| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

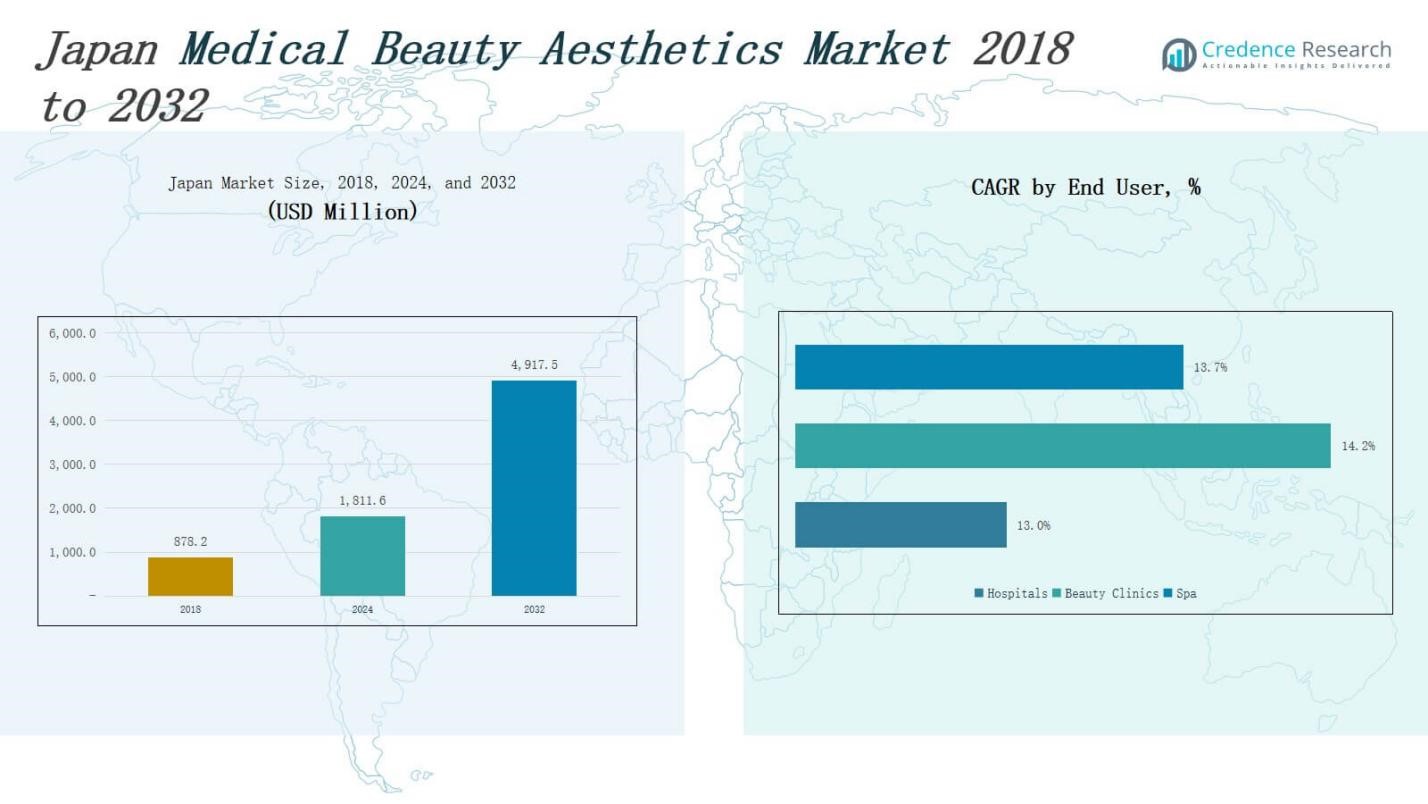

| Japan Medical Beauty Aesthetics Market Size 2024 |

USD 1,811.6 Million |

| Japan Medical Beauty Aesthetics Market, CAGR |

13.41% |

| Japan Medical Beauty Aesthetics Market Size 2032 |

USD 4,917.5 Million |

Market Overview

The Japan Medical Beauty Aesthetics Market size was valued at USD 878.2 million in 2018 to USD 1,811.6 million in 2024 and is anticipated to reach USD 4,917.5 million by 2032, at a CAGR of 13.41% during the forecast period.

Japan’s medical beauty aesthetics market is propelled by a confluence of robust macro trends and evolving consumer behavior. With a rapidly aging population—nearly 29% over age 65—demand for minimally invasive anti-aging treatments such as injectables, laser‑based skin rejuvenation, and body contouring has surged. Social media and celebrity influence alongside rising aesthetic consciousness are accelerating acceptance of non‑surgical procedures across age groups, including growing uptake among men. Technological innovation plays a pivotal role: AI‑driven diagnostic tools, advanced laser systems, and next‑generation injectables enhance procedural safety, personalization, and natural outcomes. Private investment and expansion of clinic networks are improving accessibility and service quality, while the integration of telemedicine platforms eases consultation barriers and boosts reach. Additionally, Japan’s reputation for medical excellence attracts regional medical tourism, further driving market growth. Collectively, these demographic, technological, cultural, and structural forces converge to sustain a dynamic, expanding landscape in Japan’s medical beauty aesthetics sector.

The Japan Medical Beauty Aesthetics Market demonstrates strong regional concentration, with Kanto holding the largest market share at 38%, driven by Tokyo’s advanced clinical infrastructure and affluent consumer base. Kansai follows with 24%, supported by Osaka and Kyoto’s growing demand for anti-aging and non-invasive treatments. Chubu, Kyushu, Tohoku, Hokkaido, and other regions collectively account for 38%, offering untapped potential through suburban expansion and rising medical tourism. Clinics in these areas focus on accessibility, affordability, and localized service delivery. Key players shaping the competitive landscape include Galderma S.A., Merz Pharma, Bausch Health Companies Inc., Cutera Inc., El.En. S.p.A., AbbVie, Inc., Lumenis Be Ltd, and other regional providers. These companies lead through technological innovation, localized strategies, and strong partnerships with aesthetic clinics across urban and emerging areas, ensuring broad coverage and brand visibility throughout Japan’s growing aesthetic market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Medical Beauty Aesthetics Market was valued at USD 878.2 million in 2018 and reached USD 1,811.6 million in 2024; it is projected to hit USD 4,917.5 million by 2032, growing at a CAGR of 13.41%.

- A rapidly aging population, with nearly 29% over 65, drives sustained demand for injectables, laser rejuvenation, and non-surgical facelifts across the country.

- Social media influence, changing beauty norms, and rising male participation have normalized aesthetic treatments across genders and age groups.

- Advanced technologies like AI-assisted skin diagnostics and energy-based devices enhance safety, precision, and personalized results, boosting patient satisfaction.

- Private clinic expansion, supported by medical tourism and government-backed healthcare infrastructure, is improving regional accessibility and international demand.

- Regulatory hurdles, limited procedure standardization, and a shortage of certified professionals challenge scalability and consistent quality across regions.

- Kanto leads the market with a 38% share, followed by Kansai at 24%; Chubu, Kyushu, Tohoku, Hokkaido, and others contribute 38%, offering untapped growth potential.

Market Drivers

Aging Demographics Driving Demand for Aesthetic Interventions

Japan Medical Beauty Aesthetics Market benefits significantly from its aging population, which creates consistent demand for age-defying solutions. Nearly one-third of Japan’s citizens are over the age of 65, prompting an increase in procedures targeting wrinkles, sagging skin, and facial volume loss. Consumers prefer minimally invasive options that allow faster recovery and subtle results. It supports steady growth in injectables, laser treatments, and non-surgical facelifts. Clinics expand their offerings to meet these specific age-related concerns. The aging demographic continues to be a reliable growth engine for the market.

Rising Consumer Awareness and Social Influence

Japan Medical Beauty Aesthetics Market sees momentum from heightened awareness of cosmetic procedures fueled by media, influencers, and online platforms. Younger demographics increasingly view aesthetic enhancement as routine self-care rather than vanity. It creates a shift in social norms, encouraging broader participation across genders and age groups. Celebrity endorsements and aesthetic trends further normalize cosmetic treatments. Clinics tailor their marketing to appeal to these modern consumer expectations. The cultural shift toward aesthetic self-optimization supports recurring patient engagement.

Technological Advancements Enhancing Procedure Safety and Appeal

Japan Medical Beauty Aesthetics Market leverages cutting-edge technologies to improve safety, precision, and patient outcomes. High-end laser systems, AI-powered diagnostics, and personalized skin analysis tools are now common across advanced clinics. It reduces procedural risks while improving efficacy, leading to higher satisfaction rates. Medical aesthetics professionals adopt new systems that allow for non-invasive or low-downtime solutions. Japan’s innovation ecosystem supports ongoing product development in energy-based devices and skin treatment protocols. Technology remains a competitive differentiator among top clinics.

- For instance, Alma Lasers supplies advanced laser and radiofrequency devices for non-invasive body contouring and skin tightening at leading Japanese medical aesthetic centers.

Expansion of Private Clinics and Medical Tourism

Japan Medical Beauty Aesthetics Market gains traction from expanding private clinic networks and increased inbound medical tourism. New clinics with specialized services appear across urban centers to meet rising demand. It improves accessibility and fosters regional competition. International patients travel to Japan for advanced procedures due to its high medical standards and safety reputation. Government support for inbound healthcare tourism reinforces this trend. Private providers enhance multilingual services and personalized treatment packages to attract overseas clients.

- For instance, Keio University Hospital recently expanded its International Medical Center, introducing personalized oncology and cardiovascular packages with English, Chinese, and Russian interpreters on staff, streamlining care for hundreds of medical tourists each month.

Market Trends

Growing Shift Toward Minimally Invasive and Non-Surgical Treatments

Japan Medical Beauty Aesthetics Market continues to experience a marked shift toward non-surgical solutions. Demand for injectables, laser resurfacing, radiofrequency treatments, and ultrasound-based skin tightening procedures has outpaced interest in traditional cosmetic surgery. It reflects a preference for lower-risk, outpatient procedures with minimal recovery time. These techniques appeal to working professionals and older adults who seek subtle enhancements without disrupting daily life. Clinics increasingly invest in advanced, non-invasive devices to meet this shift. This trend defines the evolving landscape of patient preferences.

- For instance, Cynosure’s Icon laser platforms are deployed across major aesthetic clinics to provide fractional laser resurfacing and IPL therapies, meeting the increasing popularity of high-tech skin rejuvenation among Japanese patients.

Rising Adoption of AI and Personalized Skin Diagnostics

Japan Medical Beauty Aesthetics Market integrates artificial intelligence and digital diagnostics into routine aesthetic care. AI tools are widely used for skin analysis, treatment planning, and monitoring progress. It enables physicians to personalize therapies based on detailed imaging and predictive modeling. Consumers value the accuracy and customized results these systems deliver. Technology also supports virtual consultations, improving access across remote areas. This shift toward data-driven, individualized care improves both patient confidence and treatment outcomes.

- For instance, Shiseido Co., Ltd. launched an AI-driven skin analysis system at its GINZA flagship store, employing imaging and deep learning to recommend tailored skincare regimens based on users’ unique skin conditions.

Increased Male Participation and Gender-Inclusive Branding

Japan Medical Beauty Aesthetics Market sees expanding participation among male clients seeking skincare and anti-aging solutions. Clinics report steady growth in male patients opting for facial rejuvenation, hair restoration, and body contouring services. It reflects a broader shift in cultural attitudes toward male grooming and self-care. Branding strategies now focus on inclusivity, with aesthetic providers offering services specifically tailored to men. Marketing campaigns emphasize professionalism, discretion, and results. The male demographic presents new growth avenues for the market.

Sustainability and Ethical Sourcing in Aesthetic Products

Japan Medical Beauty Aesthetics Market increasingly incorporates sustainability into product development and clinic operations. Clinics seek biodegradable packaging, ethically sourced ingredients, and eco-friendly energy systems. It aligns with consumer expectations for environmental responsibility and transparency in product sourcing. Manufacturers develop clean-label serums, cruelty-free injectables, and vegan-friendly skin treatments. This shift reinforces patient trust while meeting regulatory standards. Sustainability emerges as a strategic focus area that differentiates premium providers from traditional cosmetic clinics.

Market Challenges Analysis

Regulatory Complexity and Limited Procedure Standardization

Japan Medical Beauty Aesthetics Market faces ongoing challenges due to strict regulatory frameworks and inconsistent standards across treatment categories. Clinics must navigate approvals from both medical and cosmetic oversight bodies, which often slows product introductions and procedural innovation. It creates delays in adopting global aesthetic advancements. Variations in practitioner licensing and procedure classification complicate service offerings and patient expectations. Some treatments fall into legal gray areas, exposing clinics to operational risk. These issues hinder market agility and consistency in patient care.

Shortage of Skilled Professionals and Training Gaps

Japan Medical Beauty Aesthetics Market contends with a shortage of qualified aesthetic practitioners, particularly outside major metropolitan areas. High demand for precision-based, technology-driven treatments requires ongoing education and hands-on expertise. It becomes difficult for clinics to scale while maintaining consistent quality. Limited access to accredited training programs and advanced certifications restricts the talent pipeline. Some clinics rely on underqualified personnel, raising concerns over patient safety. This shortage affects service capacity and slows expansion into regional markets.

Market Opportunities

Expansion into Regional and Aging Population Centers

Japan Medical Beauty Aesthetics Market holds strong potential in regional cities and towns where access to aesthetic services remains limited. Many aging communities outside Tokyo, Osaka, and Nagoya show rising interest in non-invasive procedures but lack local providers. It creates an opportunity for clinic chains to expand geographically with tailored offerings for older populations. Mobile clinics and teleconsultation platforms can bridge service gaps effectively. Brands that prioritize accessibility and affordability will gain traction. This expansion can unlock new revenue streams while addressing unmet demand.

Development of Men’s Aesthetic and Preventive Skincare Segments

Japan Medical Beauty Aesthetics Market can capture value by targeting the growing segment of male consumers and younger clients seeking preventive care. Men increasingly seek treatments for skin health, hair maintenance, and body sculpting, creating demand for gender-specific services. It allows providers to differentiate through customized product lines, private consultation models, and discreet service environments. Younger consumers also prioritize skin longevity and early intervention. Clinics that offer educational outreach and flexible pricing can attract these audiences. This dual-target approach supports long-term patient engagement.

Market Segmentation Analysis:

By Component

Japan Medical Beauty Aesthetics Market segments into injectables, non-injectable treatments, and laser & energy-based device therapies. Injectables such as botulinum toxin and dermal fillers lead the market due to quick results and minimal recovery time. Mesotherapy and PRP treatments are also gaining popularity for skin rejuvenation and hair restoration. Non-injectable options like medical facials, microneedling, and chemical peels address routine skincare and early aging concerns. Laser and energy-based therapies—especially laser skin resurfacing, RF skin tightening, and IPL—offer strong demand due to their effectiveness and broad treatment range.

- For instance, Allergan’s Botox (a botulinum toxin product) remains a staple in Japanese clinics, with facial aesthetic procedures—especially those involving Botox and dermal fillers—commanding the majority of treatment demand due to their fast-acting effects and short recovery times.

By Application

Japan Medical Beauty Aesthetics Market finds high usage in skin resurfacing and tightening, driven by rising demand for youthful appearance and non-surgical options. Body contouring and cellulite reduction also gain traction among middle-aged consumers. Hair and tattoo removal services continue to expand, supported by evolving beauty standards and advancements in laser precision. Breast augmentation maintains a steady market share under surgical procedures. Other applications include acne treatments, scar correction, and pigmentation management, which attract a wide consumer base.

- For instance, Cutera Inc. has introduced the Secret RF microneedling system in Japan, which leverages radiofrequency technology to improve skin texture and elasticity, gaining traction especially in metropolitan medical centers.

By Procedure

Japan Medical Beauty Aesthetics Market favors nonsurgical procedures due to lower risk, quicker recovery, and growing availability of advanced devices. Treatments like fillers, facials, and laser therapies dominate clinic offerings. It aligns with patient preference for minimally invasive options. Surgical procedures remain relevant for clients seeking more dramatic or permanent results, such as rhinoplasty and breast augmentation. Both segments contribute to market growth, but the shift clearly leans toward non-invasive aesthetics supported by consistent consumer demand and technological adoption.

Segments:

Based on Component

Injectables Treatment

- Botulinum Toxin

- Dermal Fillers

- Mesotherapy

- PRP (Platelet-Rich Plasma)

Non-injectable Treatment

- Medical Facials

- Microneedling

- Chemical Peels

- Others

Laser & Energy-Based Devices Therapy

- Laser Skin Resurfacing

- RF (Radiofrequency) Skin Tightening

- Intense Pulsed Light (IPL) Therapy

- Cryolipolysis

- Ultrasonic Cavitation

- Others

Based on Application

- Skin Resurfacing & Tightening

- Body Contouring and Cellulite Reduction

- Hair and Tattoo Removal

- Breast Augmentation

- Other Applications

Based on Procedure

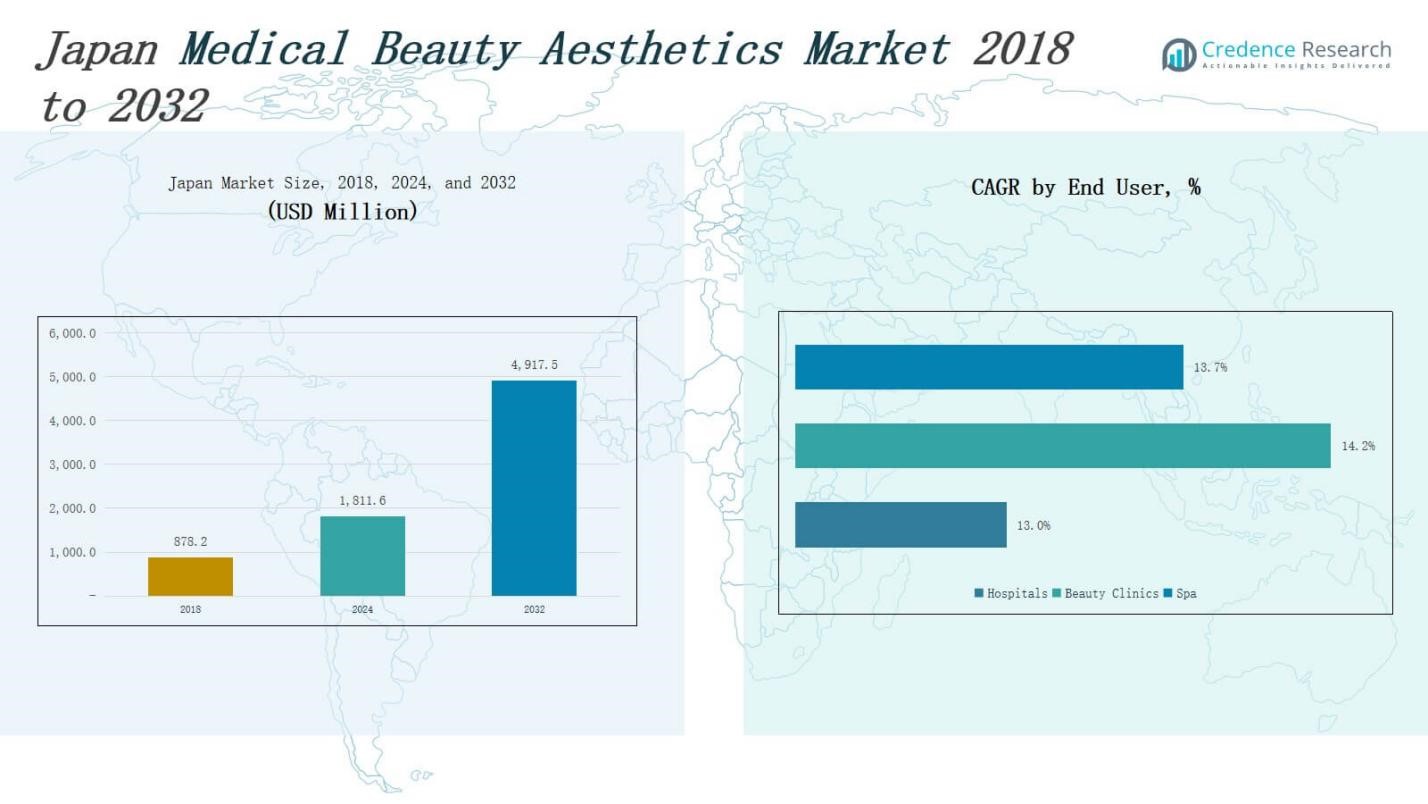

Based on End User Industry

- Hospitals

- Beauty Clinics

- Spa

Based on Region

- Kanto (Tokyo, Kanagawa, Chiba, Saitama)

- Kansai (Osaka, Kyoto, Hyogo)

- Chubu (Aichi, Shizuoka, Nagano)

- Kyushu (Fukuoka, Kumamoto)

- Tohoku (Miyagi, Fukushima)

- Hokkaido

- Other Regions

Regional Analysis

Kanto

Kanto holds the largest share of the Japan Medical Beauty Aesthetics Market at 38%. The region benefits from high population density, greater disposable income, and a concentration of premium aesthetic clinics, especially in Tokyo and Yokohama. It attracts both domestic and international clients due to advanced facilities and a strong reputation for clinical expertise. Clinics in Kanto lead in adopting cutting-edge technologies such as AI-assisted diagnostics and energy-based devices. It supports high demand for injectables, laser treatments, and personalized skincare. Consumer awareness and social acceptance of medical aesthetics are strongest in this region.

Kansai

Kansai accounts for 24% of the Japan Medical Beauty Aesthetics Market, supported by major urban centers like Osaka, Kyoto, and Kobe. The region has a growing network of clinics offering non-invasive and semi-invasive treatments to middle-aged and younger populations. It sees strong demand for anti-aging solutions, body contouring, and advanced facials. Cultural emphasis on appearance and beauty continues to drive interest in medical aesthetics. Kansai-based providers are expanding their service range and marketing reach. It remains a key growth zone due to a rising health-conscious urban consumer base.

Chubu, Kyushu, Tohoku, Hokkaido & Others

The combined regions of Chubu, Kyushu, Tohoku, Hokkaido, and others contribute 38% to the Japan Medical Beauty Aesthetics Market. Chubu, led by Aichi and Shizuoka, sees steady growth from working professionals and aging populations. Kyushu is gaining attention for medical tourism, while Tohoku and Hokkaido are still developing infrastructure. It offers untapped potential for clinic expansion, especially in suburban and rural areas. Regional providers focus on affordability and accessibility to build patient loyalty. These markets will drive the next phase of decentralized growth in Japan’s aesthetic landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Galderma S.A.

- Merz Pharma

- Bausch Health Companies Inc.

- Cutera Inc.

- En. S.p.A.

- AbbVie, Inc.

- Lumenis Be Ltd

- Other Key Players

Competitive Analysis

Japan Medical Beauty Aesthetics Market features a competitive landscape shaped by global brands and specialized local providers. Key players such as Galderma S.A., Merz Pharma, and AbbVie, Inc. dominate the injectables segment through product innovation and physician training programs. Cutera Inc., El.En. S.p.A., and Lumenis Be Ltd lead in energy-based devices with expanding portfolios and strong clinic partnerships. Bausch Health Companies Inc. and other multinationals strengthen market presence through acquisitions and targeted marketing. It favors companies that offer comprehensive service support, clinical education, and product reliability. Local clinics form strategic alliances with technology providers to expand treatment capabilities. Brand recognition, safety profiles, and regulatory compliance remain critical to competitive positioning across all segments. Companies also compete by investing in patient-centric technologies, launching region-specific products, and offering multilingual platforms. Growth opportunities lie in regional expansion, sustainable innovation, and integration of AI diagnostics, which continue to shape long-term market leadership.

Recent Developments

- In April 2025, Galderma launched the ALASTIN Restorative Skin Complex with Next Generation TriHex Technology, introducing a peptide-rich serum designed to boost collagen and elastin production for visible skin rejuvenation.

- In February 2025, Lumenis Be Ltd launched OptiLIFT™, a dynamic muscle stimulation device developed to treat lower eyelid laxity and impaired blinking, expanding its portfolio in energy-based eye rejuvenation solutions.

- In March 2025, Lumenis Be Ltd introduced FoLix™ to the Canadian market, following its successful rollout in the U.S. This FDA-cleared fractional laser targets non-invasive treatment for hair loss and scalp rejuvenation.

- In June 2025, Teijin Pharma and Merz Therapeutics received approval from Japan’s MHLW for an additional indication of XEOMIN® (incobotulinumtoxinA) to treat chronic sialorrhea in Japan.

Market Concentration & Characteristics

Japan Medical Beauty Aesthetics Market shows moderate to high market concentration, with a few global players and well-established domestic clinics controlling significant revenue share. It favors companies with broad portfolios in injectables, laser systems, and non-surgical technologies. Leading firms like Galderma, AbbVie, Merz Pharma, and Cutera maintain strong presence through strategic partnerships and continuous innovation. The market is characterized by rapid technology adoption, urban-centric demand, and strong brand loyalty. Clinics focus on service differentiation, safety assurance, and patient-centered experiences. It attracts both repeat and first-time consumers due to growing awareness and changing social attitudes toward cosmetic enhancement. Regulatory oversight enforces high safety standards, which elevates barriers to entry for new players. Demand for non-invasive procedures continues to outpace surgical alternatives, reshaping provider strategies across urban and regional centers. Japan Medical Beauty Aesthetics Market evolves with trends in personalization, convenience, and clinical excellence, offering significant opportunities for scalable growth and product diversification.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Procedure, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-invasive and low-downtime procedures will continue to increase across all age groups.

- AI-driven diagnostics and treatment personalization will become standard in advanced clinics.

- Male participation in aesthetic treatments will grow steadily, expanding target demographics.

- Regional clinic expansion will improve access in Chubu, Kyushu, Tohoku, and Hokkaido.

- Social media and digital platforms will drive consumer awareness and patient engagement.

- Providers will invest in sustainable and ethically sourced products to meet evolving consumer preferences.

- Teleconsultation and hybrid service models will enhance patient convenience and clinic reach.

- Strategic partnerships between global brands and local providers will strengthen market penetration.

- Training programs and certification systems will expand to address the skilled labor gap.

- Medical tourism will increase as Japan strengthens its global reputation for safe, high-quality aesthetic care.