| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Off the Road Tire Market Size 2023 |

USD 1,118.23 Million |

| Japan Off the Road Tire Market, CAGR |

4.86% |

| Japan Off the Road Tire Market Size 2032 |

USD 1,716.09 Million |

Market Overview:

Japan Off the Road Tire Market size was valued at USD 1,118.23 million in 2023 and is anticipated to reach USD 1,716.09 million by 2032, at a CAGR of 4.86% during the forecast period (2023-2032).

Key drivers propelling the OTR tire market in Japan include robust infrastructure development and advancements in agricultural mechanization. The Japanese government’s substantial investments in public works projects, such as highways and urban development, have led to heightened demand for heavy machinery like excavators and bulldozers, which require specialized off-road tires. These initiatives not only improve the nation’s infrastructure but also create a sustainable demand for durable and high-performing tires. Concurrently, the modernization of the agricultural sector, with an emphasis on mechanization, has escalated the need for high-quality tires to support tractors and other farming equipment. This shift enables more efficient farming practices and increases the demand for tires that can withstand various field conditions. Additionally, the growing popularity of recreational off-road activities has further fueled the demand for specialized tires, contributing to the market’s expansion.

Regionally, the OTR tire market in Japan is predominantly concentrated in areas with significant industrial and agricultural activities. The Kanto region, encompassing Tokyo and its surrounding areas, stands out due to its extensive infrastructure projects and industrial hubs. This region’s urbanization and ongoing construction projects ensure a steady demand for heavy-duty off-road tires. Similarly, the Kansai region, which includes Osaka and Kyoto, is a vital contributor, driven by its manufacturing sector and agricultural activities. The automotive and machinery industries in this region rely heavily on off-road vehicles, which in turn necessitate the use of specialized tires. Hokkaido, with its expansive agricultural landscape, also represents a crucial market segment, as the demand for agricultural machinery and, consequently, off-road tires remains high. The farming landscape in Hokkaido creates consistent demand for robust tires to support tractors, harvesters, and other machinery used in agriculture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Off the Road Tire market was valued at USD 1,118.23 million in 2023 and is expected to reach USD 1,716.09 million by 2032, growing at a CAGR of 4.86% during the forecast period (2023-2032).

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Infrastructure development and public works projects, such as highway expansion and urban development, significantly drive the demand for heavy machinery requiring specialized OTR tires.

- Agricultural mechanization, especially in rural areas like Hokkaido, has contributed to the increased demand for high-quality OTR tires for machinery like tractors and harvesters.

- Japan’s mining sector, though limited, remains a vital driver for OTR tire demand, as mining operations require durable tires to withstand harsh and abrasive environments.

- The growing popularity of recreational off-road activities such as motocross and ATV riding has expanded the OTR tire market, creating new opportunities for manufacturers to meet consumer demand.

- The market is regionally concentrated in industrial and agricultural hubs like Kanto, Kansai, and Hokkaido, which require specialized off-road tires for construction, agriculture, and manufacturing sectors.

- Despite market growth, challenges such as high manufacturing costs, economic fluctuations, and limited recycling solutions for used OTR tires remain key factors to address for long-term market sustainability.

Market Drivers:

Infrastructure Development and Construction Growth

The rapid growth in infrastructure development and construction projects in Japan plays a significant role in driving the demand for off-the-road (OTR) tires. For instance, the expanding construction industry and the increasing number of large-scale projects such as highways, bridges, tunnels, and industrial facilities are primary factors driving OTR tire demand, as highlighted by IMARC Group. The Japanese government’s continued focus on urbanization and public works projects, such as highway expansion, airport development, and railway systems, has spurred the need for heavy-duty machinery such as excavators, bulldozers, and cranes. These machines require durable and specialized OTR tires that can endure harsh working conditions. As the government accelerates its efforts to improve the nation’s infrastructure, the demand for high-performance off-road tires will continue to rise, supporting the overall growth of the OTR tire market in Japan.

Agricultural Mechanization

Agriculture remains a cornerstone of Japan’s economy, and the mechanization of farming practices is a key driver for the OTR tire market. Over recent years, there has been an increasing shift towards using advanced agricultural machinery, such as tractors, harvesters, and plows, to enhance productivity and efficiency. These machines require specialized off-road tires to operate effectively in diverse terrains, including fields with uneven ground. The growth in agricultural mechanization, particularly in rural areas and agricultural zones such as Hokkaido, has significantly driven the demand for OTR tires. For instance, companies like Trimble Inc. and AGCO Corporation have established joint ventures to provide factory-fitted and aftermarket OTR tire solutions tailored for precision agriculture, reflecting the sector’s increasing reliance on specialized tire technology. As Japan continues to invest in modernizing its agricultural sector, the need for durable tires suited to the unique demands of the industry will only intensify.

Mining and Resource Extraction

Japan’s mining sector, although limited compared to some global counterparts, remains a vital component of the country’s economy. With Japan’s rich mineral resources, particularly in the extraction of coal, precious metals, and rare earth minerals, there is a steady demand for mining equipment, which includes heavy-duty off-road vehicles. These mining operations rely heavily on robust OTR tires that can withstand extreme working conditions, such as rocky surfaces and abrasive environments. The growth in the mining and resource extraction industries, coupled with the need for specialized off-road vehicles in these sectors, continues to fuel the demand for OTR tires, contributing significantly to the market’s growth in Japan.

Recreational Off-Road Activities

In recent years, the rise in recreational off-road activities has added a new dimension to the demand for off-road tires in Japan. The increasing popularity of off-road sports, such as motocross, ATV riding, and off-road racing, has led to an upsurge in the demand for high-performance tires. As recreational off-roading becomes more mainstream, the need for tires that offer durability, safety, and optimal performance in challenging environments has grown. This shift in consumer behavior towards outdoor adventures and off-road sports has further expanded the scope of the OTR tire market in Japan, opening new opportunities for tire manufacturers to cater to this growing segment. Consequently, the recreational off-road sector now serves as a key driver for the OTR tire market in Japan.

Market Trends:

Technological Advancements in Tire Design

One of the most prominent trends shaping the Japan Off-the-Road (OTR) tire market is the continuous technological advancements in tire design and materials. Manufacturers are increasingly focusing on developing tires that offer enhanced durability, better fuel efficiency, and superior performance in challenging environments. For example, Bridgestone has developed a revolutionary air-free tire design that uses thermoplastic resin spokes to support vehicle weight, eliminating the need for air pressure. Innovations such as the incorporation of advanced rubber compounds, tire tread patterns optimized for specific applications, and the integration of sensor technology for real-time monitoring of tire performance are gaining traction. These improvements are not only designed to extend the lifespan of tires but also contribute to lowering operational costs for end-users, further driving demand for technologically superior OTR tires in Japan.

Shift Towards Eco-Friendly and Sustainable Tires

As sustainability becomes a greater priority for industries worldwide, the Japanese OTR tire market is experiencing a shift towards eco-friendly and sustainable tire solutions. Environmental concerns, including tire waste and the impact of production processes on the environment, are encouraging manufacturers to develop tires with reduced environmental footprints. The use of renewable materials, such as bio-based rubbers and recycled materials, in the production of OTR tires is growing. Moreover, manufacturers are focusing on improving the recyclability of used tires and adopting green manufacturing practices to align with stricter environmental regulations in Japan. For instance, companies like Michelin and Sumitomo are actively reducing emissions throughout the tire lifecycle and increasing the use of renewable materials, such as bio-based rubbers and recycled content, in their products. This shift towards sustainability is not only driven by consumer demand but also by the government’s increasing emphasis on eco-friendly policies and initiatives.

Integration of Smart Technologies and Digitalization

Digitalization and the integration of smart technologies are also influencing the Japan OTR tire market. The rise of connected and autonomous vehicles has led to greater emphasis on developing tires that are compatible with advanced technologies. Features such as tire pressure monitoring systems (TPMS), real-time wear monitoring, and automatic inflation systems are becoming common in OTR tire offerings. These smart technologies allow for better maintenance management, enhancing operational efficiency and reducing downtime. As industries such as construction and mining increasingly adopt digital solutions to enhance productivity, the demand for OTR tires equipped with smart technology continues to grow. This trend is contributing to a more data-driven approach to tire management, benefiting both end-users and manufacturers alike.

Growing Demand for Larger Tires

Another significant trend in the Japan OTR tire market is the increasing demand for larger tires, especially in the mining, construction, and agricultural sectors. Larger tires are essential for heavy-duty vehicles used in challenging terrains, such as mining trucks, large excavators, and agricultural machinery. As Japan’s industries grow more advanced, the need for vehicles capable of handling larger loads and navigating rougher terrains is increasing. This trend towards larger tires is being driven by the need for higher productivity and better performance under demanding conditions. Additionally, the larger tire segment offers higher durability and enhanced traction, making it a preferred choice in industries that rely on high-performance machinery. The growing adoption of these larger, more robust tires is shaping the future of Japan’s OTR tire market.

Market Challenges Analysis:

High Manufacturing Costs

One of the primary challenges faced by the Japan Off-the-Road (OTR) tire market is the high cost of manufacturing. The production of specialized OTR tires requires advanced technology, high-quality raw materials, and precise engineering to ensure durability and performance. These factors contribute to the overall high production costs. For instance, manufacturing an OTR tire involves a cost of approximately USD 17.37, with rubber and steel cord constituting the major component. Additionally, the complex manufacturing processes needed to produce tires suitable for heavy-duty applications such as mining and construction further escalate costs. For manufacturers, maintaining cost-effectiveness while ensuring high performance remains a significant challenge. As a result, the prices of OTR tires remain relatively high, which can limit their adoption in price-sensitive markets.

Economic Fluctuations and Market Uncertainty

Economic fluctuations and market uncertainty are also substantial barriers to the growth of the OTR tire market in Japan. The demand for off-road tires is closely linked to the performance of key industries such as construction, agriculture, and mining. Economic downturns or shifts in market conditions, such as declining investment in infrastructure projects or reduced agricultural activity, can lead to a decrease in demand for OTR tires. Additionally, changes in government policies and trade relations can introduce further uncertainty, impacting both tire manufacturers and end-users. These economic fluctuations make it difficult for companies to predict market demand accurately and may hinder long-term investments in the OTR tire market.

Limited Recycling and Disposal Solutions

The limited availability of effective recycling and disposal solutions for used OTR tires presents another challenge in Japan’s tire market. Despite increasing awareness around environmental sustainability, managing the disposal of used tires remains a complex issue. The accumulation of discarded OTR tires poses environmental risks, and there are insufficient infrastructure and technologies to handle large-scale recycling. This challenge is compounded by stringent regulations governing tire waste disposal, placing pressure on manufacturers to adopt more sustainable practices. As the demand for OTR tires continues to grow, addressing the environmental impact of tire disposal will be critical for the industry’s long-term sustainability.

Market Opportunities:

The Japan Off-the-Road (OTR) tire market presents significant growth opportunities driven by the ongoing expansion of infrastructure projects across the nation. As the Japanese government continues to prioritize large-scale construction initiatives, including the development of transportation networks, ports, and urban development, the demand for heavy machinery equipped with specialized OTR tires is expected to rise. This growth is further supported by advancements in construction technology and the increasing reliance on high-performance machinery for large-scale projects. Manufacturers can capitalize on this opportunity by developing durable, high-performance OTR tires tailored to the evolving needs of the construction and infrastructure sectors.

Additionally, the agricultural sector in Japan offers substantial opportunities for growth in the OTR tire market. With the increasing adoption of mechanized farming practices, particularly in rural areas like Hokkaido, the demand for advanced agricultural equipment such as tractors, harvesters, and plows has surged. These machines require specialized off-road tires to ensure optimal performance in diverse field conditions. Tire manufacturers can seize this opportunity by focusing on creating products that offer enhanced durability and traction, which are critical for the efficient operation of agricultural machinery. As Japan continues to modernize its agricultural sector, the demand for high-quality OTR tires is set to grow, providing a promising avenue for industry players to expand their market share.

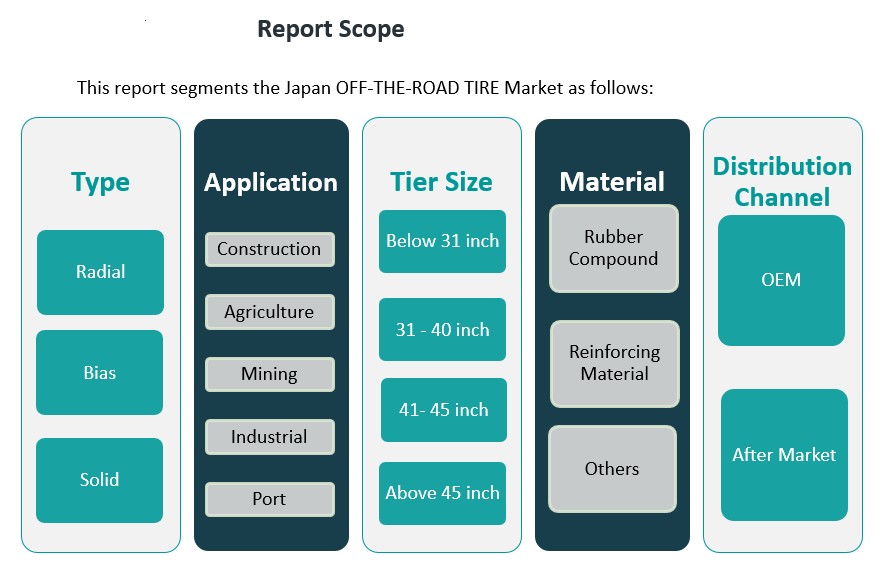

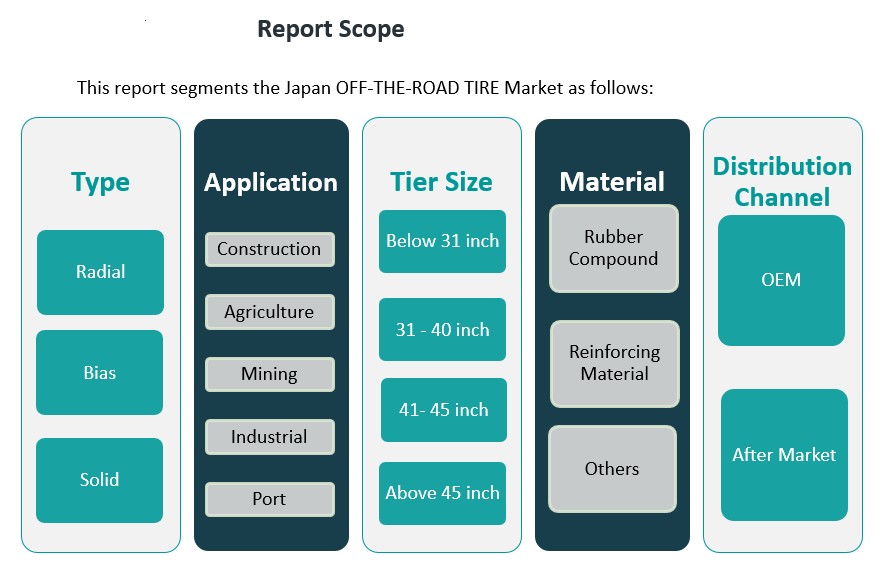

Market Segmentation Analysis:

The Japan Off-the-Road (OTR) tire market is segmented based on several key factors, each contributing uniquely to the market’s expansion.

By Type Segment

The OTR tire market in Japan is divided into radial, bias, and solid tires. Radial tires dominate the market due to their superior durability, performance, and fuel efficiency. Bias tires, while offering lower initial costs, are typically used in specific applications that do not require high-speed operations. Solid tires, which are highly durable and puncture-resistant, are increasingly used in industrial and port operations where machinery is subjected to constant heavy load.

By Application Segment

The application segment is another critical factor, with construction, agriculture, mining, industrial, and port operations driving the demand for OTR tires. Construction accounts for the largest share, driven by ongoing infrastructure projects requiring heavy machinery. Agriculture follows closely, particularly in rural areas like Hokkaido, where mechanized farming is increasing. Mining and industrial applications are significant, as Japan’s resource extraction and manufacturing sectors require robust and specialized tires. Ports also contribute to market demand, as cargo handling equipment relies on durable tires to operate efficiently.

By Tire Size Segment

The tire size segment includes categories such as below 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. Larger tires, especially those above 45 inches, are widely used in mining and heavy-duty construction equipment. Smaller tire sizes are prevalent in agricultural machinery.

By Material Segment

The material segment is classified into rubber compounds, reinforcing materials, and others, with rubber compounds being the dominant material used in OTR tire manufacturing due to their balance of durability and performance.

By Distribution Channel Segment

The market is divided into OEM and aftermarket segments. OEM tires are primarily sold with new equipment, while the aftermarket segment caters to replacement and maintenance needs, offering growth opportunities for tire manufacturers.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Japan Off-the-Road (OTR) tire market is regionally diverse, with several key areas contributing to its overall growth. Each region plays a vital role in driving the demand for off-road tires based on its industrial, agricultural, and infrastructure activities.

Kanto Region

The Kanto region, which includes Tokyo and its surrounding areas, holds the largest market share in the Japan OTR tire market, accounting for approximately 35% of the total market. The region’s strong industrial base, with significant construction, manufacturing, and transportation infrastructure development, significantly boosts the demand for heavy machinery equipped with specialized OTR tires. Ongoing infrastructure projects such as urban development and large-scale construction further elevate the region’s dominance in the OTR tire market.

Kansai Region

The Kansai region, which encompasses cities like Osaka, Kyoto, and Kobe, contributes around 25% to the Japan OTR tire market. This area is known for its manufacturing sector, including automotive production, which relies heavily on off-road vehicles for logistics and material handling. Additionally, agricultural activities in rural parts of the region, particularly in Kyoto and Nara, increase the demand for OTR tires tailored for agricultural machinery. The Kansai region’s combination of industrial and agricultural activities makes it a key player in the OTR tire market.

Hokkaido Region

Hokkaido, Japan’s northernmost island, holds a notable market share of approximately 15%. The region’s expansive agricultural landscape necessitates a significant demand for off-road tires, particularly for tractors, harvesters, and other farming machinery. With the mechanization of farming in Hokkaido growing, tire demand for agricultural equipment continues to rise. Additionally, the region’s severe winter conditions place increased emphasis on tire durability, driving demand for specialized OTR tires that can withstand extreme temperatures and rugged terrain.

Chugoku and Shikoku Regions

The Chugoku and Shikoku regions contribute around 10% to the Japan OTR tire market. These areas have a strong presence in the agricultural and construction sectors, especially in rural areas where farming and infrastructure development projects are key. Despite being smaller in terms of overall demand, the OTR tire market in these regions is growing steadily, driven by localized construction activities and agricultural modernization.

Other Regions

The remaining 15% of the market is spread across other regions of Japan, including Kyushu and Okinawa. These areas are mainly driven by small-scale mining, agriculture, and construction projects. While they contribute less to the overall market, the demand for OTR tires is expected to increase as local infrastructure projects and industrial activities continue to develop.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Yokohama Rubber Co., Ltd

- Sumitomo Rubber Industries, Ltd

Competitive Analysis:

The Japan Off-the-Road (OTR) tire market is highly competitive, with several key global and local players operating in the region. Leading tire manufacturers such as Bridgestone Corporation, Yokohama Rubber Company, and Michelin dominate the market due to their established brand reputation, extensive distribution networks, and technological innovations. Bridgestone, in particular, holds a significant share, leveraging its advanced tire designs and strong presence in both OEM and aftermarket segments. Michelin and Yokohama also maintain strong positions, offering specialized OTR tire solutions tailored to industries such as construction, mining, and agriculture. Local players such as Sumitomo Rubber Industries and Toyo Tire are focusing on expanding their market share by introducing more cost-effective solutions and enhancing product offerings with improved durability and performance. As demand for high-performance and eco-friendly tires increases, manufacturers are investing in sustainable practices and innovations to meet evolving consumer needs, maintaining fierce competition in the Japanese OTR tire market.

Recent Developments:

- In February 2025, Yokohama Rubber Co., Ltd. completed its acquisition of the Off-the-Road (OTR) tire business from The Goodyear Tire & Rubber Company. This major transaction, initially announced in July 2024, brings Goodyear’s specialized mining and construction tire operations—including advanced technologies, strong brand assets, and an experienced workforce—under Yokohama’s umbrella. The acquisition is part of Yokohama’s medium-term management plan, “Yokohama Transformation 2026,” and is intended to significantly expand its off-highway tire lineup and production capabilities. With this move, Yokohama aims to strengthen its competitive position and corporate value in the global OTR tire sector.

- In March 2024, Goodyear, a key player in the OTR tire market, launched the RL-5K OTR tire. This new product is engineered for heavy-duty loaders and wheel dozers, featuring a three-star load capacity rating to enhance durability and performance in demanding operations. The RL-5K tire showcases Goodyear’s ongoing commitment to innovation in OTR technology, focusing on efficiency, durability, and operational performance for mining and construction applications.

- In December 2023, JK Tyre & Industries, which serves the broader Asia-Pacific region including Japan, introduced 11 new OTR tires at the CII EXCON event in Bengaluru, India. Among the new offerings, the JK Tyre 18.00-25 40PR Port Champion Plus stands out for its deep treads, precise pattern, and heavy rubber center, ensuring durability, mileage, and exceptional steering performance for reach stackers.

Market Concentration & Characteristics:

The Japan Off-the-Road (OTR) tire market exhibits moderate concentration, with a few large global players dominating the market. Companies like Bridgestone, Michelin, and Yokohama Rubber lead the market, collectively commanding a significant share. These players benefit from economies of scale, extensive distribution networks, and strong brand recognition, allowing them to maintain competitive advantage. However, local manufacturers such as Sumitomo Rubber and Toyo Tire are increasingly gaining traction by offering cost-effective solutions and focusing on niche market segments. The market is characterized by a high level of technological innovation, with manufacturers emphasizing the development of durable, high-performance, and eco-friendly tires. Manufacturers are also exploring smart tire technologies, such as tire pressure monitoring systems and wear sensors, to meet the evolving demands of industries like construction, agriculture, and mining. As environmental concerns rise, sustainability is becoming a key focus, influencing both product development and manufacturing practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan OTR tire market is expected to grow steadily due to continued infrastructure development and urbanization projects.

- Increased agricultural mechanization, particularly in rural areas like Hokkaido, will drive higher demand for specialized off-road tires.

- Technological advancements in tire materials and smart features such as sensors will enhance tire performance and longevity.

- Rising environmental awareness will lead to the development of eco-friendly and sustainable OTR tire solutions.

- Demand for larger, more durable tires will rise, especially in the mining and construction sectors.

- The market will see growth in the recreational off-road segment, driven by rising popularity in outdoor activities.

- Investments in research and development will fuel innovation in tire designs for enhanced durability and fuel efficiency.

- Aftermarket sales will continue to grow, supported by the aging fleet of off-road machinery.

- Competitive pressures will intensify as local manufacturers increase focus on cost-effective solutions.

- Regional demand will shift as emerging markets in the northern and southern regions of Japan expand industrial and agricultural activities.