Market Overview

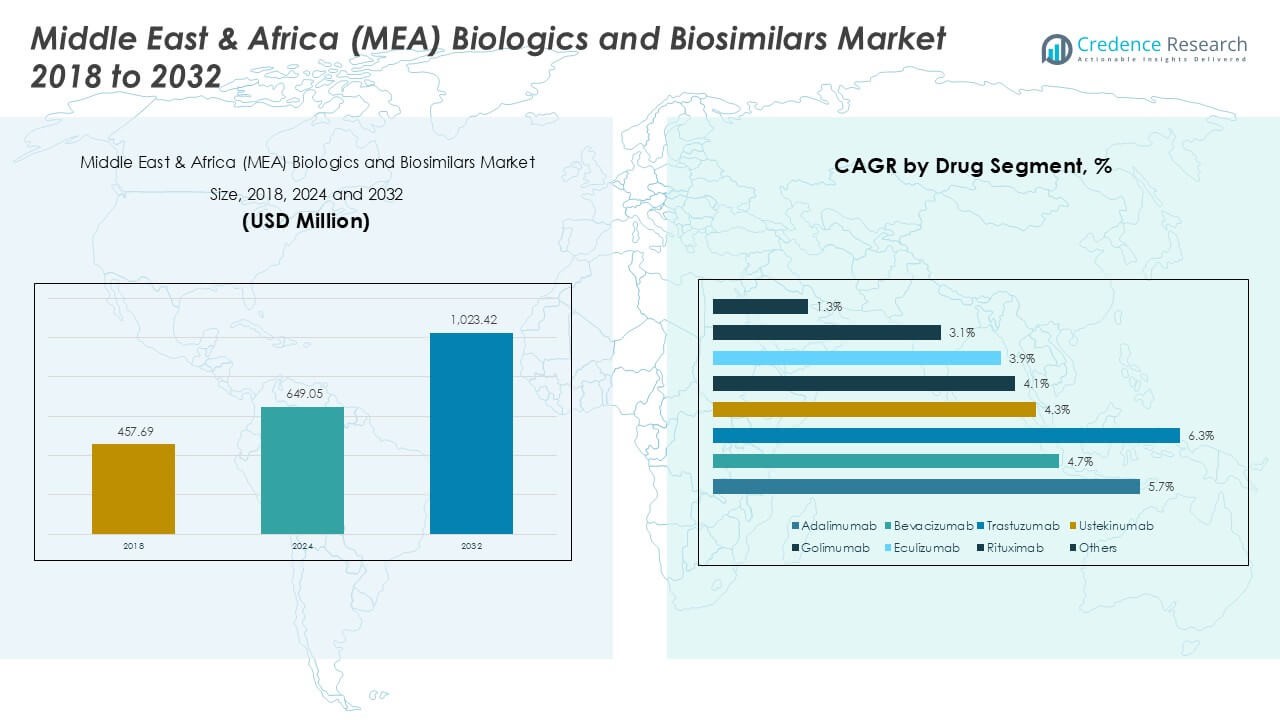

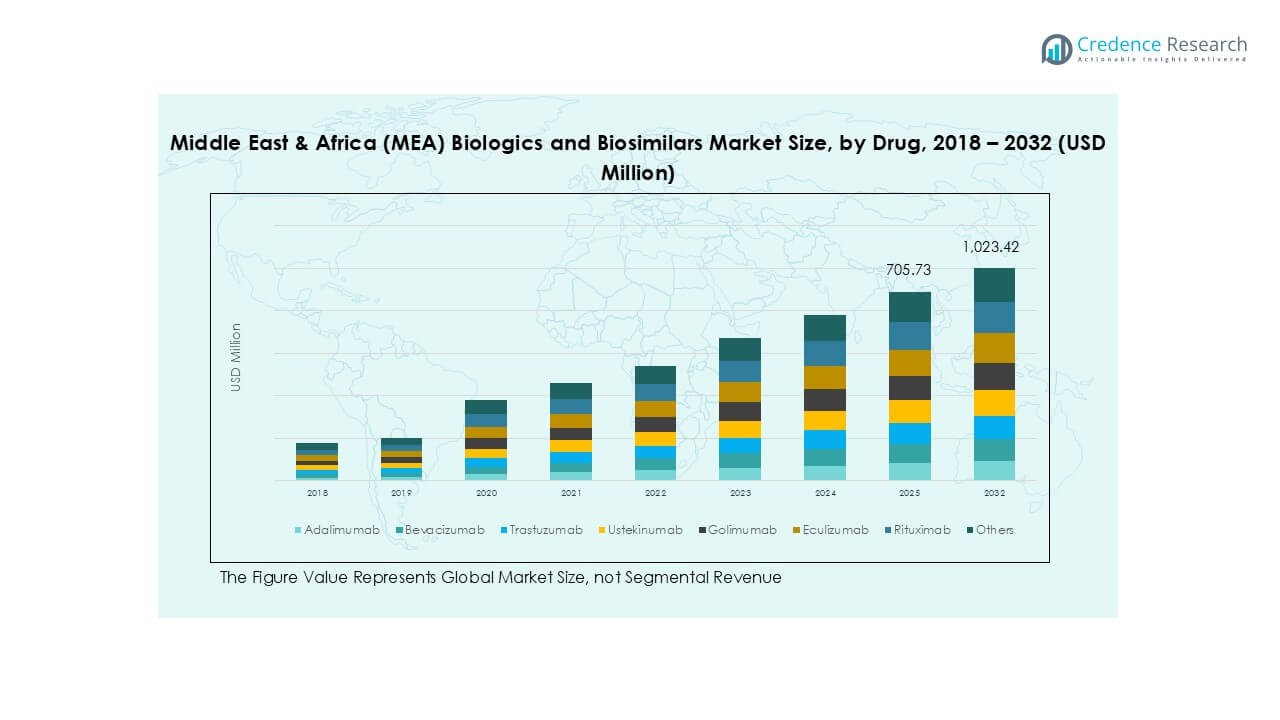

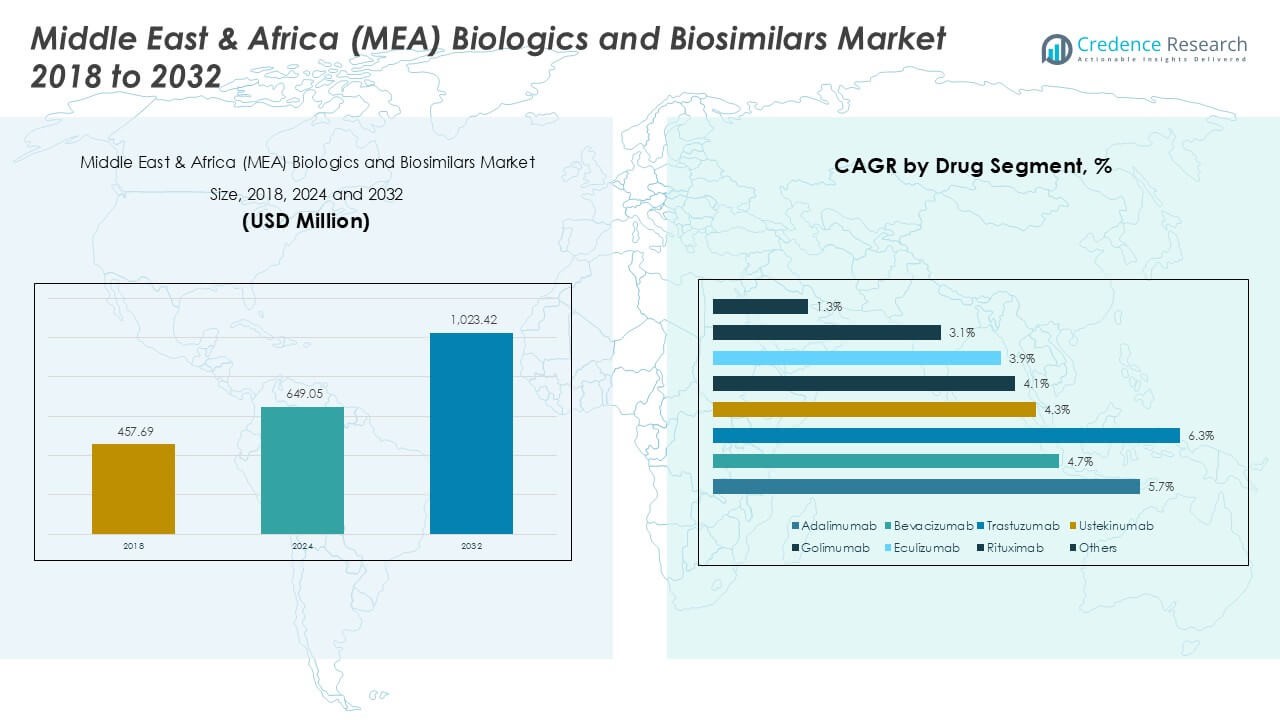

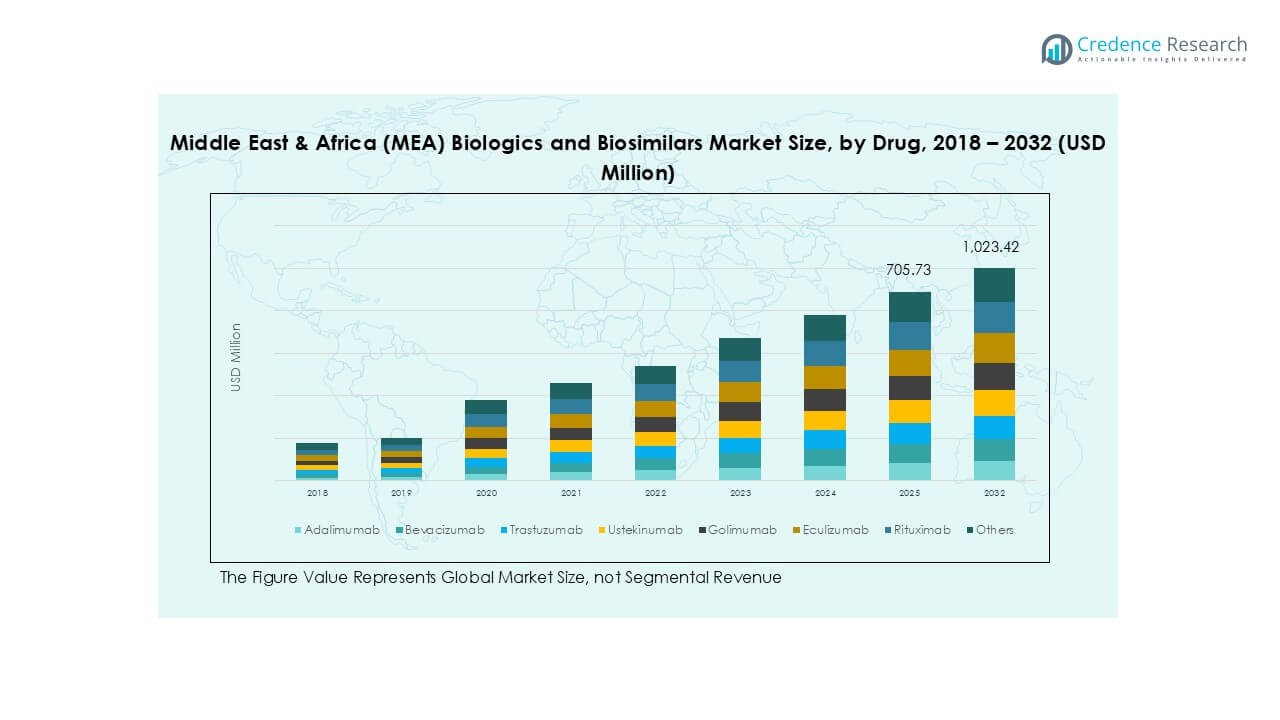

The Middle East and Africa (MEA) Biologics and Biosimilars market size was valued at USD 457.69 million in 2018, increased to USD 649.05 million in 2024, and is anticipated to reach USD 1,023.42 million by 2032, at a CAGR of 5.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East and Africa (MEA) Biologics and Biosimilars market Size 2024 |

USD 649.05 Million |

| Middle East and Africa (MEA) Biologics and Biosimilars market, CAGR |

5.45% |

| Middle East and Africa (MEA) Biologics and Biosimilars market Size 2032 |

USD 1,023.42 Million |

The Middle East & Africa (MEA) biologics and biosimilars market is led by major global players such as Johnson & Johnson, Pfizer Inc., AbbVie Inc., Amgen, F. Hoffmann–La Roche Ltd (Genentech, Inc.), Celltrion, Inc., and Eisai Co Ltd. These companies maintain a strong foothold through extensive product portfolios, strategic partnerships, and continued investment in biosimilar development and regional expansion. Among regional markets, the GCC dominates with a 34.5% market share in 2024, supported by advanced healthcare infrastructure, high biologics adoption, and government initiatives favoring biosimilar integration. Israel and Turkey also contribute significantly, driven by local manufacturing growth and supportive regulatory frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East & Africa (MEA) biologics and biosimilars market was valued at USD 649.05 million in 2024 and is projected to reach USD 1,023.42 million by 2032, growing at a CAGR of 5.45% during the forecast period.

- Growth is driven by rising incidences of chronic diseases such as cancer, autoimmune disorders, and inflammatory conditions, increasing demand for affordable treatment options like biosimilars.

- Biosimilars are gaining rapid acceptance across the region due to cost advantages, expanding local manufacturing, and favorable healthcare reforms promoting wider access.

- Major players including Johnson & Johnson, Pfizer, and AbbVie dominate the market through strong product portfolios, while Celltrion and Eisai are expanding via strategic partnerships and regional collaborations.

- The GCC accounts for 34.5% of the regional market share, followed by Israel (14.2%) and Turkey (12.6%), while Adalimumab leads the drug segment due to its widespread usage in autoimmune disease treatment.

Market Segmentation Analysis:

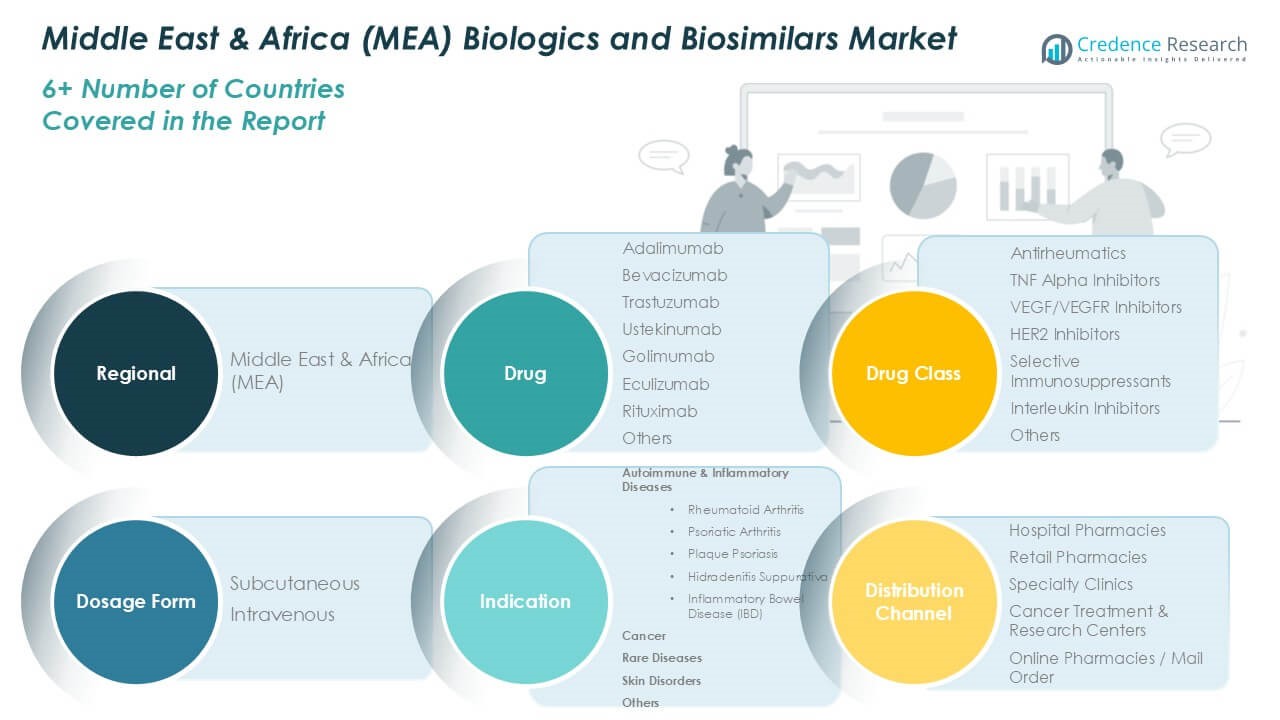

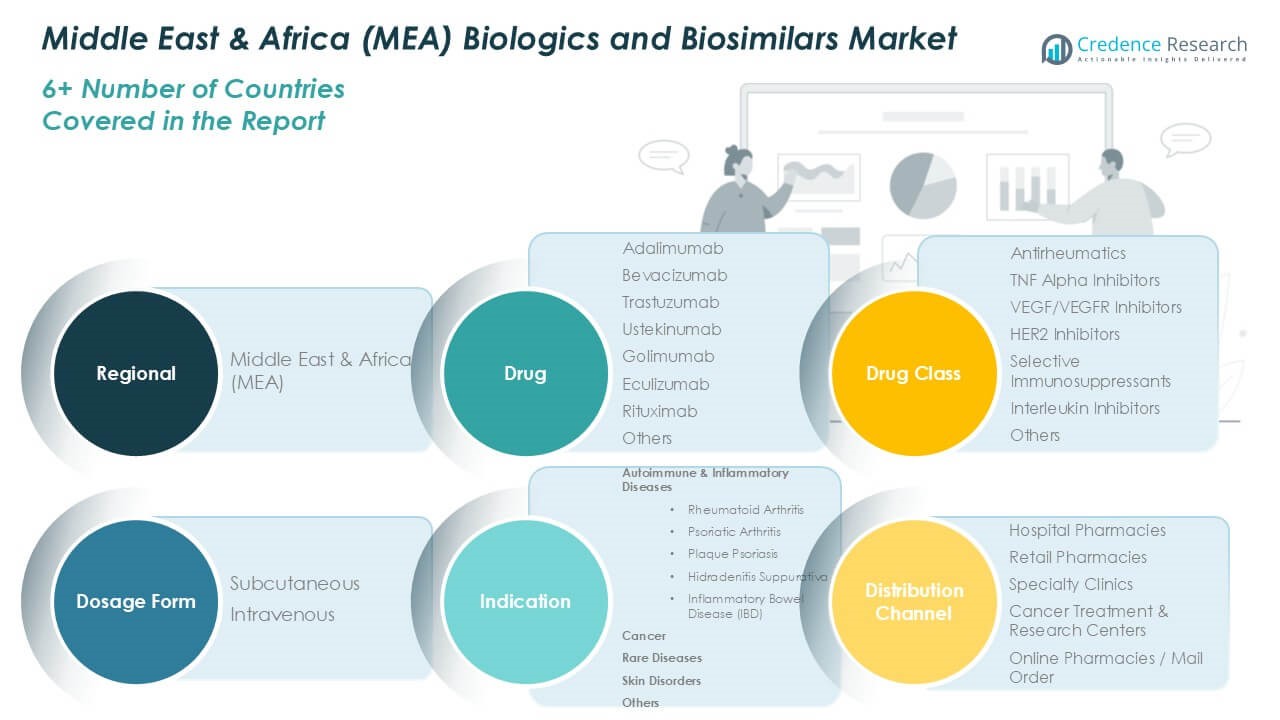

By Drug

In the MEA biologics and biosimilars market, Adalimumab held the dominant share in 2024, driven by its widespread use in treating autoimmune conditions such as rheumatoid arthritis, psoriatic arthritis, and inflammatory bowel disease. Its established clinical efficacy, brand recognition, and biosimilar approvals across several MEA countries have strengthened its market position. Additionally, the rising prevalence of autoimmune diseases and the increasing availability of biosimilar versions at reduced costs are accelerating market penetration. Other notable drugs such as Rituximab and Trastuzumab are gaining traction, particularly in cancer and rare disease indications, further diversifying the treatment landscape.

- For instance, Amgen’s biosimilar Amjevita (adalimumab-atto) received approval from the Saudi Food and Drug Authority (SFDA) in 2023 and recorded over 3,600 prescriptions within the first six months of its launch in the region.

By Drug Class

Among drug classes, TNF Alpha Inhibitors accounted for the largest market share in 2024 due to their effectiveness in managing chronic inflammatory and autoimmune conditions. The rising incidence of rheumatoid arthritis and Crohn’s disease, combined with greater biologic acceptance among clinicians and patients, has propelled this segment’s growth. In particular, high prescription volumes for agents like Adalimumab and Golimumab have reinforced dominance in this class. Other emerging segments, such as Interleukin Inhibitors and VEGF/VEGFR Inhibitors, are witnessing steady growth driven by innovation in cancer therapy and improved access to specialty biologics across MEA markets.

- For instance, Janssen’s Simponi (golimumab) was introduced in UAE hospitals in 2022 and logged over 5,200 administrations across government and private health networks within its first year.

By Dosage Form

The Subcutaneous dosage form dominated the MEA biologics and biosimilars market in 2024, accounting for the highest market share due to its convenience, patient compliance, and suitability for chronic disease management. This mode of administration supports home-based therapy, reducing the need for hospital visits, which is especially beneficial in resource-constrained settings. Subcutaneous formulations of Adalimumab, Ustekinumab, and Golimumab are key drivers in this segment. Meanwhile, the Intravenous segment remains significant for hospital-administered treatments like Rituximab and Bevacizumab, especially in oncology, where precise dosing and monitoring are critical.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic conditions such as cancer, autoimmune disorders, and rare diseases is a major driver of the MEA biologics and biosimilars market. As populations age and lifestyles evolve, the burden of non-communicable diseases is rising significantly. Biologics are often the preferred treatment option due to their targeted mechanism of action and superior efficacy in managing complex diseases. Countries in the region are witnessing higher diagnostic rates and treatment uptake, which is boosting the demand for biologic therapies and their cost-effective biosimilar counterparts.

- For instance, Roche’s Trastuzumab (Herceptin) usage in breast cancer therapy led to over 7,800 new treatment courses initiated across South Africa and Egypt in 2023, based on hospital usage reports.

Government Initiatives and Healthcare Reforms

Governments across the MEA region are actively reforming healthcare systems to improve access to advanced therapies. Initiatives include the expansion of public healthcare coverage, establishment of reimbursement frameworks for biologics and biosimilars, and support for local pharmaceutical manufacturing. Countries like Saudi Arabia, UAE, and South Africa are investing heavily in biopharma infrastructure. These reforms are encouraging biosimilar adoption as a cost-containment strategy while increasing treatment accessibility. Additionally, regulatory agencies are streamlining approval processes, accelerating market entry for biosimilars and encouraging competitive pricing.

- For instance, South Africa’s Biovac Institute secured a R1.5 billion investment deal in 2022 to develop local biologics manufacturing capabilities and began pilot-scale biosimilar production by Q3 2023.

Expanding Pharmaceutical Distribution Networks

The ongoing expansion of pharmaceutical distribution infrastructure, including hospitals, specialty clinics, and online pharmacies, is significantly enhancing the market reach of biologics and biosimilars across MEA. Improved cold chain logistics and the growth of specialty care centers are ensuring better access to temperature-sensitive biologics. Moreover, digitalization in pharmaceutical retail, particularly through online and mail-order pharmacies, is enabling wider patient reach. These improvements are particularly impactful in remote and underserved areas, reducing healthcare disparities and supporting market penetration across both urban and rural regions.

Key Trends & Opportunities

Increasing Acceptance of Biosimilars

The growing physician and patient acceptance of biosimilars is a prominent trend in the MEA market. As clinical confidence in the safety and efficacy of biosimilars strengthens, healthcare providers are more inclined to prescribe them, especially in cost-sensitive environments. Several countries are promoting biosimilar uptake through substitution policies and educational programs. With rising demand for affordable therapies, biosimilars represent a substantial opportunity to reduce treatment costs while expanding access to high-quality biologic drugs, particularly for chronic conditions like rheumatoid arthritis and cancer.

- For instance, Biocon’s Trastuzumab biosimilar (Ogivri) was incorporated into UAE’s national formulary in 2023 and accounted for over 2,400 patient initiations in oncology departments across four major emirates by early 2024.

Local Manufacturing and Strategic Partnerships

An emerging opportunity lies in the localization of biologics and biosimilars manufacturing through public-private partnerships and foreign investments. Governments are incentivizing local production to enhance drug security, reduce reliance on imports, and support national healthcare goals. Partnerships between multinational pharmaceutical companies and regional manufacturers are facilitating technology transfer and capacity building. This trend not only drives economic development but also shortens supply chains and strengthens regional resilience, creating a more sustainable ecosystem for biologics production and distribution.

Key Challenges

High Production and Development Costs

Despite their growing demand, biologics and biosimilars face significant challenges due to the high costs associated with development, manufacturing, and regulatory compliance. Biologics require complex manufacturing environments, including stringent quality control and cold chain logistics. These costs can hinder affordability and limit access, especially in price-sensitive markets within MEA. Furthermore, biosimilar development necessitates extensive clinical trials and regulatory approval, contributing to prolonged time-to-market and financial risk for developers, which can deter investment in biosimilar pipelines.

- For instance, Samsung Bioepis reported an average development cost of USD 120 million per biosimilar product, including Phase I–III clinical trials and regulatory submissions, as per its 2023 R&D disclosures.

Regulatory and Market Access Barriers

The MEA region comprises diverse regulatory frameworks, many of which are still evolving in terms of biosimilar guidelines. This lack of harmonization across countries can delay product approvals and market entry. Additionally, limited awareness among stakeholders and inconsistent reimbursement policies create hurdles for biosimilar adoption. Some markets face challenges with intellectual property rights and data exclusivity periods that favor originator biologics. These regulatory complexities, coupled with fragmented market access pathways, can inhibit timely and broad adoption of biologics and biosimilars.

Limited Healthcare Infrastructure in Some Regions

While urban areas in MEA have advanced healthcare facilities, many rural and low-income regions still face infrastructure limitations. Inadequate healthcare staffing, limited diagnostic capabilities, and lack of specialized treatment centers restrict access to biologic therapies. Moreover, biologics often require skilled administration and long-term monitoring, which may not be feasible in under-resourced settings. These infrastructural gaps contribute to unequal healthcare access, limiting the potential reach and impact of biologics and biosimilars across the broader MEA market.

Regional Analysis

GCC

The GCC region held the largest market share of approximately 34.5% in the MEA biologics and biosimilars market in 2024. This dominance is attributed to strong governmental healthcare investment, robust infrastructure, and high per capita spending. Saudi Arabia and the UAE are leading the region with strategic partnerships, growing biosimilar acceptance, and favorable reimbursement structures. The rising prevalence of cancer and autoimmune diseases has significantly increased demand for targeted biologic therapies. Moreover, national health policies promoting innovation and localization are boosting biologics accessibility, thereby reinforcing GCC’s leading position in the regional market.

- For instance, in 2023, Julphar (Gulf Pharmaceutical Industries) launched a biosimilar version of Erythropoietin (EPO) in partnership with South Korea’s CKD Bio, manufacturing over 720,000 units annually at its Ras Al Khaimah facility for GCC distribution.

Israel

Israel accounted for an estimated market share of 14.2% in 2024, supported by its advanced biotechnology sector and early adoption of biosimilars. The country’s strong clinical research infrastructure, high healthcare literacy, and government support for innovative treatments contribute to widespread biologic utilization. Biologic therapies are widely integrated into Israel’s national health insurance coverage, ensuring accessibility across patient demographics. The oncology and autoimmune treatment segments, in particular, benefit from rapid regulatory approvals and availability of high-efficacy biosimilars, maintaining Israel’s influential role in the MEA biologics and biosimilars market.

- For instance, Teva Pharmaceuticals introduced Truxima (biosimilar Rituximab) in Israel in collaboration with Celltrion, recording over 5,800 treatment courses in the country’s public hospitals between Q1 and Q4 of 2023.

Turkey

Turkey represented a market share of around 12.6% in the MEA biologics and biosimilars landscape in 2024. The country’s large population and significant disease burden are key growth drivers. Government initiatives supporting local manufacturing of biosimilars, coupled with alignment to EU-quality standards, have strengthened domestic capabilities. Turkey’s emphasis on reducing healthcare costs and expanding access through public hospitals has led to increasing adoption of biosimilars, especially in oncology and chronic inflammatory diseases. Continued expansion in biopharmaceutical R&D and investment in local production are expected to further elevate Turkey’s regional standing.

South Africa

South Africa captured approximately 11.4% of the MEA market share in 2024, driven by a dual-sector healthcare system and growing burden of cancer, HIV-related complications, and autoimmune disorders. The country benefits from a relatively mature healthcare supply chain and serves as a pharmaceutical hub for Sub-Saharan Africa. Government collaborations with biosimilar manufacturers and improved regulatory frameworks have increased product approvals and patient access. However, the high cost of biologics remains a concern in public healthcare, making biosimilars a critical solution for long-term treatment affordability and accessibility.

Egypt

Egypt held a market share of around 10.1% in the MEA biologics and biosimilars market in 2024. With a population exceeding 110 million, Egypt presents a substantial patient base for chronic disease treatments. The government is actively expanding its pharmaceutical sector through incentives for local biosimilar manufacturing and public health initiatives aimed at improving treatment access. Rising demand for cancer therapies and immunological treatments, coupled with increased biosimilar availability, is accelerating market growth. However, pricing and healthcare resource disparities between urban and rural areas still pose challenges to equitable access.

Nigeria

Nigeria accounted for a smaller market share of approximately 5.8% in 2024, limited by underdeveloped healthcare infrastructure and affordability constraints. However, the country’s large population and increasing prevalence of chronic diseases offer significant long-term market potential. While biologics are mainly available in private facilities and urban centers, donor-backed programs and government collaborations are gradually improving biosimilar access. Growth is expected to come from targeted investments in healthcare delivery, awareness campaigns, and regulatory reforms focused on essential biologics for oncology, infectious diseases, and autoimmune disorders.

Rest of Middle East & Africa

The Rest of Middle East & Africa collectively contributed around 11.4% of the regional biologics and biosimilars market share in 2024. This segment includes countries such as Algeria, Jordan, Kenya, and Morocco, which show varying degrees of healthcare access and policy maturity. While biologics usage is limited in several nations due to affordability and infrastructure gaps, international partnerships, WHO initiatives, and private sector investment are facilitating incremental improvements. Biosimilar adoption is growing, especially in oncology and immunology, as governments seek cost-effective treatment alternatives in the face of increasing disease burden.

Market Segmentations:

By Drug:

- Adalimumab

- Bevacizumab

- Trastuzumab

- Ustekinumab

- Golimumab

- Eculizumab

- Rituximab

- Others

By Drug Class:

- Antirheumatics

- TNF Alpha Inhibitors

- VEGF/VEGFR Inhibitors

- HER2 Inhibitors

- Selective Immunosuppressants

- Interleukin Inhibitors

- Others

By Dosage Form:

By Indication:

- Autoimmune & Inflammatory Diseases

- Rheumatoid Arthritis

- Psoriatic Arthritis

- Plaque Psoriasis

- Hidradenitis Suppurativa

- Inflammatory Bowel Disease (IBD)

- Cancer

- Rare Diseases

- Skin Disorders

- Others

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Specialty Clinics

- Cancer Treatment & Research Centers

- Online Pharmacies / Mail Order

By Geography:

- GCC

- Israel

- Turkey

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

Competitive Landscape

The competitive landscape of the Middle East & Africa (MEA) biologics and biosimilars market is characterized by the presence of several global pharmaceutical giants alongside emerging regional players. Leading companies such as Johnson & Johnson, Pfizer Inc., AbbVie Inc., Amgen, and F. Hoffmann–La Roche Ltd (Genentech, Inc.) dominate the market with robust product portfolios, established distribution networks, and strong R&D capabilities. These companies are actively expanding their biosimilar offerings to enhance affordability and accessibility across the MEA region. Additionally, firms like Celltrion, Inc. and Eisai Co Ltd are making strategic inroads through partnerships, regional licensing, and technology transfer initiatives. Competition is intensifying as governments promote biosimilar adoption to reduce healthcare costs, prompting innovation, pricing strategies, and local manufacturing collaborations. The market also sees growing interest from regional firms aiming to produce cost-effective biosimilars domestically. Overall, the competitive environment is dynamic, with a clear shift toward affordability, innovation, and wider patient access across diverse MEA markets.

- For instance, in 2023, Celltrion signed a technology transfer agreement with Egypt’s Eva Pharma to localize production of Remsima (infliximab biosimilar), targeting annual output of 1.1 million vials to meet regional demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson & Johnson

- Pfizer Inc.

- AbbVie Inc.

- Amgen

- Hoffmann–La Roche Ltd (Genentech, Inc.)

- Celltrion, Inc.

- Eisai Co Ltd

Recent Developments

- In 2025, Pfizer maintains a prominent position in supplying biosimilars for chronic and oncology treatments in the Middle East and Africa (MEA) region. They are actively expanding access by collaborating with local distributors and governments, especially as individual country-specific biosimilar regulations mature. This expansion is crucial as biosimilars offer more affordable alternatives to biologics, increasing access to vital treatments, particularly in low- and middle-income countries.

- In 2025, Amgen is a key player in the Middle East and Africa (MEA) biosimilars and next-generation biologics market, leveraging partnerships and gaining approvals for its cancer and immunology products. This positions them as a significant supplier in the region, particularly as the market for biosimilars continues to grow.

- In April 2025, AbbVie adjusted its global financial forecast due to increased biosimilar competition, particularly from adalimumab biosimilars, in regions like the Gulf and South Africa where cost-effective healthcare is a priority. This shift reflects the growing impact of biosimilars, especially for adalimumab, on the pharmaceutical market.

- In January 2025, Amgen launched its ustekinumab biosimilar, Wezlana, in global markets. This biosimilar references Johnson & Johnson’s Stelara (ustekinumab). The uptake in the Middle East and Africa (MEA) is anticipated to increase as regulatory approvals in those regions align with European and US standards.

Market Concentration & Characteristics

The Middle East & Africa (MEA) Biologics and Biosimilars Market exhibits a moderately concentrated structure, with a few global pharmaceutical companies commanding a significant share through their established product portfolios and strong distribution networks. It reflects a blend of mature markets, such as the GCC and Israel, and emerging markets like Nigeria and Egypt. High entry barriers related to regulatory compliance, manufacturing complexity, and clinical development restrict the presence of smaller players. The market remains highly competitive, with leading firms focusing on expanding biosimilar offerings to address cost concerns and increase patient access. Strategic alliances, local production initiatives, and government-supported healthcare reforms continue to shape its competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Drug, Drug Class, Dosage Form, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The MEA biologics and biosimilars market is expected to grow steadily due to rising demand for targeted therapies in oncology and autoimmune diseases.

- Governments across the region will likely increase investments in healthcare infrastructure and biosimilar procurement programs.

- Biosimilar adoption is set to rise as healthcare systems seek cost-effective alternatives to originator biologics.

- Local manufacturing initiatives and technology transfer agreements are expected to enhance regional production capacity.

- Regulatory harmonization across MEA countries will streamline biosimilar approvals and accelerate market entry.

- Increasing partnerships between global pharmaceutical firms and regional players will drive product availability and market reach.

- Public awareness campaigns and professional training will improve confidence in biosimilar safety and efficacy.

- Expansion of digital health platforms and online pharmacies will support wider distribution and patient access.

- Chronic disease burden, particularly cancer and autoimmune conditions, will continue to fuel biologic therapy demand.

- Innovation in subcutaneous and self-administration delivery formats will improve treatment compliance and patient convenience.