| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ULatin America Construction Aggregates Market Size 2024 |

USD 20,690.81 million |

| Latin America Construction Aggregates Market , CAGR |

3.81% |

| Latin America Construction Aggregates Market Size 2032 |

USD 27,900.60 million |

Market Overview

Latin America Construction Aggregates market size was valued at USD 20,690.81 million in 2024 and is anticipated to reach USD 27,900.60 million by 2032, at a CAGR of 3.81% during the forecast period (2024-2032).

The Latin America construction aggregates market is driven by rapid urbanization, infrastructure development, and increasing government investments in transportation and residential projects. Rising demand for sustainable and recycled aggregates, along with technological advancements in mining and processing, is shaping market growth. The region’s growing population and expanding middle class fuel the need for commercial and housing developments, further boosting aggregate consumption. Additionally, public-private partnerships (PPPs) and foreign direct investments (FDIs) are accelerating large-scale infrastructure projects, such as highways, bridges, and rail networks. Trends indicate a shift toward eco-friendly aggregates, driven by stringent environmental regulations and sustainability goals. Advancements in automation and digitalization within the mining sector are enhancing efficiency and reducing operational costs. However, market growth may face challenges due to fluctuating raw material prices and regulatory constraints. Despite these hurdles, the sector is poised for steady expansion, supported by strong economic growth and increasing construction activities.

The Latin America construction aggregates market is geographically diverse, with significant demand driven by infrastructure projects, urbanization, and industrial expansion across countries like Brazil, Argentina, Peru, Chile, and Colombia. Rapid urban growth and government investments in transportation, housing, and commercial developments are key factors influencing aggregate consumption. Brazil and Mexico lead in infrastructure development, while countries like Peru and Chile focus on earthquake-resistant construction, increasing demand for high-quality aggregates. The market is highly competitive, with key players such as CRH plc, CEMEX S.A.B. de C.V., Heidelberg Materials AG, Vulcan Materials Company, and Martin Marietta Materials Inc. dominating the industry. These companies focus on technological advancements, sustainability, and strategic acquisitions to expand their market presence. Additionally, local and regional players contribute significantly to aggregate supply, catering to growing construction demands. As sustainability concerns rise, major companies are investing in eco-friendly and recycled aggregates to align with evolving environmental regulations and industry trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America construction aggregates market was valued at USD 20,690.81 million in 2024 and is projected to reach USD 27,900.60 million by 2032, growing at a CAGR of 3.81%.

- Rapid urbanization and infrastructure investments, including roads, bridges, and residential projects, are driving market growth.

- Sustainable and recycled aggregates are gaining popularity due to strict environmental regulations and growing demand for eco-friendly construction materials.

- Leading players such as CRH plc, CEMEX S.A.B. de C.V., and Heidelberg Materials AG are expanding through acquisitions and technological advancements.

- Regulatory restrictions, fluctuating raw material prices, and supply chain disruptions pose challenges to market expansion.

- Brazil, Argentina, Peru, Chile, and Colombia are major contributors, with government-backed infrastructure projects fueling aggregate demand.

- Increasing adoption of automation, digital monitoring, and innovative processing technologies is enhancing production efficiency and cost-effectiveness in the sector.

Report scope

This report segments the Latin America Construction Aggregates Market as follows:

Market Drivers

Rapid Urbanization and Infrastructure Development

Latin America’s construction aggregates market is primarily driven by rapid urbanization and the increasing need for infrastructure development. With a growing population and expanding urban centers, governments across the region are heavily investing in roads, bridges, airports, and housing projects to meet rising demand. For instance, Brazil’s Ministry of Infrastructure has launched initiatives to modernize highways and expand airport facilities, while Mexico’s Secretariat of Communications and Transportation is focusing on large-scale railway projects to enhance connectivity. Public-private partnerships (PPPs) and government-led initiatives further accelerate construction activities, increasing the consumption of aggregates such as sand, gravel, and crushed stone. This surge in infrastructure investments significantly contributes to market expansion.

Rising Demand for Sustainable and Recycled Aggregates

Sustainability concerns and environmental regulations are reshaping the construction aggregates industry in Latin America. Governments and industry players are increasingly promoting the use of recycled and eco-friendly aggregates to minimize environmental impact. For instance, Argentina’s National Institute of Industrial Technology has been actively researching methods to recycle construction waste into usable aggregates, while Chile’s Ministry of Environment has implemented policies encouraging the use of low-carbon materials in public projects. The adoption of sustainable construction practices, such as green buildings and low-carbon materials, is driving demand for alternative aggregates like recycled concrete and slag. Additionally, strict mining regulations and land use policies are pushing companies to develop efficient recycling methods, reducing reliance on natural resources. This trend aligns with global sustainability goals and enhances the long-term viability of the aggregates market.

Growth in the Residential and Commercial Construction Sectors

The expanding middle class and increasing disposable incomes in Latin America are fueling demand for residential and commercial construction. Countries such as Colombia, Chile, and Peru are witnessing a surge in housing projects, commercial buildings, and retail spaces, driving aggregate consumption. Government-backed affordable housing initiatives and real estate investments are further boosting the market. The rise of smart cities and urban renewal programs is also accelerating the need for high-quality aggregates, reinforcing the sector’s positive growth outlook. Moreover, tourism-driven commercial infrastructure, such as hotels and resorts, is contributing to market expansion.

Technological Advancements in Mining and Processing

Technological innovations in mining and aggregate processing are playing a crucial role in improving efficiency and reducing costs. Advanced machinery, automation, and digitalization are streamlining extraction and production processes, ensuring higher output with minimal environmental impact. The adoption of artificial intelligence (AI) and data analytics is optimizing supply chain management, leading to better demand forecasting and inventory control. Additionally, innovations in crushing and screening equipment are enhancing the quality and durability of aggregates, making them more suitable for modern construction needs. These advancements not only drive market growth but also improve sustainability and operational efficiency.

Market Trends

Shift Toward Sustainable and Recycled Aggregates

Sustainability is a key trend shaping the Latin America construction aggregates market. Governments and industry players are increasingly adopting eco-friendly alternatives, such as recycled concrete, slag, and manufactured sand, to reduce environmental impact. Stricter environmental regulations are driving the shift toward sustainable mining practices and waste reduction strategies. Companies are investing in advanced recycling technologies to enhance material reuse, minimizing dependency on natural resources. As green building certifications and carbon footprint reduction goals gain traction, the demand for sustainable aggregates continues to rise, fostering long-term market growth.

Increasing Adoption of Advanced Mining and Processing Technologies

Technological advancements are transforming aggregate extraction and processing, improving efficiency and cost-effectiveness. For instance, mining companies in Mexico are utilizing AI-driven quality control systems to enhance material grading, while Brazil’s Geological Survey has adopted drones and remote sensing technologies for resource exploration and site monitoring. Innovations in crushing and screening equipment allow for better material grading and quality, meeting the evolving demands of modern construction. Additionally, the use of drones and remote sensing technologies is optimizing resource exploration and site monitoring, reducing labor costs and improving safety. These advancements enable producers to meet growing demand while maintaining high-quality standards in aggregate production.

Growing Infrastructure Investments and Public-Private Partnerships (PPPs)

Latin America’s governments are prioritizing infrastructure development to support economic growth, leading to increased investments in transportation, energy, and urban development projects. For instance, Brazil’s Ministry of Infrastructure has launched extensive highway modernization projects under PPP frameworks, while Colombia’s National Infrastructure Agency is spearheading railway development initiatives to improve connectivity. Countries like Brazil, Mexico, and Colombia are witnessing a surge in infrastructure spending, driving aggregate demand. Additionally, foreign direct investment (FDI) in the construction sector is facilitating the development of smart cities and sustainable urban planning initiatives. These infrastructure projects are expected to sustain long-term growth in the construction aggregates market.

Rising Demand for High-Performance and Specialty Aggregates

As construction projects become more complex, the demand for high-performance and specialty aggregates is increasing. Builders and contractors are seeking aggregates with superior durability, strength, and resistance to extreme weather conditions. Specialty aggregates, such as lightweight aggregates for high-rise buildings and skid-resistant materials for road construction, are gaining traction. Additionally, the growing emphasis on seismic-resistant infrastructure in earthquake-prone regions of Latin America is driving demand for high-quality aggregates. This trend is encouraging manufacturers to develop innovative aggregate solutions that meet the evolving needs of the construction industry.

Market Challenges Analysis

Regulatory and Environmental Constraints

The Latin America construction aggregates market faces significant challenges due to stringent regulatory frameworks and environmental concerns. Governments across the region are implementing stricter mining and land-use policies to mitigate the environmental impact of aggregate extraction. Compliance with these regulations increases operational costs for mining companies, as they must invest in sustainable extraction techniques and environmental impact assessments. Additionally, restrictions on quarrying in environmentally sensitive areas limit access to high-quality raw materials, affecting supply stability. Lengthy approval processes for new mining projects further delay expansion efforts, creating supply chain disruptions and potential project delays in the construction sector.

Fluctuating Raw Material Costs and Supply Chain Disruptions

Price volatility in raw materials, transportation, and energy costs poses a challenge for the construction aggregates industry. For instance, Mexico’s National Institute of Statistics and Geography has reported fluctuations in fuel and machinery costs due to inflation, impacting profit margins for aggregate producers. Additionally, supply chain disruptions caused by inadequate infrastructure, political instability, and trade restrictions can affect the timely delivery of aggregates to construction sites. Limited transportation networks in rural and remote areas further exacerbate logistical challenges, increasing costs and reducing market efficiency.

Market Opportunities

The Latin America construction aggregates market presents significant growth opportunities driven by increasing infrastructure investments and urbanization. Governments across the region are prioritizing large-scale infrastructure projects, including roads, bridges, rail networks, and ports, to support economic development. Public-private partnerships (PPPs) and foreign direct investment (FDI) are fueling the expansion of construction activities, creating a steady demand for aggregates. Additionally, the rapid growth of urban centers and rising population density are accelerating the need for residential and commercial real estate development. This surge in construction projects offers a lucrative opportunity for aggregate producers to expand their operations and meet the growing demand for high-quality materials.

Technological advancements in aggregate processing and mining efficiency are further unlocking market potential. The adoption of automated machinery, digital monitoring systems, and advanced crushing and screening technologies is enhancing productivity and reducing operational costs. Furthermore, the increasing emphasis on sustainability is opening new opportunities for recycled and eco-friendly aggregates, as governments and construction firms seek environmentally responsible alternatives. Innovations in material processing, such as the use of industrial by-products and waste materials in aggregate production, are helping companies meet regulatory requirements while improving cost efficiency. As sustainability-driven policies and smart city initiatives gain momentum, aggregate producers that invest in green solutions and advanced technologies will gain a competitive edge in the evolving market landscape.

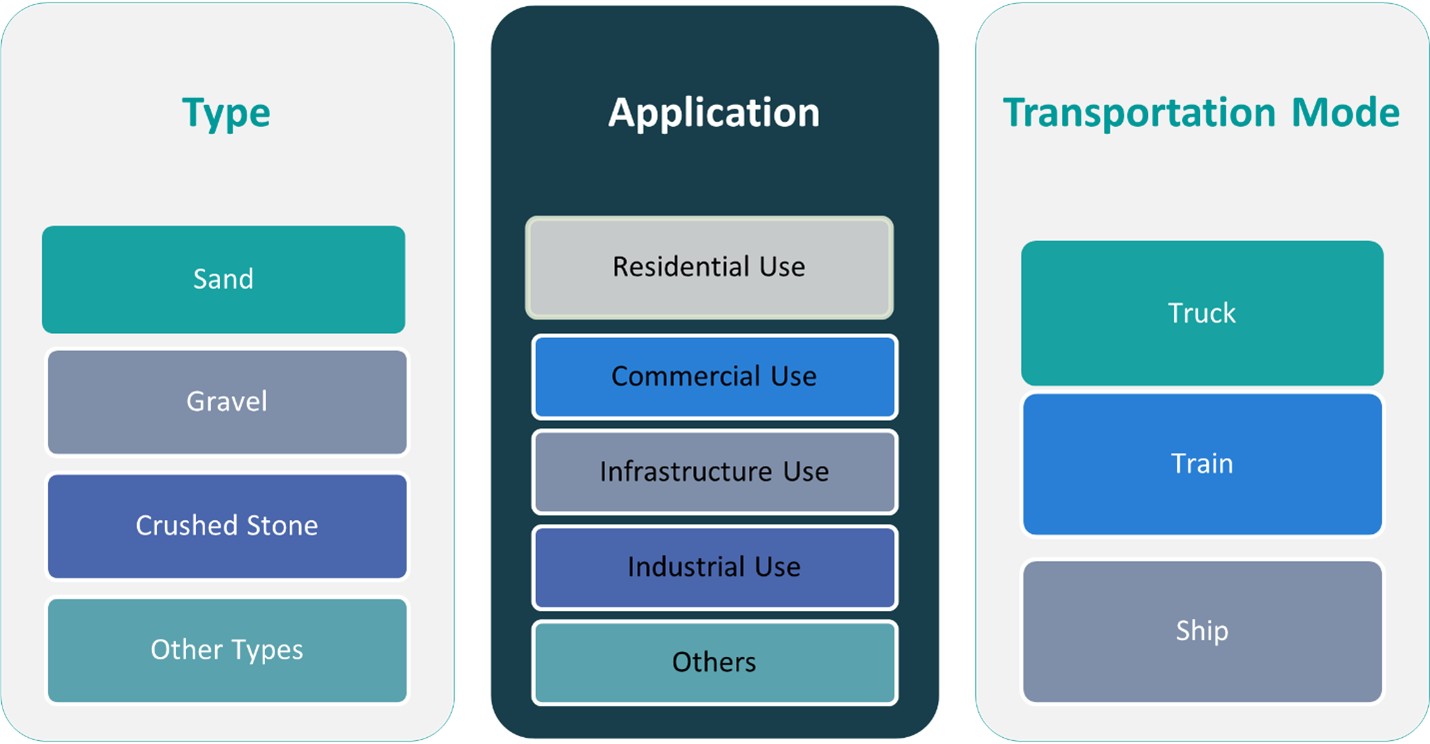

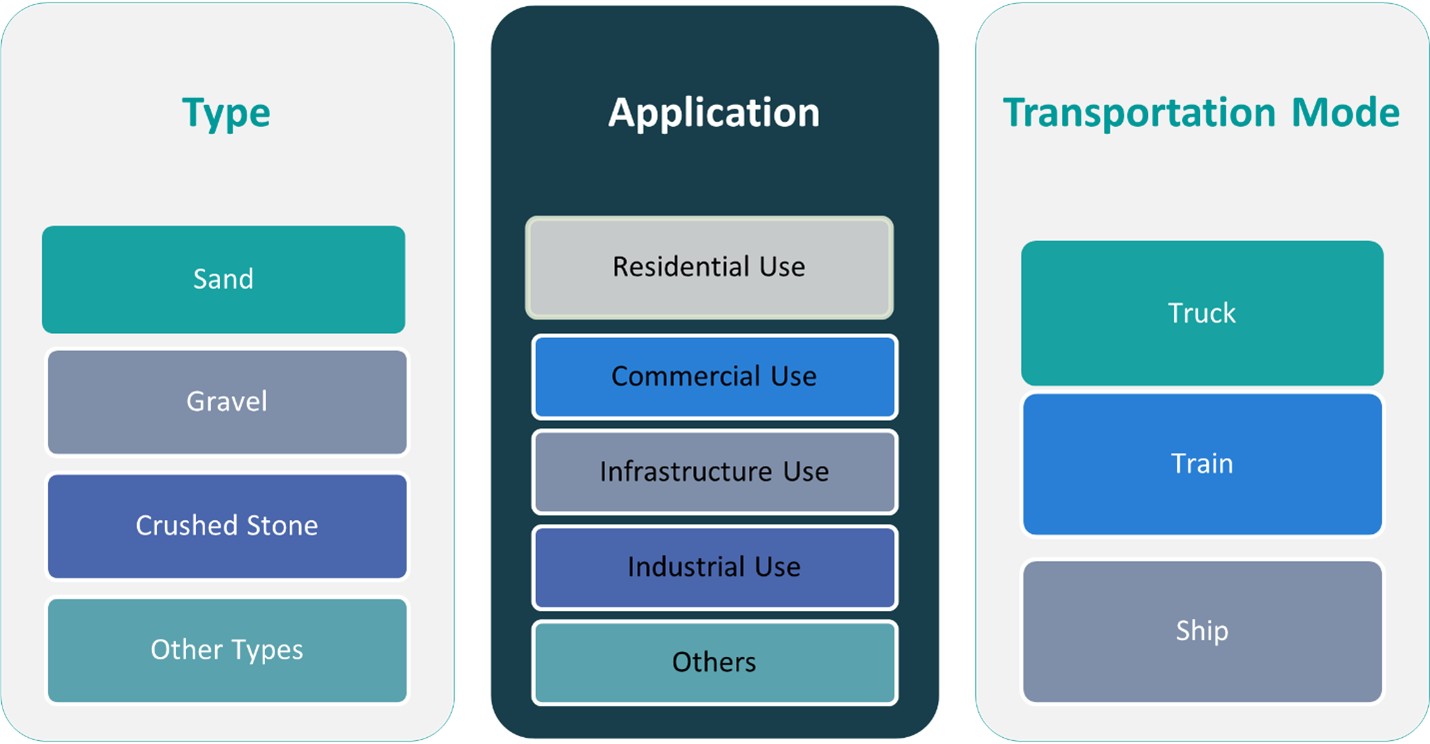

Market Segmentation Analysis:

By Type:

The Latin America construction aggregates market is categorized into sand, gravel, crushed stone, and other types, each serving distinct construction needs. Sand is a fundamental material used in concrete production, plastering, and brick manufacturing, making it a highly demanded aggregate in both residential and commercial projects. The rising construction of housing developments and office spaces continues to drive sand consumption. Gravel is widely used in road construction, drainage systems, and foundation work due to its durability and permeability. The expansion of transportation networks and infrastructure projects across Latin America fuels demand for high-quality gravel. Crushed stone is essential for heavy construction, including highways, bridges, and large-scale commercial developments, due to its superior strength and load-bearing capacity. Increasing investments in urban infrastructure and industrial zones are boosting the consumption of crushed stone. Other aggregates, including recycled and artificial aggregates, are gaining traction as sustainability concerns push the industry toward eco-friendly alternatives, presenting new opportunities for manufacturers.

By Application:

The application-based segmentation of the Latin America construction aggregates market includes residential, commercial, infrastructure, and industrial use, each playing a crucial role in market dynamics. The residential sector is a key driver of aggregate demand, with growing urbanization and government initiatives promoting affordable housing projects. The increasing middle-class population and demand for modern housing developments contribute to sustained growth in this segment. Commercial construction, including office buildings, shopping centers, and hotels, also drives aggregate consumption, fueled by foreign investments and tourism expansion. Infrastructure projects, such as roads, highways, railways, and airports, represent a major segment, with governments prioritizing transportation improvements and smart city initiatives. The industrial sector, including manufacturing facilities and logistics hubs, relies on high-quality aggregates for site development and structural foundations. With ongoing industrialization and economic growth, the demand for durable construction materials continues to rise, solidifying the market’s long-term expansion across all application segments.

Segments:

Based on Type:

- Sand

- Gravel

- Crushed Stone

- Other Types

Based on Application:

- Residential Use

- Commercial Use

- Infrastructure Use

- Industrial Use

Based on End- User:

Based on the Geography:

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

Regional Analysis

Brazil

Brazil holds the largest market share, accounting for approximately 35% of the total regional market. The country’s strong construction sector, driven by large-scale infrastructure projects, urban housing developments, and industrial expansion, fuels the demand for aggregates. The Brazilian government’s investments in transportation networks, such as roads, railways, and ports, along with preparations for international events and economic recovery initiatives, continue to drive market growth. Additionally, public-private partnerships (PPPs) and foreign direct investments (FDI) in commercial and residential real estate further boost the demand for sand, gravel, and crushed stone.

Argentina

Argentina contributes around 15% of the Latin America construction aggregates market, driven by growing investments in road construction, urban infrastructure, and commercial projects. Government-backed infrastructure programs, including highway expansion and smart city initiatives, are key factors supporting market growth. The demand for high-quality aggregates, especially crushed stone, is rising due to Argentina’s focus on strengthening transportation and industrial infrastructure. However, economic fluctuations and regulatory challenges sometimes hinder steady growth in the sector. Despite these challenges, the ongoing modernization of urban centers and increasing foreign investment in construction projects are expected to support the market’s long-term expansion.

Peru and Chile

Peru and Chile collectively account for 20% of the Latin American market, with Peru contributing 12% and Chile 8%. Peru’s construction sector benefits from strong government spending on infrastructure, including roadways, bridges, and public housing projects, boosting demand for aggregates. The country’s mining industry also plays a vital role in aggregate consumption, as large-scale mining projects require high-quality materials for site development and processing plants. Meanwhile, Chile’s market is driven by urbanization, seismic-resistant infrastructure development, and growing demand for sustainable aggregates. Chile’s emphasis on earthquake-resistant buildings has increased the demand for specialty aggregates that enhance structural durability and safety.

Colombia and the Rest of Latin America

Colombia and the Rest of Latin America together hold 30% of the market share, with Colombia contributing 10% and the remaining countries accounting for 20%. Colombia’s growing urban infrastructure, highway expansion projects, and residential construction boom are key drivers of the aggregates market. The government’s focus on improving transportation networks and increasing housing availability continues to boost demand for sand, gravel, and crushed stone. In other Latin American nations, such as Ecuador, Bolivia, and Central American countries, the construction sector is expanding due to economic growth, urban migration, and increasing government investment in infrastructure. These regions present significant opportunities for aggregate suppliers as construction demand rises across diverse sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CRH plc

- CEMEX S.A.B. de C.V.

- Heidelberg Materials AG

- Vulcan Materials Company

- Martin Marietta Materials Inc.

- Adbri Limited

- Eagle Materials Inc.

- SRC Group

- Tarmac

- Sika AG

- Boral Limited

Competitive Analysis

The Latin America construction aggregates market is highly competitive, with both global and regional players striving to strengthen their market presence through innovation, expansion, and acquisitions. Leading companies such as CRH plc, CEMEX S.A.B. de C.V., Heidelberg Materials AG, Vulcan Materials Company, and Martin Marietta Materials Inc. dominate the industry by leveraging advanced technologies, sustainable solutions, and strategic partnerships. These players focus on enhancing operational efficiency, adopting automated mining techniques, and investing in digital monitoring systems to optimize production and supply chain management. Sustainability is a key differentiator, with major companies increasingly investing in eco-friendly aggregates and recycled materials to align with environmental regulations and market trends. Additionally, mergers and acquisitions have been instrumental in consolidating market positions, enabling firms to expand their geographic reach and customer base. While global players hold significant market share, regional companies remain competitive by offering cost-effective solutions and catering to local construction demands. As infrastructure development continues across Latin America, competition among key players is expected to intensify, driving further innovation and market growth.

Recent Developments

- In September 2024, Holcim started the Holcim Sustainable Construction Academy. This is a free online training program that teaches about eco-friendly building methods. It helps people who work in construction learn new skills. The program offers both online classes and face-to-face training.

- In October 2024, CRH Ventures launched the Sustainable Building Materials accelerator to scale up creative climate and build technology firms that specialize in CO2-mineralized materials and sustainable binder solutions.

- In July 2024, Heidelberg Materials launched a recycling plant in Katowice, Poland, using a patented ReConcrete process to recycle demolition concrete and replace virgin material.

- In July 2024, Cemex USA formed a joint venture with Couch Aggregates and Premier Holdings for the production and distribution of aggregates in the Mid-South region. Cemex USA already had a strategic partnership with Couch Aggregates. The company stated that this vertical integration, combined with Premier Holdings’ Gulf Coast marine terminals, would accelerate its regional growth.

- In April 2024, Rogers Group joined The Road Forward initiative to advance sustainable asphalt production and paving practices.

- In January 2024, Heidelberg Materials launched Evo Build, its new global brand for low-carbon and circular products. This initiative aims to provide sustainable solutions for the construction industry, focusing on reducing carbon emissions and promoting circular economy principles.

Market Concentration & Characteristics

The Latin America construction aggregates market is moderately concentrated, with a mix of global industry leaders and regional suppliers competing to meet the growing demand for construction materials. Major players such as CRH plc, CEMEX S.A.B. de C.V., and Heidelberg Materials AG dominate the market through large-scale production, technological advancements, and strategic acquisitions. These companies benefit from extensive distribution networks, advanced mining techniques, and sustainability initiatives, giving them a competitive edge. However, local and mid-sized producers play a crucial role in catering to region-specific demands, offering cost-effective solutions and flexible supply chains. The market is characterized by increasing investment in automation, digitalization, and eco-friendly aggregates, as sustainability regulations become more stringent. Infrastructure development, urbanization, and rising residential and commercial construction drive market expansion. Despite challenges such as raw material price fluctuations and regulatory constraints, the industry remains dynamic, with ongoing innovations shaping the competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Latin America construction aggregates market will continue to grow due to increasing infrastructure investments and urbanization.

- Governments will prioritize road, bridge, and residential construction, driving aggregate demand.

- Sustainability regulations will encourage the use of recycled and eco-friendly aggregates.

- Technological advancements in automation and digital monitoring will enhance production efficiency.

- Public-private partnerships will play a crucial role in funding large-scale construction projects.

- Market consolidation through mergers and acquisitions will strengthen the position of key players.

- Rising construction costs and fluctuating raw material prices may pose challenges to profitability.

- Demand for high-performance aggregates will increase as construction projects become more complex.

- Countries like Brazil, Mexico, and Colombia will remain key contributors to market expansion.

- Innovation in material processing and alternative aggregates will shape the future of the industry.