Market Overview

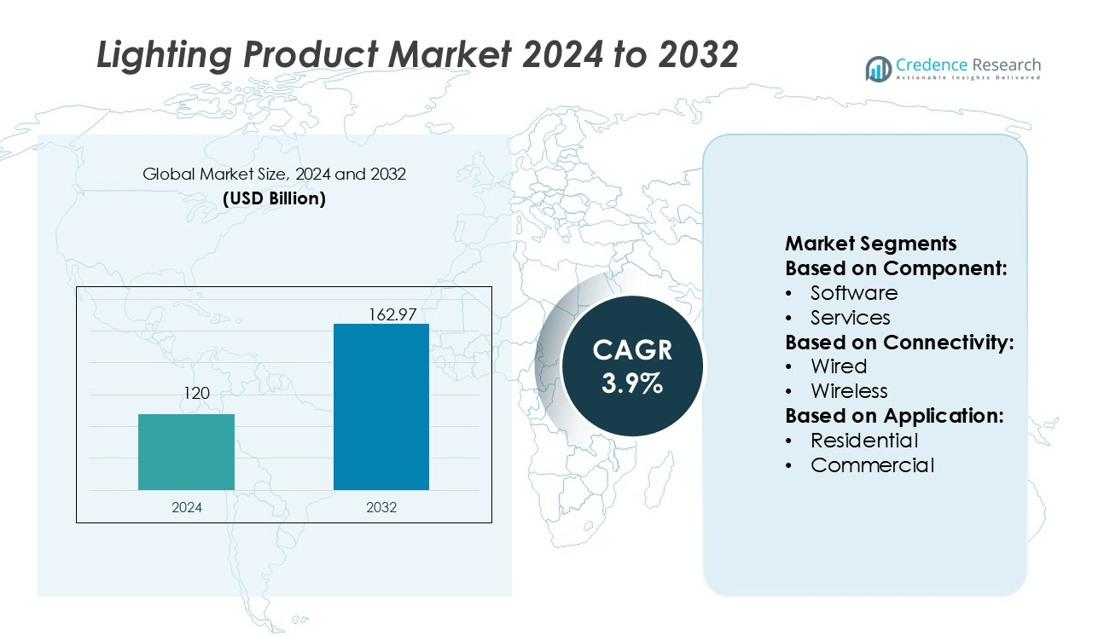

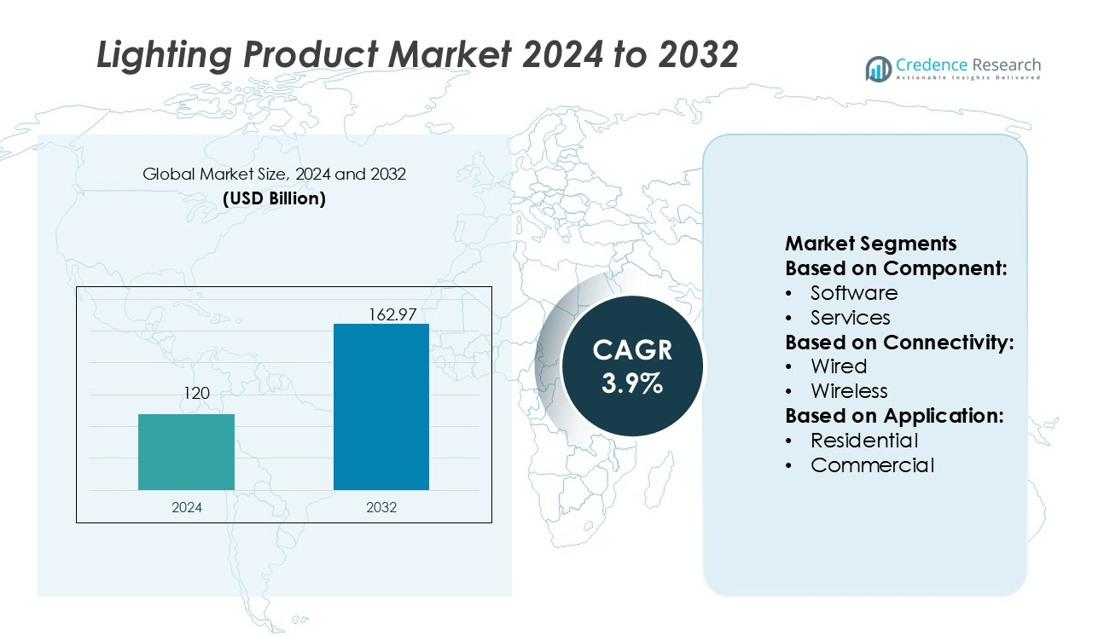

Lighting Product Market size was valued USD 120 billion in 2024 and is anticipated to reach USD 162.97 billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lighting Product Market Size 2024 |

USD 120 billion |

| Lighting Product Market, CAGR |

3.9% |

| Lighting Product Market Size 2032 |

USD 162.97 billion |

The lighting product market is shaped by leading players such as Signify Holding, Acuity Brands, Inc., OSRAM GmbH, Eaton Corporation, Cree Lighting, Nichia Corporation, GE Lighting, Seoul Semiconductor Co., Ltd., Everlight Electronics Co., Ltd., and Hubbell Incorporated. These companies drive growth through advancements in LED technology, smart lighting systems, and energy-efficient solutions tailored for residential, commercial, and industrial applications. Asia-Pacific emerges as the leading region, commanding a 34% market share in 2024, supported by rapid urbanization, large-scale construction projects, and strong government initiatives promoting energy efficiency and sustainable infrastructure development.

Market Insights

- The Lighting Product Market size was valued at USD 120 billion in 2024 and is projected to reach USD 162.97 billion by 2032, growing at a CAGR of 3.9%.

- Growing demand for energy-efficient solutions and rapid adoption of LED technology remain the key market drivers, supported by government regulations promoting sustainability and reduced energy consumption.

- The market is witnessing strong trends in smart and wireless lighting systems, with IoT-enabled and adaptive lighting gaining traction across residential and commercial applications.

- Competitive intensity is high, with companies such as Signify Holding, Acuity Brands, Inc., OSRAM GmbH, Eaton Corporation, Cree Lighting, and others investing in R&D, sustainability initiatives, and expansion into emerging markets.

- Asia-Pacific leads with 34% share in 2024, followed by North America at 29% and Europe at 27%, while indoor applications dominate with 71% share, reinforcing the region’s leadership and driving global market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment dominates the lighting product market with over 62% share in 2024. Within this segment, luminaires hold the largest portion due to their widespread adoption in residential and commercial spaces. Growth is fueled by rising demand for LED-based luminaires, which offer higher energy efficiency and longer lifespan compared to conventional lighting. Technological advancements in smart fixtures and integration of sensors further enhance adoption. Software and services remain smaller but show steady growth, driven by smart lighting management systems and after-sales maintenance needs.

- For instance, Cree Lighting’s OSQ Series area luminaire delivers between 4,000 and 85,000 lumens and reaches up to 171 LPW efficacy in outdoor lighting applications.

By Connectivity

Wireless connectivity leads the market with a 58% share, driven by the shift toward smart and connected lighting solutions. Wireless systems enable seamless integration with IoT platforms, offering control through smartphones and voice assistants. Residential and commercial users prefer wireless setups for their flexibility, reduced installation costs, and scalability. The dominance of wireless lighting is reinforced by rising adoption of Wi-Fi, Zigbee, and Bluetooth-enabled lighting devices. Wired systems still hold relevance in large-scale infrastructure projects requiring stability, but they are losing ground to wireless alternatives.

- For instance, GE’s Cync Direct Connect smart bulbs operate on the 2.4 GHz Wi-Fi band and require no hub. GE’s Daintree WIZ100 wireless module integrates PIR sensing inside a fixture and communicates via low-power wireless to control nodes.

By Application

Indoor lighting dominates the market with 71% share, driven by residential and commercial usage. Residential applications lead within this segment due to growing smart home adoption, rising renovation projects, and consumer demand for energy-efficient LED lighting. Commercial spaces, including offices, retail outlets, and hospitality facilities, also contribute significantly, driven by sustainability initiatives and smart building integration. Indoor lighting demand is further strengthened by regulatory standards pushing for energy conservation. Outdoor lighting plays a smaller role but grows steadily with investments in urban infrastructure and smart city projects.

Key Growth Drivers

Rising Adoption of LED Technology

LED lighting dominates the market due to its superior energy efficiency and long operational life. Consumers and businesses are rapidly replacing traditional incandescent and fluorescent lights with LED solutions. Governments worldwide support this shift with regulations and incentives targeting reduced energy consumption. Continuous advancements in LED chip design have lowered production costs, making LEDs more affordable. This transition not only reduces electricity bills but also aligns with sustainability goals, pushing large-scale adoption across residential, commercial, and industrial applications.

- For instance, OSRAM’s OSLON™ UV 3535 UV-C LED, a compact and durable device designed for disinfection and treatment solutions, delivering a significant 115 milliwatt optical output at a peak wavelength of 265 nanometers and a long operating lifetime of over 20,000 hours.

Growing Smart Home and Building Automation

The increasing integration of IoT technologies fuels demand for smart lighting solutions. Smart homes and connected buildings rely heavily on lighting products integrated with sensors, wireless connectivity, and automation platforms. Consumers prefer lighting systems controlled through smartphones or voice assistants for convenience and energy savings. Commercial buildings adopt smart lighting to reduce operational costs and meet sustainability certifications. This trend drives rapid innovation in adaptive lighting and demand-response systems, ensuring energy optimization and user comfort across diverse environments.

- For instance, Hubbell’s NX Distributed Intelligence™ platform uses NX Area Controllers to manage up to 1,000 NX devices (including luminaires, sensors, and switches) in wired, wireless, or hybrid mode.

Supportive Government Policies and Energy Regulations

Government mandates for energy-efficient infrastructure strongly support the market’s growth. Regulations banning incandescent bulbs and encouraging eco-friendly alternatives drive adoption of modern lighting systems. Financial incentives, tax rebates, and subsidies for energy-efficient lighting encourage both businesses and households to upgrade. National and regional policies targeting carbon neutrality further accelerate LED penetration. Public infrastructure projects, including smart cities and urban modernization, prioritize advanced lighting solutions, creating long-term growth opportunities for manufacturers and solution providers in this evolving market.

Key Trends & Opportunities

Expansion of Wireless and Smart Lighting Systems

Wireless lighting products are emerging as a dominant trend due to rising smart home adoption. Connectivity solutions like Wi-Fi, Zigbee, and Bluetooth are enabling flexible, scalable lighting systems. The ability to integrate with voice control platforms, sensors, and energy management systems enhances value. Commercial and residential customers adopt wireless lighting for convenience, energy efficiency, and reduced installation costs. As 5G networks expand, opportunities will grow for manufacturers to develop advanced wireless-enabled lighting ecosystems tailored for homes, offices, and public infrastructure.

- For instance, Nichia and Infineon launched a micro-LED matrix (µPLS) with 16,384 individual LEDs controlled via a driver IC, enabling high-definition adaptive lighting in automotive use.

Sustainability and Circular Economy Focus

Sustainability is shaping product design and corporate strategies in the lighting sector. Manufacturers are adopting recyclable materials, eco-friendly packaging, and energy-efficient designs. Circular economy models encourage refurbishment and reuse of lighting components to minimize waste. Consumers and enterprises prioritize sustainable brands aligned with environmental goals. Green certifications and building standards further amplify this trend. With increasing emphasis on reducing carbon footprints, opportunities arise for companies to innovate in low-impact lighting technologies while gaining a competitive advantage in global markets.

- For instance, Eaton’s program, which is based in France, states that it reuses up to 70% of the plastics from the returned units. The company highlights this as part of its circular economy and sustainable development initiatives.

Key Challenges

High Initial Installation and Retrofit Costs

Although energy-efficient lighting reduces long-term expenses, high upfront costs remain a barrier. Retrofitting old buildings with smart or LED lighting systems requires significant investment in hardware and installation. Small and medium enterprises often delay adoption due to budget limitations. In developing economies, consumer affordability continues to hinder mass adoption despite long-term savings. Manufacturers face the challenge of offering cost-effective solutions that balance efficiency with affordability to drive broader penetration of advanced lighting technologies worldwide.

Complexity in Integration with IoT and Building Systems

The growing reliance on smart and connected lighting introduces integration challenges. Compatibility issues between lighting products, IoT platforms, and building automation systems often slow adoption. Businesses face concerns regarding interoperability, cybersecurity, and data privacy when deploying smart lighting. Lack of standardization across wireless protocols also complicates implementation. Vendors must invest in open standards, secure platforms, and user-friendly systems to overcome these challenges. Ensuring smooth integration with broader smart building ecosystems will be essential for driving large-scale adoption.

Regional Analysis

North America

North America holds a 29% share of the lighting product market, supported by advanced infrastructure and strong adoption of smart technologies. The U.S. leads demand, driven by energy efficiency regulations, retrofitting projects, and smart building initiatives. Canada contributes with growing investments in green buildings and residential renovations. The region benefits from rapid penetration of LED luminaires and wireless lighting systems. Increasing focus on sustainability, supported by government incentives and corporate commitments to carbon neutrality, drives further adoption. Strong presence of global lighting manufacturers ensures competitive innovation, reinforcing North America’s position as a mature yet steadily growing market.

Europe

Europe accounts for 27% of the global market, with Germany, the U.K., and France leading adoption. The region’s strict environmental regulations and the EU’s focus on carbon neutrality strongly support LED and smart lighting penetration. Widespread retrofitting of old infrastructure creates high demand for energy-efficient luminaires. Smart city initiatives in countries such as the Netherlands and Spain boost adoption of wireless and connected lighting systems. European consumers prioritize sustainability, driving companies to adopt recyclable materials and eco-friendly designs. Continuous innovation, combined with regulatory support, strengthens Europe’s role as a leader in sustainable lighting technology and energy-efficient solutions.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share, led by China, India, and Japan. Rapid urbanization, expanding construction, and government-led energy-saving initiatives fuel strong growth. China is the largest producer and consumer of LED lighting, while India’s smart city projects drive rapid demand for connected solutions. Japan focuses on energy-efficient upgrades in residential and commercial spaces. Affordable manufacturing, rising disposable income, and infrastructure development create opportunities across the region. Asia-Pacific also benefits from strong supply chains and competitive pricing, positioning it as both a production hub and the fastest-growing consumer market for modern lighting solutions.

Latin America

Latin America captures a 6% market share, with Brazil and Mexico leading regional adoption. Government energy-efficiency programs and urban development projects drive demand for LED and luminaire products. Rising adoption of wireless lighting solutions in residential and commercial applications supports steady growth. However, affordability challenges and limited infrastructure investment slow wider market penetration. Multinational players are expanding their presence to meet increasing consumer demand for energy-efficient lighting. Local distributors and online channels play a growing role in adoption. Despite challenges, Latin America shows strong potential as modernization and smart city projects gain momentum in key economies.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the market, with growth fueled by infrastructure investments and smart city projects. The UAE and Saudi Arabia drive demand through large-scale construction and commercial developments, focusing on sustainable and energy-efficient solutions. Africa’s adoption is slower due to affordability barriers but is rising with renewable energy projects and urbanization. LED lighting sees growing demand due to reduced electricity costs in power-constrained areas. International manufacturers expand partnerships to address regional needs, while government initiatives supporting sustainability boost gradual market penetration across commercial, residential, and public infrastructure segments.

Market Segmentations:

By Component:

By Connectivity:

By Application:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the lighting product market features key players such as Seoul Semiconductor Co., Ltd., Cree Lighting, GE Lighting, Everlight Electronics Co., Ltd., OSRAM GmbH, Hubbell Incorporated, Nichia Corporation, Eaton Corporation, Acuity Brands, Inc., and Signify Holding. The lighting product market is defined by rapid innovation, strong focus on sustainability, and expansion of smart lighting solutions. Companies prioritize energy-efficient technologies, with LED and wireless lighting systems leading adoption across residential, commercial, and industrial applications. Market competition intensifies as manufacturers integrate IoT, sensors, and automation platforms into product portfolios to meet growing demand for connected solutions. Sustainability drives further differentiation, with emphasis on recyclable materials, eco-friendly designs, and compliance with stringent energy regulations. Strategic partnerships, mergers, and R&D investments remain central to gaining market share in this dynamic and evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Dixon Technologies and Netherlands-based multinational Signify signed a binding term sheet to form a joint venture in India to manufacture lighting products and accessories as an original equipment manufacturer (OEM). In the deal, Dixon and Signify will each own a 50% stake in the new entity.

- In January 2025, LIFX took center stage at CES with the introduction of some new lighting products, among them a new series of ‘skylights’ from its parent, Feit Electric. Some of the standout features included the LIFX Luna, a specially designed, multi-functional smart lamp engineered to improve a range of spaces, from desks and nightstands to wall-mounted displays.

- In October 2024, Bajaj Lighting, with over 80 years of generational expertise in lighting solutions, announced its revamped positioning under the tagline “Built to Shine.” This strategic shift is expected to drive positive impacts on business growth and reinforce Bajaj’s dominance in the lighting industry.

- In August 2024, Philips Hue ventured into affordability with the launch of the new Tento ceiling light lineup. Philips has tons of fully integrated smart lamps – and with modern LEDs, it’s not like you’ll be changing a lot of bulbs, anyway.

Report Coverage

The research report offers an in-depth analysis based on Component, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward LED dominance driven by efficiency and longevity.

- Wireless and IoT-enabled lighting will expand as smart homes and buildings gain traction.

- Sustainability will guide innovation with recyclable materials and eco-friendly product designs.

- Smart city projects will accelerate adoption of connected outdoor and infrastructure lighting.

- Integration with AI and sensors will enhance adaptive lighting and energy management.

- Demand for retrofitting solutions will rise as aging infrastructure requires modernization.

- Commercial and industrial sectors will drive growth through automation and cost-saving initiatives.

- Regulatory policies will further push adoption of energy-efficient lighting technologies.

- Emerging markets will witness strong growth due to urbanization and rising construction.

- Strategic collaborations and R&D investments will shape competitive differentiation and innovation.