| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Caffeinated Beverage Market Size 2024 |

USD 13,005.81 million |

| Latin America Caffeinated Beverage Market CAGR |

3.84% |

| Latin America Caffeinated Beverage Market Size 2032 |

USD 17,577.92 million |

Market Overview

Latin America Caffeinated Beverage market size was valued at USD 13,005.81 million in 2024 and is anticipated to reach USD 17,577.92 million by 2032, at a CAGR of 3.84% during the forecast period (2024-2032).

The Latin America caffeinated beverage market is experiencing steady growth, driven by rising urbanization, a growing working-class population, and increasing consumer preference for functional and energy-boosting drinks. The demand for convenient, on-the-go beverage options is fueling the popularity of ready-to-drink coffee, tea, and energy drinks across the region. Additionally, health-conscious consumers are influencing market dynamics by seeking products with natural caffeine sources, reduced sugar content, and added health benefits. Beverage manufacturers are responding with innovative formulations and sustainable packaging to cater to evolving consumer expectations. The expansion of modern retail channels and aggressive marketing strategies by leading brands are also enhancing product visibility and accessibility. Moreover, the influence of global trends, such as the premiumization of beverages and the rise of plant-based ingredients, is encouraging diversification in product offerings. These factors collectively support the sustained growth and competitive development of the caffeinated beverage market in Latin America.

The Latin America caffeinated beverage market exhibits dynamic growth across key countries including Brazil, Argentina, Colombia, Chile, and Peru, each contributing uniquely to regional demand. Brazil leads in consumption due to its strong coffee culture and growing demand for energy drinks and RTD beverages, while Argentina and Colombia are witnessing increased interest in natural caffeine sources such as yerba mate and guarana. Urbanization, evolving consumer lifestyles, and expanding retail infrastructure are driving product accessibility across both metropolitan and emerging markets. Key players actively shaping the market landscape include Nestlé, Red Bull, PepsiCo, The Coca-Cola Company, and 5-hour ENERGY. These companies are focusing on product innovation, healthier formulations, and diversified distribution channels to cater to the region’s shifting preferences. With rising awareness of wellness and functional beverages, leading brands are also leveraging digital marketing strategies and partnerships to strengthen their presence and capitalize on the region’s untapped growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America caffeinated beverage market was valued at USD 13,005.81 million in 2024 and is projected to reach USD 17,577.92 million by 2032, growing at a CAGR of 3.84% from 2024 to 2032.

- The global caffeinated beverage market was valued at USD 252,050.67 million in 2024 and is expected to reach USD 369,284.04 million by 2032, growing at a CAGR of 4.89%.

- Increased consumer focus on health and wellness is driving demand for low-sugar and natural caffeinated beverages.

- Functional drinks, including energy beverages and RTD coffee, are gaining popularity, especially among busy professionals and younger consumers.

- Brands are focusing on product innovation, using native ingredients like guarana and yerba mate to cater to regional tastes.

- The competitive landscape is dominated by major players like Nestlé, Red Bull, PepsiCo, The Coca-Cola Company, and 5-hour ENERGY.

- Regulatory challenges regarding sugar content and caffeine levels are limiting growth in some regions.

- Brazil leads the market, followed by Argentina and Colombia, while emerging markets in Chile and Peru show strong growth potential.

Report Scope

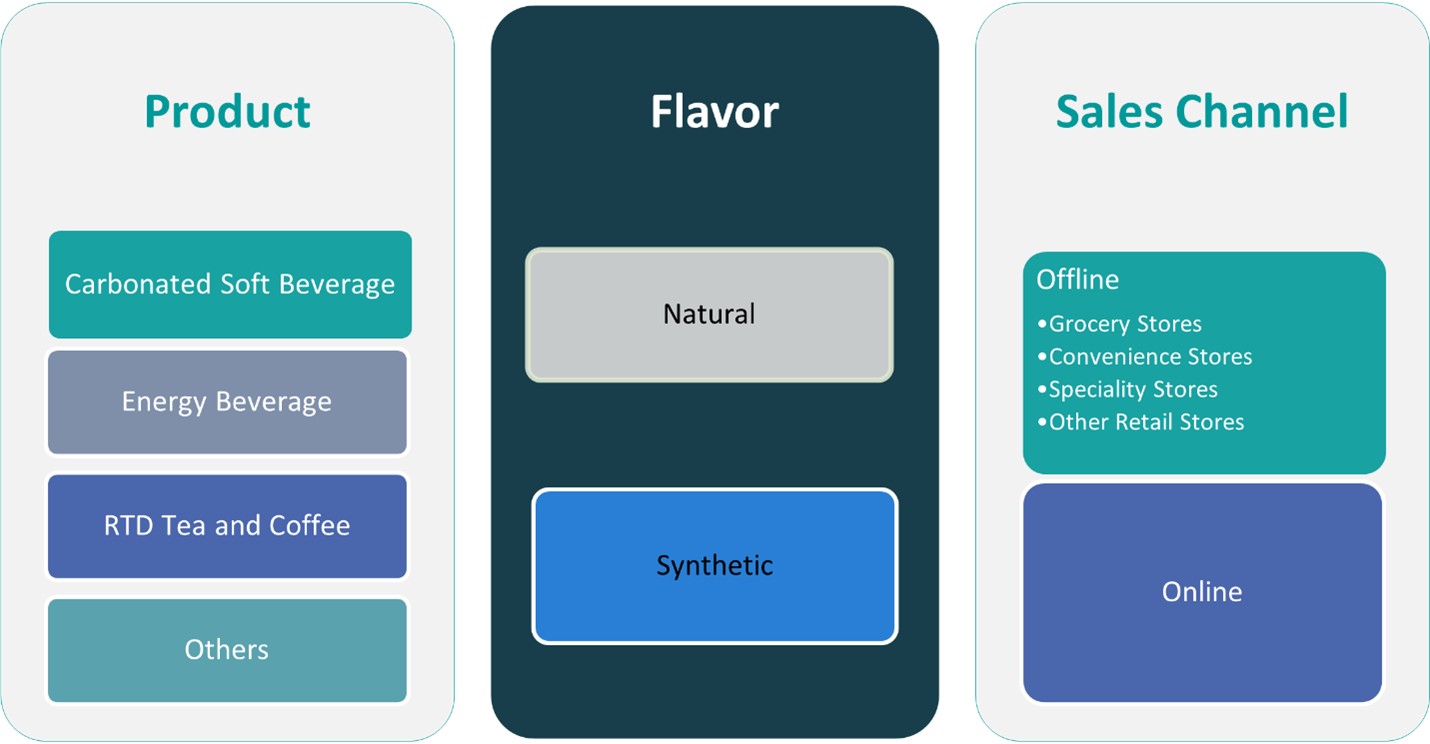

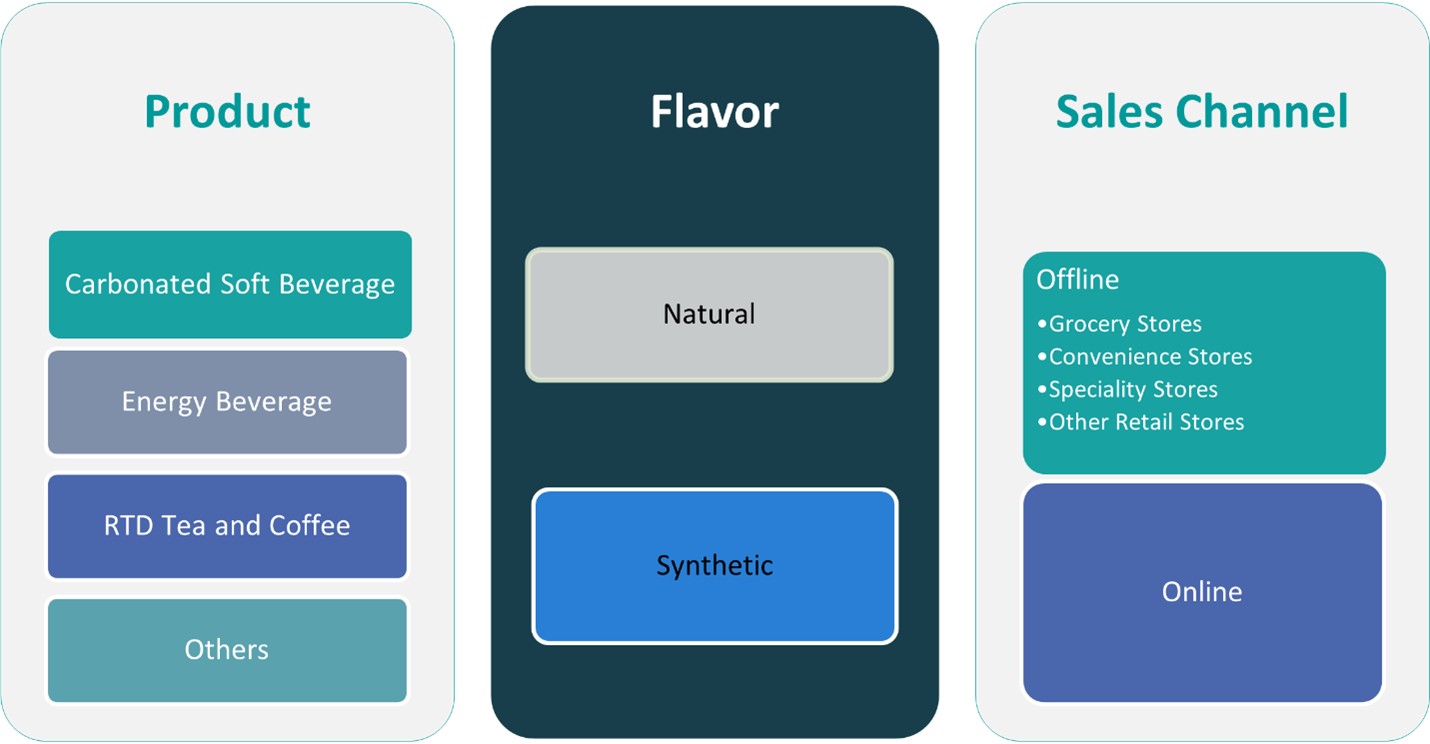

This report segments the Latin America Caffeinated Beverage Market as follows:

Market Drivers

Rising Urbanization and Changing Lifestyles

The increasing rate of urbanization across Latin America is significantly influencing the consumption patterns of beverages, particularly caffeinated ones. With more people residing in urban areas, there is a growing demand for convenient and ready-to-consume beverage options that complement fast-paced lifestyles. For instance, busy routines and the growing occurrence of on-the-go consumption have enhanced the demand for suitable and portable caffeinated beverages. Urban consumers, especially the younger demographic, are leaning toward products that provide energy and focus to keep up with their daily routines. This shift has boosted the popularity of energy drinks, cold brew coffees, and ready-to-drink teas. Furthermore, as more individuals adopt demanding work schedules and longer commuting hours, the consumption of caffeine-infused beverages has become an essential part of their daily routine, reinforcing the demand across metropolitan areas.

Expanding Middle-Class Population and Increased Disposable Income

The expansion of the middle class and the gradual rise in disposable income levels across Latin America are key drivers for the caffeinated beverage market. As income levels improve, consumers are increasingly willing to spend on premium and value-added beverage options. For instance, rising disposable incomes and improved standards of living in Latin America are anticipated to positively influence market growth. This includes specialty coffees, organic teas, and health-enhanced energy drinks that were once considered luxury products. With enhanced purchasing power, the middle-class segment is also exploring diverse flavor profiles and international brands, contributing to the diversification of the regional market. Additionally, consumers are becoming more brand-conscious, gravitating toward beverages that not only deliver on taste and functionality but also reflect aspirational lifestyles. This socio-economic development has created a fertile ground for the growth of both domestic and international beverage companies.

Growing Health Consciousness and Demand for Functional Beverages

Health awareness among Latin American consumers is rising, prompting a shift toward beverages that offer functional benefits alongside traditional caffeine content. Consumers are now looking for drinks that contain natural ingredients, reduced sugar, added vitamins, and plant-based formulations. This has led to the development of “better-for-you” caffeinated beverages that promote mental alertness, weight management, and overall well-being. The market is witnessing innovation in ingredients such as green tea extract, yerba mate, guarana, and natural caffeine sources that align with health-conscious preferences. Moreover, the COVID-19 pandemic has accelerated health and wellness trends, encouraging both consumers and manufacturers to prioritize immunity-boosting and clean-label products. As a result, the integration of health benefits into caffeinated beverages is becoming a standard rather than a niche offering.

Retail Expansion and Digital Penetration Boosting Accessibility

The expansion of modern retail infrastructure, coupled with growing digital commerce in Latin America, is significantly enhancing the accessibility of caffeinated beverages. Supermarkets, convenience stores, and specialty outlets are widening their product assortments to include a variety of caffeinated drinks catering to diverse consumer preferences. At the same time, the rise of e-commerce and food delivery platforms is making it easier for consumers to purchase their favorite beverages online, often with personalized recommendations and subscription models. Leading brands are leveraging digital channels to launch targeted campaigns, influencer collaborations, and loyalty programs that attract and retain customers. These strategic distribution and marketing initiatives are playing a pivotal role in boosting product visibility and market penetration across urban and semi-urban regions.

Market Trends

Premiumization of Caffeinated Beverage Offerings

One of the prominent trends shaping the Latin America caffeinated beverage market is the premiumization of product offerings. Consumers are increasingly seeking high-quality beverages that offer superior taste, unique flavors, and premium ingredients. This trend is evident in the rising demand for specialty coffees, single-origin blends, artisanal teas, and craft energy drinks. Brands are responding by introducing limited-edition products, ethically sourced ingredients, and innovative packaging that enhances the overall consumer experience. Premiumization also includes incorporating organic, non-GMO, and clean-label claims to appeal to health-conscious and environmentally aware consumers. As disposable incomes rise and consumer expectations evolve, premium caffeinated beverages are becoming more mainstream in both urban and semi-urban markets.

Innovation in Natural and Plant-Based Ingredients

Latin American consumers are showing a growing preference for caffeinated beverages made with natural and plant-based ingredients. Traditional sources such as guarana and yerba mate, which are native to the region, are being increasingly integrated into modern beverage formulations. For instance, Latin America’s plant-based food and beverage market is expected to grow significantly, driven by rising vegetarian and vegan populations. These ingredients are not only culturally relevant but also align with global wellness trends due to their natural energy-boosting properties. In addition, the market is witnessing the inclusion of botanical extracts, adaptogens, and herbal infusions to create functional drinks that support mental clarity, stress relief, and immune health. This trend toward natural and plant-based innovation is encouraging local and international brands to explore indigenous resources and develop sustainable, health-driven product lines.

Digital Influence and Social Media-Driven Consumption

The growing influence of digital platforms and social media is reshaping how caffeinated beverages are marketed and consumed in Latin America. Influencer collaborations, user-generated content, and targeted digital campaigns are enabling brands to connect directly with younger, tech-savvy audiences. For instance, social media and the growing influence of online marketing have been beneficial for brands to connect with their target audience and create product awareness and loyalty among consumers. Social media trends around productivity, wellness, and fitness often promote caffeinated drinks as essential lifestyle companions. In addition, the availability of online reviews, unboxing videos, and interactive content is boosting consumer confidence and encouraging trial purchases. E-commerce channels, including direct-to-consumer (DTC) models, are also expanding the reach of niche and premium products, allowing smaller brands to compete with established players in this dynamic market.

Rise of RTD (Ready-to-Drink) and On-the-Go Formats

Convenience continues to play a vital role in shaping consumer preferences, leading to the surge in popularity of ready-to-drink (RTD) and single-serve caffeinated beverages. Busy lifestyles, growing urban populations, and increased travel and work mobility have amplified the demand for portable and easy-to-consume drink options. RTD coffees, teas, and energy drinks packaged in bottles, cans, or tetra packs are gaining traction among young professionals, students, and gym-goers. These formats not only offer convenience but also help maintain product freshness and branding visibility. Brands are also experimenting with functional RTD formats that combine energy with hydration, focus enhancement, or dietary benefits, further expanding their appeal in the health-conscious segment.

Market Challenges Analysis

Regulatory Hurdles and Health Concerns Impacting Growth

One of the major challenges facing the Latin America caffeinated beverage market is the growing scrutiny from health authorities and regulatory bodies. Governments in several countries are implementing stricter regulations concerning sugar content, caffeine levels, and product labeling, particularly for energy drinks and sugar-sweetened beverages. These measures aim to combat rising rates of obesity, diabetes, and other lifestyle-related health issues. As a result, beverage manufacturers must reformulate products, add clearer labeling, and comply with evolving standards, which can increase production costs and delay product launches. For instance, Latin American governments are enforcing clearer labeling requirements for caffeinated beverages to ensure consumer awareness. Furthermore, growing consumer awareness about the potential side effects of excessive caffeine intake such as insomnia, anxiety, and cardiovascular concerns has made some segments of the population cautious, especially parents of adolescents. This rising health consciousness may dampen the appeal of certain high-caffeine products and restrict market growth if not addressed with safer and healthier alternatives.

Supply Chain Disruptions and Pricing Pressures

The Latin American caffeinated beverage market is also vulnerable to supply chain disruptions and fluctuating input costs. Sourcing quality raw materials such as coffee beans, tea leaves, and natural caffeine derivatives can be challenging due to weather-related events, geopolitical tensions, and transportation bottlenecks. Additionally, inflationary pressures and currency volatility across several Latin American countries can drive up production and distribution costs, affecting pricing strategies and profit margins for manufacturers. Smaller companies, in particular, struggle to absorb these costs or pass them on to price-sensitive consumers. Moreover, limited infrastructure in rural areas and inconsistent cold chain logistics present distribution challenges, especially for ready-to-drink formats that require temperature control. These operational barriers can hinder product availability and regional market penetration, especially for new entrants and niche brands looking to scale.

Market Opportunities

The Latin America caffeinated beverage market presents significant growth opportunities driven by evolving consumer preferences and expanding distribution networks. As awareness of health and wellness increases, there is growing demand for functional beverages that provide not only energy but also added health benefits. This trend opens avenues for brands to innovate with clean-label, organic, and natural caffeine sources such as yerba mate, guarana, and green tea. Introducing low-sugar, low-calorie, and fortified caffeinated drinks can attract health-conscious consumers, especially in urban areas. Furthermore, the increasing popularity of plant-based and sustainable ingredients aligns well with global consumer trends, offering opportunities for local and international brands to create differentiated product portfolios tailored to Latin American tastes. Customizing flavors and ingredients to reflect local preferences can also strengthen brand loyalty and market positioning.

In addition to product innovation, expanding retail infrastructure and the rapid growth of e-commerce across the region are enabling greater accessibility and visibility for caffeinated beverage brands. Convenience stores, supermarkets, and online platforms are broadening their product offerings, providing manufacturers with multiple sales channels to reach diverse consumer segments. The rise of digital marketing, influencer campaigns, and social media engagement is allowing companies to connect directly with younger demographics and build brand equity effectively. There is also an untapped potential in smaller cities and rural markets where product penetration remains relatively low. Strategic partnerships with local distributors and retailers can help brands establish a stronger foothold in these areas. Moreover, Latin America’s rich biodiversity offers unique sourcing opportunities for functional ingredients, which companies can leverage to develop regionally inspired, value-added caffeinated drinks. By aligning with local culture, health trends, and modern retail dynamics, brands can capture a larger share of the market and drive long-term growth across the region.

Market Segmentation Analysis:

By Product:

The Latin America caffeinated beverage market is segmented by product into carbonated soft beverages, energy beverages, ready-to-drink (RTD) tea and coffee, and others. Among these, energy beverages are witnessing robust growth due to rising consumer demand for functional drinks that enhance alertness and stamina, particularly among young adults and working professionals. These drinks are widely consumed in urban areas where fast-paced lifestyles prevail. RTD tea and coffee are also gaining momentum, supported by health-conscious consumers seeking natural sources of caffeine in convenient formats. This segment is benefitting from premiumization trends and the introduction of cold brews, specialty teas, and low-sugar alternatives. While carbonated soft beverages continue to hold a significant market share due to their widespread availability and affordability, their growth is relatively moderate due to increasing health concerns. The “others” category, including caffeine-infused waters and juices, is emerging as a niche but promising area. Product diversification across these categories is enabling brands to address evolving consumer needs and expand their market reach.

By Flavor:

Flavor segmentation in the Latin America caffeinated beverage market includes natural and synthetic categories, with a notable shift toward natural flavorings in recent years. Consumers are increasingly favoring beverages that contain natural ingredients, herbal infusions, and fruit-based extracts, particularly in RTD tea and coffee as well as functional energy drinks. The appeal of natural flavors is closely tied to the region’s growing health awareness and demand for clean-label products. Brands are responding by launching drinks infused with native ingredients such as guarana, yerba mate, and açaí, which not only enhance flavor but also offer cultural relevance. On the other hand, synthetic flavors, while still present in carbonated soft drinks and budget-friendly energy beverages, are facing gradual decline due to concerns over artificial additives and potential health risks. However, synthetic flavors continue to play a role in maintaining cost efficiency and achieving bold, consistent taste profiles. The growing emphasis on authenticity and wellness is expected to keep natural flavors in strong demand moving forward.

Segments:

Based on Product:

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea and Coffee

- Others

Based on Flavor:

Based on Sales Channel:

- Offline

- Grocery Stores

- Convenience Stores

- Speciality Stores

- Other Retail Stores

- Online

Based on the Geography:

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

Regional Analysis

Brazil

Brazil dominates the Latin American caffeinated beverage market, holding a substantial 40% share in 2024. This leadership stems from the country’s deep-rooted coffee culture, widespread urbanization, and expanding middle-class population. Brazil is not only one of the world’s largest coffee producers but also a significant consumer, driving strong demand for RTD coffee and specialty caffeinated drinks. Additionally, Brazilian consumers are showing increasing interest in functional energy beverages and natural formulations that incorporate native ingredients like guarana. Urban centers such as São Paulo and Rio de Janeiro serve as key consumption hubs where convenience, premiumization, and digital retail channels are fueling growth. The rapid development of retail infrastructure and the popularity of e-commerce platforms further enhance market penetration. Local brands and international players continue to invest in product innovation and marketing strategies tailored to Brazilian tastes, strengthening the country’s role as the regional market leader.

Argentina

Argentina accounts for approximately 15% of the Latin American caffeinated beverage market, making it one of the fastest-growing countries in the region. The nation’s strong yerba mate consumption has created a natural gateway for the adoption of other plant-based and caffeinated beverages. Over the past few years, energy drinks and RTD coffee have seen notable increases in demand, particularly among younger consumers and busy professionals. Additionally, there is a rising trend of health-focused beverages with low sugar and clean-label attributes, appealing to the country’s increasingly wellness-conscious population. Domestic producers and regional startups are actively leveraging Argentina’s botanical diversity and cultural preferences to develop innovative, natural caffeine alternatives. Although economic fluctuations pose short-term challenges, the country’s urban consumer base and growing digital engagement offer long-term opportunities for caffeinated beverage brands to expand their footprint.

Colombia

Colombia holds an 11% share of the Latin American caffeinated beverage market, driven largely by its status as one of the world’s leading coffee exporters and its strong local consumption patterns. The Colombian market is witnessing an increase in demand for RTD coffee and specialty brews, especially among urban youth and working professionals seeking convenience and quality. Additionally, the popularity of cold brews and bottled energy teas is steadily rising as consumers explore newer formats beyond traditional hot coffee. Government support for local coffee producers and growing investment in café chains are also supporting market development. While energy beverages are gaining momentum, the market remains primarily coffee-focused, with opportunities in flavor innovation and functional enhancements. Colombia’s café culture, combined with rising urbanization and retail diversification, is expected to sustain consistent growth in the coming years.

Chile and Peru

Chile and Peru, collectively contributing approximately 10% of the regional market, represent niche but promising segments. Chile, with its high urban population and increasing health consciousness, is seeing a shift from sugary carbonated drinks to functional RTD tea and energy beverages. The market is especially receptive to beverages featuring natural ingredients and low-calorie profiles. Meanwhile, Peru offers strong potential for caffeine-infused products that incorporate indigenous ingredients like maca and guayusa, appealing to local and regional preferences for wellness-oriented beverages. Both countries are witnessing the expansion of modern retail formats and rising internet penetration, which are improving product availability and consumer access. Local and regional companies are actively launching innovative products, often emphasizing sustainability and clean-label claims. While their overall market share is smaller compared to Brazil or Argentina, their evolving consumer trends and supportive retail ecosystems signal robust potential for growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Red Bull

- PepsiCo

- The Coca-Cola Company

- 5-hour ENERGY

Competitive Analysis

The competitive landscape of the Latin America caffeinated beverage market is dominated by major global players, including Nestlé, Red Bull, PepsiCo, The Coca-Cola Company, and 5-hour ENERGY. These companies are continuously innovating to cater to the evolving consumer demand for healthier, functional, and convenient beverages. Companies are introducing new formulations that cater to local tastes, such as beverages infused with native ingredients like guarana, yerba mate, and açaí, which have strong cultural significance in the region. Furthermore, as consumer preferences shift toward convenience, ready-to-drink (RTD) coffee, energy drinks, and bottled teas are becoming increasingly popular. There is also a notable focus on sustainability, with brands investing in eco-friendly packaging and sourcing ingredients from sustainable and local sources. Strategic partnerships with local distributors and retailers, alongside investments in e-commerce, are helping companies increase their market reach. Intense competition exists in the energy drinks segment, where players differentiate through flavor profiles, branding, and health claims. Additionally, advancements in digital marketing and social media are enabling companies to directly engage with younger, tech-savvy consumers.

Recent Developments

- In March 2025, PepsiCo expanded its Pepsi MAX Caffeine Free line with a new 500ml bottle in the UK, responding to rising demand for caffeine-free and sugar-free colas among younger consumers.

- In February 2025, Coca-Cola introduced Simply Pop, a prebiotic, fruit juice-enriched soda targeting the “better-for-you” market segment, competing with brands like Poppi and Olipop.

- In January 2025, Nestlé implemented a new global organizational structure for its Waters & Premium Beverages division, operating as a standalone business.

- In June 2024, the Starbucks Corporation, one of the renowned brands in caffeinated beverages industry launched new range of Caramel Vanilla Swirl Iced Coffee, handcrafted energy drinks and few other products. Starbucks Tripleshot Energy drink, recently launched offering is characterized by 65mg of caffeine content, protein, B vitamins. The products is provided in three flavor choices including dark caramel, bold mocha, and rich vanilla.

- In February 2024, Dunkin’, one of the applauded brands in food & beverages industry introduced SPARKD’ Energy by Dunkin’, iced beverages equipped with minerals, vitamins and some amount of caffeine. The flavors include berry burst entailing strawberry and raspberry, and peach sunshine featuring lychee and juicy peach flavors.

Market Concentration & Characteristics

The Latin America caffeinated beverage market exhibits a moderate level of concentration, with a mix of dominant global players and a growing number of regional and local brands. While multinational corporations hold a significant share, regional brands are increasingly gaining traction by catering to local tastes and preferences, particularly with beverages featuring native ingredients like yerba mate and guarana. The market is characterized by strong brand loyalty, especially in coffee-based and energy drink categories, with consumers placing high value on product quality, flavor, and functionality. Additionally, there is an emerging trend toward health-conscious products, driving demand for low-sugar, clean-label, and natural caffeinated beverages. Competition is intense, particularly in the energy drinks sector, where companies continuously innovate in terms of flavor, packaging, and marketing strategies. The retail environment is expanding, with both traditional outlets and e-commerce platforms playing key roles in increasing product availability and consumer reach across the region.

Report Coverage

The research report offers an in-depth analysis based on Product, Flavor, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Latin America caffeinated beverage market is expected to continue growing at a steady pace due to rising demand for functional drinks.

- Health-conscious consumers will drive the shift towards low-sugar, low-calorie, and clean-label products.

- Natural caffeine sources like yerba mate, guarana, and green tea will gain popularity, reflecting local tastes and preferences.

- There will be increasing demand for ready-to-drink (RTD) coffee, energy drinks, and bottled teas, particularly in urban areas.

- Product innovation will be key, with companies focusing on unique flavors and ingredients that offer additional health benefits.

- E-commerce and online retail channels will play an increasingly significant role in product distribution across the region.

- Sustainability and eco-friendly packaging will become more critical as consumers demand environmentally responsible products.

- Competitive pressure will intensify, particularly in the energy drink segment, with brands exploring new marketing and promotional strategies.

- Strategic partnerships with local distributors and retailers will be essential for brands to reach untapped markets in smaller cities and rural areas.

- Investment in digital marketing and influencer campaigns will help brands engage with younger, tech-savvy consumers across the region.