Market Overview:

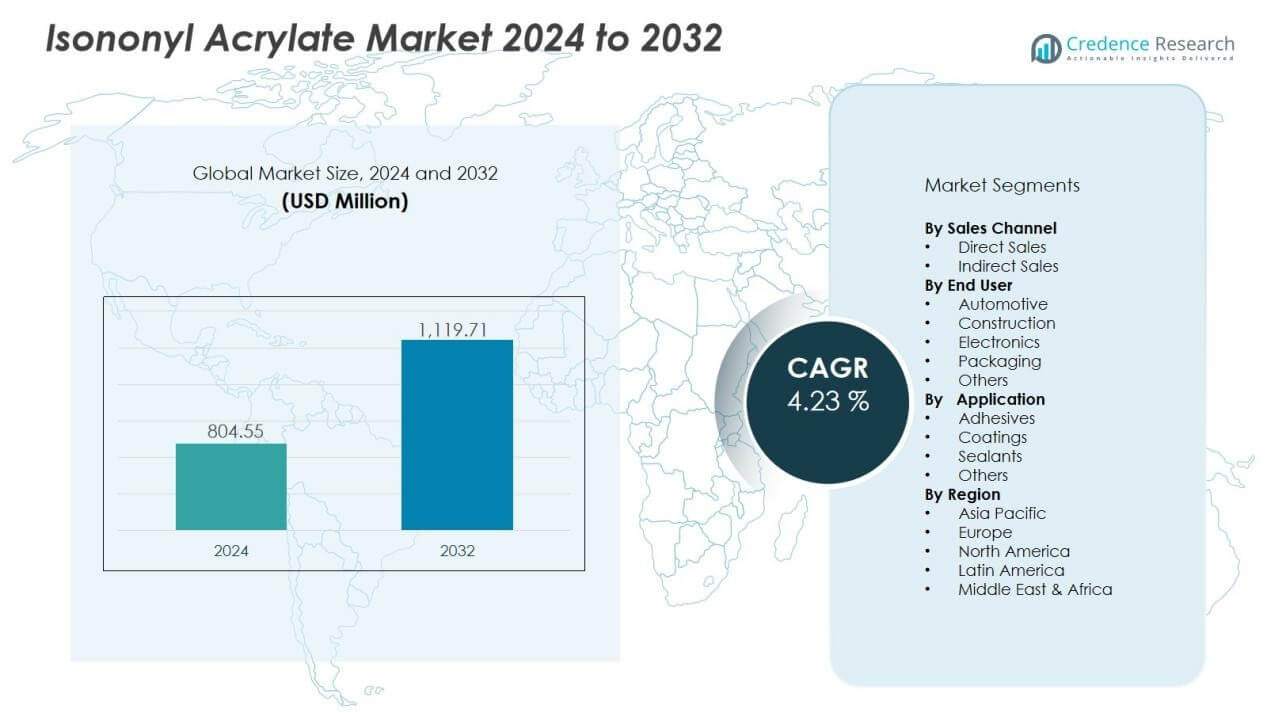

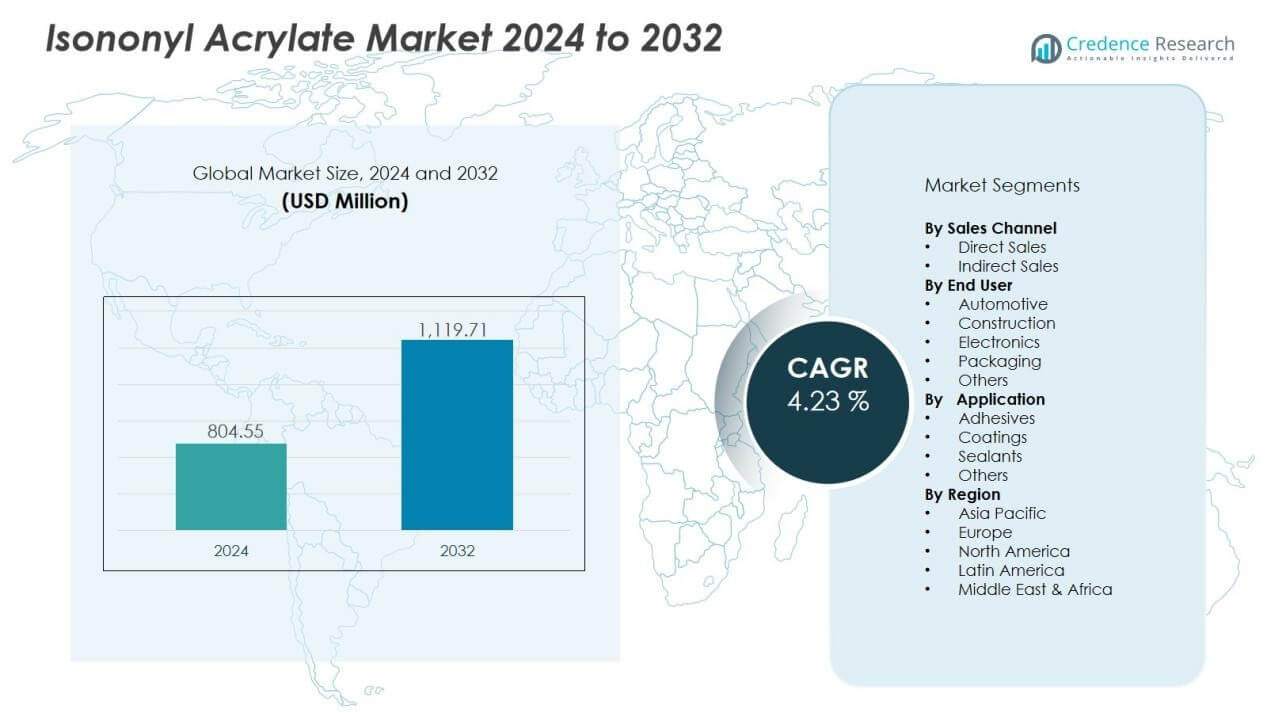

The isononyl acrylate market size was valued at USD 804.55 million in 2024 and is anticipated to reach USD 1,119.71 million by 2032, at a CAGR of 4.23% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isononyl Acrylate Market Size 2024 |

USD 804.55 Million |

| Isononyl Acrylate Market, CAGR |

4.23% |

| Isononyl Acrylate Market Size 2032 |

USD 1,119.71 Million |

Key drivers shaping this market include the growing adoption of pressure-sensitive adhesives in automotive, packaging, and electronics. Rising construction activities worldwide also fuel demand for coatings and sealants, where isononyl acrylate is a critical ingredient. Its high flexibility, durability, and resistance to environmental stress make it an essential raw material for performance-enhancing formulations. Additionally, ongoing research into sustainable and eco-friendly acrylic derivatives is opening new opportunities for manufacturers.

Regionally, Asia-Pacific dominates the market due to rapid industrialization, expanding manufacturing bases, and strong demand from automotive and electronics sectors in China, India, and Southeast Asia. North America and Europe maintain significant shares, driven by advanced infrastructure, mature automotive industries, and strict quality standards in adhesives and coatings. Emerging economies in Latin America and the Middle East & Africa are also witnessing rising demand, supported by infrastructure investments and growing industrial output.

Market Insights:

- The isononyl acrylate market was valued at USD 804.55 million in 2024 and is expected to reach USD 1,119.71 million by 2032, growing at a CAGR of 4.23%.

- Rising demand from adhesives and sealants, particularly in packaging, automotive, and construction, continues to strengthen market growth.

- Expanding applications in coatings enhance durability, weather resistance, and finish, driving adoption in automotive and construction sectors.

- Infrastructure development across emerging economies boosts usage in sealants, waterproofing, and coatings for large-scale projects.

- Sustainability trends encourage producers to focus on eco-friendly and low-VOC formulations, supported by rising R&D investments.

- Asia-Pacific led with 42% share in 2024, supported by rapid industrialization, urbanization, and strong automotive and electronics demand.

- North America held 27% share, driven by mature automotive industries, advanced construction activity, and focus on sustainable formulations.

- Europe accounted for 21% share, shaped by strict EU regulations, green building initiatives, and high-quality standards in coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Adhesives and Sealants Industry:

The isononyl acrylate market benefits strongly from its use in adhesives and sealants. It offers flexibility, strong adhesion, and resistance to stress, making it vital for packaging, automotive, and construction applications. Growing use of pressure-sensitive adhesives in tapes, labels, and films continues to boost consumption. Industrial and consumer demand for high-performance bonding solutions further supports market expansion.

- For instance, BASF’s Acronal® V 115, a water-borne acrylic dispersion, is engineered for pressure-sensitive adhesives used in packaging tapes and freezer-grade labels. It provides excellent performance at low temperatures, ensuring high adhesion even in cold storage.

Expanding Applications in Coatings and Specialty Formulations:

The isononyl acrylate market is driven by its role in high-performance coatings. It improves durability, weather resistance, and surface finish, which is critical for automotive and construction coatings. Manufacturers use it to meet rising demand for protective and decorative coatings across industries. Growing preference for advanced chemical formulations continues to enhance its market relevance.

- For Instance, An acrylic resin can be formulated using a monomer like isononyl acrylate, which, when polymerized, yields a homopolymer (polyisononyl acrylate) with a glass transition temperature (Tg) as low as approximately -58°C.

Strong Growth in Construction and Infrastructure Development:

Infrastructure expansion across emerging economies creates new opportunities for the isononyl acrylate market. It is widely used in sealants, waterproofing solutions, and surface coatings for large-scale projects. Rapid urbanization and smart city initiatives in Asia-Pacific drive strong demand. The material’s ability to withstand harsh conditions ensures long-term application in structural projects.

Increasing Focus on Sustainable and High-Performance Materials:

The isononyl acrylate market is influenced by rising interest in sustainable and efficient raw materials. Producers are focusing on eco-friendly formulations to comply with environmental regulations and customer preferences. Its ability to provide performance benefits while supporting sustainability goals strengthens adoption. Growing investments in R&D for next-generation acrylics continue to create long-term opportunities.

Market Trends:

Growing Adoption in High-Performance Adhesives, Coatings, and Sealants:

The isononyl acrylate market is witnessing rising adoption in advanced adhesives, coatings, and sealants. It offers strong flexibility, weather resistance, and durability, which makes it ideal for automotive, electronics, and construction industries. Demand for pressure-sensitive adhesives in tapes, labels, and films is expanding quickly, supported by packaging and logistics growth. Coatings manufacturers are incorporating it into formulations to enhance UV resistance and surface protection. In construction, its role in waterproofing and sealant applications continues to strengthen market penetration. The increasing use of lightweight materials in automotive and industrial applications further fuels its relevance in performance-driven solutions.

- For instance, 3M’s Scotch-Weld™ Acrylic Adhesive DP8410NS achieves an overlap shear strength of 7 MPa within 36 minutes of cure time

Rising Focus on Sustainable Solutions and Advanced Formulations:

The isononyl acrylate market is shaped by the shift toward eco-friendly and innovative materials. Manufacturers are focusing on low-VOC and bio-based derivatives to comply with global environmental regulations. It is being integrated into formulations that support green building standards and sustainable manufacturing practices. R&D efforts are driving the development of customized grades tailored for electronics, renewable energy, and specialty coatings. Growing preference for smart and energy-efficient infrastructure is further expanding its role in performance chemicals. Strong interest in next-generation acrylic solutions is positioning it as a strategic material for industries seeking both efficiency and compliance with evolving sustainability goals.

- For instance, in April 2025, Arkema launched its Rheotech™ bio-based acrylic thickeners containing 30 percent bio-sourced content, reducing cradle-to-gate carbon footprint by 25 percent compared to conventional grades.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Constraints:

The isononyl acrylate market faces pressure from volatile raw material costs linked to petrochemical derivatives. Unstable crude oil prices directly affect production costs, making price management difficult for manufacturers. It is also exposed to risks from supply chain disruptions, including transportation delays and regional shortages. These issues impact availability and increase dependency on reliable suppliers. Rising logistics expenses and global trade uncertainties further challenge cost efficiency. Market players must adopt flexible sourcing strategies to reduce vulnerability.

Regulatory Compliance and Environmental Concerns:

The isononyl acrylate market encounters challenges from strict environmental and safety regulations. It requires compliance with chemical safety standards, which can increase production and certification costs. Growing demand for sustainable alternatives also puts pressure on manufacturers to innovate. It faces scrutiny regarding emissions and environmental impact during processing. Developing eco-friendly formulations requires significant R&D investment, which may affect smaller players. High competition from greener substitutes can limit its growth in sensitive industries. Regulatory complexity across regions adds another layer of operational challenge for global suppliers.

Market Opportunities:

Expanding Role in Advanced Adhesives, Coatings, and Specialty Applications:

The isononyl acrylate market holds strong opportunities in high-performance adhesives, sealants, and coatings. Rising demand from automotive, construction, and electronics sectors creates scope for specialized formulations. It delivers durability, flexibility, and resistance to extreme conditions, which makes it suitable for next-generation industrial products. Growth in packaging and logistics industries further increases the need for pressure-sensitive adhesives. Manufacturers can capitalize on expanding infrastructure projects and smart city initiatives to strengthen their portfolios. Integration into protective coatings for renewable energy and electronics offers additional avenues for growth.

Increasing Potential in Sustainable and Bio-Based Solutions:

The isononyl acrylate market can benefit from growing global interest in eco-friendly materials. Producers are focusing on low-VOC and bio-based derivatives to align with sustainability goals. It presents opportunities in green building materials, where demand for environmentally compliant chemicals is rising. Partnerships and investments in R&D for renewable formulations enhance long-term competitiveness. Adoption in energy-efficient infrastructure and advanced manufacturing solutions creates new market segments. Expanding regulatory support for sustainable chemicals further accelerates its adoption across multiple industries.

Market Segmentation Analysis:

By Sales Channel:

The isononyl acrylate market is divided into direct sales and indirect sales through distributors and retailers. Direct sales dominate due to strong demand from large-scale manufacturers in adhesives, coatings, and sealants. It enables producers to establish long-term supply agreements and ensure consistent quality. Indirect sales continue to grow with rising adoption among small and medium enterprises. Online platforms and specialized distributors are expanding accessibility across emerging markets. This mix of channels strengthens product reach across diverse industries.

- For Instance, BASF is the world’s largest producer of acrylic monomers, with a total annual acrylic acid capacity of 1,510,000 metric tons distributed across its global production network.

By Application:

The isononyl acrylate market is segmented into adhesives, coatings, sealants, and others. Adhesives account for a significant portion due to pressure-sensitive applications in tapes, labels, and packaging. Coatings also represent a strong share, supported by demand in automotive, electronics, and construction. Sealants contribute steadily, driven by infrastructure and industrial projects. It is further used in specialty applications where high performance, flexibility, and resistance are critical. Expanding use across diverse applications ensures consistent long-term demand.

- For Instance, Acrylic adhesives can be formulated to have a very low glass transition temperature, with many typical formulations having a \(T_{g}\) between –40°C and –60°C to achieve optimal pressure-sensitive properties.

By End User:

The isononyl acrylate market serves industries such as automotive, construction, electronics, packaging, and others. Automotive remains a key segment with demand for lightweight and durable materials. Construction drives adoption in waterproofing, adhesives, and coatings for large projects. Electronics manufacturers use it in specialized coatings and adhesives that require durability. Packaging continues to show strong growth due to logistics and e-commerce expansion. The wide adoption across end-user industries positions it as a versatile and high-value chemical.

Segmentations:

By Sales Channel:

- Direct Sales

- Indirect Sales

By Application:

- Adhesives

- Coatings

- Sealants

- Others

By End User:

- Automotive

- Construction

- Electronics

- Packaging

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounted for 42% market share in 2024, led by China, India, and Japan. The region continues to post the fastest growth due to large-scale industrialization and urbanization. The isononyl acrylate market benefits from robust demand in automotive, construction, and electronics sectors. It plays a vital role in adhesives, coatings, and sealants used across expanding infrastructure projects. Growing investments in manufacturing hubs and packaging industries strengthen regional consumption. Supportive government policies and rising exports further enhance the region’s position in global trade.

North America:

North America held 27% market share in 2024, supported by the United States and Canada. The region benefits from a mature automotive sector, strong construction activity, and advanced manufacturing practices. The isononyl acrylate market is driven by demand for high-performance adhesives and coatings. It gains traction from increased adoption in packaging and energy-efficient infrastructure solutions. Strict regulatory frameworks encourage the development of sustainable and compliant formulations. Investments in R&D and innovation by leading producers enhance regional competitiveness.

Europe:

Europe accounted for 21% market share in 2024, led by Germany, France, and the United Kingdom. The region emphasizes sustainability and quality standards, driving adoption of eco-friendly formulations. The isononyl acrylate market benefits from demand across construction, automotive, and specialty coatings industries. It supports green building initiatives and advanced chemical applications aligned with EU regulations. Growth is also supported by ongoing infrastructure modernization and strong packaging demand. Collaborative efforts between producers and regulatory bodies continue to shape innovation and market direction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ExxonMobil Chemical Company

- DIC Corporation

- Dow Chemical Company

- PTT Chemical Public Company Limited

- Mitsubishi Gas Chemical Company, Inc.

- LyondellBasell Industries Holdings B.V.

- Covestro AG

- LG Chem, Ltd.

- Eastman Chemical Company

- SABIC

- Huntsman Corporation

- Evonik Industries AG

Competitive Analysis:

The isononyl acrylate market is marked by strong competition among global chemical producers. Key players include ExxonMobil Chemical Company, DIC Corporation, Dow Chemical Company, PTT Chemical Public Company Limited, Mitsubishi Gas Chemical Company, Inc., LyondellBasell Industries Holdings B.V., Covestro AG, and LG Chem, Ltd. These companies focus on expanding their product portfolios, strengthening distribution networks, and investing in R&D for advanced formulations. It is driven by the rising demand for high-performance adhesives, coatings, and sealants across automotive, construction, and electronics industries. Leading firms emphasize sustainability through the development of low-VOC and eco-friendly materials to align with strict environmental regulations. Strategic partnerships, mergers, and capacity expansions further define competitive positioning. Companies that combine cost efficiency, product innovation, and regulatory compliance are expected to sustain a strong foothold in this evolving market.

Recent Developments:

- In May 2025, ExxonMobil signed a long-term agreement with Marubeni Corporation to supply approximately 250,000 tonnes of low-carbon ammonia annually from ExxonMobil’s Baytown, Texas facility.

- In March 2025, DIC Corporation announced collaboration with the International House of Japan in visual arts and architecture.

Report Coverage:

The research report offers an in-depth analysis based on Sales Channel, Application, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The isononyl acrylate market is expected to see rising demand from adhesives and sealants manufacturers targeting packaging and automotive sectors.

- It will benefit from increasing use in high-performance coatings designed for construction and industrial applications.

- Sustainability initiatives will drive producers to focus on bio-based and low-VOC formulations that align with environmental standards.

- Expansion of infrastructure projects in Asia-Pacific will create new opportunities for product adoption.

- Electronics manufacturing growth will support demand for specialty formulations that enhance durability and performance.

- The market will witness strong R&D investments to develop customized grades for niche applications.

- Collaboration between producers and end-user industries will strengthen innovation pipelines and improve product reach.

- Regulatory compliance will shape product development strategies, particularly in Europe and North America.

- Emerging economies in Latin America and the Middle East & Africa will contribute through construction and industrial growth.

- Digitalization and smart manufacturing practices will encourage efficient production and expand the scope of advanced chemical solutions.