| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Offline Payment Service Provider (Payment Facilitator) Market Size 2024 |

USD 1791.03 Million |

| Japan Offline Payment Service Provider (Payment Facilitator) Market, CAGR |

17.9% |

| Japan Offline Payment Service Provider (Payment Facilitator) Market Size 2032 |

USD 6728.65 Million |

Market Overview:

The Japan Offline Payment Service Provider (Payment Facilitator) Market is projected to grow from USD 1791.03 million in 2024 to an estimated USD 6728.65 million by 2032, with a compound annual growth rate (CAGR) of 17.9% from 2024 to 2032.

The growth of the Japan offline payment service provider market is driven by several key factors. Technological integration, particularly the use of Artificial Intelligence (AI) and Machine Learning (ML), enhances transaction security, improves processing speed, and offers personalized customer experiences. Additionally, government initiatives aimed at promoting cashless transactions have played a pivotal role. The Japanese government has set ambitious goals to increase the cashless payment ratio, offering subsidies and incentives for both consumers and service providers. Consumer behavior is also shifting, with an increasing preference for online purchasing, which drives the demand for efficient offline payment solutions. Furthermore, the continuous expansion of the e-commerce sector contributes significantly to the market, as businesses require seamless payment systems to cater to the growing online transaction volume.

Regionally, Japan’s offline payment services market shows distinct trends across different areas. The Kanto region, home to Tokyo, leads the country in payment service adoption due to its high population density and the concentration of businesses, fostering a competitive environment for payment facilitators. In contrast, the Kansai and Chubu regions, including major urban centers like Osaka and Nagoya, are also experiencing increased demand for payment services. The ongoing development of digital infrastructure and government initiatives in these areas is accelerating the adoption of payment solutions. As a result, while Tokyo remains the market’s epicenter, other regions are steadily catching up, contributing to the overall expansion of payment services across Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan offline payment service provider market is projected to grow from USD 1,791.03 million in 2024 to USD 6,728.65 million by 2032, reflecting a CAGR of 17.9%.

- Technological advancements, especially the integration of AI and ML, are enhancing transaction security and processing speed, driving market growth.

- Government initiatives promoting cashless transactions, including subsidies and incentives, are significantly contributing to the market’s expansion.

- A cultural shift towards online shopping is increasing demand for efficient offline payment solutions.

- The e-commerce sector’s continuous growth necessitates seamless payment systems, further boosting the market.

- Regional variations exist, with the Kanto region leading in payment service adoption, while Kansai and Chubu regions are rapidly catching up.

- Despite growth, challenges like regulatory compliance, consumer trust, operational costs, and competition from traditional payment methods persist.

Market Drivers:

Technological Advancements

One of the primary drivers fueling the growth of the Japan offline payment service provider market is the rapid adoption of technological innovations. Integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) has revolutionized the payment landscape. For instance, in November 2023, MUFG signed a multiyear global agreement with AWS to accelerate its digital transformation by leveraging cloud technologies, including generative AI and ML, to enhance customer service, reduce IT operating costs, and develop new digital financial products. These technologies enhance transaction security, streamline processing times, and allow for personalized customer experiences, which are crucial in maintaining consumer trust and satisfaction. Payment facilitators are increasingly leveraging these technologies to offer seamless, faster, and more secure payment options, significantly boosting their adoption across various sectors in Japan. This shift towards technologically driven solutions is accelerating the market’s expansion as businesses seek more efficient methods to handle offline transactions.

Government Support and Cashless Initiatives

Government policies and initiatives also play a significant role in driving the offline payment services market in Japan. The Japanese government has placed considerable emphasis on encouraging a transition to cashless payments, setting ambitious targets such as achieving a cashless payment ratio of 40% by 2025. To achieve this goal, the government has introduced several incentives, including subsidies for merchants who adopt cashless payment solutions and promotional campaigns aimed at increasing consumer awareness. These measures have created an enabling environment for payment facilitators to thrive, contributing to a robust market expansion as both businesses and consumers are incentivized to shift toward digital payment methods.

Shift in Consumer Behavior

The shift in consumer behavior toward digital and contactless payment methods is another critical factor driving the market. Japanese consumers have increasingly embraced online shopping, with the country ranking as the fourth-largest e-commerce market globally. As a result, the demand for efficient offline payment services has surged. Consumers now expect more convenient, secure, and seamless payment experiences, which has led to greater adoption of payment solutions that facilitate quick and easy transactions both online and offline. For instance, the rise in QR code payments at convenience stores, where consumers increasingly opt for apps like LINE Pay or Rakuten Pay for quick purchases. This change in consumer expectations is prompting businesses to invest in reliable offline payment systems to cater to the growing demand for frictionless payment methods.

Growth of E-commerce and Retail Sectors

The continuous growth of Japan’s e-commerce and retail sectors significantly influences the demand for offline payment services. As e-commerce platforms expand and offline retail businesses adapt to the digital era, the need for seamless, integrated payment systems becomes more critical. Payment facilitators provide the necessary infrastructure for businesses to handle a high volume of transactions securely and efficiently. The integration of payment services with both physical and online retail operations is crucial for companies aiming to provide a smooth shopping experience for consumers. This growing convergence of digital and offline retail operations is further driving the market for payment facilitators in Japan, highlighting the sector’s expanding importance in the overall economy.

Market Trends:

Technological Innovations in Payment Systems

The Japan offline payment service provider market is experiencing significant transformations driven by technological innovations. The integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) has enhanced transaction security, streamlined processing times, and enabled personalized customer experiences. These advancements have led to the development of sophisticated payment solutions, contributing to the market’s growth. As technology continues to evolve, the demand for more secure, efficient, and user-friendly payment options is expected to increase, driving further market expansion.

Government Initiatives and Cashless Payment Promotion

The Japanese government’s initiatives to promote cashless payments have significantly influenced the offline payment services market. With ongoing efforts to encourage the adoption of digital payment methods, the government has introduced various policies aimed at increasing the cashless payment ratio. These efforts include providing incentives for both consumers and businesses to adopt cashless solutions, which have created a favorable environment for payment facilitators. As these government-backed initiatives continue to gain momentum, the market is poised for further growth, driven by the widespread acceptance of cashless transactions.

E-commerce Growth and Demand for Payment Solutions

The expansion of e-commerce in Japan has notably impacted the demand for offline payment solutions. With the rising popularity of online shopping, particularly among younger consumers, there is a growing need for flexible and secure payment options. The increasing reliance on electronic payments for both goods and services has spurred demand for efficient offline payment systems that can handle high transaction volumes. For instance, digital commerce platforms like Alibaba’s TAO have introduced innovative features tailored to Japanese consumers, further boosting the demand for integrated payment solutions. As e-commerce continues to flourish, the need for integrated payment solutions that bridge the gap between online and offline retail is expected to strengthen, further propelling the growth of payment service providers.

Entry of International Players and Market Competition

The Japanese payment services market is witnessing heightened competition with the entry of international players. Leading global fintech companies are making their mark by offering innovative payment solutions, thereby increasing market competition. This influx of international players is driving the development of more advanced and cost-effective payment systems, benefiting both consumers and businesses. As new players continue to enter the market, competition is likely to intensify, fostering innovation and leading to the introduction of more efficient and diversified payment options in the market. For example, PayPal’s acquisition of Paidy enhanced installment-based BNPL services in Japan. This trend is expected to contribute to the overall expansion and sophistication of Japan’s offline payment services industry.

Market Challenges Analysis:

Regulatory Challenges

The Japan offline payment service provider market faces several regulatory hurdles that can impede its growth. For example, amendments to the PSA in 2023 introduced a legal framework for stablecoins, requiring providers to register as electronic payment instrument service providers and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) measures. Payment facilitators must adhere to these stringent regulations, which can be resource-intensive and time-consuming. The evolving nature of these rules requires continuous adaptation and can pose challenges, especially for smaller or new entrants in the market who may lack the infrastructure to navigate regulatory compliance effectively.

Consumer Trust and Adoption

Despite the growing popularity of digital and offline payment solutions, consumer trust remains a key challenge in the Japanese market. Many consumers still prefer traditional payment methods, such as cash, due to concerns over security and privacy in digital transactions. This resistance to change can slow the adoption of offline payment services, as businesses must work to educate consumers about the benefits and security of these services. Furthermore, the fear of fraud or data breaches may deter individuals from fully embracing digital payment methods, limiting market growth.

High Operational Costs

The operational costs associated with implementing and maintaining offline payment systems can be significant. For payment facilitators, managing complex transaction networks, ensuring system reliability, and investing in infrastructure to meet the demands of a high-volume market require substantial financial investment. Additionally, providing customer support and maintaining compliance with local regulations adds to the overall cost burden. For smaller players in the market, these high operational costs may limit their ability to scale, thereby hindering competition and slowing the broader adoption of payment facilitation services.

Competition from Traditional Payment Methods

Traditional payment methods, such as cash and credit cards, continue to dominate the Japanese market, posing a challenge to the growth of offline payment facilitators. While digital payments are growing, the entrenched preference for cash remains strong, particularly among older generations. This preference for traditional methods can slow the uptake of alternative payment solutions, making it a challenge for payment service providers to convince businesses and consumers to transition away from established payment practices.

Market Opportunities:

The Japan offline payment service provider market presents significant opportunities driven by several key factors. One of the most notable opportunities lies in the growing adoption of cashless transactions, supported by both government initiatives and shifting consumer behavior. As Japan seeks to increase its cashless payment ratio, there is a rising demand for efficient, secure, and user-friendly offline payment solutions. Payment facilitators have the opportunity to capitalize on this demand by offering seamless and innovative services tailored to a broad range of industries, from retail to transportation. The growing integration of digital payment methods in various sectors presents an opportunity for payment facilitators to expand their service offerings and become key players in Japan’s evolving payment ecosystem.

Furthermore, the expansion of e-commerce and the increasing reliance on digital platforms create ample opportunities for offline payment service providers to integrate solutions that bridge the gap between online and offline transactions. With consumers increasingly turning to online shopping, particularly younger generations, payment facilitators have the potential to develop and offer solutions that cater to the unique needs of both businesses and consumers. This convergence of digital and offline payment methods can drive innovation, improve customer experiences, and enhance transaction efficiencies. As the market continues to evolve, payment facilitators have the opportunity to grow their market share by offering flexible and scalable payment solutions that align with the demands of the modern consumer.

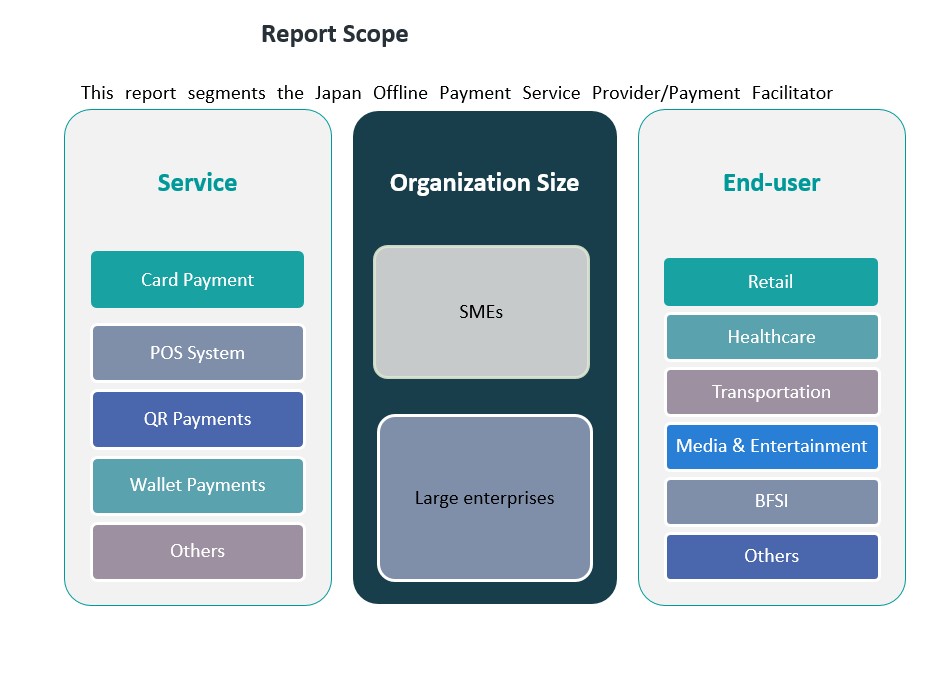

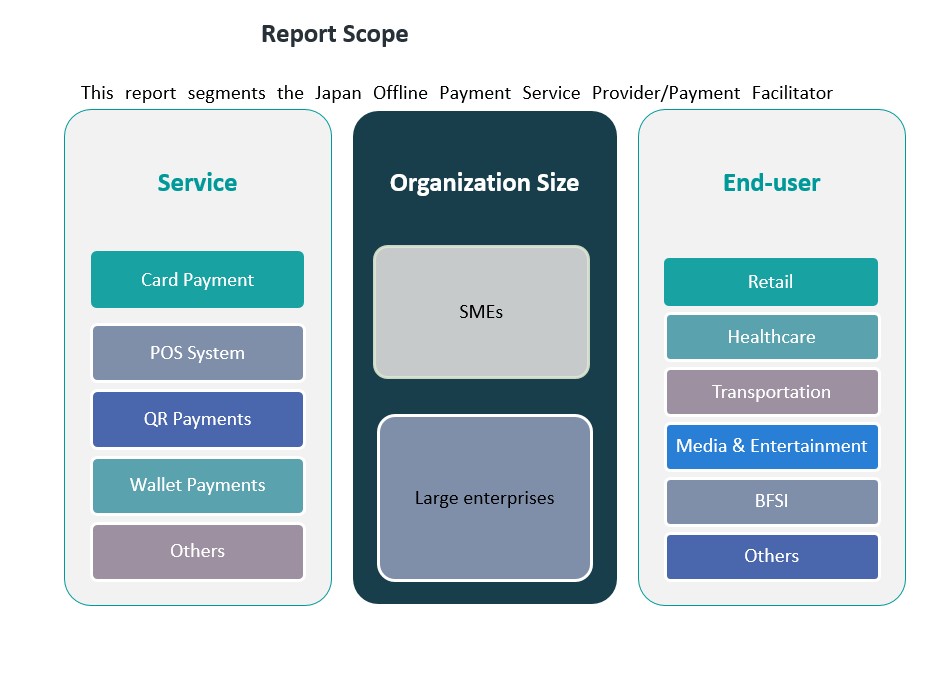

Market Segmentation Analysis:

The Japan Offline Payment Service Provider (Payment Facilitator) Market is characterized by diverse segments that cater to various customer needs across industries.

By Service Segment Analysis

The market is primarily driven by multiple payment service offerings. Card payments dominate, with consumers and businesses relying on credit and debit cards for secure and efficient transactions. The POS system segment also plays a significant role, facilitating real-time payments in physical retail locations. QR payments are gaining traction, offering contactless solutions that provide convenience and security for users. Wallet payments, driven by digital wallets and mobile payment solutions, continue to grow, as consumers increasingly embrace digital payments for offline transactions. The “Others” segment includes a variety of specialized services, such as contactless cards and biometric payment solutions.

By Organization Size Segment Analysis

The market is segmented into SMEs and large enterprises. SMEs represent a growing segment as small and medium businesses adopt digital payment solutions to enhance operational efficiency. However, large enterprises continue to lead the market, driven by their capacity to invest in advanced payment technologies and large-scale implementation of payment systems.

By End-User Segment Analysis

In terms of end users, the retail sector is the largest consumer of offline payment solutions, given the extensive adoption of cashless payment methods in stores. The healthcare and transportation sectors are also experiencing increased adoption, as more facilities and transport companies implement efficient, secure payment systems. The media & entertainment, as well as BFSI (Banking, Financial Services, and Insurance) sectors, drive demand for robust payment solutions, particularly in high-volume transaction environments. The “Others” segment covers various industries, including government and education.

Segmentation:

By Service Segment Analysis

- Card Payment

- POS System

- QR Payments

- Wallet Payments

- Others

By Organization Size Segment Analysis

By End-User Segment Analysis

- Retail

- Healthcare

- Transportation

- Media & Entertainment

- BFSI (Banking, Financial Services, and Insurance)

- Others

Regional Analysis:

Japan’s offline payment service provider (payment facilitator) market exhibits significant regional disparities, influenced by factors such as population density, economic activity, and technological infrastructure.

Kanto Region

The Kanto region, encompassing Tokyo, Yokohama, and Chiba, stands as the largest contributor to Japan’s digital payment market, accounting for approximately 45% of the market share. This dominance is attributed to its high population density, advanced digital infrastructure, and the presence of numerous financial and technology companies. The region’s tech-savvy population and extensive retail network facilitate widespread adoption of both online and offline payment solutions.

Kansai Region

Following the Kanto region, the Kansai area—including Osaka, Kyoto, and Kobe—holds about 25% of the market share. Known for its robust retail sector and thriving tourism industry, Kansai exhibits a growing adoption of digital payment methods. Both large retailers and small enterprises are increasingly implementing digital payment solutions to cater to the evolving preferences of consumers and tourists.

Chubu Region

The Chubu region, which includes cities like Nagoya, contributes significantly to the market, though specific percentages are not detailed. This area is recognized for its strong manufacturing and commercial sectors, driving the demand for efficient payment systems. The diverse economy, blending industrial and service industries, fosters a steady growth trajectory for payment facilitators.

Other Regions

Regions such as Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku are experiencing varying degrees of digital payment adoption. Urban centers and tourist destinations within these regions are witnessing increased implementation of mobile payment solutions and contactless transactions. For instance, Fukuoka in Kyushu and Sapporo in Hokkaido have seen a rise in mobile payment usage, driven by both local residents and tourists.

Key Player Analysis:

- Square Japan

- AirPAY

- PayPay

- Rakuten Pay

- Smartpay

- GMO PG

- STORES

- J-Mups

Competitive Analysis:

The Japan offline payment service provider market is highly competitive, with several key players vying for market share. Established financial institutions, such as Rakuten, PayPay, and Line Pay, are major contributors, leveraging their extensive customer bases and infrastructure to dominate the market. Rakuten, for instance, has expanded its presence in both the retail and online payment sectors, offering a range of solutions to meet the demands of both businesses and consumers. PayPay, a collaboration between SoftBank and Yahoo Japan, has also emerged as a strong contender, capitalizing on the widespread use of smartphones and the growing demand for cashless payment options. In addition to these established players, international fintech firms such as Wise and PayPal are increasingly entering the market, intensifying competition. These companies offer innovative solutions, targeting both consumer and business segments. As the market matures, further innovation and partnerships are expected to drive continued competition and growth.

Recent Developments:

- In January 2025, GMO Payment Gateway, Inc., a leading Japanese payment service provider, acquired enpay Inc., a company specializing in FinTech and SaaS platforms for the childcare and education industries. This acquisition aims to promote cashless payments and digital transformation (DX) in these sectors, which traditionally rely heavily on cash transactions. By integrating enpay’s expertise with GMO-PG’s extensive payment services, the partnership seeks to create sustainable and progressive financial solutions that enhance customer convenience and contribute to societal development.

- In July 2024, Money Forward, Inc. and Sumitomo Mitsui Card Company entered into a capital and business alliance to establish a joint venture targeting the retail business. This collaboration aims to merge Money Forward’s B2C financial services with Sumitomo Mitsui Card’s advanced digital cashless solutions, creating an open financial platform to address broader customer needs.

- On August 5, 2024, PayPay partnered with Coda Payments to integrate its mobile payment services into Codashop Japan. This collaboration allows gamers to use PayPay for purchasing in-game currency for popular titles like Call of Duty®: Mobile, ASTRA: Knights of Veda, and ZEPETO. The partnership reflects PayPay’s focus on expanding its presence in online services due to changing consumer lifestyles.

Market Concentration & Characteristics:

The Japanese offline payment service provider market is characterized by a moderate level of concentration, with several key players dominating the sector. Rakuten Card, a subsidiary of Rakuten Group, leads the market, aiming to expand its annual operating profit by venturing into the business-to-business (B2B) payments sector. This sector remains largely untapped, presenting significant growth opportunities. Other notable players include PayPay Corporation and LINE Pay Corporation, both of which are actively enhancing their digital payment offerings to capture a larger market share. The market also sees increasing competition from international entrants such as Klarna and Afterpay, which are expanding partnerships with retailers to enhance their presence. Additionally, companies like Infcurion are planning initial public offerings to accelerate growth, including through mergers and acquisitions, further intensifying market competition. The competitive landscape is further complicated by the entry of non-traditional payment providers. For example, the British fintech firm Wise has gained direct access to Japan’s bank payment clearing network, challenging existing payment infrastructures and offering alternative cross-border payment solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Service Segment Analysis, Organization Size Segment Analysis and End-User Segment Analysis. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japanese offline payment service provider market is expected to continue its rapid expansion as cashless transactions gain widespread acceptance.

- Government initiatives aimed at increasing the cashless payment ratio will further drive the adoption of offline payment solutions.

- Technological advancements, such as AI and blockchain, will play a crucial role in enhancing the security and efficiency of payment systems.

- E-commerce growth will continue to fuel demand for seamless offline payment services integrated with online platforms.

- The market will see increased competition from international players offering innovative payment solutions.

- Mobile payment solutions will gain traction as consumers increasingly prefer contactless and digital payment methods.

- Expansion into underdeveloped regions outside major urban centers will provide significant opportunities for growth.

- Strategic partnerships between payment facilitators and retailers will improve market penetration.

- Rising consumer concerns around data privacy and security will drive further innovation in payment technologies.

- The market is expected to witness consolidation as larger players acquire smaller firms to enhance service offerings.