| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Tire Market Size 2024 |

USD 5,134.56 million |

| Mexico Tire Market, CAGR |

2.36% |

| Mexico Tire Market Size 2032 |

USD 6,190.12 million |

Market Overview

Mexico Tire market size was valued at USD 5,134.56 million in 2024 and is anticipated to reach USD 6,190.12 million by 2032, at a CAGR of 2.36% during the forecast period (2024-2032).

The Mexico tire market is driven by several key factors, including the expansion of the automotive industry, which boosts the demand for both OEM and replacement tires. Increasing vehicle production and sales, particularly in the passenger car and commercial vehicle segments, are significant contributors. The growing focus on fuel efficiency and sustainability is driving innovation in eco-friendly tire technologies, such as low rolling resistance and longer-lasting tires. Additionally, the rise in vehicle ownership and demand for affordable transportation is further fueling tire sales. As the Mexican economy continues to grow, industrial development and the expanding logistics sector also contribute to the increasing need for tires. Furthermore, the introduction of advanced tire technologies, such as smart tires and tire pressure monitoring systems, is reshaping the market, improving vehicle safety and performance. These factors, combined with rising replacement tire demand, are propelling the market’s growth.

The Mexican tire market is influenced by key regions such as Mexico City, Monterrey, Guadalajara, and Tijuana, each contributing to the overall demand across various vehicle types. The market is shaped by a mix of local and international tire manufacturers, with major players including JK Tornel, Hules Banda S.A. de C.V., Galgo Pre-Q, Corpusa Tires, and Uniroyal Mexico. These companies cater to diverse segments such as passenger cars, light trucks, and commercial vehicles. While local manufacturers dominate in certain segments, international brands continue to play a significant role in shaping industry standards and offering a wide range of products. The growth of e-commerce and the rising demand for eco-friendly tires are influencing the strategies of these key players, driving innovation and the development of specialized products to meet consumer needs in Mexico’s dynamic tire market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexican tire market was valued at USD 5,134.56 million in 2024 and is expected to reach USD 6,190.12 million by 2032, growing at a CAGR of 2.36% during the forecast period (2024-2032).

- The global tire market was valued at USD 3,29,521.50 million in 2024 and is projected to reach USD 4,62,900.23 million by 2032, growing at a CAGR of 4.34% during the forecast period.

- Growing demand for replacement tires, especially for passenger and commercial vehicles, is driving market growth.

- Increasing vehicle ownership and the expansion of the logistics sector are key market drivers in Mexico.

- The trend toward eco-friendly and energy-efficient tires is shaping innovation, with a focus on sustainability.

- Competitive pressure is intense with key players such as JK Tornel, Hules Banda S.A. de C.V., and Uniroyal Mexico.

- Supply chain disruptions and raw material cost fluctuations are major market restraints.

- Regional markets like Mexico City and Monterrey are dominant, driven by automotive manufacturing and strong transportation sectors.

Report Scope

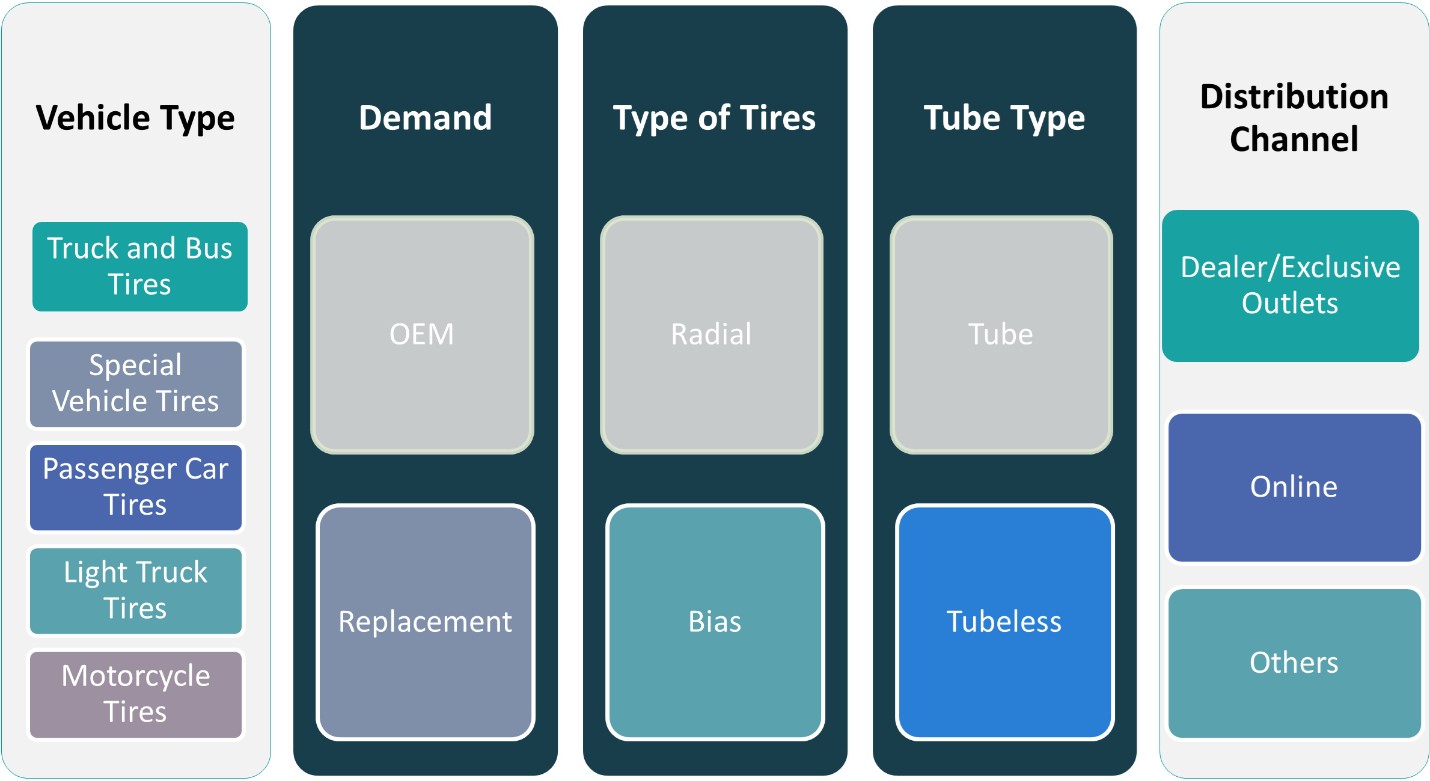

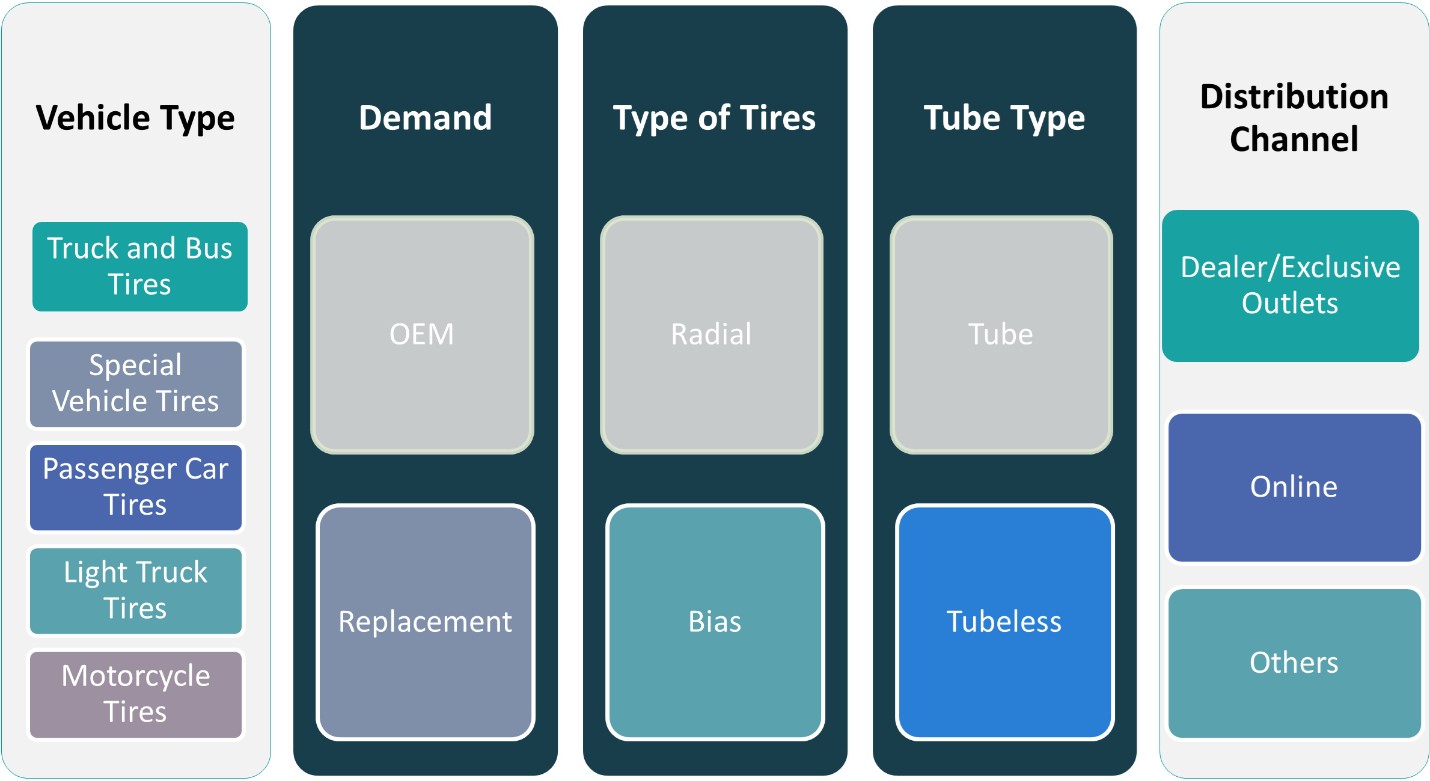

This report segments the Mexico Tire Market as follows:

Market Drivers

Expansion of the Automotive Industry

The growth of the automotive industry in Mexico plays a pivotal role in driving the tire market. Mexico has become a key hub for automobile manufacturing, attracting major global automotive players due to its strategic location, skilled labor, and favorable trade agreements such as the USMCA. For instance, Mexico’s automotive sector has seen significant foreign investment, with major tire manufacturers expanding production facilities to meet rising demand. As vehicle production increases, the demand for original equipment manufacturer (OEM) tires also rises, driving market expansion. Additionally, the increase in both domestic vehicle sales and exports contributes to a steady rise in tire consumption. This trend is particularly prominent in the passenger car, light commercial vehicle, and heavy-duty vehicle segments, all of which demand high-quality tires tailored to their specific needs.

Growth in the Logistics and Industrial Sectors

Mexico’s expanding logistics and industrial sectors are also contributing to the growth of the tire market. The country’s strategic location, which serves as a major transportation hub between North and South America, has led to an increase in goods movement, driving the demand for commercial vehicle tires. For instance, Mexico’s logistics sector has seen rapid expansion, increasing demand for commercial vehicle tires. As e-commerce continues to rise, the need for delivery vehicles has surged, increasing tire demand for trucks, vans, and other commercial vehicles. Additionally, the growth in Mexico’s industrial sector, including manufacturing, construction, and mining, requires specialized tires capable of handling heavy-duty machinery and vehicles. This trend supports the tire market by creating a demand for robust, durable tires that can withstand the demanding conditions of these sectors.

Rise in Vehicle Ownership and Replacement Demand

Vehicle ownership in Mexico has been steadily increasing, especially with the growing middle-class population and expanding urbanization. As more individuals purchase vehicles, the demand for replacement tires has surged. Tires typically need to be replaced every 3 to 5 years depending on usage, making the replacement segment a major driver for the tire market. As vehicles accumulate mileage, the need for replacement tires—due to wear and tear—becomes an ongoing necessity. Furthermore, the trend toward vehicle maintenance and safety awareness is encouraging vehicle owners to replace tires more frequently, contributing to the growth of the market.

Technological Advancements in Tire Manufacturing

Innovation and technological advancements in tire manufacturing are significantly shaping the Mexico tire market. The demand for tires that offer better fuel efficiency, increased durability, and enhanced performance is pushing manufacturers to invest in new tire technologies. For instance, the development of eco-friendly tires, such as those made from renewable materials and featuring low rolling resistance, is gaining traction. Additionally, advancements in smart tires, equipped with sensors that provide real-time data on tire pressure and performance, are reshaping the market. These innovations not only meet consumer preferences for more sustainable and efficient products but also contribute to the overall safety and performance of vehicles, further driving the demand for high-quality tires in Mexico.

Market Trends

Increasing Adoption of Smart Tire Technology

Smart tire technology is becoming an important trend in Mexico’s tire market, driven by the growing demand for enhanced vehicle safety and performance. These tires are equipped with sensors that provide real-time data on tire pressure, temperature, and tread wear. This technology helps improve fuel efficiency, extend tire life, and prevent accidents caused by tire failure. The adoption of smart tires is gaining momentum, particularly in commercial fleets and high-performance vehicles, as they offer better monitoring and maintenance capabilities. For instance, the rise of autonomous vehicles and connected cars has led to the development of smart tires integrated with IoT sensors that monitor tire pressure, tread wear, and road conditions in real-time. As vehicle manufacturers and tire companies increasingly focus on innovation, smart tires are expected to become more mainstream, further driving market growth in Mexico.

Rise in Aftermarket Tire Services

The aftermarket segment of the tire market in Mexico is experiencing a significant rise, fueled by an increasing number of vehicles on the road and the growing need for replacement tires. For instance, Mexico’s regulatory framework includes mandatory tire labeling standards that provide consumers with information about rolling resistance and safety features. As vehicle ownership continues to rise, consumers are increasingly seeking high-quality replacement tires, as well as tire-related services like balancing, alignment, and rotation. In particular, the demand for premium tires with enhanced performance and durability is expanding, driven by the increasing awareness of safety and fuel efficiency. Retailers and service providers are adapting to this trend by offering more specialized services, creating a comprehensive tire service ecosystem that meets the evolving needs of consumers.

Regulatory and Policy Support

Government policies and regulations are playing a pivotal role in shaping the future of the tire market in Mexico. The Mexican government has implemented various regulations related to vehicle emissions and tire standards, encouraging the adoption of more fuel-efficient and environmentally friendly tires. For example, the Mexican government has introduced standards for tire labeling, which provides consumers with information about rolling resistance and safety features. Additionally, regulations aimed at reducing tire waste, such as the promotion of tire recycling and retreading, are gaining traction. These regulatory efforts not only help reduce environmental impact but also create a favorable environment for manufacturers focusing on sustainability and innovation.

Integration of Tire Recycling Initiatives

Tire recycling initiatives are gaining momentum in Mexico, driven by environmental concerns and the need for more sustainable practices. The country is seeing an increasing focus on reusing tire materials for new products, including rubberized asphalt, playground surfaces, and molded products. The government and industry players are collaborating to promote tire recycling and reduce the environmental impact of used tires, which have traditionally been a significant source of waste. This trend is creating opportunities for tire manufacturers to develop more eco-friendly solutions, such as retreaded tires and products made from recycled tire materials. As sustainability becomes a more central focus for both consumers and businesses, tire recycling will play an integral role in the future growth of the Mexican tire market.

Market Challenges Analysis

Supply Chain Disruptions and Raw Material Costs

One of the key challenges facing the Mexican tire market is supply chain disruptions, particularly related to raw material shortages and increased costs. The tire manufacturing process relies heavily on materials such as natural rubber, synthetic rubber, and steel, which are subject to global price fluctuations and supply chain vulnerabilities. Recent disruptions caused by factors like the COVID-19 pandemic, geopolitical tensions, and changes in global trade dynamics have led to increased costs for these essential materials. This, in turn, affects the overall production cost of tires, potentially leading to higher prices for consumers. Manufacturers in Mexico are facing pressure to manage these increased costs while maintaining competitive pricing, which may affect profit margins and hinder market growth.

Environmental Regulations and Tire Waste Management

Environmental regulations and tire waste management continue to be significant challenges for the Mexican tire market. The increasing focus on sustainability and the proper disposal of tires has led to stricter regulations around tire production, recycling, and disposal. The disposal of used tires remains a major environmental concern, as they are often not properly recycled and contribute to waste buildup. While retreading and recycling initiatives are gaining momentum, the infrastructure for tire recycling in Mexico is still developing, limiting the effectiveness of these efforts. For instance, nearly 36 million unused tires are deposited in landfills or clandestine sites in Mexico annually, highlighting the need for improved recycling infrastructure. Tire manufacturers are required to invest in sustainable practices and technologies to comply with these regulations, which can lead to higher operational costs. Balancing environmental responsibility with cost-efficiency remains a key challenge for the industry moving forward.

Market Opportunities

The Mexican tire market presents significant growth opportunities driven by several factors, including the expansion of the automotive and logistics sectors. As Mexico continues to emerge as a key manufacturing hub for automobiles, the demand for both original equipment manufacturer (OEM) tires and replacement tires is expected to rise. The country’s strategic location within North America enhances its role as a critical player in the automotive supply chain, attracting investments from global automobile manufacturers. Furthermore, the increase in domestic vehicle ownership and the need for replacement tires create a continuous demand, particularly in the passenger and commercial vehicle segments. This growth is also supported by the expanding e-commerce sector, as consumers increasingly prefer the convenience of purchasing tires online, offering tire manufacturers and retailers a new avenue to reach customers.

Additionally, the trend toward sustainability presents significant opportunities in the Mexican tire market. As consumer awareness about environmental impact grows, there is a rising demand for eco-friendly and energy-efficient tires. Manufacturers are investing in tire innovations that utilize sustainable materials, such as bio-based rubbers and recyclable components. Moreover, the increasing adoption of electric vehicles (EVs) opens new market avenues for tires designed specifically for EVs, which require unique characteristics such as lower rolling resistance and higher durability. With the Mexican government focusing on sustainable practices and regulations around tire recycling, there is room for manufacturers to innovate in tire recycling technologies and offer retreading services, providing both economic and environmental benefits. These opportunities, coupled with continued growth in the automotive and logistics industries, position the Mexican tire market for sustained expansion.

Market Segmentation Analysis:

By Vehicle Type:

The Mexican tire market is segmented by vehicle type, each representing distinct demand drivers. Truck and bus tires account for a substantial portion of the market, driven by the growing demand for logistics and transportation services. Mexico’s strategic location as a manufacturing and export hub significantly contributes to the demand for tires in the commercial vehicle segment. The special vehicle tires segment, including tires for construction, mining, and agricultural machinery, is also gaining traction due to the ongoing expansion of infrastructure and industrial projects. On the other hand, passenger car tires are a dominant segment driven by the rising number of vehicles on the road and increasing urbanization. Light truck tires, used primarily in light commercial vehicles, benefit from the growth of small businesses and delivery services. Finally, motorcycle tires are witnessing steady growth, driven by Mexico’s large number of motorcycles used for personal transportation, particularly in urban areas.

By Demand:

The tire market in Mexico is also segmented by demand, comprising OEM and replacement tires. The OEM (Original Equipment Manufacturer) segment is driven by vehicle production in Mexico, which has become a major manufacturing hub for both domestic consumption and export. The strong presence of global automotive companies contributes to the continuous demand for OEM tires, which are fitted on vehicles at the time of manufacturing. However, the replacement tire segment holds a larger share, driven by the need for tire replacement due to wear and tear. As vehicles age and accumulate mileage, tires need to be replaced regularly, fueling the demand for replacement tires. Both the passenger car and commercial vehicle sectors contribute to the growth of this segment, with consumers prioritizing tire safety and performance. The replacement segment is expected to maintain a steady growth trajectory as vehicle ownership and fleet operations continue to rise across Mexico.

Segments:

Based on Vehicle Type:

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

Based on Demand:

Based on Type of Tires:

Based on Tube Type

Based on Distribution Channel:

- Dealer/Exclusive Outlets

- Online

- Others

Based on the Geography:

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Regional Analysis

Mexico City

Mexico City, as the capital and largest metropolitan area in the country, commands the largest market share, accounting for approximately 35% of the national tire market. The region’s economic activities, including a strong automotive industry, a growing transportation sector, and a high population density, drive tire demand, particularly in the passenger car and light commercial vehicle segments. The vast number of vehicles on the road and the high demand for both replacement and OEM tires make Mexico City the dominant region in terms of sales volume.

Monterrey

In Monterrey, the second-largest tire market region in Mexico, the demand for tires is also significant, contributing to around 20% of the national market share. As an industrial hub, Monterrey is home to numerous manufacturing facilities and a thriving logistics sector, which drives the need for commercial and special vehicle tires. The city’s strategic location near the U.S. border further enhances its importance as a key player in tire distribution, with increased demand from heavy-duty commercial vehicles and trucks serving as a major market segment. The automotive sector in Monterrey also supports the demand for OEM tires, particularly for light trucks and SUVs.

Guadalajara

Guadalajara, with its growing economy and strong industrial base, holds approximately 18% of the market share in the Mexican tire industry. As one of the largest cities in Mexico, Guadalajara is a key consumer market for both passenger car and light truck tires, driven by a rise in vehicle ownership and a bustling urban environment. Additionally, Guadalajara’s increasing role as a center for commercial vehicle fleets and logistics adds to the demand for replacement tires. The region’s expanding e-commerce industry also contributes to the growing trend of online tire sales, offering new market opportunities.

Tijuana

Tijuana rounds out the regional analysis, accounting for about 15% of Mexico’s tire market. Located along the U.S. border, Tijuana benefits from cross-border trade, particularly in the commercial vehicle and special vehicle tire segments. The region’s proximity to California’s automotive manufacturing and distribution centers drives the demand for OEM tires, while Tijuana’s robust commercial sector contributes to the steady demand for replacement tires. The tire market in Tijuana also sees growth due to the increasing presence of international automotive manufacturers, enhancing demand for tires in the light truck and passenger car segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JK Tornel

- Business Strategy

- Financial Overview

- Hules Banda S.A. de C.V.

- Galgo Pre-Q

- Corpusa Tires

- Uniroyal Mexico

Competitive Analysis

The competitive landscape of the Mexican tire market is shaped by both local and international players, each contributing to the diverse product offerings and innovation in the industry. Leading companies include JK Tornel, Hules Banda S.A. de C.V., Galgo Pre-Q, Corpusa Tires, and Uniroyal Mexico, which cater to various vehicle segments such as passenger cars, light trucks, and commercial vehicles. In the OEM market, manufacturers work closely with automotive producers to supply tires for new vehicles, while in the replacement market, they focus on meeting the demand for durable and cost-effective tires. Tire manufacturers are increasingly investing in technology and product development, with a strong emphasis on enhancing performance, fuel efficiency, and safety features. Additionally, the trend toward eco-friendly tires is shaping the competitive environment, as companies strive to offer sustainable solutions such as tires made from renewable materials or those that are recyclable. The rise of online retail and e-commerce is another key factor, with companies adapting to new sales channels to reach consumers directly. Price remains a critical factor in this competitive market, particularly as the demand for affordable, high-performance tires increases. Manufacturers are also focusing on expanding their distribution networks and improving after-sales services, including tire maintenance and repair, to gain an advantage in the growing and dynamic tire market in Mexico.

Recent Developments

- In May 2025,Continental reported its best Q1 earnings since 2021, with adjusted group earnings of €586 million, driven by cost reductions and a rebound in tire replacement demand. The company is undergoing a major overhaul, spinning off its automotive unit and planning to divest the ContiTech industrial division to focus on its profitable tires business.

- In March 2025, Bridgestone announced its 2025 motorsports plan, continuing support for professional and grassroots motorsports globally. The company is emphasizing sustainable motorsport as a “mobile laboratory” to refine technologies for commercial tire development. Bridgestone remains the exclusive tire supplier for major race series, including Japan’s SUPER GT and North America’s NTT INDYCAR® SERIES.

- In March 2025, Michelin was named one of the world’s 100 most innovative companies by Clarivate, recognizing its strong R&D capabilities. The company also launched the MICHELIN City Touring tire for bicycles, emphasizing safety and sustainability.

- In February 2025,Goodyear announced a capacity expansion at its Lawton, Oklahoma facility, targeting production of 10 million additional premium tires annually, especially larger rim sizes and higher-margin segments.

- In January 2025,Apollo highlighted double-digit growth in commercial vehicle and farm tires, high single-digit growth in passenger car tires, and continued investment in R&D and AI-driven efficiency. The company is also investing in natural rubber cultivation in India to address commodity challenges.

Market Concentration & Characteristics

The tire market in Mexico exhibits a moderate level of concentration, with a mix of local and international players dominating various segments. The market is characterized by a few large companies that hold significant market share, particularly in the OEM and replacement tire sectors. These companies offer a broad range of products, from budget-friendly tires to premium options, catering to diverse consumer needs, including passenger cars, commercial vehicles, and specialty tires. The competitive environment is driven by factors such as pricing, product innovation, quality, and the ability to meet evolving consumer preferences, especially regarding sustainability. Additionally, regional disparities in demand, driven by vehicle type and local economic conditions, shape the market dynamics. While large manufacturers lead the market, smaller, niche players continue to thrive by offering specialized products and focusing on specific consumer needs. As the market grows, new entrants may emerge, further diversifying the competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mexico’s tire market is expected to grow steadily due to an increase in vehicle production and sales, as well as a growing automotive sector.

- The demand for replacement tires is anticipated to rise, driven by the expanding vehicle fleet and increasing consumer awareness about vehicle maintenance.

- Advancements in tire technology, including the adoption of eco-friendly and energy-efficient tires, are likely to shape the future of the market.

- The rising popularity of electric vehicles (EVs) in Mexico will create new opportunities for tire manufacturers to develop specialized tires for this segment.

- Government regulations focusing on sustainability and emissions reduction will prompt tire manufacturers to invest in developing more environmentally friendly products.

- Increased investments in infrastructure projects, particularly in the road network, will boost the demand for tires in both the commercial and passenger vehicle segments.

- Online retail platforms for tires will grow, making it easier for consumers to access a wider range of tire options and services.

- Rising awareness of safety and performance will drive consumers to invest in higher-quality, premium tires.

- The shift towards a circular economy may encourage the development of tire recycling programs and innovations in tire reuse and repurposing.

- The Mexican tire market will continue to see competitive pressure, with both domestic and international players vying for market share.