Market Overview

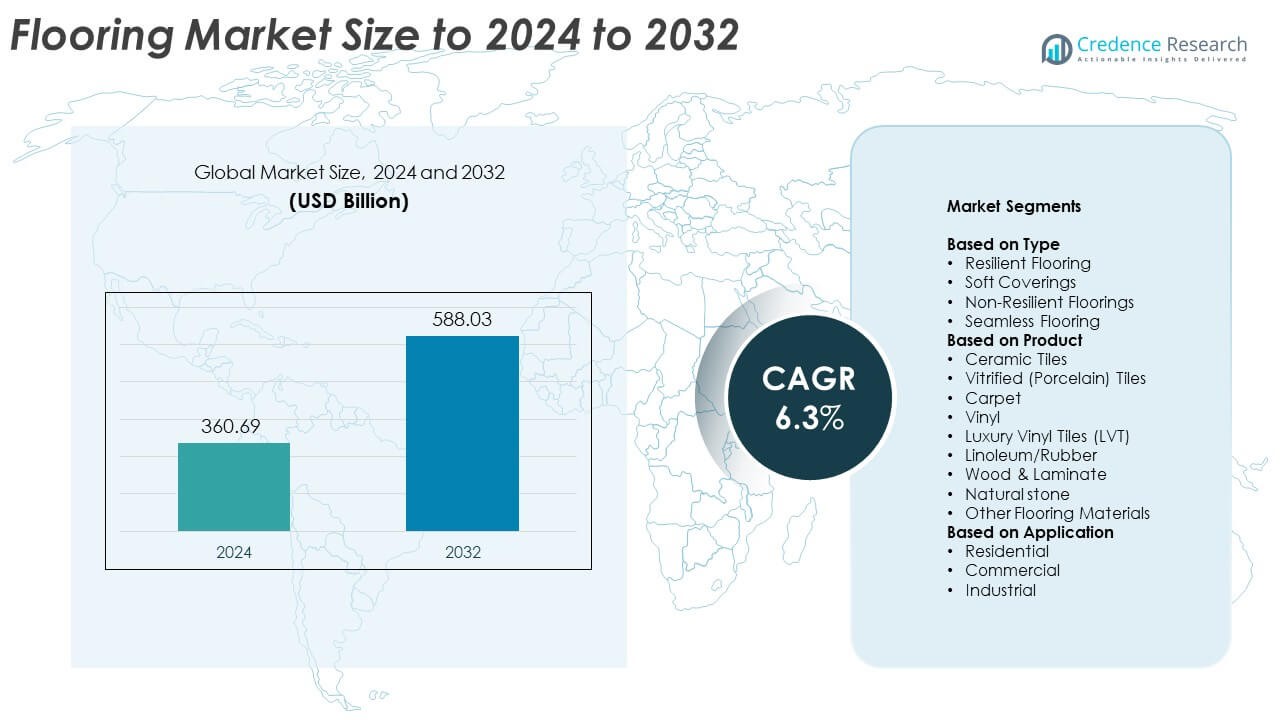

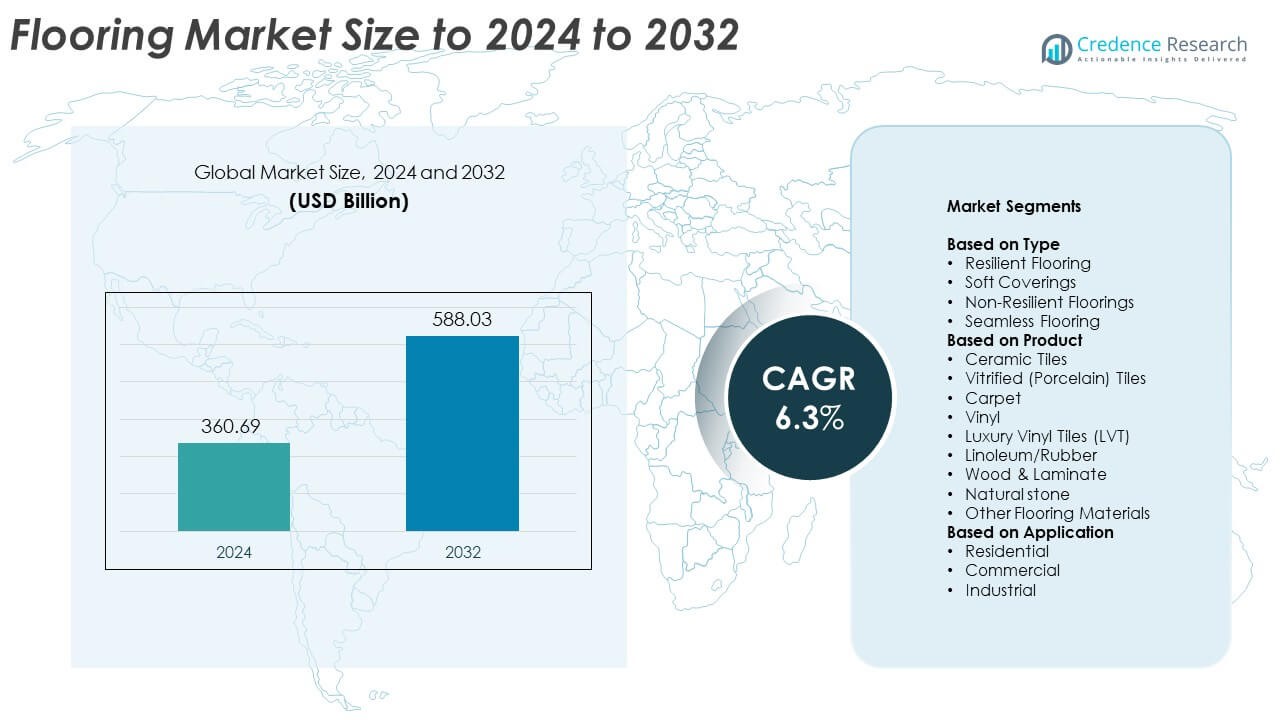

The Flooring Market size was valued at USD 360.69 Billion in 2024 and is anticipated to reach USD 588.03 Billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flooring Market Size 2024 |

USD 360.69 Billion |

| Flooring Market, CAGR |

6.3% |

| Flooring Market Size 2032 |

USD 588.03 Billion |

The flooring market size features intense competition among major players such as Tarkett Group, Gerflor Group, Shaw Industries, Mannington Mills, Forbo Holding AG, Mohawk Industries, Karndean, Interface Inc., Beaulieu International Group (BIG), Armstrong Flooring, and Congoleum Corporation. These companies lead through advanced product innovation, sustainable manufacturing, and global distribution strength. Asia Pacific dominated the market with a 34% share in 2024, supported by rapid urbanization and infrastructure expansion. North America followed with 32%, driven by renovation and remodeling demand. Europe accounted for 27%, influenced by green building regulations and rising adoption of eco-friendly flooring materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The flooring market size was valued at USD 360.69 Billion in 2024 and is projected to reach USD 588.03 Billion by 2032, growing at a CAGR of 6.3%.

- Market growth is driven by rapid urbanization, infrastructure expansion, and rising demand for durable and eco-friendly materials.

- Key trends include growing adoption of luxury vinyl tiles, digital printing advancements, and development of sustainable flooring technologies.

- The market is moderately fragmented, with global manufacturers competing through design innovation, product diversification, and sustainable material use.

- Asia Pacific led with a 34% share, followed by North America at 32% and Europe at 27%, while the resilient flooring segment dominated with a 42% share in 2024.

Market Segmentation Analysis:

By Type

Resilient flooring dominated the market in 2024 with a 42% share, driven by its strength, flexibility, and low maintenance. Vinyl and linoleum flooring are preferred in residential, healthcare, and educational buildings due to their moisture resistance and easy cleaning. The growing focus on durable and hygienic surfaces supports steady adoption. Rising renovation activities and product innovations such as enhanced acoustic insulation and anti-slip coatings further increase demand across commercial and institutional spaces.

- For instance, Recofloor (UK scheme) has collected more than 7,650 tonnes of waste vinyl flooring since its launch in 2009, with strong collections continuing in 2024.

By Product

Ceramic tiles held the largest share of 28% in the flooring market in 2024. The product’s popularity stems from its affordability, design variety, and high resistance to stains and water. Ceramic tiles are widely used in both residential and commercial settings, particularly in kitchens, bathrooms, and public spaces. Technological advancements such as 3D printing and improved glazing techniques enhance visual appeal and durability, reinforcing their dominance in construction and remodeling projects.

- For instance, RAK Ceramics operates with an annual production capacity of 118 million m² of tiles, making it one of the largest ceramic tile manufacturers worldwide and a key supplier to residential and commercial projects.

By Application

The residential segment led the flooring market in 2024 with a 52% share, supported by increasing housing construction and home renovation trends. Rising consumer spending on interior aesthetics and functional designs fuels demand for ceramic, vinyl, and laminate flooring. Urbanization and government-led affordable housing schemes further stimulate installation across apartments and single-family homes. Additionally, the growing use of eco-friendly and water-resistant flooring materials boosts the segment’s long-term growth prospects.

Key Growth Drivers

Rising Construction and Renovation Activities

The surge in residential and commercial construction is a primary driver of flooring demand. Rapid urbanization and population growth are fueling new housing projects and infrastructure expansion. Renovation activities, especially in developed markets like the U.S. and Europe, are boosting replacement flooring sales. The demand for cost-effective and durable solutions such as vinyl and laminate flooring continues to rise, supported by government incentives for green and energy-efficient buildings.

- For instance, According to market analysis covering the first point of sale, resilient flooring volume showed a slight decrease of 0.5%, from 5.876 billion square feet in 2023 to 5.846 billion square feet in 2024.

Technological Advancements in Flooring Materials

Ongoing innovation in material science is enhancing product performance and sustainability. Manufacturers are developing stain-resistant, waterproof, and antibacterial flooring solutions to meet evolving consumer needs. The adoption of digital printing, 3D textures, and click-lock installation systems has simplified customization and reduced labor costs. These technological improvements attract both residential and commercial buyers seeking durable yet stylish flooring options that support long-term maintenance efficiency and design flexibility.

- For instance, Recycling / take-back scheme strength: Recofloor has achieved over 7,650 tonnes of vinyl collected for recycling.

Growing Demand for Eco-Friendly Flooring Solutions

Environmental awareness and stricter regulations are encouraging the use of sustainable materials like bamboo, cork, and recycled vinyl. Manufacturers are focusing on reducing carbon footprints through low-emission adhesives and recyclable components. Green certifications such as LEED and BREEAM further promote sustainable flooring adoption in corporate and public buildings. This shift toward eco-friendly products strengthens market competitiveness while appealing to environmentally conscious consumers and construction firms.

Key Trends and Opportunities

Rising Popularity of Luxury Vinyl Tiles (LVT)

Luxury Vinyl Tiles continue to gain traction due to their blend of aesthetics, durability, and affordability. LVT mimics wood and stone finishes while offering easier installation and water resistance. Growth in hospitality, retail, and residential renovations accelerates its adoption worldwide. Continuous improvements in digital printing and embossing techniques also enhance the visual realism and texture quality, making LVT a preferred flooring choice across multiple segments.

- For instance, Increased recycling: Recofloor’s 7,650 tonnes collected demonstrates circular momentum in vinyl flooring.

Expansion of Smart and Modular Flooring Systems

The integration of smart technologies in flooring materials is opening new opportunities for innovation. Embedded sensors for temperature, pressure, and occupancy tracking are being adopted in commercial spaces and healthcare facilities. Modular flooring systems allow flexible installation and easier maintenance, aligning with modern design preferences. The rise of connected infrastructure and intelligent building systems supports further development of these advanced flooring solutions.

- For instance, Designing with recycled content: Forbo aims to include up to 25 % recycled content in new flooring lines.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of raw materials such as PVC, rubber, and resins affect production costs and profit margins. Dependence on petrochemical-derived components exposes manufacturers to oil price instability and supply chain disruptions. These challenges push companies to explore bio-based alternatives and strengthen local sourcing networks to ensure cost stability and sustainable production processes.

Environmental Concerns and Waste Management

Flooring waste from construction and renovation projects remains a pressing challenge. Non-recyclable materials contribute significantly to landfill accumulation and environmental pollution. Regulatory pressure to manage post-consumer waste is intensifying, compelling manufacturers to invest in recycling infrastructure and closed-loop systems. Addressing these sustainability concerns is crucial for maintaining compliance and brand reputation in a competitive global market.

Regional Analysis

North America

North America held a 32% share of the global flooring market in 2024, supported by strong residential renovation trends and advanced construction technologies. The United States leads the region due to high demand for luxury vinyl tiles, engineered wood, and sustainable flooring materials. Growth in commercial construction, including office and retail spaces, further drives adoption. The presence of key manufacturers and a strong focus on eco-friendly materials enhance regional competitiveness, while modernization of infrastructure and increasing smart home installations strengthen long-term growth prospects.

Europe

Europe accounted for a 27% share of the global flooring market in 2024, driven by sustainable building standards and rising demand for eco-friendly materials. Countries such as Germany, France, and the UK dominate the regional market with growing adoption of laminate, ceramic, and vinyl flooring. Strict EU regulations on indoor emissions encourage the use of low-VOC and recyclable flooring products. Ongoing urban housing development and renovations of historical structures contribute to stable growth. Increasing consumer awareness toward energy-efficient flooring solutions further supports market expansion across Europe.

Asia Pacific

Asia Pacific led the global flooring market with a 34% share in 2024, fueled by rapid urbanization, industrialization, and infrastructure investments. China, India, and Japan are the primary contributors, supported by expanding residential construction and smart city projects. Rising disposable income and lifestyle upgrades accelerate the demand for vinyl, ceramic, and wood flooring in urban homes. The growing presence of domestic manufacturers and government incentives for green buildings further boost market development. Continuous technological improvements and expanding distribution networks ensure strong regional dominance through 2032.

Latin America

Latin America held a 4% share of the flooring market in 2024, with Brazil and Mexico as key contributors. Increasing urban development, hospitality projects, and retail expansion are supporting steady demand. Vinyl and ceramic tiles remain the preferred materials due to their affordability and climate resilience. The region benefits from gradual recovery in construction spending and modernization of commercial infrastructure. However, economic fluctuations and import dependency pose minor challenges. Despite this, rising consumer preference for stylish and cost-effective flooring options promotes sustained market growth.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the flooring market in 2024, supported by increasing infrastructure development and urbanization. Gulf countries, including the UAE and Saudi Arabia, are investing heavily in commercial and residential construction under smart city and tourism initiatives. Demand for high-quality ceramic, stone, and vinyl flooring materials continues to grow across luxury real estate and hospitality projects. African nations such as South Africa and Nigeria show steady adoption, aided by government housing schemes and industrial expansion.

Market Segmentations:

By Type

- Resilient Flooring

- Soft Coverings

- Non-Resilient Floorings

- Seamless Flooring

By Product

- Ceramic Tiles

- Vitrified (Porcelain) Tiles

- Carpet

- Vinyl

- Luxury Vinyl Tiles (LVT)

- Linoleum/Rubber

- Wood & Laminate

- Natural stone

- Other Flooring Materials

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flooring market size is highly competitive, with major players such as Tarkett Group, Gerflor Group, Shaw Industries, Mannington Mills, Forbo Holding AG, Mohawk Industries, Karndean, Interface Inc., Beaulieu International Group (BIG), Armstrong Flooring, and Congoleum Corporation shaping the global landscape. These companies compete through continuous product innovation, sustainable material development, and advanced digital manufacturing technologies. Market leaders are focusing on expanding their product portfolios with eco-friendly and recyclable flooring solutions to align with green building standards. Strategic mergers, acquisitions, and partnerships strengthen distribution networks and global presence. Additionally, increased investment in research and development is enhancing durability, design versatility, and installation efficiency. The growing use of digital printing, click-lock systems, and water-resistant coatings enables companies to meet evolving consumer demands. Regional expansion, strong brand visibility, and technological innovation remain key factors driving competitiveness in the global flooring industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tarkett Group

- Gerflor Group

- Shaw Industries

- Mannington Mills

- Forbo Holding AG

- Mohawk Industries

- Karndean

- Interface Inc.

- Beaulieu International Group (BIG)

- Armstrong Flooring

- Congoleum Corporation

Recent Developments

- In 2025, B.I.G. launched Twilight, its first residential vinyl flooring made from 100% bio-circular PVC, and Verdite, a recyclable artificial grass backing.

- In 2025, Karndean will introduce new LVT products and collections, continuing its focus on high-quality, durable, and stylish options.

- In 2024, Forbo announced that 23% of its flooring on average consists of recycled materials, with some products containing up to 89%.

- In 2022, Mohawk acquired Mexican ceramic tile manufacturer Vitromex, enhancing its product offerings and market presence in Mexico, acquisiton completed in 2023.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of sustainable and recyclable flooring materials will shape future product innovation.

- Increasing demand for luxury vinyl tiles will continue across residential and commercial spaces.

- Advancements in digital printing and surface textures will enhance aesthetic flexibility.

- Smart flooring systems with embedded sensors will gain traction in intelligent building designs.

- Expansion of modular flooring will improve installation efficiency and design versatility.

- Rising renovation and remodeling projects will sustain demand in developed markets.

- Growth of e-commerce distribution will strengthen global accessibility for flooring products.

- Integration of eco-certifications will influence purchasing decisions among green-conscious consumers.

- Ongoing urbanization in Asia Pacific and Africa will boost large-scale flooring installations.

- Strategic mergers and acquisitions among manufacturers will enhance technological competitiveness.