Market Overview

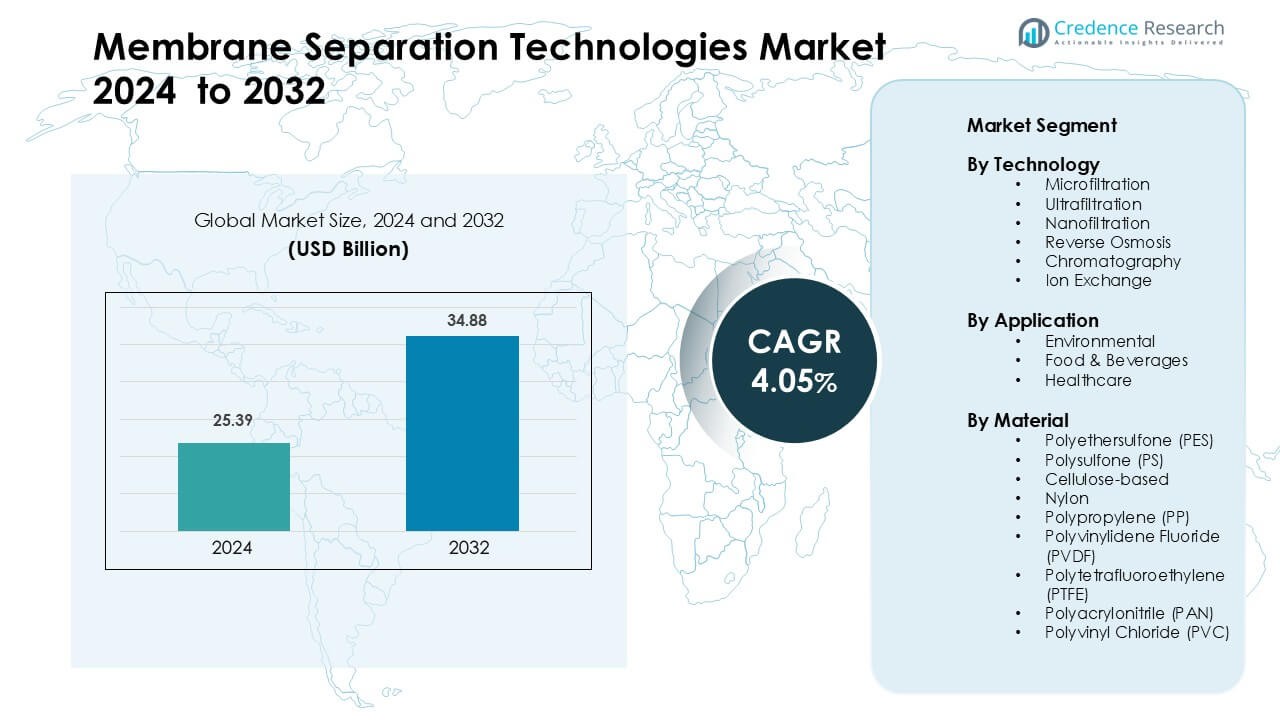

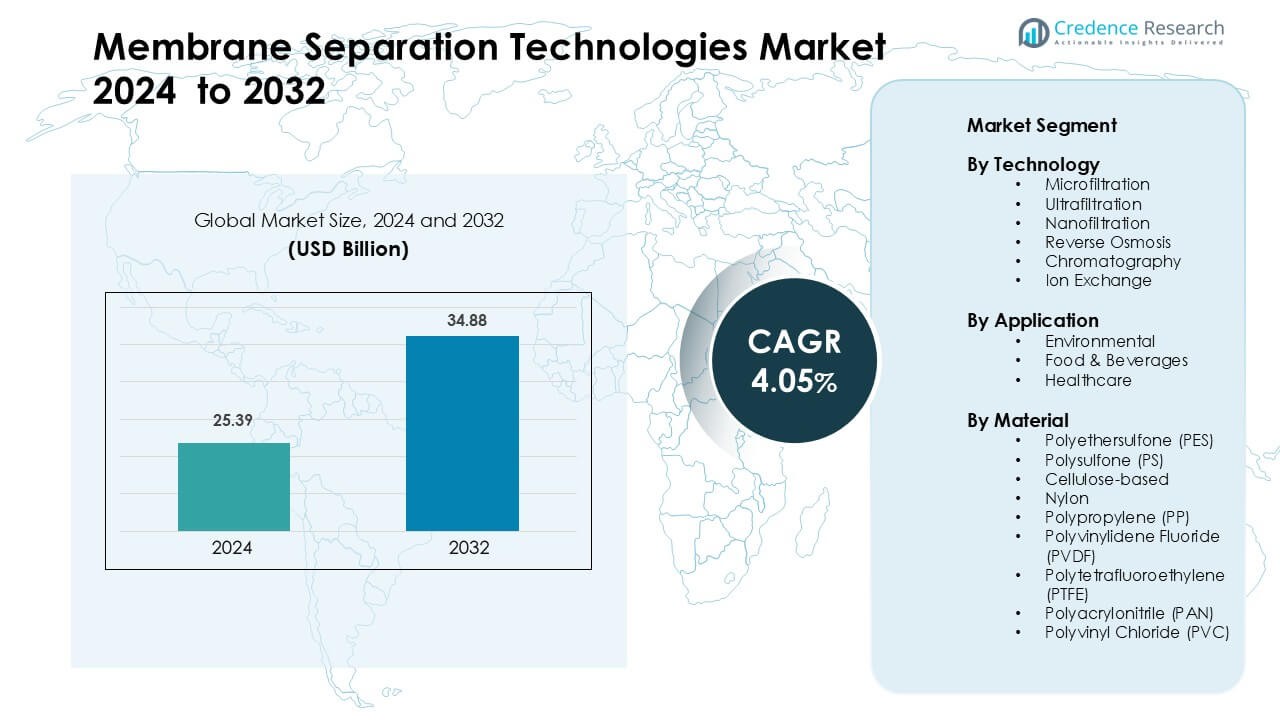

Membrane Separation Technologies Market was valued at USD 25.39 billion in 2024 and is anticipated to reach USD 34.88 billion by 2032, growing at a CAGR of 4.05 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Membrane Separation Technologies Market Size 2024 |

USD 25.39 Billion |

| Membrane Separation Technologies Market, CAGR |

4.05 % |

| Membrane Separation Technologies Market Size 2032 |

USD 34.88 Billion |

The Membrane Separation Technologies Market is shaped by leading companies such as TriSep Corporation (Microdun-Nadir US, Inc.), Amazon Filters Ltd, Merck Millipore, Pall Corporation, 3M, Advantec MFS, Inc., Novasep, GE Healthcare, Sartorius AG, and Koch Membrane Systems Inc., all of which focus on advanced materials, high-flux designs, and reliable performance for municipal and industrial applications. These players strengthen their portfolios through low-fouling membranes, high-efficiency reverse osmosis systems, and digitally monitored filtration modules used across water treatment, food processing, and healthcare. North America remains the leading region with about 34% share in 2024, supported by strict regulatory standards and strong adoption of membrane bioreactors and high-purity filtration systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Membrane Separation Technologies Market was valued at USD 25.39 billion in 2024 and is anticipated to reach USD 34.88 billion by 2032, growing at a CAGR of 4.05 % during the forecast period.

- Strong demand for clean water and wastewater reuse drives growth, with the water & wastewater treatment application already holding about 44.7% share in 2025.

- Reverse osmosis technology leads the market with approximately 42% share in 2025, and polymeric membranes remain the dominant material type.

- High capital expenditure and maintenance costs restrain adoption in smaller markets, slowing wider deployment despite strong demand.

- Asia-Pacific dominates with around 36.7% share in 2024, while North America grows rapidly thanks to regulatory pressure and industrial demand

Market Segmentation Analysis:

By Technology

Microfiltration leads this segment with about 32% share in 2024 due to strong use in wastewater treatment, dairy filtration, and clarification processes that need high flow rates and low-pressure operation. Demand grows as industries adopt membrane systems to meet tighter discharge norms and reduce reliance on chemical-based treatment. Ultrafiltration expands through rising reuse projects, while nanofiltration gains traction in softening and selective contaminant removal. Reverse osmosis remains key in desalination, supported by advanced thin-film composite membranes and energy-recovery devices used in large municipal plants. Chromatography and ion-exchange support niche high-purity applications.

- For instance, Pall Corporation’s Aria™ hollow-fiber microfiltration modules, which have a nominal pore size of 0.1 µm, are used in water treatment systems where they sustain a turbidity of under 0.1 NTU while achieving high recovery (> 98 %) in dairy clarification applications.

By Application

Environmental applications dominate with nearly 44% share in 2024 as municipalities and industries use membranes for desalination, effluent polishing, and resource recovery. Growth strengthens through strict regulations for water reuse and the push to reduce freshwater dependence in manufacturing clusters. Food and beverages follow with strong adoption in dairy concentration, beverage clarification, and ingredient purification. Healthcare gains steady growth as hospitals, labs, and pharmaceutical plants prefer high-purity filtration for sterile processing, bioprocessing steps, and laboratory workflows that require consistent pathogen-free liquid streams.

- For instance, DuPont supplied 22,000 FilmTec™ reverse-osmosis elements to the Barka desalination plant in Oman, enabling a plant capacity of 281,000 m³/day.

By Material

Polyethersulfone (PES) holds the leading share at roughly 27% in 2024 due to strong chemical resistance, thermal stability, and high flux performance used across water treatment, bioprocessing, and food filtration. Demand rises as PES supports sterilizable and long-life modules. Polysulfone (PS) follows with broad use in wastewater recycling and biotechnology. PVDF grows through strong demand in industrial effluent treatment and membrane bioreactors. PTFE and PAN serve niche high-temperature and solvent-resistant needs, while nylon, PP, PVC, and cellulose-based membranes address low-cost filtration and pre-treatment steps across utilities and manufacturing.

Key Growth Drivers

Rising Demand for Clean Water and Wastewater Reuse

Global water scarcity and strict discharge regulations push industries and municipalities toward advanced membrane systems. Governments promote large-scale desalination, reuse, and zero-liquid-discharge projects, which increases adoption of microfiltration, ultrafiltration, and reverse osmosis units. Industrial clusters in chemicals, textiles, power, and pharmaceuticals rely on membranes to cut freshwater intake and meet strong compliance norms. Growing urban populations also expand municipal treatment load, driving investment in high-efficiency membranes with longer service life and lower fouling rates. These factors create sustained demand and establish membrane technologies as essential tools in long-term water security strategies.

- For instance, in Tamil Nadu’s textile manufacturing zone, ZLD is now mandated, driving factories to install RO-based treatment systems to recycle over 90% of their effluent.

Expansion of Food, Beverage, and Bioprocessing Industries

Membrane filtration supports concentration, clarification, sterilization, and molecular separation steps in dairy, beverages, biotechnology, and pharmaceuticals. Rising global consumption of processed foods, ready-to-drink beverages, and high-purity ingredients boosts adoption of ultrafiltration and nanofiltration modules. Bioprocessing growth, fueled by vaccines, biologics, and advanced therapeutics, increases demand for sterile, low-shedding PES and PVDF membranes. Companies shift from thermal or chemical separation to membrane-based operations to improve yield, reduce energy use, and maintain product quality. This broad industrial expansion drives consistent membrane investments across production facilities worldwide.

- For instance, GEA’s cross-flow ultrafiltration units used in plant-based protein production concentrate soy proteins via diafiltration, achieving a protein-rich liquid retentate which is then further dewatered (e.g., via evaporation or reverse osmosis) and dried to produce a final product with over 90% protein content (dry basis).

Technological Advancements in High-Performance Membranes

Improved materials, advanced thin-film composites, and enhanced module designs strengthen efficiency and reduce operational cost. Anti-fouling coatings, graphene-enhanced layers, and low-pressure high-flux membranes increase productivity in desalination and industrial recycling. Manufacturers introduce smart modules integrated with real-time monitoring, automated cleaning cycles, and predictive maintenance tools that extend membrane life. Energy-recovery devices and optimized hydraulics further improve system economics. These innovations encourage wider adoption in regions where high operating cost previously restricted membrane deployment, making advanced separation technologies viable across municipal and industrial applications.

Key Trend & Opportunity

Growth of Decentralized and Modular Treatment Systems

Industries and residential communities adopt compact membrane systems for on-site treatment and reuse. Modular ultrafiltration and reverse osmosis units enable flexible installation and faster commissioning, which supports small towns, remote sites, and industrial plants seeking quick water-quality upgrades. Rising interest in circular water management creates demand for decentralized reuse units that lower freshwater dependence and reduce transport costs. Equipment manufacturers explore containerized membrane units, solar-powered systems, and plug-and-play plants to address space constraints and cost barriers, creating strong growth opportunities in developing markets.

- For instance, in South Africa, the Witsand Solar Desalination Plant delivers 100,000 liters/day of potable water using a solar-powered RO system, demonstrating how renewable-powered modular units can serve remote communities.

Increasing Use of Membranes in Resource Recovery Applications

Companies use membranes to recover valuable materials such as nutrients, solvents, metals, and high-purity chemicals from waste streams. Regulatory pressure to cut landfill waste and improve sustainability accelerates adoption of nanofiltration and ion-exchange systems for selective separation. Food processors recover proteins and sugars, while chemical and mining industries extract reusable solvents and metals. Circular-economy strategies push industries to upgrade existing treatment units with membrane-based recovery modules. This shift from waste treatment to resource extraction creates new revenue opportunities and strengthens long-term demand for advanced membranes.

- For instance, GEA’s whey-processing ultrafiltration lines recover whey proteins at concentrations up to 24% total solids, allowing cheese manufacturers to convert waste whey into protein powders with high yield.

Integration of Digital Monitoring and Predictive Maintenance

Membrane plants adopt IoT-based sensors, cloud monitoring, and AI-supported diagnostics to improve performance. Real-time tracking of pressure, turbidity, fouling rates, and cleaning cycles helps operators reduce downtime and extend membrane life. Predictive algorithms enable early detection of failure patterns, improving operational continuity in municipal and industrial systems. Digital twins and automated control panels reduce operator workload and optimize energy use. This digital shift creates strong opportunities for membrane manufacturers to pair physical systems with software-based services, enhancing both performance and revenue stability.

Key Challenge

Membrane Fouling and High Maintenance Requirements

Fouling from organic matter, colloids, microbes, and scaling agents reduces flux, increases pressure, and raises energy cost. Many industrial plants struggle with frequent cleaning cycles, chemical consumption, and performance loss over time. Although anti-fouling coatings and improved hydrophilic materials help, long-term fouling remains a major operational barrier. Plants with variable feedwater quality face higher risk, leading to inconsistent output and downtime. Managing fouling adds significant cost and restricts adoption in regions with limited technical support or budget constraints. Overcoming this challenge remains critical for broader market penetration.

High Capital and Operational Costs in Advanced Systems

Reverse osmosis, nanofiltration, and high-pressure systems require expensive modules, pumps, and energy-intensive components. Small industries and municipal bodies in developing regions struggle with upfront investment and long-term maintenance budgets. Rising electricity prices further increase operational cost, especially in desalination plants. Replacement of membranes every few years adds recurring expenses. Although innovations reduce cost, many users still perceive membrane plants as financially demanding compared to conventional treatment methods. This cost barrier limits rapid adoption and slows the transition to membrane-based purification across emerging economies.

Regional Analysis

North America

North America leads the Membrane Separation Technologies Market with about 34% share in 2024, driven by large-scale municipal wastewater reuse, strict EPA discharge standards, and strong investment in desalination and industrial recycling. Industries such as pharmaceuticals, chemicals, and food processing rely heavily on ultrafiltration and reverse osmosis to ensure high-purity output. The United States expands adoption through advanced membrane bioreactor installations and strong R&D activity in thin-film composites and low-fouling materials. Canada supports growth with rising demand for decentralized treatment units in remote communities and industrial water-quality compliance requirements.

Europe

Europe holds around 28% share in 2024 due to stringent wastewater regulations under the EU Water Framework Directive and increasing focus on circular water strategies. Germany, France, and the U.K. lead adoption in industrial wastewater recycling, while Southern Europe expands desalination capacity for drought-affected regions. Food and beverage producers use ultrafiltration and nanofiltration to meet hygiene and quality norms. Strong innovation in polymeric and ceramic membranes, supported by research institutions and sustainability goals, strengthens Europe’s transition toward low-energy and high-recovery separation systems across municipal and industrial sectors.

Asia-Pacific

Asia-Pacific accounts for roughly 31% share in 2024 and remains the fastest-growing region due to rising urbanization, industrialization, and water scarcity. China and India expand investments in desalination, zero-liquid-discharge plants, and effluent treatment for chemicals, textiles, and power generation. Japan and South Korea adopt advanced membranes for bioprocessing and high-purity electronics applications. Government programs supporting industrial reuse and stricter compliance norms accelerate uptake of reverse osmosis, ultrafiltration, and membrane bioreactors. Growing food and beverage processing and rising pharmaceutical output further strengthen regional membrane consumption.

Latin America

Latin America holds about 4% share in 2024, supported by increasing adoption of membrane systems in mining, food processing, and municipal treatment. Chile and Peru invest in desalination to support copper mining, while Brazil upgrades wastewater systems in metropolitan areas. Industrial plants adopt ultrafiltration and nanofiltration to meet tightening environmental regulations and reduce freshwater dependence. Growing interest in decentralized membrane units for rural and agricultural regions supports gradual market expansion. Limited technical expertise and budget constraints slow adoption, but long-term demand strengthens with rising sustainability goals.

Middle East & Africa

The Middle East & Africa region captures nearly 3% share in 2024, but demand remains strong due to heavy reliance on desalination to address chronic water scarcity. Gulf countries expand large-scale reverse osmosis projects and upgrade older thermal plants with membrane systems to cut energy use. Industrial zones adopt ultrafiltration and nanofiltration for process water recycling, while Africa sees gradual uptake in urban wastewater treatment. Investments in solar-powered desalination, pre-treatment membranes, and high-recovery systems support long-term growth, although limited funding and operational challenges restrict rapid scale-up.

Market Segmentations:

By Technology

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

- Chromatography

- Ion Exchange

By Application

- Environmental

- Food & Beverages

- Healthcare

By Material

- Polyethersulfone (PES)

- Polysulfone (PS)

- Cellulose-based

- Nylon

- Polypropylene (PP)

- Polyvinylidene Fluoride (PVDF)

- Polytetrafluoroethylene (PTFE)

- Polyacrylonitrile (PAN)

- Polyvinyl Chloride (PVC)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Membrane Separation Technologies Market features a mix of global filtration leaders and specialized membrane manufacturers that focus on advanced materials, high-flux designs, and improved system reliability. Companies such as TriSep Corporation (Microdun-Nadir US, Inc.), Amazon Filters Ltd, Merck Millipore, Pall Corporation, 3M, Advantec MFS, Inc., Novasep, GE Healthcare, Sartorius AG, and Koch Membrane Systems Inc. strengthen their positions through product innovation, expanded production capacity, and strong partnerships across water treatment, bioprocessing, and food industries. Manufacturers invest heavily in low-fouling membranes, thin-film composites, ceramic modules, and digitally monitored filtration systems to improve efficiency and reduce operating costs. Many players also integrate smart diagnostics, automated cleaning systems, and energy-saving components to support high-demand municipal and industrial installations. Strategic mergers, global distribution networks, and OEM collaborations further enhance competitiveness, while rising demand for sustainable, high-recovery filtration systems intensifies innovation across all major players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TriSep Corporation (Microdun-Nadir US, Inc.)

- Amazon Filters Ltd

- Merck Millipore (Merck KGaA)

- Pall Corporation

- 3M

- Advantec MFS, Inc.

- Novasep

- GE Healthcare

- Sartorius AG

- Koch Membrane Systems Inc.

Recent Developments

- In September 2025, Merck Millipore (Merck KGaA) opened a new climate-neutral filter manufacturing facility in Blarney, Ireland, expanding global capacity for critical membrane-based filtration devices used in vaccines, monoclonal antibodies, and emerging cell and gene therapy processes.

-

In December 2024, Amazon Filters Ltd launched the SupaPore TMB high-temperature PTFE membrane vent filter, designed for sterile air and gas venting in pharmaceutical and biotech applications such as WFI tank vents and fermentation air inlets under continuous hot conditions.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as industries increase investment in wastewater reuse and high-purity processing.

- Advanced low-fouling and high-flux membranes will gain wider adoption across municipal and industrial plants.

- Reverse osmosis and ultrafiltration systems will see strong growth due to rising desalination and recycling needs.

- Digital monitoring and predictive maintenance tools will become standard features in new membrane installations.

- Emerging economies will accelerate adoption through stricter environmental policies and industrial compliance norms.

- Food, beverage, and bioprocessing sectors will drive strong demand for sterile and high-performance membranes.

- Resource-recovery applications will rise as companies target nutrient, metal, and solvent recovery from waste streams.

- Energy-efficient membrane systems will replace older high-pressure units to reduce operational cost.

- Modular and decentralized membrane units will expand in rural, small-city, and industrial cluster applications.

- Collaboration among material innovators, OEMs, and digital-solution providers will strengthen technological upgrades.