Market Overview

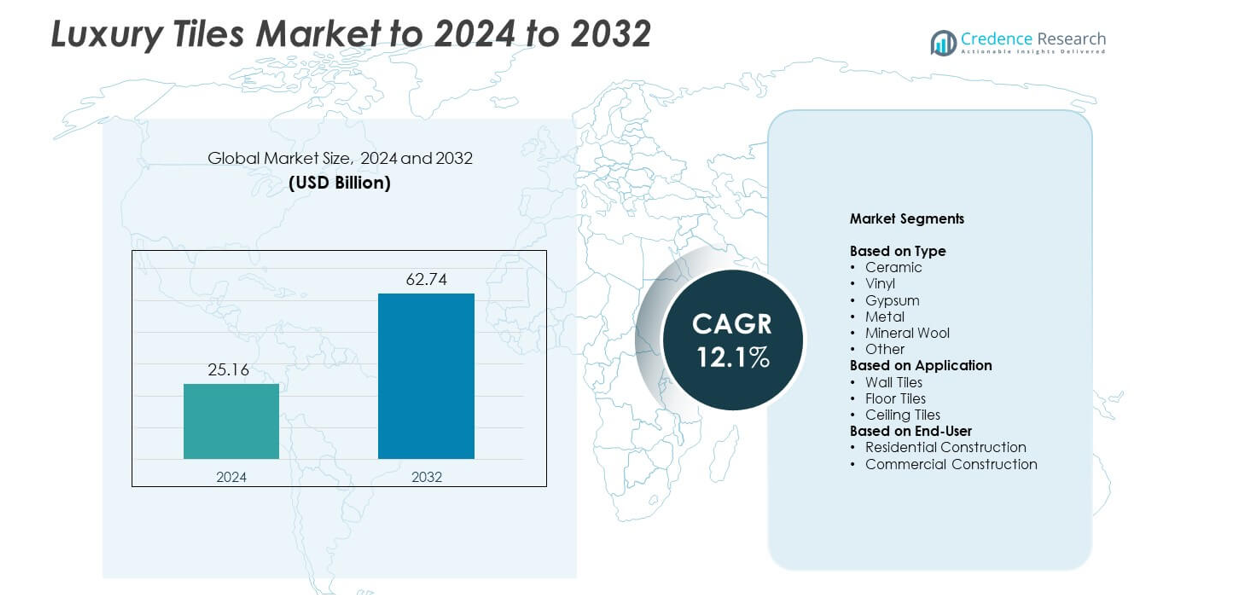

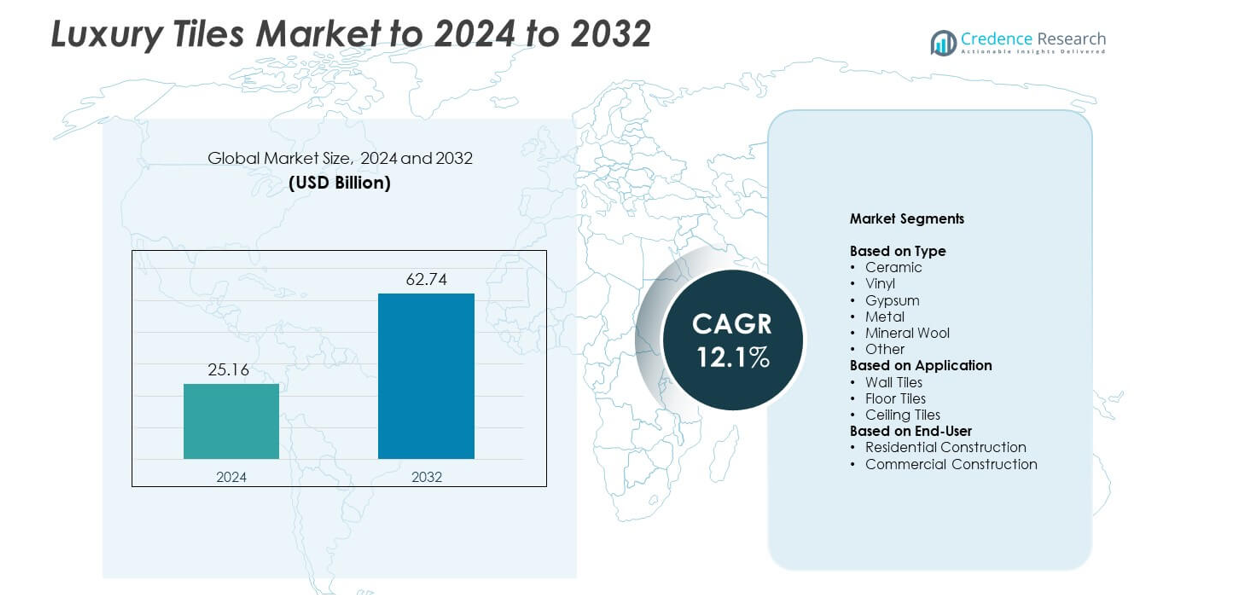

Luxury Tiles Market size was valued USD 25.16 billion in 2024 and is anticipated to reach USD 62.74 billion by 2032, at a CAGR of 12.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Tiles Market Size 2024 |

USD 25.16 billion |

| Luxury Tiles Market, CAGR |

12.1% |

| Luxury Tiles Market Size 2032 |

USD 62.74 billion |

The Luxury Tiles Market is shaped by major players such as Shaw Industries Group, SOLVAY, Rogers Corporation, LINTEC Corporation, Halocarbon, Dupont, Tarkett U.S.A. & Canada, 3M, and The Chemours Company. These companies strengthen their presence through advanced designs, digital printing, and high-performance surface technologies that meet growing demand from residential and commercial projects. Manufacturers expand premium collections and improve distribution across high-growth regions. North America remained the leading regional market in 2024 with about 34% share, driven by strong renovation activity and high preference for premium interior finishes, while Europe and Asia-Pacific followed with sizable shares supported by robust construction trends.

Market Insights

- The Luxury Tiles Market reached USD 25.16 billion in 2024 and is expected to hit USD 62.74 billion by 2032, growing at a CAGR of 12.1%.

- Demand rises due to strong renovation activity, premium home upgrades, and wider adoption of high-quality ceramic tiles, which held the largest type share at about 38% in 2024.

- Large-format designs, eco-friendly materials, and digital-printed luxury surfaces shape current trends as buyers prefer modern, durable, and low-maintenance options.

- Competition stays intense as leading brands expand product portfolios, upgrade manufacturing, and focus on premium finishes to gain share across fast-growing residential and commercial segments.

- North America led the global market with nearly 34% share in 2024, followed by Europe at about 28% and Asia-Pacific at roughly 30%, while floor tiles dominated applications with around 52% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Ceramic led the Luxury Tiles Market in 2024 with about 38% share. Ceramic tiles held a clear lead due to strong durability, wide design options, and steady adoption in premium interiors. Builders prefer ceramic products for moisture resistance and simple upkeep, which raises use across kitchens and bathrooms. Growing demand for luxury matte, polished, and textured finishes further supports this segment. Vinyl and metal tiles grow at a steady pace as buyers look for modern looks and high-performance materials in upscale projects.

- For instance, Kajaria Ceramics reported total tile capacity of 90.50 million square meters in 2025.

By Application

Floor tiles dominated the application segment in 2024 with nearly 52% share. Flooring demand stayed strong as buyers seek long-lasting and stylish surfaces in both homes and commercial spaces. Premium floor tiles offer stain resistance, scratch resistance, and a broad range of luxury designs, which boosts adoption. Rising renovation activity, hotel upgrades, and premium retail spaces help expand this segment. Wall and ceiling tiles grow steadily as designers push for decorative patterns and unique surface textures.

- For instance, RAK Ceramics has global tile production capacity of 118 million square meters per year.

By End-User

Residential construction held the top position in 2024 with around 58% share. Homeowners drive strong demand for luxury tiles as they invest in high-quality flooring, feature walls, and premium bathroom finishes. Rising urban housing, luxury apartment projects, and home renovation trends support this dominance. Builders also choose high-grade tiles for long service life and aesthetic value. Commercial construction grows due to increasing demand from hotels, offices, and retail spaces that want durable and premium-looking interiors.

Key Growth Drivers

Rising Demand for Premium Home Renovation

Home renovation activity continues to rise as buyers seek modern, stylish, and durable surfaces. Luxury tiles gain strong traction due to their long life, moisture resistance, and wide design range. Growing disposable income and urban lifestyle changes also push homeowners toward high-end flooring and wall materials. Developers use luxury tiles to enhance property value, which further lifts demand across major cities.

- For instance, Grupo Lamosa’s corporate profile and other documentation indicate the company has a global production capacity of more than 227 million square meters per year in floor and wall coverings, by the year 2021.

Expansion of Commercial Infrastructure

Hotels, offices, malls, and upscale retail spaces invest heavily in luxury interiors, which boosts tile consumption. Commercial builders choose luxury tiles for durability, stain resistance, and premium appearance. Growth in hospitality and organized retail drives steady project pipelines. Higher footfall areas need long-lasting materials, making luxury tiles a preferred choice across commercial developments worldwide.

- For instance, SCG Decor (SCGD) reports a total annual tile production capacity across all its global operations of approximately 189 million square meters.

Advancement in Manufacturing and Design Technology

Modern printing technologies, digital glazing, and high-definition textures improve tile design quality and realism. Manufacturers now offer stone, marble, and wood-like finishes that appeal to luxury buyers. Improved production lines allow thin, large-format tiles with better strength and lower maintenance needs. These technology upgrades help brands meet rising expectations for premium aesthetics.

Key Trends & Opportunities

Growing Adoption of Sustainable and Eco-Friendly Tiles

Buyers increasingly prefer tiles made from recycled materials and low-emission processes. Green construction standards encourage developers to use eco-friendly products with certified performance. This shift creates strong opportunities for brands that invest in sustainable manufacturing. Rising awareness of indoor air quality also supports demand for safe, non-toxic tile options.

- For instance, Mohawk Industries recycled 44.9 million pounds of end-of-life products through recovery programs in 2023.

Rising Popularity of Large-Format and Designer Tiles

Large slabs and designer patterns gain popularity due to sleek looks and reduced grout lines. Architects use these formats in luxury bathrooms, living areas, and commercial lobbies. Custom textures, metallic finishes, and high-gloss surfaces help brands target premium projects. The trend supports higher margins, creating strong opportunities for manufacturers offering specialty designs.

- For instance, Porcelanosa’s XTONE large-format slabs reach sizes up to 154 by 328 centimeters.

Key Challenges

High Installation and Maintenance Costs

Luxury tiles often require skilled labor, special adhesives, and precise installation, which raises project costs. Large-format tiles demand advanced handling tools and trained technicians. These factors limit adoption in cost-sensitive regions. Higher maintenance expectations for polished and designer tiles also affect buyer decisions, especially in budget-focused markets.

Intense Competition from Alternative High-End Materials

Premium materials like natural stone, engineered wood, and luxury vinyl compete directly with luxury tiles. Many buyers choose alternatives based on texture, warmth, or ease of installation. This competition pressures tile makers to innovate and offer better designs. Brands must differentiate on quality, durability, and aesthetics to maintain their share in the luxury interior market.

Regional Analysis

North America

North America held about 34% share in the Luxury Tiles Market in 2024. Strong remodeling activity and high spending on premium interiors support steady demand across the United States and Canada. Builders prefer durable and stylish surfaces for kitchens, bathrooms, and living areas. Growth in luxury apartments, hotels, and retail chains also increases tile use. Consumers choose high-quality ceramic, porcelain, and designer formats for long life and better looks. Rising adoption of sustainable tiles further strengthens regional growth. Stable economic conditions and strong home improvement trends keep North America in a leading position.

Europe

Europe accounted for nearly 28% share of the Luxury Tiles Market in 2024. The region benefits from strong design culture, advanced tile manufacturing, and steady renovation cycles. Demand rises in Italy, Spain, Germany, and France due to preference for premium surfaces. Builders use luxury tiles to meet high aesthetic expectations and strict quality standards. Growth in sustainable construction supports eco-friendly tile adoption. Commercial spaces such as hotels, offices, and retail outlets expand use of large-format and designer tiles. Stable housing demand and high preference for refined textures keep Europe a key regional market.

Asia-Pacific

Asia-Pacific captured about 30% share in 2024 and remains the fastest-growing region. Rapid urbanization and large construction activity in China, India, Japan, and Southeast Asia drive strong demand. Buyers choose luxury tiles for durability, moisture resistance, and modern designs. Growing middle-class income boosts renovation spending across major cities. Developers use premium tiles in upscale homes, malls, hotels, and office projects. Expansion of local tile manufacturing improves product range and pricing. Adoption of digital printing and large-format tiles supports further growth, making Asia-Pacific a major future demand center.

Latin America

Latin America held around 5% share of the Luxury Tiles Market in 2024. Demand rises slowly due to economic recovery and growing urban housing projects in Brazil, Mexico, and Chile. Buyers show increased interest in stylish and durable tiles for home upgrades. Commercial spaces such as hotels and offices adopt high-quality tile surfaces to improve aesthetics. Local production grows in key countries, improving access to premium designs. Rising investment in residential construction supports steady market expansion. Despite moderate growth rates, improving consumer preference for modern finishes strengthens long-term potential.

Middle East and Africa

Middle East and Africa accounted for nearly 3% share in 2024. Luxury real estate, hospitality projects, and premium retail spaces drive demand in the UAE, Saudi Arabia, and South Africa. Buyers choose high-end tiles for heat resistance, durability, and premium visual appeal. Large infrastructure projects boost consumption in commercial spaces. Residential upgrades also contribute as homeowners prefer modern interiors. Imports from Europe and Asia supply a wide range of luxury designs. Though share remains small, rising construction spending supports gradual market growth across the region.

Market Segmentations:

By Type

- Ceramic

- Vinyl

- Gypsum

- Metal

- Mineral Wool

- Other

By Application

- Wall Tiles

- Floor Tiles

- Ceiling Tiles

By End-User

- Residential Construction

- Commercial Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Luxury Tiles Market is shaped by leading companies such as Shaw Industries Group, Inc., SOLVAY, Rogers Corporation, LINTEC Corporation, Halocarbon, Dupont, Tarkett U.S.A. & Canada, 3M, and The Chemours Company. These firms focus on premium product quality and advanced surface technologies to support growing demand across residential and commercial spaces. Many manufacturers invest in digital printing and large-format tile designs to meet rising aesthetic expectations. Companies also expand sustainable material use to align with green building rules. Distribution networks strengthen as brands reach new urban markets. Production upgrades help improve strength, texture accuracy, and long-term durability. Firms also enhance product lines with modern finishes and high-performance coatings. Growing construction activity and renovation trends support steady industry growth. Competitive pressure encourages continuous innovation across design, performance, and manufacturing efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shaw Industries Group, Inc. (U.S.)

- SOLVAY (Belgium)

- Rogers Corporation (U.S.)

- LINTEC Corporation (Japan)

- Halocarbon, L.L.C. (U.S.)

- Dupont (U.S.)

- Tarkett U.S.A. & Canada (France)

- 3M (U.S.)

- The Chemours Company (U.S.)

Recent Developments

- In 2025, Shaw Industries introduced new resilient flooring designs under its Floorté Classic Series and Floorté Pro Series, featuring new sizes, fresh color additions, and innovative loose lay and flex options.

- In 2025, The Chemours Company continues to supply its Ti-Pure™ titanium dioxide, a critical pigment for luxury tiles and coatings, supporting high durability, whiteness, and opacity in tile surfaces.

- In 2024, Tarkett unveiled its True to Form premium Contour luxury vinyl tiles (LVT), featuring realistic wood, stone, marble, and mineral designs with a focus on quality and indoor air quality improvements.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as buyers continue to prefer premium interior finishes.

- Large-format and designer tiles will gain wider adoption across homes and commercial spaces.

- Demand for eco-friendly and recycled luxury tiles will rise due to green building rules.

- Digital printing and advanced glazing will enhance design quality and customization.

- Residential renovation projects will remain a major growth driver worldwide.

- Commercial spaces such as hotels and offices will increase use of durable luxury tiles.

- Manufacturers will expand premium collections to meet rising aesthetic expectations.

- Smart manufacturing and automation will improve production efficiency and consistency.

- Tile brands will increase distribution networks in emerging markets to capture new demand.

- Competition from high-end alternatives will push companies to innovate and differentiate.