Market Overview

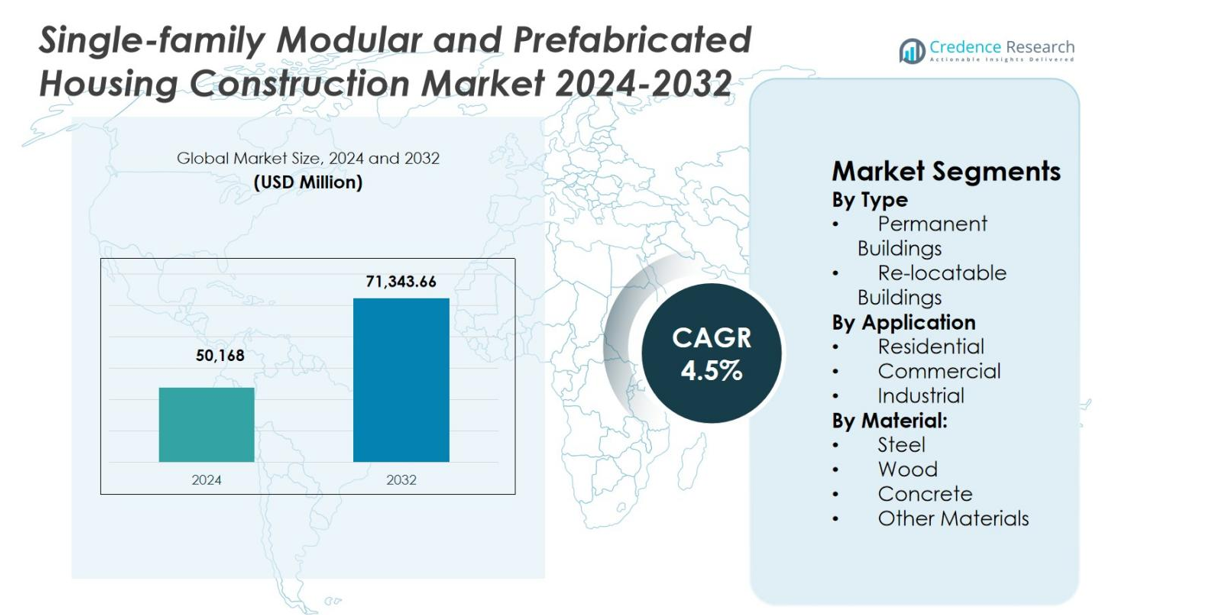

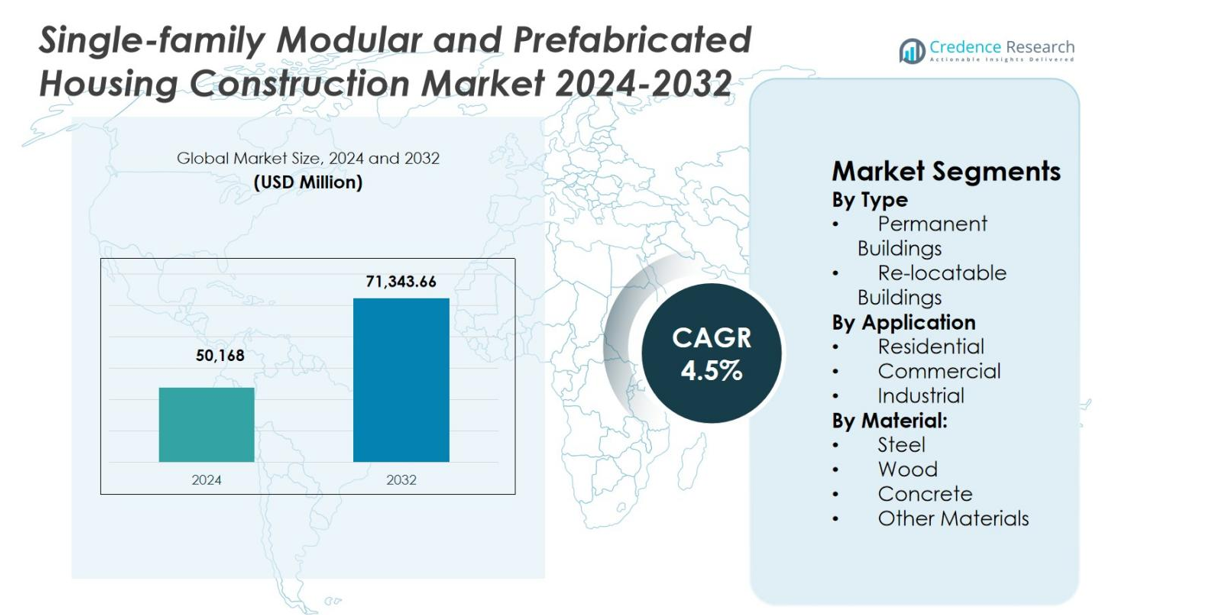

Single-family Modular and Prefabricated Housing Construction Market size was valued at USD 50,168 Million in 2024 and is anticipated to reach USD 71,343.66 Million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Family Housing Green Buildings Market Size 2024 |

USD 50,168 Million |

| Single-Family Housing Green Buildings Market, CAGR |

4.5% |

| Single-Family Housing Green Buildings Market Size 2032 |

USD 71,343.66 Million |

Single-family Modular and Prefabricated Housing Construction Market is shaped by the presence of established global construction firms and specialized modular housing providers, including Skanska AB, Bouygues Construction, Grupo ACS, Larsen and Toubro, Balfour Beatty, Kiewit Corporation, Taisei Corporation, Red Sea Housing Services, Lindal Cedar Homes, and System House R and C. These companies focus on expanding prefabrication capabilities, improving project delivery speed, and integrating digital construction technologies to strengthen market positioning. North America leads the market with a 34.8% share, supported by strong residential demand and mature modular construction practices, followed by Europe at 28.6%, driven by sustainability regulations, and Asia-Pacific with a 24.1% share, supported by rapid urbanization and large-scale housing initiatives.

Market Insights

- Single-family Modular and Prefabricated Housing Construction Market was valued at USD 50,168 Million in 2024 and is forecast to reach USD 71,343.66 Million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Demand accelerates as affordability pressures and faster delivery requirements increase, with Residential holding 74.6% share in 2024 and Permanent Buildings leading with 68.4% share, supported by durability, code compliance, and predictable project timelines.

- Offsite manufacturing adoption rises through BIM-led design, automation, and mass customization, while sustainability priorities strengthen modular uptake through reduced waste and improved energy performance in single-family homes.

- Major players such as Skanska AB, Bouygues Construction, Grupo ACS, Larsen and Toubro, Balfour Beatty, Kiewit Corporation, and Taisei Corporation strengthen positioning by expanding prefabrication capacity, optimizing supply chains, and advancing standardized systems.

- Regional demand remains led by North America at 34.8% share, followed by Europe at 28.6% and Asia-Pacific at 24.1%, while regulatory fragmentation, zoning constraints, and financing limitations continue to restrain broader adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

In the Single-family Modular and Prefabricated Housing Construction Market, Permanent Buildings dominated the type segment with a 68.4% market share in 2024, driven by rising demand for long-term housing solutions that match conventional home durability and aesthetics. Permanent modular homes benefit from faster construction timelines, lower lifecycle costs, and compliance with local building codes, making them attractive to both homeowners and developers. Increasing urbanization, housing shortages, and favorable mortgage financing for permanent structures further support adoption, while advancements in design flexibility and structural integrity reinforce their leadership over re-locatable buildings.

- For instance, Clayton Homes’ CrossMod homes are factory-built on permanent foundations with elevated roof pitches and covered porches, appraising like site-built homes while enabling quicker assembly than traditional methods.

By Application:

By application, the Residential segment accounted for a dominant 74.6% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, supported by strong demand for affordable, single-family homes. Population growth, rising land and labor costs, and the need for rapid housing delivery drive residential adoption. Modular construction enables predictable timelines, cost control, and reduced material waste, aligning with sustainability goals. Government-backed housing programs and increasing acceptance of prefabricated homes among middle-income buyers further strengthen residential dominance over commercial and industrial applications.

- For instance, Mirvac in Australia piloted prefabricated wall and floor panels for eight single-family homes at Tullamore in Melbourne, completing them 23% faster than traditional methods saving nearly seven weeks while cutting onsite waste by 50% and high-risk scaffolding work by 42%.

By Material:

In terms of material, Steel led the segment with a 41.8% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, driven by its strength, durability, and suitability for factory-based modular construction. Steel structures offer superior load-bearing capacity, resistance to pests and fire, and consistent quality control. Growing emphasis on structural safety, longer building lifespan, and reduced maintenance costs supports steel adoption. Additionally, steel’s recyclability and compatibility with sustainable construction practices enhance its preference over wood, concrete, and other materials.

Key Growth Drivers

Growing Need for Affordable and Rapid Housing Delivery

The Single-family Modular and Prefabricated Housing Construction Market is strongly driven by rising demand for affordable and quickly delivered housing solutions. Increasing land prices, labor costs, and prolonged timelines associated with traditional construction encourage adoption of modular methods. Factory-based production enables faster project completion, predictable costs, and reduced material waste. Developers and homeowners benefit from shortened construction cycles and earlier occupancy, making modular housing a practical response to housing shortages in both urban and suburban regions.

- For instance, Clayton Homes manufactured over 50,000 off-site single-family homes in 2022, including modular models like the 1,920-square-foot Paradise with three bedrooms and separated living areas.

Construction Labor Shortages and Productivity Advantages

Labor scarcity across the construction industry acts as a major growth driver for the Single-family Modular and Prefabricated Housing Construction Market. Modular construction reduces reliance on onsite labor by shifting work to controlled manufacturing environments. Standardized processes improve productivity, ensure consistent quality, and reduce project delays. As the skilled workforce continues to decline in many regions, modular housing offers an efficient and scalable alternative that supports continuous project execution.

- For instance, Japanese firm Sekisui Heim employs robots in its Kyushu factory to combat labor shortages, boosting production from 55 to 65 housing units per day while cutting operators by 20% and reassigning workers to less strenuous tasks.

Government Support and Housing Development Initiatives

Supportive government policies significantly accelerate growth in the Single-family Modular and Prefabricated Housing Construction Market. Public housing programs, tax incentives, and faster permitting processes increasingly favor prefabricated construction. Governments utilize modular housing to meet affordable housing targets, disaster recovery needs, and rural development goals. Regulatory recognition of modular standards encourages private investment and strengthens long-term market confidence.

Key Trends & Opportunities

Adoption of Digital Design and Advanced Manufacturing

The integration of digital design tools and advanced manufacturing technologies is a key trend in the Single-family Modular and Prefabricated Housing Construction Market. Building Information Modeling, automation, and precision fabrication improve design accuracy and production efficiency. These advancements support mass customization, allowing manufacturers to meet diverse design preferences without sacrificing speed or cost efficiency. Investment in smart manufacturing facilities creates new opportunities for scalability and competitive differentiation.

- For instance, CitizenM Bowery Hotel utilized BIM for fabricating 210 modular guestroom units, each fully fitted with finishes, plumbing, and furniture before site delivery.

Rising Focus on Sustainable and Energy-Efficient Homes

Sustainability creates strong opportunities within the Single-family Modular and Prefabricated Housing Construction Market. Modular construction supports energy-efficient designs through better insulation, reduced waste, and controlled material use. Manufacturers increasingly incorporate renewable energy systems and low-emission materials. Growing environmental awareness and stricter building energy standards encourage adoption of green modular homes, positioning sustainability as a long-term growth opportunity.

- For instance, Dvele integrates solar panels generating at least 6,400 kilowatt hours annually into its prefab homes, enabling self-powered operation with battery storage for grid independence.

Key Challenges

Regulatory and Zoning Complexity

Regulatory inconsistency remains a significant challenge for the Single-family Modular and Prefabricated Housing Construction Market. Differences in building codes, zoning laws, and approval processes across regions increase compliance costs and delay project execution. Modular housing often faces additional inspections compared to traditional construction, limiting rapid deployment. Lack of standardized regulations restricts scalability and slows market penetration, discouraging cross-regional expansion, increasing administrative burden, and reducing investor confidence in large-scale modular housing programs.

Market Perception and Financing Constraints

Negative perceptions regarding design limitations and long-term durability continue to challenge the Single-family Modular and Prefabricated Housing Construction Market. These perceptions influence buyer acceptance and restrict access to favorable financing. Some lenders impose stricter loan conditions for modular homes, increasing ownership costs. Addressing these barriers requires stronger market education, proven performance data, and improved collaboration with financial institutions, alongside successful project demonstrations and broader policy recognition to build long-term trust.

Regional Analysis

North America

North America held a 34.8% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, driven by strong demand for affordable housing and advanced construction practices. The United States leads the region due to high acceptance of modular homes, labor shortages in traditional construction, and supportive financing options. Canada contributes through government-backed housing initiatives and sustainable building mandates. Well-established manufacturing infrastructure, design standardization, and consumer awareness support steady adoption of modular single-family homes across suburban and semi-urban developments.

Europe

Europe accounted for a 28.6% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, supported by stringent sustainability regulations and energy-efficient housing demand. Countries such as Germany, the United Kingdom, and the Nordic region actively adopt prefabricated housing to meet carbon reduction targets. High labor costs and limited skilled workforce further encourage offsite construction methods. Strong emphasis on quality standards, modern architectural designs, and government support for green housing sustains regional growth.

Asia-Pacific

Asia-Pacific represented a 24.1% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, driven by rapid urbanization and large-scale housing requirements. China, Japan, and India lead adoption through industrialized construction programs and expanding residential developments. Rising population, increasing disposable income, and government focus on mass housing accelerate demand. Modular construction supports faster project delivery and cost efficiency, making it suitable for high-volume single-family housing in emerging and developed Asia-Pacific economies.

Latin America

Latin America captured a 7.2% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, supported by growing demand for affordable residential housing. Countries such as Brazil and Mexico increasingly adopt prefabricated homes to address urban housing deficits. Modular construction offers cost control and reduced construction time, appealing to both public and private housing projects. Improving construction regulations and rising investments in residential infrastructure contribute to gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa held a 5.3% market share in 2024 in the Single-family Modular and Prefabricated Housing Construction Market, driven by housing demand linked to population growth and urban expansion. Gulf countries adopt modular housing for workforce accommodation and residential developments, while Africa benefits from prefabrication for affordable housing programs. Limited traditional construction capacity and the need for rapid housing delivery support modular adoption, despite challenges related to regulatory frameworks and financing availability.

Market Segmentations:

By Type

- Permanent Buildings

- Re-locatable Buildings

By Application

- Residential

- Commercial

- Industrial

By Material:

- Steel

- Wood

- Concrete

- Other Materials

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis in the Single-family Modular and Prefabricated Housing Construction Market includes Skanska AB, Bouygues Construction, Grupo ACS, Larsen and Toubro, Balfour Beatty, Kiewit Corporation, Taisei Corporation, Red Sea Housing Services, Lindal Cedar Homes, and System House R and C. The market reflects a mix of global construction firms and specialized modular housing providers competing on speed, design flexibility, cost efficiency, and project execution capabilities. Key players focus on expanding prefabrication facilities, integrating digital design and offsite manufacturing technologies, and strengthening regional presence through partnerships and joint ventures. Emphasis on sustainable construction, energy-efficient building solutions, and standardized modular systems enhances differentiation. Companies increasingly invest in automation, advanced materials, and supply chain optimization to improve margins and scalability. Strategic expansion into affordable housing, disaster recovery, and large-scale residential projects further strengthens competitive positioning while reinforcing long-term market stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bouygues Construction

- Grupo ACS

- System House R and C

- Larsen and Toubro

- Lindal Cedar Homes

- Kiewit Corporation

- Balfour Beatty

- Taisei Corporation

- Red Sea Housing Services

- Skanska AB

Recent Developments

- In September 2024, ATCO Structures & Logistics Ltd. acquired NRB Modular Solutions for $40 million to strengthen its modular residential building capabilities.

- In 2025, Champion Homes launched the Concord Duplex Series, a new product segment providing affordable housing units through its national manufactured home offerings.

- In December 2025, Guangdong WELLCAMP Steel Structure & Modular Housing Co., Ltd. launched rapid-deployment folding and expandable container houses at global exhibitions for various sites including mining and disaster relief

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Single-family Modular and Prefabricated Housing Construction Market will expand steadily as demand for faster and cost-efficient housing solutions increases.

- Growing urbanization and suburban development will support long-term adoption of modular single-family homes.

- Advancements in offsite manufacturing, automation, and digital design will improve construction precision and scalability.

- Increased acceptance of modular housing among homebuyers will strengthen residential market penetration.

- Sustainability requirements will drive wider use of energy-efficient designs and eco-friendly building materials.

- Government housing programs and supportive regulatory frameworks will encourage prefabricated construction methods.

- Integration of smart home technologies will enhance the value proposition of modular single-family housing.

- Expansion of prefabrication facilities will improve regional supply capabilities and reduce project timelines.

- Strategic partnerships between developers and modular manufacturers will accelerate market growth.

- Improved financing options and evolving lender acceptance will reduce adoption barriers and support market maturity.