| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Off The Road Tire Market Size 2023 |

USD 465.72 Million |

| Mexico Off The Road Tire Market, CAGR |

3.1% |

| Mexico Off The Road Tire Market Size 2032 |

USD 613.67 Million |

Market Overview:

Mexico Off The Road Tire Market size was valued at USD 465.72 million in 2023 and is anticipated to reach USD 613.67 million by 2032, at a CAGR of 3.1% during the forecast period (2023-2032).

Key drivers propelling the OTR tire market in Mexico include robust infrastructure development, a burgeoning mining industry, and advancements in agricultural mechanization. The government’s commitment to large-scale construction projects, such as road expansions and urban developments, necessitates the use of heavy machinery, thereby boosting the demand for durable OTR tires. Additionally, the increasing need for improved transportation networks in both urban and rural areas contributes to the rising demand for tires that can withstand heavy-duty operations. Simultaneously, the mining sector’s expansion, particularly in regions like Zacatecas and Sonora, increases the need for specialized tires capable of withstanding harsh terrains and heavy loads. The growing focus on resource extraction and exportation further intensifies the demand for durable OTR tires. Moreover, the agricultural industry’s shift towards modern equipment for enhanced productivity further contributes to the market’s growth.

Geographically, the Northern region of Mexico stands out as the fastest-growing market for OTR tires. States such as Coahuila, Durango, and Chihuahua are hubs for mining activities, requiring specialized tires for heavy-duty machinery operating in rugged terrains. The region’s proximity to the U.S. border facilitates trade and logistics, further driving the demand for OTR tires used in transportation and construction equipment. Additionally, the presence of several large-scale industrial parks and manufacturing units further propels the demand for specialized tires. This region’s extensive mining activities and industrial development also contribute to the sustained need for OTR tires with enhanced durability and performance. Additionally, the Central region holds the largest market share, attributed to its diverse industrial base and ongoing infrastructure projects. Cities like Mexico City and Guadalajara are key centers of construction and industrial expansion, which in turn fuels the demand for OTR tires across multiple sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Off the Road Tire market was valued at USD 465.72 million in 2023 and is projected to reach USD 613.67 million by 2032, growing at a CAGR of 3.1% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key drivers include infrastructure development, such as road expansions and urban projects, which increase demand for heavy machinery and durable OTR tires.

- The mining sector in Mexico, particularly in regions like Zacatecas and Sonora, significantly boosts demand for specialized OTR tires designed for harsh and rugged terrains.

- Advancements in agricultural mechanization are driving the need for specialized tires to support modern farming equipment, contributing to market growth.

- Technological advancements in OTR tire design, including improved tread patterns and eco-friendly materials, are increasing tire performance, durability, and fuel efficiency.

- The Northern region of Mexico is the fastest-growing market, fueled by mining activities and industrial expansion, driving demand for heavy-duty OTR tires.

- The Central region holds the largest market share, supported by ongoing infrastructure projects and a diverse industrial base, increasing the demand for OTR tires across various sectors.

Market Drivers:

Infrastructure Development

The rapid growth of infrastructure development is a key driver in the Mexico Off-the-Road (OTR) tire market. The Mexican government has been investing heavily in large-scale infrastructure projects, including road expansions, urban developments, and public works aimed at improving connectivity across the country. For instance, in January 2024, Mexico’s Ministry of Infrastructure announced the completion of over 500 infrastructure projects, totaling an investment of approximately 220 billion Mexican pesos. This amount equates to about 1.3% of the country’s Gross Domestic Product (GDP). These initiatives have led to an increase in the use of heavy construction machinery, such as excavators, bulldozers, and cranes, which require high-performance OTR tires. As more roads, highways, and transportation networks are built, the demand for durable and reliable tires that can withstand challenging environments rises, contributing significantly to market growth. Additionally, the expansion of industrial and commercial zones further accelerates the need for specialized tires to support the machinery involved in construction activities.

Mining Sector Growth

Mexico’s mining sector plays a pivotal role in driving the demand for OTR tires. The country is one of the largest producers of silver, copper, and gold, and mining activities. For instance, major mining projects like the Juanicipio project for silver and gold in Zacatecas, the Sonora lithium project, and the Buenavista Zinc project are stimulating demand for industrial equipment and OTR tires. As mining operations continue to expand, the demand for specialized OTR tires designed for heavy-duty machinery operating in rugged terrains grows. These tires are essential to ensure the smooth functioning of equipment in harsh conditions, where durability and load-bearing capacity are critical. The expansion of mining operations and the subsequent rise in extraction activities necessitate tires that can handle extreme weight loads, rough terrain, and long operational hours, contributing to the steady growth of the OTR tire market in Mexico.

Agricultural Mechanization

The shift towards agricultural mechanization is another significant driver for the OTR tire market in Mexico. The country’s agricultural sector is increasingly adopting advanced machinery, including tractors, harvesters, and plows, to enhance productivity and efficiency. As the demand for mechanized equipment grows, so does the need for specialized tires that can operate effectively on diverse terrains such as fields, farms, and rural roads. These tires must meet specific requirements for traction, durability, and resistance to wear and tear. With the rise in mechanization, the agricultural sector in Mexico is expected to continue driving the demand for high-quality OTR tires that are capable of supporting heavy equipment under varying conditions, further expanding the market.

Technological Advancements in Tire Design

Technological advancements in tire design and materials are significantly influencing the growth of the OTR tire market in Mexico. The introduction of innovative tire technologies, such as improved tread patterns, reinforced sidewalls, and environmentally friendly materials, has led to the development of OTR tires that offer better performance, greater fuel efficiency, and enhanced durability. As industries such as construction, mining, and agriculture place greater emphasis on efficiency and cost reduction, these technological advancements are crucial in driving market demand. Tires with superior wear resistance, higher load-bearing capacity, and the ability to perform in extreme conditions are now more in demand, aligning with the evolving needs of machinery operators in Mexico. This continuous innovation in tire design is expected to be a key factor in the sustained growth of the OTR tire market.

Market Trends:

Adoption of Advanced Tire Technologies

The Mexico Off-the-Road (OTR) tire market is witnessing a significant shift towards the adoption of advanced tire technologies. Manufacturers are increasingly focusing on enhancing the load-bearing capacity, durability, and fuel efficiency of OTR tires to meet the demanding requirements of industries such as mining, construction, and agriculture. For instance, OTR Engineered Solutions has announced the opening of a new 152,738-square-foot facility in Apodaca, Monterrey, designed to provide OEM customers with value-added services like tire mounting, sequencing, and just-in-time supply, reflecting the industry’s focus on efficiency and technological integration. Innovations include the development of tires with improved tread designs, reinforced sidewalls, and the integration of advanced materials to enhance performance in harsh environments. These technological advancements not only extend the lifespan of tires but also contribute to reducing operational costs for end-users. As industries continue to modernize their equipment fleets, the demand for high-performance OTR tires equipped with these advanced technologies is expected to rise, driving market growth.

Growth in Aftermarket Sales

The aftermarket segment is emerging as a dominant force in the Mexico OTR tire market. With the increasing utilization of heavy-duty machinery across various sectors, the need for tire replacements due to wear and tear is escalating. OTR Engineered Solutions, for example, is expanding its local presence to supply both OEM and aftermarket customers, providing services such as warehousing and tire mounting to support replacement needs efficiently. Operators are increasingly turning to aftermarket solutions, including retreaded and budget-friendly tires, as cost-effective alternatives to new tires. This trend is particularly pronounced in industries like mining and construction, where equipment operates in challenging conditions, leading to frequent tire replacements. The growth in aftermarket sales is further supported by the expansion of distribution channels, including online platforms and specialized retailers, making it more convenient for operators to access a wide range of OTR tire options. As the demand for replacement tires continues to rise, the aftermarket segment is poised to play a pivotal role in shaping the market dynamics.

Focus on Sustainability and Eco-Friendly Solutions

Sustainability is becoming a central theme in the Mexico OTR tire market. There is a growing emphasis on developing eco-friendly tire solutions that minimize environmental impact. Manufacturers are investing in research and development to produce tires with lower rolling resistance, reduced carbon emissions, and longer service lives. Additionally, the adoption of retreading practices is gaining traction as an environmentally sustainable alternative to purchasing new tires. Retreading not only extends the lifespan of tires but also reduces the demand for raw materials, contributing to a circular economy. As environmental regulations become more stringent and companies strive to meet sustainability goals, the demand for eco-friendly OTR tire solutions is expected to grow, influencing market trends.

Regional Expansion and Infrastructure Investments

The Northern region of Mexico is experiencing rapid industrialization, leading to increased demand for OTR tires. States such as Coahuila, Durango, and Chihuahua are witnessing significant investments in mining, agriculture, and manufacturing sectors, all of which rely heavily on off-the-road vehicles and equipment. The expansion of infrastructure projects, including road networks and industrial facilities, is further propelling the need for specialized tires capable of handling the demands of heavy machinery operating in rugged terrains. This regional growth is attracting both domestic and international tire manufacturers to establish production facilities and distribution networks in proximity to key industrial hubs. The strategic positioning of manufacturing units in these regions not only reduces logistics costs but also enhances the supply chain efficiency, thereby supporting the overall growth of the OTR tire market in Mexico.

Market Challenges Analysis:

High Cost of Tires

One of the primary challenges faced by the Mexico Off-the-Road (OTR) tire market is the high cost of tires, particularly for specialized models required in industries like mining, agriculture, and construction. The advanced technology incorporated in modern OTR tires, such as reinforced sidewalls and enhanced tread patterns, significantly increases production costs. These high costs are further exacerbated by the need for durable tires that can withstand harsh conditions in sectors such as mining, where frequent replacements are necessary. Smaller enterprises, in particular, may struggle to afford these high-cost tires, limiting their ability to upgrade machinery or purchase the most suitable tire solutions for their needs. This financial burden could potentially slow down the adoption of advanced OTR tire technologies and constrain market growth.

Lack of Skilled Labor for Tire Maintenance

Another challenge hindering the growth of the OTR tire market in Mexico is the shortage of skilled labor for proper tire maintenance and repair. As OTR tires require specialized knowledge and expertise for installation, monitoring, and maintenance, a lack of adequately trained personnel may lead to inefficiencies in tire usage. Inadequate tire management can reduce the lifespan of tires, leading to increased operational costs and downtime for equipment. This problem is particularly significant in remote areas where the availability of skilled workers is limited, making it difficult for industries to maximize the performance and longevity of their tire investments.

Dependence on Importation

The Mexico OTR tire market faces a significant challenge in its reliance on imported tires and raw materials. There is an absence of local OTR tire production facilities, making the market highly dependent on imports. For instance, unstable exchange rates, import duties, and transportation expenses can considerably impact the prices of imported tires, further straining the financial resources of businesses operating in price-sensitive sectors. This dependency also exposes the market to risks associated with global supply chain disruptions and changes in demand patterns, making it challenging for Mexican companies to remain competitive and limiting the market’s expansion potential.

Market Opportunities:

The Mexico Off-the-Road (OTR) tire market presents significant growth opportunities, particularly driven by the ongoing expansion of the country’s infrastructure and mining sectors. The Mexican government’s commitment to enhancing transportation networks and supporting large-scale infrastructure projects, such as road construction and urban development, creates a robust demand for heavy machinery. This, in turn, fuels the need for specialized OTR tires that can withstand the demanding conditions of construction and mining equipment. As these sectors continue to grow, businesses in the OTR tire industry have the opportunity to capitalize on the rising demand for durable, high-performance tires to support the expanding industrial base. Moreover, the growth of mining activities, particularly in resource-rich regions like Zacatecas and Sonora, presents an additional avenue for market expansion, with significant demand for OTR tires suited to mining vehicles.

Another key opportunity lies in the increasing trend toward agricultural mechanization. As Mexican agriculture modernizes with the adoption of advanced machinery, including tractors, harvesters, and plows, the demand for specialized OTR tires capable of handling diverse and challenging terrains is rising. This shift toward mechanization is expected to continue as farmers seek more efficient solutions to increase productivity. Additionally, the growing emphasis on sustainability within the tire industry, with innovations focused on eco-friendly materials and retreaded tires, presents another growth opportunity. As environmental regulations become stricter, companies that invest in sustainable tire solutions can differentiate themselves in the market, meeting the rising demand for green alternatives.

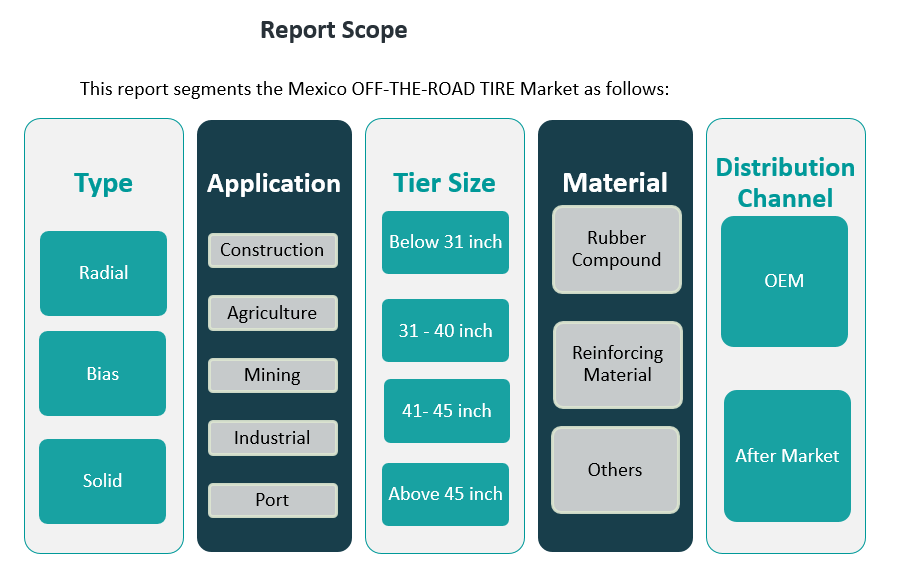

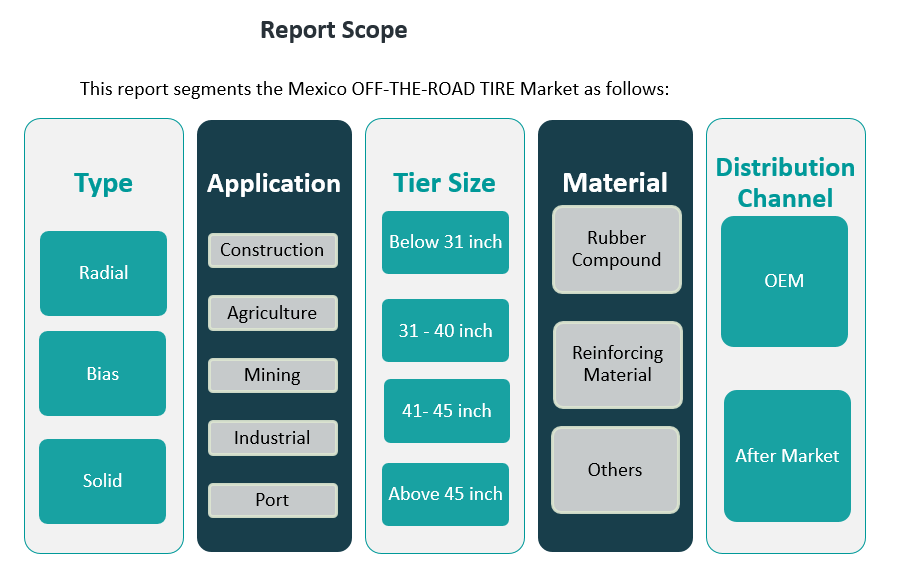

Market Segmentation Analysis:

The Mexico Off-the-Road (OTR) tire market is categorized into several segments, each with distinct characteristics and growth drivers.

By Type segment, radial tires are experiencing significant demand due to their superior durability, fuel efficiency, and longer lifespan compared to bias and solid tires. Bias tires remain popular in cost-sensitive applications, while solid tires are increasingly used in environments where flat tires are a concern, such as in industrial and port operations.

By Application segment, construction and mining sectors dominate the market, driven by Mexico’s growing infrastructure and mining industries. Agriculture is also a key segment, with the mechanization of farming driving demand for specialized tires that can handle rough agricultural terrains. The industrial and port applications are witnessing steady growth as these sectors rely on heavy-duty equipment that demands durable OTR tires.

By Tire Size segment shows a clear preference for 31-40 inch and 41-45 inch tires, commonly used in construction and mining equipment. Tires above 45 inches are increasingly sought after for large-scale mining operations, while below 31 inch tires cater to smaller machinery and agricultural equipment.

By Material segment, rubber compound remains the most widely used material due to its resilience and ability to withstand wear and tear in harsh environments. Reinforcing materials such as steel are essential for enhancing tire strength, while other materials are used in specific applications.

By Distribution Channel segment is split between OEM (original equipment manufacturer) sales and the aftermarket, with aftermarket sales growing as operators frequently replace tires due to wear and tear.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Mexico Off-the-Road (OTR) tire market exhibits distinct regional dynamics, with the Northern region leading in demand due to its robust mining and industrial activities. States such as Coahuila, Durango, and Chihuahua are central to this growth, hosting significant mining operations that necessitate specialized OTR tires for heavy-duty equipment. The proximity to the U.S. border further facilitates trade and logistics, enhancing the accessibility of OTR tire products in this region.

The Central region, encompassing areas like Mexico City and Puebla, holds the largest market share, attributed to its diverse industrial base and ongoing infrastructure projects. The demand for OTR tires in this region is driven by construction activities, agricultural mechanization, and industrial operations, all of which require durable and high-performance tires. The concentration of economic activities in this area contributes to its dominant position in the OTR tire market.

In contrast, the Southern region, including states such as Chiapas and Oaxaca, represents a smaller portion of the market. While agricultural activities are prevalent, the demand for OTR tires is limited by less intensive industrialization and infrastructure development compared to other regions. Consequently, the Southern region’s share in the OTR tire market remains relatively modest.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

Competitive Analysis:

The Mexico Off-the-Road (OTR) tire market is highly competitive, with both domestic and international players vying for market share. Key global players such as Michelin, Bridgestone, and Goodyear dominate the market due to their extensive product portfolios, strong brand recognition, and advanced tire technologies. These companies offer a wide range of OTR tires catering to various industries, including construction, mining, and agriculture. Additionally, they benefit from established distribution networks, which provide them with a competitive edge in the region. Local manufacturers, while smaller in scale, are increasingly contributing to market competition by offering cost-effective alternatives and focusing on customization for regional needs. Furthermore, the growing demand for eco-friendly and durable OTR tires is prompting both global and local companies to invest in sustainable tire solutions. The competition in the Mexico OTR tire market is expected to intensify as innovation, quality, and pricing remain key differentiators.

Recent Developments:

- In April 2024, ZC Rubber announced plans to establish a highly automated 600,000 square meter manufacturing facility in Mexico, aiming to enhance speed, safety, and efficiency in off-the-road (OTR) tire production. This significant investment is designed to strengthen ZC Rubber’s global production network and underscores the company’s commitment to expanding its presence in the North American market, particularly within Mexico’s growing OTR tire sector.

- In December 2023, Sailun Group entered into a partnership with TD International Holdings to build a USD 240 million tire plant in León, Guanajuato, Mexico. The new facility is projected to produce six million semi-steel radial tires annually for the North American market. This joint venture is a strategic move by Sailun to reinforce its international market position and meet the rising demand for OTR and other tires in the region.

Market Concentration & Characteristics:

The Mexico Off-the-Road (OTR) tire market is characterized by moderate concentration, with a mix of global and regional players. Major international brands such as Bridgestone, Michelin, Goodyear, and Continental dominate the market, leveraging their extensive product portfolios and established distribution networks. These companies offer a wide range of OTR tires catering to various industries, including construction, mining, and agriculture. Their strong brand recognition and technological advancements in tire design contribute to their significant market share. In addition to these global players, regional manufacturers like JK Tornel and ZC Rubber are also active in the market. These companies focus on providing cost-effective alternatives and catering to specific regional needs, thereby increasing market competition. The presence of both global and regional players fosters a competitive environment, encouraging innovation and improving product offerings. This competitive landscape benefits end-users by providing a diverse range of OTR tire options, catering to various performance requirements and budget considerations. The market’s growth is further supported by increasing demand from sectors such as construction and mining, which require durable and high-performance tires for heavy machinery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Mexico Off-the-Road (OTR) tire market is set for steady growth due to the increasing demand across various industries.

- Radial tires are expected to maintain dominance owing to their durability, performance, and cost-effectiveness in heavy-duty operations.

- The construction sector will continue to be a significant driver of market growth as infrastructure development projects expand.

- The aftermarket segment is projected to grow significantly, driven by the frequent need for tire replacements in machinery and vehicles.

- Technological advancements in tire materials and design will enhance product performance, leading to increased demand for advanced tire solutions.

- The Central region is likely to remain the largest market share holder due to its industrial base and active infrastructure projects.

- The Northern region is expected to see substantial growth, fueled by the expansion of mining activities and heavy-duty machinery requirements.

- The Southern region’s market share is expected to grow at a slower pace due to less industrialization and infrastructure activity compared to other regions.

- Local manufacturers will expand their market presence by offering region-specific solutions tailored to the needs of the Mexican market.

- The focus on sustainability will increase, with eco-friendly tire solutions, such as retreading and alternative materials, becoming more popular.