Market Overview

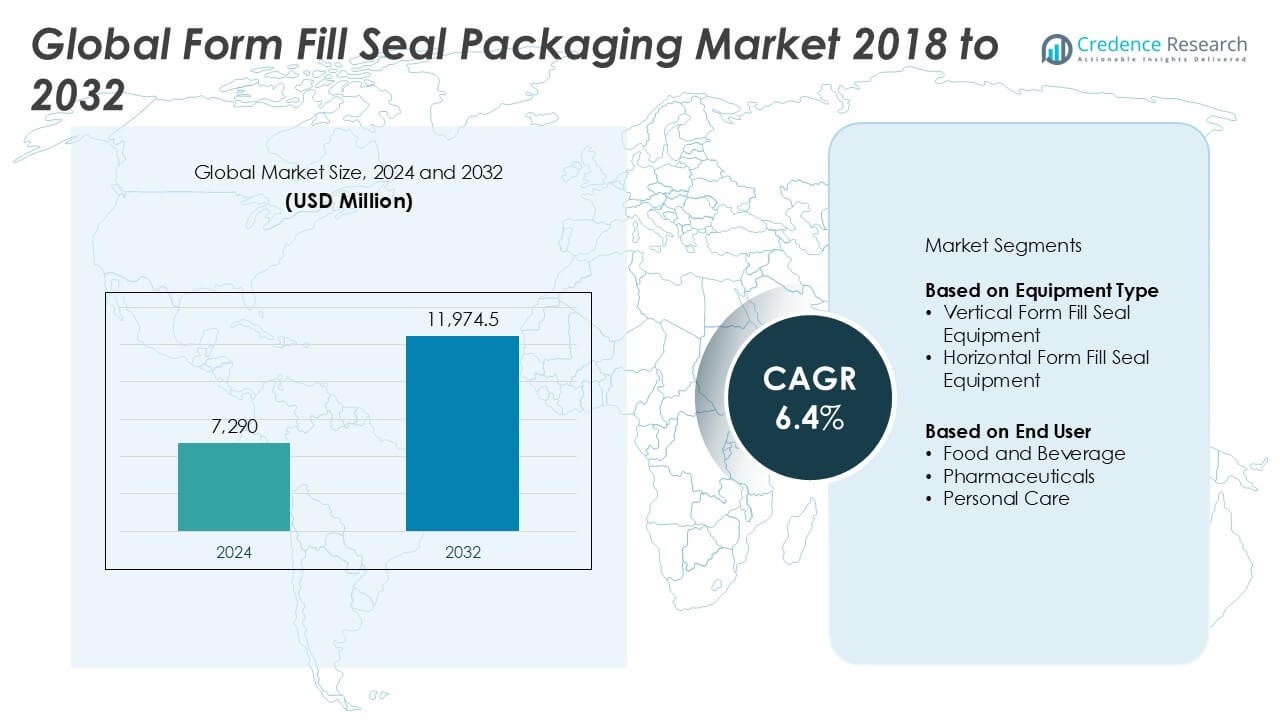

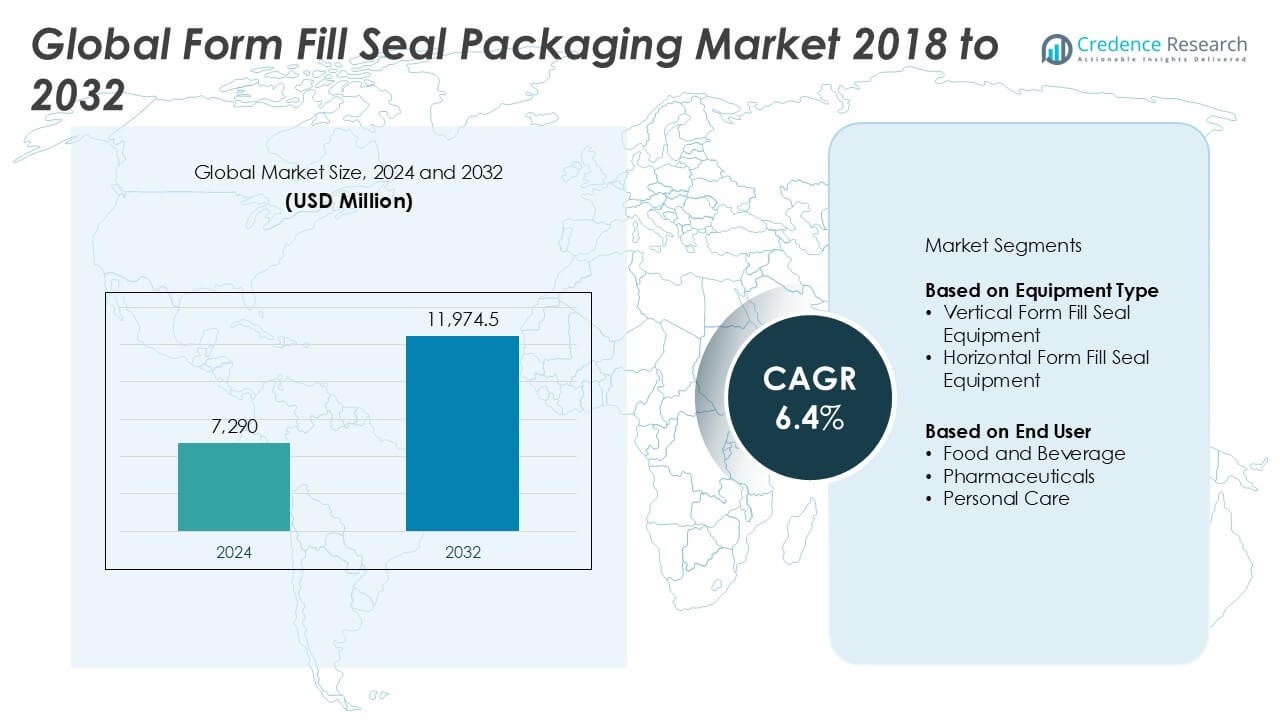

The Form Fill Seal Packaging market size was valued at USD 7,290 million in 2024 and is anticipated to reach USD 11,974.5 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Form Fill Seal Packaging Market Size 2024 |

USD 7,290 Million |

| Form Fill Seal Packaging Market, CAGR |

6.4% |

| Form Fill Seal Packaging Market Size 2032 |

USD 11,974.5 Million |

Top players in the Form Fill Seal Packaging market include Rovema GmbH, Syntegon Technology, Multivac, Ishida Co., Ltd., and IMA Group. These companies lead the industry with strong technological capabilities, global distribution networks, and broad product portfolios that cater to food, pharmaceutical, and personal care sectors. They focus on automation, energy efficiency, and sustainable packaging solutions to maintain competitive advantage. Asia Pacific emerges as the leading region, commanding approximately 35% of the global market share in 2024, driven by high demand for packaged goods, rapid industrialization, and expanding middle-class populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Form Fill Seal Packaging market was valued at USD 7,290 million in 2024 and is expected to reach USD 11,974.5 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- Rising demand for packaged and processed foods, especially in urban areas, along with growth in the pharmaceutical sector, is driving the adoption of efficient, automated FFS packaging systems.

- Key trends include the shift toward sustainable and recyclable packaging materials and the integration of smart technologies for enhanced production efficiency and traceability.

- Major players like Rovema GmbH, Syntegon Technology, Multivac, and Ishida Co., Ltd. are investing in R&D and expanding globally, while smaller companies focus on niche markets and regional strengths.

- Asia Pacific holds the largest regional share at 35%, followed by North America with 28% and Europe with 25%; the food and beverage segment dominates the end-user category due to high consumption of ready-to-eat products.

Market Segmentation Analysis:

By Equipment Type

The Form Fill Seal Packaging market, segmented by equipment type, is dominated by Vertical Form Fill Seal (VFFS) Equipment, which holds the largest market share in 2024. This dominance is attributed to its compact design, faster production capabilities, and lower operational costs, making it ideal for packaging granular, powdered, and liquid products in vertical pouches or sachets. The growing demand in food, beverage, and pharmaceutical sectors for efficient, high-speed packaging lines further drives VFFS equipment adoption. In contrast, Horizontal Form Fill Seal (HFFS) Equipment is gaining traction in packaging solid and irregular-shaped products, especially in the personal care and snack food industries.

- For instance, Rovema GmbH’s BVC 145 TwinTube vertical machine achieves an output of up to 500 bags per minute, significantly reducing changeover time and increasing production speed.

By End User

Among the end-user segments, the Food and Beverage industry emerges as the dominant segment, accounting for the highest market share in 2024. The demand is primarily fueled by the rising consumption of ready-to-eat meals, packaged snacks, and beverages that require extended shelf life and hygienic packaging. Form Fill Seal packaging solutions provide superior sealing integrity and customizable options, which cater effectively to this industry’s evolving needs. Pharmaceuticals and personal care follow, driven by increasing healthcare awareness and consumer preference for single-use and tamper-evident packaging formats that ensure safety and convenience.

- For instance, Syntegon Technology’s SVE 2520 DZ vertical bagger is widely used in the snack food industry and is capable of packaging up to 200 pillow, gusseted, or block-bottom bags per minute, contributing to high-output, hygienic production environments.

Key Growth Drivers

Rising Demand for Packaged and Processed Foods

The increasing global consumption of packaged and processed foods is a primary driver for the growth of the Form Fill Seal (FFS) Packaging market. Urbanization, changing lifestyles, and a preference for convenient, ready-to-eat products have accelerated demand across developed and emerging economies. FFS packaging offers high-speed, cost-effective solutions suitable for mass production, making it an attractive choice for food manufacturers. The ability to maintain product freshness and extend shelf life further contributes to its widespread adoption in the food and beverage sector.

- For instance, Ishida Co., Ltd. supplied their Inspira bagmaker to a major Asian snack manufacturer, achieving an operational speed of 250 bags per minute while reducing film waste by 25 kilograms per shift.

Advancements in Packaging Automation and Technology

Continuous advancements in packaging technology are fueling market growth by enhancing equipment efficiency, precision, and flexibility. Innovations such as servo-driven systems, intelligent sensors, and automation software enable faster changeovers and reduced downtime. These technologies improve production output and reduce labor dependency, making FFS systems appealing to manufacturers aiming to streamline operations. Additionally, smart packaging features such as QR code integration and real-time monitoring support brand differentiation and product traceability, aligning with evolving consumer expectations and regulatory requirements.

- For instance, ULMA Packaging’s TFS 700 line integrates real-time diagnostics and predictive maintenance alerts, reducing unplanned downtime by 30% across multiple European food production facilities.

Growing Pharmaceutical Industry and Sterile Packaging Needs

The pharmaceutical industry is witnessing significant expansion, particularly in emerging markets, driving demand for sterile, tamper-evident packaging. FFS machines are increasingly adopted due to their ability to maintain hygiene and reduce human contact during the packaging process. The rising prevalence of chronic diseases and increased production of over-the-counter (OTC) drugs and medical supplies further propel demand. Regulatory emphasis on secure and contamination-free packaging reinforces the use of FFS systems, especially in the production of sachets and pouches for tablets, powders, and liquid medications.

Key Trends & Opportunities

Sustainability and Eco-friendly Packaging Solutions

A notable trend shaping the FFS packaging market is the shift toward sustainable and eco-friendly materials. Manufacturers are increasingly adopting biodegradable films, recyclable plastics, and compostable packaging to align with global environmental regulations and consumer expectations. This transition opens new opportunities for suppliers to innovate in material science while maintaining packaging integrity. Additionally, brands that promote sustainability gain competitive advantages, enhancing consumer loyalty and meeting corporate social responsibility goals in a resource-conscious market landscape.

- For instance, Multivac collaborated with film manufacturer Schur Flexibles to introduce recyclable mono-material packaging solutions, which reduced plastic usage by 60 tons annually for one of Germany’s largest dairy producers.

Customization and Digital Printing Capabilities

The rising demand for customized packaging and small batch production is creating new opportunities for FFS solutions with integrated digital printing capabilities. Digital printing allows for quick design changes, brand personalization, and cost-effective short runs, making it ideal for promotional packaging and niche product lines. This trend is especially prominent in food, personal care, and pet care products, where visual appeal and differentiation drive purchase decisions. The flexibility of FFS systems to incorporate such features enhances their value proposition for modern brand strategies.

- For instance, ProMach’s Matrix Morpheus series includes integrated digital printing modules that support variable data printing and reduced lead times by 40%, enabling CPG clients to execute targeted marketing campaigns with shorter time-to-shelf.

Key Challenges

High Initial Investment and Maintenance Costs

One of the primary challenges in the Form Fill Seal Packaging market is the significant capital required for equipment installation and maintenance. Small and medium-sized enterprises often face budget constraints, limiting their ability to adopt advanced automated FFS systems. Additionally, the costs associated with equipment upgrades, skilled operator training, and machine servicing can be substantial, affecting profitability. These financial barriers may slow market penetration in cost-sensitive regions or industries with limited automation maturity.

Material Compatibility and Sustainability Trade-offs

Although sustainability is a growing trend, achieving compatibility between eco-friendly materials and high-speed FFS machines presents challenges. Many biodegradable or recyclable films may not offer the same sealing strength, barrier properties, or machinability as traditional plastics. This discrepancy can lead to operational inefficiencies, increased waste, and product spoilage. Manufacturers must invest in R&D to develop materials that balance environmental responsibility with performance, which may slow the transition toward greener solutions and pose a challenge in complying with both technical and regulatory standards.

Stringent Regulatory Compliance and Quality Standards

Adhering to strict industry regulations and quality standards, particularly in the food and pharmaceutical sectors, presents a significant challenge for FFS packaging manufacturers. Compliance with hygiene, safety, labeling, and traceability requirements necessitates continuous upgrades to machinery and processes. Failure to meet these standards can result in product recalls, legal penalties, or loss of market access. Keeping pace with changing regulatory landscapes across different regions also demands specialized knowledge and resource allocation, complicating operations for global manufacturers.

Regional Analysis

North America

North America holds a substantial share of the Form Fill Seal (FFS) Packaging market, accounting for approximately 28% of the global market in 2024. The region benefits from strong demand in the food and pharmaceutical industries, driven by consumer preference for convenient and hygienic packaging formats. Technological advancements and automation in packaging processes further fuel market growth. The United States leads the regional market due to its well-established manufacturing base, high consumer spending, and stringent regulatory standards that encourage the adoption of tamper-evident and secure packaging, particularly in pharmaceutical applications.

Europe

Europe represents around 25% of the global Form Fill Seal Packaging market, supported by its advanced food processing industry and growing focus on sustainable packaging. Countries such as Germany, France, and the UK are major contributors, with demand driven by packaged food consumption and increasing health awareness. Regulatory frameworks emphasizing recyclable and compostable materials have prompted regional manufacturers to adopt eco-friendly FFS solutions. Additionally, the rise in pharmaceutical production across the region supports market expansion, with automated, hygienic packaging systems gaining traction due to strict EU compliance requirements.

Asia Pacific

Asia Pacific dominates the global Form Fill Seal Packaging market with a market share of approximately 35%, driven by rapid industrialization, expanding middle-class population, and a booming food and beverage sector. Countries like China, India, and Japan are key contributors, offering high-volume production capacities and growing demand for convenient packaged goods. Additionally, increasing pharmaceutical production and rising healthcare spending across emerging economies further boost market growth. The region’s cost-competitive manufacturing environment and growing investments in automation and flexible packaging technologies continue to position Asia Pacific as a critical growth hub.

Latin America

Latin America holds around 7% of the global Form Fill Seal Packaging market, with Brazil and Mexico serving as primary contributors. The region’s market is driven by increased demand for packaged food, expanding retail networks, and rising consumer awareness about hygiene and product safety. While the adoption of automated packaging remains limited compared to more developed regions, there is growing interest among regional manufacturers in upgrading packaging processes to improve efficiency and output. Economic recovery and foreign investment in the food and pharmaceutical sectors are expected to support gradual market growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the global Form Fill Seal Packaging market. The market is gradually expanding, supported by rising demand for packaged food products, pharmaceuticals, and personal care items. The Gulf countries, including the UAE and Saudi Arabia, are witnessing increased investment in manufacturing and automation, which is expected to drive demand for FFS systems. However, limited infrastructure in some parts of Africa and economic volatility pose challenges. Despite this, urbanization and improving consumer purchasing power offer long-term opportunities for market growth in the region.

Market Segmentations:

By Equipment Type

- Vertical Form Fill Seal Equipment

- Horizontal Form Fill Seal Equipment

By End User

- Food and Beverage

- Pharmaceuticals

- Personal Care

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Form Fill Seal (FFS) Packaging market features a moderately consolidated competitive landscape, with several global and regional players competing based on technology, product range, customization, and service capabilities. Leading companies such as Rovema GmbH, Syntegon Technology, Multivac, and Ishida Co., Ltd. dominate the market with advanced automation solutions, extensive distribution networks, and strong brand recognition. These players continually invest in R&D to enhance machine efficiency, accommodate sustainable packaging materials, and integrate digital technologies for real-time monitoring and quality control. Meanwhile, emerging players and specialized manufacturers like WeighPack Systems Inc. and Ossid focus on niche applications and regional expansion to strengthen their presence. Strategic partnerships, acquisitions, and new product launches are common as companies aim to expand their portfolios and enter untapped markets. The growing demand for flexible, eco-friendly, and high-speed packaging solutions is pushing competitors to innovate and offer cost-effective, customizable systems tailored to diverse end-user requirements across food, pharmaceutical, and personal care industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CFT Group

- Ishida Co., Ltd.

- Schubert Group

- JLS Automation

- ULMA Packaging

- ProMach

- Sidel

- Marchesini Group

- Hayssen Flexible Systems

- Rovema GmbH

- WeighPack Systems Inc.

- Multivac

- Syntegon Technology

- 3M

- GEA Group

- Ossid

- KHS Group

- IMA Group

- Cama Group

- PFM Packaging Machinery

Recent Developments

- In November 2024, IMA Life, one of the three pharma divisions of IMA Group and global leader in advanced, aseptic pharmaceutical process and production solutions, announced a strategic partnership with RheaVita, a pioneer in controlled, continuous freeze-drying technology for biopharmaceuticals. This partnership includes a financial investment in RheaVita by IMA Life.

- In October 2024, ProMach announced the acquisition of HMC Products, a prominent manufacturer of horizontal form-fill-seal machines and aftermarket support services. This strategic move aims to enhance ProMach’s packaging solutions by integrating HMC’s expertise in form-fill-seal technology, thereby expanding its capabilities in the packaging industry.

- In November 2023, Formpeel P, a new recyclable thermoforming film from Coveris, was introduced at COMPAMED in Düsseldorf. The most recent addition to Coveris’s line of eco-friendly materials is Formpeel P, which is for medical clients employing form-fill-seal machinery to produce devices in bulk.

- In August 2023, Ahlstrom and The Paper People LLC collaborated to create and introduce a novel and environmentally friendly frozen food packaging solution. This innovative range of packaging is specifically made to replace conventional plastic and films made of fossil fuels for frozen food packing. It is fibre-based and certified recyclable.

- In May 2024, Matrix Packaging Machinery showcased its innovative vertical form-fill-seal machines at Expo Pack Mexico, held from June 4-7, 2024, in Mexico City. Visitors to booth 1702 can explore the MVI-280E, a versatile fill-form-seal machine capable of processing various bag sizes, and the Pacraft TT-8D-N pre-made pouch filler/sealer.

- In February 2023, PC Flexible Packaging LLC, a prominent personalized flexible packaging supplier, purchased StePac, MAPfresh Holdings, located in Tefen, Israel. PPC is leading the way in flexible film conversion, printing, pouches, and other creative package ideas, including prototypes. It is acknowledged as a leader in the cleanroom packaging industry for horticulture, pet care, consumer snacks, speciality produce, organic brands, and medical and healthcare applications.

Market Concentration & Characteristics

The Form Fill Seal Packaging Market demonstrates moderate market concentration, with a mix of well-established global manufacturers and emerging regional players. It is characterized by a strong presence of companies offering integrated, automated solutions that cater to high-volume production needs across food, pharmaceutical, and personal care industries. The market rewards innovation, particularly in sustainability, energy efficiency, and digital integration. Leading firms maintain competitive advantage through technological advancements, global service networks, and diverse product lines. It demands high capital investment, making entry barriers significant for new players. It favors companies that can deliver custom, high-speed packaging solutions with minimal downtime. Demand is consistently high in regions with expanding urban populations and rising packaged food consumption. Sustainability, compliance with strict hygiene regulations, and compatibility with biodegradable materials shape product development. Consolidation through mergers and acquisitions remains a key strategy among dominant firms aiming to expand geographic reach and customer base. It continues to evolve toward higher automation and precision.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Form Fill Seal Packaging market is expected to grow steadily, driven by rising demand for automation in packaging processes.

- Food and beverage will remain the dominant end-use sector due to increased consumption of packaged and ready-to-eat products.

- The pharmaceutical segment is projected to witness strong growth owing to stringent hygiene standards and rising drug production.

- Sustainability initiatives will drive innovation in eco-friendly and recyclable packaging materials compatible with FFS systems.

- Digital integration and smart packaging technologies will enhance operational efficiency and product traceability.

- Asia Pacific will continue to lead the global market due to expanding industrial infrastructure and consumer base.

- Manufacturers will invest more in flexible and multi-functional equipment to meet diverse packaging needs.

- Customized packaging solutions and short production runs will gain traction across niche product categories.

- Ongoing mergers, acquisitions, and strategic partnerships will reshape the competitive landscape.

- Regulatory compliance and cost-efficiency will remain key priorities for packaging equipment suppliers.