Market Overview

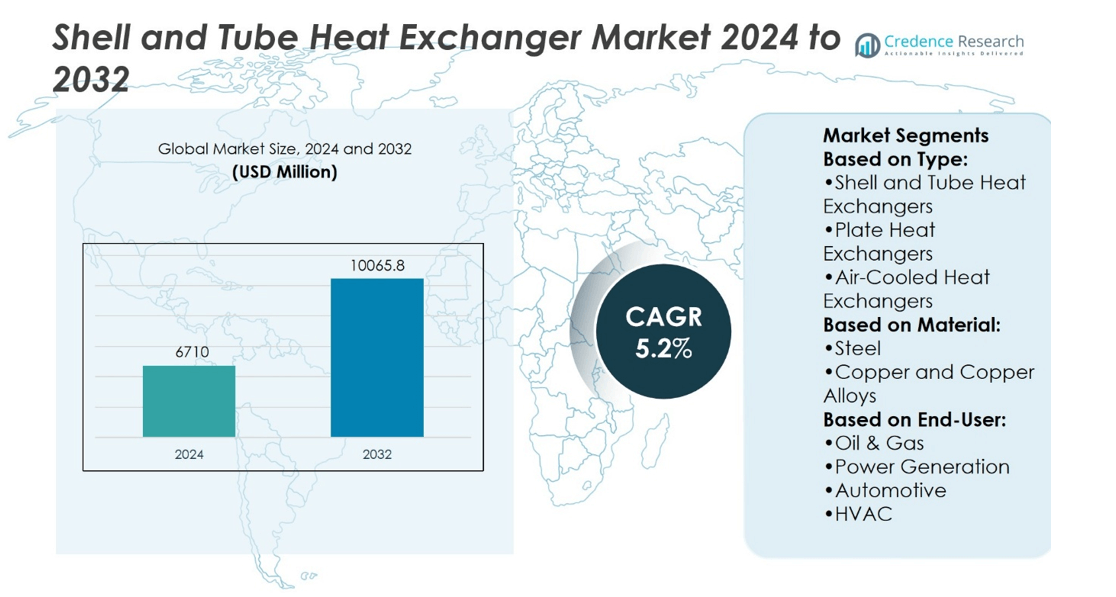

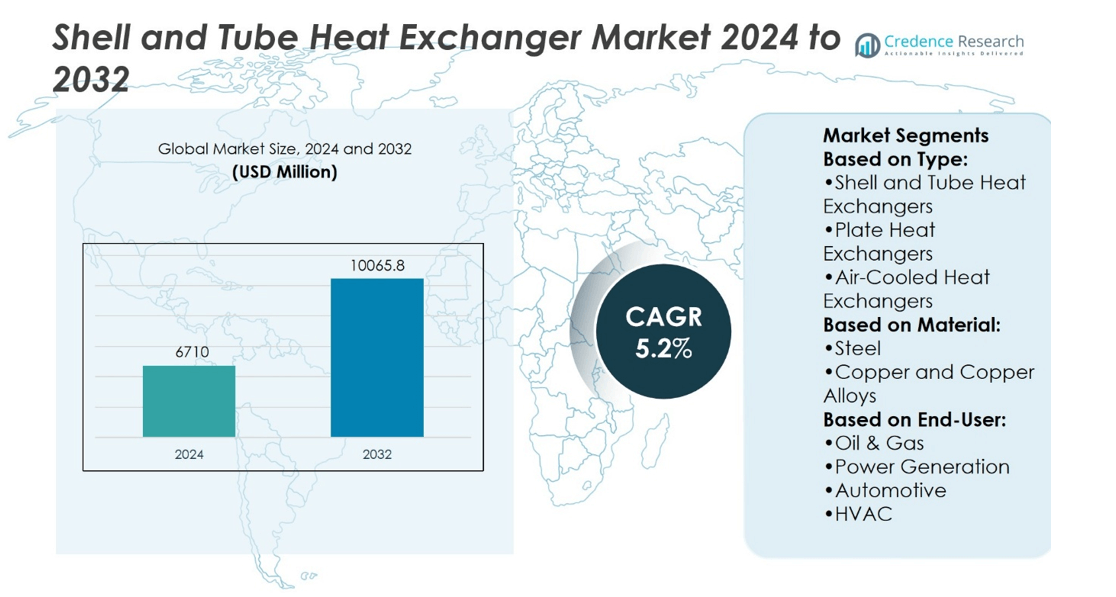

Shell and Tube Heat Exchanger Market size was valued at USD 6710 million in 2024 and is anticipated to reach USD 10065.8 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shell and Tube Heat Exchanger Market Size 2024 |

USD 6710 million |

| Shell and Tube Heat Exchanger Market, CAGR |

5.2% |

| Shell and Tube Heat Exchanger Market Size 2032 |

USD 10065.8 million |

The Shell and Tube Heat Exchanger Market is driven by rising demand for energy efficiency, expansion of oil and gas refining, and increasing power generation projects across developed and emerging economies. Industries adopt advanced systems to handle high pressures, extreme temperatures, and large fluid volumes with precision. Stricter environmental regulations encourage use of corrosion-resistant materials and designs that minimize energy loss. Trends highlight growing integration of digital simulation tools, preference for compact modular configurations, and expansion into renewable energy applications. The market advances as manufacturers focus on innovation, reliability, and sustainability to meet evolving industrial and regulatory requirements.

The Shell and Tube Heat Exchanger Market shows strong adoption across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific holding the largest share due to rapid industrialization and power generation projects. North America and Europe remain mature markets driven by oil, gas, and regulatory compliance, while Latin America and the Middle East grow through refining and infrastructure expansion. Key players include Alfa Laval, API Heat Transfer, Chart Industries, Danfoss, GEA Group, Kelvion, and Mersen.

Market Insights

- The Shell and Tube Heat Exchanger Market size was USD 6710 million in 2024 and will reach USD 10065.8 million by 2032 at a CAGR of 5.2%.

- Rising demand for energy efficiency and large-scale adoption in oil and gas refining drive growth.

- Power generation projects create sustained demand for durable systems handling high pressures and temperatures.

- Trends include digital simulation tools, compact modular designs, and expansion into renewable energy applications.

- Competition remains strong with players focusing on innovation, reliability, and global service support.

- High material costs and maintenance requirements act as restraints for cost-sensitive industries.

- Asia-Pacific leads the market, followed by North America and Europe, while Latin America and the Middle East show growth through refining and infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Energy Efficiency and Process Optimization

The Shell and Tube Heat Exchanger Market benefits from strong demand for energy-efficient solutions across industries. Companies aim to lower fuel consumption and reduce operational costs. Heat exchangers transfer thermal energy effectively, supporting optimized performance in chemical plants, refineries, and manufacturing sites. Adoption grows in sectors focused on sustainability and resource management. It enhances heat recovery in high-temperature processes while improving plant productivity. Efficiency gains strengthen competitiveness and help industries meet environmental standards.

- For instance, Danfoss H48T-CH Micro Plate™ brazed heat exchanger is designed for high-pressure applications, featuring a maximum working pressure of 140 bar (2030 psi) on its primary (CO2) side and 90 bar (1305 psi) on its secondary (water/glycol) side. The capacity of this series is up to 150 kW, though the actual thermal capacity of any specific unit is dependent on its specific plate count and the operating conditions of the application.

Expanding Applications in Oil, Gas, and Petrochemicals

The Shell and Tube Heat Exchanger Market secures growth from rising energy exploration and refining capacity. Refineries require robust equipment that withstands extreme temperatures and pressures. Heat exchangers manage large volumes of fluids in distillation and separation processes. It ensures consistent performance in offshore rigs and downstream facilities. Petrochemical plants depend on reliable systems to maintain product quality and operational safety. Global investments in LNG terminals and crude processing plants increase deployment.

- For instance, Alfa Laval boosted its Hybloc™ PCHE production to 1,000 units per year after installing two next-gen diffusion-bonding furnaces—supporting hydrogen refuelling systems under pressures up to 1,250 bar.

Growth in Power Generation and Industrial Infrastructure

The Shell and Tube Heat Exchanger Market supports expanding power generation capacity worldwide. Utilities demand efficient systems for steam condensation and turbine cooling. Heat exchangers provide durability and long operational lifespans under heavy workloads. It plays a critical role in nuclear, thermal, and renewable energy projects. Industrial infrastructure, including steel, cement, and food processing, also drives adoption. Ongoing expansion of electricity grids amplifies equipment requirements in both developed and emerging economies.

Advancements in Material Technology and Custom Designs

The Shell and Tube Heat Exchanger Market advances with new alloys and design innovations. High-strength materials resist corrosion and extend equipment life in harsh environments. Manufacturers deliver custom configurations tailored to unique process requirements. It supports greater flexibility in industrial operations and reduces downtime. Compact designs improve space efficiency without reducing capacity. Ongoing R&D fosters development of models with improved thermal performance. Innovation secures stronger positions for suppliers in global supply chains.

Market Trends

Integration of Advanced Design Software and Simulation Tools

The Shell and Tube Heat Exchanger Market evolves with adoption of advanced design and simulation software. Digital platforms help manufacturers optimize thermal efficiency and structural reliability. Engineers use computational fluid dynamics to improve flow distribution and minimize pressure drop. It enables faster prototyping and reduces testing costs. Virtual models support precise customization for industries with complex requirements. Use of digital design strengthens accuracy while shortening development cycles.

- For instance, the GEA REKULUVO/REKUGAVO flue gas heat exchangers, designed for thermal power and chemical plants, operate at flow rates between 5,000 and 2,000,000 \(Nm^{3}\)/h.

Rising Preference for Compact and Modular Configurations

The Shell and Tube Heat Exchanger Market reflects a growing trend toward compact and modular designs. Industrial plants seek equipment that saves floor space while delivering high performance. Modular units allow easier installation, maintenance, and capacity expansion. It provides flexibility for facilities that operate under varying process loads. Compact designs gain traction in offshore platforms, marine applications, and small industrial sites. Demand for efficient use of plant space supports stronger adoption of these models.

- For instance, Mersen’s Graphite Plate Heat Exchangers provide a compact, modular layout. They deliver heat transfer areas up to 29 m², operate over temperatures from –30 °C to +200 °C, and handle pressures up to 6 bar, all in a slim, adjustable package.

Focus on Sustainability and Use of Corrosion-Resistant Materials

The Shell and Tube Heat Exchanger Market advances through innovations in eco-friendly materials. Manufacturers invest in alloys that resist corrosion and extend equipment lifespan. It supports sustainable operations by reducing material waste and downtime. The trend aligns with stricter environmental regulations across industries. Demand grows for exchangers that operate with reduced leaks and higher durability. Enhanced material performance improves long-term cost efficiency for end users.

Expansion of Aftermarket Services and Maintenance Solutions

The Shell and Tube Heat Exchanger Market shows rising emphasis on aftermarket support. End users value reliable service contracts for inspection, cleaning, and part replacement. It helps companies maintain peak efficiency and minimize unexpected failures. Service providers integrate predictive maintenance tools to detect potential issues early. Global operators require standardized maintenance programs across facilities. The trend strengthens long-term supplier-client relationships and supports recurring revenue streams for manufacturers.

Market Challenges Analysis

High Maintenance Needs and Operational Downtime

The Shell and Tube Heat Exchanger Market faces challenges linked to regular maintenance and potential downtime. Scaling, fouling, and corrosion reduce efficiency and require frequent cleaning. It demands skilled labor and planned shutdowns that increase operational costs. Refineries and power plants often experience delays during maintenance cycles, which impacts productivity. Replacement of tubes or seals can be expensive and time consuming. Industries operating in harsh environments encounter greater risks of damage and shorter component lifespans. The requirement for continuous upkeep limits cost efficiency for many end users.

Rising Material Costs and Pressure of Regulatory Compliance

The Shell and Tube Heat Exchanger Market encounters obstacles from increasing material prices and stricter compliance rules. High-grade alloys such as titanium and stainless steel raise manufacturing costs. It challenges suppliers to balance durability with affordability. Global regulations on emissions and workplace safety push manufacturers to redesign equipment, often raising expenses further. Companies struggle to standardize systems across regions with different compliance requirements. Procurement delays caused by supply chain disruptions add another layer of complexity. These factors restrain adoption among price-sensitive industries and prolong decision cycles for large projects.

Market Opportunities

Expanding Role in Renewable Energy and Sustainable Industries

The Shell and Tube Heat Exchanger Market presents opportunities through its integration into renewable energy projects. Geothermal plants, biomass facilities, and solar thermal stations depend on heat exchangers for efficient energy transfer. It supports the shift toward low-carbon technologies by offering reliable thermal management systems. Demand increases as industries align operations with global sustainability targets. Equipment capable of handling varied temperatures and fluids strengthens adoption in new energy sectors. Manufacturers that deliver specialized models gain an edge in this expanding market segment.

Growing Demand in Emerging Economies and Industrial Infrastructure

The Shell and Tube Heat Exchanger Market benefits from rapid industrial development in Asia-Pacific, Latin America, and the Middle East. Expanding power generation, chemical production, and refining capacity create strong opportunities. It enables industries in these regions to adopt modern heat transfer solutions for large-scale projects. Governments invest heavily in infrastructure that requires efficient thermal systems. Rising urbanization and manufacturing activity further strengthen equipment deployment. Suppliers that expand footprints in these high-growth regions capture long-term revenue potential and establish stronger global positions.

Market Segmentation Analysis:

By Type

The Shell and Tube Heat Exchanger Market is dominated by shell and tube heat exchangers due to their versatility and ability to handle high pressures and temperatures. It remains the preferred choice in oil refineries and power plants for large-scale operations. Plate heat exchangers gain traction in industries that demand compact designs and efficient heat transfer, particularly in food processing and HVAC applications. Air-cooled heat exchangers expand their presence in regions with limited water resources, supporting industries where cooling requirements are critical. Others, including finned and spiral models, serve specialized applications that require enhanced surface area or unique thermal solutions. Each type addresses distinct operational requirements, creating diverse adoption across industries.

- For instance, Chart’s SPINTUBE™ Replacement Bundles retrofit TEMA-type shell-and-tube units. They boost thermal performance by up to 40% and eliminate flow-induced vibrations. Charts can use standard maintenance routines after retrofit. Tube diameters range from ⅜″ to 1¼″.

By Material

Steel dominates the material segment because of its durability, resistance to high temperatures, and suitability for harsh operating environments. The Shell and Tube Heat Exchanger Market benefits from its wide use in petrochemical, power, and heavy industrial sectors. Copper and copper alloys hold importance due to superior thermal conductivity, often applied in HVAC and automotive systems. It ensures rapid heat transfer while maintaining efficiency in compact designs. Plastic materials enter niche applications that require corrosion resistance and lighter weight, though their scope is limited to low-pressure environments. Others, such as composite materials, gain recognition for balancing strength, corrosion resistance, and reduced weight in advanced systems.

- For instance, the Hairpin Heat Exchangers offer true counter-current flow. They excel in high-pressure tube-side applications with temperature differences above 149 °C (300 °F). Built with movable support brackets and separate tube sheets, these units handle thermal cycling more effectively.

By End User

Oil and gas leads the end-user segment, driven by continuous demand for refining and petrochemical processes that rely heavily on heat exchangers. The Shell and Tube Heat Exchanger Market finds strong application in power generation, where systems are essential for steam condensation and turbine efficiency. Automotive manufacturers adopt these systems for cooling engines, transmissions, and battery technologies. It supports higher vehicle performance and reliability under varying conditions. HVAC represents another major end user, where heat exchangers deliver energy efficiency and maintain indoor climate control in commercial and residential spaces. Each end-user group highlights the broad scope and essential role of these systems across industries.

Segments:

Based on Type:

- Shell and Tube Heat Exchangers

- Plate Heat Exchangers

- Air-Cooled Heat Exchangers

Based on Material:

- Steel

- Copper and Copper Alloys

Based on End-User:

- Oil & Gas

- Power Generation

- Automotive

- HVAC

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the Shell and Tube Heat Exchanger Market share, supported by its strong presence in oil and gas refining, petrochemicals, and power generation sectors. The United States leads adoption due to large-scale refining operations, shale gas production, and strict energy efficiency regulations. It benefits from advanced manufacturing capabilities and the presence of global suppliers who focus on innovation and automation. Canada contributes through its oil sands projects, which require durable equipment capable of handling high-pressure environments. HVAC applications in commercial and residential buildings also strengthen demand across the region. Rising investments in upgrading old energy infrastructure continue to provide opportunities for market expansion in North America.

Europe

Europe holds 24% of the Shell and Tube Heat Exchanger Market share, driven by mature industrial infrastructure, environmental regulations, and the focus on energy transition. Countries such as Germany, France, and Italy lead adoption through advanced manufacturing and high emphasis on renewable energy integration. It plays a vital role in district heating and cooling projects, which are widely implemented in northern and central Europe. The market gains further traction from the automotive and chemical industries, where strict emission norms require efficient thermal systems. Growing investments in offshore wind and nuclear projects also stimulate demand for advanced exchangers. Suppliers in Europe continue to innovate with compact, high-performance models tailored to meet sustainability targets.

Asia-Pacific

Asia-Pacific represents the largest share at 32% of the Shell and Tube Heat Exchanger Market, fueled by rapid industrialization, expanding power generation capacity, and strong oil and gas demand. China dominates adoption with large-scale refining complexes, chemical plants, and extensive energy projects. India shows rising demand due to investments in thermal and nuclear power plants, while Japan and South Korea contribute through advanced manufacturing and automotive industries. It benefits from growing infrastructure development, urbanization, and rising energy consumption across emerging economies. Government initiatives supporting renewable energy and industrial growth further strengthen adoption. The scale of demand and cost-sensitive market dynamics create opportunities for both global and regional suppliers.

Latin America

Latin America accounts for 8% of the Shell and Tube Heat Exchanger Market share, supported by oil refining, petrochemicals, and growing industrial infrastructure. Brazil leads adoption, driven by offshore oil exploration and a growing manufacturing sector. Mexico contributes with its refining capacity and industrial expansion in automotive and food processing. It experiences growing demand in HVAC and power generation applications due to urban development. Market growth is restrained by slower technological adoption and budget constraints in some regions. Still, modernization of existing plants and infrastructure investments create opportunities for suppliers. Local partnerships and cost-effective designs are critical to expanding presence in this region.

Middle East & Africa

The Middle East & Africa hold 8% of the Shell and Tube Heat Exchanger Market share, driven primarily by oil and gas projects, petrochemical plants, and desalination facilities. Gulf countries, including Saudi Arabia, the UAE, and Qatar, lead adoption with significant investments in refining and chemical production. Africa, particularly Nigeria and South Africa, contributes with growing demand in power generation and industrial processing. It benefits from government-led infrastructure development and energy diversification programs. High dependence on hydrocarbons ensures steady demand for large-capacity heat exchangers. Suppliers target this region with robust, corrosion-resistant models that withstand extreme operating environments. Continued energy diversification into renewables also presents new opportunities in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hisaka Works

- Danfoss

- Hamon & Cie

- Alfa Laval

- Cleveland Wire Cloth

- Kelvion

- API Heat Transfer

- Chart Industries

- Mersen

- GEA Group

Competitive Analysis

The competitive landscape of the Shell and Tube Heat Exchanger Market features include Alfa Laval, API Heat Transfer, Chart Industries, Cleveland Wire Cloth, Danfoss, GEA Group, Hamon & Cie, Hisaka Works, Kelvion, and Mersen. The Shell and Tube Heat Exchanger Market demonstrates a highly competitive environment where manufacturers focus on performance optimization, energy efficiency, and durability. Companies differentiate themselves through advanced design capabilities, integration of digital simulation tools, and development of compact models suited for modern industrial applications. Strong emphasis is placed on corrosion-resistant materials and flexible configurations that address the needs of oil and gas, power generation, automotive, and HVAC industries. Competition also extends to service offerings, with suppliers providing maintenance, inspection, and predictive monitoring solutions to enhance equipment reliability. Innovation in materials and customized engineering continues to drive competitive advantage, while global supply chains and regional partnerships strengthen market reach.

Recent Developments

- In June 2025, Alfa Laval launches Clariot™, a next generation, AI-based condition monitoring solution, precision-built for hygienic process equipment sustainability and advanced digitalization of heat exchanger systems, enabling real-time monitoring and performance optimization.

- In January 2024, DASCO Co., Ltd. marked the inauguration of its Mieum Factory in Busan, South Korea, celebrating the milestone with its employees. Overcoming various challenges, the factory is now operational, specializing in the design and production of heat exchangers and pressure vessels.

- In November 2023, Danfoss Heat Exchangers signed an agreement with Danfoss Commercial Compressors to establish an in-house test capability for propane located in the ATEX-certified lab in Trevoux in France.

- In October 2023, Conflux Technology has started production on metal 3D printed heat exchanger. The new launch will enhance remarkable success of the new heat exchanger in the M 4K system, AMCM plans to apply this same principle to enhance their recently announced M 8K system.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for energy-efficient thermal systems.

- Power generation projects will create strong opportunities for advanced exchanger designs.

- Oil and gas industries will continue to drive adoption in large-scale facilities.

- Renewable energy plants will increase deployment for geothermal, biomass, and solar applications.

- Use of corrosion-resistant alloys will improve durability in harsh environments.

- Compact and modular models will gain preference in space-limited industrial sites.

- Digital design and simulation tools will support faster product development cycles.

- Aftermarket services will grow as industries demand predictive maintenance and upgrades.

- Emerging economies will boost adoption through industrialization and infrastructure expansion.

- Global regulations on energy efficiency will reinforce investment in innovative heat exchangers.