Market Overview

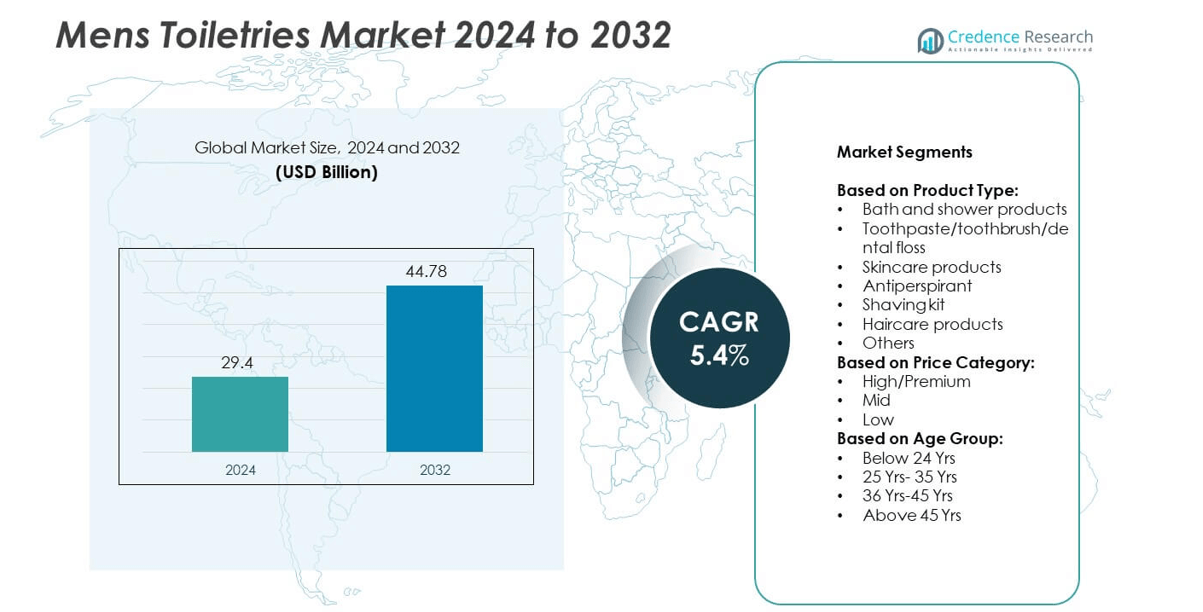

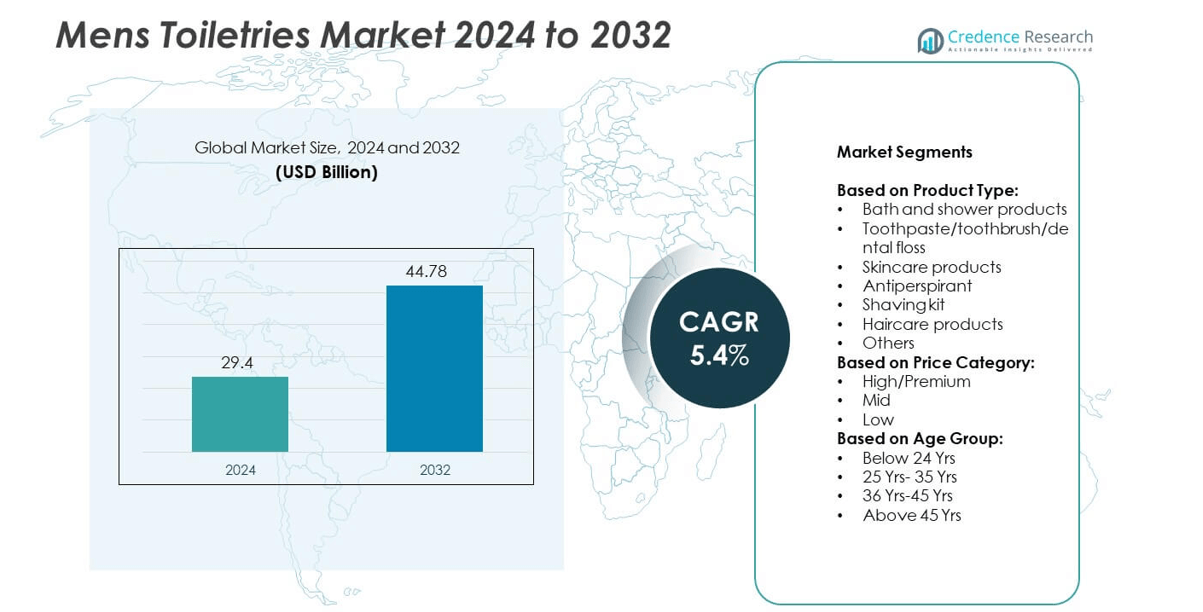

The Mens Toiletries Market size was valued at USD 29.4 billion in 2024 and is anticipated to reach USD 44.78 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Men’s Toiletries Market Size 2024 |

USD 29.4 billion |

| Men’s Toiletries Market, CAGR |

5.4% |

| Men’s Toiletries Market Size 2032 |

USD 44.78 billion |

The Mens Toiletries market grows through rising grooming awareness, urban lifestyle shifts, and demand for premium products. Consumers increasingly prefer natural, sustainable, and multifunctional solutions, reflecting stronger health and eco-conscious choices. Digital platforms and e-commerce channels expand accessibility, while influencer marketing boosts brand visibility among younger audiences. Innovation in skincare, haircare, and oral care continues to attract diverse age groups. The market benefits from evolving consumer behavior, stronger product personalization, and expanding reach in emerging economies.

The Mens Toiletries market shows strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads growth with expanding urban populations and rising disposable incomes, while Europe emphasizes premium and sustainable grooming solutions. North America remains driven by innovation and digital-first retail strategies. Key players such as Procter & Gamble, Unilever, L’Oréal, and Beiersdorf AG focus on product innovation, sustainability, and strategic distribution to strengthen global competitiveness.

Market Insights

- The Mens Toiletries market was valued at USD 29.4 billion in 2024 and is projected to reach USD 44.78 billion by 2032, growing at a CAGR of 5.4% during the forecast period.

- Growth is fueled by rising male grooming awareness, urbanization, higher disposable incomes, and increasing demand for premium and natural grooming products across all consumer segments.

- Trends highlight a shift toward eco-friendly, multifunctional, and personalized toiletries, supported by digital marketing, influencer collaborations, and strong e-commerce expansion.

- Competition remains intense with global leaders and regional players focusing on innovation, sustainability, and affordable product lines to capture diverse demographics.

- Restraints include high competition, rising production costs, strict regulatory compliance requirements, and the risk of counterfeit products affecting brand trust.

- Regional insights show Asia Pacific driving growth with rapid adoption, Europe focusing on sustainable luxury, and North America emphasizing innovation and digital-first retail strategies, while Latin America and the Middle East & Africa record steady expansion.

- The market demonstrates continuous innovation in product categories like skincare, haircare, shaving kits, and oral care, with companies aligning strategies to changing consumer expectations and lifestyle shifts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Male Grooming and Personal Care Adoption

The Mens Toiletries market grows strongly due to rising focus on male grooming routines. Consumers increasingly prefer specialized products designed for skincare, haircare, and hygiene. It reflects a shift in perception where grooming is linked with confidence and lifestyle. Premium product launches further enhance customer interest and create brand loyalty. Companies invest in expanding product lines with natural and dermatologically tested formulations. These developments encourage consistent market expansion across multiple regions.

- For instance, MANSCAPED® launched its Skin Ultra™ skincare line and The Face Buffer Pro electric scrubber in May 2025. The scrubber offers three cleansing modes and delivers an exfoliating cleanse in only 60 seconds.

Expanding Urban Population and Lifestyle Changes

Rapid urbanization strengthens demand for varied grooming products tailored for busy lifestyles. Young professionals emphasize appearance, driving consumption of deodorants, shaving products, and skincare. It shows clear growth in metropolitan areas where disposable income levels are higher. International brands expand presence through supermarkets, online channels, and exclusive outlets. Companies introduce travel-friendly packs targeting frequent travelers and urban professionals. These efforts position the Mens Toiletries market as highly adaptable to lifestyle shifts.

- For instance, Philips introduced its i9000 Shaver Series, featuring intelligent sensors that analyze beard density 500 times per second and automatically adjust cutting power in real time.

Product Innovation and Influence of Digital Platforms

Companies rely on product innovation to differentiate in a competitive environment. They introduce organic, sustainable, and multifunctional toiletries appealing to health-conscious customers. It demonstrates how product performance and eco-friendly claims shape purchase decisions. Social media platforms play a crucial role in shaping brand visibility and consumer preferences. Influencer-led campaigns increase awareness among younger audiences seeking trendy grooming solutions. Such marketing strength supports steady growth of the Mens Toiletries market.

Regulatory Standards and Distribution Network Expansion

Stringent quality standards drive companies to maintain high safety and performance benchmarks. Compliance strengthens consumer trust and builds brand credibility in global markets. It ensures that new product development aligns with evolving regulatory frameworks. Retailers and e-commerce channels expand accessibility, offering wide product ranges at competitive prices. Strong distribution networks allow companies to reach tier-two and tier-three cities effectively. The Mens Toiletries market benefits from these strategies that combine regulation and accessibility.

Market Trends

Growing Demand for Natural and Sustainable Formulations

The Mens Toiletries market increasingly shifts toward natural and eco-friendly product formulations. Consumers prefer plant-based ingredients and chemical-free options that align with health concerns. It reflects heightened awareness about sustainability and long-term environmental impact. Brands introduce biodegradable packaging and cruelty-free certifications to build trust. Product portfolios expand with vegan-friendly shampoos, deodorants, and skincare essentials. This trend highlights how eco-consciousness shapes product development and consumer loyalty.

- For instance, MANSCAPED® expanded its retail footprint by launching in 127 Best Buy Canada stores—its first major consumer electronics retail partnership in that country—strengthening visibility among tech-savvy, urban consumers

Premiumization and Personalization of Grooming Products

Rising income levels drive consumers to adopt premium grooming and personal care lines. It shows strong demand for customized solutions addressing skin type, age, or lifestyle. Companies use advanced formulations to deliver targeted benefits in skincare and haircare. Subscription-based models provide personalized product bundles tailored to individual needs. Luxury packaging and exclusive fragrances further enhance brand differentiation. The Mens Toiletries market demonstrates how premiumization strengthens value-driven consumption.

- For instance, Anforh, the premium male grooming brand by stylist Robin James, launched with its debut three-piece haircare line crafted over two years of refinement. It includes Texture Volume Spray (£30), Texture Shampoo (£28), and Conditioning Treatment (£26). Each was formulated based on community feedback and real-world testing.

Influence of Digital Engagement and E-Commerce Growth

Digital platforms significantly shape awareness and purchase behavior across global markets. It boosts product visibility through influencer collaborations and social media campaigns. Online retail channels expand accessibility, offering a wide variety of brands and price points. Consumers rely on peer reviews and digital ads to make informed buying decisions. Direct-to-consumer models grow rapidly, enabling faster product launches and customer engagement. This trend underlines the shift toward digital-first growth in the Mens Toiletries market.

Rising Popularity of Multi-Functional and Convenient Products

Consumers increasingly seek multi-functional grooming solutions that save time and cost. It reflects demand for products combining skincare, cleansing, and hydration in single formulations. Travel-size packs and all-in-one kits appeal to modern, fast-paced lifestyles. Companies focus on efficiency-driven innovation to address this growing preference. Demand grows in urban centers where convenience remains a strong purchase driver. The Mens Toiletries market benefits from these multi-functional trends shaping consumer expectations.

Market Challenges Analysis

High Competition and Brand Differentiation Difficulties

The Mens Toiletries market faces strong competition from global and regional brands. Established players dominate shelves with wide portfolios, leaving limited space for new entrants. It forces companies to invest heavily in marketing and innovation to stand out. Price sensitivity in emerging markets further complicates differentiation strategies. Consumers often switch brands due to frequent product launches and discounts. Maintaining consistent brand loyalty becomes a challenge when options are abundant and accessible.

Rising Costs, Regulatory Compliance, and Supply Chain Pressures

Strict regulatory standards require significant investment in testing, certification, and sustainable sourcing. It raises costs and delays product launches for many companies. Global supply chains also face raw material shortages and transportation disruptions. Rising production costs directly affect margins, especially in price-sensitive segments. Counterfeit products entering markets reduce trust and harm established brand reputations. The Mens Toiletries market must balance compliance, cost control, and reliable supply to sustain growth.

Market Opportunities

Expansion into Emerging Markets and Untapped Consumer Segments

The Mens Toiletries market holds strong potential in emerging economies with rising disposable income. Young urban men increasingly adopt grooming routines influenced by global lifestyle trends. It creates opportunities for brands to launch affordable yet aspirational product lines. Tier-two and tier-three cities offer untapped demand, supported by improved retail infrastructure. Companies that adapt pricing and packaging to local preferences can secure early advantage. Expanding product availability in these regions strengthens long-term market growth.

Innovation in Product Categories and Digital Commerce Growth

Product innovation offers vast scope to capture diverse consumer needs in grooming and hygiene. It includes multi-functional, organic, and technologically advanced formulations designed for specific skin and hair types. Growing demand for eco-conscious and personalized solutions drives continuous research and development. Digital commerce expansion further enhances accessibility, supported by direct-to-consumer strategies. Brands leveraging e-commerce platforms can strengthen engagement and accelerate product adoption. The Mens Toiletries market benefits from combining innovation with strong digital presence.

Market Segmentation Analysis:

By Product Type:

The Mens Toiletries market covers a wide range of essentials. Bath and shower products remain the most widely used, driven by daily hygiene needs across all demographics. Toothpaste, toothbrush, and dental floss represent consistent demand due to rising oral health awareness. Skincare products grow rapidly with men focusing on anti-aging, moisturization, and sun protection. Antiperspirants hold steady demand, especially in urban areas with higher pollution and temperature variations. Shaving kits maintain relevance, though demand shifts toward electric trimmers and precision tools. Haircare products experience growth from concerns about hair fall and styling preferences, while other products such as fragrances add diversity to the segment.

- For instance, LeBron James’ The Shop launched a men’s grooming collection—including skin, beard, and haircare products—available in 1,600 Walmart stores and online.

By Price Category:

The market divides into high, mid, and low segments. Premium offerings gain traction among urban professionals who associate grooming with lifestyle and identity. It shows demand for luxury brands providing advanced formulations and unique fragrances. The mid-range segment dominates, appealing to middle-income consumers balancing affordability with quality. Low-cost products remain vital in rural and semi-urban regions where budget plays a major role. Companies tailor distribution strategies to reach all price levels, ensuring broad accessibility. This pricing structure strengthens the overall reach of the Mens Toiletries market across different consumer groups.

- For instance, Philips Sonicare electric toothbrushes deliver 62,000 brush strokes per minute, ensuring deep yet gentle cleaning—detailing this on their product pages.

By Age Group:

The market demonstrates varied consumption patterns. The below 24 years segment emphasizes grooming linked with fashion and personal image. It drives demand for skincare, hair styling, and deodorants. Consumers between 25 and 35 years invest in premium and multifunctional products, reflecting rising incomes and lifestyle awareness. The 36 to 45 years group shows interest in anti-aging solutions and dental care. Above 45 years, consumers focus on health-driven grooming with priority on oral care and mild formulations. It highlights how companies must align product development with age-specific expectations to secure stronger loyalty and market presence.

Segments:

Based on Product Type:

- Bath and shower products

- Toothpaste/toothbrush/dental floss

- Skincare products

- Antiperspirant

- Shaving kit

- Haircare products

- Others

Based on Price Category:

Based on Age Group:

- Below 24 Yrs

- 25 Yrs- 35 Yrs

- 36 Yrs-45 Yrs

- Above 45 Yrs

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the global Mens Toiletries market share, making it one of the most developed regions for grooming and personal care adoption. The region benefits from high consumer awareness about hygiene, wellness, and grooming routines. It demonstrates strong demand for premium and natural formulations, with many consumers favoring eco-friendly packaging and sustainable sourcing. Leading brands focus on expanding product lines across skincare, deodorants, shaving kits, and haircare to match shifting preferences. Retail channels such as supermarkets, hypermarkets, and specialty stores remain crucial, but online sales are growing rapidly with younger demographics. The presence of established players and their constant innovation keeps competition intense. North America continues to lead in introducing advanced, multifunctional toiletries designed for both convenience and premium appeal.

Europe

Europe contributes 25% of the Mens Toiletries market share, reflecting a mature market driven by established grooming traditions and cultural emphasis on personal care. The region shows strong demand for premium and luxury toiletries, particularly in countries like Germany, France, and the UK. Skincare and shaving products dominate, with growing attention to natural, vegan, and dermatologically tested formulations. European consumers prioritize sustainable packaging and eco-conscious sourcing, which compels companies to adopt strict environmental standards. Online platforms and pharmacy-based sales channels play a strong role in consumer purchasing behavior. It highlights how European demand is shaped by quality, safety, and ethical product development. Strong regulatory frameworks ensure that innovation aligns with consumer trust and compliance, sustaining consistent market growth.

Asia Pacific

Asia Pacific leads the Mens Toiletries market with 32% of the global share, supported by rapid population growth and urbanization. Rising disposable incomes in countries such as China, India, and Japan drive grooming adoption among younger men. It reflects growing lifestyle changes, where grooming is increasingly associated with professionalism, confidence, and social appeal. Skincare and haircare products dominate, while demand for deodorants and shower products expands rapidly in urban regions. E-commerce platforms strongly influence purchasing behavior, with direct-to-consumer models and mobile-first strategies gaining popularity. The region experiences intense competition between local and international brands, each tailoring offerings to cultural preferences. Asia Pacific’s dominance is reinforced by continuous product innovation, affordability, and mass-market accessibility across both metropolitan and semi-urban areas.

Latin America

Latin America holds 9% of the Mens Toiletries market share, reflecting steady growth supported by rising middle-class populations. Grooming habits are increasingly influenced by urbanization and exposure to international lifestyle trends. Brazil and Mexico represent the largest contributors, with strong demand for deodorants, shower products, and haircare solutions. It highlights the importance of affordability, as price sensitivity shapes consumer choices across the region. Local brands compete with international players by offering cost-effective solutions adapted to regional needs. Distribution networks, including supermarkets and pharmacies, remain essential, but online sales are gradually increasing. Latin America’s market growth depends on striking a balance between affordability and access to premium innovations, making it a promising but competitive landscape.

Middle East and Africa

The Middle East and Africa represent 6% of the Mens Toiletries market share, showing gradual adoption across diverse economies. Gulf countries demonstrate stronger demand for premium grooming products influenced by high-income levels and preference for luxury brands. It reflects cultural shifts where grooming is increasingly linked with modern lifestyle standards. Skincare, fragrance, and shower products lead consumption, with men showing higher interest in global trends. In Africa, affordability shapes demand, with basic toiletries dominating rural and semi-urban markets. E-commerce channels expand gradually, supported by rising smartphone penetration and digital payment adoption. The region remains an emerging opportunity where tailored pricing, cultural adaptation, and distribution strategies can strengthen growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Natura & Co.

- Bulldog Skincare

- Procter & Gamble

- The Clorox Company

- Colgate-Palmolive Company

- Estee Lauder Companies Inc.

- Reckitt Benckiser

- LVMH Moët Hennessy Louis Vuitton

- Bayer AG

- Johnson & Johnson

- Unilever

- Kao Corporation

- Shiseido Company Limited

- Beiersdorf AG

- L’Oréal

- Baxter of California

- Henkel AG & Co. KGaA

Competitive Analysis

The Mens Toiletries market features strong competition among leading players such as Natura & Co., Bulldog Skincare, Procter & Gamble, The Clorox Company, Colgate-Palmolive Company, Estee Lauder Companies Inc., Reckitt Benckiser, LVMH Moët Hennessy Louis Vuitton, Bayer AG, Johnson & Johnson, Unilever, Kao Corporation, Shiseido Company Limited, Beiersdorf AG, L’Oréal, Baxter of California, and Henkel AG & Co. KGaA. These companies dominate the market with broad product portfolios covering skincare, shaving kits, haircare, oral care, and shower essentials. They focus on brand positioning through innovative formulations, sustainability commitments, and premium packaging. Intense competition pushes companies to differentiate with natural, organic, and multifunctional products appealing to health-conscious men. Global leaders emphasize digital marketing and influencer campaigns to reach younger audiences and build stronger loyalty. Innovation in personalized grooming and eco-friendly packaging helps maintain an edge in mature markets. Regional players challenge international brands by offering affordable, locally adapted toiletries that target price-sensitive consumers. Expanding e-commerce channels and direct-to-consumer strategies create new avenues for faster adoption. Each company invests in research and product diversification to align with evolving consumer expectations. Competitive intensity will remain high as established brands and emerging entrants continue to strengthen their presence.

Recent Developments

- In May 2024, Baxter of California the company collaborated with the Los Angeles Rams to release limited-edition Rams‑inspired grooming bundles, integrating its products into sports-themed promotions across digital and live-event channels.

- In 2024, P&G streamlined its Gillette supply chain by shifting its razor steel sourcing to India, helping protect margins amid tariff pressures.

- In 2024, Natura & Co. the company further digitalized its relationship selling model and opened a virtual store on Mercado Livre in Brazil and Chile, while revamping e‑commerce and opening over 1,000 new physical Natura stores.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Price Category, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and sustainable toiletries will expand across global markets.

- Skincare and haircare categories will continue to record the fastest growth.

- Premium grooming products will attract young urban professionals with rising incomes.

- E-commerce and direct-to-consumer models will strengthen distribution reach.

- Brands will invest more in personalized and multifunctional product innovations.

- Regulatory compliance will shape product development and packaging standards.

- Emerging markets will offer significant opportunities for affordable grooming solutions.

- Digital marketing and influencer engagement will drive stronger brand visibility.

- Convenience-driven products such as travel packs will gain higher adoption.

- Competition between global leaders and regional players will intensify further.