| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Disposable Medical Supplies Market Size 2023 |

USD 6,257.63 Million |

| Mexico Disposable Medical Supplies Market, CAGR |

3.99% |

| Mexico Disposable Medical Supplies Market Size 2032 |

USD 8,907.19 Million |

Market Overview

Mexico Disposable Medical Supplies Market size was valued at USD 6,257.63 million in 2023 and is anticipated to reach USD 8,907.19 million by 2032, at a CAGR of 3.99% during the forecast period (2023-2032).

The Mexico Disposable Medical Supplies market is driven by increasing healthcare demands, an aging population, and rising awareness of hygiene and infection prevention. Advancements in medical technology and the growing prevalence of chronic diseases are further fueling the demand for disposable medical products. The expansion of healthcare infrastructure and the surge in medical procedures are also contributing to market growth. Additionally, the COVID-19 pandemic has heightened the need for disposable products, particularly in hospitals and clinics, to reduce the risk of cross-contamination. Rising healthcare spending, along with government and private sector investments in healthcare, is expected to support the market’s expansion. Moreover, the growing focus on sustainability and eco-friendly disposable products is shaping future trends in the industry. The increasing demand for cost-effective and efficient healthcare solutions is further propelling market growth, with disposable medical supplies being a key component of modern healthcare practices.

The geographical landscape of Mexico’s disposable medical supplies market is shaped by key urban centers such as Mexico City, Monterrey, Guadalajara, and Tijuana, where access to advanced healthcare infrastructure and growing patient populations drive demand for high-quality disposable products. These regions serve as hubs for both public and private healthcare services, medical tourism, and specialized treatments, supporting consistent use of products like diagnostic kits, surgical disposables, and protective equipment. Leading companies operating in this space include global and regional players such as Smith+Nephew, Medtronic, Procter & Gamble, Ontex, and Molnlycke Health Care. These key players are actively expanding their presence through partnerships, innovation, and investments in sustainable and high-performance disposable solutions. Local manufacturers like Narang Medical Limited and Nu-Life Medical & Surgical Supplies Inc also play a vital role in meeting domestic demand and ensuring a steady supply of essential medical disposables across diverse healthcare settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico disposable medical supplies market was valued at USD 6,257.63 million in 2023 and is projected to reach USD 8,907.19 million by 2032, growing at a CAGR of 3.99% during 2023–2032.

- The global Disposable Medical Supplies market was valued at USD 2,45,000 million in 2023 and is expected to reach USD 3,93,306.92 million by 2032, growing at a CAGR of 5.40% during the forecast period.

- Rising healthcare awareness and increased demand for infection control products are key drivers boosting the market.

- Adoption of eco-friendly and biodegradable materials is a growing trend, aligning with global sustainability goals.

- Companies like Smith+Nephew, Medtronic, and Ontex are expanding their product lines and market presence through innovation and strategic partnerships.

- Regulatory complexities and supply chain disruptions pose significant challenges for both local and international manufacturers.

- Mexico City, Monterrey, Guadalajara, and Tijuana are the leading regions with high demand due to dense healthcare infrastructure and medical tourism.

- The market shows strong potential in home healthcare and chronic disease management, driving long-term demand for disposable medical products.

Report Scope

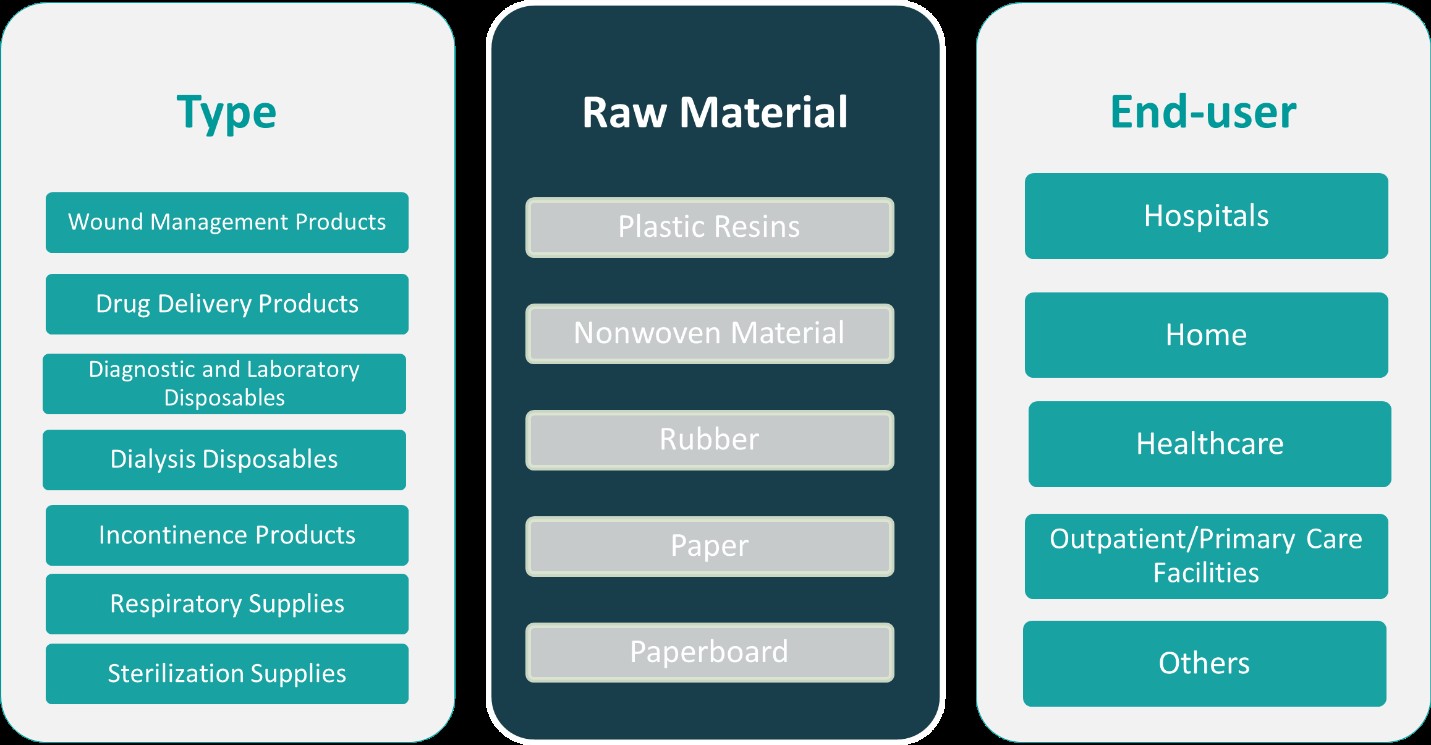

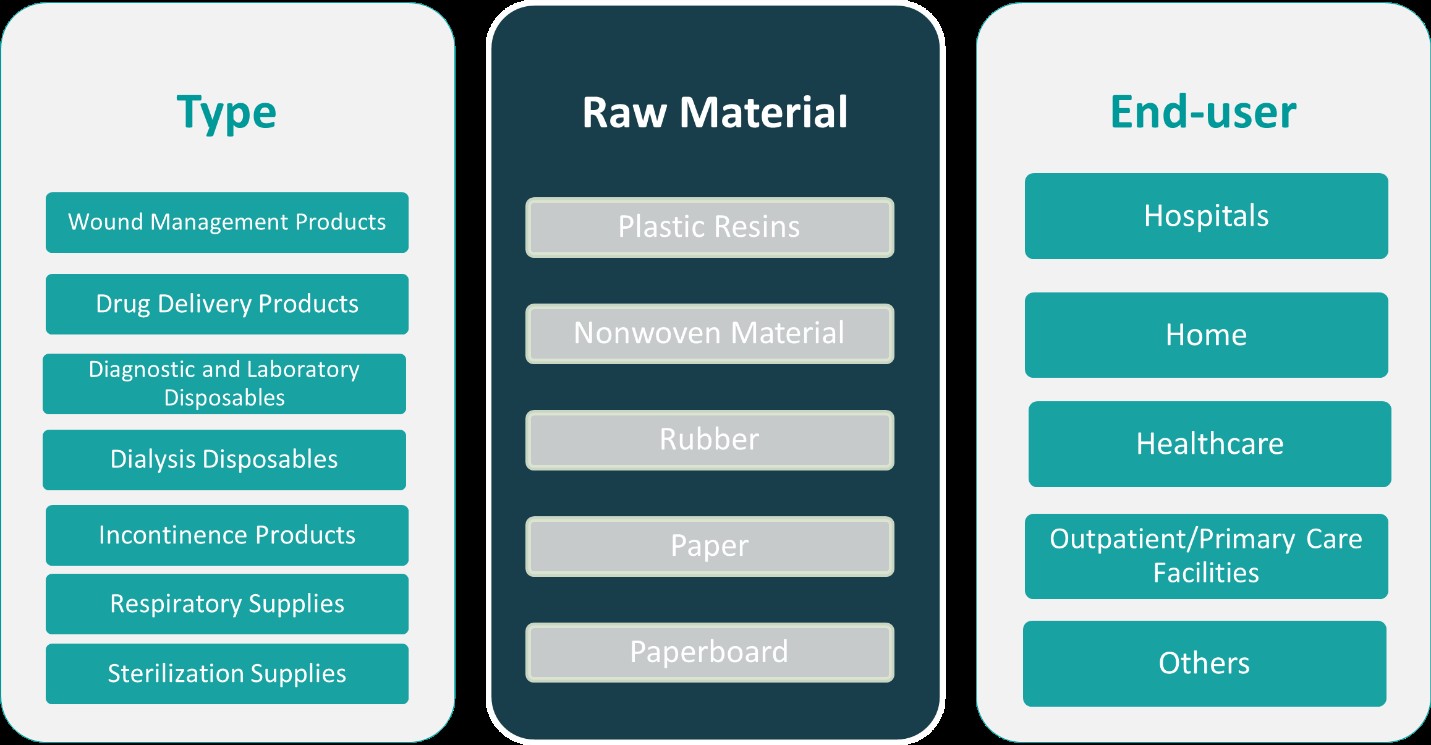

This report segments the Mexico Disposable Medical Supplies Market as follows:

Market Drivers

Growing Healthcare Demand and Population Dynamics

One of the key drivers for the growth of Mexico’s disposable medical supplies market is the increasing healthcare demand, fueled by demographic shifts, including an aging population. For instance, the Mexican National Institute of Statistics and Geography (INEGI) reports that over 12% of Mexico’s population is aged 60 and above, with a significant prevalence of chronic conditions like diabetes and cardiovascular diseases. Reports from the Ministry of Health emphasize the reliance on disposable medical supplies such as syringes, gloves, and wound care products to ensure infection control and patient safety during frequent medical visits and treatments.

Increased Focus on Hygiene and Infection Prevention

The heightened emphasis on hygiene and infection control has significantly impacted the demand for disposable medical supplies in Mexico. For instance, the Federal Commission for Protection against Sanitary Risks (COFEPRIS) has issued guidelines promoting the use of disposable gloves, masks, and gowns to reduce cross-contamination risks in healthcare settings. Reports from the World Health Organization (WHO) highlight the sustained demand for personal protective equipment (PPE) in hospitals and clinics, reflecting the growing public awareness of hygiene and infection prevention.

Technological Advancements and Improved Healthcare Infrastructure

Technological advancements in medical devices and healthcare treatments are significantly boosting the demand for disposable medical supplies in Mexico. The development of more sophisticated, efficient, and precise medical devices, combined with innovations in healthcare delivery, requires corresponding advancements in disposable products. For instance, the growth of minimally invasive procedures, robotic surgeries, and diagnostic imaging has led to the increased use of disposable medical instruments such as needles, catheters, and sterile kits. Additionally, the expansion of healthcare infrastructure in Mexico, driven by both public and private investments, is creating a greater need for disposable medical products. As more hospitals, clinics, and healthcare centers are built or upgraded, the demand for disposable supplies grows to meet the increased volume of medical procedures and treatments.

Cost-Effectiveness and Operational Efficiency

The cost-effectiveness and operational efficiency provided by disposable medical supplies are significant market drivers. In a cost-sensitive healthcare environment like Mexico, disposable products offer significant advantages over reusable alternatives. Disposable medical supplies help healthcare institutions reduce the costs associated with cleaning, sterilization, and maintaining reusable products. Furthermore, they streamline healthcare operations by saving time and labor, which is particularly important in busy hospitals and clinics. The ability to use a product once and discard it eliminates the risk of cross-contamination and ensures that patients receive the highest standard of care. As healthcare facilities in Mexico aim to optimize resources while maintaining quality, disposable medical supplies become an essential part of their strategy for delivering efficient and cost-effective healthcare.

Market Trends

Surge in Demand for Disposable Medical Gloves

One of the most prominent trends in the Mexico disposable medical supplies market is the rising demand for disposable medical gloves. For instance, the Federal Commission for Protection against Sanitary Risks (COFEPRIS) has issued guidelines emphasizing the use of nitrile gloves in healthcare settings due to their superior chemical resistance and durability. Additionally, public awareness campaigns by the Ministry of Health have encouraged the adoption of gloves for personal hygiene practices, further boosting demand. Additionally, the growing awareness among the general public about hygiene practices in the post-pandemic world is further driving the adoption of disposable gloves for both professional and personal use.

Expansion of Disposable Surgical Devices

Another key trend in Mexico’s disposable medical supplies market is the expansion of disposable surgical devices. For instance, the Ministry of Health has reported an increase in minimally invasive surgical procedures, which require specialized disposable tools such as electrosurgical devices and sutures. These innovations are particularly critical in addressing the growing number of surgeries linked to chronic health conditions and an aging population. As the number of surgeries in Mexico continues to increase due to an aging population and rising chronic health conditions, the demand for disposable surgical devices is expected to expand in tandem.

Integration of Smart and Sustainable Solutions

A significant emerging trend in the Mexico disposable medical supplies market is the integration of smart technologies and sustainable solutions. Smart disposable medical products, such as those with integrated RFID tags for inventory tracking, are becoming more common as healthcare facilities seek to streamline operations and reduce costs. These technologies enhance supply chain management, ensuring that hospitals and clinics can track the usage and expiration of products more efficiently. In parallel, there is growing concern about the environmental impact of medical waste, and this is prompting the development of more sustainable disposable products. Manufacturers are now exploring biodegradable and compostable materials to replace traditional plastics and synthetics used in disposable medical products. These innovations align with global sustainability goals and are being increasingly adopted in Mexico as environmental consciousness rises among healthcare providers and consumers alike.

Growth in Home Healthcare and Medical Tourism

The expansion of home healthcare services and Mexico’s increasing popularity as a destination for medical tourism are significant factors influencing the disposable medical supplies market. As the demand for at-home care rises due to an aging population and more chronic illnesses being managed outside of traditional healthcare settings, the need for disposable medical products such as home infusion kits, personal protective equipment, and home-use diagnostic devices has escalated. These products enable patients to receive care in the comfort of their own homes while maintaining high standards of hygiene and infection control. Moreover, Mexico’s thriving medical tourism industry, particularly in cities like Tijuana, Monterrey, and Guadalajara, is driving the demand for disposable medical products. International patients seeking affordable medical treatments, including surgeries and dental work, are a key market for disposable products, as they require sterile, one-time-use items during procedures.

Market Challenges Analysis

Regulatory and Compliance Challenges

One of the key challenges facing the Mexico disposable medical supplies market is navigating the complex regulatory environment. For instance, the Federal Commission for the Protection against Sanitary Risk (COFEPRIS) has implemented stringent guidelines for medical product approval, requiring manufacturers to meet ISO certifications and Good Manufacturing Practices (GMP) standards. The process for obtaining approval for new products or entering the market can be lengthy and resource-intensive, which poses a significant challenge for manufacturers, especially smaller companies. Furthermore, ensuring compliance with international standards, such as ISO certifications and Good Manufacturing Practices (GMP), can be challenging for companies seeking to compete in the global market. Non-compliance with these regulations can lead to product recalls, fines, or damage to a company’s reputation, adding complexity to market operations.

Supply Chain and Raw Material Issues

The disposable medical supplies market in Mexico also faces challenges related to supply chain disruptions and raw material shortages. Global supply chain issues, especially post-pandemic, have caused delays in the production and delivery of key raw materials used in medical disposables, such as plastics, rubber, and chemicals. These disruptions have led to price volatility and increased manufacturing costs, which can significantly impact profitability. Additionally, the reliance on imported raw materials exposes manufacturers to fluctuations in international prices and currency exchange rates, making cost control more difficult. In Mexico, where manufacturing is a vital industry, this has led to delays in product availability and strained relationships with healthcare providers who rely on a consistent and timely supply of medical products. These supply chain vulnerabilities underscore the need for companies to develop more resilient and diversified sourcing strategies to mitigate risks and maintain a steady supply of disposable medical supplies.

Market Opportunities

The Mexico disposable medical supplies market presents several significant opportunities, particularly as the healthcare sector continues to expand and modernize. With a growing population and an increasing number of healthcare facilities, there is a rising demand for high-quality medical disposables. The aging population in Mexico is driving a surge in the prevalence of chronic diseases, which, in turn, requires more frequent medical interventions, surgeries, and diagnostic procedures, creating a consistent need for disposable supplies such as syringes, surgical instruments, and diagnostic kits. Additionally, the expansion of private healthcare and medical tourism is contributing to an increased demand for disposable products, especially in urban centers where international patients seek affordable, high-quality care. This growing market for disposable products in both public and private sectors offers opportunities for manufacturers to tap into a burgeoning demand for medical disposables.

Moreover, there is a clear opportunity for manufacturers to innovate in response to the rising demand for eco-friendly and sustainable medical products. As environmental concerns grow, both healthcare providers and consumers are becoming more conscious of the ecological impact of medical waste. Manufacturers can capitalize on this trend by developing biodegradable or recyclable disposable products that meet the same high standards of hygiene and safety required in healthcare settings. Innovations in smart disposable medical products, such as those with RFID technology for inventory management, present another opportunity to enhance operational efficiency in healthcare facilities. By focusing on sustainability and technology integration, manufacturers can differentiate themselves in a competitive market while aligning with global trends toward environmentally responsible healthcare solutions. This positions the Mexico disposable medical supplies market for growth driven by both innovation and the evolving needs of the healthcare sector.

Market Segmentation Analysis:

By Type:

The Mexico disposable medical supplies market is segmented by product type, with key categories including wound management products, drug delivery products, diagnostic and laboratory disposables, dialysis disposables, and incontinence products. Among these, diagnostic and laboratory disposables hold a significant market share, driven by the rising demand for early and accurate disease detection, especially in the wake of increased health screenings and routine testing. Wound management products are also in high demand due to the growing number of surgical procedures and chronic wound cases, particularly among the elderly population. Drug delivery products, including syringes and IV kits, are experiencing steady growth as chronic disease treatments become more prevalent. Incontinence products are witnessing growing adoption due to a rising geriatric demographic and increased public awareness around personal hygiene. Dialysis disposables, while a more niche category, are expanding steadily with the increase in renal disease cases. This diverse segmentation allows manufacturers to target a broad range of clinical and home care needs across Mexico’s healthcare landscape.

By Raw Material:

Based on raw material, the disposable medical supplies market in Mexico is segmented into plastic resins, nonwoven material, rubber, paper, and paperboard. Plastic resins dominate the segment due to their wide applicability in the production of syringes, tubing, IV bags, and various packaging materials, thanks to their flexibility, durability, and cost-effectiveness. Nonwoven materials, primarily used in the manufacture of surgical masks, gowns, and drapes, are gaining traction due to their superior barrier properties and disposability, making them essential for infection control protocols. Rubber materials are commonly used in gloves and catheters and remain in demand for their elasticity and resilience. Meanwhile, paper and paperboard are increasingly used in packaging and disposable diagnostic products, with rising interest in biodegradable options. The growing focus on eco-friendly materials and sustainable manufacturing processes is influencing the raw materials segment, encouraging innovation in recyclable and compostable alternatives. This raw material diversification supports varied product development and strengthens market resilience amid evolving environmental and regulatory expectations.

Segments:

Based on Type:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

Based on Raw Material:

- Plastic Resins

- Nonwoven Material

- Rubber

- Paper

- Paperboard

Based on End- User:

- Hospitals

- Home

- Healthcare

- Outpatient/Primary Care Facilities

- Others

Based on the Geography:

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Regional Analysis

Mexico City

Mexico City holds the largest share of the disposable medical supplies market in Mexico, accounting for approximately 35% of the national market. As the capital and most populous city, Mexico City is home to a vast network of public and private healthcare facilities, including some of the country’s most advanced hospitals and research institutions. The region benefits from high healthcare spending, a concentration of medical professionals, and strong infrastructure, all of which contribute to a sustained demand for disposable medical products. In addition, Mexico City serves as a central distribution hub for many medical suppliers, enhancing its strategic importance in the overall market. The city’s proactive adoption of advanced healthcare technologies and its responsiveness to public health emergencies also support the growth of the disposable medical supplies sector.

Monterrey

Monterrey, one of Mexico’s leading industrial and economic centers, represents around 25% of the country’s disposable medical supplies market. Known for its well-developed private healthcare system, Monterrey boasts numerous specialty hospitals and medical institutions that drive demand for high-quality, single-use medical products. The city’s focus on advanced surgical procedures, coupled with a growing medical tourism sector, has significantly increased the use of items such as disposable surgical tools, diagnostic kits, and protective gear. Monterrey also benefits from its strong manufacturing base, which supports local production of medical disposables, thereby reducing dependence on imports and encouraging product innovation. As healthcare needs continue to grow in northern Mexico, Monterrey is expected to remain a critical player in the market.

Guadalajara

Guadalajara accounts for approximately 20% of the Mexico disposable medical supplies market. As a major metropolitan area in western Mexico, Guadalajara hosts a thriving network of public and private hospitals, medical schools, and research centers. The city has become a regional hub for healthcare innovation, particularly in biomedical technology and pharmaceutical development. Its increasing elderly population and rising prevalence of chronic diseases have led to higher consumption of wound care products, incontinence supplies, and diagnostic disposables. Guadalajara’s commitment to enhancing healthcare delivery and expanding access to modern medical services continues to drive the demand for reliable, safe, and cost-effective disposable supplies across various medical applications.

Tijuana

Tijuana, strategically located on the U.S.–Mexico border, holds an estimated 15% market share of the disposable medical supplies sector. It serves as a key entry point for international medical tourists, particularly from the United States, seeking affordable and quality healthcare services. This demand fuels the consistent use of disposable medical products across clinics and surgical centers catering to cross-border patients. Moreover, Tijuana hosts a growing number of medical device and supply manufacturers, leveraging its proximity to U.S. markets and benefiting from favorable trade agreements. The city’s focus on enhancing medical infrastructure and supporting health tourism ensures a rising demand for high-standard disposable medical supplies, making it a vital region in Mexico’s healthcare economy.

Key Player Analysis

- Smith+Nephew

- Shanghai Neo-Medical Co., Ltd

- Procter & Gamble

- Principle Business Enterprises, Inc

- Ontex

- Medtronic

- Nu-Life Medical & Surgical Supplies Inc

- Narang Medical Limited

- Molnlycke Health Care

- Mellon Medical B.V.

- MedGyn Products, Inc

- MED-CON Inc.

Competitive Analysis

The competitive landscape of the Mexico disposable medical supplies market is characterized by the presence of both global giants and regional players, each contributing to innovation, product diversification, and market growth. Leading companies such as Smith+Nephew, Medtronic, Procter & Gamble, Ontex, Molnlycke Health Care, Narang Medical Limited, Nu-Life Medical & Surgical Supplies Inc, Shanghai Neo-Medical Co., Ltd, Principle Business Enterprises, Inc, Mellon Medical B.V., MedGyn Products, Inc, and MED-CON Inc. play a prominent role in shaping the industry through strategic initiatives including mergers, acquisitions, partnerships, and new product launches. These companies focus on providing high-quality, cost-effective, and technologically advanced disposable products tailored to meet the evolving demands of healthcare providers in Mexico. Innovation in biodegradable materials, smart disposables with tracking capabilities, and infection-control-focused products help companies maintain a competitive edge. Additionally, they emphasize expanding regional distribution networks and forming local collaborations to enhance market penetration. The strong brand presence and robust R&D capabilities of these players allow them to cater to a wide range of healthcare needs, from hospital surgical supplies to homecare disposables, ensuring continued growth and resilience in a dynamic healthcare environment.

Recent Developments

- In March 2025, At the AAOS Annual Meeting, Smith+Nephew introduced the TESSA Spatial Surgery System, a 510(k)-pending technology combining augmented reality and advanced imaging for arthroscopic surgeries.

- In March 2025, Ontex inaugurated a new R&D center in Segovia, Spain, focusing on sustainable feminine care innovations and eco-friendly production processes.

- In May 2024, PBE invested in expanding production capacity for plus-size incontinence products, launching new 3XL disposable pull-on underwear with breathable materials to enhance comfort and skin health.

- In 2024, Medtronic initiated the limited release of its Evolut FX+ Transcatheter Aortic Valve Replacement device for minimally invasive heart surgeries.

- In May 2023, P&G acquired an established antiseptic brand to strengthen its hygiene portfolio, reflecting a strategic expansion into the personal hygiene market.

Market Concentration & Characteristics

The Mexico disposable medical supplies market exhibits a moderately concentrated structure, with a mix of established global corporations and emerging regional manufacturers competing for market share. The market is characterized by a steady demand for a wide range of products including wound care items, diagnostic disposables, drug delivery systems, and surgical instruments. High product usage in both hospital and homecare settings ensures consistent consumption across urban and semi-urban regions. Key players maintain competitive advantage through innovation, product quality, and strong distribution networks, while local manufacturers contribute by offering cost-effective alternatives tailored to regional healthcare needs. The market is also defined by regulatory compliance, evolving healthcare standards, and growing emphasis on infection control, which collectively influence product design and procurement decisions. Additionally, the push toward sustainable and eco-friendly disposables is shaping product development trends, making environmental responsibility an emerging characteristic of the sector. Overall, the market reflects a dynamic balance of quality, affordability, and accessibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Raw Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Mexico disposable medical supplies market is projected to grow steadily, driven by increasing healthcare expenditure and the expansion of healthcare infrastructure.

- Rising prevalence of chronic diseases and an aging population are contributing to the sustained demand for disposable medical products across various healthcare settings.

- The adoption of eco-friendly and biodegradable materials is gaining momentum, aligning with global sustainability goals and environmental regulations.

- Technological advancements, such as smart packaging and antimicrobial coatings, are enhancing the functionality and safety of disposable medical supplies.

- The expansion of home healthcare services is driving the demand for disposable products designed for home use, including infusion kits and monitoring devices.

- Integration of artificial intelligence and machine learning in inventory management is optimizing supply chains and reducing waste.

- The growth of medical tourism in Mexico is increasing the demand for high-quality disposable medical supplies to cater to international patients.

- Government initiatives to improve healthcare access in rural areas are creating opportunities for market expansion and increased product penetration.

- The market is witnessing increased competition among global and regional players, leading to innovation and diversification of product offerings.

- Strategic partnerships and collaborations among key stakeholders are fostering the development of advanced disposable medical products and expanding market reach.