Market Overview

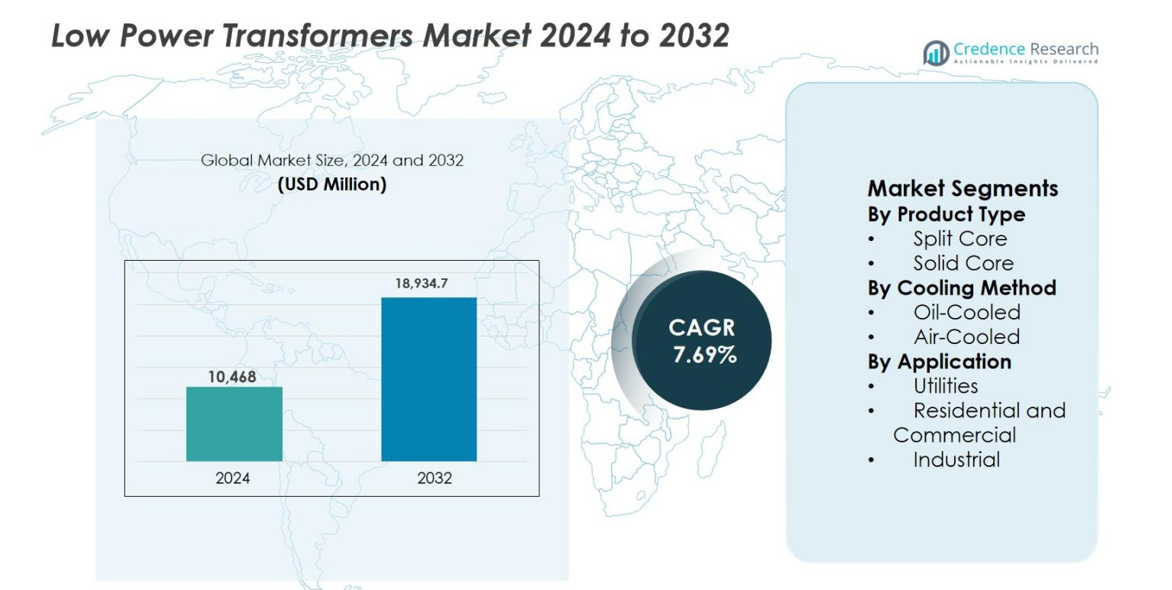

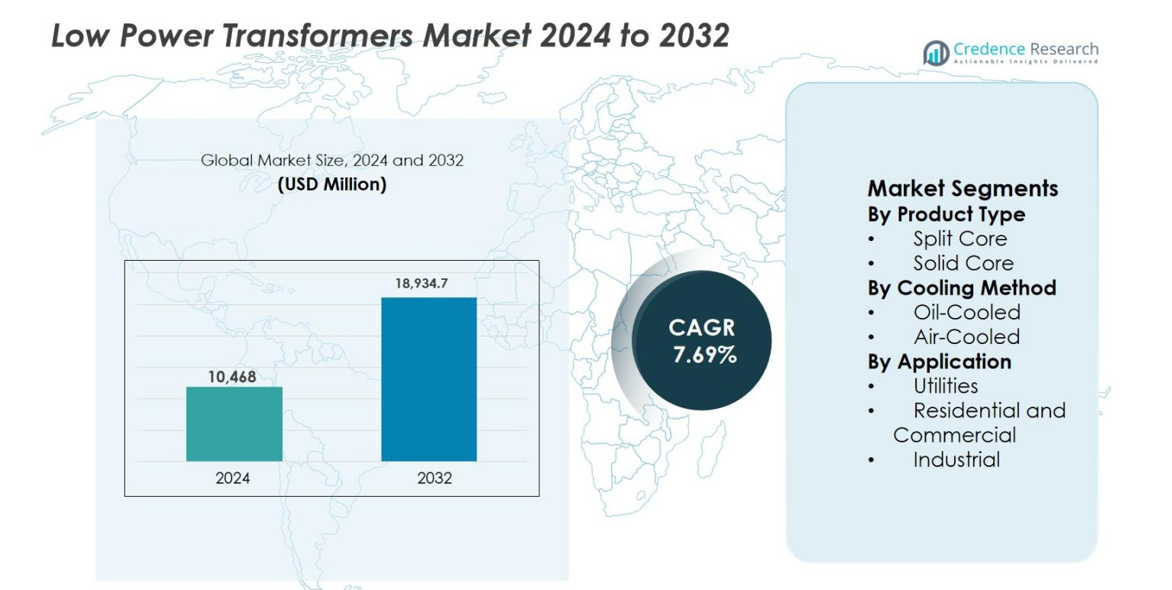

The Low Power Transformers Market size was valued at USD 10,468 million in 2024 and is anticipated to reach USD 18,934.7 million by 2032, growing at a CAGR of 7.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Power Transformers Market Size 2024 |

USD 10,468 million |

| Low Power Transformers Market, CAGR |

7.69% |

| Low Power Transformers Market Size 2032 |

USD 18,934.7 million |

The Low Power Transformers Market is led by established global players such as ABB Ltd., Siemens AG, Schneider Electric SE, Hitachi Energy Ltd., GE Vernova Inc., Mitsubishi Electric Power Products, Inc., Toshiba International Corporation, and Hyosung Corporation, which focus on energy-efficient designs, smart transformer technologies, and grid modernization solutions. Regional manufacturers including CG Power & Industrial Solutions Ltd. and Bharat Heavy Electricals Limited (BHEL) strengthen competition through localized production and strong utility partnerships. Asia-Pacific dominates the Low Power Transformers Market with a 34.8% share, driven by rapid urbanization, grid expansion, and industrial growth, followed by North America at 28.6% and Europe at 24.3%, supported by infrastructure upgrades and strict efficiency regulations.

Market Insights

- The Low Power Transformers Market was valued at USD 10,468 million in 2024 and is projected to reach USD 18,934.7 million by 2032, expanding at a CAGR of 7.69% during the forecast period.

- Market growth is driven by grid modernization, smart metering deployment, and rising electrification across residential, commercial, and industrial sectors, with utilities remaining the largest application segment holding nearly 45.7% share due to continuous upgrades in distribution networks.

- Key trends include increasing adoption of air-cooled transformers, which dominate with around 68.4% share, and growing integration of digital monitoring and smart sensing technologies to support predictive maintenance and energy efficiency.

- The market features strong competition among global players such as ABB, Siemens, Schneider Electric, and Hitachi Energy, alongside regional manufacturers focusing on cost efficiency, localized production, and utility partnerships to strengthen market presence.

- Asia-Pacific leads the market with a 34.8% share, followed by North America at 28.6% and Europe at 24.3%, driven by rapid urbanization, infrastructure investment, and strict energy efficiency regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The By Product Type segment of the Low Power Transformers Market is led by Solid Core transformers, which accounted for 62.8% market share in 2024. Solid core designs dominate due to their higher efficiency, lower magnetic losses, and suitability for continuous load applications. These transformers are widely used in metering, protection, and power distribution systems where accuracy and durability are critical. Growing investments in grid modernization, smart metering infrastructure, and industrial automation continue to drive demand. In contrast, split core transformers gain traction mainly in retrofit and maintenance applications due to easier installation.

- For instance, Siemens introduced its Sensformer™ digital transformer portfolio at Hannover Messe, adding connectivity and monitoring capabilities across transformer classes to support grid visibility.

By Cooling Method

The By Cooling Method segment is dominated by Air-Cooled transformers, holding 68.4% of the market share in 2024. Air-cooled systems are preferred for low power applications due to their lower maintenance requirements, environmental safety, and cost-effectiveness compared to oil-cooled alternatives. Increasing adoption in commercial buildings, data centers, and light industrial facilities supports growth. Stricter environmental regulations restricting oil usage and rising demand for compact, indoor-installed transformers further strengthen air-cooled dominance, while oil-cooled units remain limited to specific utility and heavy-duty operating conditions.

- For instance, ABB has documented the use of its RESIBLOC® dry-type transformer technology in industrial facilities, highlighting reduced maintenance needs and compliance with strict indoor fire-safety standards.

By Application

Within the By Application segment, Utilities emerged as the dominant sub-segment, capturing 45.7% of the market share in 2024. Utilities rely heavily on low power transformers for voltage regulation, monitoring, and protection across distribution networks. Rising investments in smart grids, renewable energy integration, and grid reliability enhancement drive sustained demand. Utility-led replacement of aging infrastructure and increased deployment of distribution automation systems further reinforce this dominance. Meanwhile, residential, commercial, and industrial applications grow steadily with expanding urbanization and electrification initiatives.

Key Growth Drivers

Grid Modernization and Smart Infrastructure Expansion

Grid modernization initiatives are a major growth driver for the Low Power Transformers Market as utilities upgrade aging transmission and distribution networks. Low power transformers support voltage regulation, metering, protection, and monitoring functions critical to smart grid deployment. Investments in advanced metering infrastructure, automated substations, and digital control systems increase demand for efficient and reliable transformers. Governments focus on improving grid resilience, reducing outages, and enabling real-time monitoring. Integration of distributed energy resources further accelerates replacement of conventional equipment, driving sustained adoption of low power transformers across utility and infrastructure projects.

- For instance, Hitachi Energy launched its TXpert™ ecosystem, enabling digital monitoring of transformers to support predictive maintenance and real-time grid intelligence in modern substations.

Rising Electrification and Urban Infrastructure Development

Rapid urbanization and expanding electrification across residential, commercial, and light industrial sectors significantly drive the Low Power Transformers Market. New housing developments, commercial complexes, transportation systems, and public utilities require reliable power distribution and control equipment. Low power transformers enable step-down applications for building management systems, lighting, safety equipment, and automation controls. Strong infrastructure spending in emerging economies and smart city initiatives further boost installations. Growing electricity consumption from digital devices, HVAC systems, and connected systems reinforces demand for efficient and compact transformer solutions.

- For instance, Toshiba Energy Systems & Solutions has supplied dry-type and molded-case low power transformers for commercial buildings and transportation infrastructure, emphasizing compact design and indoor safety for urban electrification projects.

Industrial Automation and Energy Efficiency Requirements

Industrial automation drives steady growth in the Low Power Transformers Market as factories adopt robotics, process control systems, and smart manufacturing technologies. These systems require stable, precise, and efficient power supply for control circuits and monitoring devices. Simultaneously, rising focus on energy efficiency and loss reduction encourages replacement of older transformers with high-efficiency models. Regulatory standards promoting lower energy losses and operating costs support adoption. Manufacturers seek improved productivity, reduced downtime, and compliance with efficiency norms, strengthening demand for advanced low power transformer solutions.

Key Trends & Opportunities

Adoption of Air-Cooled and Eco-Friendly Transformer Designs

The Low Power Transformers Market is witnessing a shift toward air-cooled and environmentally friendly designs. Air-cooled transformers offer lower maintenance, reduced fire risk, and elimination of oil-related environmental concerns. These features make them suitable for indoor applications such as commercial buildings, data centers, and residential installations. Increasing regulatory pressure on oil usage and sustainability goals encourage manufacturers to develop dry-type, recyclable, and low-emission products. This trend creates opportunities for innovation in compact design, noise reduction, and thermal efficiency.

- For instance, Schneider Electric has advanced its Trihal® dry-type transformer range using cast-resin insulation, designed for indoor commercial buildings and data centers with zero oil leakage and enhanced fire safety.

Integration with Smart Monitoring and Digital Technologies

Integration of digital monitoring and smart sensing technologies presents a strong opportunity in the Low Power Transformers Market. Utilities and industries increasingly demand transformers with embedded sensors and communication capabilities for real-time performance tracking. Smart transformers enable predictive maintenance, reduce unplanned downtime, and improve grid reliability. Growing adoption of digital substations, IoT platforms, and Industry 4.0 solutions accelerates demand. Manufacturers offering digitally enabled transformers can capture higher-value applications and long-term service-based revenue opportunities.

- For instance, Toshiba Energy Systems & Solutions has developed digitally monitored distribution and control transformers that support condition monitoring and remote diagnostics for substations and industrial power networks.

Key Challenges

Price Sensitivity and Competitive Pressure

Price sensitivity remains a major challenge in the Low Power Transformers Market, particularly in cost-driven regions. Customers often prioritize initial purchase cost over lifecycle efficiency, limiting adoption of advanced products. Intense competition among global and regional manufacturers further compresses margins. Standardization across low power transformer offerings reduces differentiation. Companies must balance cost optimization with quality, efficiency, and regulatory compliance, requiring continuous improvement in manufacturing efficiency and supply chain management.

Raw Material Price Volatility and Supply Chain Risks

Volatility in raw material prices, especially copper, aluminum, and electrical steel, poses a significant challenge for the Low Power Transformers Market. Fluctuating input costs directly impact production expenses and profitability. Supply chain disruptions and geopolitical uncertainties add further risk. Smaller manufacturers face greater exposure to margin pressure and project delays. Effective risk management through long-term sourcing contracts, alternative materials, and improved inventory planning is essential to maintain pricing stability and operational continuity.

Regional Analysis

North America

North America accounted for 28.6% of the Low Power Transformers Market in 2024, driven by strong investments in grid modernization, smart metering, and infrastructure upgrades. Utilities across the United States and Canada actively replace aging electrical assets to improve reliability and energy efficiency. Rising deployment of data centers, commercial buildings, and industrial automation systems further supports demand. Regulatory emphasis on energy-efficient equipment and safety standards accelerates adoption of advanced air-cooled and digitally enabled low power transformers. Ongoing electrification initiatives and renewable energy integration continue to reinforce steady market growth across the region.

Europe

Europe held 24.3% market share in 2024 in the Low Power Transformers Market, supported by strict energy efficiency regulations and sustainability-focused policies. Countries such as Germany, France, and the UK invest heavily in grid resilience, renewable integration, and smart grid technologies. Strong demand from commercial infrastructure, rail networks, and industrial automation applications fuels market expansion. The region shows high adoption of eco-friendly, dry-type, and air-cooled transformers due to environmental compliance requirements. Continuous replacement of legacy systems and emphasis on low-loss electrical equipment sustain long-term growth prospects.

Asia-Pacific

Asia-Pacific dominated the Low Power Transformers Market with 34.8% market share in 2024, making it the largest regional contributor. Rapid urbanization, industrialization, and expanding electrification programs across China, India, Southeast Asia, and South Korea drive strong demand. Large-scale investments in power distribution networks, smart cities, manufacturing facilities, and renewable energy projects significantly boost transformer installations. Growing residential and commercial construction further supports adoption of low power transformers. Government-led infrastructure development, coupled with rising electricity consumption, positions Asia-Pacific as the fastest-growing regional market during the forecast period.

Latin America

Latin America captured 6.1% of the Low Power Transformers Market in 2024, supported by gradual upgrades to power distribution infrastructure. Countries such as Brazil, Mexico, and Chile invest in grid expansion, renewable energy projects, and urban electrification. Demand from utilities remains the primary growth driver, while commercial and light industrial applications gain traction. Although budget constraints and slower project execution limit rapid expansion, increasing focus on grid reliability and reduction of power losses supports steady adoption. Modernization of aging electrical networks continues to create incremental growth opportunities.

Middle East & Africa

The Middle East & Africa region accounted for 6.2% market share in 2024 in the Low Power Transformers Market. Growth is driven by investments in power infrastructure, urban development, and industrial projects across Gulf countries and select African economies. Expansion of commercial complexes, transportation networks, and utility distribution systems supports transformer demand. Renewable energy integration and electrification initiatives in emerging African markets further contribute to growth. Despite challenges related to infrastructure gaps and funding constraints, ongoing energy diversification and grid expansion projects sustain moderate market growth across the region.

Market Segmentations:

By Product Type

By Cooling Method

By Application

- Utilities

- Residential and Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Low Power Transformers Market is characterized by the presence of well-established global manufacturers and strong regional players competing on efficiency, reliability, and technological advancement. Leading companies such as ABB Ltd., Siemens AG, Schneider Electric SE, Hitachi Energy Ltd., GE Vernova Inc., Mitsubishi Electric Power Products, Inc., Toshiba International Corporation, and Hyosung Corporation focus on product innovation, energy-efficient designs, and digital integration to strengthen market positioning. Regional players including CG Power & Industrial Solutions Ltd. and Bharat Heavy Electricals Limited (BHEL) leverage localized manufacturing and utility relationships to expand their footprint. Strategic initiatives such as capacity expansion, smart transformer development, and partnerships with utilities support competitive differentiation. Continuous investment in R&D, compliance with efficiency standards, and expansion across high-growth emerging markets remain key strategies shaping competition in the Low Power Transformers Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hyosung Corporation

- Siemens AG

- CG Power & Industrial Solutions Ltd.

- ABB Ltd.

- Toshiba International Corporation

- Hitachi Energy Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- Schneider Electric SE

- Mitsubishi Electric Power Products, Inc.

- GE Vernova Inc.

Recent Developments

- In October 2025, VoltaGrid and Halliburton announced a strategic collaboration to deliver distributed power generation solutions globally, combining VoltaGrid’s QPac power platform with Halliburton’s operational scale to support data center energy infrastructure a partnership impacting power distribution systems that include transformer-related deployment solutions.

- In October 2025, Electroalfa International announced it will soon launch a new transformer production plant in Botoșani, Romania, aimed at expanding manufacturing capacity for transformer products, including low-power units.

- In December 2024, Bourns, Inc. announced the addition of the automotive-grade AEC-Q200 compliant Model HVMA03F40C-ST10S flyback transformer to its transformer product family, enhancing power density and performance for electric vehicles and industrial systems.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Cooling Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Low Power Transformers Market will continue to benefit from sustained investments in grid modernization and distribution network upgrades.

- Rising adoption of smart grids and advanced metering infrastructure will increase demand for accurate and efficient low power transformers.

- Air-cooled and dry-type transformers will see higher penetration due to safety, environmental, and maintenance advantages.

- Integration of digital monitoring, sensors, and IoT-enabled features will become increasingly standard across product offerings.

- Growing urbanization and construction activity will support steady demand from residential and commercial applications.

- Utilities will remain the dominant end users as they replace aging equipment and expand distribution capacity.

- Energy efficiency regulations will encourage the adoption of low-loss and high-performance transformer designs.

- Industrial automation and smart manufacturing initiatives will drive demand for reliable low power control transformers.

- Emerging economies will register faster growth due to electrification programs and infrastructure expansion.

- Strategic partnerships, local manufacturing, and product innovation will shape competitive positioning over the forecast period.