Market Overview

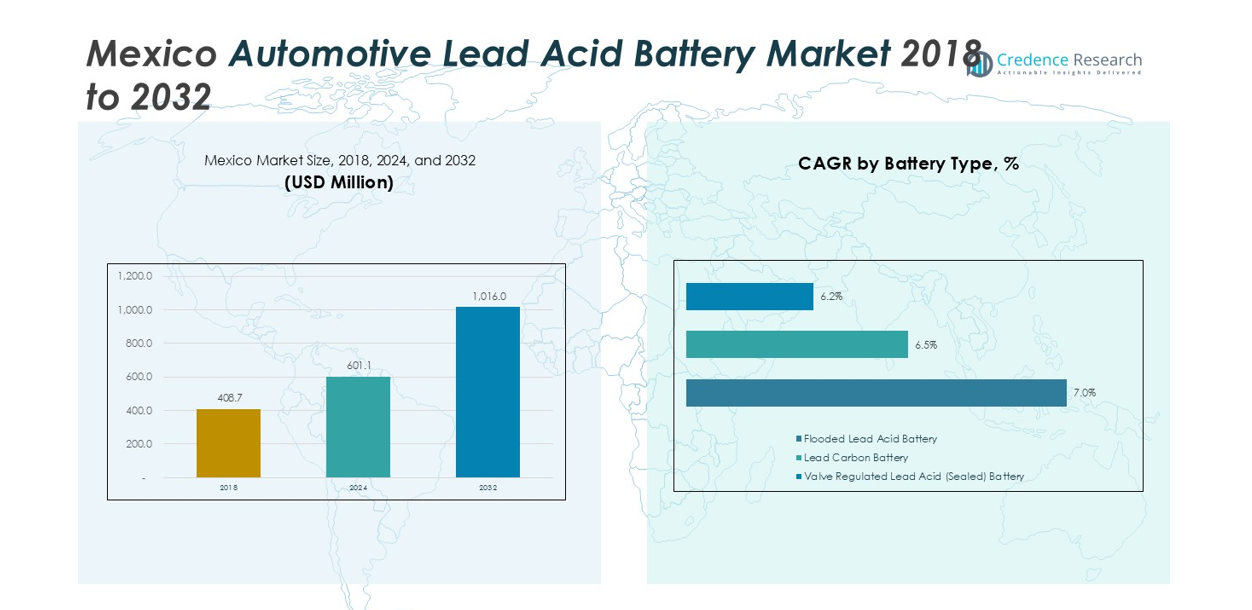

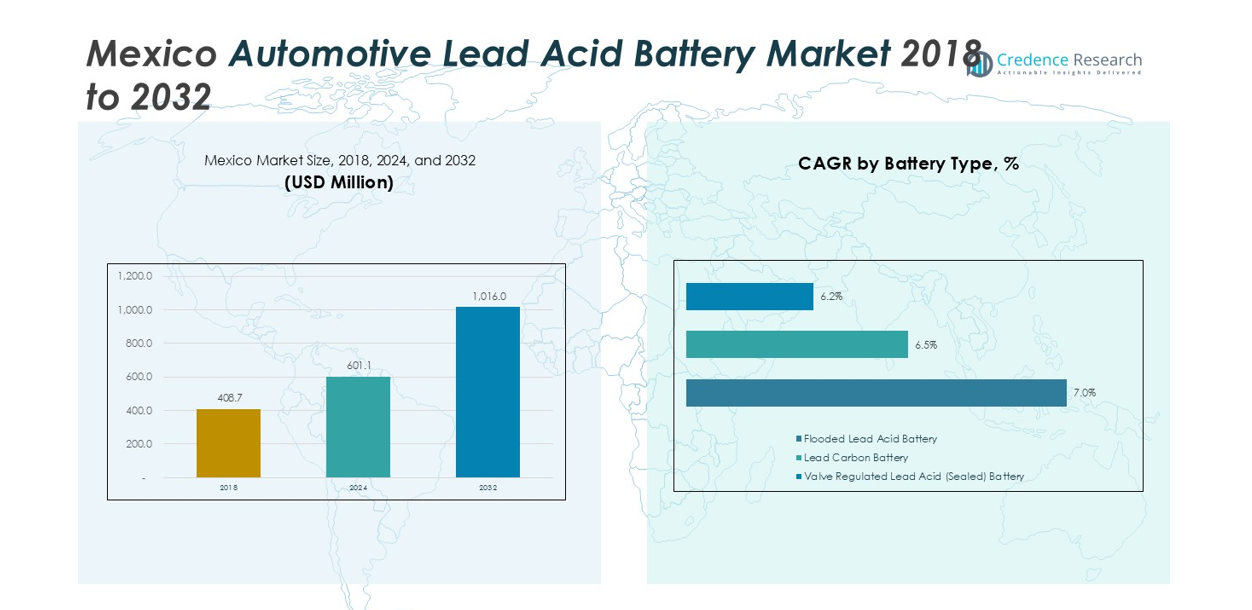

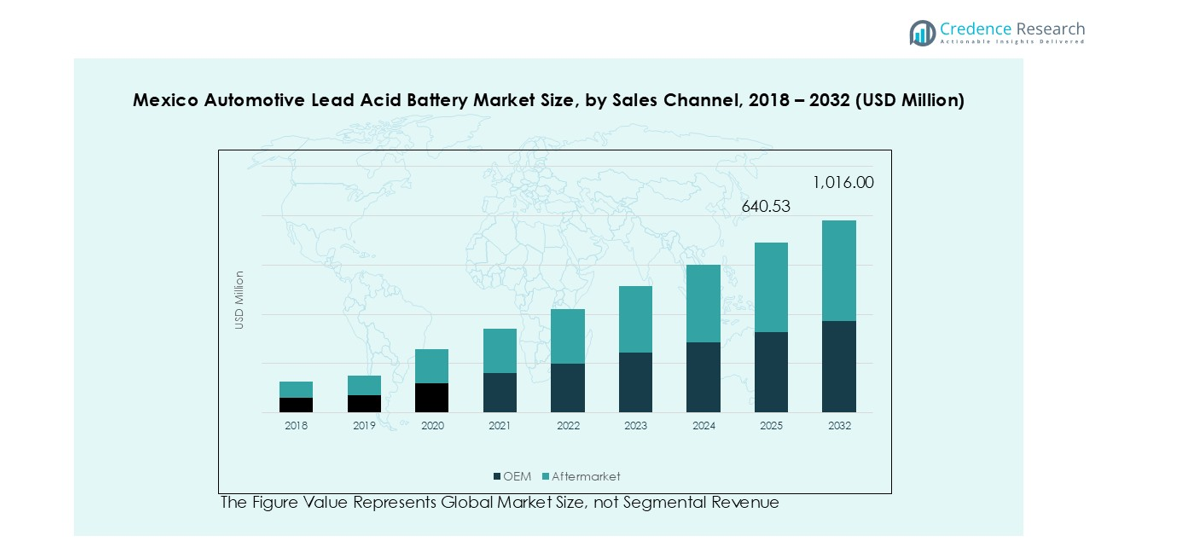

Mexico Automotive Lead Acid Battery market size was valued at USD 408.7 million in 2018 to USD 601.1 million in 2024 and is anticipated to reach USD 1,016.0 million by 2032, at a CAGR of 6.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Automotive Lead Acid Battery Market Size 2024 |

USD 601.1 million |

| Mexico Automotive Lead Acid Battery Market , CAGR |

6.81% |

| Mexico Automotive Lead Acid Battery Market Size 2032 |

USD 1,016.0 million |

The Mexico Automotive Lead Acid Battery Market is led by major players such as Clarios, LTH Baterías, ACDelco, East Penn Manufacturing, EnerSys, and Exide Industries Ltd. Clarios, through its LTH brand, dominates with an estimated 35% market share, supported by extensive OEM partnerships and nationwide distribution. ACDelco and East Penn Manufacturing follow, focusing on premium and maintenance-free battery segments. EnerSys and Exide Industries Ltd. strengthen competition with advanced lead-acid technologies and export capabilities. Regionally, Mexico City leads with nearly 30% market share, driven by dense vehicle ownership and replacement demand, while Monterrey and Guadalajara contribute significantly through strong industrial and logistics activity.

Market Insights

- The Mexico Automotive Lead Acid Battery Market was valued at USD 601.1 million in 2024 and is projected to reach USD 1,016.0 million by 2032, growing at a CAGR of 6.81%.

- Market growth is driven by high vehicle ownership, expanding aftermarket demand, and a strong replacement cycle across passenger and commercial vehicle fleets.

- Flooded lead acid batteries dominate with over 45% share, while AGM and lead-carbon variants gain traction in start-stop and high-performance vehicles.

- The competitive landscape is led by Clarios, LTH Baterías, and ACDelco, supported by extensive OEM collaborations, strong dealer networks, and sustainability-focused production.

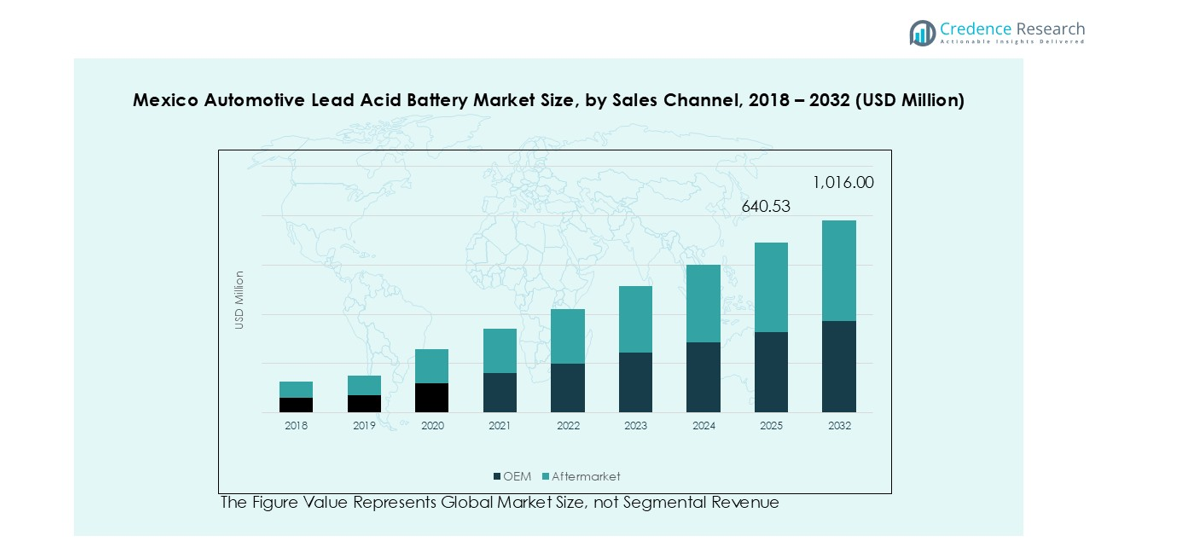

- Regionally, Mexico City holds about 30% share due to its dense vehicle base, followed by Monterrey (25%), Guadalajara (20%), and Tijuana (15%); aftermarket channels account for over 60% of total sales, reflecting strong consumer preference for cost-effective replacement solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

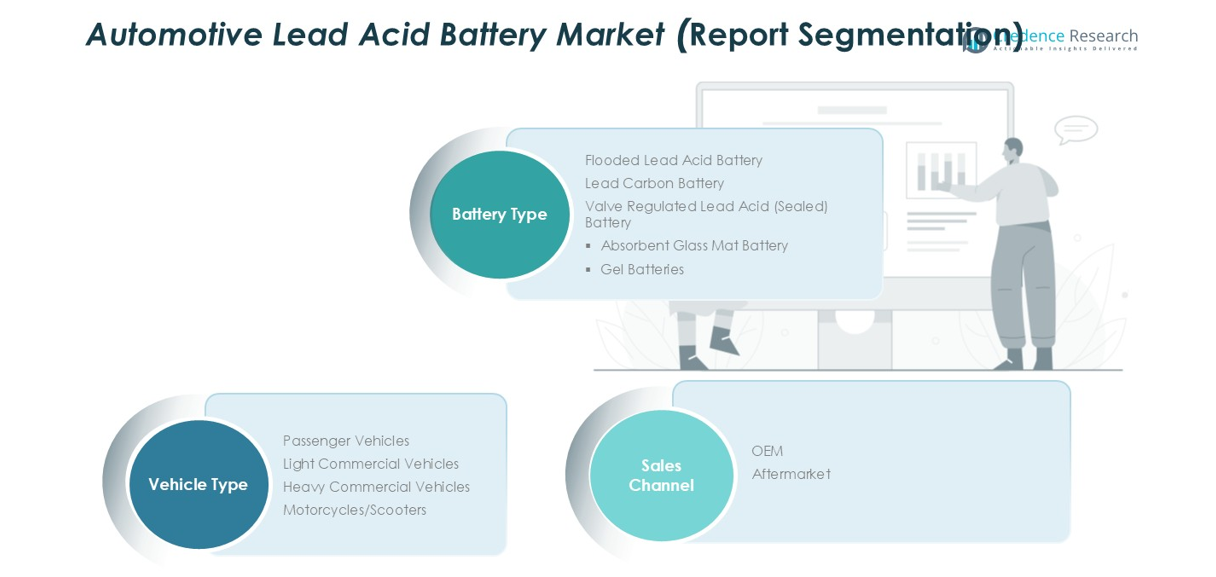

Market Segmentation Analysis:

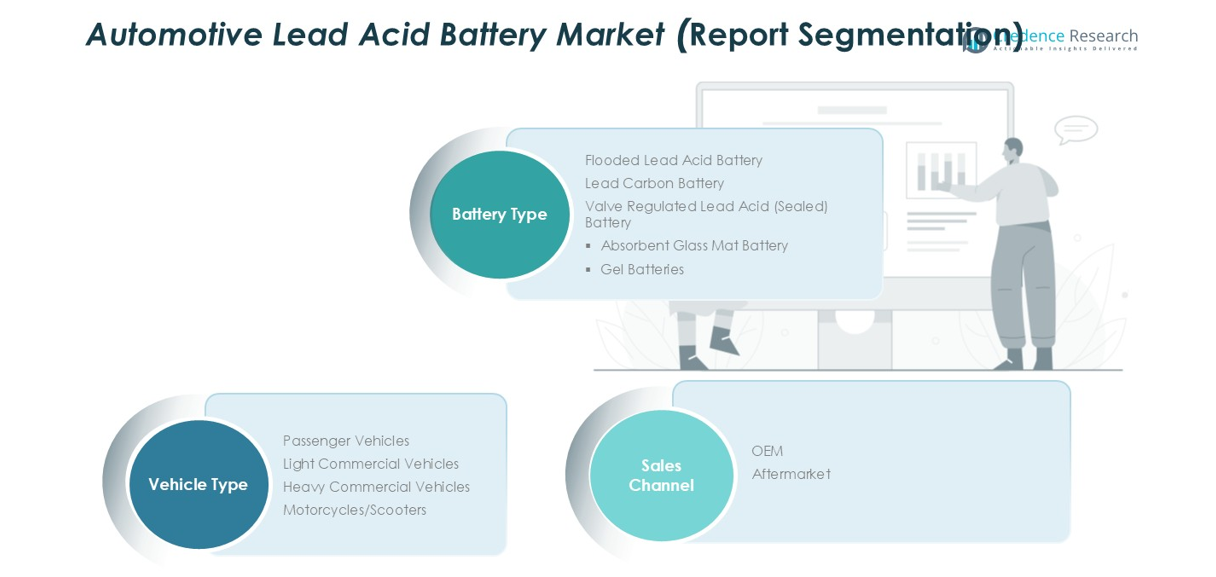

By Battery Type

Battery type segmentation shows clear performance and cost differences across applications. Flooded lead acid batteries hold the dominant market share, accounting for over 45% of demand. The segment benefits from low cost, easy availability, and wide acceptance in conventional vehicles. Fleet operators and price-sensitive buyers prefer this option. Valve regulated lead acid batteries follow, driven by maintenance-free operation and better vibration resistance. Absorbent glass mat batteries gain traction in start-stop vehicles due to faster charge acceptance. Lead carbon and gel batteries remain niche, supported by durability and longer cycle life.

- For instance, Exide Industries offers the Drive100L (or Xpress XP1000) flooded lead-acid battery with a 100 Ah capacity, which is widely used in heavy vehicles like trucks, buses, and LCVs across India.

By Vehicle Type

Vehicle type segmentation highlights strong demand from mass-market mobility. Passenger vehicles represent the dominant sub-segment with nearly 50% market share. High vehicle parc size, frequent battery replacement cycles, and urban usage patterns support this position. Light commercial vehicles follow, driven by logistics growth and intra-city delivery fleets. Heavy commercial vehicles contribute steady demand due to high battery capacity needs and long operating hours. Motorcycles and scooters show consistent replacement demand, supported by Mexico’s large two-wheeler base. Cost sensitivity and reliability remain key purchase drivers across all vehicle categories.

- For instance, LTH batteries, a leading brand in Mexico owned by Clarios (formerly part of Johnson Controls), supplies the L-24F 12V battery with 650 CCA for light trucks and other popular models like the LTH Group 31 for heavy-duty vehicles, meeting performance needs of urban delivery and long-haul fleets.

By Sales Channel

Sales channel analysis shows clear leadership from the aftermarket segment, holding more than 60% market share. High battery replacement frequency and aging vehicle fleets drive aftermarket demand. Consumers prefer quick availability and competitive pricing through independent dealers. OEM sales follow, supported by stable new vehicle production and long-term supply contracts. OEM demand focuses on quality consistency and compliance with vehicle specifications. Warranty replacements also support this channel. Strong distribution networks and brand recognition influence buyer choice. Price competitiveness, service reach, and product reliability remain core drivers across both sales channels.

Key Growth Drivers

High Vehicle Ownership and Strong Replacement Cycles

Mexico has a large and steadily aging vehicle fleet across passenger and commercial categories. Most vehicles rely on lead acid batteries for starting and electrical support. These batteries require replacement every few years due to limited cycle life. Hot climate conditions and dense traffic accelerate battery wear. Urban driving patterns increase frequent engine starts and electrical load. This environment supports consistent aftermarket demand. Passenger vehicles generate the highest replacement volumes due to daily usage. Commercial fleets also replace batteries frequently to prevent downtime. Easy availability and fast installation support preference for lead acid technology. Wide service networks strengthen accessibility across regions. Price sensitivity among consumers further reinforces replacement demand. These structural factors sustain long-term volume stability in the market.

- For instance, Clarios operates manufacturing facilities in Mexico that produce automotive batteries under brands like LTH and Heliar, contributing to a global production of over 150 million batteries annually. These products serve a large and aging fleet of over 35 million registered vehicles in Mexico (as of early 2025), which require regular aftermarket replacement, partly due to the effects of high heat and urban usage conditions.

Cost Efficiency and Established Recycling Ecosystem

Lead acid batteries offer a clear cost advantage over alternative chemistries. Mexican consumers and fleet operators remain highly price conscious. Lead acid solutions meet core performance needs at lower upfront cost. The country has a mature recycling ecosystem for lead acid batteries. High recycling rates reduce raw material dependency and stabilize supply. Recovered lead lowers production costs and supports circular operations. Manufacturers benefit from predictable input pricing. OEMs continue selecting lead acid batteries to control vehicle costs. Aftermarket buyers prefer affordable and proven products. Recycling infrastructure also supports regulatory compliance. This closed-loop system strengthens economic and environmental viability. Cost efficiency remains a key driver across all vehicle segments.

- For instance, Clarios operates a large-scale battery recycling facility in Nuevo León, Mexico, which is a cornerstone of the North American lead-acid battery closed-loop supply chain. This facility contributes to the company’s overall operations, which recover and reuse up to 99% of the materials in their

Expansion of Commercial Transport and Logistics Activity

Mexico’s logistics and transportation sector continues to expand steadily. Growth in e-commerce drives demand for delivery vans and light trucks. These vehicles operate intensively in urban and intercity routes. Frequent starts and auxiliary equipment increase battery stress. Fleet operators favor lead acid batteries due to reliability and service ease. Fast replacement minimizes operational downtime. Heavy commercial vehicles also use multiple high-capacity batteries. Construction, agriculture, and cross-border trade support fleet expansion. Stable commercial activity sustains recurring battery demand. Cost control remains critical for fleet economics. Lead acid batteries align well with these operational priorities.

Key Trends & Opportunities

Rising Demand for Enhanced Lead Acid Technologies

Advanced lead acid variants gain traction across Mexico’s automotive market. AGM batteries support vehicles with higher electrical loads. Start-stop systems increase adoption of maintenance-free solutions. AGM designs offer faster charge acceptance and improved durability. Lead carbon batteries reduce sulfation under partial charge conditions. OEMs increasingly adopt these technologies in newer models. The aftermarket also shows interest in premium battery upgrades. Consumers seek longer service life and improved reliability. Manufacturers benefit from higher margins on advanced products. Local production investments support supply availability. Technology upgrades create growth opportunities beyond traditional flooded batteries.

- For instance, Clarios is implementing AI automation and capacity upgrades at its existing facilities in Mexico to immediately increase U.S.-available battery supply and enhance efficiency within the North American supply chain.

Strengthening Circular Economy and Sustainability Practices

Sustainability gains importance across the automotive supply chain. Lead acid batteries fit well within circular economy models. Mexico’s recycling rates remain among the highest globally. Manufacturers recover lead efficiently for reuse. This reduces environmental impact and raw material imports. Fleet operators value sustainability credentials in procurement decisions. Regulatory alignment favors compliant recycling systems. Formal collection channels continue to expand. Recycling also lowers total ownership cost for users. Brand trust improves through responsible waste handling. Circular practices enhance long-term competitiveness for market participants.

Key Challenges

Increasing Competition from Lithium-Ion Technologies

Lithium-ion batteries gain attention in modern vehicle platforms. Cost gaps continue to narrow with scale improvements. Some OEMs adopt lithium solutions for auxiliary systems. Perceived advantages include lighter weight and longer lifespan. Electrification policies increase visibility of lithium technologies. These shifts pressure lead acid market share in premium segments. Manufacturers must defend cost and safety advantages. Recycling strength remains a key differentiator. Limited charging infrastructure still favors lead acid use. Failure to innovate could weaken competitiveness. Technology transition remains a long-term challenge.

Lead Price Volatility and Regulatory Compliance Pressure

Lead prices fluctuate due to global supply conditions. Volatility impacts manufacturing costs and margins. Producers face pressure to absorb or pass on cost increases. Environmental regulations around lead handling remain strict. Compliance requires continuous investment in safety systems. Smaller manufacturers face higher operational strain. Informal recycling channels create uneven competition. Regulatory enforcement varies across regions. Companies must maintain strong compliance frameworks. Cost management and regulation adherence remain persistent challenges.

Regional Analysis

Mexico City

Mexico City leads the market, accounting for approximately 30% of the total market share. This dominance is primarily due to the region’s status as the country’s economic and industrial hub. Mexico City hosts numerous automotive manufacturers, suppliers, and distribution networks, making it a central player in the automotive sector. The demand for lead-acid batteries is also supported by the high number of passenger vehicles in the region, with both local manufacturers and foreign brands contributing to the steady demand for automotive batteries. Additionally, the region’s focus on fuel efficiency and eco-friendly technologies drives the adoption of advanced lead-acid battery types such as Enhanced Flooded Batteries (EFBs) and Absorbent Glass Mat (AGM) batteries.

Monterrey

Monterrey, one of the major industrial cities in Mexico, holds a market share of around 25%. The city is recognized as a critical center for manufacturing, particularly in the automotive sector. Monterrey’s proximity to the U.S. border and its established automotive production base make it a key market for both domestic and international automakers. The region is home to several manufacturing plants for major global car brands, contributing to the high demand for automotive lead-acid batteries. Additionally, Monterrey’s significant automotive aftermarket industry ensures a steady replacement market for lead-acid batteries, further boosting the demand in the region.

Guadalajara

Guadalajara, with its growing automotive industry, captures approximately 20% of the market share for automotive lead-acid batteries. As one of Mexico’s largest cities, Guadalajara is increasingly becoming a hub for both domestic and international vehicle manufacturers. The city has seen a rise in the production of vehicles equipped with advanced technologies, including start-stop systems that rely on lead-acid batteries. This, coupled with an expanding consumer base, positions Guadalajara as an important region for lead-acid battery manufacturers. Furthermore, the demand for commercial vehicles in the area helps maintain a steady need for high-performance batteries in heavy-duty applications.

Tijuana

Tijuana, located on the U.S.-Mexico border, accounts for around 15% of the automotive lead-acid battery market share. Tijuana’s strategic location, combined with its focus on manufacturing, especially in the automotive and electronics sectors, makes it an important region for automotive battery demand. The city’s automotive industry is highly influenced by cross-border trade with the U.S., and the growing number of electric and hybrid vehicle sales in the region has created additional demand for specialized lead-acid batteries. The market for two- and three-wheeler batteries is also notable in Tijuana, with increasing demand for small vehicles contributing to the region’s share in the overall market.

Market Segmentations:

By Battery Type

- Flooded Lead Acid Battery

- Lead Carbon Battery

- Valve Regulated Lead Acid (Sealed) Battery

- Absorbent Glass Mat Battery

- Gel Batteries

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Motorcycles and Scooters

By Sales Channel

By Geography

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Competitive Landscape

The competitive landscape of the Mexico Automotive Lead Acid Battery Market is moderately consolidated, with key global and regional players competing on technology, brand presence, and distribution reach. Leading companies such as Clarios, LTH Baterías, ACDelco, East Penn Manufacturing, and EnerSys dominate the market through established OEM partnerships and extensive aftermarket networks. Local firms like Baterías Revos and LTH Baterías strengthen supply through localized production and service accessibility. Manufacturers focus on improving battery life, vibration resistance, and maintenance-free performance to capture replacement demand. Continuous investment in recycling and sustainability initiatives enhances compliance with environmental standards. Strategic collaborations, capacity expansion, and R&D in AGM and lead-carbon technologies are shaping competition. The aftermarket segment remains the largest battleground, driving differentiation through pricing, distribution, and warranty offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- C&D Technologies, Inc

- Clarios

- ACDelco

- East Penn Manufacturing Company

- EnerSys

- Exide Industries Ltd.

- Johnson Controls

- Baterías Revos

- Leoch International Technology Limited

- LTH Baterías

- Robert Bosch LLC

Recent Developments

- In November 2024, EnerSys showcased the iQ Mini™ battery monitoring device and maintenance-free NexSys® Thin Plate Pure Lead (TPPL) batteries, which offer longer service life and faster recharge rates.

- In August 2023, Clarios, a global leader in advanced low-voltage battery manufacturing and recycling, is acquiring Paragon GmbH & Co. KGaA’s power business, which specializes in batteries and battery management systems for the automotive industry. This acquisition enhances Clarios’ engineering capabilities and supports its low-voltage and lithium-ion projects, significantly expanding the team dedicated to developing new low-voltage architectures.

- In May 2023, C&D Technologies, Inc. introduced the Pure Lead Max (PLM) VRLA battery, designed for long lifespan and improved performance in UPS and data center applications.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from a stable and aging vehicle fleet across Mexico.

- Aftermarket demand will remain strong due to frequent battery replacement cycles.

- Flooded lead acid batteries will retain relevance in cost-sensitive vehicle segments.

- AGM and enhanced batteries will gain adoption in start-stop and modern vehicles

- Commercial vehicle growth will support steady demand for high-capacity batteries.

- Recycling infrastructure will continue to strengthen supply stability and cost control.

- OEM partnerships will focus on durability and maintenance-free battery solutions.

- Sustainability practices will improve brand trust and regulatory alignment.

- Competition will intensify as manufacturers invest in product performance upgrades.

- Lead acid technology will remain competitive where affordability and reliability matter most.