| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Enhanced Oil Recovery (EOR) Market Size 2024 |

USD 1,293.53 Million |

| Mexico Enhanced Oil Recovery (EOR) Market, CAGR |

5.81% |

| Mexico Enhanced Oil Recovery (EOR) Market Size 2032 |

USD 2,032.61 Million |

Market Overview

The Mexico Enhanced Oil Recovery (EOR) Market is projected to grow from USD 1,293.53 million in 2024 to an estimated USD 2,032.61 million by 2032, with a compound annual growth rate (CAGR) of 5.81% from 2025 to 2032. The increasing demand for oil recovery methods and the need to maximize production from aging oil fields are driving the growth in this market.

Several factors contribute to the growth of the Mexico EOR market, including advancements in technology, the rising need for energy security, and significant investments in oil exploration and recovery projects. Enhanced oil recovery methods, such as CO2 injection, chemical flooding, and thermal recovery, are becoming increasingly important for optimizing recovery from Mexico’s complex oil fields. Furthermore, government policies promoting energy reforms and collaboration with private entities are boosting EOR development.

Geographically, Mexico holds a significant position in the Latin American oil market, with its vast oil reserves, including the Cantarell and Ku-Maloob-Zaap fields. Key players in the market include Pemex, Schlumberger, Halliburton, and Baker Hughes, which are playing vital roles in deploying advanced EOR technologies to enhance production. These companies are also focusing on strategic partnerships and technology innovations to strengthen their market presence in Mexico.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico EOR market is projected to grow from USD 1,293.53 million in 2024 to USD 2,032.61 million by 2032, driven by the need to enhance oil recovery from aging reservoirs.

- Technological advancements such as CO2 injection, chemical flooding, and thermal recovery methods are key drivers propelling the growth of EOR in Mexico.

- Government reforms and energy policies that encourage private-sector participation are fostering investments in EOR technologies, further driving market growth.

- High initial investment costs and complex implementation processes are significant barriers, particularly for smaller operators or those with limited financial resources.

- Geological complexities in Mexico’s oil fields can hinder the effectiveness of some EOR techniques, requiring tailored solutions for different reservoirs.

- The Gulf Coast region dominates the market due to its vast offshore oil fields, while the Southern region’s onshore fields continue to drive the adoption of thermal recovery and chemical flooding.

- Key players like Pemex, Schlumberger, and Halliburton are focusing on strategic collaborations and technological innovations to enhance production in Mexico’s mature oil fields.

Report Scope

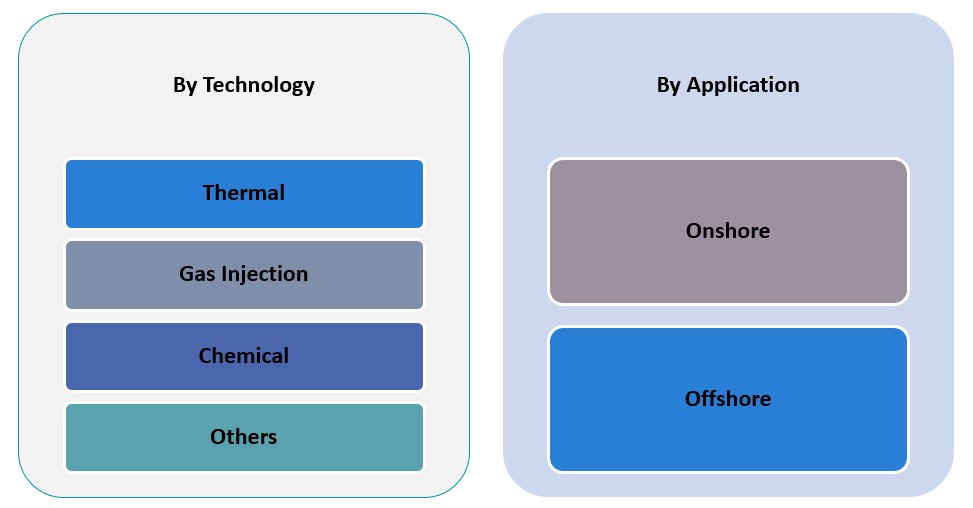

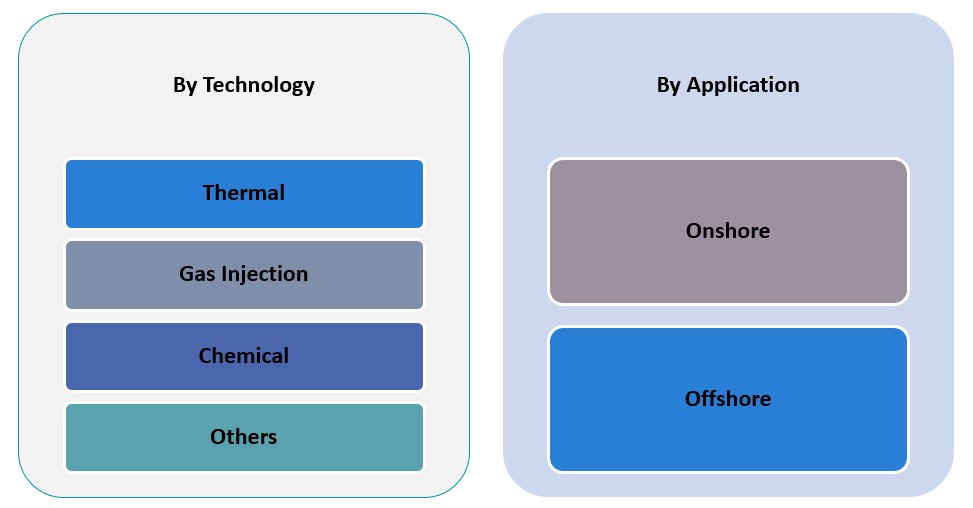

This report segments the Mexico Enhanced Oil Recovery (EOR) Market as follows:

Market Drivers

Rising Demand for Oil and Gas

The global demand for oil and gas remains robust, driving the need for advanced oil recovery techniques. For instance, Mexico produced approximately 1.6 million barrels of crude oil per day in 2022, a significant decline from its peak of 3.4 million barrels per day in 2004. As the world’s energy requirements continue to grow, particularly in emerging economies, Mexico’s role as a significant oil producer becomes even more critical. The country’s oil production has been relatively stable over the years, but many of its major oil fields are aging, with conventional recovery methods becoming less effective. To sustain production levels and meet both domestic and global demand, Mexico is increasingly turning to Enhanced Oil Recovery (EOR) techniques. EOR provides a solution for extracting more oil from existing reservoirs, which is essential for maximizing output from mature fields. By employing methods such as CO2 injection, chemical flooding, and thermal recovery, the country can boost production from declining fields, thus ensuring the long-term supply of oil and securing its energy future. This growing demand for consistent and sustainable oil output directly fuels the need for EOR technologies in the market.

Maturing Oil Fields and Decreasing Production Rates

Mexico’s oil fields, particularly the Cantarell and Ku-Maloob-Zaap fields, are among the largest in the world but are also some of the oldest and most depleted. For instance, the Cantarell field, once producing over 2 million barrels per day in the early 2000s, now produces less than 200,000 barrels per day. The natural decline in production rates from these mature fields has led to the urgent need for more effective oil recovery methods. As conventional extraction methods become less efficient, EOR techniques become necessary to increase the volume of oil recovered from existing reservoirs. EOR methods such as thermal recovery, CO2 injection, and chemical flooding have proven effective in enhancing the recovery factor of mature fields by altering the reservoir’s pressure and flow properties. The adoption of such advanced techniques is not only essential to sustain production levels but also to extend the lifespan of the nation’s valuable oil assets. With declining output from traditional wells, Mexico’s oil operators are looking toward EOR as a strategic method to maximize oil production and reduce reliance on new exploration projects, which are often costlier and more complex.

Government Support and Energy Reforms

The Mexican government has recognized the need to modernize the country’s energy sector to maintain oil production levels and attract foreign investment. In recent years, Mexico has enacted significant energy reforms aimed at liberalizing the sector and encouraging private and foreign participation in oil exploration and production activities. These reforms have opened the door for greater adoption of advanced technologies, including EOR, by providing incentives for companies to invest in mature oil fields and implement recovery methods that were previously underutilized. The government’s support, particularly through its regulatory frameworks, has created a conducive environment for EOR techniques to flourish. Mexico’s state-owned oil company, Pemex, alongside international players, has also been exploring joint ventures to share the financial burden of implementing these high-cost recovery methods. The backing of the Mexican government, coupled with the policy push for energy security, plays a critical role in the growth of the EOR market in the country.

Technological Advancements and Innovation in EOR Methods

Technological advancements in EOR methods have significantly improved the efficiency and effectiveness of these techniques, thus driving their adoption in Mexico. The development of new CO2 injection technologies, for instance, has enhanced the ability to inject and store carbon dioxide at higher pressures, increasing oil extraction rates from depleted reservoirs. Chemical flooding has also become a more viable option, with advancements in surfactants, polymers, and other chemicals enabling better displacement of oil from tight rock formations. Moreover, thermal recovery techniques, including steam injection, have evolved with the use of more efficient equipment and better reservoir management strategies, making them more cost-effective for large-scale implementation. These innovations have made it more economically feasible for Mexico to deploy EOR technologies in its aging oil fields. The continuous improvement of these technologies is crucial for making EOR a sustainable, long-term solution for Mexico’s oil industry. As more companies implement these advanced technologies, the overall efficiency of EOR methods is expected to improve, which will further stimulate their widespread use in the country. Additionally, partnerships with technology providers and research institutions are ensuring that new, more efficient methods are constantly being developed and deployed.

Market Trends

Increased Adoption of CO2 Injection Technology

CO2 injection is one of the most widely utilized EOR methods in Mexico due to its ability to significantly increase oil recovery rates in mature fields. This method involves injecting carbon dioxide into oil reservoirs to reduce the viscosity of the crude oil, enabling it to flow more easily. For instance, the International Energy Agency (IEA) reported that CO2-EOR techniques have the potential to store between 60 and 240 gigatonnes of CO2 globally, while also enhancing oil recovery. In Mexico, particularly in fields like Cantarell, CO2 injection has shown positive results in enhancing recovery rates. The Mexican government’s energy reforms, coupled with the push for more sustainable energy practices, have driven the adoption of CO2 EOR projects. The growing awareness of CO2’s role in both improving oil recovery and contributing to carbon capture is fostering investments in this technology. Several companies in Mexico, including Pemex and international players, are prioritizing CO2 injection to optimize production in aging fields, making it a key trend in the market.

Focus on Chemical Flooding for Increased Efficiency

Chemical flooding, particularly polymer and surfactant flooding, is gaining momentum in Mexico’s EOR market as a cost-effective solution for boosting oil recovery from mature fields. This method involves injecting chemicals into reservoirs to alter the flow properties of the oil, making it easier to extract. For example, surfactant flooding has been shown to reduce interfacial tension to ultralow values, enabling greater oil recovery. Chemical flooding is particularly effective in reservoirs with low permeability, which are common in Mexico’s oil fields. With the continuous development of more effective and affordable chemicals, the use of chemical flooding has become more economically viable for large-scale operations. The demand for this technique is growing as oil operators seek to improve the efficiency of their recovery processes without the high costs associated with more complex methods like thermal recovery. As a result, chemical flooding is emerging as a preferred EOR method for many companies operating in Mexico’s oil sector.

Integration of Digital Technologies and Automation

The integration of digital technologies and automation in the EOR process is becoming a defining trend in Mexico’s oil industry. The use of data analytics, machine learning, and artificial intelligence (AI) is helping operators optimize oil recovery by predicting reservoir behavior and improving the precision of injection techniques. Real-time monitoring systems are also being employed to track oil and gas production, providing insights into reservoir performance and enabling better decision-making. Automation technologies, such as automated injection systems and robotics, are reducing the operational costs and risks associated with EOR projects. In Mexico, Pemex and private companies are increasingly adopting these technologies to improve efficiency, reduce downtime, and lower the environmental impact of their operations. The growing reliance on digital tools for optimizing EOR operations is a major trend, enhancing the overall effectiveness of the recovery process.

Sustainability and Environmental Considerations in EOR Practices

Sustainability has become a key focus in the Mexican EOR market, as companies aim to minimize the environmental impact of enhanced oil recovery techniques. With Mexico’s commitment to reducing carbon emissions and achieving sustainability goals, there is a growing emphasis on adopting environmentally friendly EOR technologies. CO2 injection, for example, not only enhances oil recovery but also contributes to carbon sequestration, aligning with Mexico’s broader environmental objectives. Additionally, operators are exploring alternative, less invasive chemical agents and energy-efficient thermal methods to reduce the ecological footprint of EOR operations. The growing public and governmental push for cleaner energy practices is encouraging oil producers to adopt more sustainable methods. Consequently, sustainability is driving the development and implementation of more eco-friendly EOR solutions, making it a prominent trend in the country’s oil and gas sector.

Market Challenges

High Implementation Costs and Financial Barriers

One of the significant challenges facing the Enhanced Oil Recovery (EOR) market in Mexico is the high capital investment required for the implementation of advanced recovery techniques. EOR methods such as CO2 injection, chemical flooding, and thermal recovery demand substantial financial resources for infrastructure, equipment, and operational expenses. For instance, reports indicate that the installation of CO2 injection facilities can cost upwards of $1 million per well, including the construction of pipelines for CO2 transportation and the establishment of injection wells. Additionally, chemical flooding requires specialized chemicals that must be sourced, managed, and injected with precision. These high costs make it challenging for both state-owned companies like Pemex and private operators to justify the large initial investments, especially when oil prices are volatile. Although EOR techniques can increase recovery rates in mature fields, the financial barriers to entry remain a significant concern, particularly in the context of fluctuating oil prices and economic uncertainty. To address these challenges, oil companies in Mexico must find innovative financing solutions, such as joint ventures or partnerships, to share the financial burden and mitigate the risks associated with implementing EOR projects. Without sufficient capital investment and financial backing, the growth potential of EOR in Mexico could be hindered.

Geological and Reservoir Challenges

Mexico’s oil fields are characterized by complex geological formations and varying reservoir characteristics, which pose challenges for the effective application of EOR techniques. Many of the country’s mature fields, such as those in the Cantarell and Ku-Maloob-Zaap areas, are located in reservoirs with varying permeability, porosity, and fluid characteristics, making it difficult to apply a one-size-fits-all solution. For instance, CO2 injection may be less effective in certain fields with poor CO2 retention properties, or chemical flooding may not be as successful in reservoirs with highly heterogeneous rock formations. These geological complexities can lead to inconsistent results from EOR operations, affecting overall efficiency and increasing the risk of costly operational failures. Additionally, EOR methods such as thermal recovery can pose challenges in fields with high levels of sand or clay, as they may cause blockages or damage to equipment. Overcoming these challenges requires a high level of expertise in reservoir management and a deep understanding of the specific characteristics of each field. While technological advancements continue to improve the effectiveness of EOR methods, Mexico’s diverse and complex oil reservoirs remain a significant challenge for widespread EOR adoption. Addressing these geological and operational issues is crucial for maximizing the potential of EOR in the country.

Market Opportunities

Government Support for Energy Sector Modernization

The Mexican government’s ongoing efforts to modernize the country’s energy sector present a significant opportunity for the Enhanced Oil Recovery (EOR) market. With the implementation of energy reforms aimed at attracting private investments and enhancing the country’s oil production capabilities, there is a growing emphasis on adopting advanced oil recovery methods. As part of these reforms, the government is encouraging the use of EOR techniques to maximize production from aging oil fields, which constitute a substantial portion of Mexico’s oil reserves. By offering incentives, subsidies, and creating a more favorable regulatory environment, the Mexican government is positioning EOR as a key element in boosting the country’s oil output. This creates an opportunity for both local and international companies to invest in EOR technologies, driving growth in the market. Additionally, public-private partnerships and joint ventures between state-owned companies like Pemex and private operators can provide the financial resources and expertise needed to scale EOR projects, opening doors for further market expansion.

Technological Advancements and New Applications of EOR Methods

Another significant opportunity for the EOR market in Mexico lies in the continuous development and application of new, more efficient EOR technologies. As technological advancements in CO2 injection, chemical flooding, and thermal recovery evolve, the efficiency and economic feasibility of these methods improve. For example, innovations in CO2 capture and storage technologies are enhancing the effectiveness of CO2 injection in fields that previously may not have been ideal candidates. Additionally, the growing trend of automation and digitalization in EOR operations presents opportunities to optimize production, reduce operational costs, and enhance reservoir management. As Mexico’s oil fields continue to mature, the adoption of these cutting-edge technologies will play a crucial role in boosting oil recovery rates and extending the life of aging reservoirs. This creates a promising opportunity for companies involved in EOR technology development and application to tap into the Mexican market and contribute to the country’s energy sustainability goals.

Market Segmentation Analysis

By Application

The application of Enhanced Oil Recovery (EOR) methods in Mexico can be broadly divided into two primary categories: onshore and offshore. Onshore operations account for the majority of the EOR market in Mexico, with several of the country’s largest and most mature oil fields located on land. These onshore fields, such as those in the Southern region, face production declines, making them prime candidates for the application of EOR techniques like CO2 injection and thermal recovery. The ease of access and relatively lower operational costs in onshore fields make them more attractive for EOR applications compared to offshore sites. However, offshore fields, such as the deep-water reserves in the Gulf of Mexico, are also increasingly adopting EOR technologies. Offshore operations are more complex due to their higher cost and logistical challenges, but they are vital for enhancing recovery rates from deep-water reservoirs, where conventional extraction methods are often less effective. The growing demand for sustainable production and technological advancements in offshore EOR techniques, including gas injection and chemical flooding, will likely drive growth in offshore EOR applications in Mexico.

By Technology

The technology segment of the Mexico EOR market consists of several key techniques, each with its own advantages and applications. Thermal recovery is one of the most widely used methods, especially in onshore fields, as it involves injecting heat, often through steam, to reduce the viscosity of heavy crude oil, making it easier to pump to the surface. This method is particularly effective in Mexico’s heavy oil reservoirs, where conventional recovery methods often fall short. Gas injection, including CO2 and nitrogen injection, is another prominent technology in the Mexican EOR market. CO2 injection, in particular, is increasingly being deployed in mature fields to enhance oil recovery and facilitate carbon capture, aligning with both economic and environmental goals. Chemical EOR techniques, which involve injecting chemicals like surfactants and polymers to alter the fluid properties of oil and improve flow, are also gaining traction in Mexico. Chemical flooding is proving effective in reservoirs with low permeability, where traditional methods are less successful. Other EOR technologies, including microbial and hybrid methods, are being explored, though these remain less common in Mexico compared to thermal, gas, and chemical techniques.

Segments

Based on Application

Based on Technology

- Thermal

- Gas Injection

- Chemical

- Others

Based on Region

- Gulf Coast

- Southern Mexico

- Central region

Regional Analysis

Gulf Coast Region (45%)

The Gulf Coast region is the largest contributor to Mexico’s EOR market, accounting for approximately 45% of the market share. This region is home to some of the country’s largest offshore oil fields, such as those located in the deep waters of the Gulf of Mexico. The complexity of these offshore reservoirs and the higher cost of operation make EOR technologies, particularly gas injection (CO2 and nitrogen), essential for enhancing oil recovery rates. The use of CO2 injection has gained significant traction due to its dual benefit of increasing production while facilitating carbon capture, aligning with both economic and environmental goals. The adoption of advanced offshore EOR technologies is expected to grow further as the region continues to mature and requires enhanced recovery methods to maintain production levels.

Southern Region (35%)

The Southern region of Mexico, home to many of the country’s largest onshore oil fields, such as the Cantarell and Ku-Maloob-Zaap fields, holds approximately 35% of the EOR market share. These fields have been in operation for decades and are now facing natural production declines, making EOR techniques, particularly thermal recovery methods like steam injection and chemical flooding, crucial for prolonging the life of these fields. The Southern region has seen increasing adoption of these methods as oil companies look to optimize production from these aging assets. The region’s infrastructure and relatively lower operational costs also contribute to the higher utilization of EOR in this area.

Key players

- Chevron Corporation

- ExxonMobil Corporation

- Occidental Petroleum Corporation

- ConocoPhillips

- Marathon Oil Corporation

- Kinder Morgan, Inc.

- Denbury Resources Inc.

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

Competitive Analysis

The Mexico Enhanced Oil Recovery (EOR) market is highly competitive, with major players leveraging advanced technologies and substantial financial resources to capitalize on the growing demand for EOR solutions. Companies such as Chevron, ExxonMobil, and Occidental Petroleum dominate the market, utilizing innovative techniques like CO2 injection and chemical flooding to optimize production in both onshore and offshore fields. These players have established strong market positions due to their extensive experience in oil recovery, strategic partnerships, and the ability to invest in large-scale projects. Schlumberger, Halliburton, and Baker Hughes further enhance their competitive edge by providing cutting-edge EOR equipment and technical services, enabling them to support operators with efficient, cost-effective solutions. As the market continues to mature, these key players are expected to increase their collaboration with Mexico’s state-owned Pemex, driving the adoption of EOR technologies and ensuring sustainable growth in the country’s oil sector.

Recent Developments

- In April 2025, Shell and SLB (formerly Schlumberger) announced a partnership to deploy Petrel subsurface software across Shell’s assets worldwide. This collaboration aims to enhance digital capabilities and drive operating cost efficiencies, potentially impacting EOR projects.

- In April 2025, Eni confirmed a significant oil discovery at the Capricornus 1-X well in Namibia’s Orange Basin. The well found 38 meters of net pay with good petrophysical properties, indicating potential for future EOR applications.

- In 2024, TotalEnergies reported a 23% increase in net electricity production and invested $4 billion in Integrated Power. This growth contributed to lowering the lifecycle carbon intensity of the company’s energy products sold by 16.5% in 2024 compared to 2015, aligning with its sustainability and climate objectives.

- In March 2025, Equinor announced plans to drill 600 improved oil recovery wells and about 250 exploration wells to maintain production on the Norwegian Continental Shelf towards 2035.

- In January 2025, OMV continued its Enhanced Oil Recovery program with carbon dioxide injection on Ivanić and Žutica fields.

- In April 2025, MOL Group continued its EOR program with CO₂ injection on Ivanić and Žutica fields, and installed a new steam turbine at the Molve plant to decrease electrical energy purchase and reduce CO₂ emissions.

Market Concentration and Characteristics

The Mexico Enhanced Oil Recovery (EOR) market is moderately concentrated, with a mix of global oil majors and specialized service providers playing a significant role. Key players like Chevron, ExxonMobil, Occidental Petroleum, and Schlumberger dominate the market, leveraging their technological expertise and financial resources to deploy advanced EOR methods such as CO2 injection, chemical flooding, and thermal recovery. The market characteristics reflect a strong focus on mature, declining oil fields, especially in onshore regions such as Cantarell, where EOR technologies are essential for maximizing production. While state-owned Pemex remains a major player in the Mexican oil sector, collaborations with international companies are increasingly common to overcome the financial and technological challenges of implementing EOR. The market is driven by the need to sustain output from aging reservoirs, with companies continuously innovating and adapting their techniques to improve recovery rates and address the country’s evolving energy demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for EOR techniques will continue to rise as Mexico’s mature oil fields require advanced methods to sustain production. Increased adoption of CO2 injection and chemical flooding will dominate the market.

- Mexico’s energy reforms will further facilitate private sector involvement in EOR, providing incentives for technological investments and fostering partnerships with international companies.

- Continuous advancements in EOR technologies, particularly in CO2 injection and chemical flooding, will enhance the efficiency and cost-effectiveness of these methods, driving growth in the market.

- The offshore oil fields in the Gulf of Mexico will see increased EOR activity, particularly through gas injection and CO2 methods, as these fields become more reliant on advanced recovery techniques.

- Partnerships between Pemex and global players like Schlumberger and Halliburton will increase, allowing for the transfer of technology and knowledge to improve EOR processes in Mexico’s aging reservoirs.

- There will be a growing focus on environmentally sustainable EOR solutions, with CO2 sequestration becoming a key driver, aligning with Mexico’s commitment to reducing carbon emissions.

- The Southern region of Mexico, with its mature onshore oil fields, will see continued growth in thermal recovery and chemical flooding applications as operators work to extend the life of these fields.

- Improved reservoir management practices, driven by data analytics and real-time monitoring, will optimize the performance of EOR techniques and improve oil recovery rates.

- Operators will increasingly seek integrated EOR solutions that combine multiple technologies, such as thermal recovery combined with CO2 injection, to maximize output from complex reservoirs.

- The competitive landscape in the EOR market will intensify as new players enter the market and existing companies expand their EOR operations, fostering innovation and driving market growth.