Market Overview

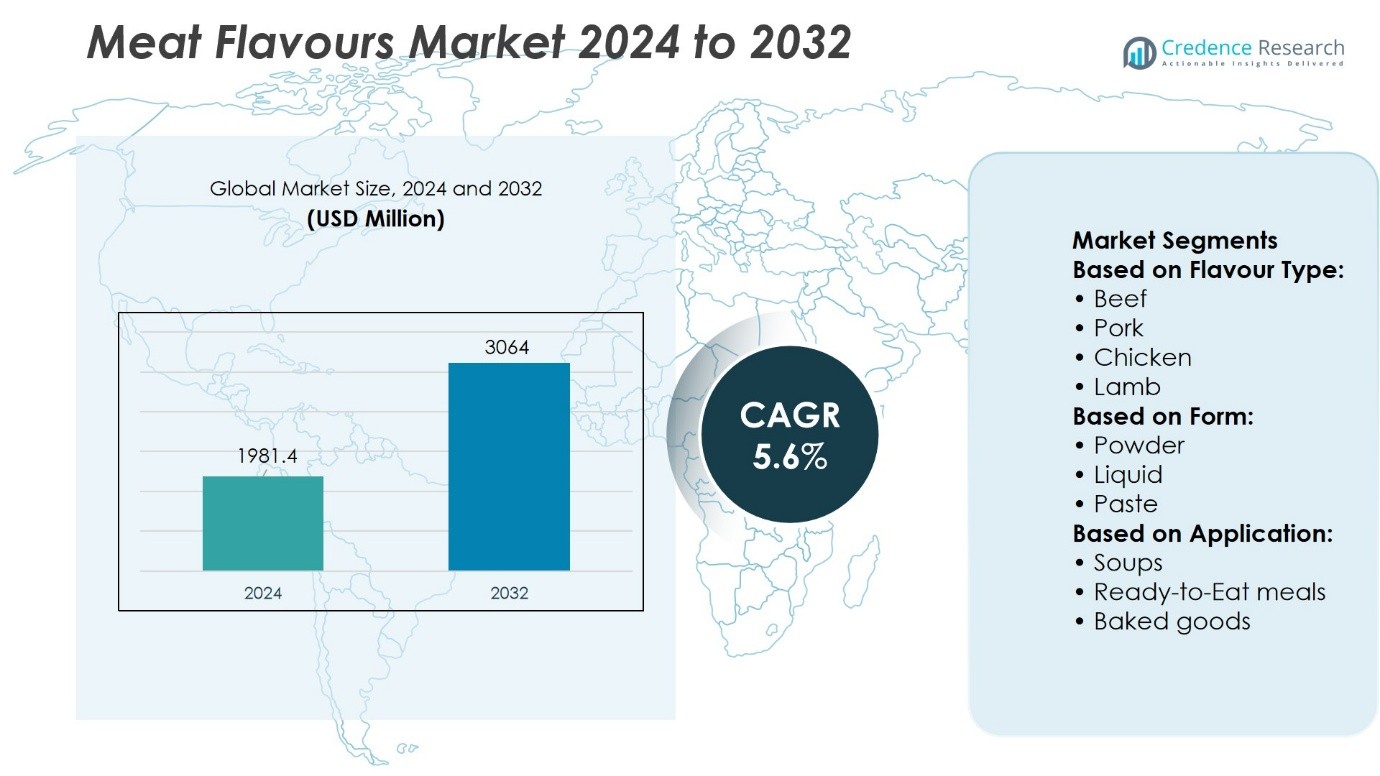

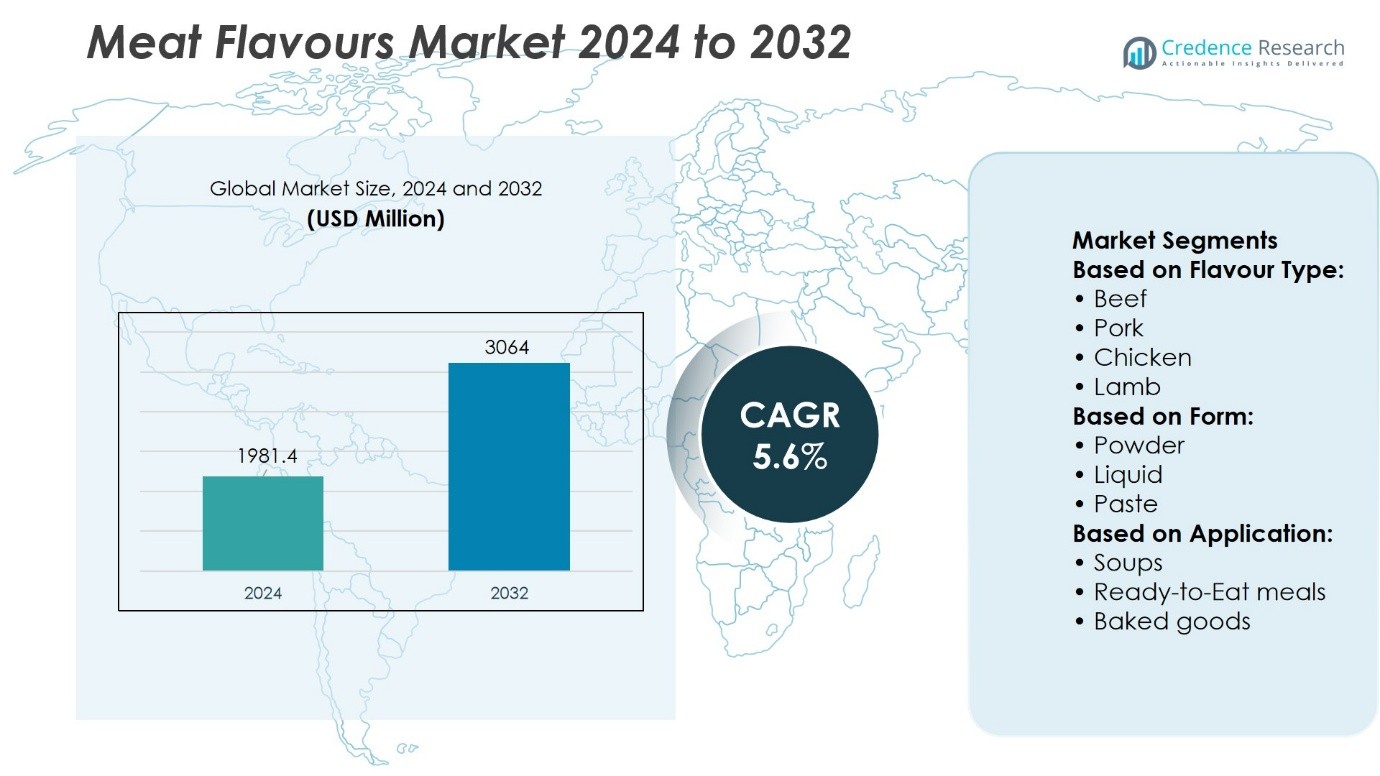

Meat Flavours Market size was valued at USD 1981.4 million in 2024 and is anticipated to reach USD 3064 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Meat Flavours Market Size 2024 |

USD 1981.4 Million |

| Meat Flavours Market, CAGR |

5.6% |

| Meat Flavours Market Size 2032 |

USD 3064 Million |

The Meat Flavours Market grows on strong demand for authentic taste replication in processed foods, ready-to-eat meals, and plant-based alternatives. Rising consumer preference for natural, clean-label, and allergen-free ingredients drives reformulation efforts, while regulatory focus on safety and traceability reinforces the role of established suppliers. Advances in biotechnology and flavor encapsulation enhance product stability and sensory performance, supporting broader applications across diverse food categories. It benefits from expanding convenience food consumption, regional taste adaptation, and increasing collaborations between flavor developers and food manufacturers, positioning innovation and sustainability as central trends shaping the market’s long-term trajectory.

The Meat Flavours Market shows strong regional demand led by North America and Europe, where established food industries and regulatory standards drive consistent adoption. Asia-Pacific emerges as a high-growth region, supported by expanding processed food and plant-based sectors. Latin America and the Middle East & Africa display steady potential through rising convenience food consumption. Key players include Givaudan, Kerry Group, Symrise, International Flavors & Fragrances, Firmenich, Sensient Technologies, and Takasago, all focusing on innovation, natural solutions, and regional flavor customization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Meat Flavours Market size was valued at USD 1981.4 million in 2024 and is projected to reach USD 3064 million by 2032, at a CAGR of 5.6%.

- Rising demand for authentic meat-like taste in processed foods, ready-to-eat meals, and plant-based alternatives drives market expansion.

- Clean-label, allergen-free, and natural formulations remain dominant trends shaping product innovation and consumer adoption.

- Leading players such as Givaudan, Kerry Group, Symrise, IFF, Firmenich, Sensient Technologies, and Takasago strengthen positions through R&D and regional customization.

- High regulatory compliance requirements and raw material cost fluctuations act as key restraints for smaller suppliers.

- North America and Europe maintain strong demand through established food industries, while Asia-Pacific shows high growth supported by expanding plant-based and convenience food sectors.

- Strategic collaborations, biotechnology advances, and flavor encapsulation techniques support broader applications and improved performance in diverse food categories.

Market Drivers

Rising Demand for Authentic Meat-Based Flavour Profiles in Processed Foods

The Meat Flavours Market benefits from growing consumer preference for authentic taste experiences in ready-to-eat and convenience foods. It responds to increased urbanisation and busier lifestyles by supplying natural and clean-label flavour solutions that align with health-conscious choices. Manufacturers invest in developing formulations that replicate the complexity of traditional meat dishes while meeting regulatory standards on additives. Product lines expand to include chicken, beef, pork, and lamb flavour variants for multiple cuisine styles. The trend supports product differentiation in competitive retail spaces. It continues to influence innovation in both savoury snacks and meal kits.\

- For instance, Kerry Group’s Taste & Nutrition segment operates a state-of-the-art flavour development facility in Naas, Ireland, where the annual production of meat-flavour concentrates exceeds 5 million litres, enabling large-scale clean-label flavour innovation for convenience meals.

Expanding Applications Across Plant-Based and Hybrid Meat Products

It addresses demand in the rapidly evolving plant-based and hybrid protein sector by providing flavour systems that mimic the sensory attributes of real meat. Producers integrate advanced flavour encapsulation techniques to enhance stability and shelf life in plant-derived matrices. The market encourages collaborations between flavour houses and alternative protein manufacturers to achieve authentic umami depth. Developments cater to consumer expectations for texture-flavour synergy in meat substitutes. It also supports culinary versatility for foodservice applications. These advancements enable broader adoption of meat-like profiles in diverse product categories.

- For instance, Lightlife Foods, under Greenleaf Foods, expanded its Shelbyville, Indiana processing plant reportedly the largest North American plant‑based protein facility to target an annual output of 60 million pounds of plant‑based meat products, including pea‑protein burgers, thereby enabling scalable flavour application across hybrid and entirely plant‑based formulations.

Technological Innovation in Flavour Extraction and Delivery Systems

The Meat Flavours Market advances through improvements in extraction processes, including enzymatic hydrolysis and thermal reaction technology. These methods yield concentrated, high-impact flavour bases with consistent quality. Manufacturers implement microencapsulation to protect volatile compounds during processing and storage. It ensures superior flavour release during cooking, enhancing consumer satisfaction. Investment in process automation improves scalability and cost efficiency for large-scale production. Such innovations contribute to greater competitiveness in domestic and international markets.

Strong Demand from Quick Service Restaurants and Prepared Meal Producers

It gains momentum from the rising penetration of quick service restaurants (QSRs) and pre-packaged meal providers seeking distinctive, consistent flavour profiles. Suppliers work closely with QSR chains to create signature tastes that reinforce brand identity. The market supports rapid menu diversification through adaptable flavour systems compatible with multiple cooking methods. Partnerships extend to frozen and chilled meal producers to ensure flavour integrity across supply chains. Enhanced distribution networks facilitate timely delivery of custom formulations. This demand sustains steady growth in both retail and foodservice sectors.

Market Trends

Increasing Integration of Natural and Clean-Label Meat Flavour Solutions

The Meat Flavours Market experiences a shift toward natural and clean-label formulations in response to rising health awareness. It focuses on removing artificial additives while maintaining authentic taste profiles for processed foods. Flavour developers utilise plant extracts, yeast derivatives, and natural reaction flavours to replicate meat characteristics. This approach aligns with regulatory guidelines and consumer expectations for transparency. Brands emphasise ingredient sourcing to reinforce trust and quality perception. The trend supports wider adoption across premium and mainstream product lines.

- For instance, Kemin Food Technologies has standardized its FORTIUM® rosemary extract production to deliver controlled levels of carnosic acid, manufacturing over 15 million grams of the extract annually to serve meat processors seeking a clean-label antioxidant alternative to synthetic additives.

Growth in Demand for Flavour Systems in Plant-Based and Hybrid Meat Products

It expands its role in the plant-based protein sector by offering solutions that replicate the sensory depth of traditional meats. Manufacturers invest in advanced flavour layering techniques to deliver complexity and authenticity. Partnerships between flavour houses and alternative protein brands create bespoke formulations suited to various processing methods. The trend addresses texture-flavour synergy to meet consumer demands for realistic eating experiences. It also enhances flavour stability in frozen and shelf-stable plant-based products. This growth reinforces its strategic position in the evolving protein market.

- For instance, T. Hasegawa USA developed its PLANTREACT™ flavouring line using fermentation, Maillard reactions, and enzymatic biotransformation to precisely mimic chicken, beef, and pork profiles; during its first year of commercial rollout the company produced 2 million grams of PLANTREACT™ formulations to support flavour application in hybrid and plant‑based products.

Advancements in Flavour Delivery and Encapsulation Technologies

The Meat Flavours Market leverages innovation in encapsulation and controlled-release systems to optimise flavour performance. Microencapsulation protects volatile compounds from degradation during production and storage. It ensures consistent flavour release under varied cooking conditions, enhancing product appeal. Technology adoption reduces wastage and improves operational efficiency for manufacturers. This capability strengthens its application across soups, sauces, snacks, and ready meals. The approach supports scalability without compromising taste authenticity.

Expansion of Customised Flavour Development for Foodservice and QSR Sectors

It meets increasing demand from quick service restaurants and foodservice providers for signature flavour profiles. Collaborative development enables brands to differentiate menus and maintain consistency across outlets. The trend supports rapid product innovation cycles to respond to shifting consumer preferences. Formulations are tailored for compatibility with multiple preparation methods, including grilling, frying, and baking. It also ensures stability in frozen and chilled supply chains. These advancements enhance competitive positioning in both domestic and export markets.

Market Challenges Analysis

Regulatory Compliance and Ingredient Sourcing Constraints

The Meat Flavours Market faces complex regulatory frameworks that vary across regions, creating challenges for global product standardisation. It must adapt formulations to meet strict labelling, allergen disclosure, and additive usage requirements. Compliance demands continuous monitoring of evolving food safety regulations, increasing operational costs for manufacturers. Ingredient sourcing presents further difficulties, with volatility in supply chains for natural extracts and animal-derived flavour bases. Ethical and sustainability concerns add pressure to secure traceable and responsibly produced raw materials. These constraints require strategic supplier partnerships and robust quality assurance systems to maintain market competitiveness.

Fluctuating Consumer Preferences and Competitive Pressures

It operates in an environment where consumer tastes shift rapidly, influenced by dietary trends, cultural preferences, and health considerations. Balancing demand for authentic meat flavours with the growing interest in plant-based alternatives poses formulation challenges. Price competition intensifies as both established flavour houses and new entrants vie for market share. Innovation cycles shorten, requiring faster product development without sacrificing quality or compliance. The presence of counterfeit and low-cost substitutes risks brand reputation and market trust. Overcoming these pressures demands continuous investment in R&D, market intelligence, and brand differentiation strategies.

Market Opportunities

Expansion Potential in Plant-Based and Hybrid Protein Segments

The Meat Flavours Market can capitalise on the rising demand for plant-based and hybrid meat products by supplying flavour systems that replicate the depth and complexity of traditional meats. It can leverage advanced reaction flavour technology to deliver authentic profiles suitable for alternative protein matrices. Collaboration with plant-based manufacturers offers opportunities for co-developing tailored solutions that enhance taste while meeting clean-label expectations. Growing consumer adoption of flexitarian diets creates a consistent demand stream for meat-like flavours in diverse product categories. The ability to adapt formulations for frozen, chilled, and ambient-stable products strengthens its relevance. This segment presents a pathway for long-term growth and portfolio diversification.

Technological Advancements in Flavour Delivery and Customisation

It can benefit from emerging encapsulation and controlled-release technologies that optimise flavour stability and performance in varied processing environments. These innovations enable the creation of customised flavour profiles for specific cooking methods and regional taste preferences. Expanding partnerships with quick service restaurants and food manufacturers can lead to exclusive flavour solutions that enhance brand identity. Data-driven consumer insights support targeted product development, increasing market responsiveness. Investment in sustainable ingredient sourcing further boosts appeal among environmentally conscious consumers. These factors create a competitive edge and open new channels for domestic and international expansion.

Market Segmentation Analysis:

By Flavour Type

The Meat Flavours Market offers a diverse range of flavour profiles, with beef and chicken leading demand due to their broad application across global cuisines. Beef flavours deliver rich, savoury notes suited for soups, sauces, gravies, and meat-based snacks. Chicken flavours provide versatility for both traditional dishes and lighter, health-oriented recipes. Pork flavours remain essential for regional specialities, particularly in processed meats and snack seasonings. Lamb flavours cater to niche but premium markets, often used in gourmet ready meals and ethnic cuisine. Turkey flavours find growing interest in lean protein segments and seasonal product lines. Other meat flavours, including fish and seafood, meet the needs of manufacturers seeking to expand into marine-based savoury products.

- For instance, Kerry Group supplies over 1.2 billion units of savoury flavour systems globally through its Taste & Nutrition division, with beef and chicken formulations prominently featured across out‑of‑home and retail food applications.

By Form

It is segmented into powder, liquid, and paste formats to serve diverse manufacturing requirements. Powdered flavours offer long shelf life, easy handling, and compatibility with dry blends for seasonings and snack coatings. Liquid flavours provide fast integration in wet formulations such as soups, sauces, and marinades, ensuring consistent flavour dispersion. Paste formats deliver concentrated taste intensity, ideal for high-impact applications in gravies and gourmet preparations. Each form addresses specific production needs, balancing flavour stability, ease of storage, and cost efficiency. Manufacturers often choose formats based on processing environment, product texture, and target flavour release profile.

- For instance, Givaudan produces over 2.3 billion doses of savoury flavour solutions annually, with powdered meat flavours forming a substantial share for use in snack coatings and seasoning blends.

By Application

The Meat Flavours Market serves multiple end-use categories, with soups, sauces, and gravies accounting for significant usage due to their reliance on robust, authentic flavour bases. Ready-to-eat meals represent a growing segment, where stable and versatile flavour systems support menu diversity and product consistency. Baked goods increasingly incorporate meat flavours in savoury pastries, filled breads, and snack rolls to cater to evolving taste trends. The snacks segment leverages meat flavours to enhance appeal in chips, crackers, and extruded products. It continues to adapt formulations for each application to ensure optimal taste performance under varied processing and storage conditions. This versatility strengthens its position across both retail and foodservice markets.

Segments:

Based on Flavour Type:

Based on Form:

Based on Application:

- Soups

- Ready-to-Eat meals

- Baked goods

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 32% of the Meat Flavours Market, driven by high consumption of processed and convenience foods. The region benefits from strong demand in ready-to-eat meals, snacks, and quick service restaurant offerings that rely on consistent and distinctive flavour profiles. It shows significant adoption of both natural and clean-label formulations, aligning with consumer preferences for transparency and quality. Technological innovation in flavour delivery systems, particularly encapsulation for shelf-stable products, supports product development. Regulatory compliance in the United States and Canada encourages manufacturers to refine ingredient sourcing and labelling practices. Strong collaborations between flavour houses and food manufacturers ensure tailored solutions for diverse cuisines. The mature but innovation-driven market creates steady growth opportunities in retail and foodservice channels.

Europe

Europe accounts for 27% of the Meat Flavours Market, supported by a well-established food processing industry and a high demand for premium and authentic flavour solutions. It benefits from a strong culinary heritage that values regional specialities, influencing the demand for customised meat flavour profiles. The region’s stringent food safety and labelling regulations push producers toward natural and sustainable ingredients. Growth in plant-based and hybrid meat categories has further expanded the need for flavour systems that replicate traditional meat characteristics without compromising authenticity. The market also gains momentum from private-label product innovation, particularly in soups, sauces, and bakery applications. Strategic investments in R&D and clean-label technologies remain key competitive factors for European manufacturers.

Asia-Pacific

Asia-Pacific holds 24% of the Meat Flavours Market, with rapid urbanisation, rising disposable incomes, and evolving dietary habits fuelling demand. The region’s diverse culinary traditions create strong market potential for varied flavour types, from chicken and pork to seafood-based profiles. It benefits from the expansion of quick service restaurants and convenience food outlets, particularly in China, India, Japan, and Southeast Asia. Manufacturers in the region invest in scalable flavour production to meet the volume needs of large domestic markets. Plant-based and hybrid meat product innovation is also gaining traction, with flavour houses providing tailored solutions for regional palates. Growing e-commerce distribution channels enhance access to flavoured packaged foods across both urban and semi-urban markets.

Latin America

Latin America represents 9% of the Meat Flavours Market, with Brazil and Mexico as leading contributors. It sees rising consumption of processed meats, snacks, and ready meals, which fuels demand for robust flavour systems. Regional cuisine, rich in grilled and spiced meat traditions, drives interest in customised beef, pork, and chicken flavours. Economic growth and expanding middle-class populations increase appetite for affordable yet flavourful packaged foods. Manufacturers collaborate with local food producers to develop cost-effective solutions that retain authenticity. The region is also witnessing gradual adoption of plant-based alternatives, creating opportunities for meat-like flavour formulations.

Middle East & Africa

The Middle East & Africa holds 8% of the Meat Flavours Market, supported by a growing food processing sector and an expanding retail landscape. Demand is influenced by traditional meat-centric cuisines, particularly in Gulf Cooperation Council (GCC) countries and South Africa. The market shows strong interest in halal-certified flavour solutions that meet religious and cultural standards. Rising urban populations and tourism fuel consumption of quick service and packaged food products. Flavour houses work closely with regional manufacturers to ensure product compatibility with diverse cooking styles. Increasing investments in local production facilities help reduce import reliance and improve supply chain efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mane SA

- Frutarom Industries Ltd.

- Givaudan

- Firmenich SA

- Symrise AG

- Robertet Group

- Sensient Technologies Corporation

- Kerry Group

- Takasago International Corporation

- International Flavors & Fragrances Inc. (IFF)

Competitive Analysis

The Meat Flavours Market features including Mane SA, Frutarom Industries Ltd., Givaudan, Firmenich SA, Symrise AG, Robertet Group, Sensient Technologies Corporation, Kerry Group, Takasago International Corporation, and International Flavors & Fragrances Inc. (IFF). The Meat Flavours Market is highly competitive, with companies striving to differentiate through innovation, customised formulations, and strategic collaborations with food manufacturers. Industry leaders focus on expanding natural and clean-label product ranges to align with consumer preferences for transparency and authenticity. Advances in flavour delivery systems, including encapsulation and controlled-release technologies, enhance stability and performance across varied applications. Sustainability initiatives, such as responsible sourcing and eco-friendly production methods, are becoming key competitive factors. The growing demand for plant-based and hybrid meat products drives the development of flavour systems that replicate the sensory depth of traditional meats. Success in this market depends on balancing global reach with local adaptability, enabling producers to cater to diverse culinary traditions and evolving dietary trends.

Recent Developments

- In June 2025, Mane participated in the SIMPPAR 2025 event, showcasing their advancements in flavor technology.

- In March 2025, Takasago International Corporation (Japan) opened a new flavour innovation center to strengthen R&D in natural meat flavour formulation.

- In February 2025, Gold Coast Ingredients (USA) launched a new range of clean-label meat flavours specifically designed for plant-based food applications.

- In August 2024, Kerry Group (Ireland) introduced an AI-driven flavour creation platform aimed at enhancing speed and customization in meat flavour development.

Market Concentration & Characteristics

The Meat Flavours Market shows moderate concentration with a mix of global players and specialized regional producers, creating a competitive environment shaped by innovation, product authenticity, and regulatory compliance. It demonstrates strong reliance on natural extracts, yeast derivatives, and process flavors, with companies investing in technologies that replicate meat taste profiles across vegetarian and alternative protein applications. Demand remains anchored in processed meat, ready-to-eat meals, and savory snacks, while rising consumer focus on health and clean labels drives reformulation toward natural and allergen-free options. The market operates under stringent food safety standards, requiring traceable sourcing and transparent labeling, which reinforces the position of established suppliers with validated processes. It also benefits from ongoing flavor diversification strategies, where manufacturers tailor solutions to regional taste preferences and dietary patterns. Overall, the industry balances scale efficiencies of major multinationals with the agility of niche players that deliver customized solutions to dynamic food applications.

Report Coverage

The research report offers an in-depth analysis based on Flavour Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for natural and clean-label flavor solutions.

- Plant-based and alternative protein industries will drive higher adoption of meat flavors.

- Innovation in encapsulation technologies will enhance stability and shelf life of flavor products.

- Regional taste customization will become a critical focus for global flavor suppliers.

- Food safety and regulatory compliance will continue to shape product development priorities.

- Investment in sustainable sourcing of raw materials will gain stronger emphasis.

- Advances in biotechnology will support production of authentic meat-like flavor compounds.

- Convenience food and ready-to-eat segments will sustain strong demand for flavor applications.

- Strategic partnerships between flavor houses and food manufacturers will increase.

- Consumer preference for allergen-free and low-sodium formulations will guide future product launches.