| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan POS Software Market Size 2024 |

USD 1616.06 Million |

| Japan POS Software Market , CAGR |

6.32% |

| Japan POS Software Market Size 2032 |

USD 2638.63Million |

Market Overview:

The Japan POS Software Market is projected to grow from USD 1616.06 million in 2024 to an estimated USD 2638.63 million by 2032, with a compound annual growth rate (CAGR) of 6.32% from 2024 to 2032.

Several factors are propelling the expansion of the POS software market in Japan. The government’s “Cashless Vision” initiative aims to increase cashless payments to 40% by 2025, encouraging businesses to adopt electronic payment systems. This push is also supported by incentives for both consumers and businesses to transition from cash to digital payments. Additionally, the rise of e-commerce and omnichannel retailing necessitates sophisticated POS solutions capable of managing transactions across multiple platforms. As consumers demand seamless shopping experiences, retailers are adopting integrated POS systems that unify online and offline operations. The hospitality and healthcare sectors are also contributing to market growth by implementing POS systems to enhance operational efficiency and customer service. These industries are increasingly focused on improving customer satisfaction and streamlining business operations, further fueling demand for advanced POS software solutions.

Urban centers such as Tokyo, Osaka, and Nagoya are at the forefront of POS software adoption. These cities benefit from advanced infrastructure, high population density, and a tech-savvy consumer base, fostering the widespread use of modern payment technologies. With a strong emphasis on digital transformation, these regions are seeing rapid integration of POS systems in both retail and service industries. In contrast, rural areas exhibit slower adoption rates due to lower population density and a cultural preference for cash transactions. Despite this, there is increasing awareness of the benefits of POS systems in rural areas, leading to gradual adoption. This regional disparity underscores the need for targeted strategies to promote POS software adoption nationwide, particularly through educational initiatives and tailored solutions that address the unique needs of smaller businesses and rural communities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan POS software market is projected to grow from USD 1,616.06 million in 2024 to USD 2,638.63 million by 2032, reflecting a CAGR of 6.32%.

- The government’s “Cashless Vision” initiative aims to increase cashless payments to 40% by 2025, promoting digital payment adoption.

- The rise of e-commerce and omnichannel retailing necessitates POS systems that manage transactions across multiple platforms.

- The hospitality and healthcare sectors are adopting POS systems to enhance operational efficiency and customer service.

- Urban centers like Tokyo, Osaka, and Nagoya lead in POS software adoption due to advanced infrastructure and a tech-savvy population.

- Rural areas exhibit slower POS adoption, hindered by lower population density and a cultural preference for cash transactions.

- High initial investment and integration complexities with legacy systems pose challenges, especially for SMEs.

Market Drivers:

Government Initiatives Promoting Cashless Payments

One of the key drivers of the Japan POS software market is the government’s active promotion of cashless payments. Through initiatives like the “Cashless Vision,” the government aims to increase cashless transactions to 40% by 2025. This vision includes efforts to incentivize consumers and businesses to adopt digital payment methods, including tax benefits for cashless transactions. By encouraging the widespread use of electronic payments, the government is accelerating the shift from traditional cash-based systems to digital transactions. This shift directly influences the demand for POS software solutions that support seamless, secure, and efficient payment processing across various industries.

Growth of E-commerce and Omnichannel Retailing

The rapid growth of e-commerce and the increasing importance of omnichannel retailing are significant drivers of the POS software market in Japan. As consumers increasingly shop online and expect consistent experiences across both digital and physical channels, retailers are compelled to adopt integrated POS systems that unify inventory management, customer data, and sales across all touchpoints. For example, omnichannel strategies in Japan leverage high store footfall to boost online sales while integrating advanced technologies like AI-powered analytics and cloud-based solutions to optimize operations. These systems enable businesses to offer a seamless shopping experience, whether the transaction occurs online, in-store, or via mobile platforms. The need for POS software that can manage multi-platform transactions is further bolstered by the shift towards convenience-driven purchasing behavior, making integrated solutions essential for retailers’ success in the modern digital economy.

Demand from the Hospitality and Healthcare Sectors

The hospitality and healthcare industries are experiencing rapid adoption of advanced POS software solutions, contributing significantly to market growth. In the hospitality sector, businesses such as restaurants, hotels, and entertainment venues are increasingly relying on POS systems to improve operational efficiency, enhance customer experience, and streamline transactions. These systems offer capabilities such as order management, payment processing, and customer relationship management. Similarly, the healthcare industry is adopting POS solutions for smoother billing processes and to improve service delivery. The integration of POS systems in both these sectors enables businesses to maintain accuracy, reduce transaction times, and ensure high levels of customer satisfaction, driving further adoption across Japan.

Technological Advancements and Increased Consumer Expectations

Technological advancements in payment systems and the evolving needs of consumers are also vital drivers of the POS software market. Japan is known for its technology-driven economy, and as consumer expectations evolve, businesses must stay ahead by adopting cutting-edge POS solutions that enhance security, speed, and user experience. For example, Japan plans to launch a unified QR code payment system (JPQR) by April 2025 to streamline cross-border payments for tourists from countries like Singapore and Thailand. Features such as contactless payments, mobile wallet integration, and real-time transaction processing have become increasingly popular, responding to consumer demand for faster, safer, and more convenient payment methods. As consumers continue to prioritize convenience and security in their purchasing decisions, businesses are turning to advanced POS software to meet these demands, thereby further fueling the market’s growth.

Market Trends:

Shift Towards Cloud-Based POS Solutions

One of the most prominent trends in the Japan POS software market is the growing adoption of cloud-based POS systems. As businesses seek more flexible, scalable, and cost-effective solutions, cloud-based platforms have gained popularity due to their ability to offer real-time data access, automatic software updates, and centralized management. For example, Seven-Eleven Japan plans to implement self-checkout systems across all its stores by 2025, leveraging cloud-based technology to enable real-time updates and centralized management. This shift allows businesses to manage multiple locations from a single interface and significantly reduces the need for on-premises hardware. The convenience and low maintenance requirements of cloud-based systems are encouraging more small and medium-sized enterprises (SMEs) to invest in POS software, expanding the reach of these solutions beyond larger corporations. Furthermore, the flexibility of cloud-based systems enables businesses to scale up or down according to their needs, making them an ideal choice for Japan’s diverse market landscape.

Rise of Contactless and Mobile Payments

Another key trend in the Japan POS software market is the increasing popularity of contactless and mobile payments. With consumers becoming more focused on convenience and safety, particularly in the wake of the COVID-19 pandemic, contactless payments have experienced a significant surge in adoption. POS software providers are enhancing their systems to support a wide range of mobile payment options, such as Apple Pay, Google Pay, and local payment solutions like Rakuten Pay. This trend aligns with Japan’s culture of technological innovation, where consumers are quick to embrace digital payment methods. As contactless payments become more mainstream, businesses are upgrading their POS systems to support these methods, enhancing both customer experience and operational efficiency.

Integration of Artificial Intelligence and Data Analytics

The integration of artificial intelligence (AI) and data analytics into POS software is a growing trend in Japan’s retail and service industries. AI-powered POS systems can analyze transaction data in real-time, providing businesses with valuable insights into customer behavior, inventory management, and sales trends. These insights allow businesses to make data-driven decisions, improve customer personalization, and optimize their operations. Retailers, for instance, can leverage AI to recommend products to customers based on past purchases, while restaurants and hotels can use AI to streamline bookings and enhance service delivery. The increasing use of data analytics to inform business strategies is transforming POS software from a simple transaction tool to a comprehensive solution for improving overall business performance.

Enhanced Security Features

As digital payments continue to gain traction, there is an increasing demand for advanced security features within POS systems. Businesses in Japan are prioritizing the implementation of enhanced security measures, including end-to-end encryption, biometric authentication, and multi-factor authentication (MFA), to protect sensitive customer data and comply with stringent regulatory requirements. Japan’s focus on cybersecurity, driven by both consumer concerns and government regulations, has made security a critical aspect of POS software development. For example, Ingenico introduced Palm Vein Identification technology in 2023, offering enhanced privacy and security compared to fingerprint or facial recognition. These advancements in security not only protect businesses from data breaches and fraud but also build customer trust, which is essential in encouraging continued use of digital payment methods. The trend toward heightened security features is expected to persist as the market continues to evolve.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the significant challenges in the Japan POS software market is the high initial investment and ongoing maintenance costs associated with implementing advanced POS systems. While cloud-based solutions are becoming more affordable, traditional on-premises POS systems often require significant upfront capital for hardware, software licenses, and installation. For instance, self-service kiosks tailored for retail environments can cost several thousand dollars each, making them prohibitive for smaller businesses. Additionally, businesses must factor in the ongoing costs of system maintenance, updates, and security patches. These financial barriers can be particularly challenging for small and medium-sized enterprises (SMEs) that operate on limited budgets, potentially hindering their adoption of sophisticated POS solutions. As a result, businesses may hesitate to invest in POS systems despite their long-term benefits.

Integration Complexity with Legacy Systems

Another challenge faced by businesses in Japan is the complexity of integrating modern POS software with legacy systems. Many established retail and service businesses still rely on outdated POS infrastructure, which may not be easily compatible with newer software solutions. This can lead to difficulties in streamlining operations and data flows between old and new systems. The integration process can be time-consuming and costly, often requiring custom solutions to ensure seamless connectivity. This presents a significant hurdle for businesses looking to modernize their operations without disrupting existing workflows, thus slowing down the adoption of updated POS systems.

Security and Data Privacy Concerns

With the increased use of digital payments, security and data privacy concerns have emerged as significant challenges in the Japan POS software market. Cybersecurity threats, such as data breaches and fraud, pose a constant risk to businesses and consumers alike. Japanese businesses must comply with stringent data protection regulations, such as the Act on the Protection of Personal Information (APPI), which requires POS systems to have robust security features. While advancements in security measures have been made, the evolving nature of cyber threats presents an ongoing challenge for POS software developers and users, making it essential to continually update and upgrade security protocols.

Resistance to Change in Traditional Businesses

Resistance to change remains a barrier to the widespread adoption of POS software, particularly in Japan’s more traditional industries. Many small businesses, particularly in rural areas, continue to rely on cash transactions and may be hesitant to transition to digital payment systems. This reluctance to adopt new technologies is often driven by cultural preferences for cash-based transactions and concerns over the reliability of digital systems. Overcoming this resistance requires not only technological solutions but also educational initiatives that highlight the benefits of POS systems, such as improved operational efficiency and enhanced customer service.

Market Opportunities:

One of the most significant market opportunities in the Japan POS software market lies in the rapid expansion of e-commerce and omnichannel retailing. As consumer shopping habits evolve, businesses are increasingly seeking POS solutions that can seamlessly integrate online and offline sales channels. The ability to offer a unified customer experience across various touchpoints—such as brick-and-mortar stores, mobile apps, and websites—presents a considerable growth opportunity for POS software providers. Retailers and service businesses in Japan are increasingly adopting integrated POS systems to manage inventory, sales, and customer data in real-time, creating an opportunity for software developers to offer scalable solutions that meet the needs of businesses operating in a digital-first environment.

Technological advancements in payment systems, particularly in mobile wallets, contactless payments, and AI-powered analytics, also present a substantial opportunity for POS software growth in Japan. As consumer preferences shift toward faster, more secure, and convenient payment methods, businesses are seeking POS solutions that can accommodate these demands. Additionally, the increasing focus on data-driven decision-making within the retail and service industries creates an opportunity for POS systems with advanced analytics capabilities. By leveraging AI, machine learning, and big data, businesses can gain insights into customer behavior and operational efficiency. This growing demand for cutting-edge POS systems offers a significant market opportunity for software providers that can offer innovative, secure, and adaptable solutions to meet the evolving needs of Japanese businesses.

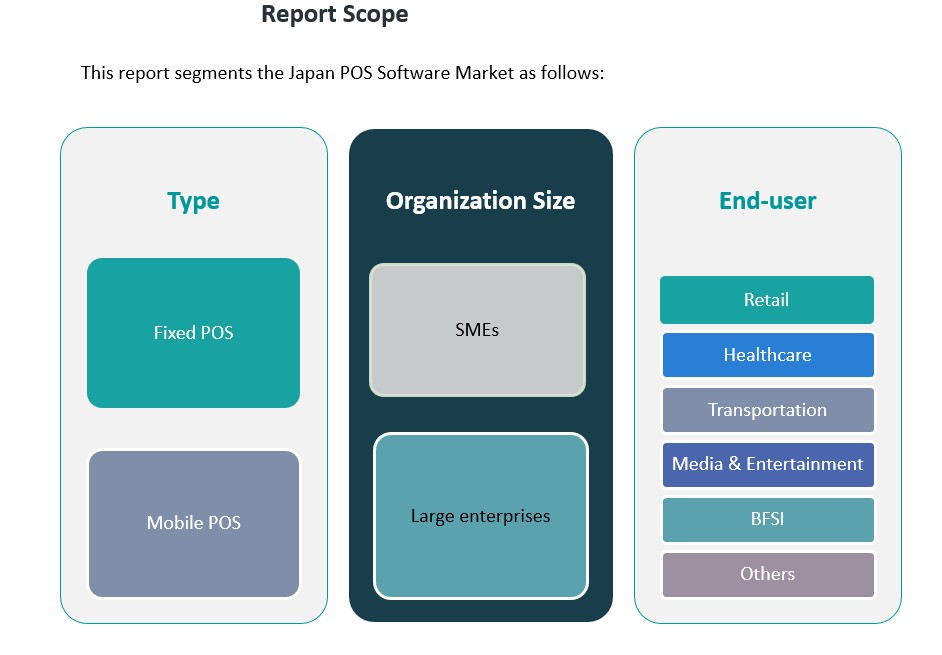

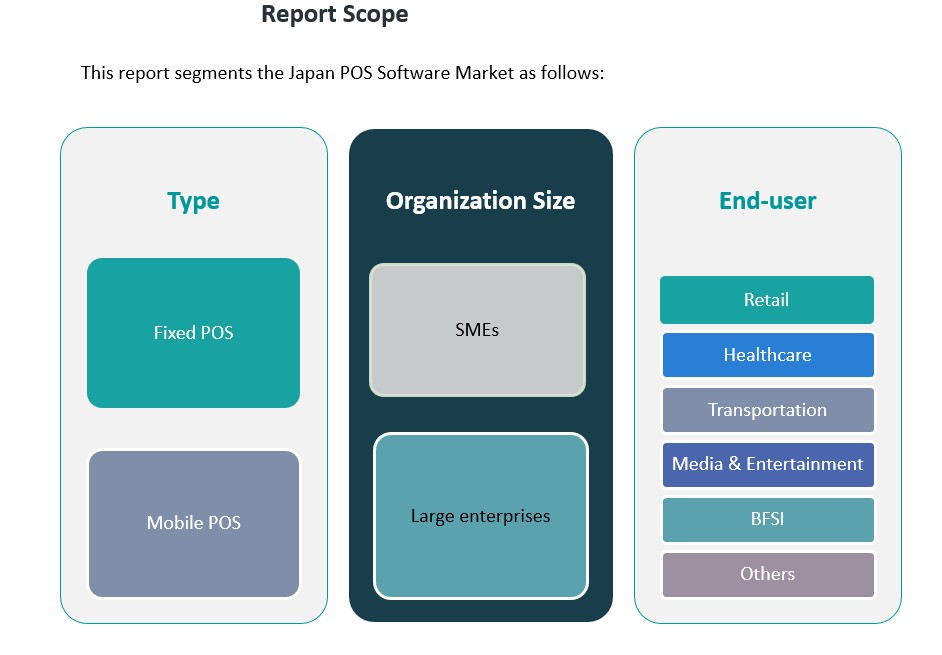

Market Segmentation Analysis:

The Japan POS software market is segmented into various categories, each catering to different business needs and operational requirements.

By Type Segment Analysis

The market is primarily divided into two types of POS systems: Fixed POS and Mobile POS. Fixed POS systems, which are typically installed in retail locations, continue to dominate due to their reliability and integration with extensive inventory and sales systems. However, the mobile POS (mPOS) segment is gaining traction, particularly in businesses requiring flexibility, such as restaurants, cafes, and field sales. mPOS systems offer enhanced mobility, enabling transactions to be processed anywhere, which is particularly appealing in dynamic retail environments.

By Organization Size Segment Analysis

The POS software market is further segmented by organization size into SMEs (Small and Medium Enterprises) and large enterprises. SMEs are increasingly adopting POS solutions as they become more affordable and accessible, enabling smaller businesses to streamline operations and improve customer service. On the other hand, large enterprises continue to make up a significant portion of the market, with more complex needs requiring advanced, integrated POS solutions that can support multiple locations and manage large volumes of transactions.

By End-User Segment Analysis

Key end-users of POS software in Japan include the retail, healthcare, transportation, media & entertainment, and BFSI sectors. The retail sector remains the largest adopter, driven by the need for efficient customer transactions and inventory management. The healthcare sector is also increasingly adopting POS solutions to streamline billing and patient transactions. The transportation sector, along with media, entertainment, and BFSI, are also embracing POS technology to enhance customer experiences and operational efficiency. Other sectors are gradually adopting POS systems to meet specific transaction needs.

Segmentation:

By Type Segment Analysis

By Organization Size Segment Analysis

- SMEs (Small and Medium Enterprises)

- Large Enterprises

By End-User Segment Analysis

- Retail

- Healthcare

- Transportation

- Media & Entertainment

- BFSI (Banking, Financial Services, and Insurance)

- Others

Regional Analysis:

Regional Analysis of the Japan POS Software Market

Japan’s POS software market is shaped by a variety of regional dynamics, with urban centers leading adoption due to their technological infrastructure, high population density, and business activity. The market exhibits notable regional disparities, with metropolitan areas experiencing rapid POS system adoption, while rural regions face slower uptake.

Tokyo and the Greater Kanto Area

The Tokyo Metropolitan Area, which includes surrounding cities in the Greater Kanto region such as Yokohama and Chiba, holds the largest market share in Japan’s POS software sector. Tokyo, as Japan’s economic and technological hub, is home to numerous large-scale retail chains, hospitality businesses, and service industries that have been early adopters of advanced POS systems. The high concentration of consumers with disposable income, along with the city’s advanced infrastructure, makes Tokyo an ideal market for sophisticated POS solutions. Additionally, the government’s push toward a cashless society has accelerated digital payment adoption, further driving the growth of POS software in this region. The Greater Kanto area’s market share is estimated to be around 35%, with businesses of all sizes investing in integrated POS solutions to cater to their increasingly tech-savvy customer base.

Osaka and the Kansai Region

Osaka, along with other cities in the Kansai region such as Kyoto and Kobe, holds the second-largest market share for POS software in Japan. Osaka is a major economic center, home to a large number of retail, hospitality, and manufacturing businesses. The region’s diverse business environment, coupled with a growing number of tourists, has spurred demand for POS systems that can handle various payment methods, including mobile wallets and contactless payments. Kansai’s market share is estimated to be approximately 25%. The local government’s initiatives to promote cashless payments have further accelerated POS software adoption, especially in high-traffic tourist areas.

Nagoya and the Chubu Region

Nagoya, located in the Chubu region, is another key market for POS software in Japan. As the country’s third-largest metropolitan area, Nagoya is a manufacturing powerhouse with a large retail sector. The demand for advanced POS solutions is growing in response to the increasing adoption of digital payments and the rise of e-commerce in the region. The Chubu region, including cities like Aichi and Shizuoka, is expected to hold around 15% of the overall market share. Retailers and businesses are increasingly investing in POS systems to enhance operational efficiency, improve customer service, and integrate online and offline sales channels.

Hokkaido and Rural Regions

Rural regions such as Hokkaido, Tohoku, and parts of Kyushu have slower adoption rates of POS software compared to urban areas. These regions are characterized by lower population density and a stronger preference for cash transactions. However, the Japanese government’s push for digital transformation, combined with rising awareness of the benefits of POS systems, is gradually driving adoption in these areas. The market share in these regions is relatively smaller, estimated at around 25%. Over time, the government’s incentives and efforts to enhance digital infrastructure may further stimulate POS software adoption, even in more rural and less densely populated areas.

Key Player Analysis:

- Square Japan

- AirREGI

- STORES POS (Hey, Inc.)

- Ubiregi

- Toshiba TEC

- NEC

- GMO Payment Gateway

- TableCheck

- Fooding Journal

Competitive Analysis:

The Japan POS software market is highly competitive, with both local and global players striving to meet the growing demand for advanced payment solutions. Key players in this market include global companies like Square, Toshiba, and NCR Corporation, which offer integrated and cloud-based POS systems. These providers are leveraging their technological expertise and global presence to capture market share. Local players, such as NEC Corporation and Rakuten, also hold a significant market position, offering tailored solutions that cater to the specific needs of Japanese businesses. These companies are focusing on providing seamless integration with local payment methods, such as mobile wallets and contactless payments, to meet consumer preferences in Japan. Competition is intensifying as the market evolves with emerging technologies such as AI, mobile payment solutions, and data analytics. Companies are increasingly differentiating themselves by offering secure, customizable, and scalable POS systems that cater to various industries, from retail to hospitality.

Recent Developments:

- On January 8, 2025, GMO Payment Gateway acquired enpay Inc., a FinTech SaaS platform provider specializing in cashless payment solutions. This acquisition aims to enhance GMO-PG’s offerings in the childcare and education sectors by integrating enpay’s expertise with GMO-PG’s payment services.

- In February 2024, Ingenico partnered with Anycover, a Singapore-based Insurtech startup, to provide embedded insurance on in-store POS terminals. This innovative approach integrates insurance products into non-insurance transaction platforms, enhancing consumer accessibility during the point of sale process.

- In February 2023, Ingenico introduced the Android AXIUM DX8000 Smart POS in Japan. This device offers a premium digital experience in-store, enhancing security, productivity, and performance. It supports various payment methods, including EMV Chip & PIN, magstripe, contactless payments, QR-code scanning, and digital wallets.

Market Concentration & Characteristics:

The Japan POS software market is moderately concentrated, with a mix of global and local players competing for market share. While international giants like Square, NCR, and Toshiba dominate the high-end POS software segment, local companies such as NEC Corporation and Rakuten are also well-positioned, offering solutions tailored to the specific needs of Japanese businesses. These companies differentiate themselves by providing localized payment systems, ensuring compatibility with Japanese mobile wallets and contactless payment methods. The market is characterized by a high degree of technological innovation, with continuous advancements in cloud-based solutions, AI-powered analytics, and seamless mobile payment integration. Moreover, the growing trend of e-commerce and omnichannel retailing has pushed POS software developers to focus on providing flexible, scalable, and integrated solutions that can handle both online and offline transactions. As the market continues to evolve, players must adapt to shifting consumer demands and regulatory requirements to maintain competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment Analysis, Organization Size Segment Analysis and End-User Segment Analysis. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to grow at a steady pace, driven by the increasing adoption of cashless payment solutions across Japan.

- Cloud-based POS systems will dominate, offering businesses more flexibility, scalability, and cost-efficiency.

- The integration of AI and data analytics in POS software will enhance real-time decision-making and customer personalization.

- Mobile payment systems, including contactless solutions, will continue to gain traction, particularly in urban centers.

- The hospitality and healthcare sectors will increasingly invest in POS software to streamline operations and improve customer service.

- Small and medium-sized enterprises (SMEs) will adopt POS systems due to the growing availability of affordable, user-friendly solutions.

- Regional adoption will expand as rural areas experience a gradual shift towards digital payments through government incentives.

- The demand for omnichannel POS solutions will rise, driven by the integration of online and offline retail channels.

- Enhanced security features in POS systems will become a top priority to address growing cybersecurity concerns.

- Collaboration between local providers and international players will foster innovative, market-specific solutions to cater to diverse business needs.