Market Overview:

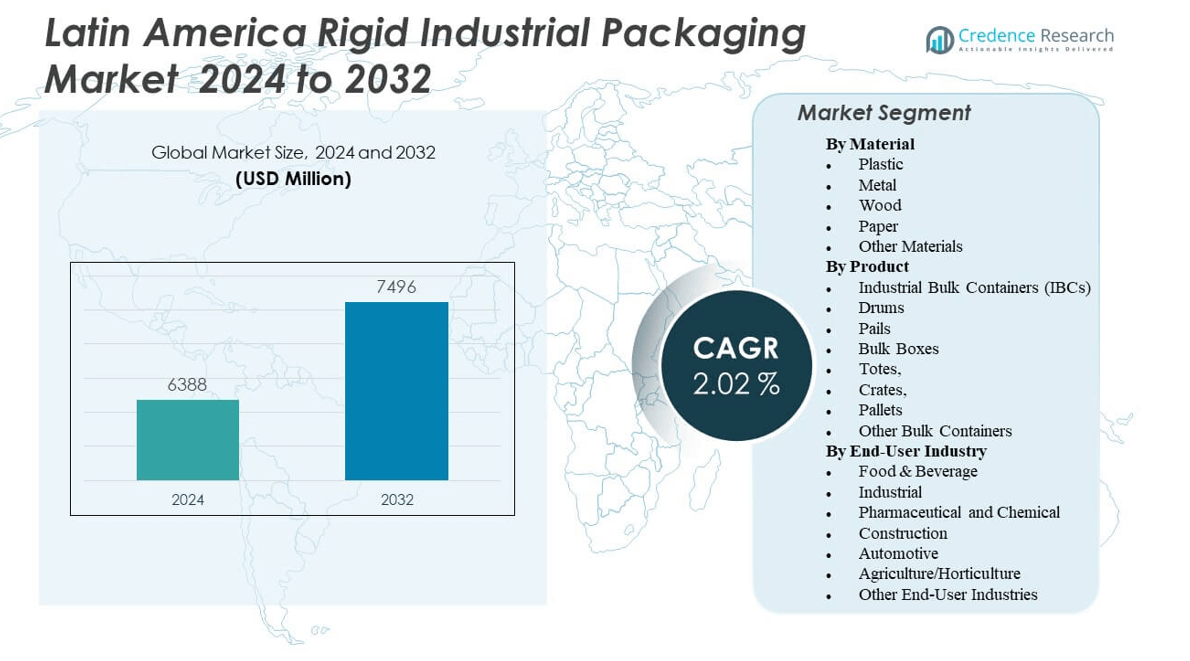

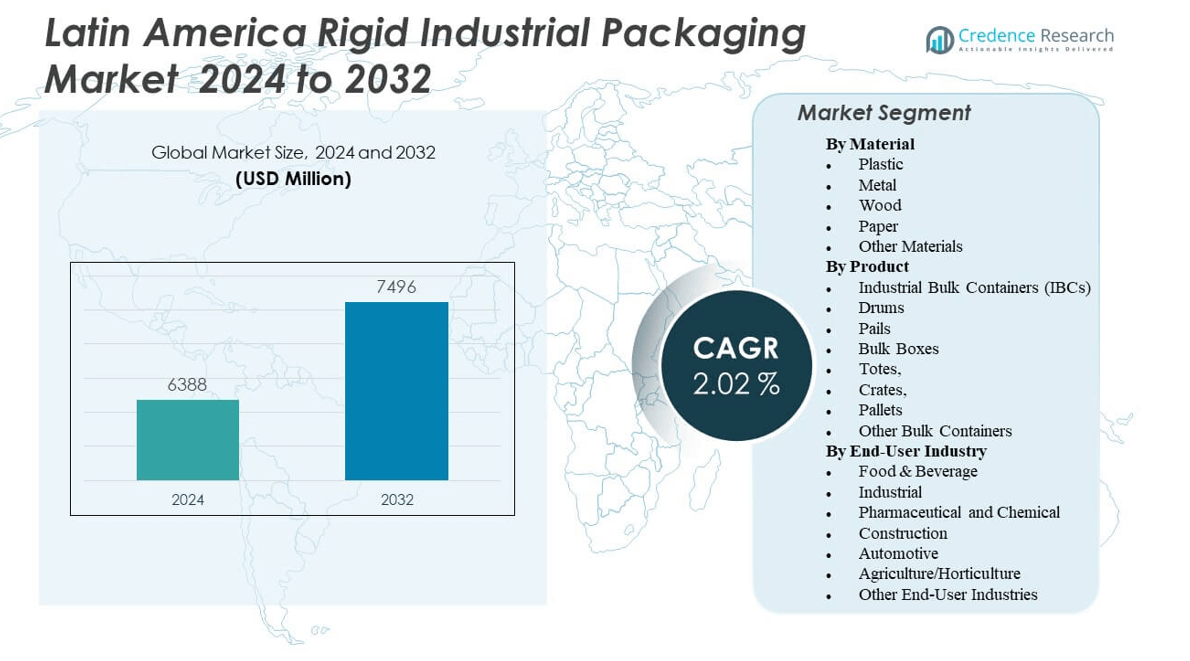

The Latin America Rigid Industrial Packaging Market is projected to grow from USD 6388 million in 2024 to an estimated USD 7496 million by 2032, with a compound annual growth rate (CAGR) of 2.02% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Rigid Industrial Packaging Market Size 2024 |

USD 6388 million |

| Latin America Rigid Industrial Packaging Market, CAGR |

2.02% |

| Latin America Rigid Industrial Packaging Market Size 2032 |

USD 7496 million |

The market is driven by increasing demand for secure and durable packaging across key industries such as chemicals, pharmaceuticals, food and beverage, and oil and gas. Rising industrialization, coupled with the need for efficient bulk handling, supports the adoption of rigid packaging solutions like drums, IBCs, and pails. Companies in the region are actively seeking cost-effective packaging that offers superior product protection, reusability, and compliance with international transport regulations. The push for environmental sustainability is also prompting manufacturers to invest in recyclable and reusable rigid packaging formats.

Geographically, Brazil leads the Latin America Rigid Industrial Packaging Market due to its extensive industrial base, well-established manufacturing sector, and high export volumes. Mexico follows closely, benefiting from strong trade relations with North America and a growing logistics infrastructure. Argentina and Colombia are emerging as important markets, driven by expanding chemical and food processing industries. The adoption of global standards and increasing investment in industrial development are enabling these countries to scale up packaging demand, positioning them as potential growth hotspots in the regional landscape.

Market Insights:

- The Latin America Rigid Industrial Packaging Market was valued at USD 6388 million in 2024 and is projected to reach USD 7496 million by 2032, growing at a CAGR of 2.02%.

- Rising demand for bulk transportation of chemicals and agrochemicals is a primary driver of market expansion across key industries.

- Growing adoption of recyclable and returnable packaging formats is reshaping supply chains and supporting circular economy goals.

- High capital costs and limited access to advanced manufacturing technology remain key restraints for small and mid-sized players.

- Brazil leads the regional market with 38% share, driven by industrial density, export activities, and packaging infrastructure.

- Mexico follows with 27% share, supported by strong cross-border trade and growing manufacturing clusters.

- Emerging economies like Argentina, Colombia, and Chile are showing accelerated demand due to expanding agriculture, construction, and logistics sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Industrial Logistics and Bulk Handling Efficiency

The Latin America Rigid Industrial Packaging Market is experiencing growth due to the increasing need for secure logistics and efficient bulk handling across key industrial sectors. Packaging formats such as drums, intermediate bulk containers (IBCs), and crates are in high demand to support chemical, agrochemical, and oil and gas industries. The rise in cross-border trade and regional exports is pushing manufacturers to adopt packaging that ensures product integrity during transportation. It benefits industries requiring large-volume shipments and extended storage periods. The market is also supported by the expansion of industrial hubs and free-trade zones. Companies seek packaging solutions that align with strict safety and hygiene standards. Demand for rigid packaging is expected to increase with the scaling of industrial output and logistical operations. The Latin America Rigid Industrial Packaging Market benefits directly from these macro-level industrial trends.

- For instance, the ALPLA 0.75-liter PET wine bottle weighs only 50 grams—eight times less than its glass counterpart and compatible with standard bottling lines.

Expansion of the Chemical and Petrochemical Industries Across the Region

The rise in chemical and petrochemical production is a major catalyst driving the Latin America Rigid Industrial Packaging Market. Countries such as Brazil and Mexico have seen considerable investments in refining capacity and chemical processing infrastructure. These industries require durable, impact-resistant packaging to safely transport hazardous and non-hazardous materials. The ability of rigid packaging to offer leak-proof containment and reusability enhances its appeal. It supports regulatory compliance in terms of packaging material strength and chemical compatibility. Local and multinational manufacturers are focusing on packaging innovation to meet industry-specific storage requirements. With infrastructure expansion, packaging demand is rising across the supply chain. The market responds to the increasing need for chemically stable and stackable packaging options.

Rising Adoption of Recyclable and Reusable Rigid Packaging Solutions

Sustainability initiatives across Latin America are influencing the rigid industrial packaging landscape. Governments and corporations alike are prioritizing the reduction of single-use plastic in favor of reusable and recyclable rigid containers. The Latin America Rigid Industrial Packaging Market is adapting by promoting environmentally friendly materials like high-density polyethylene (HDPE) and steel drums. Manufacturers are offering returnable packaging programs to industrial clients. It reduces overall carbon footprint and contributes to circular economy goals. The focus on lifecycle cost efficiency is driving preference for long-lasting, refillable packaging types. Industrial buyers see value in packaging solutions that combine durability with low total cost of ownership. This shift aligns with broader ESG goals across industries.

- For example, Amcor Rigid Packaging developed a 100% label-less PET bottle for Danone’s Villavicencio brand in Argentina, made entirely from 100% post-consumer resin. The engraved design eliminates adhesives, maintains optical clarity and strength, and reduces carbon footprint by nearly 21% compared to the previous version.

Increased Investment in Manufacturing and Infrastructure Development

Latin America’s growing infrastructure investment and industrialization rate fuel the demand for high-strength packaging formats. Governments are investing in transport corridors, industrial parks, and smart logistics facilities. It increases the movement of goods in bulk and fuels demand for rigid packaging. Local manufacturers and global investors are expanding production lines that require safe material storage. The packaging industry plays a critical role in safeguarding equipment, raw materials, and chemicals. As the pace of construction accelerates, packaging needs grow across cement, metal, and component transport. The Latin America Rigid Industrial Packaging Market supports these growth segments by supplying rugged, industrial-grade solutions. Market players are scaling up regional production and distribution networks to meet this rising demand.

Market Trends:

Integration of Smart Tracking Technologies into Rigid Packaging Formats

Companies are integrating RFID tags, QR codes, and IoT-based sensors into rigid industrial packaging to improve supply chain visibility. The Latin America Rigid Industrial Packaging Market is evolving to meet the growing need for real-time asset tracking. These technologies help monitor location, temperature, and tampering throughout the product lifecycle. It enables greater transparency and control in chemical, food, and pharmaceutical logistics. Adoption is increasing among exporters seeking to meet international compliance and traceability standards. This trend is reshaping customer expectations toward smarter and more connected packaging systems. Investment in digital transformation across logistics is accelerating this adoption. Packaging firms are collaborating with tech providers to embed intelligence into containers.

- For instance, Greif’s GCube IBCs come equipped with the GCube Connect system, using LoRaWAN and GPS sensors for location tracking, fill level monitoring, and temperature control, offering 99.8% connectivity uptime in pilot studies across Brazil and Mexico.

Surge in Demand for High-Performance Composite Materials

There is growing demand for rigid packaging constructed from composite materials that provide enhanced strength-to-weight ratios. In the Latin America Rigid Industrial Packaging Market, such materials support the handling of heavy-duty goods without compromising mobility or durability. Manufacturers are shifting to multi-layered plastics, reinforced polymers, and fiber-based composites. It supports weight reduction and increases resistance to external stresses. Sectors such as automotive and construction are driving this shift through high-volume requirements. These materials also extend product lifespan and lower overall packaging waste. Market participants are investing in material science to improve packaging resilience and reduce environmental impact. The trend favors hybrid packaging solutions that outperform traditional alternatives.

- For example, Greif’s Liquipak® fibre drums feature a laminated plastic interior bonded to a durable fibreboard body, designed for the secure transport of liquid and solid industrial goods. These drums are compliant with NMFC standards and can handle payloads of up to 700 pounds (approximately 317 kilograms). The combination of lightweight construction and internal polymer lining offers enhanced chemical resistance and moisture protection.

Customization and Branding of Rigid Industrial Packaging Products

Industrial buyers are demanding packaging that offers branding potential and customization in terms of labeling, color, and design. The Latin America Rigid Industrial Packaging Market is witnessing an uptrend in customer-specific packaging solutions. Manufacturers are offering tailored mold designs and print-ready surfaces to enable better visibility and differentiation. It is particularly relevant in competitive sectors such as chemicals and lubricants. Customization also helps reinforce product authenticity and reduce counterfeiting risks. Companies are leveraging packaging as a marketing extension and to align with brand identity. Investments in printing technologies and mold customization capabilities are increasing. This trend reflects a broader shift toward value-added packaging.

Rise of Industry-Specific Packaging Innovations

There is a growing emphasis on developing packaging tailored to the specific operational needs of individual sectors. In the Latin America Rigid Industrial Packaging Market, players are innovating with product formats suitable for harsh handling, hazardous content, or precise dosing. For example, the pharmaceutical sector prefers tamper-evident containers, while agriculture seeks UV-resistant options. It reflects the shift toward purpose-built packaging over one-size-fits-all models. The trend enhances safety, improves compliance, and boosts operational efficiency. Manufacturers are co-developing packaging with end-users for optimal compatibility. This development cycle improves client retention and product functionality. Industry-driven customization is becoming a key competitive differentiator.

Market Challenges Analysis:

High Capital Costs and Limited Access to Advanced Manufacturing Technologies

The Latin America Rigid Industrial Packaging Market faces challenges related to the high initial cost of production infrastructure and limited access to automated technologies. Many small and mid-sized manufacturers struggle with the financial burden of setting up advanced injection molding or blow molding units. It hampers scalability and restricts innovation in packaging design and material integration. Import dependency for machinery and resin compounds further escalates operational costs. Regional disparities in manufacturing capabilities limit market competitiveness. Countries with weak infrastructure face delays and quality inconsistencies. These barriers hinder local players from entering premium segments. The market needs stronger policy support to reduce these entry barriers.

Fluctuating Raw Material Prices and Regulatory Complexities

Frequent volatility in the prices of key raw materials such as plastic resins, metals, and additives disrupts cost planning and margin stability. The Latin America Rigid Industrial Packaging Market is vulnerable to global supply chain disruptions that affect pricing and availability. It complicates inventory forecasting and contract stability. Regulatory compliance also varies by country, with inconsistent standards for packaging reuse, waste handling, and labeling. Companies must navigate diverse regulations across Latin American markets, leading to increased administrative costs. Meeting these evolving compliance norms delays product launches. Complex documentation and cross-border approvals extend time-to-market and reduce operational agility.

Market Opportunities:

Expansion of Export-Oriented Industries Demanding Compliant Packaging

Export-oriented industries in Latin America, including agriculture, chemicals, and pharmaceuticals, are creating opportunities for growth in compliant packaging solutions. The Latin America Rigid Industrial Packaging Market can benefit from increasing international shipments that require UN-certified and hazard-rated containers. It positions rigid packaging manufacturers to serve high-value exports that demand robust protection. Regulatory alignment with US and EU standards encourages companies to upgrade packaging systems. Certification-backed rigid containers unlock opportunities in cross-border distribution networks. Exporters seek consistent, reliable packaging partners to ensure compliance and safety. Market players can capitalize on this demand by offering traceable and regulation-ready solutions.

Growth Potential in Circular Economy and Refurbishment Models

The circular economy model opens significant opportunities for reusable and returnable rigid packaging systems. In the Latin America Rigid Industrial Packaging Market, stakeholders are exploring refurbishment, cleaning, and redistribution networks for IBCs, drums, and crates. It supports both environmental goals and long-term cost reductions. Industrial clients increasingly value suppliers who can offer closed-loop systems and lifecycle services. The focus on zero-waste and carbon-reduction targets encourages the adoption of reusable solutions. Companies investing in refurbishing infrastructure and logistics hubs gain a competitive advantage. It unlocks recurring revenue streams while supporting sustainability mandates. Strategic partnerships with recyclers and logistics firms can accelerate adoption.

Market Segmentation Analysis:

The Latin America Rigid Industrial Packaging Market is segmented by material, product type, and end-user industry, reflecting diverse demand across sectors.

By material, plastic dominates due to its versatility, chemical resistance, and cost-efficiency. Metal follows with strong adoption in high-risk applications like hazardous chemical storage. Wood and paper segments serve niche requirements in agriculture and perishables, while other materials, including textiles, support specialty packaging.

- For example, Greif’s GCube® IBCs, made of high-density polyethylene (HDPE), offer robust protection for hazardous chemicals and food-grade materials. These plastic containers combine lightweight construction with UN-certified durability, making them ideal for large-scale transport while reducing handling risks compared to metal alternatives.

By product, drums and industrial bulk containers (IBCs) lead the market due to widespread use in chemicals, pharmaceuticals, and food processing. Pails and bulk boxes cater to mid-volume applications requiring safe and compact handling. Totes, crates, and pallets serve logistics and warehousing needs, offering stackability and reusability. Other bulk containers cover specialized formats that address custom industrial requirements.

- For mid-volume applications, Mauser Packaging Solutions offers UN-certified HDPE open-head pails designed for the safe transport of regulated substances such as agrochemicals and specialty coatings. These containers comply with UN Group II packaging standards and are widely adopted in the Latin American chemical and agricultural sectors.

By end-user industry, the pharmaceutical and chemical sector holds a significant share due to its reliance on compliant and durable packaging. Food and beverage follow, driven by hygienic and bulk transport needs. Construction and automotive industries demand heavy-duty, impact-resistant solutions. Agriculture and horticulture utilize packaging for fertilizers, seeds, and produce. It serves multiple sectors through customized, robust solutions tailored to industrial standards.

Segmentation:

By Material

- Plastic

- Metal

- Wood

- Paper

- Other Materials (such as textiles, etc.)

By Product

- Industrial Bulk Containers (IBCs)

- Drums

- Pails

- Bulk Boxes

- Totes,

- Crates,

- Pallets

- Other Bulk Containers

By End-User Industry

- Food & Beverage

- Industrial

- Pharmaceutical and Chemical

- Construction

- Automotive

- Agriculture/Horticulture

- Other End-User Industries

By Region

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Peru

- Rest of Latin America

Regional Analysis:

Brazil dominates the Latin America Rigid Industrial Packaging Market with a market share of 38%. It benefits from a well-developed manufacturing sector, strong chemical and petrochemical production, and a large domestic demand for bulk packaging solutions. The country’s export-oriented economy drives continuous demand for industrial containers such as drums and IBCs. Regulatory advancements and the presence of global packaging companies further strengthen the market. Brazil’s industrial hubs, including São Paulo and Rio de Janeiro, contribute significantly to volume consumption. With investments in logistics and automation, the market continues to expand in both scale and capability.

Mexico holds the second-largest share in the Latin America Rigid Industrial Packaging Market, accounting for 27% of the total regional value. The country benefits from its proximity to North America, fostering high export volumes and robust cross-border trade. Its automotive, food processing, and chemical sectors drive demand for secure and efficient rigid packaging. Manufacturing clusters in Monterrey, Guadalajara, and Mexico City support the growth of local packaging suppliers. Government initiatives to boost industrial exports have enhanced the demand for packaging that meets international standards. Mexico’s focus on sustainable packaging practices is also reshaping the rigid packaging landscape.

Argentina, Colombia, and Chile collectively account for 35% of the Latin America Rigid Industrial Packaging Market. Argentina is seeing growth through its expanding agribusiness and chemical sectors, while Colombia’s infrastructure and construction investments fuel demand for industrial containers. Chile’s mining and export-driven economy supports packaging applications requiring durability and bulk capacity. These emerging economies are investing in industrial logistics and supply chain development, which increases reliance on rigid packaging formats. Local manufacturers are upgrading production lines to cater to specialized industry requirements. It reflects a broader trend of regional diversification in packaging demand across Latin America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Greif Inc.

- ALPLA Group (ALPLA Werke Alwin Lehner GmbH & Co KG)

- Berry Global Inc.

- Sonoco Products Company

- Amcor Group GmbH

- Grupo Lantero

Competitive Analysis:

The Latin America Rigid Industrial Packaging Market features a mix of global players and regional manufacturers competing on product durability, customization, and cost-efficiency. Leading companies such as Greif Inc., Mauser Packaging Solutions, SCHÜTZ GmbH & Co. KGaA, and Time Technoplast Ltd. maintain a strong presence through localized production, distribution networks, and strategic partnerships. Regional firms focus on flexible manufacturing and servicing niche sectors such as agrochemicals and lubricants. It fosters competitive intensity and drives innovation in material selection and design. Companies prioritize sustainability, with investments in recyclable and reusable packaging formats. Competitive strategies revolve around expanding manufacturing footprints, improving turnaround times, and meeting international compliance standards. The market remains dynamic, shaped by customer-specific requirements and increasing regulatory scrutiny.

Recent Developments:

- In July 2025, Greif Inc. finalized an agreement to divest its containerboard business, including mills and corrugated sites, to Packaging Corporation of America in a deal valued at $1.8 billion. This strategic move is designed to sharpen Greif’s portfolio and support its growth priorities.

- In June 2025, ALPLA Group announced the acquisition of German-based closure specialist KM Packaging. This acquisition significantly increases ALPLA’s injection-moulding capabilities, integrating six manufacturing sites across Europe and the US and expanding ALPLAinject’s range of high-quality closures for cosmetics, pharmaceuticals, and food packaging.

- In June 2025, Sonoco Products Company launched a new all-paper can featuring a recycled fiber body and paper bottom, elevating sustainability in the rigid industrial packaging segment. Designed for maximum recyclability and consumer convenience, this paper can has already been adopted by major brands and won industry recognition for its sustainable design.

- In March 2025, Amcor Group GmbH partnered with Insymmetry® to introduce an industry-first 2oz retort bottle using StormPanel™ technology, tailored to provide 12-month shelf life for nutritional shots and low-acid shelf-stable products. Around the same period,

Market Concentration & Characteristics:

The Latin America Rigid Industrial Packaging Market exhibits moderate-to-high market concentration, led by a few multinational corporations with strong regional infrastructure. It remains fragmented in smaller countries where local manufacturers serve specialized applications. The market is price-sensitive, yet quality and regulatory compliance play critical roles in purchasing decisions. Long-term client relationships, technical support, and customization capabilities define competitive positioning. It favors suppliers offering integrated logistics and sustainability-focused solutions. Demand stability across sectors like chemicals, food, and automotive ensures consistent market activity. The presence of returnable and recyclable packaging systems marks a shift toward performance-based, sustainable packaging models.

Report Coverage:

The research report offers an in-depth analysis based on material, product type, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Regional manufacturing expansion will increase the demand for durable and efficient rigid industrial packaging solutions.

- Infrastructure development and improved logistics networks will support wider adoption of bulk packaging formats.

- Export growth in chemicals and agrochemicals will drive the need for compliant and certified packaging systems.

- Rising sustainability mandates will push manufacturers toward recyclable and reusable rigid packaging models.

- Integration of smart technologies such as RFID and IoT will improve product tracking and supply chain visibility.

- Cross-border trade within Latin America will accelerate the need for standardized and high-strength packaging.

- Industry-specific demands will grow, especially in pharmaceuticals, mining, and food processing sectors.

- Global packaging leaders will continue to expand their regional footprint through joint ventures and facility upgrades.

- Focus on material innovation will lead to lightweight packaging options without compromising performance.

- Circular economy practices will gain traction, encouraging service models for packaging refurbishment and closed-loop reuse.