Market Overview:

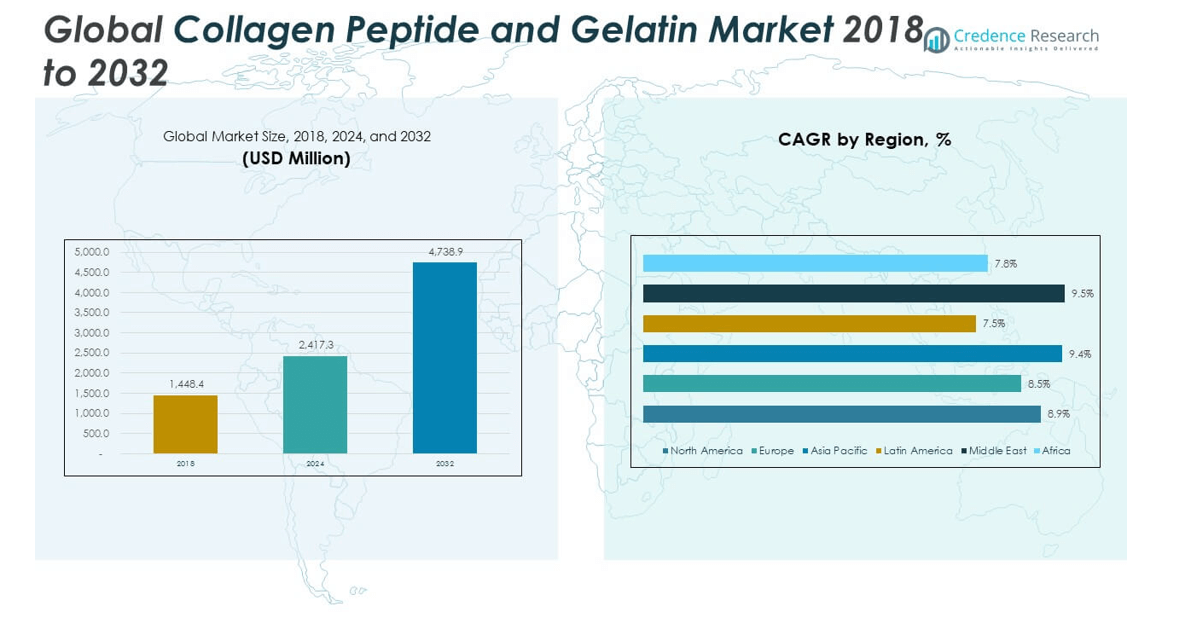

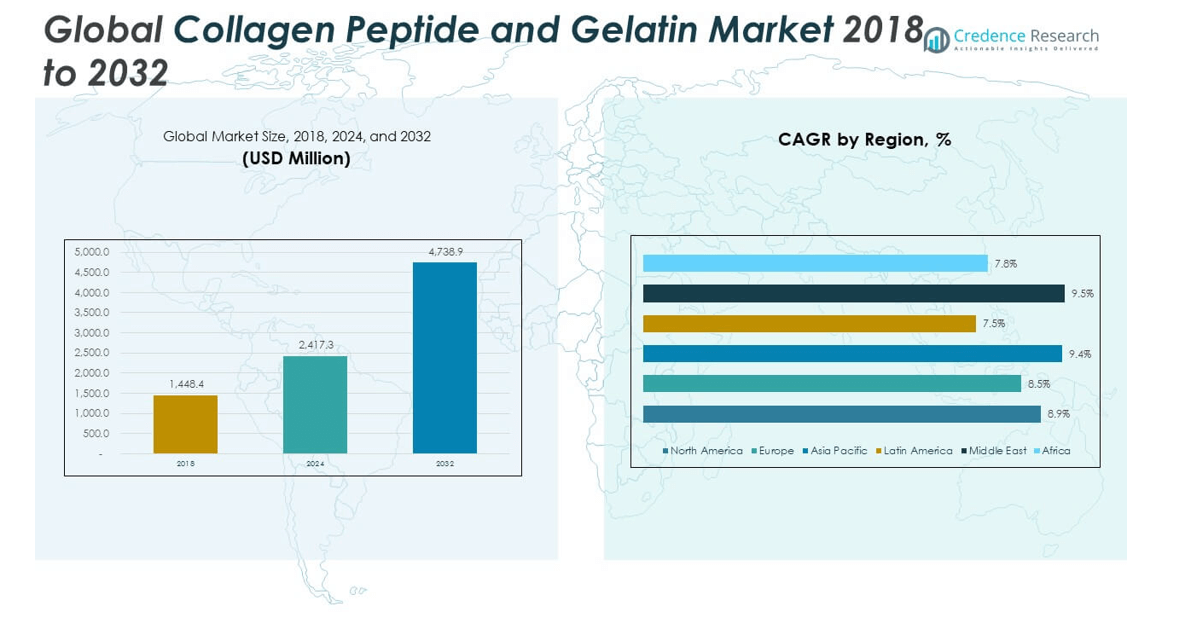

The Collagen Peptide and Gelatin Market size was valued at USD 1,448.4 million in 2018 to USD 2,417.3 million in 2024 and is anticipated to reach USD 4,738.9 million by 2032, at a CAGR of 8.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Collagen Peptide and Gelatin Market Size 2024 |

USD 2,417.3 million |

| Collagen Peptide and Gelatin Market CAGR |

8.81% |

| Collagen Peptide and Gelatin Market Size 2032 |

USD 4,738.9 million |

The market growth is driven by increasing consumer demand for functional and nutritional products in food, beverage, and dietary supplements. Rising awareness of collagen’s health benefits, such as supporting joint health, skin elasticity, and muscle recovery, is fueling adoption across diverse demographics. Expanding applications in pharmaceuticals, cosmetics, and nutraceuticals further strengthen market prospects, supported by continuous innovations in processing technology and growing preference for clean-label, protein-rich ingredients.

Regionally, North America leads due to high consumer awareness, established nutraceutical industries, and robust demand from the beauty and wellness sector. Europe follows closely, driven by its advanced food processing sector and increasing applications in functional foods. Asia-Pacific is emerging as a high-growth region, fueled by rising disposable incomes, expanding dietary supplement consumption, and a growing middle-class population seeking preventive healthcare and beauty-enhancing products.

Market Insights:

- The Collagen Peptide and Gelatin Market was valued at USD 2,417.3 million in 2024 and is projected to reach USD 4,738.9 million by 2032, growing at a CAGR of 8.81%.

- Rising demand for functional foods, nutraceuticals, and beauty-from-within supplements is driving consistent market expansion.

- Advancements in extraction and processing technologies are enhancing product quality, bioavailability, and application versatility.

- Regulatory compliance complexities and raw material price volatility remain key restraints affecting production stability.

- Europe led the market in 2024, driven by strong demand for clean-label, functional, and fortified products.

- Asia Pacific is expected to witness the fastest growth due to rising disposable incomes and increasing preventive healthcare awareness.

- North America maintains a strong position supported by advanced manufacturing capabilities and a robust nutraceutical sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Functional and Nutraceutical Products Across Diverse Demographics

The Collagen Peptide and Gelatin Market experiences strong momentum from the global shift toward functional and nutraceutical products. Consumers seek protein-rich, bioactive ingredients that promote joint health, skin vitality, and muscle recovery. It benefits from increasing awareness of collagen’s role in supporting healthy aging and physical performance. Food and beverage companies integrate collagen into fortified snacks, beverages, and meal replacements to attract health-conscious buyers. Pharmaceutical and nutraceutical brands adopt collagen in formulations to target preventive wellness. Beauty-from-within supplements gain popularity, linking collagen directly to skincare benefits. The demand remains consistent across multiple age groups, strengthening its market stability. Continuous consumer education campaigns further expand awareness and adoption.

- For xample, Wellnex, a brand of Nitta Gelatin, offers Replenwell™ collagen peptides that have been clinically studied and produced using proprietary enzymatic hydrolysis processes to deliver bioactive dipeptides with targeted health benefits. These collagen peptides are formulated to support wellness applications, including joint, skin, and overall health, and are developed under Nitta Gelatin’s global operations.

Expanding Applications in the Beauty and Personal Care Industry Globally

Beauty and personal care manufacturers drive significant demand by using collagen peptides in anti-aging creams, serums, and oral supplements. The Collagen Peptide and Gelatin Market benefits from consumer preference for natural, science-backed beauty solutions. It supports the shift toward ingestible beauty products that complement topical treatments. Cosmetic brands leverage collagen’s association with skin elasticity and wrinkle reduction to enhance product appeal. Growing e-commerce platforms enable faster penetration of collagen-based beauty products in emerging economies. The influence of social media accelerates awareness, particularly among younger demographics. Collaborations between supplement and skincare brands expand product innovation. Demand from premium beauty categories ensures higher margins for producers.

- For example, Mibelle Biochemistry launched CollPerfect™ P6, an encapsulated bioactivating hexapeptide inspired by the human skin type I collagen sequence. It stimulates collagen synthesis and dermal remodeling by promoting procollagen I production, boosting hyaluronic acid release, defending dermal collagen fibers from aging, improving facial contours, and increasing skin elasticity and density.

Increased Utilization in Food and Beverage Formulations for Health Positioning

Food and beverage manufacturers integrate collagen peptides into products to meet rising demand for functional, clean-label offerings. The Collagen Peptide and Gelatin Market gains from its compatibility with various formulations, including protein bars, dairy products, and sports drinks. It enhances product value propositions by adding health claims related to joint support and tissue repair. Collagen’s neutral taste and high solubility allow easy incorporation without affecting flavor. Manufacturers target athletes and fitness enthusiasts with protein blends containing collagen for muscle recovery. The growing trend toward preventive nutrition strengthens its adoption in everyday consumables. Industry innovations in flavor masking and formulation stability broaden application potential. Increased product launches showcase collagen as a key functional ingredient in mainstream diets.

Technological Advancements in Extraction and Processing Methods

The adoption of advanced extraction and processing technologies enhances purity, bioavailability, and sustainability of collagen production. The Collagen Peptide and Gelatin Market benefits from innovations that reduce production costs while maintaining product quality. It sees growth from cleaner, environmentally friendly manufacturing processes that appeal to eco-conscious consumers. Enzymatic hydrolysis methods improve peptide absorption, boosting effectiveness in supplements and functional foods. Technological improvements enable consistent molecular weight control, ensuring predictable performance in formulations. Producers develop tailored collagen types for specific applications, from sports nutrition to clinical healthcare. Enhanced supply chain efficiencies lower lead times and improve market responsiveness. These advancements strengthen industry competitiveness and product differentiation.

Market Trends

Emergence of Plant-Based Collagen Alternatives in Product Portfolios

Growing consumer interest in plant-derived solutions influences product innovation strategies. The Collagen Peptide and Gelatin Market witnesses brands introducing botanical collagen boosters from ingredients such as bamboo extract and seaweed. It caters to vegan and vegetarian populations without compromising on beauty and wellness benefits. Marketing campaigns highlight sustainability and ethical sourcing as key differentiators. Brands position plant-based collagen as complementary to traditional animal-derived products rather than a replacement. Research into bioactive plant compounds expands the potential efficacy of these offerings. Start-ups and established companies explore hybrid formulations to appeal to broader demographics. Consumer willingness to experiment with alternatives strengthens market diversity.

- For example, Organika Health Products offers a Plant-Based Collagen Booster that blends seven synergistic plant-based ingredients including ginseng peptide and carrot peptide to support natural type I collagen production and help protect existing collagen from degradation.

Rising Popularity of Ready-to-Consume Collagen-Infused Beverages and Snacks

Convenience-driven lifestyles boost demand for collagen-infused products in ready-to-drink and on-the-go formats. The Collagen Peptide and Gelatin Market adapts to this shift with innovative product launches. It includes flavored collagen waters, protein shakes, and snack bars targeted at health-conscious consumers. Brands position these products as daily wellness enhancers, integrating them into regular routines. Functional beverages appeal to urban consumers seeking quick nutrition without complex preparation. Celebrity endorsements and influencer marketing amplify product visibility. Retailers expand collagen beverage placements in health and wellness aisles. The segment’s portability and ease of use drive repeat purchases.

Personalized Nutrition Solutions Incorporating Targeted Collagen Blends

Advances in nutritional science encourage personalized supplement development. The Collagen Peptide and Gelatin Market leverages this trend through customized blends addressing specific needs like joint health, skin hydration, or muscle repair. It benefits from data-driven recommendations via health apps and genetic testing services. Brands offer tailored dosage forms, including powders, capsules, and gummies, to match lifestyle preferences. E-commerce platforms enable direct-to-consumer subscription models with ongoing personalization. Cross-industry collaborations between tech firms and nutraceutical companies strengthen tailored nutrition adoption. Consumer trust grows as transparency in ingredient sourcing and composition improves. The move toward personalization aligns with broader preventive healthcare trends.

Integration of Collagen with Complementary Functional Ingredients

Manufacturers enhance collagen’s appeal by combining it with synergistic ingredients like hyaluronic acid, vitamin C, and probiotics. The Collagen Peptide and Gelatin Market benefits from the enhanced functional profile of such formulations. It aligns with consumer expectations for multi-benefit products that address various wellness goals. These blends support better nutrient absorption and improved health outcomes. Co-branding strategies with established supplement brands increase credibility. Innovation extends to combining collagen with superfoods for added antioxidant benefits. Formulators explore novel delivery formats such as collagen coffee creamers and dessert mixes. The approach strengthens product differentiation in competitive markets.

- For example, Codeage’s Multi Collagen Peptides + Hyaluronic Acid powder combines five collagen types (I, II, III, V, X) from multiple animal sources with hyaluronic acid, vitamin C, and probiotics. This all-in-one formula delivers 10 g collagen and 9 g protein per serving to support skin, joint, and digestive health.

Market Challenges Analysis

Sourcing Limitations and Price Volatility in Raw Material Supply Chains

Producers face significant challenges due to fluctuating availability of high-quality raw materials from bovine, porcine, and marine sources. The Collagen Peptide and Gelatin Market is impacted by livestock industry constraints, disease outbreaks, and seasonal fishing regulations. It faces cost pressures when raw material supply tightens, leading to price instability for manufacturers. Ethical sourcing concerns add complexity, with growing consumer demand for traceability and humane practices. Import restrictions and regulatory requirements in different countries slow cross-border trade. Small-scale manufacturers face greater difficulty securing consistent supply. Maintaining quality standards while managing price volatility requires strategic supplier partnerships.

Regulatory Compliance and Consumer Perception Barriers in Global Markets

Manufacturers navigate diverse regulatory frameworks governing collagen and gelatin use across food, cosmetics, and pharmaceuticals. The Collagen Peptide and Gelatin Market faces delays in product approvals in regions with stringent safety evaluations. It also contends with skepticism from consumers questioning efficacy or safety of animal-derived collagen. Negative publicity surrounding overpromised beauty or health claims can erode trust. Market penetration in certain regions is hindered by cultural dietary restrictions. Compliance costs rise as labeling, safety testing, and certification requirements evolve. Building consumer confidence demands transparent communication and scientifically validated claims.

Market Opportunities

Expansion into Emerging Economies with Rising Health and Beauty Awareness

Emerging economies present significant growth potential due to increasing disposable incomes and evolving lifestyle preferences. The Collagen Peptide and Gelatin Market benefits from the rapid expansion of e-commerce channels in these regions. It can leverage growing urbanization and higher adoption of dietary supplements to expand distribution. Partnerships with local distributors and influencers can accelerate awareness. Demand for beauty-from-within products is particularly strong among younger populations. Early entry into these markets allows brands to establish strong loyalty. Government initiatives promoting health and wellness further boost product acceptance. Localization of formulations to match regional tastes and cultural preferences can improve market penetration.

Product Diversification Through Cross-Sector Innovation and Co-Branding

Innovation opportunities arise from combining collagen with trending functional ingredients to create premium multi-benefit products. The Collagen Peptide and Gelatin Market can expand into niche categories like sports nutrition, clinical nutrition, and pet care. It benefits from co-branding with reputable cosmetic, wellness, or food brands. Collaboration with research institutions can drive science-backed claims. This approach enhances differentiation and strengthens positioning in competitive markets. Launching limited-edition or seasonal collagen-based products can generate excitement and trial. Leveraging advanced delivery formats such as gummies, effervescent powders, and ready-to-drink formulas can attract a wider consumer base.

Market Segmentation Analysis:

By Source, the Collagen Peptide and Gelatin Market is dominated by the bovine segment due to its widespread availability, cost-effectiveness, and favorable functional properties in food, nutraceutical, and pharmaceutical applications. Porcine collagen holds a significant share, supported by its compatibility in processed food products and certain medical applications, though cultural and dietary restrictions limit its adoption in specific regions. Poultry-derived collagen is gaining momentum, driven by rising consumer preference for alternative protein sources and innovations in extraction technology. The others segment, including marine and plant-based sources, is expanding rapidly, driven by demand for sustainable, allergen-free, and culturally acceptable options.

- For example, Nutra Organics’ “Collagen Beauty” supplement features VERISOL® bioactive bovine collagen peptides supported by clinical studies to enhance skin elasticity, hydration, and structural integrity, while also supporting hair, nail, and gut health within an 8-week daily regimen.

By Application, food and beverages represent the largest segment, driven by demand for functional foods, fortified snacks, and protein-enhanced beverages. The Collagen Peptide and Gelatin Market benefits from strong integration of collagen in bakery, confectionery, and dairy categories to enhance texture and nutritional value. Nutraceuticals form the second-largest segment, fueled by the rising focus on preventive health, joint support, and beauty-from-within products. Pharmaceuticals leverage collagen for wound healing, drug delivery systems, and regenerative medicine due to its biocompatibility and structural benefits. The others segment encompasses cosmetics, personal care, and pet nutrition, each contributing to diversification of revenue streams and expanding the overall market scope.

- For example, Totally Derma offers a high-strength powdered collagen drink supplement that combines hydrolyzed bovine collagen peptides with hyaluronic acid, antioxidants, and key minerals to support skin firmness, elasticity, and hydration.

Segmentation:

By Source

- Bovine

- Porcine

- Poultry

- Others

By Application

- Food and Beverages

- Nutraceuticals

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Collagen Peptide and Gelatin Market size was valued at USD 384.54 million in 2018 to USD 646.76 million in 2024 and is anticipated to reach USD 1,280.93 million by 2032, at a CAGR of 8.9% during the forecast period. It accounts for 26.74% of the global market in 2024. The region’s dominance is supported by strong consumer awareness of collagen benefits, a well-developed nutraceutical sector, and extensive applications in beauty and personal care. It benefits from advanced manufacturing capabilities and a robust distribution network, ensuring consistent supply across industries. The U.S. drives most of the demand through functional food launches and beauty-from-within supplements. Growing investment in sports nutrition and preventive healthcare enhances adoption. Canada and Mexico contribute through expanding dietary supplement markets and increased food processing activity. Strategic partnerships between collagen producers and major food brands further consolidate regional market share.

Europe

The Europe Collagen Peptide and Gelatin Market size was valued at USD 457.10 million in 2018 to USD 750.56 million in 2024 and is anticipated to reach USD 1,439.21 million by 2032, at a CAGR of 8.5% during the forecast period. It holds 31.03% of the global market in 2024. Strong demand for clean-label, functional, and fortified products drives growth, supported by a mature food and beverage industry. The region benefits from well-established cosmetic and pharmaceutical sectors integrating collagen in high-value formulations. Regulatory frameworks ensure high quality and safety standards, enhancing consumer trust. Germany, France, and the UK lead innovation in beauty-from-within and nutraceutical products. Mediterranean countries expand collagen use in functional foods and skincare. The market is further shaped by sustainability initiatives, with marine and alternative collagen sources gaining traction.

Asia Pacific

The Asia Pacific Collagen Peptide and Gelatin Market size was valued at USD 317.48 million in 2018 to USD 549.13 million in 2024 and is anticipated to reach USD 1,126.91 million by 2032, at a CAGR of 9.4% during the forecast period. It represents 22.71% of the global market in 2024. Rapid urbanization, rising disposable incomes, and increasing awareness of wellness products drive regional growth. China, Japan, and South Korea lead in collagen adoption for beauty, health, and functional foods. It benefits from a growing middle class with higher demand for preventive healthcare. E-commerce platforms accelerate product accessibility and market penetration. Japan’s established nutraceutical culture and South Korea’s beauty innovation play key roles. India and Southeast Asia are emerging markets with expanding food processing industries and growing personal care sectors. Local production capacity is increasing, reducing reliance on imports.

Latin America

The Latin America Collagen Peptide and Gelatin Market size was valued at USD 147.88 million in 2018 to USD 230.85 million in 2024 and is anticipated to reach USD 410.86 million by 2032, at a CAGR of 7.5% during the forecast period. It accounts for 9.55% of the global market in 2024. Brazil dominates demand through its large food and beverage sector and expanding nutraceutical consumption. It benefits from increased interest in sports nutrition and beauty-enhancing products. Argentina shows growing adoption in fortified foods and dietary supplements. Market expansion is supported by improved retail infrastructure and broader availability of collagen-based products. Rising health awareness fuels consumer acceptance. Domestic manufacturers are investing in advanced processing technologies to improve product quality. Distribution partnerships with global brands strengthen regional presence.

Middle East

The Middle East Collagen Peptide and Gelatin Market size was valued at USD 106.02 million in 2018 to USD 184.09 million in 2024 and is anticipated to reach USD 379.59 million by 2032, at a CAGR of 9.5% during the forecast period. It holds 7.61% of the global market in 2024. Growth is driven by rising demand for premium beauty and wellness products, particularly in Gulf Cooperation Council countries. It benefits from a young population with increasing interest in sports nutrition and healthy lifestyles. Regional food manufacturers integrate collagen into functional beverages and protein snacks. Expanding retail channels, including e-commerce, improve product accessibility. The UAE and Saudi Arabia lead adoption due to high consumer spending power. Import reliance remains high, but localized production capacity is gradually improving. Product positioning focuses on high-quality, halal-certified collagen to meet cultural preferences.

Africa

The Africa Collagen Peptide and Gelatin Market size was valued at USD 35.34 million in 2018 to USD 55.87 million in 2024 and is anticipated to reach USD 101.41 million by 2032, at a CAGR of 7.8% during the forecast period. It accounts for 2.31% of the global market in 2024. Growth is supported by expanding urban populations and rising middle-class consumption of fortified foods and supplements. South Africa leads demand with a developed retail sector and strong interest in health-focused products. It benefits from increasing awareness of collagen benefits in skincare and joint health. Limited local production results in reliance on imports from Europe and Asia. Distribution challenges in rural areas slow penetration. Opportunities exist in cosmetics and nutraceuticals targeting wellness-conscious consumers. Regional players are exploring partnerships to improve supply chain efficiency and product reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amicogen

- BioCell Technology LLC

- Lonza Group Ltd

- Nitta Gelatin, Inc.

- Norland Products, Inc.

- Chinatech Peptides Co. Ltd

- Catalent, Inc.

- GELITA

- Vornia Biomaterials Ltd.

- Other Key Players

Competitive Analysis:

The Collagen Peptide and Gelatin Market features a mix of global leaders and regional specialists competing through product innovation, capacity expansion, and strategic partnerships. Key players such as GELITA, Nitta Gelatin, Lonza Group, and Catalent focus on enhancing production efficiency and developing high-purity, application-specific collagen solutions. It benefits from diversified portfolios covering food, nutraceutical, pharmaceutical, and cosmetic applications. Companies invest in sustainable sourcing and advanced extraction technologies to meet regulatory and consumer expectations. Market leaders strengthen their positions through acquisitions, mergers, and collaborations with food and beauty brands. Emerging players target niche segments like marine and plant-based collagen to differentiate offerings. Competitive strategies emphasize brand credibility, quality certifications, and expanded distribution networks.

Recent Developments:

- In July 2025, Brenntag Nutrition announced a partnership with Genu-in to distribute collagen and gelatin ingredients across new markets. This collaboration is set to expand the reach of high-quality collagen peptides and gelatin products, supporting manufacturers in developing innovative health and nutrition solutions amidst rising demand in both the food and pharmaceutical sectors.

- In May 2025, Darling Ingredients and Tessenderlo Group announced a strategic partnership to merge their collagen and gelatin operations under a new entity named Nextida™. This collaboration aims to accelerate growth in the Collagen Peptide and Gelatin Market by leveraging combined capabilities across health, wellness, and nutrition sectors. The venture is expected to integrate the businesses of PB Leiner and Rousselot, pending regulatory approval.

Market Concentration & Characteristics:

The Collagen Peptide and Gelatin Market is moderately consolidated, with a few multinational corporations holding significant global shares. It demonstrates strong entry barriers due to capital-intensive production, stringent quality requirements, and established supplier relationships. Competitive advantage often depends on proprietary processing technology, diversified raw material sources, and global distribution capabilities. The market shows steady demand across multiple industries, creating resilience against economic fluctuations. Product differentiation focuses on purity, bioavailability, and tailored applications to address diverse consumer needs. Rising focus on sustainable sourcing and ethical production practices is influencing competitive positioning. Companies adopting innovation-led strategies and expanding into emerging markets are expected to strengthen their long-term market presence.

Report Coverage:

The research report offers an in-depth analysis based on Source and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising integration of collagen in functional foods and beverages will expand product adoption across mainstream consumer markets.

- Advancements in extraction and processing technologies will enhance bioavailability and product versatility.

- Increasing demand for beauty-from-within supplements will strengthen opportunities in the personal care sector.

- Expansion of e-commerce platforms will improve accessibility and global reach for collagen-based products.

- Growing interest in sustainable and alternative collagen sources will diversify product portfolios.

- Strategic partnerships between ingredient suppliers and end-product manufacturers will drive innovation.

- Rising awareness of preventive healthcare will boost collagen usage in nutraceutical and pharmaceutical applications.

- Emerging markets will contribute significantly to global demand through evolving dietary and lifestyle trends.

- Regulatory alignment across regions will facilitate smoother cross-border trade and market expansion.

- Enhanced marketing strategies focusing on science-backed benefits will improve consumer trust and brand loyalty.