| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Luxury Vinyl Tiles Flooring Market Size 2023 |

USD 21734.6 million |

| Latin America Luxury Vinyl Tiles Flooring Market, CAGR |

10.25% |

| Latin America Luxury Vinyl Tiles Flooring Market Size 2032 |

USD 52307.7 million |

Market Overview:

The Latin America Luxury Vinyl Tiles Flooring Market is projected to grow from USD 21734.6 million in 2023 to an estimated USD 52307.7 million by 2032, with a compound annual growth rate (CAGR) of 10.25% from 2023 to 2032.

The Latin America Luxury Vinyl Tiles (LVT) flooring market grows steadily due to several critical factors. Rapid urbanization and increasing infrastructure development drive demand for modern, durable, and cost-effective flooring solutions across residential, commercial, and institutional sectors. Consumers and builders prefer LVT for its superior durability, water resistance, and ease of maintenance compared to traditional flooring materials. Innovations in design and printing technology enable LVT to closely replicate natural materials such as wood and stone, which boosts its aesthetic appeal and popularity among interior designers and homeowners. Additionally, LVT offers a competitive cost advantage over hardwood or ceramic flooring, making it an attractive choice in budget-conscious markets. Growing awareness of sustainable and eco-friendly building materials further supports LVT adoption, with manufacturers increasingly offering recyclable and low-VOC options that align with green building certifications. The combination of these factors strengthens LVT’s position as a versatile and preferred flooring option in the region.

Brazil leads the Latin America Luxury Vinyl Tiles Flooring market, propelled by significant construction activity, urban expansion, and modernization initiatives. The country’s robust commercial real estate sector, including retail, hospitality, and healthcare infrastructure, contributes substantially to LVT demand. Argentina, Chile, and Peru also demonstrate notable market growth, driven by urban housing developments and renovation projects in metropolitan areas. In these countries, rising disposable incomes and evolving consumer preferences for stylish yet practical flooring solutions stimulate LVT uptake. The commercial sector, seeking durable and easy-to-maintain flooring, represents a major application segment, while the residential segment benefits from increasing renovation trends. Moreover, governmental incentives promoting sustainable construction practices encourage the use of eco-friendly LVT products across the region. Overall, the Latin American market’s geographic diversity, combined with growing urbanization and modernization efforts, creates a dynamic environment favoring the sustained expansion of the LVT flooring market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Latin America Luxury Vinyl Tiles Flooring Market is projected to grow from USD 21,734.6 million in 2023 to USD 52,307.7 million by 2032, registering a CAGR of 10.25%.

- Rapid urbanization and expanding infrastructure projects across residential, commercial, and institutional sectors drive strong demand for durable and cost-effective flooring solutions.

- Innovations in printing and manufacturing technology enable LVT to mimic natural materials like wood and stone, increasing its appeal among homeowners and designers.

- LVT offers a competitive cost advantage and low maintenance requirements compared to hardwood and ceramic, making it attractive in budget-conscious markets.

- Growing awareness of sustainable building materials fuels demand for eco-friendly LVT products with recyclable content and low VOC emissions.

- Brazil leads the regional market, supported by significant construction activity and modernization in commercial real estate, while Argentina, Chile, and Peru show notable growth due to urban housing developments.

- Challenges include high initial costs, competition from alternative flooring materials, and limited consumer awareness coupled with a shortage of skilled installers, which restrict wider market penetration.

Report Scope

The report segments the Latin America Luxury Vinyl Tiles Flooring Market as follow

Market Drivers:

Rapid Urbanization and Expanding Infrastructure Projects Fuel Demand for Durable Flooring Solutions

The Latin America Luxury Vinyl Tiles Flooring Market benefits significantly from the region’s rapid urbanization and continuous expansion of infrastructure projects. Governments and private sectors invest heavily in commercial complexes, residential buildings, hospitals, and educational institutions. These construction activities create a substantial need for reliable and cost-effective flooring materials that deliver both longevity and aesthetic appeal. It offers durability and resistance to wear, which suits the high-traffic environments common in urban developments. The ease of installation and maintenance further drives its preference among contractors and developers. Increasing investments in public infrastructure support the sustained demand for high-performance flooring products. This trend underpins the market’s strong growth trajectory over the forecast period.

- For example, Wellmade Performance Flooring’s HDPC® Waterproof Vinyl Planks are engineered with a rigid core that is entirely waterproof and highly resistant to moisture damage, making them suitable for high-traffic commercial and public spaces such as hospitals and educational institutions.

Advancements in Design Technology Enhance Aesthetic Appeal and Consumer Preference

Innovations in design and manufacturing technologies have elevated the attractiveness of luxury vinyl tiles in the Latin American market. It now offers an extensive variety of patterns, textures, and finishes that convincingly replicate natural materials like wood, stone, and ceramic. These realistic designs cater to evolving consumer tastes seeking sophisticated and stylish interiors without the high cost or maintenance demands of traditional materials. Interior designers and homeowners favor the flexibility of LVT to create customized looks tailored to residential and commercial spaces. Such design versatility expands application possibilities, which positively impacts market growth. The ability to combine aesthetics with functionality strengthens the product’s competitive position in flooring alternatives. Consequently, these design advancements drive broader acceptance and increased adoption of LVT.

- For example, Milliken’s LVT features ProGuard MAX™, a proprietary urethane coating that provides superior protection against scuffing and scratching, maintaining the visual integrity of intricate printed designs even in high-traffic areas.

Cost-Effectiveness and Low Maintenance Requirements Drive Market Expansion

The Latin America Luxury Vinyl Tiles Flooring Market attracts buyers due to its cost advantages and low upkeep needs. It presents a more affordable option compared to hardwood, natural stone, or ceramic tiles while maintaining comparable visual appeal and durability. Property owners and developers prioritize flooring solutions that reduce long-term expenses related to repairs, replacements, and cleaning. LVT’s water resistance and scratch-proof surface contribute to its reputation as a practical choice for various applications, including commercial spaces prone to heavy foot traffic. The material’s ability to withstand environmental stress and daily wear ensures extended product life, which enhances value for money. These financial and functional benefits motivate widespread acceptance among budget-conscious consumers. Therefore, the cost-effectiveness and convenience of LVT act as critical growth drivers in the region.

Increasing Emphasis on Sustainable and Eco-Friendly Building Practices Supports Demand

Sustainability trends in Latin America stimulate demand for environmentally friendly construction materials, which favorably impacts the LVT flooring market. Manufacturers have responded by developing products with recyclable content and low volatile organic compound (VOC) emissions that comply with green building standards. It meets the growing regulatory requirements and corporate social responsibility goals adopted by construction firms and developers. Consumer awareness of health and environmental issues prompts preference for flooring options that minimize ecological impact without compromising quality. The incorporation of sustainable materials and processes aligns LVT with global efforts to promote eco-conscious development. This alignment enhances its appeal in both public and private sectors seeking certification and compliance with international sustainability frameworks. Consequently, the increasing focus on green building practices drives demand for luxury vinyl tiles in Latin America.

Market Trends:

Adoption of Advanced Printing and Embossing Techniques Enhances Product Realism and Consumer Appeal

The Latin America Luxury Vinyl Tiles Flooring Market experiences significant growth driven by advances in printing and embossing technologies. These innovations enable LVT manufacturers to produce tiles that closely mimic the appearance and texture of natural materials such as wood, stone, and ceramic. It allows for highly detailed and authentic designs that satisfy the increasing demand for aesthetically pleasing flooring solutions. The enhanced realism broadens the application of LVT in both residential and commercial sectors. Consumers and designers increasingly prefer LVT for its ability to deliver style without the drawbacks of traditional materials. Continuous refinement of these techniques supports product differentiation and market competitiveness. The trend toward hyper-realistic finishes strengthen LVT’s position as a preferred flooring alternative in Latin America.

- For instance, Embossed-in-Register (EIR) technology, as documented by major producers, aligns surface texture precisely with printed visuals, resulting in products that not only look but also feel like natural materials.

Expansion of Commercial and Institutional Construction Drives Increased LVT Installation

Construction growth in commercial and institutional sectors propels demand for luxury vinyl tiles across Latin America. It gains traction in retail stores, offices, hospitals, hotels, and educational facilities due to its durability and ease of maintenance. The flooring’s resistance to moisture and heavy foot traffic suits the rigorous demands of these environments. Developers prioritize materials that reduce long-term maintenance costs while offering design flexibility. The trend toward sustainable building practices further encourages LVT usage in large-scale projects aiming for green certifications. This steady increase in non-residential construction activity supports sustained market expansion. LVT’s adaptability to various commercial applications solidifies its market relevance.

- For instance, major brands such as Tarkett and Gerflor have documented the deployment of LVT in large-scale projects, where the product’s durability reduces long-term maintenance costs and supports green building certifications through low-VOC emissions and recycled content.

Growing Consumer Preference for DIY and Easy Installation Flooring Solutions

The Latin America Luxury Vinyl Tiles Flooring Market benefits from rising consumer interest in do-it-yourself (DIY) home improvement projects. It appeals to homeowners seeking flooring options that combine style, functionality, and straightforward installation processes. Many LVT products feature click-lock or adhesive-free installation systems that simplify fitting, reduce labor costs, and shorten project timelines. This ease of installation encourages both professional contractors and end-users to choose LVT over more complex flooring materials. The growing trend of home renovation and remodeling drives demand for versatile and user-friendly products. Retailers and manufacturers capitalize on this by expanding product lines and offering installation support. The increasing preference for DIY-compatible flooring supports steady market growth.

Integration of Eco-Friendly and Sustainable Materials Meets Regulatory and Consumer Demands

Sustainability remains a vital trend influencing the Latin America Luxury Vinyl Tiles Flooring Market. It reflects manufacturers’ efforts to develop eco-friendly products incorporating recyclable materials and reducing harmful emissions. The industry aligns with regional environmental regulations and global green building standards, appealing to environmentally conscious consumers and developers. LVT products increasingly feature low volatile organic compounds (VOCs) and certifications that validate their environmental compliance. This focus on sustainability enhances brand reputation and expands market opportunities, especially in public sector projects and commercial developments. The trend encourages innovation in material sourcing and production processes. Eco-consciousness thus remains a key factor shaping market dynamics and product evolution.

Market Challenges Analysis:

High Initial Investment and Competition from Alternative Flooring Materials Limit Market Penetration

The Latin America Luxury Vinyl Tiles Flooring Market faces challenges related to the relatively high upfront cost of premium LVT products compared to conventional flooring options such as ceramic tiles, laminate, and carpet. It may deter cost-sensitive buyers, particularly in price-competitive residential sectors. The availability of cheaper alternatives with established market presence creates intense competition, limiting LVT adoption in certain regions. Manufacturers must balance product quality and pricing strategies to attract a broader customer base without compromising profitability. Furthermore, fluctuating raw material prices and supply chain disruptions impact production costs, affecting market stability. The presence of counterfeit or low-quality products in the market also poses risks to consumer confidence and brand reputation. These factors collectively hinder rapid market expansion despite the growing demand for durable and stylish flooring.

- For example, U.S. government procurement contracts list Tarkett commercial LVT at prices ranging from approximately $27 to $93 per square meter, depending on the product line and specifications.

Limited Awareness and Technical Expertise Impede Wider Acceptance and Application

The Latin America Luxury Vinyl Tiles Flooring Market encounters challenges stemming from limited consumer awareness and a shortage of skilled installation professionals in some areas. It affects the correct selection, handling, and installation of LVT products, which can compromise performance and longevity. Lack of technical knowledge among installers leads to suboptimal outcomes, reducing customer satisfaction and deterring future purchases. The market’s growth depends on educating end-users, architects, and contractors about the benefits and installation requirements of LVT flooring. Inadequate training programs and insufficient marketing efforts contribute to slower market penetration, especially in emerging markets within the region. Overcoming these challenges requires coordinated efforts from manufacturers, distributors, and industry associations to enhance awareness and technical support. Improving education and expertise will facilitate broader acceptance and sustained market development.

Market Opportunities:

Expansion in Residential Renovation and Urban Housing Projects Presents Significant Growth Potential

The Latin America Luxury Vinyl Tiles Flooring Market benefits from the rising trend of residential renovations and urban housing developments across key countries in the region. It offers an attractive flooring solution for homeowners seeking durable, stylish, and cost-effective upgrades. Increasing disposable incomes and evolving consumer preferences for modern interior design fuel demand for innovative LVT products. The growth of affordable housing initiatives and urbanization further supports market expansion. Manufacturers and distributors can capitalize on this opportunity by tailoring products to meet local tastes and price sensitivities. Enhancing distribution networks and customer education will facilitate penetration into emerging residential markets. This segment represents a promising avenue for sustained revenue growth.

Technological Advancements and Sustainable Product Innovations Unlock New Market Segments

The Latin America Luxury Vinyl Tiles Flooring Market holds opportunities through ongoing technological advancements and the development of eco-friendly, sustainable products. It can leverage innovations such as improved wear layers, enhanced waterproofing, and realistic design capabilities to attract commercial and institutional customers seeking high-performance flooring. Growing emphasis on green building certifications encourages demand for LVT products with low environmental impact and recyclable materials. Collaborations between manufacturers and construction firms aiming to meet sustainability goals will expand market reach. Investing in research and development to improve product durability and sustainability will strengthen competitive advantage. These opportunities position LVT flooring as a preferred choice in evolving construction and renovation landscapes.

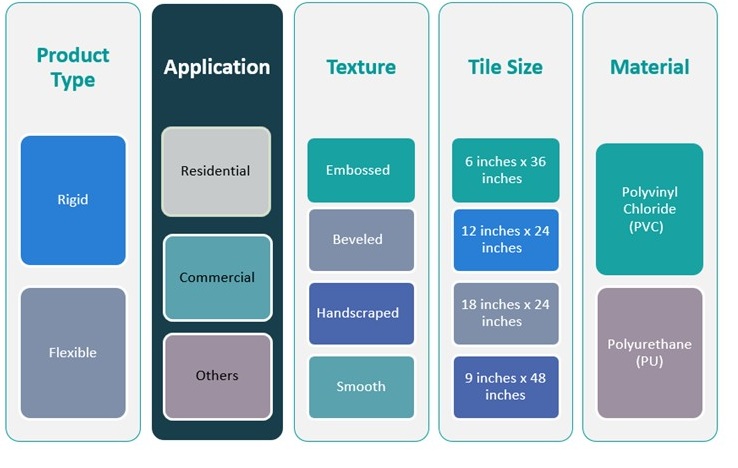

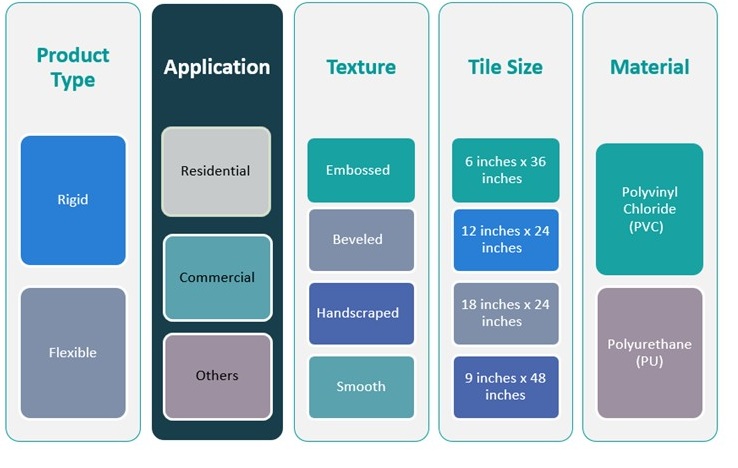

Market Segmentation Analysis:

The Latin America Luxury Vinyl Tiles Flooring Market segments provide a comprehensive view of the diverse product offerings and applications catering to regional demand.

By product type, the market divides into rigid and flexible tiles. Rigid LVT offers enhanced durability and structural stability, ideal for high-traffic commercial spaces, while flexible tiles provide versatility and ease of installation, appealing strongly to residential users.

By application segment includes residential, commercial, and others. Residential applications drive demand through growing urbanization and renovation trends, with homeowners prioritizing aesthetics and cost-efficiency. Commercial spaces, including retail, healthcare, and hospitality, favor LVT for its durability and low maintenance, while other sectors like institutional buildings contribute to steady demand.

By Texture options such as embossed, beveled, handscraped, and smooth expand design possibilities. Embossed and handscraped textures replicate natural wood finishes, satisfying consumer preferences for authentic aesthetics. Beveled and smooth finishes cater to modern and minimalist interior styles, broadening market appeal.

By Tile sizes vary, including 6 inches x 36 inches, 12 inches x 24 inches, 18 inches x 24 inches, and 9 inches x 48 inches. These options address different installation needs and design preferences, enabling customization in both small and large spaces.

By Material-wise, polyvinyl chloride (PVC) dominates due to cost-effectiveness and durability, while polyurethane (PU) offers enhanced wear resistance and comfort. It positions the Latin America Luxury Vinyl Tiles Flooring Market to meet diverse performance and design requirements across industries.

Segmentation:

By Product Type:

By Application:

- Residential

- Commercial

- Others

By Texture:

- Embossed

- Beveled

- Handscraped

- Smooth

By Tile Size:

- 6 inches’ x 36 inches

- 12 inches’ x 24 inches

- 18 inches’ x 24 inches

- 9 inches’ x 48 inches

By Material:

- Polyvinyl Chloride (PVC)

- Polyurethane (PU)

Regional Analysis:

Brazil Dominates the Latin America Luxury Vinyl Tiles Flooring Market with Largest Market Share

Brazil commands the largest share of the Latin America Luxury Vinyl Tiles Flooring Market, accounting for nearly 40% of the regional revenue. The country’s extensive urbanization and robust construction sector drive substantial demand for modern flooring solutions. It benefits from significant investments in residential, commercial, and infrastructure projects that prioritize durable and aesthetically appealing materials. Brazil’s growing middle class and increasing disposable income boost consumer spending on home improvement and renovation activities. The presence of several local and international LVT manufacturers facilitates wide product availability and competitive pricing. Brazil’s leadership in the market establishes it as a critical growth engine for the region. Continued expansion in its construction industry will sustain Brazil’s dominance in the near term.

Argentina and Mexico Emerge as Key Growth Markets with Expanding Construction Activities

Argentina and Mexico collectively hold around 30% of the Latin America Luxury Vinyl Tiles Flooring Market share, driven by rising urban development and infrastructure modernization. Argentina’s residential and commercial sectors show increasing preference for cost-effective and stylish flooring options like LVT, supported by favorable government policies promoting housing projects. Mexico experiences rapid industrialization and retail expansion, which fuel demand for low-maintenance and durable flooring solutions. Both countries witness rising interest from investors and developers seeking innovative materials that meet functional and design requirements. The growth potential in these markets attracts new entrants and encourages product diversification. Enhanced distribution channels and awareness campaigns further accelerate market penetration in Argentina and Mexico.

Chile, Peru, and Colombia Exhibit Growing Market Presence through Urbanization and Renovation Trends

Chile, Peru, and Colombia collectively account for approximately 20% of the Latin America Luxury Vinyl Tiles Flooring Market revenue, reflecting their expanding urban populations and increasing home renovation activities. These countries experience growth in middle-income households investing in improved living standards and interior design enhancements. It caters to demand from both residential consumers and commercial entities, including hospitality and healthcare sectors. Government initiatives to improve urban infrastructure and promote sustainable construction stimulate LVT adoption. The development of local manufacturing and import partnerships enhances product availability and competitive pricing in these markets. The sustained economic growth and modernization efforts in Chile, Peru, and Colombia position them as important contributors to the regional market’s future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Shaw Industries

- Mohawk Industries, Inc.

- Tarkett

- Gerflor

- Decno Group

Competitive Analysis:

The Latin America Luxury Vinyl Tiles Flooring Market features a competitive landscape dominated by several multinational and regional players striving to expand their market presence. Leading companies focus on product innovation, broadening design portfolios, and enhancing durability to meet diverse consumer preferences. It intensifies competition through strategic partnerships, acquisitions, and expanded distribution networks across key countries such as Brazil, Mexico, and Argentina. Companies invest in sustainable product development to align with evolving regulatory standards and growing environmental awareness. Price competitiveness and after-sales service quality also serve as critical differentiators in this market. Local manufacturers leverage regional supply chain advantages to offer cost-effective solutions, challenging global brands. Continuous marketing efforts and customer education initiatives improve brand visibility and market penetration. The dynamic competitive environment in the Latin America Luxury Vinyl Tiles Flooring Market drives innovation and compels players to adapt quickly to shifting market demands to secure long-term growth.

Recent Developments:

- In February 2025, Shaw Industries introduced 18 new resilient flooring styles, including luxury vinyl tile products, expanding its design leadership with versatile, durable, and aesthetically pleasing options suitable for whole-home design. This launch includes new tile designs such as Majestic, a sophisticated 12 x 24 porcelain tile mimicking marble, enhancing their product assortment for residential and commercial use.

- In 2025, Decno Group has made significant strides by unveiling innovative SPC flooring and wall panel products that combine aesthetic appeal with advanced functionality. In early 2025, Decno introduced the MINIsize Herringbone SPC Flooring and Grout Line SPC Tile, which blend structural stability with realistic designs, targeting both residential and commercial markets globally, including Latin America.

- In Nov 2022, Mohawk acquired Elizabeth Revestimentos in Brazil and Vitromex in Mexico, significantly boosting its ceramic tile market share in these key Latin American countries with four production facilities each. These acquisitions bolster Mohawk’s position in the region’s flooring market, including luxury vinyl tile segments, by enhancing operational capacity and product offerings

Market Concentration & Characteristics:

The Latin America Luxury Vinyl Tiles Flooring Market exhibits a moderately concentrated structure characterized by the presence of several key multinational corporations alongside emerging regional manufacturers. It balances innovation-driven global players with cost-competitive local companies that cater to diverse market segments. The market features a mix of premium and value-oriented products designed to address various consumer preferences and economic conditions across different countries. It benefits from technological advancements in design and manufacturing, enhancing product quality and variety. The competitive landscape encourages collaboration, strategic alliances, and regional expansion to strengthen distribution channels. Market characteristics include growing demand for sustainable and durable flooring solutions, increasing urbanization, and evolving consumer aesthetics. This blend of concentrated leadership and dynamic regional participation defines the market’s trajectory and competitiveness in Latin America.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Texture, Tile Size and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued urbanization and infrastructure development will drive sustained demand for LVT flooring across Latin America.

- Increasing adoption of eco-friendly and recyclable materials will enhance market appeal and regulatory compliance.

- Technological innovations in design and wear resistance will improve product performance and consumer satisfaction.

- Expansion of affordable housing projects will open new opportunities for cost-effective LVT solutions.

- Rising consumer preference for easy-to-install flooring will boost DIY market segments.

- Growth in commercial sectors such as retail, hospitality, and healthcare will increase LVT usage.

- Strengthened distribution networks will improve product accessibility in emerging regional markets.

- Strategic partnerships between manufacturers and construction firms will accelerate market penetration.

- Digital marketing and consumer education will raise awareness and drive adoption rates.

- Investment in local manufacturing capabilities will reduce costs and enhance supply chain resilience.