Market Overview:

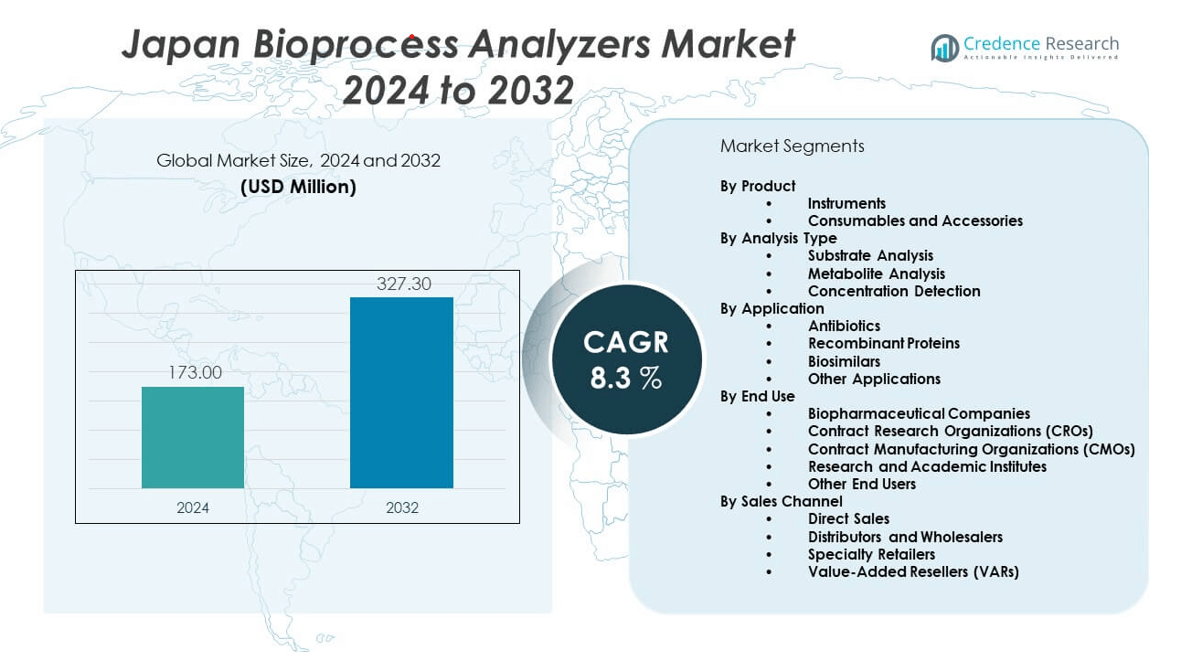

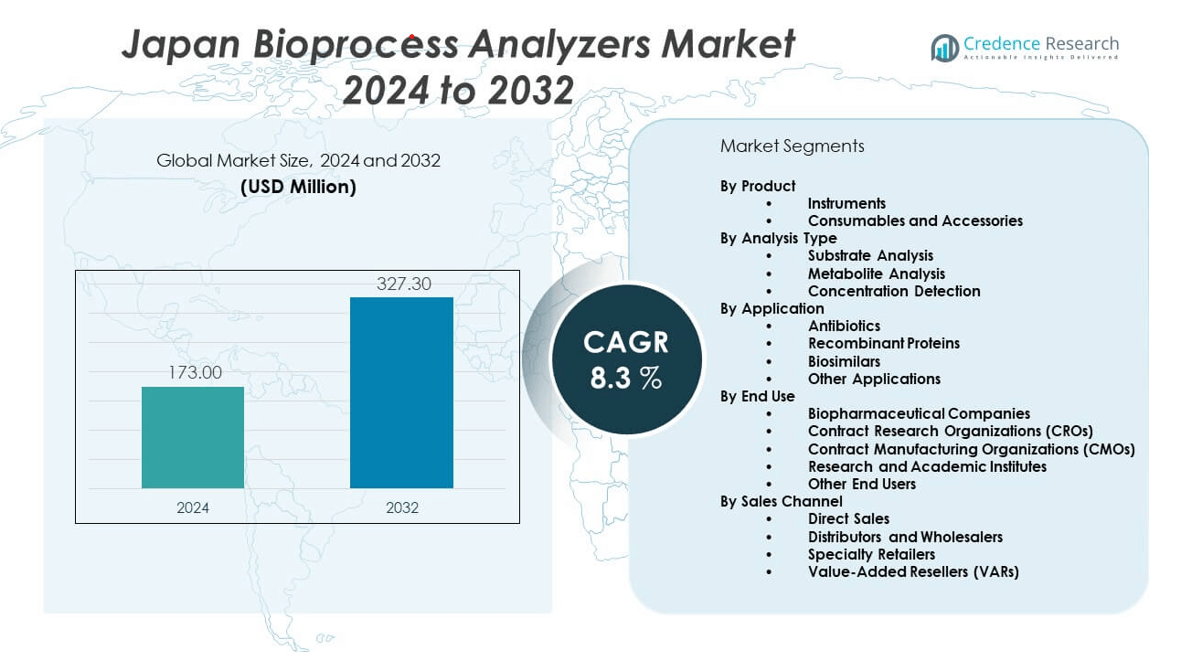

The Japan bioprocess analyzers market is projected to grow from USD 173 million in 2024 to an estimated USD 327.3 million by 2032, with a compound annual growth rate (CAGR) of 8.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Bioprocess Analyzers Market Size 2024 |

USD 173 million |

| Japan Bioprocess Analyzers Market, CAGR |

8.3% |

| Japan Bioprocess Analyzers Market Size 2032 |

USD 327.3 million |

The market is witnessing robust growth due to rising demand for high-efficiency bioprocess monitoring and control systems in pharmaceutical and biotechnology industries. With Japan’s strong focus on regenerative medicine, cell therapy, and biopharmaceutical production, there is an increasing need for real-time analysis tools that ensure product quality and regulatory compliance. Technological advancements in analyzers, integration of automation, and growing R&D investments further fuel the adoption of bioprocess analyzers across various manufacturing stages.

Within Japan, regions with high concentrations of pharmaceutical and biotechnology hubs—such as the Greater Tokyo Area and Kansai region—lead the demand for bioprocess analyzers. These areas benefit from established academic institutions, innovation clusters, and major industry players that drive advanced bioprocessing research. Meanwhile, emerging areas are gaining traction as local governments incentivize biotech startups and infrastructure development. Japan’s mature healthcare ecosystem, strong regulatory framework, and export-oriented life sciences sector contribute to a favorable environment for market expansion.

Market Insights:

- The Japan bioprocess analyzers market is projected to grow from USD 173 million in 2024 to USD 327.3 million by 2032, registering a CAGR of 8.3% during the forecast period.

- Growing demand for real-time bioprocess monitoring in pharmaceutical and biotechnology sectors is driving market growth.

- Rising adoption of single-use technologies and PAT frameworks strengthens the need for modular, high-efficiency analyzer systems.

- High capital cost of advanced analyzers limits accessibility for small and mid-sized enterprises.

- Complexity in integrating analyzers with legacy systems presents operational and technical challenges.

- The Greater Tokyo and Kansai regions lead the market due to their concentration of biotech hubs and advanced R&D infrastructure.

- Emerging biotech zones supported by government incentives are creating new growth avenues across regional research institutes and mid-scale production units.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Precision Biomanufacturing Drives Adoption of Analytical Solutions:

The Japan bioprocess analyzers market benefits from the rising emphasis on precision biomanufacturing in pharmaceutical and biotechnology sectors. Companies seek high-efficiency analytical tools to ensure consistency and compliance with quality standards. The increased complexity of biologics and cell-based therapies has intensified the need for real-time process monitoring. Bioprocess analyzers support critical decision-making during upstream and downstream production. Firms prioritize reduced batch failure rates and improved yield. Japan’s regulatory authorities encourage implementation of PAT (Process Analytical Technology) frameworks. This environment supports the deployment of sophisticated bioprocess control systems. It strengthens overall manufacturing reliability across product pipelines.

- For instance, Thermo Fisher Scientific Asia has developed high-throughput bioprocess analyzers capable of delivering real-time multi-parameter monitoring with measurement cycle times under 2 minutes, facilitating rapid batch-to-batch consistency and reducing failures by over 15% in client manufacturing runs in Japan.

Expansion of Biopharmaceutical and Cell Therapy Pipeline Encourages Analyzer Integration:

Japan’s growing biopharmaceutical pipeline, especially in cell and gene therapies, increases reliance on advanced bioprocess control instruments. Companies developing regenerative medicines require continuous monitoring tools to maintain viability and function of living cells. The Japan bioprocess analyzers market grows steadily due to this shift toward complex biologics. Large pharmaceutical companies and smaller research entities adopt process analyzers to gain better control over critical parameters. Academic-industry collaborations promote innovation in real-time analytical technologies. Government programs like AMED funding support R&D in life sciences instrumentation. This policy support drives market confidence. It ensures sustained integration of analyzers across early-stage and commercial-scale manufacturing.

Increased Regulatory Pressure Fuels Demand for Real-Time Quality Monitoring Systems:

The Pharmaceutical and Medical Device Agency (PMDA) enforces stringent quality standards for biologics manufacturing. Companies must maintain tight control over production processes to meet compliance mandates. The Japan bioprocess analyzers market addresses this regulatory need through solutions that offer real-time, non-invasive monitoring. Quality-by-design (QbD) frameworks are becoming common across industry practices. Firms leverage bioprocess analyzers to reduce variability, improve reproducibility, and comply with audits. Product recalls and manufacturing halts due to non-compliance pressure firms to invest in analytical precision. Regulatory shifts align with global standards, urging local firms to modernize their quality infrastructure. It strengthens the demand for advanced instrumentation.

Growth in Single-Use Technologies Encourages Deployment of Modular Analyzer Systems:

Single-use bioreactor systems are gaining traction across Japan’s small- to mid-scale production facilities. These systems require compact, plug-and-play analyzers compatible with flexible operations. The Japan bioprocess analyzers market responds with portable, modular solutions that integrate with disposable bioprocessing systems. Manufacturers prefer analyzers that reduce contamination risk and improve ease of cleaning validation. This shift supports faster batch turnaround and cost efficiency. Flexible production setups in clinical manufacturing further drive demand. OEMs and technology providers collaborate to offer analyzer solutions tailored for single-use environments. It creates opportunities for scalable, configurable instruments that support dynamic process needs.

Market Trends:

Integration of Artificial Intelligence with Bioprocess Monitoring Platforms:

Artificial intelligence is playing a growing role in enhancing bioprocess decision-making. AI-powered bioprocess analyzers enable predictive control by analyzing historical and real-time process data. The Japan bioprocess analyzers market is embracing this trend through embedded machine learning algorithms in analytical platforms. These systems identify deviations earlier and recommend process corrections. It reduces dependence on manual interpretation and supports continuous improvement strategies. Biomanufacturers explore AI to optimize fermentation, nutrient feed, and downstream separation. The use of AI accelerates feedback cycles and improves process efficiency. It makes bioprocessing more data-driven, automated, and robust against fluctuations.

- For instance, Cytiva’s latest AI-integrated Raman spectroscopy analyzer deployed in Japan demonstrated a 20% faster detection of process deviations during monoclonal antibody production, leading to a 10% increase in downstream purification yields.

Shift Toward Miniaturized and Lab-on-Chip Analyzer Systems:

Technological advancements are enabling miniaturization of bioprocess analyzers without compromising functionality. The Japan bioprocess analyzers market is witnessing demand for lab-on-chip formats and microfluidic-based analyzers. These compact platforms offer cost-effective, fast, and high-throughput measurements. They are ideal for R&D labs, pilot plants, and portable setups. Miniaturized analyzers support multiplexing and reduce sample consumption. Device manufacturers introduce compact models with enhanced integration into process control software. It allows smaller labs and startups to access advanced analytics. This trend aligns with space-constrained facilities and supports decentralized process development.

- For instance, Merck Life Science launched a microfluidic-based bioprocess analyzer in early 2025 that reduces sample volume requirements by 70% while providing multiplexed substrate and metabolite analysis with results in under 5 minutes, facilitating rapid process adjustments in constrained facility environments.

Growing Emphasis on PAT-Compatible, Multi-Parameter Monitoring Systems:

Bioprocessors increasingly require integrated analyzers capable of monitoring multiple parameters simultaneously. The Japan bioprocess analyzers market reflects this trend with systems that measure pH, DO, glucose, lactate, and viable cell density in one unit. This all-in-one design reduces equipment footprint and simplifies data interpretation. Firms value real-time insights that correlate metabolic activity with product quality. Multi-parameter systems support consistent control strategies across batches. They improve operational transparency and process repeatability. Vendors are bundling sensors and software for seamless data capture and regulatory reporting. It enhances system usability and shortens development timelines.

Customization and Modular Design Rise in Importance for Bioprocess Workflows:

Manufacturers now demand analyzer systems tailored to specific workflows and bioproduct types. The Japan bioprocess analyzers market is shifting toward modular, configurable solutions that adapt to unique production needs. Flexible design enables integration into hybrid bioreactor systems. It supports expansion into multi-product and multi-line facilities. Biomanufacturers request customizable user interfaces and parameter sets. OEMs respond by offering modular sensor packages and upgradable platforms. This customization enables better fit with evolving process strategies. It maximizes return on analyzer investments across product lifecycles.

Market Challenges Analysis:

High Capital Cost of Advanced Analyzers Limits Adoption in Small-Scale Operations:

Despite strong industry interest, the high upfront cost of advanced analyzers hinders broader deployment. Small- and medium-sized biopharmaceutical firms in Japan often operate on constrained budgets. The Japan bioprocess analyzers market faces resistance from these players when investing in high-end process control systems. Cost-intensive calibration and validation requirements increase operational expenses. Some firms delay upgrading legacy systems to manage capital expenditures. Leasing and service-based models offer partial relief but lack long-term financial appeal. High system cost also restricts adoption in academia and early-stage research labs. It creates a divide between large manufacturers and smaller innovators. Broader access depends on cost-effective entry-level models.

Complexity of Integration with Existing Bioprocess Infrastructure Slows Implementation:

Bioprocess analyzers often require complex integration with upstream and downstream control systems. The Japan bioprocess analyzers market must address compatibility challenges with legacy automation platforms. Older facilities may lack standard interfaces for data exchange. Inconsistencies in sensor calibration and signal formats hinder real-time process synchronization. Staff training for new analyzers adds to implementation barriers. IT infrastructure upgrades are often required to support advanced analytics and connectivity. Data security and regulatory compliance introduce further integration concerns. This complexity extends implementation timelines and affects return on investment. Vendors must offer better plug-and-play solutions with minimal system disruption.

Market Opportunities:

Rising Investments in Regenerative Medicine Create Demand for Advanced Monitoring Tools:

Japan leads global innovation in regenerative medicine, supported by national programs and clinical research activity. The Japan bioprocess analyzers market finds strong opportunity in supplying real-time monitoring tools for cell therapy and tissue engineering. These therapies require precise process control to maintain cell viability, differentiation, and potency. Analyzer manufacturers can cater to this need with highly sensitive, non-invasive systems. Hospitals and research institutes investing in GMP-compliant manufacturing units provide new customer segments. It positions analyzers as essential tools for both process development and clinical production environments.

Strategic Collaborations with Biotech Start-ups Open New Growth Channels:

The expanding biotech start-up ecosystem in Japan presents an untapped opportunity for analyzer vendors. These emerging firms seek compact, user-friendly, and cost-effective analytical systems. The Japan bioprocess analyzers market can benefit by forming partnerships to co-develop tailored solutions. Start-ups involved in biosimilars, vaccines, and enzymes represent diverse application areas. Analyzer companies offering application-specific models gain first-mover advantage. Support through technical training and flexible pricing can convert early-stage firms into long-term clients. It allows technology providers to diversify their market base and foster innovation adoption.

Market Segmentation Analysis:

By Product

The Japan bioprocess analyzers market is divided into instruments and consumables and accessories. Instruments hold a dominant share, driven by their central role in real-time monitoring and automated process control. Consumables and accessories contribute steady revenue through recurring usage in calibration, maintenance, and sampling procedures.

- For instance, Yokogawa Life Science (Tokyo, Japan), in collaboration with Securecell (Zurich, SW), applied the Lucullus® Process Information Management System to control Advanced Control Bioreactor Systems, enabling real-time glucose concentration monitoring of CHO cells, which led to optimal monoclonal antibody productivity by tracking specific nutrient utilization and implementing precise process control.

By Analysis Type

This segment includes substrate analysis, metabolite analysis, and concentration detection. Substrate analysis leads the category due to its critical role in monitoring nutrient levels essential for cell growth. Metabolite analysis supports process optimization by tracking byproducts, while concentration detection ensures consistent yield and product quality throughout bioprocessing stages.

- For example, Metabolite analysis supports process optimization by tracking byproducts; for instance, Human Metabolome Technologies (HMT), a Japan-based company, can identify more than 1,000 distinct metabolites in a sample using its proprietary capillary electrophoresis-mass spectrometry (CE-MS) platform, which provides comprehensive process profiling for quality control and risk mitigation in drug production.

By Application

Key applications include antibiotics, recombinant proteins, biosimilars, and other biologics. Recombinant proteins dominate this segment, supported by Japan’s strong biopharmaceutical R&D pipeline. Biosimilars are gaining traction due to cost-effectiveness and expanding regulatory support. Antibiotics and other applications maintain relevance across industrial and research environments.

By End Use

End users include biopharmaceutical companies, CROs and CMOs, research and academic institutes, and other entities. Biopharmaceutical companies represent the largest user base, leveraging analyzers for efficiency and compliance. CROs and CMOs demand scalable solutions, while academic institutes drive innovation through experimental research.

By Sales Channel

Sales channels are categorized into direct sales, distributors and wholesalers, specialty retailers, and value-added resellers (VARs). Direct sales account for the bulk of transactions with major clients. Distributors and VARs expand reach to smaller labs and research units, offering integrated solutions and support services.

Segmentation:

By Product

- Instruments

- Consumables and Accessories

By Analysis Type

- Substrate Analysis

- Metabolite Analysis

- Concentration Detection

By Application

- Antibiotics

- Recombinant Proteins

- Biosimilars

- Other Applications

By End Use

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Contract Manufacturing Organizations (CMOs)

- Research and Academic Institutes

- Other End Users

By Sales Channel

- Direct Sales

- Distributors and Wholesalers

- Specialty Retailers

- Value-Added Resellers (VARs)

Regional Analysis:

Kanto Region (Tokyo, Yokohama, etc.) – 48% Market Share

The Kanto region holds the largest share of the Japan bioprocess analyzers market, accounting for approximately 48%. This dominance is driven by the presence of major pharmaceutical companies, research universities, and advanced healthcare infrastructure in Tokyo and its surrounding cities. The region serves as the hub for biopharmaceutical R&D, with strong government and private investments fueling demand for precision analyzers. Kanto benefits from strategic collaborations between global bioprocess solution providers and local manufacturers, facilitating rapid technology adoption. It supports large-scale production and clinical research, increasing the uptake of both instruments and consumables. Strong academic-industry partnerships sustain innovation and early-phase bioprocess development.

Kansai Region (Osaka, Kyoto, etc.) – 27% Market Share

Kansai represents the second-largest regional market, contributing around 27% of the total share. The region is home to several leading biopharmaceutical manufacturers and contract research organizations. Osaka’s industrial base and Kyoto’s academic institutions form a balanced ecosystem supporting both commercial production and experimental bioprocessing. It shows rising adoption of real-time analyzers in GMP-compliant manufacturing environments. Strong emphasis on biotechnology and regenerative medicine enhances the demand for metabolite and concentration detection systems. Kansai’s access to regulatory support and skilled workforce further boosts its regional competitiveness in bioprocess analytics.

Chubu, Kyushu, and Other Regions – 25% Market Share (Combined)

Together, the Chubu, Kyushu, and other regions contribute about 25% to the Japan bioprocess analyzers market. While these areas trail Kanto and Kansai, they show steady growth driven by expanding biotechnology clusters and increased outsourcing of R&D. Prefectures such as Aichi and Fukuoka are emerging as attractive hubs for startups and CMOs focusing on biosimilars and bioprocess scale-up. Government initiatives to decentralize biotech development encourage the spread of analytical infrastructure beyond metropolitan centers. Local demand is largely supported through distributor networks and value-added resellers. These regions present long-term growth potential as they invest in lab modernization and biomanufacturing capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Fisher Scientific Asia

- Cytiva

- Merck Life Science (Merck KGaA)

- Danaher Asia-Pacific

- FUJIFILM Irvine Scientific

- Sartorius AG

- Bio-Rad Laboratories Inc.

- Roche Holding AG

- Bio-Techne Corp

- Lonza Group Ltd

Competitive Analysis:

The Japan bioprocess analyzers market is moderately competitive, with a mix of global leaders and regionally focused companies offering advanced analytical instruments and consumables. Thermo Fisher Scientific, Cytiva, and Merck dominate the high-end instrument space through extensive product portfolios and strong R&D capabilities. Sartorius and Bio-Rad strengthen their presence through localized support and integrated bioprocessing solutions. FUJIFILM Irvine Scientific and Danaher leverage regional infrastructure and partnerships to meet specific biopharma demands. Companies compete on technological innovation, regulatory compliance, and service differentiation. Strategic collaborations and distribution agreements remain key to expanding customer reach. Market players prioritize compact, automation-ready analyzers and AI-enhanced platforms to gain competitive advantage.

Recent Developments:

- In July 2025, Asahi Kasei Life Science, a division of Asahi Kasei, announced plans to construct a new spinning plant in Nobeoka, Japan, aimed at the production of its Planova virus removal filters. This move reflects ongoing investments in bioprocessing infrastructure within Japan to support advanced biologics manufacturing.

Market Concentration & Characteristics:

The Japan bioprocess analyzers market is moderately concentrated, with a few multinational firms holding substantial shares through direct presence and distribution networks. It features high entry barriers due to strict regulatory requirements, technical expertise, and long sales cycles. The market favors established brands that offer validated, GMP-compliant systems and localized support. Demand centers around innovation in inline monitoring, real-time analytics, and integration with bioreactor systems. Customer loyalty is high due to the critical nature of process validation and batch consistency in biomanufacturing environments.

Report Coverage:

The research report offers an in-depth analysis based on product, analysis type, application, end use, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for real-time bioprocess monitoring will increase across commercial-scale production.

- Local manufacturing initiatives will strengthen domestic supply chains for analytical systems.

- AI-driven analyzers will gain adoption in high-throughput and precision workflows.

- Rising biosimilar development will expand the application base for advanced analytics.

- Integration of bioprocess analyzers with digital twins will enable predictive control.

- Academic-industry partnerships will support early-stage research and validation tools.

- Compact, automation-compatible analyzers will find wider use in CMOs and CROs.

- Regulatory focus on process validation will elevate demand for compliance-ready systems.

- Direct sales and distributor collaboration will improve access in Tier 2 and Tier 3 cities.

- Continued investment in R&D will drive product innovation and market penetration.