| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Pressure Sensor Market Size 2024 |

USD 1,008.22 Million |

| Latin America Fat Free Yogurt Market, CAGR |

3.27% |

| Latin America Fat Free Yogurt Market Size 2032 |

USD 1,304.53 Million |

Market Overview

The Latin America Pressure Sensor Market is projected to grow from USD 1,008.22 million in 2024 to an estimated USD 1,304.53 million by 2032, with a compound annual growth rate (CAGR) of 3.27% from 2025 to 2032. This steady growth is driven by increasing industrial applications, advancements in sensor technology, and the rising demand for automation and process control in various industries across the region.

Several factors contribute to the market’s expansion, including the growing adoption of smart technologies in industries such as oil & gas, automotive, and healthcare. Additionally, the trend toward Industry 4.0 and automation is further increasing the need for accurate pressure measurement tools. The rising awareness of safety and operational efficiency, coupled with the development of cost-effective sensor technologies, is expected to drive market growth. Innovations such as wireless sensors and miniaturization of devices also play a significant role in enhancing market prospects.

Geographically, Brazil, Mexico, and Argentina are the key players in the Latin American pressure sensor market, owing to their well-established manufacturing bases and growing industrial activities. Brazil leads the market with a large demand for pressure sensors in sectors like oil and gas, automotive, and healthcare. Key players in the market include Honeywell International, Bosch Sensortec, and Emerson Electric, which are focusing on product innovation and strategic partnerships to strengthen their market position in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America Pressure Sensor Market is projected to grow from USD 1,008.22 million in 2024 to USD 1,304.53 million by 2032, with a CAGR of 3.27% from 2025 to 2032.

- The growth is driven by increasing industrial automation, advancements in sensor technology, and the rising demand for precise pressure measurement in sectors like oil & gas, automotive, and healthcare.

- High initial costs of advanced pressure sensors and a shortage of skilled workforce in the region may slow the adoption of new technologies in certain industries.

- The ongoing adoption of Industry 4.0 and automation across various industries in Latin America is significantly boosting the demand for pressure sensors in process control systems.

- Brazil, Mexico, and Argentina lead the market, with strong demand for pressure sensors in oil & gas, automotive, and renewable energy sectors.

- Wireless, miniaturized, and IoT-enabled pressure sensors are becoming increasingly popular due to their ability to improve efficiency and reduce operational costs.

- Growth in renewable energy projects, particularly in wind and solar power, is creating new opportunities for pressure sensor applications in energy generation and management.

Market Drivers

Increasing Demand from the Oil & Gas Industry

The oil & gas industry in Latin America has traditionally been a significant contributor to economic growth, and its demand for pressure sensors remains high. Pressure sensors are critical for monitoring the pressure levels of various fluids, gases, and drilling equipment used in exploration, extraction, and transportation activities. Accurate pressure monitoring is essential for ensuring the safety and efficiency of oil and gas operations, particularly in harsh environments such as deep-sea drilling platforms or offshore rigs. These sensors help to prevent equipment failures, manage flow rates, and ensure optimal performance of machinery, ultimately minimizing risks and improving productivity.The Latin American region is home to major oil-producing countries like Brazil, Mexico, and Venezuela, where ongoing investments in exploration and production activities continue to drive demand for pressure sensors. In addition, the increased focus on the development of new energy reserves and the expansion of shale oil extraction in countries like Argentina further boosts the demand for advanced monitoring systems, creating long-term growth opportunities for the pressure sensor market.

Technological Advancements and Innovation in Sensor Solutions

The development of next-generation pressure sensor technologies is another critical driver propelling the growth of the market in Latin America. Technological advancements in sensor design, such as miniaturization, wireless capabilities, and improved sensitivity, have enhanced the functionality and versatility of pressure sensors. Innovations in sensor materials, such as the use of piezoelectric, capacitive, and optical technologies, have also contributed to improved accuracy, durability, and performance.Wireless pressure sensors, in particular, are gaining traction due to their ability to transmit real-time data remotely, reducing the need for complex wiring and installation costs. This technology is particularly beneficial for applications in remote or hard-to-reach locations, such as offshore oil rigs, pipelines, and underground mining sites. Additionally, the integration of pressure sensors with IoT (Internet of Things) systems allows for better monitoring, data analysis, and predictive maintenance, further boosting market demand. Latin American industries are increasingly adopting these cutting-edge solutions to stay competitive, which is driving the growth of the pressure sensor market.

Growing Industrial Automation and Process Control

The increasing adoption of industrial automation across various sectors in Latin America is a key driver of the pressure sensor market. Industries such as manufacturing, automotive, oil & gas, and chemical processing are embracing automation to improve efficiency, reduce operational costs, and enhance precision. Pressure sensors play a crucial role in these automated systems by providing real-time data to control and optimize processes. The need for accurate and reliable pressure measurements to monitor and control parameters such as temperature, fluid pressure, and gas pressure is driving the demand for advanced pressure sensor technologies.For instance, industries in Latin America are increasingly integrating smart sensors and IoT-driven devices into their production systems. These technologies enable real-time monitoring and predictive maintenance, which are critical for optimizing processes and reducing downtime. Brazilian manufacturers are leveraging AI and machine learning to enhance operational efficiency and safety in sectors like automotive and oil & gas. The push towards Industry 4.0, which emphasizes smart manufacturing and interconnected systems, is a significant factor behind this growth. As automation becomes more integral to industrial operations, the market for pressure sensors is expected to continue expanding at a steady pace.

Expansion of the Automotive Sector

The automotive industry in Latin America is experiencing a strong resurgence, with a notable rise in vehicle production, sales, and exports. Pressure sensors are integral to modern automotive systems, where they are used for various applications such as tire pressure monitoring systems (TPMS), engine control, and brake systems. As Latin America’s automotive industry expands, the demand for pressure sensors in vehicles is expected to grow accordingly.For instance, the automotive sector in Latin America is witnessing significant advancements in automation. Automakers are adopting technologies like SCADA systems and robotics to streamline manufacturing processes, reduce human error, and meet the growing demand for electric vehicles (EVs). BYD has announced plans to expand its EV production facilities in Mexico, demonstrating how automation supports the region’s shift towards sustainable mobility. In addition to traditional internal combustion engine vehicles, the shift towards EVs is further bolstering the adoption of pressure sensors. These sensors are essential in monitoring battery pressure, fluid pressure, and air pressure in EV systems, ensuring safety and operational efficiency. Stricter environmental regulations, particularly in Brazil and Mexico, have led automakers to adopt more sophisticated sensors to optimize fuel consumption and reduce emissions.

Market Trends

Focus on Environmental Sustainability and Energy Efficiency

Environmental sustainability is an increasingly important concern in Latin America, and this is influencing the demand for pressure sensors that can help optimize energy use and reduce emissions. In industries such as oil & gas, automotive, and manufacturing, pressure sensors are being integrated into systems designed to monitor and control energy consumption. For instance, in the automotive sector, pressure sensors are used to monitor tire pressure, ensuring optimal fuel efficiency and reducing vehicle emissions. Similarly, in the oil & gas sector, pressure sensors are crucial for monitoring pressure levels in pipelines, ensuring the efficient transportation of fuel, and detecting leaks that could lead to environmental damage.The push for sustainable and energy-efficient operations is also driving the demand for sensors that can monitor air and fluid pressure in industrial processes, helping to reduce waste and energy consumption. With stricter environmental regulations being enforced in many Latin American countries, industries are increasingly adopting pressure sensors that comply with sustainability standards. This trend is being further supported by technological advancements that allow pressure sensors to operate more efficiently, use less energy, and last longer. The increasing focus on environmental sustainability is therefore becoming a key driver for the adoption of advanced pressure sensor technologies in the region.

Integration of Pressure Sensors in Emerging Industries

As new industries emerge in Latin America, particularly in renewable energy, smart cities, and electric vehicles (EVs), pressure sensors are finding new applications. In the renewable energy sector, pressure sensors are used to monitor the performance of solar and wind energy systems, ensuring they operate at optimal pressure levels. For instance, wind turbines use pressure sensors to monitor hydraulic pressure in their braking systems, while solar power systems use sensors to manage fluid pressure in cooling systems.The electric vehicle (EV) market is another area where pressure sensors are seeing increased demand. EV manufacturers require pressure sensors for battery management systems, where they are used to monitor the pressure in the battery cooling system, ensuring that the battery operates within safe parameters. This is essential for both safety and efficiency, as proper thermal management is crucial for EV performance. As the region’s automotive market continues to shift towards electric mobility, the demand for pressure sensors in EV systems is expected to rise significantly.Furthermore, the development of smart cities in Latin America is also contributing to the adoption of pressure sensors. Smart cities require a wide range of sensors to manage urban infrastructure efficiently, from water supply systems to waste management. Pressure sensors play a vital role in ensuring the optimal flow of water and gas through pipelines, as well as monitoring the pressure in HVAC systems used in smart buildings. As more Latin American cities move toward smart city initiatives, pressure sensors will be increasingly integrated into various systems to ensure the efficient and sustainable management of urban resources.

Adoption of Wireless and IoT-Enabled Pressure Sensors

One of the most significant trends in the Latin America pressure sensor market is the growing adoption of wireless and IoT-enabled pressure sensors. As industries increasingly seek to optimize operations and reduce maintenance costs, the demand for remote sensing solutions has surged. Wireless pressure sensors, which transmit real-time data without the need for physical wiring, are becoming more common in sectors like oil & gas, automotive, and manufacturing. These sensors not only improve operational efficiency but also enhance safety by allowing for remote monitoring of critical parameters.For instance, a leading oil and gas company in Brazil has implemented wireless pressure sensors across its offshore drilling platforms, enabling real-time monitoring of wellhead pressure from a centralized control room. This implementation has significantly reduced the need for manual inspections in hazardous areas and improved overall operational efficiency. The integration of Internet of Things (IoT) technology into pressure sensors is further boosting this trend, enabling seamless data exchange between pressure measurement devices and centralized control systems. This allows for better monitoring, predictive maintenance, and quicker decision-making, particularly valuable in harsh or inaccessible environments.

Miniaturization and Increased Sensitivity of Pressure Sensors

Another key trend shaping the Latin American pressure sensor market is the ongoing miniaturization of pressure sensors, combined with improvements in their sensitivity. The need for smaller, more precise sensors is growing, driven by the increasing demand for compact and efficient devices in industries like automotive, medical, and aerospace. Miniaturization allows for integration into smaller, space-constrained applications, such as tire pressure monitoring systems (TPMS) in vehicles, health monitoring devices, and advanced avionics systems.In the automotive sector, a major manufacturer in Mexico has integrated miniaturized pressure sensors into its latest vehicle models for tire pressure monitoring. These sensors, barely larger than a coin, provide highly accurate readings and can transmit data wirelessly to the vehicle’s onboard computer, enhancing safety and fuel efficiency. In the healthcare industry, a hospital in Argentina has adopted ultra-sensitive pressure sensors in its intensive care units for continuous patient monitoring. These miniature sensors, incorporated into wearable devices, allow for non-invasive blood pressure monitoring and early detection of respiratory issues, improving patient care and reducing the need for more intrusive monitoring methods. The trend toward miniaturization, along with enhanced performance, is helping to drive the market for pressure sensors across various industries in Latin America.

Market Challenges

Lack of Skilled Workforce and Technical Expertise

Another challenge affecting the growth of the pressure sensor market in Latin America is the lack of skilled professionals with the necessary technical expertise to implement, maintain, and optimize sensor systems. As industries increasingly turn to advanced pressure sensors for automation and data-driven decision-making, there is a growing need for engineers and technicians who can design, install, and troubleshoot these sophisticated systems. However, there is a shortage of qualified professionals in the region, particularly in more remote or developing areas, where access to specialized training and education is limited. This skills gap can result in increased operational costs, longer downtimes, and potential inefficiencies, as companies struggle to properly integrate pressure sensors into their processes. Moreover, the rapid pace of technological advancements in sensor technology means that ongoing training and upskilling are necessary to keep the workforce up to date, which can be a resource-intensive process for businesses. Addressing this challenge requires investment in education and training programs, which could be a significant hurdle for companies operating in cost-sensitive markets.

High Initial Cost of Advanced Pressure Sensors: A Market Challenge in Latin America

One of the significant challenges facing the Latin America pressure sensor market is the high initial cost of advanced sensor technologies. While pressure sensors are crucial for improving efficiency and safety in various industries, the adoption of state-of-the-art sensors can be expensive, particularly for small and medium-sized enterprises (SMEs) in the region. The cost of high-performance sensors, including those with wireless capabilities, IoT integration, and enhanced sensitivity, can be a major barrier to entry for businesses operating on tight budgets.For instance, the production of MEMS pressure sensors requires cleanroom environments and costly fabrication processes similar to those used in semiconductor manufacturing, leading to substantial initial investments for setting up production facilities and supply chains. Additionally, the development of compact yet powerful solutions with enhanced sensitivity and functionality demands significant research and development efforts, further contributing to the high costs associated with advanced pressure sensor technologies.Many companies in Latin America may hesitate to invest in these advanced systems due to the upfront costs, despite the long-term benefits of improved operational efficiency and reduced maintenance costs. This financial barrier is especially prominent in industries like manufacturing and oil & gas, where businesses must weigh the return on investment against the high cost of implementing these advanced sensor solutions. Consequently, the market may see slower adoption of next-generation pressure sensors in these sectors, limiting the overall market growth in the short term.

Market Opportunities

Growth of Renewable Energy and Smart Infrastructure Projects

The increasing investment in renewable energy and smart infrastructure in Latin America presents a significant opportunity for the pressure sensor market. As countries in the region focus on reducing carbon emissions and enhancing energy sustainability, renewable energy sources such as wind, solar, and hydroelectric power are gaining momentum. Pressure sensors are essential for monitoring the performance and efficiency of renewable energy systems, such as managing fluid pressures in hydraulic systems for wind turbines or monitoring water pressure in hydroelectric plants. Furthermore, the rise of smart cities and urban development projects in Latin America also requires advanced sensor technologies to optimize the management of utilities like water, gas, and HVAC systems. These emerging sectors offer substantial growth potential for pressure sensor providers, especially those offering innovative, high-performance sensors designed for these specific applications.

Expansion of the Automotive Sector and Electric Vehicle (EV) Market

The Latin American automotive industry, particularly the electric vehicle (EV) segment, presents a growing market opportunity for pressure sensors. As Latin America continues to expand its automotive production, the demand for pressure sensors in vehicle systems, including tire pressure monitoring systems (TPMS) and engine control systems, is expected to rise. Moreover, with the increasing adoption of electric vehicles in the region, pressure sensors are essential for monitoring battery systems, fluid management in cooling systems, and ensuring optimal vehicle performance. As governments in countries like Brazil and Mexico implement stricter environmental regulations and promote the adoption of EVs, there will be a heightened need for advanced pressure sensor technologies to support the growth and performance of these vehicles, further driving demand in the automotive sector.

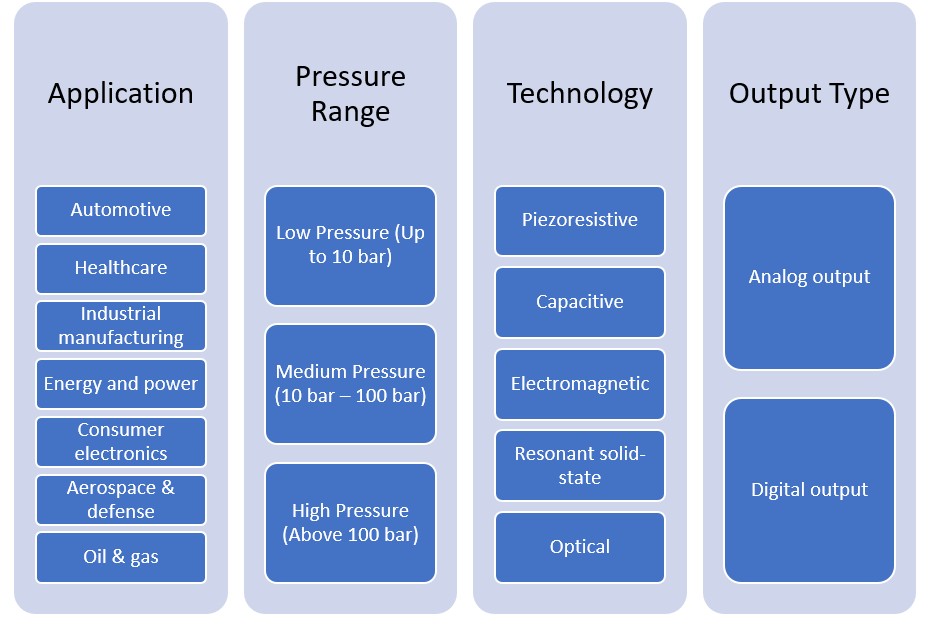

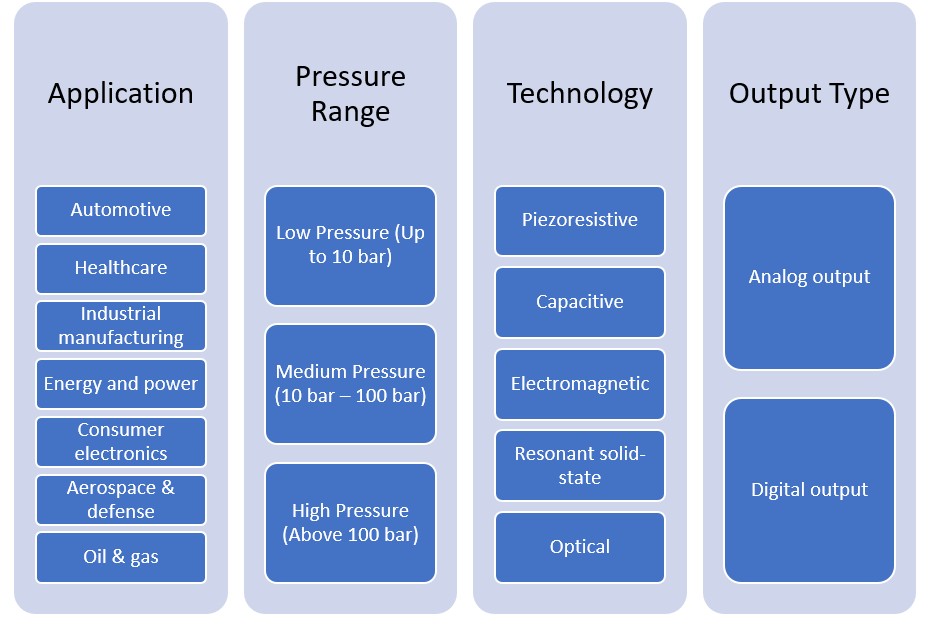

Market Segmentation Analysis

By Application

Pressure sensors are widely used in automotive systems, including tire pressure monitoring systems (TPMS), engine control, and fuel systems. The growing automotive production in Latin America, coupled with an increasing shift towards electric vehicles (EVs), is driving demand for pressure sensors in this sector.In the healthcare industry, pressure sensors are used in medical devices such as blood pressure monitors, respiratory equipment, and infusion pumps. The demand for these sensors is rising as healthcare systems modernize and the adoption of advanced medical technologies grows across the region.Pressure sensors are essential for industrial automation, ensuring precise control over processes in manufacturing. With the ongoing push towards Industry 4.0, the demand for pressure sensors in automation and process control systems is expanding, especially in industries such as chemicals, food and beverage, and pharmaceuticals.The energy and power sector, particularly in oil, gas, and renewable energy, significantly relies on pressure sensors to monitor and control pressure levels in pipelines, drilling operations, and energy systems. The growing focus on sustainable energy and the expansion of renewable energy projects further fuel the demand for pressure sensors.Consumer electronics such as wearable devices and smart home appliances increasingly rely on pressure sensors to provide functionality in features like air quality monitoring and touch-sensitive interfaces. This segment is experiencing growth as more devices incorporate smart sensor technology.Aerospace and defense applications demand highly reliable and durable pressure sensors for monitoring pressure in various systems, such as fuel systems and environmental control systems. Latin America’s growing aerospace industry, particularly in Brazil, is contributing to the demand for these sensors.The oil and gas industry is a dominant user of pressure sensors for monitoring fluid and gas pressure in exploration, extraction, and transportation processes. Given Latin America’s rich reserves in countries like Brazil, Mexico, and Venezuela, the demand for these sensors in the oil & gas industry is substantial.

By Pressure Range

Low Pressure (Up to 10 bar) sensors designed for low-pressure applications are used in systems requiring low-pressure measurement, such as HVAC systems, automotive, and water treatment facilities. This segment is growing as industries increasingly adopt sensors for monitoring and regulating low-pressure environments. Medium Pressure (10 bar – 100 bar) sensors are commonly used in applications such as industrial manufacturing and automotive systems. The demand for these sensors is increasing as industries focus on optimizing process control and enhancing system safety.High Pressure (Above 100 bar) sensors are critical in demanding applications like oil and gas, aerospace, and power generation. These sensors are designed to withstand extreme pressures and provide accurate measurements in high-stress environments. The oil & gas sector, in particular, continues to be a key driver for high-pressure sensors.

Segments

Based on Application

- Automotive

- Healthcare

- Industrial manufacturing

- Energy and power

- Consumer electronics

- Aerospace & defenseOil & gas

Based on pressure Range

- Low Pressure (Up to 10 bar)

- Medium Pressure (10 bar – 100 bar)

- High Pressure (Above 100 bar)

Based on Technology

- Piezoresistive

- Capacitivem

- Electromagnetic

- Resonant solid-state

- Optical

Based on Output Type

- Analog output

- Digital output

Based on Region

- Brazil

- Mexico

- Argentina and Chile

- Other Latin American Countries

Regional Analysis

Brazil (45%)

Brazil holds the largest share of the Latin American pressure sensor market, accounting for approximately 45% of the total market. This is due to Brazil’s strong industrial base, particularly in the automotive, oil & gas, and aerospace sectors. The country’s vast oil reserves and offshore oil rigs significantly drive the demand for pressure sensors, as these systems are essential for monitoring and controlling fluid and gas pressures during exploration and extraction processes. Additionally, Brazil’s automotive industry, one of the largest in the region, heavily relies on pressure sensors for applications such as tire pressure monitoring and engine control systems. The country’s increasing investment in renewable energy, particularly wind and solar power, also presents new growth opportunities for pressure sensor applications.

Mexico (30%)

Mexico is another key player in the Latin American pressure sensor market, contributing about 30% of the market share. The country’s automotive industry, which is one of the largest in the world, remains a major driver for demand. Mexico’s manufacturing capabilities, especially in vehicle production, require the integration of pressure sensors in various systems, including engine control units and safety systems. Moreover, Mexico’s increasing focus on energy efficiency, both in industrial operations and renewable energy projects, is contributing to the rising demand for advanced pressure sensors in sectors like oil & gas and energy. The growing use of sensors for managing energy consumption and ensuring the safe operation of critical infrastructure adds to the market’s expansion in Mexico.

Key players

- Emerson Electric Co.

- TE Connectivity Ltd.

- ABB Ltd.

- Yokogawa Electric Corporation

- NXP Semiconductors N.V.

Competitive Analysis

The Latin America pressure sensor market is highly competitive, with key players leveraging technological innovation, strong market presence, and diverse product portfolios to maintain their leadership positions. Emerson Electric Co. leads with a comprehensive range of pressure sensor solutions designed for industrial, automotive, and energy applications. TE Connectivity Ltd. offers advanced sensors with a focus on wireless and IoT-enabled solutions, capitalizing on the region’s growing demand for connected systems. ABB Ltd. focuses on high-performance, industrial-grade sensors, with a strong emphasis on automation and energy efficiency. Yokogawa Electric Corporation is known for its precision sensors tailored to the energy and process control sectors, while NXP Semiconductors N.V. excels in automotive and consumer electronics applications, offering compact and cost-effective pressure sensors. These companies differentiate themselves through innovation, strategic partnerships, and robust market strategies, positioning them to capitalize on emerging opportunities in Latin America’s rapidly evolving industrial and automotive sectors.

Recent Developments

- In March 2025, Honeywell International Inc launched the TruStability NSC Series pressure sensors, offering uncompensated and unamplified options for customers to perform their own calibration while benefiting from industry-leading stability, accuracy, and repeatability.

- In August 2024, Bosch Sensortec introduced the BMP581 barometric pressure sensor, utilizing capacitive technology instead of piezoresistive, resulting in 85% lower current consumption (1.3 µA), 80% reduced noise (0.08 Pa), and 33% improved temperature coefficient offset (± 0.5 Pa/K).

- In July 2024, Analog Devices Inc. released the MAX40109 low-power precision sensor interface SoC for pressure sensor applications, featuring a high-precision programmable analog front-end and digital signal processing capabilities.

- In November 2023, IFM Electronic released a series of wireless pressure sensors designed specifically for remote monitoring in oil and gas applications.

Market Concentration and Characteristics

The Latin America Pressure Sensor Market exhibits moderate to high market concentration, with a few dominant players holding significant market shares, such as Emerson Electric Co., TE Connectivity Ltd., ABB Ltd., Yokogawa Electric Corporation, and NXP Semiconductors N.V. These companies lead the market by offering advanced and diversified product portfolios, focusing on industrial, automotive, energy, and healthcare applications. The market is characterized by strong competition driven by technological innovation, particularly in wireless and IoT-enabled sensors, and a growing demand for precise and reliable pressure monitoring solutions. While the market is still evolving, it is increasingly shaped by large multinational corporations with global expertise, alongside regional players focusing on sector-specific needs. This dynamic allows for a mix of high-end, specialized sensors and cost-effective solutions, catering to both large industries and smaller businesses across various sectors in Latin America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Pressure Range, Technology, Output Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As Latin America embraces Industry 4.0, pressure sensors will see increased adoption in automated manufacturing systems, driving demand for precision measurement tools. This trend will promote operational efficiency and reduce maintenance costs across sectors.

- The expansion of renewable energy in Latin America, particularly in solar and wind power, will lead to greater use of pressure sensors in energy generation and management systems. These sensors will help optimize the performance of renewable energy infrastructure.

- The demand for IoT-enabled pressure sensors will grow as industries seek smarter, connected systems for real-time data monitoring and decision-making. IoT integration will enable enhanced performance and predictive maintenance capabilities.

- As electric vehicle (EV) production accelerates in Latin America, pressure sensors will be increasingly utilized for battery management and cooling systems. The shift toward EVs will create new opportunities for sensor suppliers in the automotive sector.

- The oil and gas industry will remain a key market driver, with pressure sensors essential for monitoring drilling operations, pipelines, and offshore rigs. Ongoing exploration activities in countries like Brazil and Mexico will support this growth.

- Advancements in sensor technologies, such as miniaturization and enhanced sensitivity, will fuel demand for more precise and reliable pressure sensors. These innovations will cater to emerging applications in aerospace, healthcare, and automotive sectors.

- As industries prioritize energy efficiency and sustainability, pressure sensors will be critical in managing energy consumption, reducing emissions, and ensuring the safe operation of industrial systems. Regulations will encourage the use of more advanced sensor solutions.

- The development of smart cities in Latin America will create opportunities for pressure sensors in urban infrastructure systems, such as water, gas, and HVAC networks. Smart city initiatives will drive demand for real-time pressure monitoring solutions.

- Pressure sensors will increasingly be integrated into healthcare devices such as blood pressure monitors and respiratory systems. The growing focus on health monitoring and medical advancements will contribute to higher demand for sensors in the healthcare sector.

- While Brazil and Mexico dominate the market, emerging economies in Latin America will see growth in pressure sensor adoption. Countries like Argentina, Chile, and Colombia will contribute to market expansion through increased industrial activities and infrastructure investments.