Market Overview:

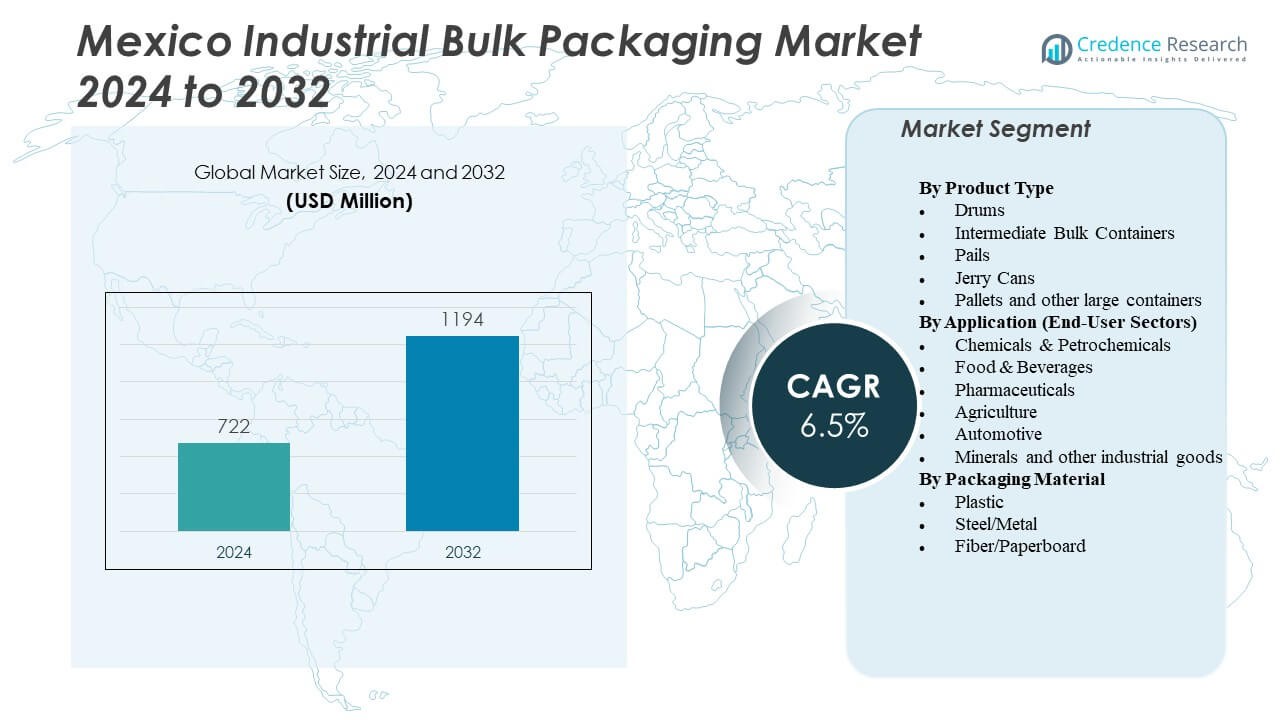

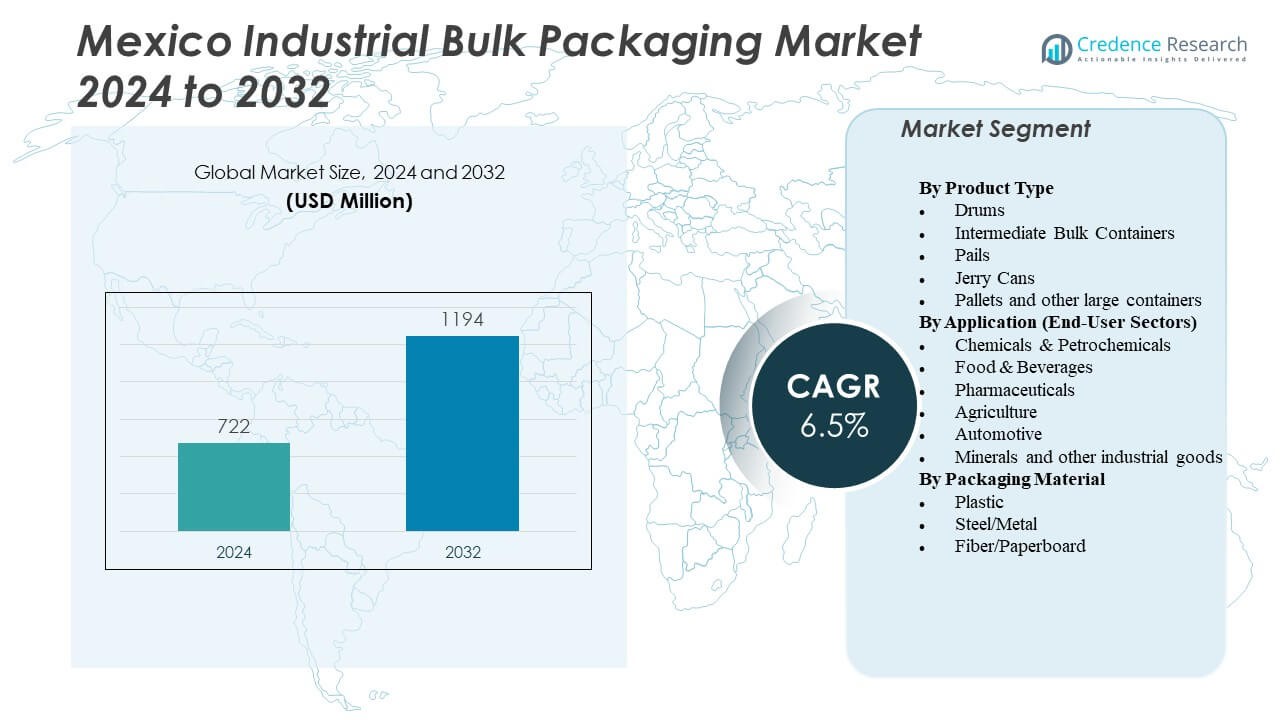

The Mexico Industrial Bulk Packaging Market is projected to grow from USD 722 million in 2024 to an estimated USD 1,194 million by 2032, with a compound annual growth rate (CAGR) of 6.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Industrial Bulk Packaging Market Size 2024 |

USD 722 Million |

| Mexico Industrial Bulk Packaging Market, CAGR |

6.5% |

| Mexico Industrial Bulk Packaging Market Size 2032 |

USD 1,194 Million |

Driven by the expansion of manufacturing sectors such as chemicals, food and beverage, and automotive, the market is experiencing robust growth as companies demand reliable and cost‑effective solutions for storing and transporting large‑volume materials. Manufacturers are investing in stronger, reusable containers to minimize waste and improve supply chain efficiency. Heightened focus on sustainability, coupled with rising industrial output and infrastructure development, reinforces adoption of industrial bulk packaging across sectors in Mexico.

Regionally, the Mexican bulk packaging market is concentrated in industrial hubs such as Mexico City, the Bajío region (including Querétaro and Guanajuato), and the northern border states like Nuevo León and Chihuahua, where manufacturing and export activities are most intense. Emerging areas include coastal corridors and lesser‑developed central regions, which are seeing increased investment in food processing and chemicals production. Mexico’s proximity to the U.S. and established logistics corridors further strengthen demand in border states, while inland regions are advancing as next‑wave growth zones.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Industrial Bulk Packaging Market is projected to grow from USD 722 million in 2024 to USD 1,194 million by 2032, registering a CAGR of 6.5% during the forecast period.

- Rapid industrialization and rising exports in sectors such as chemicals and automotive are driving demand for bulk packaging formats like drums and IBCs.

- Government-backed infrastructure improvements and nearshoring trends are strengthening supply chain efficiency, supporting market expansion.

- High dependence on plastic-based packaging is facing scrutiny due to environmental regulations and raw material cost fluctuations.

- Northern Mexico leads the market with a 38% share, followed by central and southern regions, driven by manufacturing density and logistics access.

- Adoption of sustainable materials and reusable packaging formats is accelerating across food, pharma, and industrial applications.

- Challenges around compliance with cross-border packaging standards and volatility in material sourcing continue to affect small-scale manufacturers.

Market Drivers:

Rising Industrial Manufacturing Output Across Core Sectors

The Mexico Industrial Bulk Packaging Market is strongly driven by the country’s growing industrial output, particularly in automotive, chemicals, and food processing sectors. These industries require bulk quantities of raw materials and intermediate products to be transported safely and efficiently. Packaging solutions such as intermediate bulk containers (IBCs), flexible intermediate bulk containers (FIBCs), and drums enable high-volume handling. The demand for sturdy and reusable packaging formats aligns with the operational requirements of these sectors. Manufacturers are focusing on streamlining their supply chains, which directly supports packaging upgrades. This rising demand also stems from the country’s role as a key supplier to the U.S. and Latin American markets. The need for efficient transport packaging plays a critical role in preserving product quality during long-haul logistics. The Mexico Industrial Bulk Packaging Market benefits directly from these trends.

- For instance, Greif’s GCUBE IBC features a tubular galvanized steel cage whose square‑tube frame withstands bending forces 40 % higher than those cited for competing designs in laboratory testing, enhancing durability and performance in high‑frequency transport applications

Expansion of Export-Oriented Manufacturing Zones

Growth in the Mexico Industrial Bulk Packaging Market is closely linked to the expansion of export-oriented industries in free trade zones and maquiladora regions. These zones require reliable, large-scale packaging formats to ship goods across borders, particularly to North America. Industries engaged in cross-border trade prioritize bulk packaging that meets regulatory standards and minimizes product damage. The presence of established logistics infrastructure and industrial parks increases the adoption of high-volume packaging solutions. Many international companies have set up manufacturing bases in Mexico to take advantage of trade treaties, increasing the demand for industrial packaging. Export goods including resins, auto parts, and agrochemicals frequently use customized packaging formats. It is crucial for packaging manufacturers to align with export timelines and safety standards. The growing complexity of supply chains in these zones accelerates the market’s growth trajectory.

Increased Emphasis on Cost Efficiency and Reusability

Packaging manufacturers and end users in the Mexico Industrial Bulk Packaging Market are prioritizing reusability and cost efficiency in packaging solutions. Reusable packaging formats such as rigid containers and metal drums help reduce long-term logistics costs. This is especially important for sectors with high-frequency shipments and reverse logistics models. Cost-effective packaging not only reduces material waste but also supports sustainability goals. Bulk packaging systems that are easy to clean and maintain are gaining favor among industrial users. Companies are investing in durable materials that lower replacement rates and improve total cost of ownership. Reusability directly contributes to enhanced operational efficiency, a key concern in price-sensitive industries. It has become an important driver as businesses seek packaging solutions that offer long-term returns on investment.

Government Support and Infrastructure Development Initiatives

The Mexico Industrial Bulk Packaging Market is supported by infrastructure initiatives aimed at improving logistics and industrial transportation. Government-led programs are enhancing road and rail connectivity, which expands opportunities for bulk shipments. Public and private investments in industrial zones and distribution hubs foster increased industrial activity. These developments promote demand for large-capacity packaging that ensures product safety and regulatory compliance during transit. Logistics firms are optimizing cargo management by using bulk packaging formats suited for specific freight routes. Transport infrastructure improvements reduce shipment time, encouraging high-volume packaging adoption. The market also benefits from national sustainability targets promoting efficient packaging systems. With the government promoting manufacturing growth, bulk packaging demand is projected to rise consistently. It

enables packaging manufacturers to scale operations in sync with broader industrial strategies.

- For instance, Mauser’s partnership with RIKUTEC introduced the Poly‑MT IBC Series featuring GPS tracking, NFC, and QR integration for full IoT-enabled logistics support in industrial corridors

Market Trends:

Adoption of Smart Packaging Solutions for Industrial Applications

The Mexico Industrial Bulk Packaging Market is witnessing increased adoption of smart packaging technologies that integrate tracking and condition monitoring features. These innovations help users monitor the location and environmental parameters of bulk shipments. RFID tags, QR codes, and IoT-based systems are being incorporated into containers to enhance traceability. Real-time data access helps reduce pilferage and identify handling issues during transit. Smart packaging also improves inventory management in industrial supply chains. Companies using such solutions gain better control over logistics and warehousing. It enables stakeholders to optimize storage space and reduce turnaround times. These technological upgrades are becoming more common in high-value industrial segments.

Customization of Packaging Formats for Specific End-Use Industries

Manufacturers in the Mexico Industrial Bulk Packaging Market are increasingly customizing packaging products based on industry-specific requirements. The chemical sector demands corrosion-resistant containers, while food-grade bulk packaging emphasizes hygiene and regulatory compliance. This trend supports the use of barrier materials, tamper-evident seals, and specialized linings. Packaging designs are also adapting to fit standardized pallet sizes and intermodal transport units. Customization helps reduce wastage and streamline packaging workflows in factories. It supports safe storage and handling of hazardous or sensitive materials. The need to meet export and domestic handling regulations further drives tailored packaging formats. It reflects an industry shift toward application-specific solutions rather than one-size-fits-all approaches.

- For example, custom packaging formats aligned with standard intermodal pallet sizes (1,200 mm × 1,000 mm) are increasingly used in automated factory lines to enhance loading efficiency. These designs help reduce material usage and streamline handling in both consumer and industrial sectors.

Integration of Sustainable Materials in Industrial Packaging Design

Sustainability remains a prominent trend shaping the Mexico Industrial Bulk Packaging Market, with companies increasingly adopting recyclable and biodegradable materials. Demand for eco-friendly options such as recycled polymers and renewable fiber-based containers is growing. Packaging manufacturers are developing lightweight solutions that reduce material usage while maintaining structural integrity. This shift aligns with corporate environmental goals and emerging regulatory frameworks. Industrial buyers prefer packaging formats that lower carbon footprints without compromising product safety. The focus on sustainable sourcing extends to secondary packaging and pallet systems as well. Adoption of such materials demonstrates a commitment to environmental stewardship while catering to evolving consumer and government expectations. It enhances brand value across industrial supply chains.

- For instance, Nefab’s Guadalajara facility, inaugurated in March 2025, specializes in thin-gauge thermoformed trays with 100% recycled polypropylene content, recovering and reprocessing up to 800 metric tons of packaging scrap annually onsite.

Growth in Contract Packaging and Logistics Outsourcing

Contract packaging services are gaining prominence in the Mexico Industrial Bulk Packaging Market due to increasing reliance on third-party logistics (3PL) and value-added warehousing. Companies are outsourcing their bulk packaging requirements to specialized firms that offer scalable solutions. This approach helps industrial firms focus on core operations while ensuring packaging compliance and efficiency. Contract packagers provide access to advanced equipment and trained personnel, improving packaging quality and consistency. The trend also supports faster order fulfillment and reduced inventory management costs. Industries using just-in-time models benefit from flexible packaging partnerships. It enables businesses to respond swiftly to market fluctuations and seasonal demand peaks. The outsourcing model is helping reshape the packaging value chain.

Market Challenges Analysis:

Fluctuations in Raw Material Prices and Supply Chain Disruptions

The Mexico Industrial Bulk Packaging Market faces challenges related to raw material cost volatility, particularly for plastics, metals, and fiber-based materials. Global fluctuations in crude oil prices significantly impact plastic resin availability and pricing. Metal drums and rigid containers are affected by shifts in steel and aluminum costs. These inconsistencies disrupt production planning and reduce profit margins for packaging manufacturers. Supply chain delays—whether due to geopolitical tensions, port congestion, or transportation strikes—further complicate inventory management. Import dependency on certain raw materials exposes the market to foreign exchange risks and regulatory barriers. Manufacturers must frequently adjust sourcing strategies to manage costs and maintain delivery schedules. It puts pressure on small and medium enterprises with limited purchasing power.

Stringent Regulations and Environmental Compliance Burdens

Stringent regulations related to packaging waste, chemical handling, and cross-border logistics pose challenges for the Mexico Industrial Bulk Packaging Market. Compliance with domestic and international standards requires continuous updates to materials, labeling, and design practices. Industrial packaging that fails to meet safety or environmental norms risks penalties and market rejection. Smaller packaging firms face financial and technical difficulties in adopting certified processes or obtaining necessary approvals. The rising focus on circular economy principles increases pressure to offer recyclable and reusable products. Adapting to these demands requires significant capital investment and process restructuring. Ensuring compliance while maintaining competitive pricing remains a persistent concern across the industry.

Market Opportunities:

Expansion of Nearshoring and Regional Supply Chains

The Mexico Industrial Bulk Packaging Market presents strong growth opportunities through the expansion of nearshoring and regional manufacturing networks. With global brands shifting production closer to North American markets, Mexico is emerging as a strategic manufacturing hub. This transformation drives demand for localized packaging production and distribution. Bulk packaging suppliers can capitalize by offering cost-effective and timely services within regional industrial clusters. Nearshoring reduces transit times and supports greater agility in packaging and shipment planning. It also creates new customer segments across intermediate goods manufacturers and exporters. Mexico’s favorable trade policies and proximity to the U.S. market enhance its potential to scale industrial packaging operations. It offers packaging firms opportunities to diversify product lines and expand client portfolios.

Investments in Circular Economy and Closed-Loop Packaging Systems

Growing awareness of circular economy principles is opening new opportunities in the Mexico Industrial Bulk Packaging Market, particularly in closed-loop packaging systems. Industrial sectors are increasingly adopting reusable packaging formats with reverse logistics models. This shift supports investment in collection, cleaning, and redistribution infrastructure. Companies that offer bulk packaging as a service—through rental or leasing models—are gaining traction. The opportunity lies in building sustainable systems that offer environmental benefits and cost savings. Packaging manufacturers can collaborate with end users to design long-lasting, repairable products. It encourages innovation in modular design and standardized components that facilitate reuse. Embracing circular models enhances market differentiation and long-term customer retention.

Market Segmentation Analysis:

The Mexico Industrial Bulk Packaging Market is segmented by product type, application, and packaging material, reflecting the varied needs of industrial supply chains.

By product types

Drums made from plastic, steel, or fiber hold a significant share due to their versatility in handling liquids and semi-solids. Intermediate Bulk Containers (IBCs) continue to gain traction for their efficient volume capacity and reusability, especially in export-oriented industries. Pails and jerry cans serve smaller volume applications, while pallets and other large containers support bulk stacking and transport in warehousing environments.

- For instance, MAUSER Group provides UN-certified HDPE open‑head pails across Latin America, widely adopted in chemical and agrochemical sectors for regulatory compliance and durability

By application

The chemicals and petrochemicals sector leads the market due to its demand for durable, compliant, and safe packaging formats. Food and beverage industries utilize hygienic bulk containers to preserve quality, while pharmaceuticals rely on regulatory-compliant packaging solutions. Agriculture, automotive, and minerals sectors also contribute steadily to market demand, requiring both rigid and flexible packaging suited to their respective materials and distribution networks.

- For instance, Greif introduced the aseptic GCUBE IBC Flex for high-value food, beverage, and pharmaceutical ingredients, with a CDF-engineered liner that enhances sanitary transport and product evacuation

By packaging material

Plastic dominates due to its lightweight, cost-effective, and corrosion-resistant properties. Steel and metal packaging serve heavy-duty applications where strength and fire resistance are critical. Fiber and paperboard options are emerging as sustainable alternatives in non-hazardous material handling. The segmentation highlights the Mexico Industrial Bulk Packaging Market’s adaptability to diverse industrial requirements and growing environmental considerations.

Segmentation:

By Product Type

- Drums (including plastic, steel, fiber/paperboard)

- Intermediate Bulk Containers (IBCs)

- Pails

- Jerry Cans

- Pallets and other large containers

By Application (End-User Sectors)

- Chemicals & Petrochemicals (the largest segment)

- Food & Beverages

- Pharmaceuticals

- Agriculture

- Automotive

- Minerals and other industrial goods

By Packaging Material

- Plastic

- Steel/Metal

- Fiber/Paperboard

By Geography/Region

- Northern Mexico (e.g., Nuevo León, Chihuahua, Coahuila)

- Central Mexico (e.g., Mexico City, Querétaro, Guanajuato)

- Southern Mexico (e.g., Veracruz, Tabasco, Yucatán)

Regional Analysis:

The northern region of Mexico holds the largest share of the Mexico Industrial Bulk Packaging Market, accounting for 38% of the total market value. This region benefits from its proximity to the United States and concentration of manufacturing clusters in states such as Nuevo León, Chihuahua, and Coahuila. Export-driven industries including automotive, electronics, and chemicals drive high demand for industrial bulk packaging solutions. Well-established logistics infrastructure and free trade zones support efficient cross-border transport, encouraging the use of large-volume, durable packaging formats. Industrial parks in this region rely heavily on cost-effective and standardized packaging to meet international shipping standards. The strategic location continues to position the north as the primary growth engine for the market.

The central region, including Mexico City, Querétaro, and Guanajuato, contributes 34% to the Mexico Industrial Bulk Packaging Market. This area hosts a dense network of food and beverage, pharmaceutical, and industrial goods manufacturers that require specialized bulk packaging for safe storage and handling. Growing urbanization and investments in industrial corridors are expanding production capacities, further fueling demand for IBCs, drums, and FIBCs. Central Mexico benefits from strong rail and road connectivity to both coastal and border regions, enhancing internal distribution networks. The region’s increasing emphasis on logistics modernization and packaging sustainability also supports rising demand. Its strong integration with national supply chains makes it a critical node in the industrial packaging value chain.

The southern region represents 28% of the Mexico Industrial Bulk Packaging Market, showing emerging potential driven by infrastructure development and growing industrial diversification. States such as Veracruz, Tabasco, and Yucatán are attracting new investments in agro-processing, construction, and petrochemical sectors, creating fresh demand for bulk packaging formats. Although the industrial base here is relatively nascent compared to the north and center, ongoing development projects are strengthening logistics capabilities and enabling market expansion. Ports and coastal trade activities offer strategic advantages for packaging suppliers targeting export-oriented customers. The region’s lower operational costs and untapped industrial potential make it an attractive area for future growth. The market is poised to gain from state-led incentives and foreign direct investments into southern manufacturing zones.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- MAUSER Group B.V.

- Greif Inc.

- International Paper Company

- Hoover Container Solutions, Inc.

- Menasha Corporation (ORBIS Corporation/Response Packaging)

- Cleveland Steel Container Corporation

- Composite Containers LLC

- XIFA Group

- FIBCA México

- Industrias Plásticas de México

- SCHÜTZ ELSA Mexico

- Grupo Phoenix

- Aptar Group Inc.

- Amcor Rigid Packaging Mexico

- ALPLA Mexico SA de CV

Competitive Analysis:

The Mexico Industrial Bulk Packaging Market features a competitive landscape with a blend of global leaders and strong domestic manufacturers. Key players such as MAUSER Group B.V., Greif Inc., and International Paper Company dominate the high-volume segment with diversified product portfolios and integrated supply chains. Domestic firms like FIBCA México and Industrias Plásticas de México serve regional demand with customized flexible intermediate bulk containers (FIBCs) and cost-efficient solutions. The market shows continuous innovation in sustainable and reusable packaging systems, driven by industrial efficiency requirements. Competitive advantage stems from production capacity, pricing strategies, and logistics reach. Manufacturers invest in localized production and distribution to meet evolving regulatory and client specifications. The Mexico Industrial Bulk Packaging Market is defined by intense rivalry, where players compete on quality, compliance, and customer-centric design capabilities.

Recent Developments:

- In June 2025, International Paper Company made strategic changes in its North American operations. The company exited the molded fiber market and sold Mexican assets, including a containerboard mill and two recycling plants, to APSA. In May 2025, International Paper also announced the consolidation of its Rio Grande Valley operations: closing its Edinburg, Texas facilities while investing in expanding its McAllen, Texas, and Reynosa, Mexico operations, including relocating current Reynosa activities to a more modern facility.

- In March 2025, Composites One (related to Composite Containers LLC) expanded its strategic partnership with Magnum Venus Products to include the Mexican market. This move strengthens distribution and technical support in composites and bulk packaging solutions across Mexico.

- In December 2024, Greif Inc. launched its innovative ModCan™ modular packaging solution. ModCan™ was introduced to enhance efficiency and safety for shipping and storing dissimilar materials, making it especially valuable for the specialty manufacturing and pharmaceutical industries in North America, including Mexico.

- In May 2024, Mauser Group B.V. agreed to acquire Taenza, S.A. de C.V., a Mexican manufacturer of tin-steel aerosol cans and steel pails. This acquisition, expected to close by April 2024, expands Mauser’s rigid metal packaging capabilities in Mexico and broadens its customer base in the paint, coatings, and chemical sectors.

Market Concentration & Characteristics:

The Mexico Industrial Bulk Packaging Market shows moderate-to-high concentration, with multinational corporations occupying a significant share and regional firms catering to niche applications. It exhibits a balanced mix of rigid and flexible packaging demand, shaped by the needs of key sectors such as chemicals, automotive, and food processing. The market favors vendors offering scalable, compliant, and sustainable packaging formats. Rapid industrialization, trade integration, and regional supply chain shifts influence purchasing behavior and contract terms. It requires continuous investment in material innovation, certifications, and operational efficiency to remain competitive. Strategic partnerships and localized production capabilities are becoming essential for long-term market positioning.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and packaging material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for reusable and sustainable bulk packaging solutions is expected to increase, driven by industrial sustainability goals and regulatory shifts.

- Growth in export-oriented manufacturing will boost the need for durable and compliant bulk packaging formats.

- Advances in material science will lead to lighter, stronger, and more cost-effective packaging options across industrial applications.

- The expansion of nearshoring and regional supply chains will strengthen local demand for flexible and rigid bulk containers.

- Adoption of smart packaging technologies will rise, improving traceability, condition monitoring, and supply chain visibility.

- Investment in packaging automation and efficiency-enhancing machinery will accelerate production capacity across major hubs.

- Greater customization of packaging designs will support industry-specific handling, storage, and transport requirements.

- Regulatory alignment with global standards will influence packaging specifications, especially in cross-border trade.

- Increasing participation of small and medium enterprises will diversify the market and introduce competitive innovation.

- Infrastructure development in emerging regions will open new growth avenues for bulk packaging suppliers and service providers.