical Co., Ltd. received FDA 510(k) clearance K200463 for a Huber Needle Infusion Set that offers non-coring needles from 19G to 25G with lengths between 0.5 and 1.5 inches, and allows power injection of contrast media at up to 325 psi with maximum infusion rates of 5 ml/s for 19G–20G and 2 ml/s for 22G on compatible ports.

By Application

The transfusion of blood segment dominated the application category in 2024 with nearly 42% share, supported by rising port-based transfusion procedures in oncology and chronic hematology patients. Hospitals selected Huber needles for transfusions because they lower coring risk and protect implanted ports during repeated access cycles. Cancer applications also expanded, backed by growing chemotherapy volumes, while parental nutrition and other medical uses advanced as long-term infusion therapies gained adoption.

- For instance, B. Braun Medical’s Surecan Safety II port access needle is documented as a high-pressure-resistant non-coring safety needle suitable for power injections up to 325 psi, with cannula length options such as 20 mm and multiple gauges designed specifically for implanted intravenous port access in oncology and other infusion therapies.

By End User

Hospitals held the largest end-user share in 2024 at approximately 49%, due to high patient inflow, large oncology departments, and broader use of implanted ports for chemotherapy and transfusion care. Hospitals favored Huber needles because they enhance safety, support consistent infusion workflows, and comply with sterility standards. Clinics and ambulatory surgical centers increased uptake as outpatient chemotherapy and home-based infusion programs expanded, but hospitals remained dominant due to greater procedural volume and advanced infusion infrastructure.

Key Growth Drivers

Rising Use of Implanted Ports in Oncology

Demand increased as more cancer patients received long-term chemotherapy through implanted ports. Hospitals preferred Huber needles because the design lowers coring risk and maintains port integrity during repeated access. Oncology departments also expanded infusion volumes, which strengthened adoption across both inpatient and outpatient settings. This trend positioned oncology-related port access as a major growth driver and supported continuous procurement across global cancer care networks.

- For instance, Bard Access Systems, Inc. reports in FDA filings, such as 510(k) K153440 and K241353, that its PowerLoc™ Max Power Injectable Infusion Set uses non-coring Huber needles in 19G, 20G, and 22G sizes. The recommended maximum power-injection flow rates are 5 ml/s for 19G–20G and 2 ml/s for 22G at up to 325 psi when used with indicated implanted ports.

Growth in Chronic Disease Management Requiring Repeated Infusions

Chronic conditions such as renal disorders, immune deficiencies, and hematologic diseases required frequent vascular access, which increased reliance on Huber needles. Healthcare providers used these needles to ensure safe, stable, and low-trauma access during ongoing infusion cycles. Rising patient survival rates and longer treatment timelines supported steady demand. This made chronic-disease infusion management a key driver for market expansion across hospitals and specialty clinics.

- For instance, Nipro Group’s Safetouch Huber Needle Set product data sheet lists 19G, 20G, and 22G coreless non-coring needles in lengths of 19, 25, and 38 mm (or 3/4, 1, and 1 1/2 inches, respectively) with a standard tube length of 200 mm.

Expansion of Parenteral Nutrition and Long-Term Home-Care Therapies

The rising adoption of home-based parenteral nutrition and long-term infusion therapies pushed demand for Huber needles with enhanced safety features. Patients on prolonged nutrition support or long-term medication infusions required reliable port access, which reinforced procurement by home-care providers. Manufacturers responded with ergonomic designs and improved needle stabilization. This shift toward long-duration therapies strengthened market growth and positioned home-care infusion expansion as a significant driver.

Key Trends and Opportunities

Shift Toward Safety-Engineered and Non-Coring Technologies

Healthcare systems moved toward advanced Huber needles designed with safety shields, better bevel geometry, and improved non-coring tips. These innovations reduced needle-stick injuries and enhanced reliability during port access. Regulatory encouragement for safety-engineered devices created strong adoption prospects. Manufacturers that invested in ergonomic safety mechanisms gained wider acceptance, making this shift an important trend and a major opportunity for product differentiation.

- For instance, Infusion Safety Products, Inc. achieved FDA clearance under 510(k) K170881 for the ISP Safety Huber Needle Infusion Set, classified as a non-coring hypodermic single-lumen needle (product code PTI, Class II), with an integrated safety mechanism intended to reduce accidental needlestick injuries during port access.

Rising Preference for Outpatient and Home-Infusion Models

The growing transition of infusion care from hospitals to outpatient centers and home-care settings created new opportunities for Huber needle suppliers. Patients with chronic diseases favored home therapy due to convenience, while providers used Huber needles for safer long-term access. This shift encouraged demand for easy-to-use, secure, and patient-friendly needle designs. Companies that targeted the expanding ambulatory care segment experienced stronger growth potential.

- For instance, ICU Medical’s Gripper Plus Safety Port Access Needle is listed with a box quantity of 12 units and incorporates a safety mechanism that activates with an audible click and visible engagement during needle removal, while offering multiple needle sizes and lengths tailored for ambulatory and home-infusion port access.

Digital Tracking and Sterility-Assurance Solutions

Manufacturers explored smart packaging, batch-tracking, and enhanced sterility-assurance systems to support quality compliance. Healthcare providers valued traceability, especially for oncology and nutrition therapies. Improved sterilization indicators and digital audit trails increased confidence in product integrity. This trend opened opportunities for suppliers to integrate supply-chain visibility tools and strengthen market competitiveness.

Key Challenges

Risk of Port-Related Complications and Needle Misplacement

Huber needle access errors can cause port damage, infection, or occlusion, which raised concerns among clinicians. Maintaining correct insertion angles and ensuring proper stabilization remained critical, especially in high-volume oncology units. Training gaps and limited skill consistency created operational challenges. These risks made procedure-related complications a notable challenge for broader adoption.

Price Pressure and Limited Reimbursement in Some Regions

Many healthcare systems faced cost constraints, pushing buyers to select lower-priced needle variants or delay procurement. Outpatient and home-care programs struggled with inconsistent reimbursement for long-term port access supplies. This environment limited premium product uptake, despite their safety benefits. As a result, pricing pressure and reimbursement gaps emerged as key challenges for sustained market growth.

Regional Analysis

North America

North America dominated the huber needles market in 2024 with about 38% share, driven by high adoption of implanted ports for oncology and chronic disease therapies. Hospitals and specialty infusion centers increased procurement as cancer incidence rose and outpatient chemotherapy programs expanded. The region also benefited from strong regulatory support for safety-engineered needles, which encouraged faster replacement cycles. Growing home-infusion use across the United States further supported demand and strengthened market penetration. These factors positioned North America as the leading region with steady growth across clinical and ambulatory care settings.

Europe

Europe held nearly 29% share of the huber needles market in 2024 due to rising usage of port-based therapies across oncology, parenteral nutrition, and hematology care. Healthcare systems prioritized safety-enhanced non-coring needles to reduce complications and meet strict procedural guidelines. Demand increased in countries with strong reimbursement structures for infusion therapies. Expansion of day-care oncology units and a shift toward minimally invasive access methods supported broader adoption. Growing clinical preference for reliable vascular access solutions kept Europe a significant regional market with consistent uptake across hospitals and outpatient centers.

Asia Pacific

Asia Pacific accounted for about 23% share in 2024 and showed the fastest expansion due to rising cancer incidence, growing investment in advanced infusion services, and rapid expansion of private healthcare facilities. Countries such as China and India increased use of implanted ports for chemotherapy, which strengthened demand for huber needles with proven safety features. Improving access to oncology care and wider availability of home-infusion programs supported uptake. Local manufacturing growth also reduced costs and improved product availability. These factors positioned Asia Pacific as a high-growth region with strong long-term potential.

Latin America

Latin America captured roughly 6% share of the huber needles market in 2024, supported by expanding oncology services and gradual adoption of implanted ports in major urban hospitals. Countries such as Brazil, Mexico, and Argentina increased investment in infusion infrastructure, which helped boost procurement volumes. Limited reimbursement and uneven access to advanced cancer care constrained broader uptake, but awareness improved as more providers adopted non-coring needles to reduce port complications. Growth remained steady in private healthcare networks, making Latin America a developing but important regional market.

Middle East & Africa

Middle East & Africa accounted for nearly 4% share in 2024, driven by rising adoption of infusion therapies in advanced medical centers across the Gulf states and South Africa. Oncology units expanded port-based treatment volumes, which lifted demand for reliable huber needles. However, limited penetration in low-income regions and inconsistent access to specialized care slowed wider adoption. Increasing investment in cancer treatment and expansion of private hospitals strengthened market presence. Although smaller in scale, the region showed improving demand supported by gradual upgrades in clinical infrastructure and infusion services.

Market Segmentations:

By Product

- Straight Huber Needles

- Curved Huber Needles

By Application

- Transfusion of Blood

- Application for Cancer

- Parental Nutrition

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The huber needles market features major players such as Mekon, InfuSystem, Exelint International Co., Smiths Medical Inc. (ICU Medical Inc), Medline Industries, B. Braun Medical Inc., Becton, Dickinson and Company. Competition intensified as manufacturers expanded production capacity, enhanced sterility assurance, and improved needle geometry to reduce port complications. Companies focused on safety-engineered, non-coring designs that supported regulatory compliance and reduced needlestick injuries. Innovation centered on ergonomic hubs, better stabilization wings, and secure locking mechanisms. Suppliers also strengthened distribution networks to meet rising global demand for long-term infusion therapies. Strategic partnerships with hospitals and infusion centers increased product visibility, while growing adoption in outpatient and home-care settings encouraged development of user-friendly designs. Firms invested in quality improvements and clinical training programs to build trust among oncology and chronic-care providers, shaping a market defined by safety, reliability, and steady technological refinement.

Key Player Analysis

- Mekon

- InfuSystem

- Exelint International Co.

- Smiths Medical Inc. (ICU Medical Inc)

- Medline Industries

- Braun Medical Inc.

- Becton

- Dickinson

Recent Developments

- In 2025, Mekon released a new range of safety Huber needles and sets with improved features.

- In 2023, B. Braun launched the Introcan Safety® 2 IV Catheter with Multi-Access Blood Control.

- In 2022, InfuSystem announced a new partnership with Sanara MedTech Inc. to introduce new products, including needles, for comprehensive wound care solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as cancer cases increase and implanted port usage expands.

- Safety-engineered Huber needles will gain broader adoption across hospitals and clinics.

- Home-infusion therapy growth will strengthen long-term market penetration.

- Manufacturers will focus on ergonomic designs that reduce insertion errors.

- Outpatient chemotherapy centers will drive higher procurement volumes.

- Regulatory focus on non-coring safety standards will reshape product innovation.

- Emerging markets will invest more in port-based infusion infrastructure.

- Digital tracking and improved sterilization assurance will enhance product reliability.

- Training programs for clinicians will reduce complications and increase acceptance.

- Competitive pricing pressure will expand affordable product lines for wider access.