Market Overview

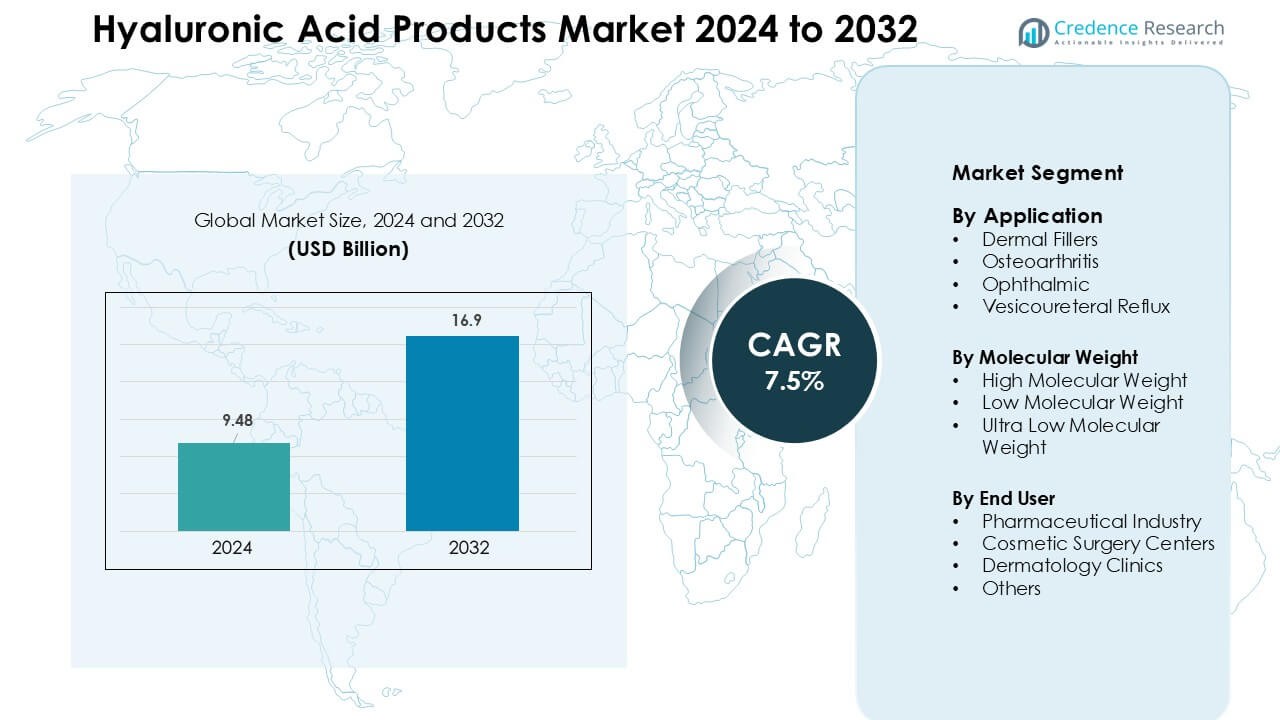

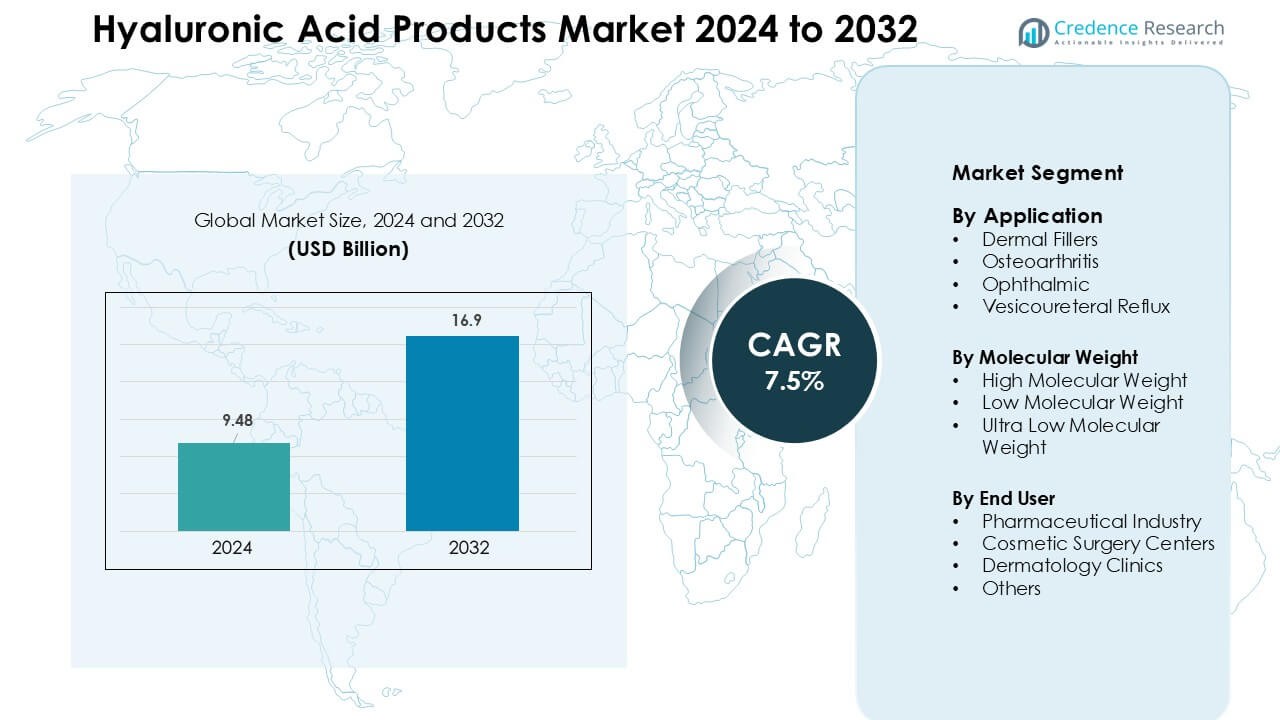

Hyaluronic Acid Products Market was valued at USD 9.48 billion in 2024 and is anticipated to reach USD 16.9 billion by 2032, growing at a CAGR of 7.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyaluronic Acid Products Market Size 2024 |

USD 9.48 Billion |

| Hyaluronic Acid Products Market, CAGR |

7.5 % |

| Hyaluronic Acid Products Market Size 2032 |

USD 16.9 Billion |

The Hyaluronic Acid Products Market is shaped by major companies such as Galderma Laboratories L.P., Zimmer Biomet, Ferring B.V., Genzyme Corporation, Lifecore Biomedical LLC, Sanofi, Smith & Nephew plc, Allergan, Salix Pharmaceuticals, and F. Hoffmann-La Roche AG. These players strengthen the market through advanced dermal fillers, viscosupplementation therapies, ophthalmic viscoelastics, and expanding R&D pipelines. Their strong clinical networks and global distribution support sustained adoption across medical and aesthetic applications. North America remained the leading region in 2024 with 38% share, driven by high procedure volumes, strong consumer spending on aesthetics, and widespread orthopedic and ophthalmic usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hyaluronic Acid Products Market reached USD 9.48 billion in 2024 and is projected to hit USD 16.9 billion by 2032, growing at a 7.5 % CAGR.

- Strong demand for dermal fillers drives market growth, with the Dermal Fillers segment holding about 48% share due to rising aesthetic procedures and wider acceptance of minimally invasive treatments.

- Key trends include adoption of crosslinked, long-lasting HA formulations and growing opportunities in topical skincare, regenerative medicine, and advanced drug-delivery systems.

- Competitive activity intensifies as leading players expand portfolios and enhance clinical partnerships, with companies focusing on product longevity, safety, and global distribution reach.

- North America led the market with 38% share, followed by Europe at 32% and Asia Pacific at 24%, driven by high procedure volumes, strong healthcare access, and rising aesthetic and orthopedic adoption across these regions.

Market Segmentation Analysis:

By Application

Dermal fillers dominated the application segment in 2024 with about 48% share, driven by growing demand for minimally invasive aesthetic treatments and wider acceptance of facial enhancement procedures. Rising adoption among younger consumers, strong influence of social media, and broader availability of premium injectable formulations supported the leadership of dermal fillers. Osteoarthritis applications also expanded as aging populations sought long-acting viscosupplementation options, while ophthalmic uses maintained steady demand due to high surgical volumes. Vesicoureteral reflux treatments remained smaller but benefited from improved pediatric clinical outcomes.

- For instance, in the United States alone, over 5.3 million hyaluronic‑acidbased filler procedures were reported in 2023 including more than 1.58 million lip enhancement treatments underscoring the scale at which leading products (e.g. Juvéderm, Restylane) are being used.

By Molecular Weight

High molecular weight HA held the largest share in 2024 with nearly 52%, supported by strong use in ophthalmic surgery, viscosupplementation, and premium dermal filler formulations. Its higher viscosity, longer retention time, and better mechanical stability made it the preferred choice among medical professionals. Low molecular weight HA grew due to its deeper skin penetration, wider role in topical skincare, and expanding use in regenerative therapies. Ultra-low molecular weight HA gained traction in advanced wound care and targeted drug delivery, though the category remained a smaller contributor compared to high molecular weight products.

- For instance, HMW HA with molecular weights around 1-3 MDa have been shown to form a more viscous gel that remains longer in the joint animal and human-synovial-fluid studies demonstrated that HMW HA sustains joint lubrication and viscoelastic stability compared to lower-MW HA.

By End User

Pharmaceutical companies led the end-user segment in 2024 with approximately 44% share, driven by strong production of injectable HA products for osteoarthritis, ophthalmology, and aesthetic treatments. Their dominance stemmed from large-scale R&D investments, expanded regulatory approvals, and wider commercialization channels. Cosmetic surgery centers grew with rising demand for facial contouring and anti-aging procedures, especially in urban markets. Dermatology clinics retained consistent adoption due to routine filler procedures and skincare treatments. Other end users, including research institutes and wellness centers, contributed smaller shares but supported niche applications and product innovation.

Key Growth Drivers

Rising Demand for Minimally Invasive Aesthetic Procedures

The demand for minimally invasive aesthetic treatments continues to rise as consumers seek faster procedures with shorter recovery times and natural-looking results. Hyaluronic acid products play a central role in facial fillers, volume restoration, lip augmentation, and wrinkle reduction, which strengthens their adoption in cosmetic clinics and surgery centers. Media influence, younger consumer interest, and broader availability of premium filler brands increase procedure volumes each year. Advancements in HA crosslinking and consistency improve product longevity and safety, driving repeat usage. The shift toward preventive aesthetics also expands treatment frequency. Urbanization, rising disposable income, and global acceptance of medical aesthetics support wider uptake across Europe, North America, and Asia. Together, these trends create a strong growth pathway for HA-based dermal fillers.

- For instance, the aesthetic injectables segment encompassing HA fillers remains one of the fastest-growing globally, with rising adoption in Asia-Pacific as urban clinics expand and more consumers seek “quick refresh” procedures.

Expanding Use of HA in Osteoarthritis and Orthopedic Treatments

The growing prevalence of osteoarthritis, driven by aging populations and lifestyle factors, boosts the demand for HA-based viscosupplementation therapies. These products help reduce joint pain, improve mobility, and delay surgical intervention, making them a preferred option among patients seeking non-surgical relief. Physicians increasingly recommend HA injections because they deliver longer-lasting lubrication and cushioning in knee and hip joints. Clinical evidence supporting improved patient outcomes strengthens confidence in these formulations. New multi-injection and single-injection regimens enhance adherence and expand accessibility across orthopedic centers. Rising healthcare expenditure and the global shift toward non-opioid pain management further boost adoption. This expansion enhances the role of HA across broader therapeutic applications.

- For instance, according to a 2024 meta-analysis, patients receiving intra-articular HA experienced statistically greater reductions in pain (per VAS scores) compared to placebo, with benefits lasting through 6 months post-injection.

Growing Adoption of HA in Ophthalmic and Advanced Medical Applications

Hyaluronic acid products continue to gain traction in ophthalmic surgeries, including cataract, corneal, and vitreoretinal procedures, due to their superior viscoelastic properties. Surgeons rely on HA-based viscoelastics to protect ocular tissues and maintain space during operations. Growth in surgical procedures, technological improvements in viscoelastic formulations, and expanding access to eye care in developing regions strengthen market demand. Beyond ophthalmology, HA is increasingly used in wound care, drug delivery, tissue engineering, and regenerative medicine due to biocompatibility and moisture-retention capabilities. These emerging medical applications attract strong R&D investments and new product approvals, broadening the clinical footprint of HA products across global healthcare systems.

Key Trends & Opportunities

Shift Toward Crosslinked and Long-Lasting HA Formulations

A major trend shaping the market is the shift toward advanced crosslinked HA formulations that provide longer durability, improved lifting capacity, and greater stability. These innovations help reduce the frequency of repeat injections and enhance patient satisfaction in aesthetic procedures. Manufacturers invest in technologies that optimize particle size, cohesiveness, and rheology to achieve natural outcomes and precise application. The opportunity here lies in premiumization, as clinics increasingly prefer high-performance fillers with tailored characteristics for lips, cheeks, jawlines, and fine-line correction. Growth in digital consultations and influencer-driven beauty trends further expands demand for differentiated HA filler portfolios across markets.

- For instance, studies comparing injectable dermal fillers showed that viscoelastic and rheological properties such as gel elasticity, cohesivity, and viscosity vary widely across crosslinked HA (XL-HA) fillers, with some products exhibiting up to nearly a 20-fold difference in complex viscosity (|η*|) and a 10-fold difference in rigidity modulus (|G*|) between lower- and higher-performance gels.

Expansion of Non-Invasive Skincare and Topical HA Applications

The global shift toward non-invasive skincare fuels strong interest in topical HA products such as serums, creams, and masks. Consumers look for hydration-focused formulations that enhance skin plumpness, elasticity, and barrier strength. Low and ultra-low molecular weight HA offer deep absorption benefits, creating opportunities for advanced multi-layer hydration systems. Skincare brands use HA as a hero ingredient due to strong consumer trust and proven cosmetic efficacy. Growing e-commerce penetration, rising male grooming trends, and the surge in dermatology-led skincare lines widen the market base. This trend allows companies to diversify product offerings beyond injectables and enter high-growth beauty retail channels.

- For instance, a controlled study showed that using a topical HA serum increased skin hydration (measured by corneometry) by about 55% over 6 weeks, demonstrating a marked boost in skin moisture and plumpness.

Opportunities in Regenerative Medicine and Novel Drug Delivery Systems

Hyaluronic acid’s biocompatibility and biodegradability create strong opportunities in regenerative medicine, where it supports tissue repair, cell migration, and healing processes. Researchers increasingly explore HA-based scaffolds, hydrogels, and nanoparticles for controlled drug delivery, cancer therapy, and chronic wound management. These innovations attract collaboration between biotech firms and medical research institutions. Regulatory support for advanced biologics and rising investment in personalized medicine further boost the development pipeline. This trend positions HA as a foundational biomaterial in next-generation medical solutions, expanding its role far beyond traditional aesthetic and orthopedic uses.

Key Challenges

Concerns Related to Product Safety, Quality, and Counterfeit HA Fillers

Ensuring product safety and maintaining strict quality standards remain major challenges, especially in regions where counterfeit or unregulated HA fillers circulate. Substandard formulations can lead to complications such as swelling, vascular occlusion, or infection. These risks increase consumer hesitation and place pressure on clinics to procure verified products. Regulatory agencies enforce strict guidelines, but uneven enforcement across markets allows gray-market products to persist. Manufacturers must invest in authentication, traceability, and clinician training to maintain trust. Rising awareness of safety concerns also pushes customers to seek certified providers, but it limits rapid market penetration in emerging economies.

High Treatment Costs and Limited Reimbursement in Medical Applications

Hyaluronic acid injections for aesthetic use and viscosupplementation often involve high out-of-pocket costs for patients due to limited insurance coverage. This creates affordability barriers, especially in price-sensitive regions. While demand remains strong in premium urban markets, many patients delay or avoid treatment due to cost. In osteoarthritis care, reimbursement varies widely across countries, creating inconsistent access to HA injections. Hospitals and clinics also face procurement challenges as prices fluctuate based on molecular weight, formulation type, and brand. These cost-related hurdles slow adoption in both aesthetic and medical segments, despite proven clinical benefits.

Regional Analysis

North America

North America led the Hyaluronic Acid Products Market in 2024 with about 38% share, driven by high demand for dermal fillers, viscosupplementation therapies, and ophthalmic viscoelastics. Strong presence of established aesthetic brands, advanced dermatology clinics, and high surgical volumes support regional dominance. The U.S. benefits from strong consumer spending on cosmetic treatments and robust orthopedic adoption for osteoarthritis management. Growing preference for long-lasting fillers and premium HA formulations strengthens market value. Rising focus on non-opioid pain relief and steady R&D investments also widen the therapeutic footprint of HA across medical and aesthetic applications.

Europe

Europe accounted for nearly 32% share in 2024, supported by strong aesthetic procedure adoption across Germany, France, Italy, and the U.K. High demand for HA-based dermal fillers, coupled with widespread use of viscosupplementation in osteoarthritis care, drives regional growth. Cosmetic treatment acceptance is high due to cultural preference for subtle enhancements and strong regulatory oversight ensuring product quality. Ophthalmic surgeries involving HA viscoelastics also contribute significantly. Expanding aging populations and growing investment in regenerative medicine strengthen HA product usage. Increasing clinical trials and new CE-approved formulations keep Europe a leading innovation hub.

Asia Pacific

Asia Pacific captured around 24% share in 2024 and remains the fastest-growing region due to rising cosmetic procedure volumes in China, South Korea, Japan, and India. The region benefits from a large millennial and Gen-Z customer base seeking non-surgical facial enhancement and hydration-based skincare. Strong medical tourism in South Korea and Thailand boosts HA filler procedures. Expanding orthopedic care access and ophthalmic surgery growth further enhance demand. Local production of HA raw materials and competitively priced fillers increases market penetration. Rapid urbanization and growing disposable income continue to strengthen long-term adoption across both aesthetic and medical segments.

Latin America

Latin America held about 4% share in 2024, supported by growing demand for aesthetic injectables in Brazil, Mexico, and Argentina. Strong beauty-driven culture and expanding private dermatology clinics encourage HA filler usage. Rising interest in non-invasive cosmetic procedures and increasing social media influence promote steady growth. Access to viscosupplementation for osteoarthritis is improving, though coverage varies by country. Ophthalmic HA applications also gain traction with expanding surgical capacities. Despite economic fluctuations, competitive pricing and growing medical tourism help the region maintain stable adoption. Continued urbanization and wider availability of certified injectors support market expansion.

Middle East & Africa

The Middle East & Africa region accounted for roughly 2% share in 2024, with growth led by the UAE, Saudi Arabia, and South Africa. Rising cosmetic treatment demand, increasing clinic investments, and expanding premium skincare adoption support regional progress. Medical tourism hubs such as Dubai enhance HA filler usage due to advanced aesthetic facilities. Orthopedic and ophthalmic applications grow gradually with improving healthcare infrastructure. However, limited reimbursement and uneven access slow broader adoption. Despite challenges, rising disposable income and stronger aesthetic awareness continue to push HA product penetration across key urban centers.

Market Segmentations:

By Application

- Dermal Fillers

- Osteoarthritis

- Ophthalmic

- Vesicoureteral Reflux

By Molecular Weight

- High Molecular Weight

- Low Molecular Weight

- Ultra Low Molecular Weight

By End User

- Pharmaceutical Industry

- Cosmetic Surgery Centers

- Dermatology Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hyaluronic Acid Products Market features strong competition from established medical and aesthetic manufacturers that offer diversified HA-based portfolios across dermal fillers, viscosupplements, viscoelastics, and topical formulations. Leading companies such as Galderma Laboratories L.P., Zimmer Biomet, Ferring B.V., Genzyme Corporation, Lifecore Biomedical LLC, Sanofi, Smith & Nephew plc, Allergan, Salix Pharmaceuticals, and F. Hoffmann-La Roche AG drive market strength through broad clinical usage and global distribution networks. These firms invest heavily in product innovation, focusing on crosslinked fillers, long-lasting formulations, improved viscoelastic properties, and safer injection technologies. Strategic moves include partnerships with dermatology clinics, regulatory approvals for new indications, and expansion into regenerative medicine and drug delivery systems. Competition remains intense as companies enhance manufacturing capabilities, pursue biologic-based formulations, and target fast-growing regions in Asia and Latin America. This competitive environment drives continuous improvement in product quality and treatment outcomes across aesthetic and medical applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Galderma Laboratories L.P.

- Zimmer Biomet

- Ferring B.V.

- Genzyme Corporation

- Lifecore Biomedical, LLC

- Sanofi

- Smith & Nephew plc

- Allergan

- Salix Pharmaceuticals

- F. Hoffmann-La Roche AG

Recent Developments

- In September 2025, Allergan Aesthetics (AbbVie) launched the Naturally You with Injectable Hyaluronic Acid Fillers campaign to educate consumers, counter misinformation, and promote safe, natural-looking outcomes from its HA filler portfolio.

- In January 2025, Galderma Laboratories L.P. Presented new clinical data on recently launched Restylane SHAYPE™ and Relfydess® at IMCAS 2025, reinforcing category leadership in HA injectables.

Report Coverage

The research report offers an in-depth analysis based on Application, Molecular Weight, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive aesthetic procedures will continue to rise worldwide.

- Adoption of advanced crosslinked HA fillers will expand due to longer-lasting results.

- Osteoarthritis viscosupplementation use will grow as aging populations increase.

- Ophthalmic surgeries will drive strong demand for high-viscosity HA viscoelastics.

- Topical HA skincare products will see higher adoption through e-commerce growth.

- Regenerative medicine applications will accelerate with new HA-based biomaterials.

- Emerging markets will gain stronger access to premium HA fillers and injectables.

- Clinical innovation will advance with next-generation HA formulations for targeted delivery.

- Regulatory approvals will increase for broader therapeutic indications in orthopedics and ophthalmology.

- Competition will intensify as global manufacturers expand portfolios and strengthen distribution networks.