Market Overview

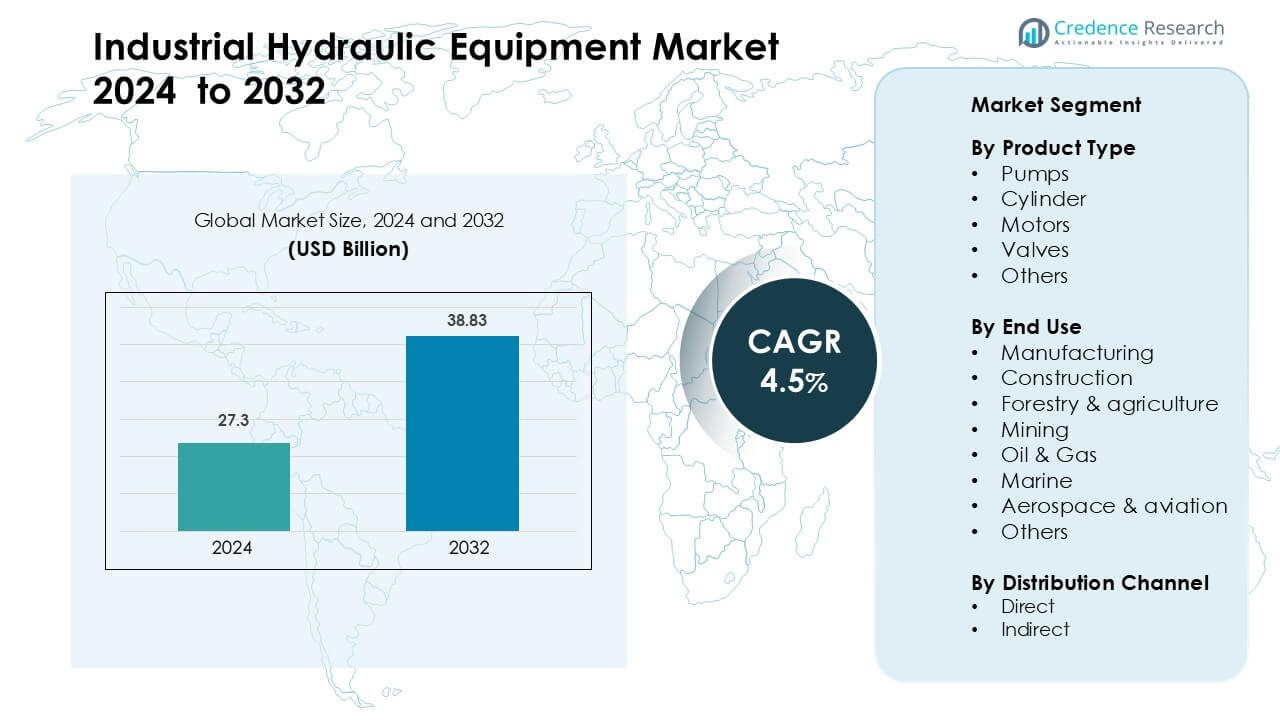

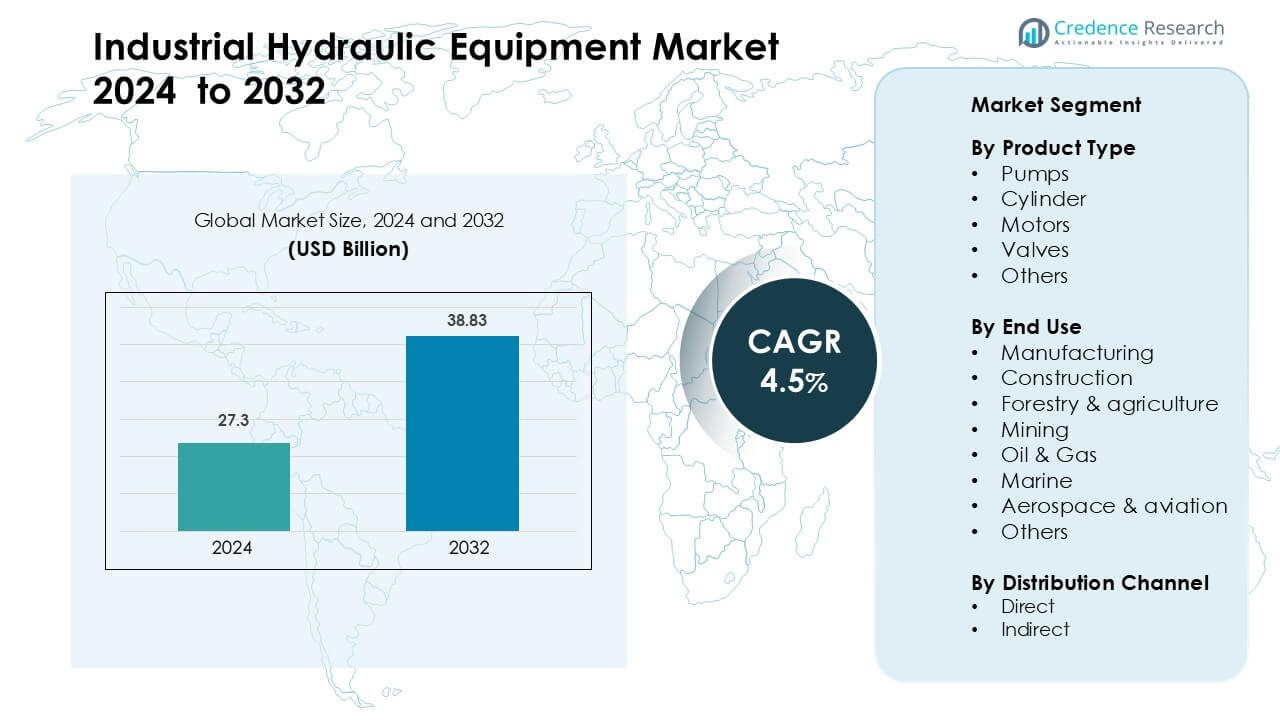

Industrial Hydraulic Equipment Market was valued at USD 27.3 billion in 2024 and is anticipated to reach USD 38.83 billion by 2032, growing at a CAGR of 4.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Hydraulic Equipment Market Size 2024 |

USD 27.3 Billion |

| Industrial Hydraulic Equipment Market, CAGR |

4.5 % |

| Industrial Hydraulic Equipment Market Size 2032 |

USD 38.83 Billion |

The Industrial Hydraulic Equipment Market is shaped by major companies such as Komatsu, HYDAC International, Bosch Rexroth, Hitachi Construction Machinery, Danfoss, Caterpillar, HAWE Hydraulik, Kawasaki Heavy Industries, Eaton, and Bucher Hydraulics. These players compete through advanced pump systems, high-efficiency cylinders, smart valves, and electro-hydraulic solutions that support automation and heavy-duty performance. Their focus on digital control, durability, and energy-saving designs strengthens global adoption across manufacturing, construction, mining, and mobile machinery. Asia-Pacific leads the market with about 36% share in 2024 due to rapid industrial growth, strong equipment production, and large-scale infrastructure projects across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Industrial Hydraulic Equipment Market was valued at USD 27.3 billion in 2024 and is anticipated to reach USD 38.83 billion by 2032, growing at a CAGR of 4.5 % during the forecast period.

- Demand grows as pumps (holding about 42% share) and cylinders support rising automation in manufacturing, construction, and mining equipment, driving higher adoption of energy-efficient hydraulic systems.

- Digital hydraulics, IoT-enabled monitoring, and electro-hydraulic integration shape new trends, with smart valves and predictive-maintenance-ready components gaining strong traction across heavy machinery fleets.

- Competition intensifies among Komatsu, HYDAC International, Bosch Rexroth, Hitachi Construction Machinery, Danfoss, Caterpillar, HAWE Hydraulik, Kawasaki Heavy Industries, Eaton, and Bucher Hydraulics as companies invest in advanced efficiency, durability, and global service networks.

- Asia-Pacific leads with 36% share, followed by North America at 32%, while manufacturing remains the top end-use segment with around 34% share due to expanding industrial modernization.

Market Segmentation Analysis:

By Product Type

Pumps hold the dominant share at about 42% in 2024 due to their essential role in fluid transfer across manufacturing, construction, and heavy equipment systems. Demand rises as industries upgrade to energy-efficient pump designs that support stable pressure control and longer duty cycles. Cylinders follow because of high use in lifting and pressing tasks, while motors and valves grow with automation in industrial plants. The others category supports niche control units and accessories used in specialized hydraulic assemblies.

- For instance, Parker Hannifin’s PD Series variable‑displacement axial piston pump can deliver continuous pressures up to 4,060 psi (280 bar) with a flow rate of about 250 L/min, enabling high‑performance fluid transfer with low energy loss.

By End Use

Manufacturing leads this segment with nearly 34% share in 2024, supported by strong adoption of hydraulic presses, forming machines, and automated handling systems. Growth accelerates as factories modernize equipment to raise precision and workload capacity. Construction ranks second due to rising deployment of excavators, loaders, and cranes that rely on high-performance hydraulic systems. Mining, oil & gas, marine, and aerospace show steady gains as operators focus on reliability, higher force output, and safety compliance.

- For instance, Bosch Rexroth’s Smart Function Kit for servo presses generates pressing forces up to 70 kN, a capability that enables highly repeatable forming in automotive battery and component manufacturing.

By Distribution Channel

Direct sales dominate this segment with about 57% share in 2024 because large industrial buyers prefer customized configurations, technical support, and long-term maintenance contracts. Manufacturers strengthen direct supply models to serve OEMs and heavy-duty equipment producers that demand consistent performance standards. Indirect channels support small and mid-scale users through distributors and dealers that offer broader product access, faster delivery, and replacement parts availability across regional markets.

Key Growth Drivers

Growing Automation in Manufacturing and Heavy Equipment

Automation expands rapidly across factories, construction fleets, agricultural machinery, and material-handling systems, driving strong demand for advanced hydraulic equipment. Manufacturers now adopt high-pressure pumps, servo-hydraulic cylinders, and electronically controlled valves to improve cycle speed, load precision, and repeatability. Automated assembly lines depend on robust hydraulic systems that offer stable force output and long-duty performance, especially in metal forming, stamping, forging, and injection molding applications. Construction and mining firms upgrade fleets with hydraulic excavators, loaders, and drilling rigs to raise productivity and lower downtime. The shift toward Industry 4.0 accelerates this trend, as companies integrate real-time monitoring, proportional control, and predictive diagnostics into hydraulic units. Global OEMs also introduce hybrid electro-hydraulic platforms to support energy-efficient operations, which increases replacement and retrofit opportunities. These improvements position automation as a primary catalyst for sustained adoption of hydraulic components across industries.

- For instance, Parker Hannifin’s P2/P3 high‑pressure mobile piston pump supports displacements from 60 to 145 cc/rev and can operate at pressures up to 320 bar, enabling precise high-force applications in mobile hydraulic systems.

Infrastructure Expansion and Rising Construction Activities

Large-scale infrastructure programs in transportation, urban development, energy networks, and industrial corridors fuel the need for high-performance hydraulic systems. Excavators, cranes, bulldozers, and drilling machines rely on pumps, cylinders, and motors to operate under heavy loads, making hydraulic technology central to modern construction machinery. Rapid urbanization in Asia-Pacific and the Middle East pushes demand for earthmoving equipment, concrete handling systems, and lifting solutions that depend on advanced hydraulic components. Governments also invest heavily in road expansion, rail projects, and renewable energy facilities, all of which require hydraulic-powered equipment for installation and maintenance. Hydraulics also benefit from growing use in tunneling, underground mining, and pipeline construction due to their superior force density and reliability. As infrastructure programs scale, OEMs increase production capacity and launch upgraded hydraulic solutions with higher efficiency and digital control, strengthening market growth.

- For instance, Caterpillar’s 320D3 GC excavator features a hydraulic system with a maximum working pressure of 35,000 kPa (350 bar) and a total system flow of 400 L/min, enabling powerful and precise operation under demanding construction loads.

Increasing Adoption of Energy-Efficient and Low-Maintenance Systems

Industries seek hydraulic solutions that lower energy consumption, reduce leakage risk, and extend component life, creating strong demand for next-generation systems. Energy-efficient pumps, variable-speed drives, and smart valves help operators cut power usage during idle cycles and part-load conditions. Manufacturers introduce compact designs with improved sealing materials and noise-reduction capabilities to enhance performance in manufacturing, agriculture, and construction environments. Predictive maintenance tools now monitor pressure, temperature, and flow patterns to detect early-stage failures, lowering unplanned downtime. The push for sustainable operations also increases interest in electro-hydraulic hybrids that combine traditional hydraulic power with electronic actuation for smoother and cleaner motion control. As industries focus on total cost of ownership, high-efficiency systems gain preference, supporting replacement of older hydraulic units that consume more energy and require frequent servicing.

Key Trends and Opportunities

Integration of Smart and Connected Hydraulic Systems

Smart hydraulic systems emerge as a major trend as factories and equipment fleets adopt sensors, IoT platforms, and real-time monitoring solutions. Connected pumps, valves, and cylinders gather performance data that helps operators optimize force output, detect inefficiencies, and prevent equipment failures. OEMs embed telematics into heavy machinery to track system pressure, temperature, and operating hours, enabling predictive maintenance schedules that reduce downtime. Digital hydraulics also enhance precision and allow fine control in robotics, aerospace systems, and automated industrial equipment. Growing use of electro-hydraulic actuators in mobile machinery strengthens this trend, giving users a blend of high force and digital responsiveness. As industries move toward data-driven maintenance and higher productivity, smart hydraulics create long-term opportunities for both OEMs and aftermarket suppliers.

- For instance, Bosch Rexroth’s CytroConnect Solutions platform uses IoT gateways and condition monitoring sensors (measuring oil purity, temperature, etc.) to collect a significant amount of data weekly in industrial plants. This data collection helps detect anomalies in hydraulic machinery and supports predictive maintenance by providing actionable insights and reports.

Rising Use of Hydraulic Equipment in Renewable and Energy Projects

Growth in wind power, solar infrastructure, and grid modernization stimulates demand for specialized hydraulic components used in lifting, torque control, and maintenance systems. Hydraulic systems support blade pitch control in wind turbines, providing fast response and high torque capacity under variable wind speeds. Solar farms employ hydraulic trackers for panel alignment, improving energy yield through precise motion control. Hydraulics also support large maintenance cranes, heavy cable-laying systems, and energy storage manufacturing equipment. As renewable energy installations expand, operators seek durable and efficient hydraulic solutions capable of handling harsh environmental conditions. This creates strong opportunities for manufacturers offering corrosion-resistant materials, energy-saving pumps, and advanced motion control technologies.

- For instance, HAWE Hydraulik SE’s wind turbine pitch drive comprises cylinders, accumulators, and proportional valves rated for pressures up to 250 bar, and is designed to operate reliably for up to 20 years even in harsh offshore conditions.

Key Challenges

High Maintenance Requirements and Leakage Risks

Hydraulic systems demand routine inspections, frequent oil changes, seal replacements, and contamination control to ensure reliable performance. Leakage remains a persistent issue, leading to energy loss, environmental concerns, and equipment downtime. Contaminated fluids can damage pumps, valves, and cylinders, raising operating costs for industries such as construction, mining, and manufacturing. In remote or harsh environments, maintenance challenges intensify because skilled technicians and replacement parts are often limited. These factors push some industries toward electric actuators, which require less servicing. While modern designs reduce leakage and improve sealing, maintenance challenges continue to restrict adoption in settings where uptime and cleanliness are critical.

Volatility in Raw Material Prices and Supply Chain Disruptions

Hydraulic equipment production depends heavily on steel, aluminum, seals, and electronic control components, making the market sensitive to raw material fluctuations. Price instability increases production costs for pumps, cylinders, and motors, affecting profit margins for OEMs and aftermarket suppliers. Global supply chain disruptions also delay deliveries of precision parts, impacting assembly timelines for heavy machinery and industrial systems. Semiconductor shortages influence availability of electronic control units used in advanced hydraulic systems. While manufacturers diversify sourcing and adopt modular platforms, supply risks continue to challenge market stability. These pressures push companies to adjust pricing strategies and maintain larger inventories, impacting overall competitiveness.

Regional Analysis

North America

North America holds about 32% share in 2024, driven by strong demand from manufacturing, construction, and mining sectors. The region benefits from high adoption of advanced pumps, cylinders, and electronically controlled valves used in automated production lines. Investments in infrastructure renewal and heavy equipment upgrades support steady growth across the United States and Canada. OEM presence and strong aftermarket networks ensure fast servicing and replacement availability. Rising use of electro-hydraulic systems in material handling, agriculture, and defense further strengthens market expansion. Digital monitoring and predictive maintenance adoption also increase equipment replacement cycles in key industries.

Europe

Europe accounts for nearly 28% share in 2024, supported by strong industrial automation in Germany, Italy, and France. Manufacturers invest in energy-efficient hydraulic pumps and compact cylinders to comply with strict emission and noise standards. The region sees rising use of hydraulic equipment in metalworking, automotive production, and aerospace assembly lines. Growth remains stable due to expanding construction projects across Western and Eastern Europe. Demand for advanced valves and hybrid electro-hydraulic systems increases as OEMs modernize machinery fleets. Sustainability goals also push industries toward low-leakage designs and smart diagnostic systems that enhance operational performance.

Asia-Pacific

Asia-Pacific leads the global market with about 36% share in 2024, driven by rapid industrialization and large construction programs in China, India, and Southeast Asia. Heavy machinery manufacturers expand production capacity to meet strong demand from mining, agriculture, and infrastructure projects. Hydraulic pumps, motors, and cylinders see high use across manufacturing hubs that prioritize automation and higher productivity. The region also benefits from government investment in transport networks, renewable energy sites, and industrial corridors. Rising adoption of smart hydraulic systems and cost-competitive component manufacturing further boosts regional dominance.

Latin America

Latin America holds around 8% share in 2024, supported by construction activity, agricultural modernization, and mining expansion in Brazil, Mexico, and Chile. Hydraulic cylinders and pumps remain essential in earthmoving equipment, sugarcane machinery, and mineral extraction operations. Import-dependent markets increase demand for mid-range hydraulic components that balance performance and cost. Infrastructure upgrades, including roads, ports, and energy facilities, contribute to steady adoption of hydraulic systems. However, economic fluctuations and equipment replacement delays restrict faster growth. OEMs strengthen distribution networks to improve service access and expand aftermarket sales across key countries.

Middle East & Africa

The Middle East & Africa region captures about 6% share in 2024, driven by oil & gas exploration, construction megaprojects, and mining operations. Demand for heavy-duty pumps, valves, and hydraulic motors remains strong in drilling rigs, pipeline machinery, and lifting equipment. GCC countries invest in large infrastructure programs and industrial diversification, increasing adoption of advanced hydraulic systems. Africa sees rising demand from mining and agriculture, although limited technical support slows widespread modernization. Harsh climate conditions raise the need for corrosion-resistant and high-durability components, strengthening opportunities for premium hydraulic solutions.

Market Segmentations:

By Product Type

- Pumps

- Cylinder

- Motors

- Valves

- Others

By End Use

- Manufacturing

- Construction

- Forestry & agriculture

- Mining

- Oil & Gas

- Marine

- Aerospace & aviation

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Industrial Hydraulic Equipment Market features strong participation from global manufacturers that deliver advanced pumps, valves, cylinders, and motors for high-performance applications. Companies such as Komatsu, HYDAC International, Bosch Rexroth, Hitachi Construction Machinery, Danfoss, Caterpillar, HAWE Hydraulik, Kawasaki Heavy Industries, Eaton, and Bucher Hydraulics compete by expanding product efficiency, digital control capability, and reliability under heavy-duty conditions. Many players focus on electro-hydraulic integration that improves precision and supports automation in manufacturing, construction, and mobile machinery. Product portfolios increasingly include low-leakage designs, energy-efficient pumps, and smart components equipped with sensors for real-time diagnostics. OEMs strengthen global service networks, invest in regional assembly units, and collaborate with equipment manufacturers to support faster deliveries and customization. Continuous innovation in digital hydraulics, durability enhancements, and predictive maintenance platforms drives competitive differentiation, while aftermarket service capability remains a major advantage across key regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu

- HYDAC International

- Bosch Rexroth

- Hitachi Construction Machinery

- Danfoss

- Caterpillar

- HAWE Hydraulik

- Kawasaki Heavy Industries

- Eaton

- Bucher Hydraulics

Recent Developments

- In 2025, Hitachi Construction Machinery signed an agreement with Rio Tinto to co-develop remote operation and partial autonomy technologies for ultra-large hydraulic excavators used in mining operations

- In 2025, Komatsu announced the PC220LCi-12 new-generation hydraulic excavator with integrated intelligent machine control and ICT features, aimed at boosting productivity and safety on construction sites.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation will increase demand for advanced pumps, cylinders, and smart valves.

- Electro-hydraulic systems will gain wider use in construction, mining, and manufacturing.

- Predictive maintenance features will become standard in most hydraulic equipment.

- Energy-efficient designs will drive replacement of older, high-loss hydraulic units.

- Digital diagnostics and IoT connectivity will expand across mobile and industrial machinery.

- Sustainability goals will push industries toward low-leakage, eco-friendly hydraulic solutions.

- Hybrid hydraulic-electric platforms will grow in material handling and mobile equipment.

- OEMs will strengthen aftermarket services to support faster repairs and parts availability.

- Asia-Pacific will remain the strongest growth region due to large infrastructure programs.

- Customizable hydraulic modules will rise as users demand application-specific performance.