| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cultured Meat Bioreactors Market Size 2024 |

USD 301.87 Million |

| Cultured Meat Bioreactors Market, CAGR |

4.93% |

| Cultured Meat Bioreactors Market Size 2032 |

USD 456.22 Million |

Market Overview

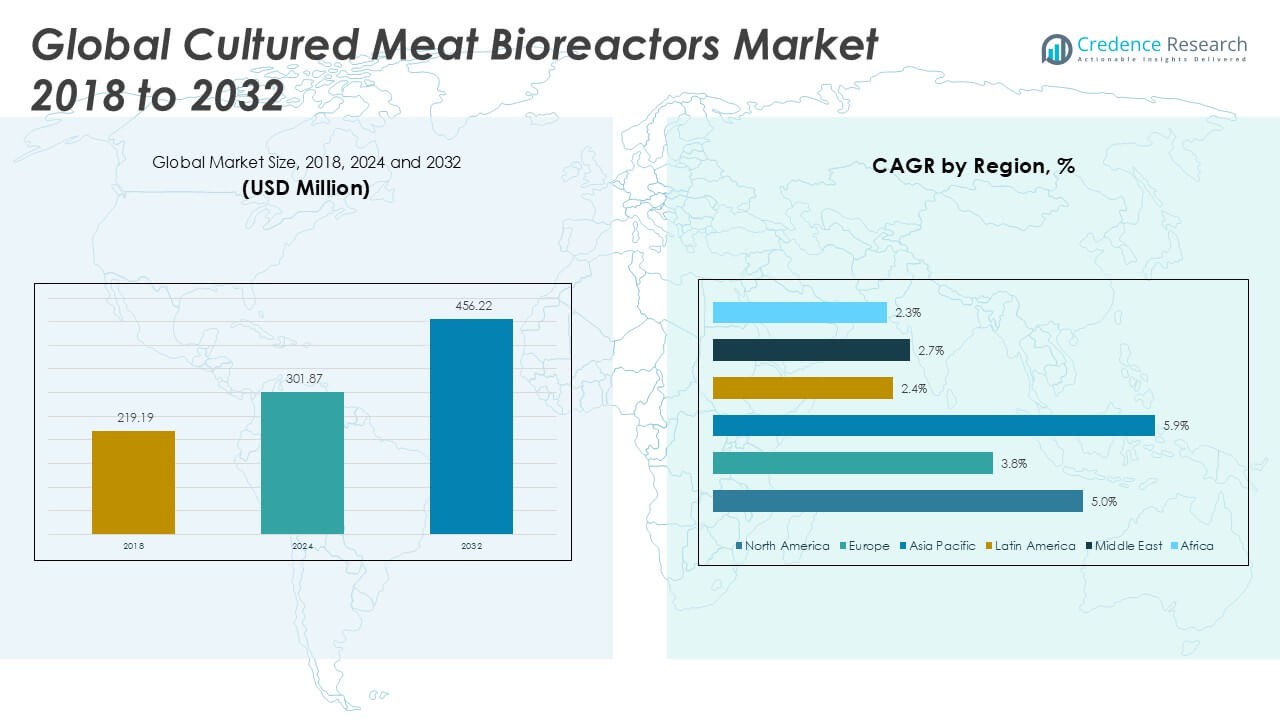

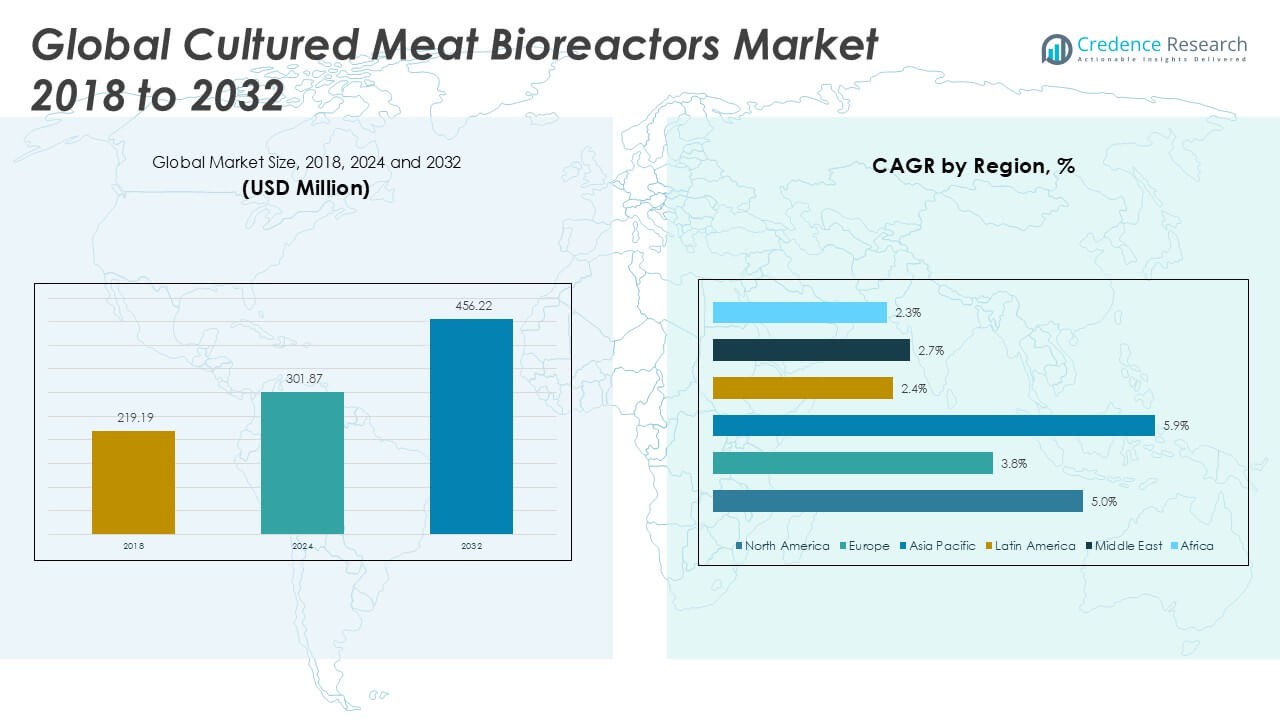

The Cultured Meat Bioreactors Market size was valued at USD 219.19 million in 2018, grew to USD 301.87 million in 2024, and is anticipated to reach USD 456.22 million by 2032, at a CAGR of 4.93% during the forecast period.

The Cultured Meat Bioreactors Market is experiencing steady growth driven by rising demand for sustainable and ethical protein sources, as well as increasing investment from food technology companies and venture capitalists. Advances in bioprocess engineering and scalable bioreactor designs have enhanced production efficiency and cell yield, making cultured meat more commercially viable. Consumer awareness of environmental concerns, animal welfare, and food security continues to support market expansion. Key trends include the integration of automation and artificial intelligence to optimize cell culture processes, the development of single-use bioreactor systems, and strategic collaborations among industry players to accelerate product development. However, high initial capital requirements and stringent regulatory frameworks remain significant challenges. Despite these hurdles, ongoing research and innovation are expected to drive the adoption of advanced bioreactor technologies, positioning the market for continued growth as alternative protein becomes an increasingly important part of the global food landscape.

Geographical analysis of the Cultured Meat Bioreactors Market reveals strong growth momentum in North America, Asia Pacific, and Europe, supported by active investments, regulatory progress, and robust R&D infrastructure. North America, led by the United States, benefits from advanced food technology startups and established biotech firms, while Asia Pacific gains traction through rising consumer acceptance and significant government support in countries like China, Japan, and Singapore. Europe demonstrates innovation and cross-industry collaboration, particularly in Germany and the Netherlands. Key players driving market development include Merck KGaA, Eppendorf AG, and GEA, each leveraging their expertise in bioprocess engineering and manufacturing solutions to support commercial-scale cultured meat production. These companies play a crucial role in advancing bioreactor technology, enabling the market to meet growing demand for sustainable protein sources.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cultured Meat Bioreactors Market was valued at USD 219.19 million in 2018, reached USD 301.87 million in 2024, and is projected to hit USD 456.22 million by 2032 at a CAGR of 4.93%.

- Strong demand for sustainable protein sources and ethical food production continues to drive market growth, with increasing awareness of environmental impacts fueling adoption of cultured meat technologies.

- The market is witnessing trends such as adoption of single-use bioreactor systems, integration of automation and artificial intelligence, and expansion of applications across various meat alternatives including beef, poultry, and pork.

- Leading companies like Merck KGaA, Eppendorf AG, and GEA are investing in advanced bioprocess engineering and scalable bioreactor designs, strengthening their competitive position in global markets.

- High initial capital requirements, complex manufacturing processes, and regulatory uncertainty remain key restraints, limiting the entry of new participants and slowing industry expansion.

- North America and Asia Pacific exhibit strong growth momentum, backed by supportive investments, technological advancements, and favorable regulatory environments, while Europe focuses on food safety and collaborative innovation.

- Regional markets in Latin America, the Middle East, and Africa are showing gradual development, driven by local research initiatives and government interest, though challenges such as infrastructure and funding persist.

Market Drivers

Rising Demand for Sustainable Protein Fuels Market Expansion

Growing consumer awareness regarding the environmental impact of traditional meat production continues to drive the Cultured Meat Bioreactors Market. Increasing concerns over greenhouse gas emissions, land use, and water consumption associated with conventional livestock farming have led to greater interest in cultured meat as a sustainable alternative. Food industry players recognize the need to adopt cleaner and more resource-efficient processes, prompting investment in bioreactor technology. Regulatory pressure to reduce the carbon footprint of food production also supports this shift. The market benefits from heightened public discourse on ethical eating and responsible sourcing. Companies actively position cultured meat as a solution for global protein needs, aligning with broader sustainability goals.

- For instance, Mosa Meat reported in 2021 that its pilot plant in Maastricht, Netherlands, operates a 500-liter bioreactor dedicated to producing cultured beef.

Technological Advancements in Bioreactor Design Enhance Production

Advances in bioprocess engineering play a key role in supporting the Cultured Meat Bioreactors Market. Development of scalable, automated, and single-use bioreactor systems increases production efficiency and cell yield. Companies invest in optimizing parameters such as oxygen transfer, nutrient delivery, and waste removal, enabling higher-quality cultured meat output. Improved control systems and real-time monitoring capabilities streamline manufacturing and reduce operational costs. The integration of artificial intelligence for process optimization further enhances performance. These technological improvements help bridge the gap between laboratory research and commercial-scale production, paving the way for broader market adoption.

- For instance, Merck KGaA’s Mobius® single-use bioreactors are available in sizes up to 2,000 liters, and are routinely used in food and pharma applications to enable high-volume, sterile production environments.

Strong Investment Activity and Industry Collaboration Accelerate Growth

Substantial funding from venture capital firms and established food companies accelerates innovation within the Cultured Meat Bioreactors Market. Industry leaders form strategic partnerships to combine resources, expertise, and infrastructure for rapid product development. Joint ventures and collaborations with biotechnology firms expand access to cutting-edge technologies. Governments and research institutions also allocate grants and support for cultured meat initiatives, recognizing the potential for job creation and food security. This influx of capital and knowledge sharing fuels advancements in bioreactor technology, helping startups and established players scale production and meet market demand.

Consumer Awareness and Regulatory Developments Shape Market Dynamics

Increasing public knowledge of animal welfare, food safety, and the potential health benefits of cultured meat drives positive sentiment toward the Cultured Meat Bioreactors Market. Educational campaigns and media coverage play a role in shaping consumer perceptions and acceptance. Regulatory agencies develop standards to ensure product quality and safety, influencing the pace and direction of market growth. While navigating complex regulatory landscapes remains a challenge, progress toward clear guidelines encourages greater investment and innovation. As the market evolves, ongoing dialogue among stakeholders supports transparency and trust, helping to build a strong foundation for future growth.

Market Trends

Adoption of Single-Use Bioreactor Systems Drives Innovation

The Cultured Meat Bioreactors Market is witnessing a strong shift toward single-use bioreactor systems, enabling greater flexibility and reducing risks of cross-contamination. Manufacturers are developing disposable bioreactor components to streamline cleaning processes and lower operational downtime. This trend addresses the need for scalable and hygienic production in a highly regulated industry. Single-use technologies also support rapid batch changeovers, making it easier for companies to develop a variety of cultured meat products. The ability to minimize turnaround time and operational costs appeals to both established producers and new entrants. This shift plays a key role in supporting commercialization efforts.

- For instance, Eppendorf’s BioBLU® single-use vessels are available in working volumes ranging from 0.25 liters to 40 liters, allowing for quick transition from lab to pilot scale.

Integration of Automation and Digital Monitoring Enhances Efficiency

The integration of automation and advanced digital monitoring technologies is a defining trend in the Cultured Meat Bioreactors Market. Automation solutions improve process consistency, reduce human error, and support real-time monitoring of critical parameters. Companies implement artificial intelligence and machine learning algorithms to optimize cell culture conditions and maximize yields. Advanced sensor technologies enable precise control over temperature, pH, and nutrient concentrations, ensuring optimal bioreactor performance. These digital tools provide actionable insights, enabling proactive adjustments and efficient resource management. This focus on automation positions market participants for cost-effective and scalable production.

- For instance, Infors HT’s Minifors 2 bioreactor features automated control for temperature (range: 5°C–60°C), pH (accuracy: ±0.01), and dissolved oxygen (accuracy: ±1%), delivering precise cell culture environments.

Focus on Cost Reduction and Commercial Scale-Up Intensifies

Efforts to lower production costs and achieve commercial-scale output remain at the forefront of trends in the Cultured Meat Bioreactors Market. Companies prioritize innovations that reduce reliance on expensive growth media and improve cell proliferation rates. Research into alternative raw materials and optimized bioprocessing protocols continues to gain traction. Market leaders invest in pilot and demonstration plants to validate scalability and refine operational workflows. Cost-efficiency directly impacts product accessibility and market competitiveness. These initiatives are critical for transforming cultured meat from niche innovation to mainstream protein solution.

Strategic Collaborations and Regulatory Alignment Shape the Landscape

Strategic collaborations between technology providers, food producers, and regulatory bodies are shaping the future of the Cultured Meat Bioreactors Market. Industry partnerships accelerate research, development, and market entry for new bioreactor technologies. Companies engage with regulatory authorities to establish clear standards and gain approval for novel production processes. International harmonization of regulations supports global market expansion and fosters consumer confidence. Cross-industry alliances bring together expertise from biotechnology, engineering, and food science. This collaborative approach drives industry-wide progress and paves the way for broader adoption of cultured meat products.

Market Challenges Analysis

High Capital Investment and Complex Manufacturing Limit Market Entry

The Cultured Meat Bioreactors Market faces significant barriers related to high initial capital requirements and complex manufacturing processes. Companies must invest in advanced bioreactor infrastructure, sophisticated monitoring systems, and specialized materials to ensure consistent quality and safety. Many startups encounter difficulties in securing funding for large-scale facilities, which limits their ability to compete with established food producers. Scaling up from laboratory to commercial production demands substantial resources and technical expertise. The need for continuous innovation in bioprocessing technology also increases operational costs. These financial and technical challenges restrict market entry for new participants and slow overall industry growth.

Regulatory Uncertainty and Limited Consumer Acceptance Hinder Adoption

Uncertainty around regulatory approval processes and evolving food safety standards presents ongoing challenges for the Cultured Meat Bioreactors Market. Companies must navigate varying regulatory frameworks across different countries, often facing lengthy approval timelines and complex compliance requirements. Public perception of cultured meat remains mixed, with concerns related to product safety, nutritional value, and naturalness influencing consumer acceptance. Market participants invest in education and outreach to build trust, but overcoming skepticism requires time and transparent communication. The interplay of regulatory complexity and cautious consumer sentiment impacts the speed and scale of market adoption, creating hurdles for industry expansion.

Market Opportunities

Expansion into Emerging Markets and Diverse Applications Fuels Growth Potential

The Cultured Meat Bioreactors Market has strong opportunities for growth through expansion into emerging markets and diversification of end-use applications. Rapid urbanization and rising incomes in Asia-Pacific, Latin America, and the Middle East drive interest in alternative protein sources. Companies that establish local partnerships and manufacturing facilities in these regions can benefit from untapped demand and favorable government policies. Opportunities extend beyond traditional meat substitutes, with potential applications in pet food, specialty ingredients, and medical research. Broadening the market scope enables industry players to reach new customer segments and create resilient business models.

Advancements in Bioprocessing and Strategic Collaborations Unlock Innovation

Ongoing advancements in bioprocessing technologies present significant opportunities for the Cultured Meat Bioreactors Market. Innovations that improve cell culture efficiency, reduce production costs, and enhance scalability enable wider market adoption. Companies pursuing strategic collaborations with academic institutions, biotechnology firms, and food manufacturers gain access to cutting-edge research and technical expertise. These partnerships foster innovation and accelerate product development cycles. By investing in research and forming alliances across the value chain, market participants can differentiate their offerings and position themselves as leaders in the evolving alternative protein landscape.

Market Segmentation Analysis:

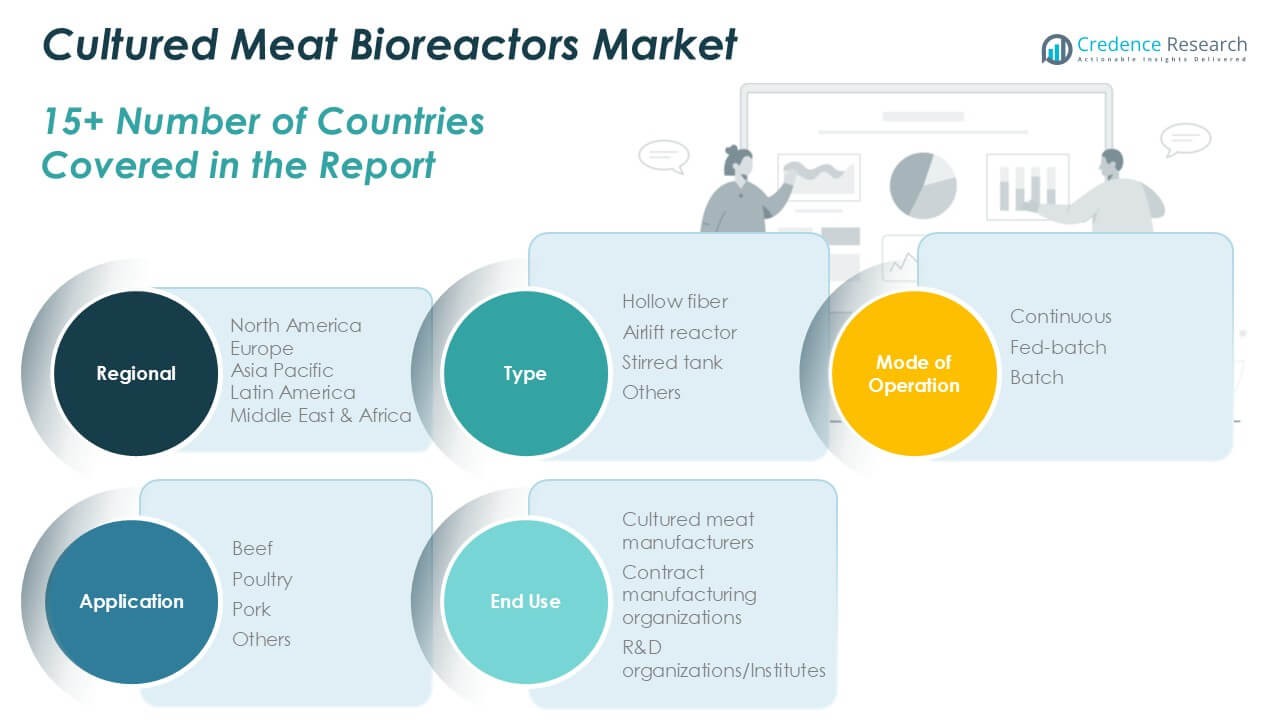

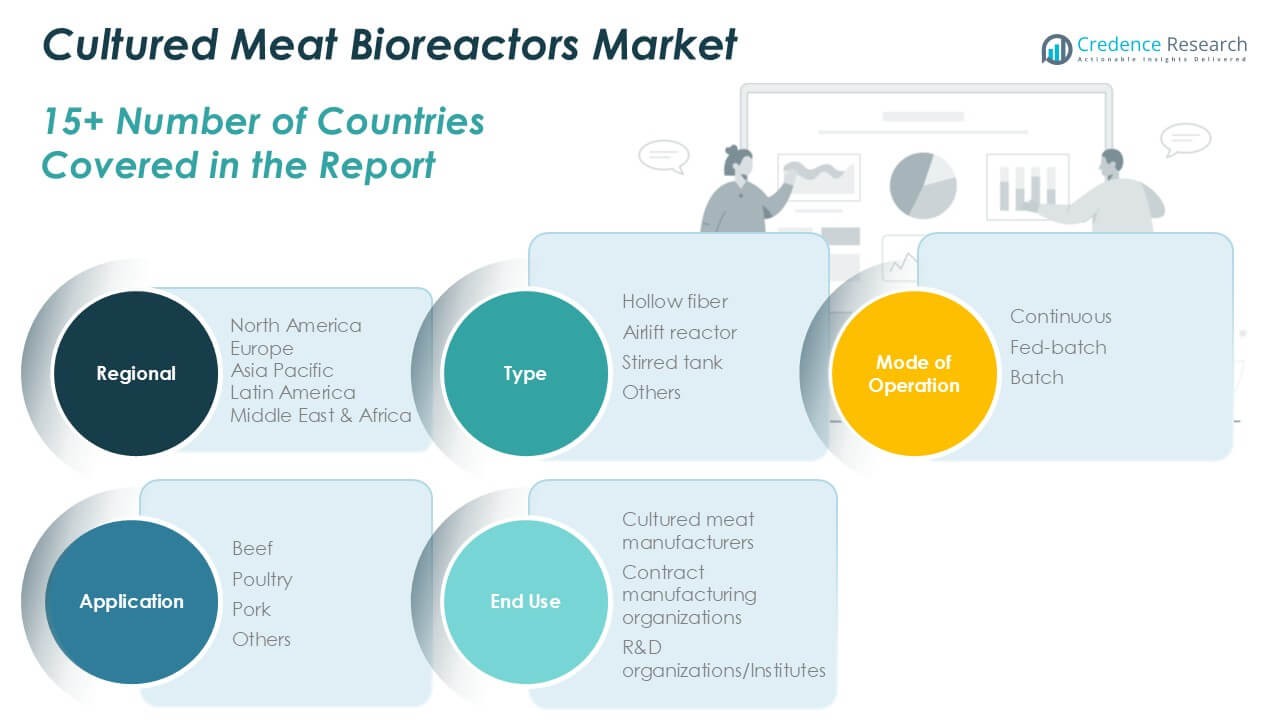

By Type:

The Cultured Meat Bioreactors Market features a diverse product landscape by type, with hollow fiber, airlift reactor, stirred tank, and other specialized designs meeting varying production requirements. Stirred tank bioreactors hold a significant share due to their established use in cell culture, robust scalability, and efficient mixing capabilities. Hollow fiber bioreactors offer advantages for high-density cell cultures, appealing to companies focused on optimizing yields in a limited footprint. Airlift reactors, with low shear environments and reduced energy consumption, find adoption in processes sensitive to cell damage. Other bioreactor types, including packed bed and wave bioreactors, address specific research or niche production needs, reflecting ongoing innovation in bioprocess engineering.

- For instance, FiberCell Systems’ C2025 hollow fiber bioreactor supports culture densities of up to 1×10¹⁰ cells per cartridge, ideal for high-yield protein production.

By Mode of Operation:

The market segments into continuous, fed-batch, and batch processes. Continuous bioreactor systems drive efficiency through ongoing cell harvest and nutrient replenishment, supporting large-scale, cost-effective production. Fed-batch reactors offer flexibility, enabling precise control over nutrient feed and optimal growth conditions during key production phases. Batch operations remain relevant for smaller-scale or experimental runs, favored in research and development environments where process validation and parameter optimization are priorities. Each mode of operation addresses different scalability and cost-efficiency requirements, aligning with the diverse needs of cultured meat producers and researchers.

- For instance, GEA’s Perfusion bioreactor systems can process continuous flows of up to 1,000 liters per hour for biomanufacturing applications.

By Application:

The Cultured Meat Bioreactors Market serves a broad spectrum of meat alternatives, including beef, poultry, pork, and others. Beef applications command a prominent share due to strong market demand for sustainable and ethical alternatives to conventional beef. Poultry follows closely, driven by consumer preference for chicken and ongoing innovation in avian cell culture techniques. Pork applications benefit from regional demand and efforts to diversify cultured meat portfolios. The “others” segment includes emerging options such as seafood, exotic meats, and hybrid products, reflecting the market’s adaptability and pursuit of novel protein sources.

Segments:

Based on Type:

- Hollow fiber

- Airlift reactor

- Stirred tank

- Others

Based on Mode of Operation:

- Continuous

- Fed-batch

- Batch

Based on Application:

Based on End-Use:

- Cultured meat manufacturers

- Contract manufacturing organizations

- R&D organizations/Institutes

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Cultured Meat Bioreactors Market

North America Cultured Meat Bioreactors Market grew from USD 87.36 million in 2018 to USD 118.94 million in 2024 and is projected to reach USD 180.31 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.0%. North America is holding a 40% market share. The United States leads regional growth, driven by robust investments in food technology, favorable regulatory progress, and a strong ecosystem of startups and established players. Canada also contributes to market expansion with active research initiatives and partnerships. The region’s focus on sustainability, innovation, and ethical food production supports continued advancement in bioreactor technologies.

Europe Cultured Meat Bioreactors Market

Europe Cultured Meat Bioreactors Market grew from USD 43.50 million in 2018 to USD 56.82 million in 2024 and is expected to reach USD 78.57 million by 2032, registering a CAGR of 3.8%. Europe accounts for a 17% market share. Key contributors include Germany, the Netherlands, and the United Kingdom, where government support and leading biotech firms drive market growth. The region places a high priority on food safety and environmental standards, which shapes market strategies and bioreactor innovation. Collaboration between academic institutions and industry stakeholders accelerates adoption across the continent.

Asia Pacific Cultured Meat Bioreactors Market

Asia Pacific Cultured Meat Bioreactors Market grew from USD 71.55 million in 2018 to USD 103.42 million in 2024 and is set to reach USD 168.90 million by 2032, posting the highest CAGR of 5.9%. Asia Pacific holds a 37% market share. China, Japan, and Singapore emerge as pivotal markets, backed by strong government investment and growing consumer acceptance of alternative proteins. Strategic partnerships and expansion of pilot facilities in the region foster rapid technology adoption. The drive to address food security and environmental concerns enhances regional momentum.

Latin America Cultured Meat Bioreactors Market

Latin America Cultured Meat Bioreactors Market grew from USD 6.87 million in 2018 to USD 9.28 million in 2024 and is forecasted to reach USD 11.58 million by 2032, with a CAGR of 2.4%. Latin America represents a 3% market share. Brazil and Argentina lead in research and early-stage development of cultured meat technology. The region benefits from a rising interest in sustainable food sources but faces barriers including limited funding and regulatory uncertainty. Market expansion depends on overcoming infrastructural and investment challenges.

Middle East Cultured Meat Bioreactors Market

Middle East Cultured Meat Bioreactors Market grew from USD 6.02 million in 2018 to USD 7.56 million in 2024 and is estimated to reach USD 9.60 million by 2032, growing at a CAGR of 2.7%. The Middle East contributes a 2% market share. Countries such as Israel and the United Arab Emirates lead in innovation and attract international partnerships. The focus on food security and technological advancement positions the region as an emerging hub for cultured meat development. Supportive government initiatives play a role in market visibility and investment.

Africa Cultured Meat Bioreactors Market

Africa Cultured Meat Bioreactors Market grew from USD 3.89 million in 2018 to USD 5.85 million in 2024 and is projected to reach USD 7.25 million by 2032, reflecting a CAGR of 2.3%. Africa holds a 2% market share. South Africa leads regional progress, supported by local research institutions and collaborations. Limited infrastructure and funding remain key constraints, but awareness of alternative proteins is gradually increasing. Market participants focus on pilot projects and knowledge transfer to stimulate growth and adoption across the continent.

Key Player Analysis

- KBiotech GmBH

- Merck KGaA

- Eppendorf AG

- Esco Lifesciences Group

- GEA

- ABEC

- Alfa Laval

- Bioengineering AG

- Infors HT

- INNOVA Bio-meditech

Competitive Analysis

The Cultured Meat Bioreactors Market features a competitive landscape shaped by established bioprocess technology leaders and specialized manufacturers. Key players such as Merck KGaA, Eppendorf AG, GEA, ABEC, Alfa Laval, Bioengineering AG, Esco Lifesciences Group, Infors HT, and KBiotech GmBH drive technological innovation and industry adoption. These companies focus on developing advanced, scalable bioreactor solutions tailored to the needs of cultured meat production, emphasizing precision control, automation, and cost efficiency. Market leaders invest heavily in research and development, integrating automation, real-time monitoring, and artificial intelligence to enhance productivity and reduce operational costs. Strategic collaborations with research institutions and cultured meat producers accelerate product development and market adoption. Firms compete by offering tailored solutions that address regulatory requirements, ease of use, and flexibility for diverse applications. This dynamic landscape drives continuous advancements in bioreactor design, digital integration, and process optimization, enabling the market to respond quickly to evolving industry demands and expanding opportunities in alternative protein production.

Recent Developments

- In February 2025, Ever After Foods and Bühler partnered to launch commercial scale cultivated meat production system. The company aims to accelerate the development and deployment of its proprietary edible packed-bed (EPB) technology platform.

- In March 2025, ABEC launched Advanced Therapy Bioreactor (ATB), a revolutionary platform poised to transform cell expansion for advanced therapy medicinal products.

- In November 2024, Integriculture launched a starter kit to drive innovation and accelerate R&D in the cultivated meat sector. The cultivated meat starter kit includes Oxy-thru Cultivator (bioreactor), IMEM1.0 (a base culture medium), iDisper (an agent for cell dissociation), iCoater, (a coating solution for the extracellular matrix), and iFreezer (a solution for cryopreservation).

- In September 2023, Eat Just Inc. announced a strategic partnership with Halal Products Development Company (HPDC), wholly owned by the Public Investment Fund of Saudi Arabia. Through this collaboration, HPDC would provide advisory solutions to help Eat Just obtain “Halal” certification and approvals needed to operate as a Halal food distributor. The partnership would also leverage HPDC’s services to help Eat Just develop a sustainable strategy to enter the Halal market, paving the way to export its products to local and regional markets.

- In April 2023, BlueNalu announced the signing of a Letter of Intent (LOI) with Nutreco, a prominent player in animal nutrition and aquafeed. This marked their third agreement, following initial collaborations in December 2019 and Nutreco’s participation in BlueNalu’s Series A round financing. The LOI underscored their mutual commitment to establishing and expanding a food-grade supply chain for cell-cultured seafood production. It also signified Nutreco’s investment in developing food grade supply chain infrastructure in tandem with BlueNalu’s progression from pilot-scale development to regulatory stages and commercialization efforts. This partnership’s initial phase would focus on reducing cell feed costs and defining specifications for crucial raw materials necessary for creating BlueNalu’s unique cell-cultured seafood products.

Market Concentration & Characteristics

The Cultured Meat Bioreactors Market displays a moderate to high level of concentration, with a few global bioprocess technology providers and engineering specialists dominating the competitive landscape. It features strong barriers to entry, driven by significant capital requirements, advanced technological expertise, and strict regulatory demands. Established firms leverage their research capabilities and industry partnerships to maintain leadership, while emerging companies seek differentiation through niche applications and innovative bioreactor designs. The market is characterized by a focus on scalability, automation, and compliance with evolving food safety standards. Continuous investment in R&D and collaboration with research institutions help accelerate product development and address the unique needs of cultured meat producers. It values precision, process efficiency, and adaptability, supporting the shift toward sustainable and ethical protein production. The dynamic interplay between established leaders and agile innovators shapes the pace of technological progress and market adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Mode of Operation, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cultured Meat Bioreactors Market is expected to witness steady growth with rising global demand for sustainable protein.

- Adoption of single-use bioreactor technologies will accelerate production efficiency and support commercial scaling.

- Automation and artificial intelligence will play a larger role in process optimization and quality control.

- Regulatory clarity and evolving standards will facilitate faster product approvals and market entry.

- Expansion into emerging markets will create new opportunities for local manufacturing and partnerships.

- Investment in research and development will lead to innovations in bioprocessing and cost reduction.

- Broader application across meat types, including seafood and hybrid proteins, will diversify product offerings.

- Strategic collaborations between technology providers, food producers, and research institutes will drive industry growth.

- Consumer acceptance and education efforts will increase demand for cultured meat products worldwide.

- The industry will focus on sustainability, resource efficiency, and ethical considerations to strengthen its market position.