Market Overview:

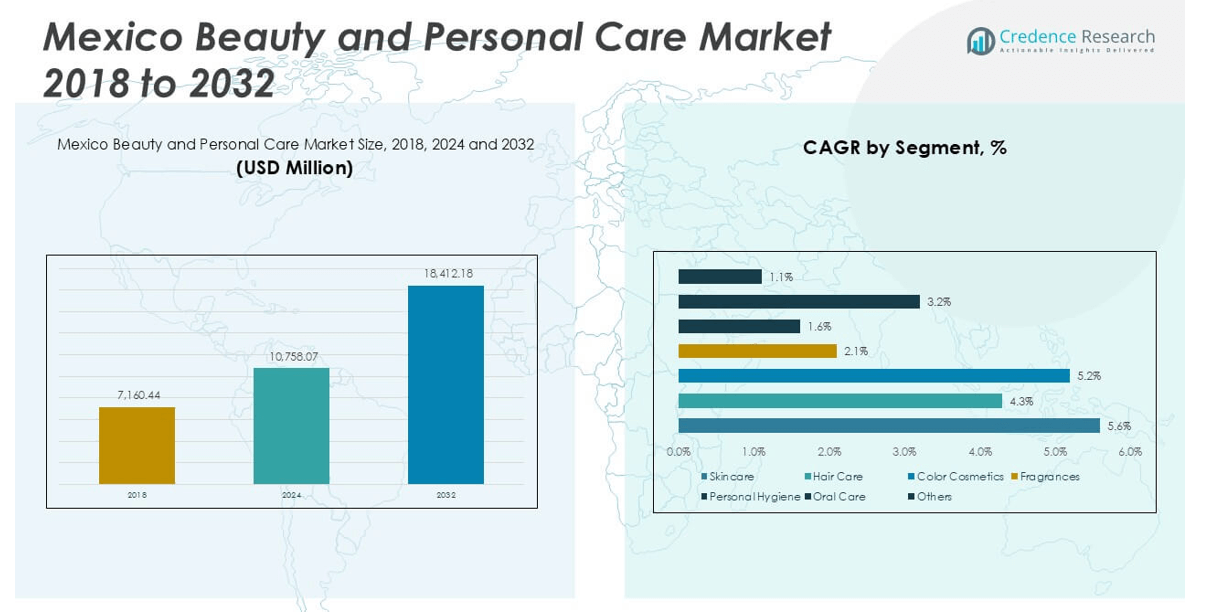

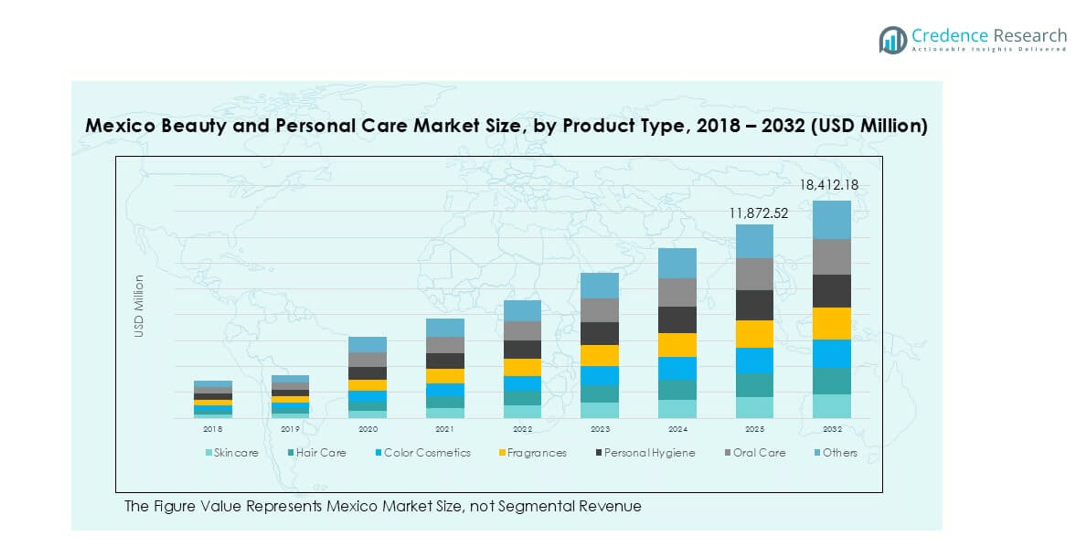

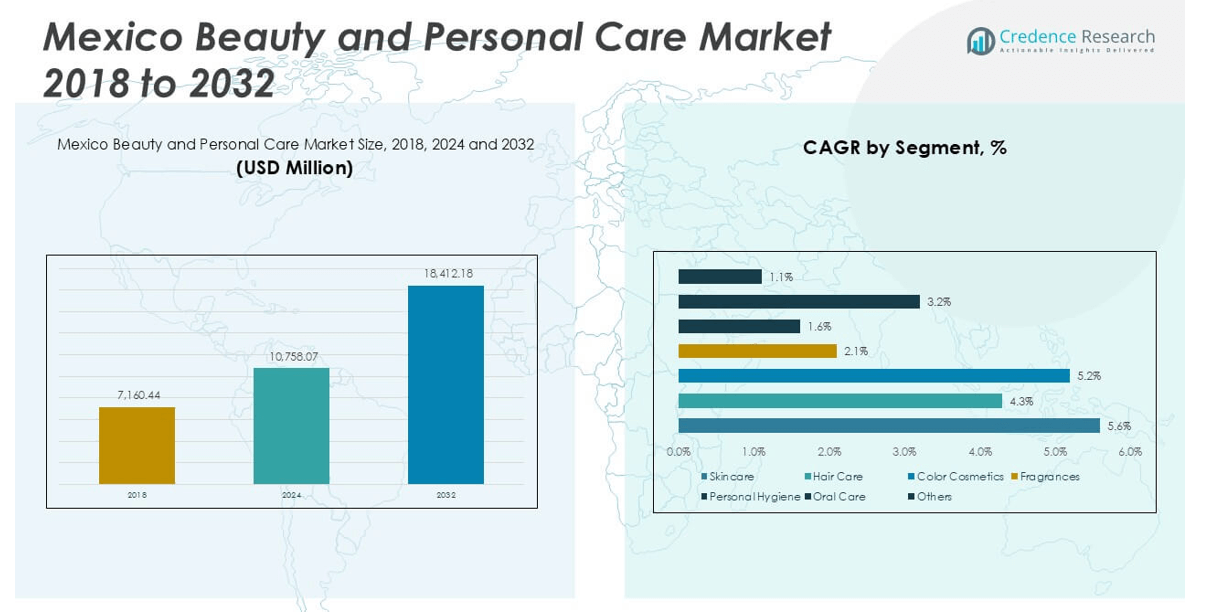

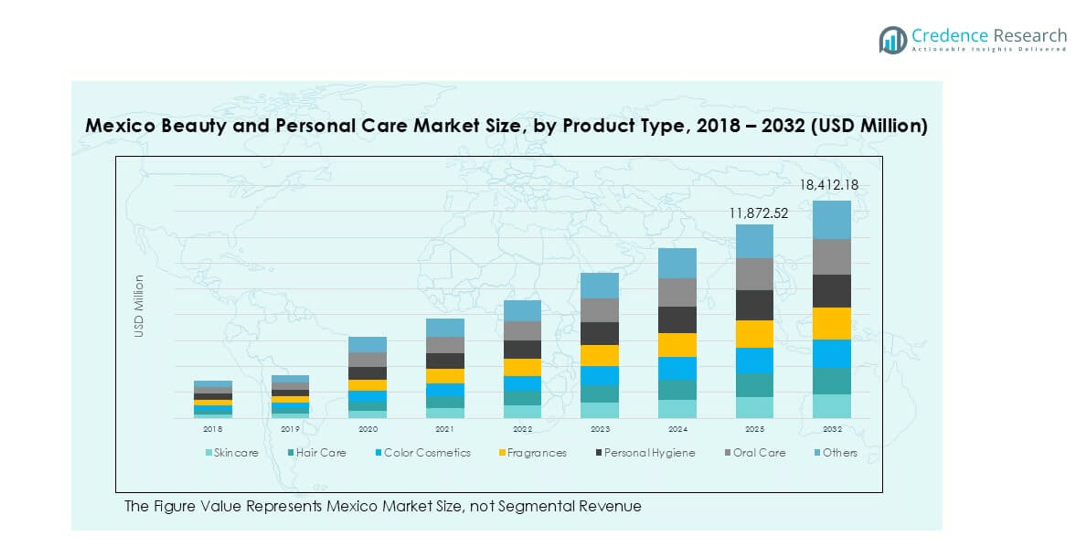

Mexico Beauty and Personal Care market size was valued at USD 7,160.44 million in 2018, increased to USD 10,758.07 million in 2024, and is anticipated to reach USD 18,412.18 million by 2032, at a CAGR of 6.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Beauty and Personal Care Market Size 2024 |

USD 10,758.07 million |

| Mexico Beauty and Personal Care Market, CAGR |

6.47% |

| Mexico Beauty and Personal Care Market Size 2032 |

USD 18,412.18 million |

The Mexico beauty and personal care market is led by prominent players such as Avon Cosmetics, Unilever PLC, Procter & Gamble, Genomma Lab Internacional, and Kimberly-Clark de México, all of which maintain strong brand recognition and extensive distribution networks across the country. These companies dominate key segments including skincare, hair care, personal hygiene, and color cosmetics, driven by continuous innovation and marketing strategies. Emerging brands like NudaEst and INA VILLARREAL are gaining momentum by catering to the growing demand for natural and sustainable products. Mexico City stands out as the leading regional market, contributing approximately 35% of the national market share, supported by a large urban population, high purchasing power, and widespread access to premium retail and e-commerce platforms.

Market Insights

- The Mexico beauty and personal care market was valued at USD 10,758.07 million in 2024 and is projected to reach USD 18,412.18 million by 2032, growing at a CAGR of 6.47% during the forecast period.

- Market growth is driven by rising disposable income, increased urbanization, and heightened awareness of personal grooming, particularly in skincare and hair care segments which dominate the product type share.

- A key trend is the growing demand for natural and organic products, alongside the rapid adoption of e-commerce and digital beauty platforms, especially among younger consumers.

- The competitive landscape features major players like Avon Cosmetics, Unilever PLC, Procter & Gamble, and Genomma Lab Internacional, with newer brands such as NudaEst and INA VILLARREAL tapping into niche, sustainable product demands.

- Regionally, Mexico City holds the largest market share at 35%, followed by Monterrey (20%), Guadalajara (18%), and Tijuana (10%), reflecting high urban consumption patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

In the Mexico beauty and personal care market, the skincare segment holds the largest market share, driven by increasing consumer awareness about skin health, anti-aging concerns, and the influence of social media trends. Consumers are increasingly opting for products with natural and organic ingredients, which has fueled growth in this sub-segment. Hair care and personal hygiene products also contribute significantly to the market, supported by rising urbanization and daily grooming habits. Fragrances and color cosmetics are gaining traction among younger demographics, especially in urban areas, while oral care continues to see steady demand due to routine consumption.

- For instance, L’Oréal has launched over 250 skincare products through its Garnier and L’Oréal Paris lines tailored to Latin American skin types, focusing on natural actives like aloe and vitamin C.

By Gender:

The women segment dominates the Mexico beauty and personal care market, accounting for a substantial share owing to high consumption of skincare, cosmetics, and personal hygiene products. The increasing participation of women in the workforce and their growing purchasing power contribute to this trend. Moreover, beauty influencers and digital campaigns have effectively expanded the reach of female-focused products. However, the men’s segment is witnessing growing interest, particularly in grooming and skincare solutions, as changing beauty standards and lifestyle shifts encourage men to invest in personal care routines.

- For instance, Procter & Gamble’s Gillette brand introduced its SkinGuard line with over 60,000 units sold in Mexico within the first launch quarter, driven by a campaign targeting sensitive male skin.

By Distribution Channel:

Supermarkets and hypermarkets lead the distribution channel segment, capturing the largest market share due to their extensive product variety, accessibility, and competitive pricing. These stores serve as a one-stop shop for many consumers, offering both premium and mass-market beauty products. Pharmacies and drug stores follow closely, particularly for skincare and oral care items. E-commerce is rapidly emerging as a key channel, driven by digital transformation, the convenience of home delivery, and wider product access. Specialty and department stores cater to premium consumers, while convenience stores maintain relevance for on-the-go personal care purchases.

Market Overview

Rising Disposable Income and Urbanization

The steady growth in disposable income and rapid urbanization in Mexico have significantly boosted consumer spending on beauty and personal care products. Urban consumers, especially in metropolitan areas, are increasingly adopting sophisticated grooming routines and are more inclined to purchase premium products. With an expanding middle class and enhanced living standards, consumers are prioritizing personal appearance and wellness. This shift in lifestyle and purchasing power directly fuels demand across skincare, cosmetics, and hair care segments, encouraging brands to expand their product portfolios and geographic reach within the country.

- For instance, Unilever increased its SKU count in Mexico by 112 across skincare and deodorant categories between 2021 and 2023 to meet evolving urban consumer preferences.

Increasing Digital Penetration and E-commerce Adoption

The expansion of digital platforms and widespread internet access have transformed the way consumers shop for beauty and personal care products in Mexico. E-commerce channels offer convenience, competitive pricing, and access to a wide range of products, making them increasingly popular, especially among younger demographics. Influencer marketing and social media campaigns have further elevated product visibility and brand engagement. As more consumers shift to online shopping for both daily and luxury personal care items, brands are investing in digital transformation strategies to enhance customer experience and drive online sales.

- For instance, Avon Mexico recorded over 1.2 million online orders through its digital storefront and app in 2023, reflecting a 38% increase in mobile-based transactions from the previous year.

Preference for Natural and Organic Products

Growing awareness about health, sustainability, and the long-term impact of synthetic ingredients has led Mexican consumers to favor natural and organic beauty products. Demand for clean-label products has increased, particularly in skincare and hair care segments, driven by informed consumers seeking transparency and environmentally responsible choices. Brands are responding by reformulating products, using biodegradable packaging, and highlighting ethical sourcing practices. This shift in consumer preferences offers a competitive advantage for companies investing in sustainable innovation and presents new market opportunities for eco-conscious product lines.

Key Trends & Opportunities

Expansion of Men’s Grooming Segment

The men’s grooming market in Mexico is experiencing steady growth as cultural perceptions around male grooming evolve. Increasing awareness of skincare, hair care, and hygiene among male consumers has expanded the market beyond basic products to include facial cleansers, moisturizers, beard care, and fragrance lines. This trend is particularly strong among urban millennials and Gen Z consumers, who are more open to experimenting with grooming products. Brands tapping into this emerging demand through targeted marketing and product innovation are likely to capture a new, loyal customer base.

- For instance, Genomma Lab Internacional expanded its Just For Men and Asepxia for Men lines to include 14 new products between 2022 and 2023, specifically addressing acne and scalp care.

Growth of Premium and Customized Products

Rising consumer sophistication and the desire for personalized experiences are driving demand for premium and customized beauty solutions. Mexican consumers are seeking products tailored to their skin type, tone, and lifestyle needs, prompting brands to introduce product lines with customizable features. From skin analysis tools to personalized subscription boxes, innovation in this space is attracting attention. The premiumization trend is especially prominent among middle-to-upper-income consumers who are willing to pay more for high-quality, efficacious products that align with their individual beauty goals.

Key Challenges

Price Sensitivity in Lower-Income Segments

Despite growth in disposable income, a significant portion of the Mexican population remains price-sensitive, particularly in rural and semi-urban areas. Consumers in these regions often prioritize essential goods over discretionary spending on beauty and personal care products. This price sensitivity poses a challenge for premium and mid-tier brands attempting to expand their market reach. Companies must balance product quality with affordability to appeal to a broader customer base without compromising profitability.

- For instance, Kimberly-Clark de México introduced a 3-unit multipack of its KleenBebé baby wipes priced for budget-conscious households, reaching 500,000 new rural customers in its first fiscal year.

Regulatory Hurdles and Product Compliance

The beauty and personal care industry in Mexico faces evolving regulatory requirements concerning product safety, labeling, and environmental compliance. Adhering to local standards while maintaining global formulations can be complex and time-consuming, especially for international brands entering the market. Delays in approvals and changes in compliance norms can hinder product launches and disrupt supply chains. Companies must stay agile and maintain strong regulatory affairs capabilities to ensure smooth market operations.

Counterfeit Products and Brand Dilution

The prevalence of counterfeit beauty and personal care products in the Mexican market poses a major challenge for authentic brands. Fake products often mimic packaging and branding, misleading consumers and potentially causing health risks due to unregulated ingredients. This not only damages brand reputation but also undermines consumer trust. To counteract this issue, brands are investing in anti-counterfeiting technologies, consumer education, and tighter distribution controls to protect product integrity and maintain market credibility.

Regional Analysis

Mexico City

Mexico City dominates the beauty and personal care market in the country, accounting for approximately 35% of the total market share. As the nation’s capital and largest metropolitan area, it benefits from a dense population, higher disposable incomes, and strong retail infrastructure. The region’s consumers exhibit high brand awareness and preference for premium and international products, especially in skincare, fragrances, and color cosmetics. The presence of flagship retail stores, specialty beauty outlets, and advanced e-commerce services further supports market growth. Additionally, beauty trends are quickly adopted here, influenced by social media, celebrity endorsements, and urban lifestyle shifts.

- For instance, Sephora operates 9 stores in Mexico City alone and reported a 22% increase in footfall between 2022 and 2023, largely driven by fragrance and luxury skincare purchases.

Monterrey

Monterrey holds around 20% of the Mexico beauty and personal care market share, making it a key regional hub for product consumption and distribution. As an industrial and economic center, the city boasts a relatively affluent population that values personal grooming and wellness. Demand is particularly strong for hair care, skincare, and men’s grooming products, reflecting the professional and appearance-conscious lifestyle of its residents. Monterrey also serves as a gateway for U.S. brands entering northern Mexico, benefiting from cross-border trade and cultural influences. Retail development and digital adoption continue to enhance consumer access and brand penetration in this region.

- For instance, Estée Lauder launched a regional warehouse in Monterrey in 2022, reducing delivery time by 36 hours for northern Mexico e-commerce orders.

Guadalajara

Guadalajara captures nearly 18% of the national market share, driven by its growing middle class, vibrant youth population, and expanding beauty retail landscape. Known for its innovation and fashion-forward culture, the region shows high demand for color cosmetics and fragrance products. Local consumers are receptive to new trends and are increasingly engaging with digital platforms for product discovery and purchases. The city’s thriving retail environment, with a mix of local boutiques and global brands, supports product diversity. Additionally, Guadalajara’s position as a tech and creative hub influences brand marketing strategies and the popularity of beauty tech tools.

Tijuana

Tijuana represents about 10% of the Mexico beauty and personal care market, with strong cross-border influences from the United States shaping consumer preferences. The city’s beauty market is characterized by demand for both mass-market and niche products, with skincare and personal hygiene segments performing particularly well. Local consumers are price-conscious but value quality, leading to the popularity of mid-range brands. Proximity to California facilitates the entry of U.S. beauty trends and products, often resulting in faster adoption of innovations compared to other regions. Retail chains, pharmacies, and growing e-commerce channels support product accessibility across various income groups.

Market Segmentations:

By Product Type:

- Skincare

- Hair Care

- Color Cosmetics

- Fragrances

- Personal Hygiene

- Oral Care

- Others

By Gender:

By Distribution Channel:

- Supermarkets/Hypermarkets

- Pharmacies and Drug Stores

- E-commerce

- Specialty Stores

- Department Stores

- Convenience Stores

- Others

By Geography:

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Competitive Landscape

The competitive landscape of the Mexico beauty and personal care market is characterized by a mix of global corporations, regional players, and emerging local brands. Leading companies such as Unilever PLC, Procter & Gamble, and Avon Cosmetics maintain strong market positions through extensive product portfolios, widespread distribution networks, and aggressive marketing strategies. These multinational players focus on innovation, premiumization, and digital engagement to strengthen consumer loyalty. Domestic companies like Genomma Lab Internacional and Kimberly-Clark de México leverage their local insights and established brand presence to capture significant market share, especially in the personal hygiene and skincare segments. Niche and emerging brands such as NudaEst and INA VILLARREAL are gaining traction by offering natural, organic, and cruelty-free products aligned with current consumer preferences. E-commerce and social media are reshaping competition, enabling smaller brands to reach wider audiences. Overall, the market remains dynamic, with companies investing in product innovation, sustainability, and personalization to stay competitive.

- For instance, NudaEst increased its product SKU count from 8 to 26 within two years, expanding into organic serums, shampoo bars, and clay-based masks, with distribution in over 120 specialty stores across Mexico.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Avon Cosmetics

- Unilever PLC

- Genomma Lab Internacional

- Kimberly‑Clark de México

- NudaEst

- Procter & Gamble

- INA VILLARREAL

Recent Developments

- In July 2025, Genomma Lab reported a 0.5% increase in second-quarter sales, or a 5.5% increase excluding the impact of Argentina’s currency fluctuations. To mitigate the impact of weather on sales, particularly in warmer regions of Mexico, the company is strategically expanding its distribution network by adding 120 new routes within the country.

- In July 2025, Avon released its beauty brochure in Mexico, featuring new products like the “Ultra Wild” makeup collection, new face powders, and fresh shades for their Glimmersticks, demonstrating the brand’s focus on trend-driven summer products.

- In September 2023, Amorepacific, ‘Korea’s largest’ beauty conglomerate, launched its skincare brand, Laneige, in the Mexican beauty market. The expansion into Mexico is in partnership with Sephora Mexico.

- In August 2023, Prada announced the worldwide launch of Prada Skin and Prada Color, debuting with the “Rethinking Beauty” campaign. The collection reimagines existing definitions and expectations to open new perspectives and possibilities of beauty.

- In March 2022, Sephora (an LVMH brand) makeup and beauty products chain expanded in Mexico, opened five stores, and planned to open nearly 60 stores within five years.

Market Concentration & Characteristics

The Mexico Beauty and Personal Care Market exhibits moderate to high market concentration, with a few multinational companies holding significant market share across key segments. Major players such as Unilever PLC, Procter & Gamble, and Avon Cosmetics lead in product availability, brand recognition, and distribution reach. These companies dominate due to strong retail networks, consistent innovation, and strategic marketing efforts. Local firms like Genomma Lab Internacional and Kimberly-Clark de México maintain a competitive edge by catering to regional preferences and price sensitivity. The market features diverse product categories including skincare, hair care, personal hygiene, and color cosmetics. It continues to evolve due to shifting consumer preferences, increasing demand for natural and organic products, and growing digital engagement. Urban regions, especially Mexico City, drive most of the sales volume through organized retail and e-commerce platforms. Consumers show strong brand loyalty, though younger demographics display openness to new, niche, and sustainable offerings. The market remains dynamic, shaped by lifestyle changes, income growth, and access to global beauty trends.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Gender, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding steadily, supported by rising consumer spending on personal grooming and wellness.

- Skincare and hair care segments are expected to witness the highest demand due to increased awareness of self-care routines.

- E-commerce platforms will play a larger role in product distribution, especially among urban and younger consumers.

- Demand for natural, organic, and cruelty-free products will increase, influencing product innovation and brand positioning.

- Men’s grooming products will gain more traction, driven by changing beauty standards and targeted marketing campaigns.

- Local and niche brands will grow their presence by offering affordable and sustainable alternatives.

- Premiumization will accelerate as more consumers seek personalized and high-quality beauty solutions.

- Digital marketing and influencer-led promotions will dominate brand communication strategies.

- Companies will invest in localized product development to address regional skin and hair care needs.

- Regulatory compliance and anti-counterfeiting measures will remain key focus areas for maintaining consumer trust.