Market Overview:

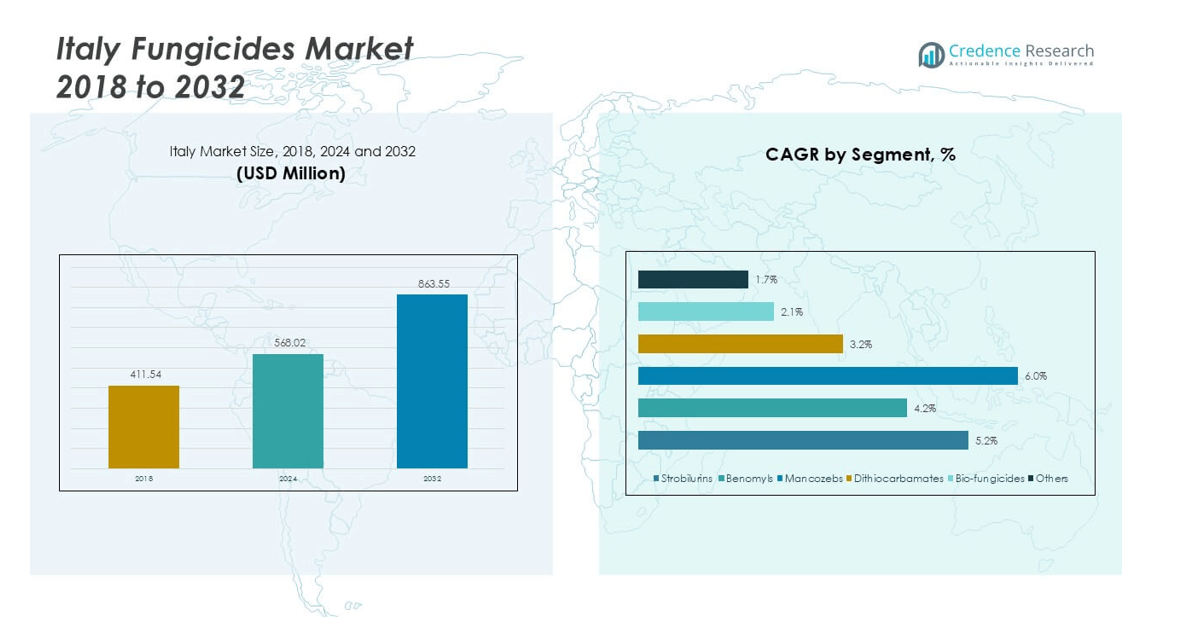

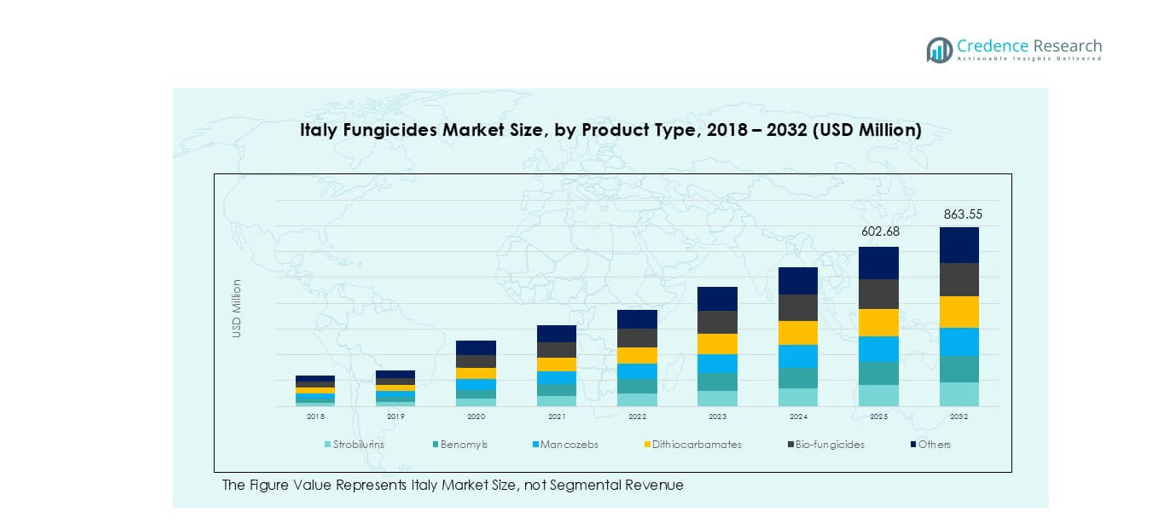

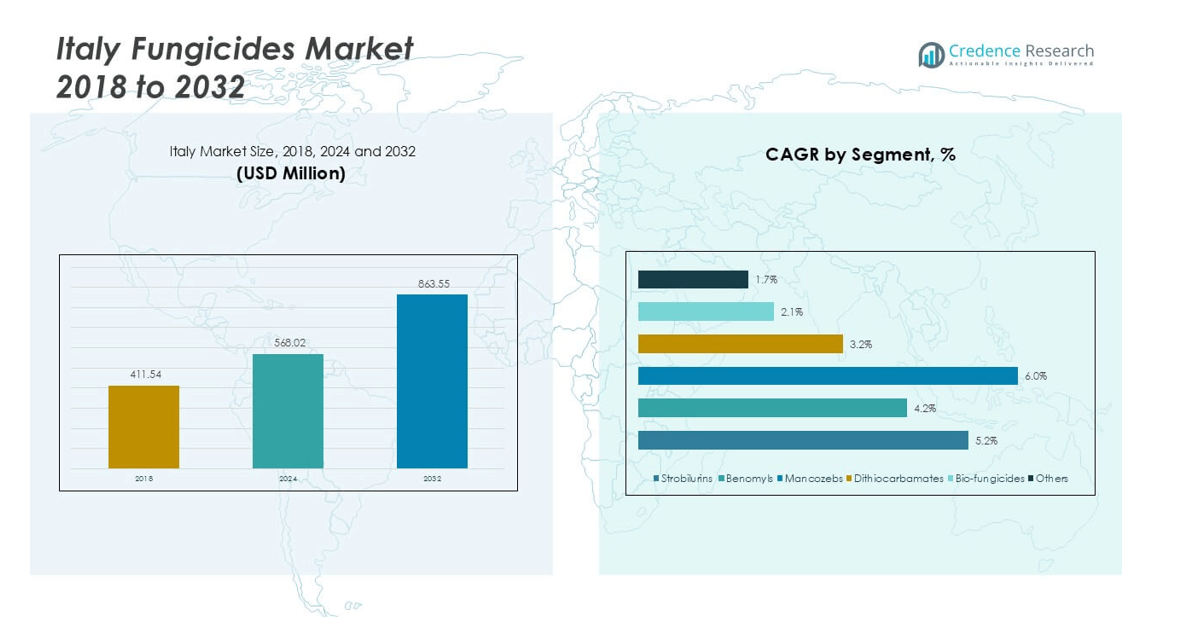

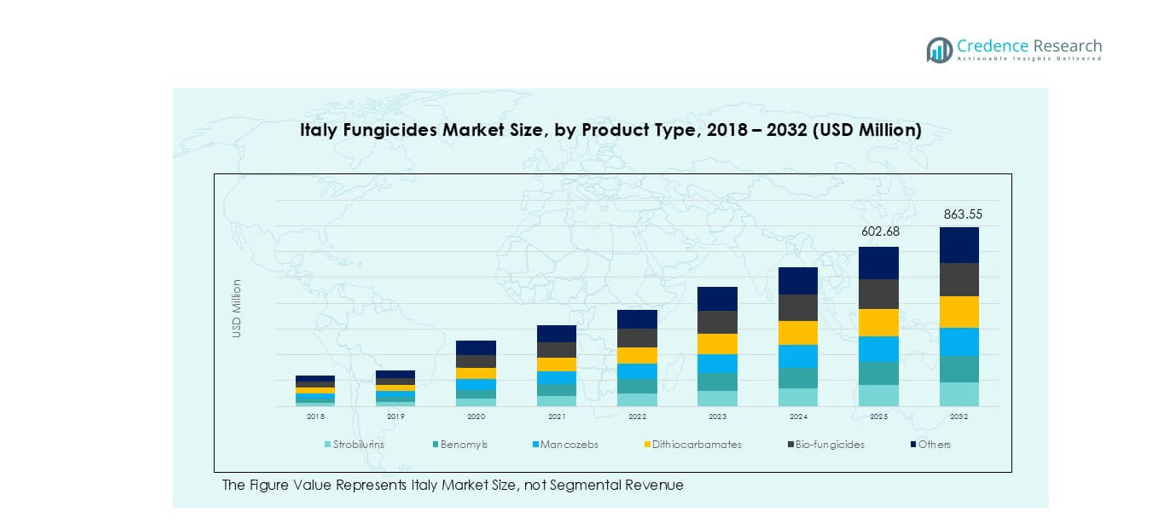

Italy Fungicides market size was valued at USD 411.54 million in 2018, grew to USD 568.02 million in 2024, and is anticipated to reach USD 863.55 million by 2032, at a CAGR of 5.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Fungicides Market Size 2024 |

USD 568.02 million |

| Italy Fungicides Market, CAGR |

5.27% |

| Italy Fungicides Market Size 2032 |

USD 863.55 million |

The Italy fungicides market is led by global players including Bayer CropScience, BASF SE, Syngenta AG, Corteva AG, UPL Ltd, Adama Agricultural Solutions, and Sumitomo Chemical, alongside regional firms such as Nufarm SRL, XEDA Italia, and Chemia SPA. These companies compete through broad product portfolios, strong distribution networks, and innovation in bio-fungicides to address EU sustainability standards. Northern Italy accounts for 45% of the market, driven by extensive vineyards and fruit orchards, while Central Italy holds 30%, supported by grape and olive cultivation. Southern Italy contributes 25%, with high demand from citrus and vegetable production. This regional spread highlights a market shaped by crop diversity and strong export orientation.

Market Insights

- The Italy fungicides market was valued at USD 568.02 million in 2024 and is projected to reach USD 863.55 million by 2032, growing at a CAGR of 5.27%.

- Market growth is driven by rising demand from vineyards, fruit orchards, and vegetable farms, with strobilurins holding the largest product share due to their broad-spectrum disease control.

- A key trend is the increasing adoption of bio-fungicides, supported by EU sustainability targets and consumer demand for residue-free produce.

- Competition is strong, led by global firms like Bayer, BASF, Syngenta, Corteva, and UPL, along with regional companies such as Nufarm SRL and XEDA Italia focusing on bio-based innovations.

- Northern Italy holds 45% of the market, followed by Central Italy with 30% and Southern Italy at 25%; by application, fruits and vegetables dominate, supported by Italy’s export-oriented wine, citrus, and tomato production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Strobilurins dominate the Italy fungicides market with the largest share, supported by their broad-spectrum activity and preventive properties. They are widely used in vineyards and fruit orchards due to strong protection against downy mildew and powdery mildew. Mancozebs also hold a significant position as cost-effective multi-site protectants for cereals and vegetables. Bio-fungicides are steadily gaining traction, driven by rising demand for residue-free produce and compliance with EU sustainability goals. Dithiocarbamates and benomyls remain niche, serving specific crops where traditional fungicides remain effective. The market reflects a shift toward environmentally safer formulations.

- For instance, Xemium (active ingredient fluxapyroxad), a carboxamide-class fungicide developed by BASF, is used to combat a broad spectrum of fungal diseases but is ineffective against downy mildew (Plasmopara viticola). It works by inhibiting succinate dehydrogenase (SDHI), a crucial enzyme in fungal cell respiration.

By Application

Fruits and vegetables represent the dominant application segment, accounting for the largest market share in Italy. High-value crops such as grapes, tomatoes, and apples demand intensive fungicide use due to susceptibility to fungal diseases. The cereals and grains segment also shows consistent demand, particularly in northern regions where wheat and barley cultivation is concentrated. Ornamentals and pulses & oilseeds contribute smaller shares but remain important for specialty growers. Rising consumer preference for premium quality fresh produce and stringent EU regulations on crop health standards drive fungicide adoption across all applications.

- For instance, in 2022, Syngenta reported that its fungicide Switch was used across a significant portion of Italian vineyards to control Botrytis cinerea and preserve grape quality.

Market Overview

Expansion of High-Value Crop Cultivation

Italy’s fungicides market benefits from the expansion of high-value crops such as grapes, apples, and tomatoes. These crops are vulnerable to fungal infections like downy mildew, powdery mildew, and botrytis, driving consistent fungicide demand. Vineyards in particular represent a critical sector, as Italy is a leading global wine producer requiring intensive crop protection. Farmers adopt advanced fungicide solutions to ensure quality yields that meet export standards. The focus on safeguarding premium produce secures steady growth for strobilurins and other high-performance fungicides in the country.

- For instance, in 2022, BASF continued to be an active supplier of fungicides to Italian growers, including for grapes and cereals. That year, the company’s notable activities in the Italian market included the launch of its new Revysion fungicide and the integration of digital farming tools from the acquired company Horta to assist with fungicide decisions on grapes.

Adoption of Sustainable Agricultural Practices

The Italian fungicides market is strongly driven by the shift toward sustainable agriculture aligned with EU Green Deal objectives. Farmers are transitioning to bio-fungicides and integrated pest management (IPM) strategies to reduce chemical reliance. This trend is supported by government incentives and strict regulatory frameworks targeting reduced residues in food products. Demand for eco-friendly formulations rises as retailers and consumers prioritize safety and sustainability. Bio-fungicides, with their low environmental impact, gain significant adoption in fruit and vegetable farming, ensuring compliance with evolving environmental standards.

- For instance, Bayer’s Serenade ASO bio-fungicide is suitable for use on fruit and vegetable farms to help growers meet organic certification standards. In countries like Italy, it is used on various crops as part of pest management strategies to reduce reliance on conventional chemical fungicides.

Rising Export-Oriented Production

Italy’s position as a major exporter of fresh produce and wine supports fungicide demand. Export markets in Europe and beyond impose strict phytosanitary requirements, compelling growers to maintain disease-free crops. Compliance with international quality standards fuels the use of reliable and efficient fungicides across cultivation zones. Producers increasingly invest in preventive treatments to protect crops during extended supply chains. This export-driven agricultural model ensures strong demand for both synthetic and biological fungicides, sustaining market expansion while supporting Italy’s competitiveness in global food trade.

Key Trends & Opportunities

Shift Toward Bio-Fungicides

A major trend shaping the Italian fungicides market is the growing adoption of bio-fungicides. Farmers and cooperatives increasingly embrace microbial and plant-based formulations due to their safety and compliance with EU residue limits. Bio-fungicides offer opportunities for companies to expand product portfolios targeting organic farming. This shift also supports consumer demand for sustainable food production. Suppliers that innovate in biological control solutions and ensure compatibility with conventional fungicides stand to capture greater market share in Italy’s evolving agricultural landscape.

- For instance, in 2021, the bio-fungicide Botector, containing the naturally occurring fungus Aureobasidium pullulans, was used on vineyards in Italy to manage Botrytis cinerea (grey mould). The product works by outcompeting the pathogen for space and nutrients on the fruit surface

Digital Farming and Precision Application

Precision agriculture presents a strong opportunity for the Italy fungicides market. Advanced technologies such as drones, sensors, and digital platforms enable accurate fungicide application, reducing waste and improving crop protection efficiency. Farmers adopt precision spraying in vineyards and orchards to minimize input costs and meet sustainability goals. This trend supports higher yields while addressing environmental concerns over excessive fungicide use. Technology-driven adoption is likely to expand as digital farming tools become more affordable and accessible across Italian agricultural regions.

Key Challenges

Stringent Regulatory Framework

The Italian fungicides market faces challenges due to strict EU regulations on chemical usage and residue levels. Continuous updates under the EU Green Deal and Farm-to-Fork strategy push for reduced reliance on synthetic fungicides. Companies must invest heavily in compliance, reformulation, and registration processes, increasing costs and limiting product availability. These rules particularly affect multi-site fungicides like mancozebs, whose usage faces tighter restrictions. While driving sustainability, regulatory pressure creates operational hurdles for manufacturers and growers dependent on conventional products.

Climate Variability and Disease Pressure

Unpredictable climate patterns in Italy increase the complexity of managing fungal diseases. Rising temperatures and irregular rainfall intensify the spread of pathogens such as downy mildew and leaf spots. Farmers often struggle with sudden outbreaks that require higher fungicide use, raising input costs and operational risks. Regional disparities in climate further complicate product adoption strategies. The need for adaptable, broad-spectrum, and climate-resilient fungicide solutions is critical. Addressing these challenges demands continuous innovation from agrochemical companies and better disease forecasting systems.

Regional Analysis

Northern Italy

Northern Italy holds the largest share of the country’s fungicides market at 45%, driven by its dominance in viticulture and cereal cultivation. The region’s vineyards, especially in Piedmont, Veneto, and Lombardy, are highly vulnerable to downy mildew and powdery mildew, requiring intensive fungicide application. Fruit crops such as apples and pears also contribute significantly to demand. Advanced farming practices and higher adoption of strobilurins and bio-fungicides further strengthen the region’s leadership. Export-oriented wine and fruit production creates a consistent need for crop protection, making Northern Italy the most dynamic and profitable regional market.

Central Italy

Central Italy accounts for 30% of the fungicides market, with Tuscany and Lazio leading in vineyard and horticulture cultivation. Grapes, olives, and vegetables dominate cropping patterns, generating steady fungicide demand to manage fungal infections like botrytis and leaf spots. Farmers in this region are increasingly adopting bio-fungicides to comply with sustainability initiatives and promote organic produce. The emphasis on high-value crops linked to wine and olive oil production boosts reliance on fungicides. Central Italy’s moderate climate and strong agri-food exports sustain demand growth, making the region an important contributor to the national fungicides market.

Southern Italy

Southern Italy represents 25% of the fungicides market, with key production centered in Sicily, Campania, and Puglia. The region’s warm climate and extended growing seasons increase fungal disease pressure on crops such as tomatoes, citrus fruits, and vegetables. Fungicide adoption is strong in greenhouse farming and open-field cultivation to ensure export-quality produce. While traditional chemical fungicides remain important, rising demand for bio-fungicides reflects efforts to align with EU residue regulations. Southern Italy’s dependence on agriculture as a major economic driver ensures consistent fungicide usage, with opportunities for growth in sustainable and climate-resilient formulations.

Market Segmentations:

By Product Type

- Strobilurins

- Benomyls

- Mancozebs

- Dithiocarbamates

- Bio-fungicides

- Others

By Application

- Fruits & Vegetables

- Cereals & Grains

- Ornamentals

- Pulses & Oilseeds

- Others

By Geography

- Northern Italy

- Central Italy

- Southern Italy

Competitive Landscape

The Italy fungicides market is characterized by strong competition among global agrochemical leaders and regional specialists. Multinational companies such as Bayer CropScience, BASF SE, Syngenta AG, Corteva AG, UPL Ltd, Adama Agricultural Solutions, and Sumitomo Chemical dominate with extensive product portfolios covering both chemical and bio-based fungicides. These players invest in R&D, sustainability initiatives, and precision agriculture solutions to meet EU regulatory requirements and farmer demand for residue-free produce. Regional firms like Nufarm SRL, XEDA Italia, and Chemia SPA enhance competition by offering localized expertise, niche bio-fungicide products, and cost-effective alternatives tailored for Italian crops. Partnerships with cooperatives and distributors strengthen market presence, ensuring effective product penetration across vineyards, orchards, and vegetable farms. Increasing emphasis on bio-fungicides and integrated pest management (IPM) is reshaping competitive strategies, with players focusing on innovative, eco-friendly formulations. The competitive landscape reflects a balance between global innovation and regional adaptability, positioning Italy as a key growth market within Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nufarm SRL

- XEDA Italia

- Chemia SPA

- Sumitomo Chemical

- Syngenta AG

- UPL Ltd

- Adama Agricultural Solutions

- Corteva AG

- Bayer CropScience

- BASF SE

Recent Developments

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

- In October 2023, “Bayer”, one of the well-known agriculture products companies based in the U.K., received approval from the Chemicals Regulation Division (CRD) for its new active substance to be used in fungicides. The new substance is isoflucypram, which will be used in its product called Vimoy.

- In August 2023, Bayer AG announced a significant investment of EUR 220 million in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In September 2022, BASF, a well-known agriculture nutrition manufacturer, announced the launch of its all-new innovative fungicide product called Revylution, which received approval for use in New Zealand.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy fungicides market will continue to grow with strong demand from vineyards.

- Fruits and vegetables will remain the dominant application segment for fungicide use.

- Bio-fungicides adoption will accelerate due to EU sustainability goals and residue regulations.

- Strobilurins will sustain the largest share because of broad-spectrum effectiveness.

- Innovation in precision spraying and digital farming will improve fungicide efficiency.

- Northern Italy will keep leading with the highest regional market share.

- Central Italy will see steady growth supported by grape and olive farming.

- Southern Italy will expand with rising demand from citrus and tomato production.

- Competition will intensify as global and regional firms invest in eco-friendly solutions.

- Climate variability will drive demand for adaptable and resilient fungicide formulations.