| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Meat Snacks Market Size 2024 |

USD 19,507.12 million |

| Meat Snacks Market, CAGR |

6.87% |

| Meat Snacks Market Size 2032 |

USD 34,478.52 million |

Market Overview

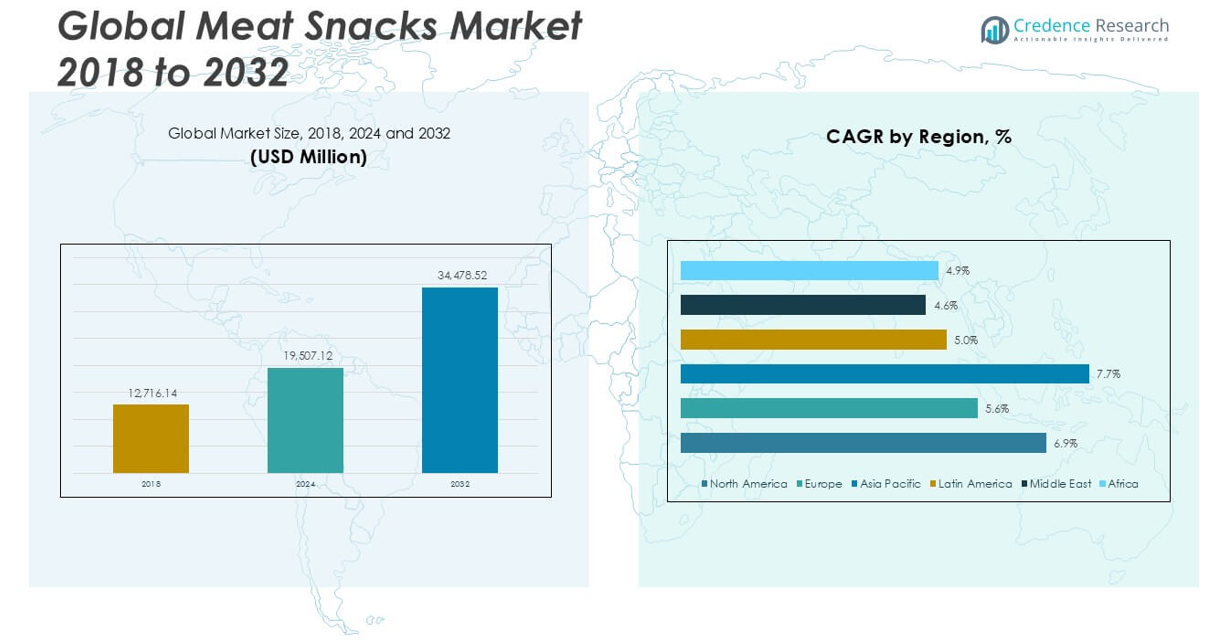

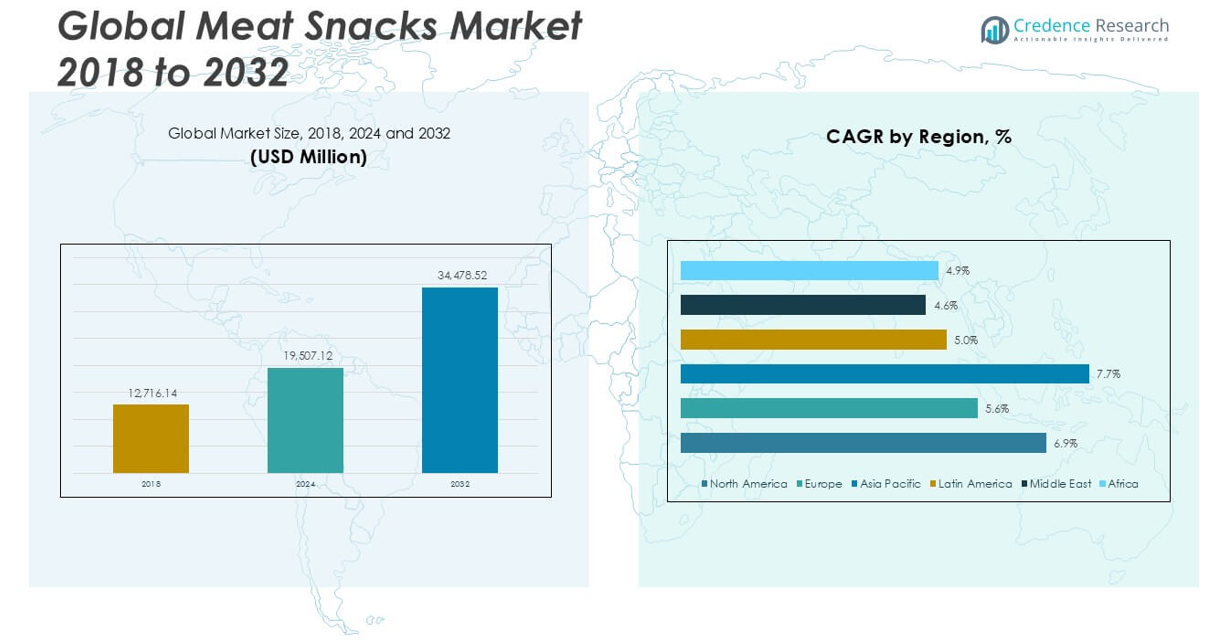

The Meat Snacks Market size was valued at USD 12,716.14 million in 2018 and reached USD 19,507.12 million in 2024. It is anticipated to reach USD 34,478.52 million by 2032, growing at a CAGR of 6.87% during the forecast period.

The meat snacks market is experiencing robust growth, driven by rising consumer demand for high-protein, convenient, and on-the-go snacking options. Busy lifestyles and increasing health consciousness have led consumers to seek alternatives to traditional carbohydrate-based snacks, fueling the popularity of jerky, meat sticks, and other protein-rich products. Additionally, growing awareness of the nutritional benefits of meat snacks, including low sugar content and high satiety value, supports market expansion. Manufacturers are innovating with exotic flavors, organic ingredients, and clean-label products to appeal to health-focused and adventurous consumers. The rising influence of e-commerce and digital marketing has further enhanced product accessibility and brand visibility, especially among younger demographics. Sustainability and ethical sourcing have also emerged as key trends, with brands focusing on traceable meat sources and eco-friendly packaging to align with evolving consumer values. These combined drivers and trends continue to strengthen the global presence of meat snacks across diverse market segments.

The geographical analysis of the Meat Snacks Market highlights significant growth across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America leads due to strong consumer demand for protein-rich snacks and innovative product offerings, with the United States and Canada representing major consumption hubs. Europe sees rising popularity of high-protein diets, particularly in the United Kingdom and Germany, while Asia Pacific is experiencing rapid market expansion led by China, Japan, and Australia as urbanization and changing lifestyles drive demand. Latin America, the Middle East, and Africa show steady growth supported by evolving retail channels and increasing consumer awareness. Among the leading players in the global meat snacks industry are Nestle USA Inc., JACK LINK’S LLC., and Conagra Brands Inc., each focusing on expanding their product portfolios and leveraging strong distribution networks to maintain a competitive edge in the evolving snacking landscape.

Market Insights

- The Meat Snacks Market is projected to grow from USD 18,716.13 million in 2024 to USD 34,478.53 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.8%.

- The market benefits from rising consumer preference for protein-rich, convenient snacking options, driven by growing awareness of health and fitness.

- Product innovation continues to shape the industry, with manufacturers introducing new flavors, organic offerings, and premium meat snack formats to capture wider consumer segments.

- Key players such as Nestle USA Inc., JACK LINK’S LLC., and Conagra Brands Inc. maintain strong market positions by expanding their product portfolios and investing in broad distribution networks.

- Challenges include fluctuating raw material prices and concerns about processed meats, which can limit growth prospects and lead to increased operational costs for producers.

- North America and Asia Pacific represent the largest and fastest-growing regions, respectively, supported by robust retail infrastructure and changing dietary preferences in emerging markets.

- E-commerce and digital marketing channels are becoming essential for market expansion, allowing companies to reach younger demographics and adapt quickly to evolving consumer trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Protein and Convenient Snack Options Fuels Market Expansion

The Meat Snacks Market is gaining traction due to the growing consumer shift toward high-protein, low-carbohydrate diets. Consumers are increasingly seeking snacks that provide satiety and nutritional value without compromising convenience. Meat snacks, such as jerky and sticks, meet this demand by offering a portable and shelf-stable source of protein. Busy lifestyles and rising health consciousness among working professionals and fitness enthusiasts have boosted their adoption. It appeals to individuals looking for quick and satisfying food choices throughout the day. The demand for meat-based snacks continues to rise in both developed and emerging economies due to their alignment with modern dietary preferences.

- For instance, Jack Link’s introduced a fully automated packaging line at its Wisconsin facility, which now enables the production of up to 1,500 bags of jerky per minute to support increasing consumer demand.

Innovative Product Development and Flavor Diversification Attract Broader Consumer Base

The Meat Snacks Market benefits significantly from continuous product innovation and an expanding range of flavors. Manufacturers are introducing bold, global-inspired seasonings, organic ingredients, and specialty meat varieties like bison, venison, and turkey. It supports differentiation and meets the growing expectations of consumers seeking variety and premium experiences. Brands are also focusing on clean-label formulations, reducing additives and preservatives to enhance appeal. These innovations help capture the interest of health-conscious and flavor-seeking buyers across age groups. Product versatility has widened the customer base, driving higher consumption across various retail channels.

- For instance, Conagra Brands launched 18 new meat snack products under Slim Jim and Duke’s in 2022, offering consumers unique choices like Hatch Green Chile and Maple Bourbon flavors.

Expansion of Online Retail and E-Commerce Enhances Market Accessibility

The rise of e-commerce has opened new avenues for growth in the Meat Snacks Market. Online platforms enable brands to reach consumers directly, bypassing traditional retail constraints and expanding geographic coverage. It offers greater convenience, subscription models, and access to niche and artisanal products that are not always available in physical stores. Digital marketing strategies, influencer partnerships, and targeted advertising have helped increase brand awareness and consumer engagement. E-commerce also allows for rapid feedback, enabling companies to adapt quickly to changing preferences. This shift toward online sales has become a strong driver of volume and visibility.

Increased Focus on Sustainability and Ethical Sourcing Supports Consumer Trust

Sustainability trends are playing a larger role in shaping purchasing decisions within the Meat Snacks Market. Consumers are becoming more mindful of how their food is sourced, placing emphasis on transparency, animal welfare, and environmental impact. It has prompted brands to adopt ethical sourcing practices and sustainable packaging materials. Companies are investing in traceable supply chains to strengthen consumer trust and brand credibility. Eco-conscious initiatives resonate particularly well with younger demographics who prioritize responsible consumption. This focus on sustainability is not only improving brand loyalty but also attracting a new segment of environmentally aware consumers.

Market Trends

Growing Preference for High-Protein and Low-Carb Snack Options Among Health-Conscious Consumers

Consumers are increasingly prioritizing protein-rich and low-carbohydrate diets to support active lifestyles and weight management. The Meat Snacks Market benefits from this trend, as products like jerky and meat sticks offer a convenient source of lean protein. It appeals to fitness enthusiasts, busy professionals, and individuals seeking healthier snacking alternatives to chips or sweets. Brands are focusing on clean-label formulations with low sugar, minimal processing, and high nutritional value to meet evolving health standards. The shift toward functional snacking supports continued demand across both developed and emerging regions. It reinforces consumer trust in meat snacks as a guilt-free and nutritious option.

- For instance, Hormel Foods’ product line features over 20 meat snack varieties containing less than 1 gram of sugar per serving, meeting clean-label demands.

Product Innovation Through Diverse Flavors and Alternative Meat Sources Gains Momentum

Flavor variety and the use of alternative meat types are driving new interest in the Meat Snacks Market. It now features offerings made from turkey, bison, venison, and plant-based blends alongside traditional beef products. Brands introduce global-inspired flavors such as teriyaki, chipotle, or Korean BBQ to satisfy evolving consumer palates. This focus on innovation helps differentiate products in a crowded marketplace and attracts repeat purchases. It supports market expansion by appealing to both traditional meat lovers and adventurous consumers. Product diversification aligns well with the trend of personalized and premium snacking experiences.

- For instance, Nestlé’s Wild West brand launched four new flavor variants of turkey jerky in 2023, including Sriracha and Korean BBQ, with each pack containing 13 grams of protein.

Sustainable Sourcing and Eco-Friendly Packaging Emerge as Key Purchase Influencers

Sustainability concerns are shaping consumer behavior in the Meat Snacks Market. It prompts manufacturers to prioritize ethical sourcing, transparency in supply chains, and environmentally friendly packaging. Consumers are more inclined to purchase products from brands that align with values around animal welfare and reduced carbon footprint. Companies now emphasize recyclable materials, traceable meat sources, and minimal processing methods to improve brand perception. These efforts address rising consumer demand for responsible consumption. It also fosters long-term loyalty among eco-conscious buyers.

E-Commerce Growth and Direct-to-Consumer Channels Expand Market Reach

Online platforms are transforming product availability and accessibility within the Meat Snacks Market. It allows brands to bypass traditional retail limitations and connect directly with consumers. Subscription services, personalized recommendations, and targeted advertising support higher engagement. E-commerce offers convenience, enabling shoppers to explore niche and premium offerings from anywhere. Brands leverage digital feedback to refine products and respond quickly to market trends. It strengthens customer relationships and drives sustained growth in a competitive environment.

Market Challenges Analysis

Rising Health Concerns and Negative Perception of Processed Meats Impact Consumer Adoption

The Meat Snacks Market faces growing scrutiny due to increasing awareness of health risks linked to processed and red meat consumption. Consumers concerned about sodium, preservatives, and saturated fat often avoid meat snacks despite their protein benefits. Health organizations and dietary guidelines that caution against frequent processed meat intake contribute to this hesitation. It affects purchasing behavior, especially among health-conscious and older demographics. Demand may shift toward plant-based or minimally processed alternatives, which are perceived as cleaner and safer. Brands struggle to balance flavor, shelf life, and health appeal without relying on traditional additives. The challenge lies in reformulating products while retaining taste and texture that consumers expect.

Fluctuating Raw Material Costs and Supply Chain Disruptions Create Pricing Pressures

Volatility in meat prices and disruptions in livestock supply chains pose a significant challenge for manufacturers. It leads to unstable production costs, making it difficult to maintain competitive pricing in a crowded snack market. Seasonal variations, feed costs, and regulatory changes in livestock farming further complicate procurement strategies. Brands often absorb the increased costs or pass them on to consumers, which may reduce demand in price-sensitive markets. Import-export restrictions and logistical issues can also delay production schedules and affect product availability. The Meat Snacks Market must adapt quickly to market shocks while preserving product quality and distribution efficiency. Managing these uncertainties remains critical to sustaining growth and profitability.\

Market Opportunities

Rising Demand for Clean-Label and Functional Snacking Offers Growth Potential

The shift toward health-conscious eating creates strong opportunities for clean-label and functional meat snacks. Consumers seek products with transparent ingredient lists, minimal additives, and enhanced nutritional benefits. It encourages brands to introduce offerings fortified with vitamins, collagen, or natural energy boosters. The Meat Snacks Market can tap into this demand by developing options that support fitness goals, immunity, or weight management. Retailers and e-commerce platforms favor such products due to their premium appeal and higher margins. Clear messaging around health attributes helps build trust and attract repeat customers who prioritize wellness.

Expanding Consumer Base in Emerging Markets and Non-Traditional Channels

Rising disposable incomes and urbanization in Asia-Pacific, Latin America, and the Middle East create new demand for protein-rich convenience foods. It allows the Meat Snacks Market to grow beyond mature markets and diversify its revenue streams. Increasing exposure to Western snacking habits through social media and travel also drives trial and adoption. Localizing flavors and sourcing regional meats can further boost acceptance in culturally diverse regions. Convenience stores, fitness centers, and online subscription models offer alternative sales channels that enhance market reach. Targeted marketing and tailored product offerings help build brand loyalty among first-time buyers in emerging economies.

Market Segmentation Analysis:

By Product:

Jerky dominates the product segment due to its wide acceptance, long shelf life, and high protein content. It appeals to health-conscious consumers seeking portable, nutrient-dense snacks. Meat sticks also hold a significant share, favored for their convenience and flavor variety. Sausages are gaining popularity in premium snacking due to their seasoning profiles and portion control benefits. Poultry meat products attract consumers looking for leaner protein options. The “others” category, which includes exotic meat blends and dried meat bars, supports niche demand and offers room for innovation. The Meat Snacks Market benefits from this diverse product range that caters to varying taste preferences and dietary needs.

- For instance, Monogram Foods reported that it shipped over 45 million units of jerky and meat sticks to U.S. retailers in 2022, reflecting strong consumer demand for product diversity.

By Source:

Beef remains the leading source in meat snacks, valued for its rich flavor and strong consumer familiarity. It is widely used in jerky and sticks, making it a staple in traditional product lines. Pork ranks next, especially in markets where it is culturally accepted, offering a distinct taste and texture. Poultry and chicken are growing rapidly due to their lean protein appeal and perception of being healthier than red meat. These options support the market’s movement toward low-fat and high-protein offerings. The “others” segment includes bison, venison, and turkey, which cater to consumers seeking novelty and premium nutrition. It adds value by meeting specific lifestyle choices and dietary restrictions.

- For instance, Golden Valley Natural increased its annual turkey jerky output to 1.2 million pounds in 2023 to meet rising demand for leaner meat snack alternatives.

By Distribution Channel:

Supermarkets and hypermarkets hold the largest share in distribution due to their extensive shelf space and high footfall. These channels support bulk purchases and brand visibility. Convenience stores follow closely, offering ready access for impulse buyers and on-the-go consumers. Online retail is expanding steadily, driven by the rising preference for doorstep delivery and access to niche products. It enables brands to reach wider audiences and experiment with direct-to-consumer models. The “others” category, including vending machines and specialty health stores, plays a role in targeted sales. The Meat Snacks Market benefits from this multi-channel approach, which enhances accessibility and supports volume growth across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product:

- Jerky

- Sticks

- Sausages

- Poultry Meat

- Others

Based on Source:

- Beef

- Pork

- Poultry

- Chicken

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Meat Snacks Market

North America Meat Snacks Market grew from USD 4,024.02 million in 2018 to USD 6,084.56 million in 2024 and is projected to reach USD 10,795.74 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.9%. North America is holding a 31% market share. The United States and Canada drive regional consumption, supported by robust retail distribution, demand for protein-rich snacks, and product innovations. Leading brands have expanded portfolios to cater to health-conscious consumers and younger demographics. Strong presence of convenience stores and e-commerce platforms sustains high sales volumes. It continues to set trends in premium and organic meat snacks.

Europe Meat Snacks Market

North America Meat Snacks Market grew from USD 2,410.47 million in 2018 to USD 3,498.26 million in 2024 and is projected to reach USD 5,631.47 million by 2032, recording a CAGR of 5.6%. Europe accounts for a 16% market share. The United Kingdom, Germany, and France represent key markets. Shifts toward high-protein and low-carb diets influence product development and sales. Manufacturers invest in sustainable sourcing and novel flavors to capture diverse consumer preferences. The region benefits from strong supermarket penetration and growing online sales.

Asia Pacific Meat Snacks Market

Asia Pacific Meat Snacks Market grew from USD 5,080.86 million in 2018 to USD 8,109.01 million in 2024 and is projected to reach USD 15,285.54 million by 2032, posting a CAGR of 7.7%. Asia Pacific captures a 42% market share, making it the largest regional segment. China, Japan, and Australia lead demand, driven by rising disposable income and westernization of food habits. Expanding urban populations and changing lifestyles fuel demand for convenient, protein-rich snacks. Multinational and local players compete by offering diverse flavors and formats.

Latin America Meat Snacks Market

Latin America Meat Snacks Market grew from USD 539.80 million in 2018 to USD 816.62 million in 2024 and is expected to reach USD 1,258.56 million by 2032, with a CAGR of 5.0%. Latin America holds a 4% market share. Brazil and Mexico dominate the region, propelled by increased snacking occasions and retail expansion. Companies focus on affordability and traditional flavors to appeal to a broad customer base. New product launches and promotional campaigns support steady market growth.

Middle East Meat Snacks Market

Middle East Meat Snacks Market grew from USD 361.77 million in 2018 to USD 508.03 million in 2024 and is forecasted to reach USD 760.03 million by 2032, achieving a CAGR of 4.6%. The Middle East accounts for a 2% market share. Key countries include Saudi Arabia and the United Arab Emirates, where rising tourism and a young population drive demand. Companies introduce halal-certified and innovative meat snacks to align with local tastes and dietary requirements. Retail chains and convenience outlets continue to broaden product accessibility.

Africa Meat Snacks Market

Africa Meat Snacks Market grew from USD 299.21 million in 2018 to USD 490.62 million in 2024 and is expected to reach USD 747.19 million by 2032, reflecting a CAGR of 4.9%. Africa represents a 2% market share. South Africa and Nigeria are prominent contributors. Market growth is supported by urbanization, changing consumer lifestyles, and increasing acceptance of packaged snacks. Local manufacturers emphasize affordability and traditional meat varieties, aiming to expand reach through modern trade channels. It continues to register gradual yet promising growth across emerging economies.

Key Player Analysis

- Nestle USA Inc.

- JACK LINK’S LLC.

- Monogram Food Solutions Inc.

- Golden Valley Natural

- Marfood USA Inc.

- Werner Gourmet Meat Snacks

- Conagra Brands Inc.

- Hormel Foods Corporation

- The Meatsnacks Group

Competitive Analysis

The competitive landscape of the Meat Snacks Market is characterized by the presence of several prominent players, including Nestle USA Inc., JACK LINK’S LLC., Conagra Brands Inc., Hormel Foods Corporation, and Monogram Food Solutions Inc. These companies dominate the market through diverse product portfolios, strong brand recognition, and extensive distribution networks. Leading players consistently invest in research and development to introduce innovative flavors, healthier ingredients, and convenient packaging, responding directly to evolving consumer preferences. Strategic acquisitions and partnerships enable them to strengthen their market position and expand their geographic reach, especially in emerging markets. Competitive pricing and effective marketing campaigns further support brand loyalty and consumer retention. Private label brands and regional manufacturers present additional competition, compelling global players to maintain high product quality and adapt to local tastes. With consumer demand for protein-rich and on-the-go snacks rising, top companies are leveraging supply chain efficiencies, sustainability initiatives, and digital marketing to capture a larger share of the market and sustain long-term growth.

Recent Developments

- In October 2023, Meat snack brand, Country Archer Provisions, launched two new meat snack products including Rosemary Turkey Mini Sticks and Original Beef Jerky Snack Packs. As per the company, the portioned protein snacks offer clean-label ingredients for health-conscious consumers. Furthermore, the company claims that the Rosemary Turkey Mini Sticks are fortified with herbs and spices like rosemary, basil, thyme, garlic, and onion, and the original Beef Jerky Snack Packs are made from grass-fed beef combined with spices like garlic and onion powder.

- In September 2023, A United States-based company Volpi Foods expanded its presence in the meat snacks category with a new line of Salami Stix. The company claims the products to be high-quality, all-natural with the best ingredients. Furthermore, the company asserts the products are available in 2-oz packages, in two flavors, Spicy and Original.

- In April 2023, Doki Foods, a New Delhi-based startup launched chicken chips and buffalo jerky in the country. As per the company, the products are available in flavors like Korean Gochujang, Tokyo Teriyaki, and Telicherry pepper.

Market Concentration & Characteristics

The Meat Snacks Market exhibits a moderately concentrated structure, with a handful of large multinational corporations accounting for a significant portion of total sales while regional and private label brands continue to expand their footprint. It is defined by intense competition, rapid product innovation, and evolving consumer preferences for healthier, high-protein snacks. Companies focus on brand differentiation through new flavors, premium ingredients, and convenient packaging, which enhances shelf appeal and drives consumer interest. Efficient distribution networks, strong retail partnerships, and expanding e-commerce presence further reinforce the dominance of leading players. The market demonstrates resilience to economic fluctuations, supported by the enduring popularity of ready-to-eat snacks and the global trend toward active, health-conscious lifestyles. It benefits from continuous investment in marketing, sustainability initiatives, and quality assurance, which helps build brand loyalty and consumer trust across established and emerging markets

Report Coverage

The research report offers an in-depth analysis based on Product, Source, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, driven by increasing demand for high-protein and convenient snack options.

- Consumers will prefer clean-label meat snacks with minimal additives and transparent ingredient lists.

- Manufacturers will focus more on introducing exotic flavors and alternative meat sources to attract diverse consumer groups.

- Online retail channels will expand further, offering direct-to-consumer sales and subscription-based models.

- Plant-based and hybrid meat snack options will emerge to meet the needs of flexitarian and health-conscious buyers.

- Sustainability will become a stronger focus, with brands adopting eco-friendly packaging and ethical sourcing practices.

- Regional players in emerging markets will play a key role in market expansion through localized products.

- Innovation in functional meat snacks with added health benefits will help differentiate brands in a competitive landscape.

- Regulatory compliance and food safety standards will become more critical for global manufacturers.

- Strategic collaborations and acquisitions will increase as companies aim to strengthen their distribution and product portfolios.