Market Overview:

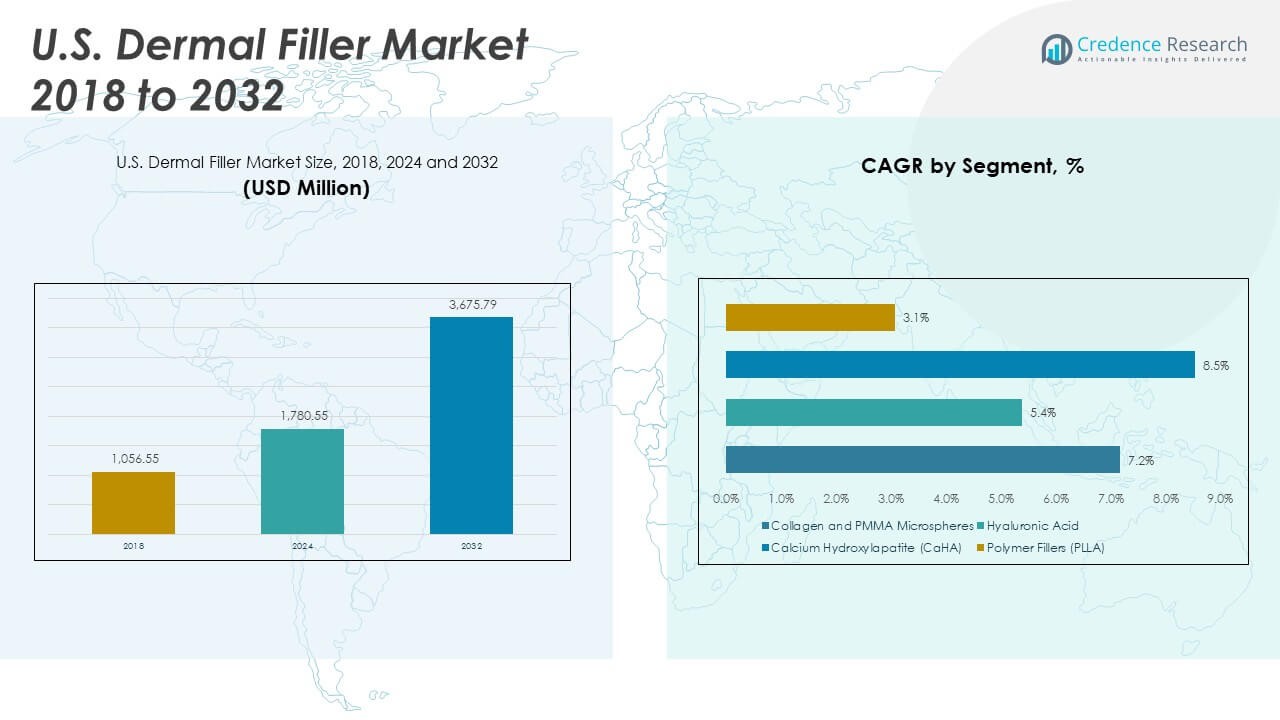

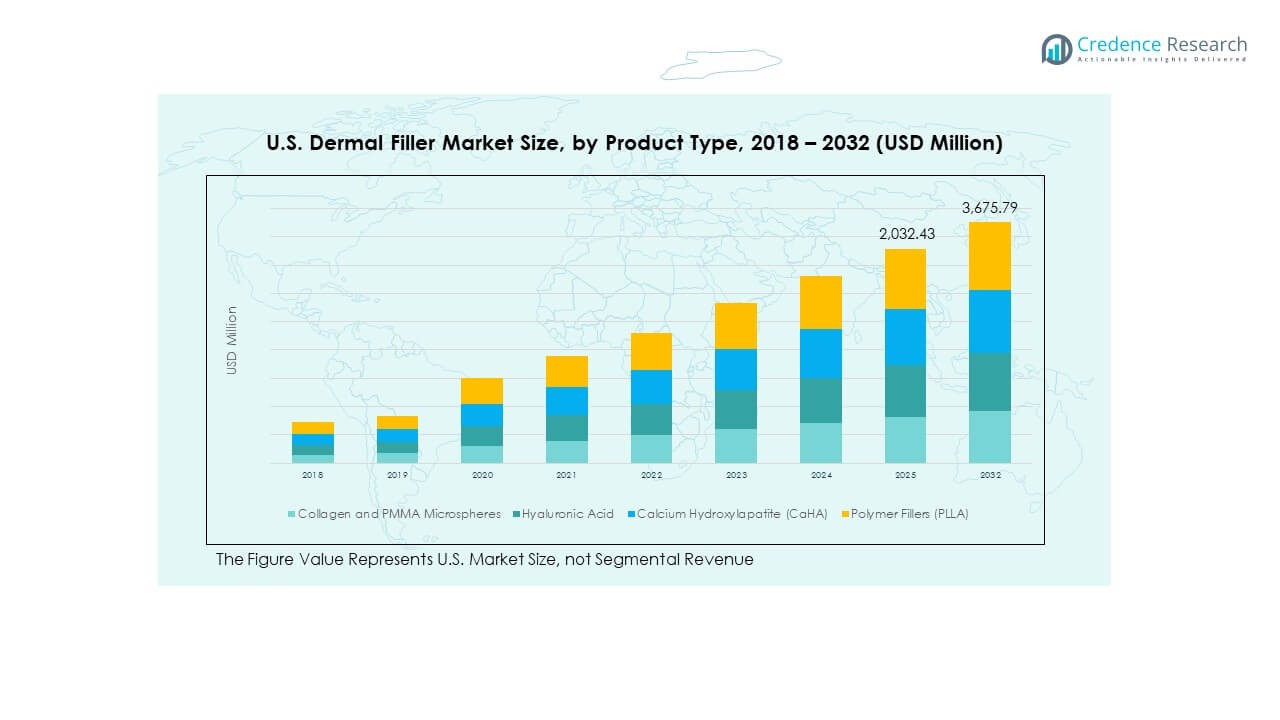

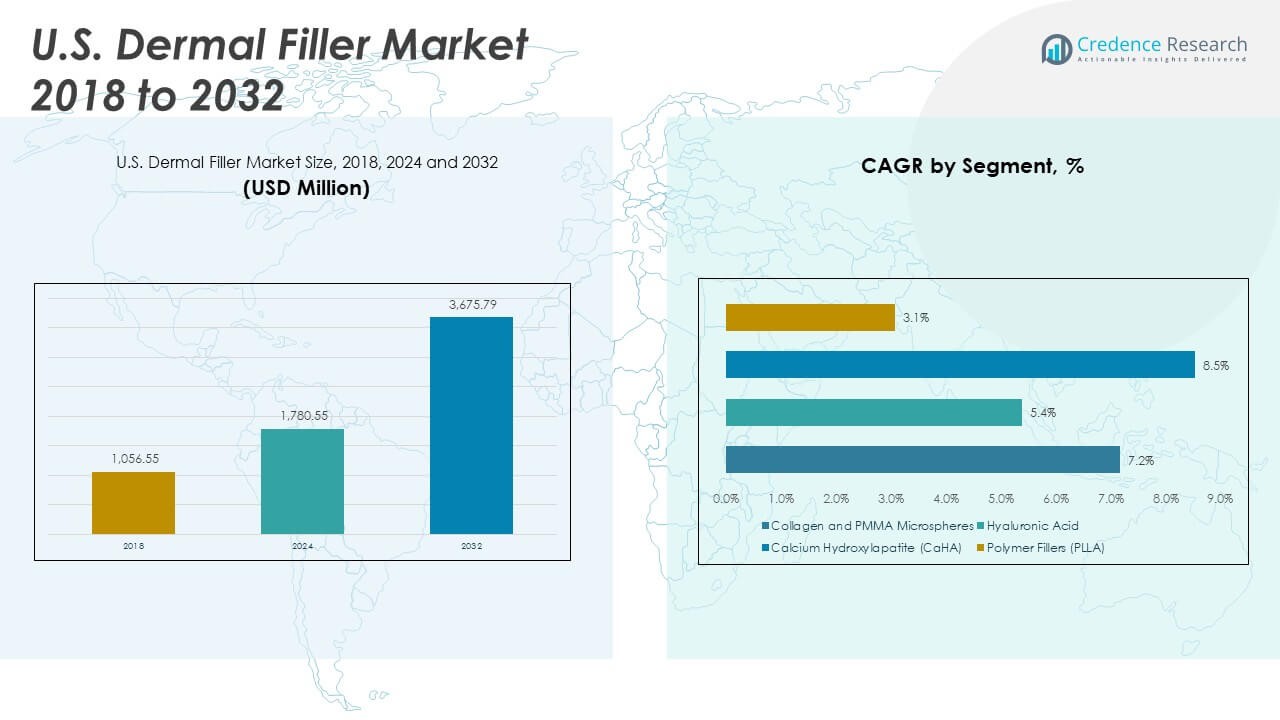

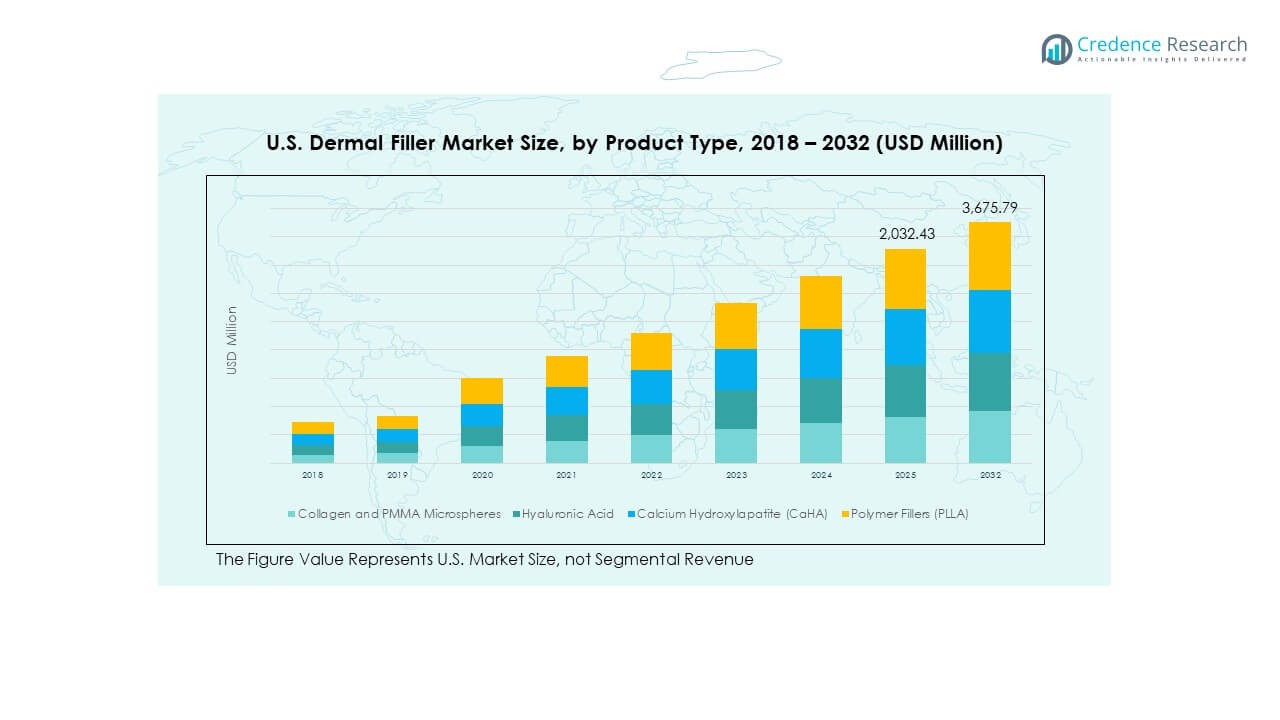

The U.S. Dermal Filler Market size was valued at USD 1,056.55 million in 2018 to USD 1,780.55 million in 2024 and is anticipated to reach USD 3,675.79 million by 2032, at a CAGR of 8.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Dermal Filler Market Size 2024 |

USD 1,780.55 Million |

| U.S. Dermal Filler Market, CAGR |

8.83% |

| U.S. Dermal Filler Market Size 2032 |

USD 3,675.79 Million |

The market experiences significant growth due to rising consumer demand for minimally invasive aesthetic treatments. An aging population, increasing awareness of facial rejuvenation, and social media influence drive the popularity of dermal fillers. Technological innovations and the introduction of advanced filler formulations enhance safety, longevity, and results, making procedures more appealing. Growing numbers of certified professionals and expanding medspa chains also contribute to wider access and increased adoption, while regulatory support ensures quality and safety compliance.

Regionally, the U.S. leads the dermal filler market due to high disposable income, aesthetic consciousness, and established cosmetic infrastructure. Urban areas such as California, New York, and Florida represent major hubs due to the presence of dermatology clinics, aesthetic professionals, and high demand. Emerging markets include midwestern and southern states where awareness and access are increasing. The expansion of online platforms and teleconsultations helps dermatologists reach broader demographics, further strengthening geographic penetration across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Dermal Filler Market was valued at USD 1,056.55 million in 2018, reached USD 1,780.55 million in 2024, and is projected to hit USD 3,675.79 million by 2032, growing at a CAGR of 8.83%.

- Rising demand for non-invasive cosmetic treatments continues to drive market growth across younger and aging populations.

- An increase in certified dermatology clinics and trained injectors boosts service availability and patient trust.

- Technological advancements in filler formulations enhance durability, safety, and natural appearance.

- Safety concerns, misinformation, and risks of side effects deter some potential first-time users.

- The market shows strong performance in states like California, New York, and Florida due to high aesthetic awareness.

- Growth opportunities exist in emerging regions and underserved urban areas supported by digital consultation platforms.

Market Drivers:

Strong Consumer Demand for Minimally Invasive Aesthetic Procedures Fuels Market Expansion:

The U.S. Dermal Filler Market continues to expand with growing consumer preference for non-surgical aesthetic procedures. Consumers seek quicker results with minimal recovery time, making dermal fillers an ideal solution. Clinics and medspas report rising patient volumes, particularly for facial rejuvenation treatments. Increasing awareness and education about aesthetic enhancements boost demand among younger demographics. Social media influences appearance-related expectations, encouraging cosmetic intervention. Busy lifestyles drive the preference for treatments that offer instant results without downtime. The accessibility of skilled practitioners also supports adoption. The market gains momentum as aesthetic standards evolve across diverse age groups.

- For instance, Allergan Aesthetics reported that over 16 million treatments were conducted globally with their JUVÉDERM® family of fillers between 2018 and 2023, reflecting a tangible surge in consumer utilization of minimally invasive options.

Aging U.S. Population Drives Demand for Anti-Aging Cosmetic Solutions:

An aging population base creates sustained demand for cosmetic procedures targeting wrinkles and volume loss. The U.S. Dermal Filler Market benefits from growing interest among individuals aged 40 and above. Consumers aim to maintain a youthful appearance without undergoing invasive surgery. Hyaluronic acid-based fillers address signs of aging effectively, making them a preferred option. Increased life expectancy influences prolonged focus on appearance enhancement. Medical professionals promote early adoption of injectables to delay more extensive interventions. The aging workforce also contributes to market growth by prioritizing appearance in professional settings. This demographic shift fuels recurring treatments, strengthening market growth.

- For instance, Galderma’s Restylane® product line exceeded 30 million treatments globally by 2023, with a majority of U.S. patients in the 40+ age group, underscoring the robust demand among mature consumers.

Advancements in Filler Formulations and Injection Techniques Boost Acceptance:

Product innovation strengthens market competitiveness and increases patient satisfaction. The U.S. Dermal Filler Market gains from the introduction of next-generation fillers with enhanced duration and texture. Manufacturers develop formulations that mimic natural tissue, improving safety and aesthetic results. Lidocaine-integrated fillers reduce discomfort, making procedures more tolerable. Technological advances in micro-cannulas and delivery systems improve precision. Clinics promote personalized treatments tailored to facial anatomy and skin types. Innovation fosters physician confidence and repeat patient engagement. These advances elevate procedural outcomes and encourage first-time users. The market thrives on innovation aligned with user safety and effectiveness.

Expanding Network of Certified Professionals and Clinics Enhances Accessibility:

Growth in the number of certified dermatologists and aesthetic clinics enhances service availability. The U.S. Dermal Filler Market benefits from easier access to trained injectors across both urban and suburban regions. Professional training programs and certifications ensure consistent standards. A growing number of medspa chains and dermatology clinics cater to diverse income segments. Providers offer competitive pricing and installment plans to attract broader consumer groups. Familiarity with treatment protocols builds patient trust and satisfaction. The expansion of aesthetic practices improves reach into untapped regions. This widespread accessibility accelerates market penetration and fosters regular procedures.

Market Trends:

Integration of Artificial Intelligence and Imaging Tools Enhances Precision and Planning:

AI-driven facial mapping tools assist professionals in designing treatment plans with enhanced accuracy. The U.S. Dermal Filler Market adopts digital technologies to improve injection precision. Real-time imaging enables symmetrical correction and volume distribution. Clinics use software to simulate post-treatment results during consultations. AI platforms assist in dosage optimization and risk mitigation. Digital tools also support patient education by providing 3D visualizations. This trend fosters a data-driven approach to aesthetics. Adoption of these technologies aligns with patient expectations for tailored and accurate results.

Growing Popularity of Preventive Aesthetics Among Younger Demographics:

Millennials and Gen Z increasingly adopt dermal fillers for prevention rather than correction. The U.S. Dermal Filler Market observes a shift toward early aesthetic intervention. Younger individuals pursue injectables to delay visible signs of aging. Social media influencers normalize cosmetic enhancements, reducing stigma. This demographic values subtle, natural-looking results over dramatic changes. Demand rises for low-dose and maintenance filler strategies. Clinics tailor marketing to this group with age-specific campaigns. This trend ensures long-term customer retention and recurrent treatments.

Rise of Combination Treatments Enhances Patient Outcomes and Clinic Revenue:

Dermal fillers are now often paired with Botox, lasers, and skincare regimens for synergistic results. The U.S. Dermal Filler Market benefits from bundled treatment plans promoting comprehensive rejuvenation. Clinics offer all-in-one packages targeting multiple concerns simultaneously. Combination therapies reduce the need for surgical alternatives. Providers promote full-face balancing techniques using multiple product categories. This approach improves patient satisfaction and outcome longevity. Multi-modality strategies increase average revenue per visit. This trend reflects the shift toward holistic and customizable facial aesthetics.

Emergence of Natural and Biocompatible Filler Materials Shapes Consumer Preferences:

Consumers increasingly demand products with natural and body-compatible ingredients. The U.S. Dermal Filler Market sees rising adoption of hyaluronic acid and collagen-based fillers. Biocompatibility reduces side effects and accelerates recovery. Manufacturers emphasize clinical data supporting safety and natural outcomes. Organic formulation claims attract environmentally conscious buyers. Marketing highlights ingredients found naturally in the body. This trend enhances product transparency and brand trust. Providers favor these materials for new patients and sensitive skin types.

Market Challenges Analysis:

Regulatory Scrutiny and Classification Complexities Impact Product Development:

Navigating the FDA’s regulatory landscape remains a significant challenge for manufacturers. The U.S. Dermal Filler Market must comply with stringent safety, testing, and classification standards. Manufacturers invest heavily in clinical trials and documentation to meet approval requirements. Delays in regulatory clearance hinder new product rollouts and innovation cycles. Variations in classification between medical devices and cosmetics add complexity. Marketing claims are subject to legal scrutiny, limiting promotional strategies. Ongoing updates to safety protocols demand constant adaptation. These challenges create entry barriers for new players and increase operational costs.

Concerns Over Safety, Side Effects, and Misinformation Restrain First-Time Adoption:

Despite growing popularity, a segment of potential consumers remains hesitant due to safety concerns. The U.S. Dermal Filler Market encounters resistance fueled by misinformation and fear of adverse reactions. Negative experiences shared on social media can deter new users. Unqualified providers and counterfeit products create risk in unregulated environments. Bruising, asymmetry, or nodules can occur when procedures are improperly performed. Patient trust declines when expectations are not managed well. Education efforts must counteract misconceptions and highlight certified providers. This skepticism slows market conversion among new consumers.

Market Opportunities:

Expansion of Male Aesthetic Segment Creates Untapped Revenue Potential:

The rising interest in cosmetic enhancements among men presents a new growth avenue. The U.S. Dermal Filler Market sees increased demand for subtle facial contouring in male patients. Clinics design male-focused services promoting jawline enhancement and under-eye correction. Marketing strategies shift toward gender-neutral messaging. This segment values privacy, natural outcomes, and procedural efficiency. Providers respond with tailored techniques respecting male facial anatomy. Expanding into this demographic opens new revenue streams.

Growth in Teleconsultation and Digital Booking Broadens Market Accessibility:

The expansion of virtual consultations and digital platforms supports market scalability. The U.S. Dermal Filler Market benefits from easier appointment scheduling, virtual follow-ups, and remote pre-assessments. Clinics use digital tools to reach patients in underserved areas. Online platforms educate users and encourage informed decision-making. Telehealth integration supports continuity of care and provider-patient engagement. This digital shift enhances convenience and improves patient onboarding.

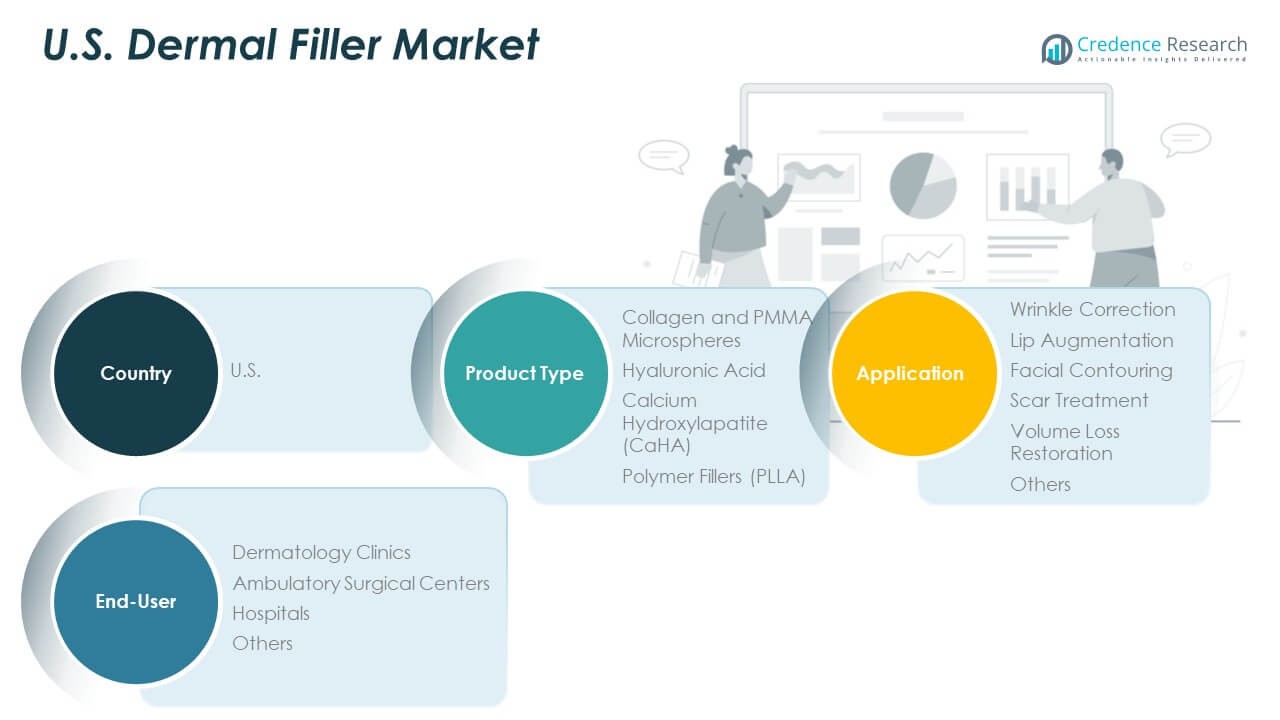

Market Segmentation Analysis:

By Product Type

The U.S. Dermal Filler Market features a range of product types designed to address specific cosmetic needs. Hyaluronic acid dominates the market due to its biocompatibility, reversibility, and natural appearance. It is widely used for wrinkles, lips, and under-eye hollows. Calcium Hydroxylapatite (CaHA) appeals to patients needing deeper volume restoration and facial contouring. Collagen and PMMA microspheres provide longer-lasting structural correction, though their adoption is more selective. Polymer-based fillers like PLLA stimulate collagen growth and support gradual, sustained results, especially in mid-face and temple areas.

By Application

Wrinkle correction represents the largest application area, fueled by aging baby boomers and increased attention to facial lines. Lip augmentation follows closely, driven by younger adults seeking fuller lips and enhanced facial balance. Facial contouring gains traction for reshaping cheekbones, jawlines, and chins without surgery. Scar treatment addresses both cosmetic and post-surgical needs, while volume loss restoration meets age-related facial fat depletion. Other uses, including hand rejuvenation and tear trough correction, support market expansion with diversified treatment options.

- For instance, the JUVÉDERM® VOLUMA XC product received FDA approval for chin augmentation in 2020, and as of 2023, more than 200,000 U.S. patients have undergone off-surgical contouring using this specific filler, reflecting the growing preference for injectable facial reshaping.

By End User

Dermatology clinics lead in procedure volume due to specialized expertise, brand trust, and repeat clientele. Ambulatory surgical centers offer cost-efficient treatments and attract patients seeking quick recovery. Hospitals support medically complex cases or combined interventions, providing credibility and multidisciplinary care. Other end users include aesthetic centers and medspas, which increasingly serve mainstream consumers with flexible service offerings and loyalty-based programs. The U.S. Dermal Filler Market strengthens across all end-user segments through targeted services and improved procedural access.

Segmentation:

By Product Type:

- Collagen and PMMA Microspheres

- Hyaluronic Acid

- Calcium Hydroxylapatite (CaHA)

- Polymer Fillers (PLLA)

By Application:

- Wrinkle Correction

- Lip Augmentation

- Facial Contouring

- Scar Treatment

- Volume Loss Restoration

- Others

By End User:

- Dermatology Clinics

- Ambulatory Surgical Centers

- Hospitals

- Others

Regional Analysis:

Western U.S. Dominates with Aesthetic Awareness and Strong Infrastructure

The Western region holds the largest share of the U.S. Dermal Filler Market, accounting for approximately 35% of the total revenue. High aesthetic consciousness, celebrity influence, and a dense network of dermatology clinics drive this dominance. California leads the region due to a large urban population, high disposable income, and strong cosmetic culture. States like Washington and Arizona contribute to growth through expanding medspa chains and certified professionals. The region attracts both local and international consumers seeking advanced, non-invasive procedures. This concentration of demand supports ongoing investments in innovation and skilled practitioner training.

Northeast U.S. Maintains Strong Growth through Urban Demand

The Northeast region represents around 27% of the U.S. Dermal Filler Market share. Cities such as New York and Boston drive market activity due to dense populations, high-income groups, and a strong presence of aesthetic dermatology clinics. The region benefits from a mature consumer base that values cosmetic procedures for professional and social reasons. Institutions also support advanced aesthetic training, producing highly skilled practitioners. Urban centers attract medical tourism and repeat clients seeking combination treatments. The Northeast remains a strategic hub for product launches and premium service offerings.

South and Midwest Regions Show Accelerating Adoption with Rising Accessibility

The Southern region accounts for roughly 22% of the U.S. Dermal Filler Market, while the Midwest holds a 16% share. The South sees increasing demand in states like Texas, Florida, and Georgia due to population growth, expanding healthcare access, and cultural acceptance of aesthetic procedures. Clinics in suburban and smaller metro areas now offer competitive services previously limited to coastal cities. The Midwest shows gradual growth supported by improving infrastructure and awareness campaigns. Both regions benefit from rising use of online booking, teleconsultations, and loyalty programs. The market grows steadily as cost-effective service models attract first-time users across broader demographics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Allergan Aesthetics (AbbVie Inc.)

- Galderma

- Merz Pharma

- Sinclair Pharma

- Bioxis Pharmaceuticals

- Suneva Medical

- Prollenium Medical Technologies

- Revance Therapeutics

Competitive Analysis:

The U.S. Dermal Filler Market is highly competitive and features established players with strong product portfolios and wide distribution networks. Key companies include Allergan Aesthetics (AbbVie Inc.), Galderma, Merz Pharma, and Revance Therapeutics. These players invest heavily in clinical trials, product innovation, and branding to retain market share. Strategic collaborations, continuous product upgrades, and aesthetic training programs support their dominance. Emerging players such as Bioxis Pharmaceuticals and Suneva Medical aim to differentiate through novel formulations and targeted applications. The market fosters innovation in biocompatible and long-lasting fillers. It remains dynamic due to rapid product lifecycle updates, practitioner preferences, and shifting consumer expectations.

Recent Developments:

- In January 2025, Allergan Aesthetics (AbbVie Inc.) launched its new AA Signature Program at IMCAS World Congress 2025 to redefine patient-centric, multimodal treatment plans. The program provides advanced training for healthcare professionals, focusing on integrating Allergan Aesthetics’ facial product portfolio to create personalized “signature looks” addressing multiple facial needs. This launch aims to set a new standard in holistic treatment planning and patient outcomes.

- In July 2025, Galderma reaffirmed its leadership in the U.S. dermal filler market with the recent launch of Restylane® SHAYPE™, a hyaluronic acid injectable powered by proprietary NASHA HD™ Technology, which boasts the highest G-prime among commonly used HA-fillers. At IMCAS 2025, new clinical data and the broad presence of this innovative product underscored Galderma’s commitment to advancing aesthetics and patient satisfaction.

- In January 2025, Merz Pharma marked a major milestone by merging Merz Lifecare and WindStar Medical to form Merz Lifecare Holding GmbH. This integration effectively doubled their business, strengthened their position in the healthcare market, and enabled a broader, more health-oriented product portfolio, reinforcing Merz’s presence in the U.S. and internationally.

- In February 2025, Sinclair Pharma demonstrated its commitment to innovation in the U.S. market by showcasing Lanluma at IMCAS 2025. Their participation in scientific sessions and workshops highlighted advancements in collagen stimulation for body contouring and reinforced their educational leadership within the industry.

Market Concentration & Characteristics:

The U.S. Dermal Filler Market exhibits moderate-to-high concentration, with a few major players controlling the majority share. It is characterized by strong brand loyalty, physician-driven recommendations, and regulatory oversight. The market supports frequent innovation cycles, driven by consumer demand for safe and natural-looking outcomes. Companies differentiate through training programs, targeted marketing, and advanced product delivery technologies. It operates under strict FDA regulations, ensuring safety and efficacy. The aesthetic focus of the industry fuels product diversification and clinical advancements.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, and End User segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for non-surgical aesthetic procedures will continue to fuel market expansion.

- Increasing adoption among millennials and Gen Z will sustain long-term customer engagement.

- Product innovations focusing on biocompatibility and longer-lasting results will shape future offerings.

- Growth of combination treatments will enhance average spend per patient across clinics.

- Digital consultations and AI-driven treatment planning will improve patient outcomes and convenience.

- Expansion of male-oriented aesthetic procedures will unlock new revenue streams.

- Training programs for injectors will improve procedural safety and increase service availability.

- Urban markets will remain strong, while suburban and rural adoption will steadily rise.

- Regulatory developments will ensure high safety standards and guide product innovation.

- Mergers and partnerships among top players will drive competitive positioning and portfolio expansion.