Market Overview:

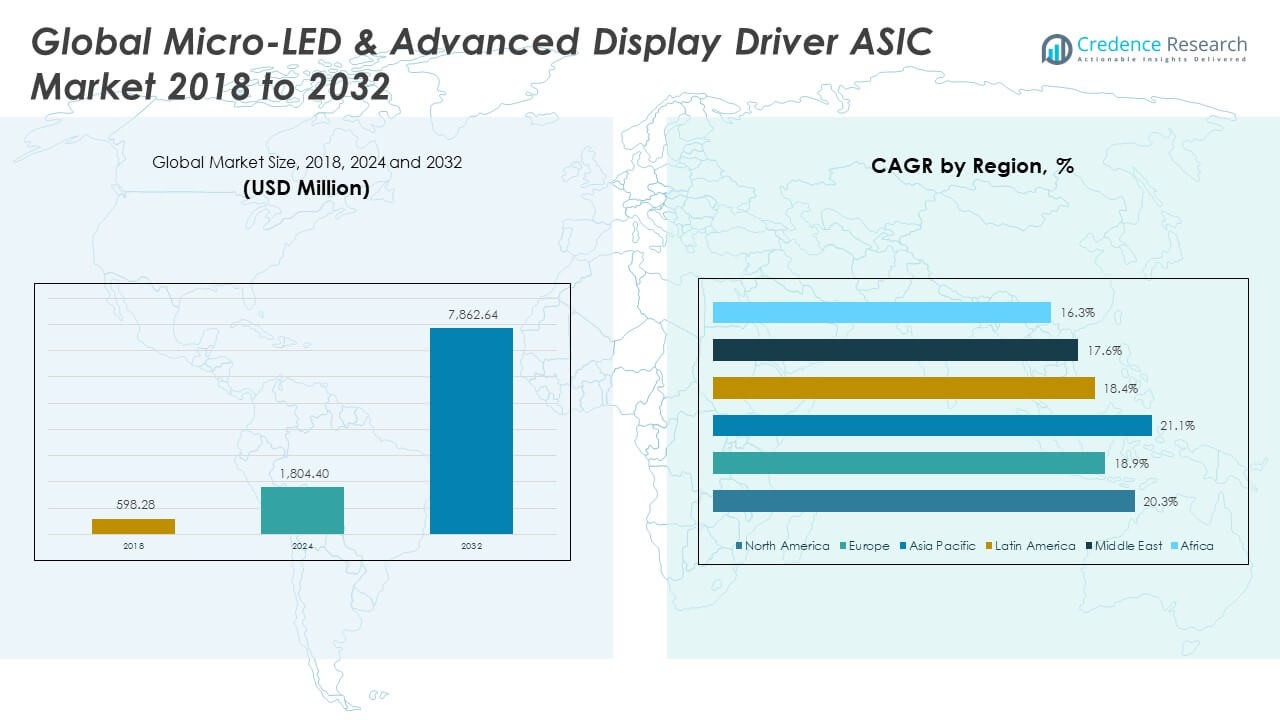

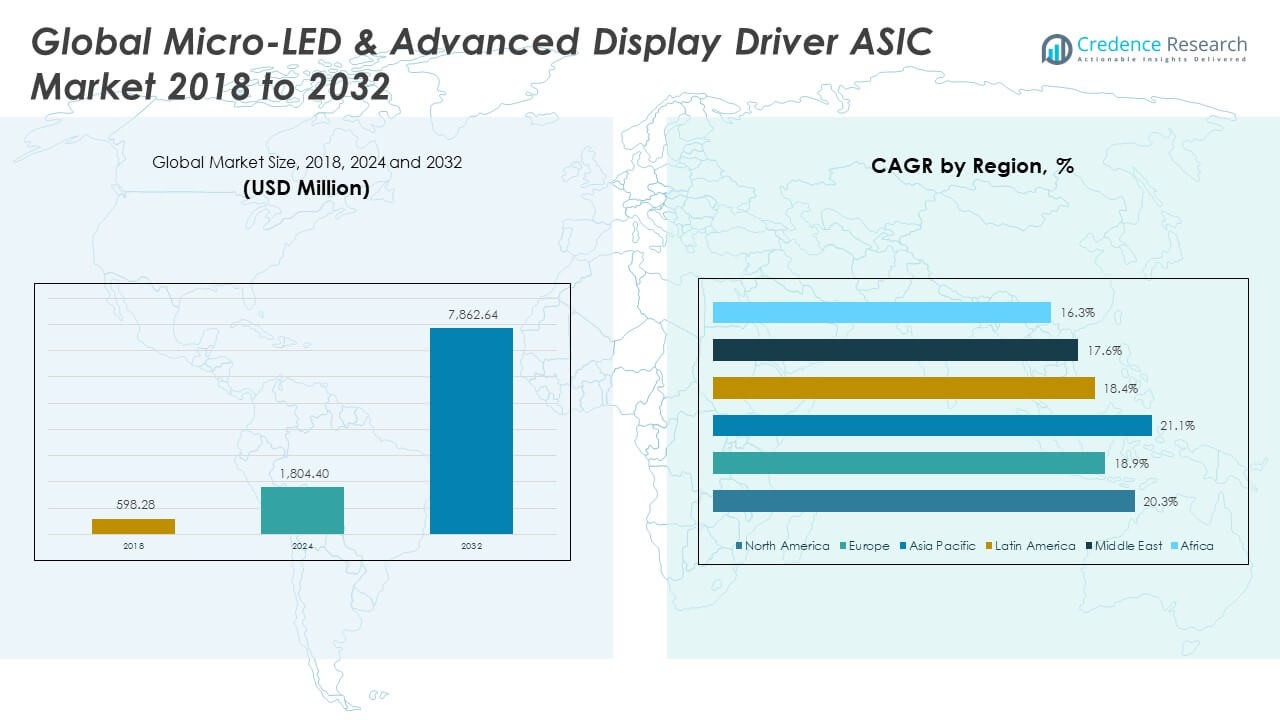

The Global Micro-LED & Advanced Display Driver ASIC Market was valued at USD 598.28 million in 2018 to USD 1,804.40 million in 2024 and is projected to reach USD 7,862.64 million by 2032, growing at a CAGR of 20.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro-LED & Advanced Display Driver ASIC Market Size 2024 |

USD 1,804.40Million |

| Micro-LED & Advanced Display Driver ASIC Market, CAGR |

20.20% |

| Micro-LED & Advanced Display Driver ASIC Market Size 2032 |

USD 7,862.64 Million |

Key drivers of market growth include the rapid technological advancements in micro-LED display technology, which offer better contrast ratios, thinner panels, and lower power consumption. The growing use of micro-LEDs in high-end televisions, smartphones, wearables, and automotive displays has increased the need for advanced display driver ASICs to support these innovations. As consumers demand improved display quality and energy efficiency, the need for specialized display drivers that can handle micro-LED configurations becomes more critical, stimulating significant investments in the ASIC market.

Regionally, North America and Asia-Pacific are the dominant players in this market. North America benefits from a strong presence of semiconductor companies and continuous advancements in display technologies. The U.S., in particular, is witnessing considerable investments in micro-LED development from key industry players. Meanwhile, Asia-Pacific, especially China and South Korea, has become a rapidly emerging market due to its booming electronics sector and government support for technological innovation. Europe is also witnessing increased adoption of micro-LED technology in automotive displays and wearables, contributing to its growing market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Micro-LED & Advanced Display Driver ASIC Market was valued at USD 598.28 million in 2018 and is projected to reach USD 7,862.64 million by 2032, growing at a CAGR of 20.20% during the forecast period. The market is driven by growing demand for high-quality, energy-efficient displays across industries such as consumer electronics, automotive, and digital signage.

- Technological advancements in micro-LED are driving growth, offering superior brightness, contrast, and energy efficiency, particularly in high-end displays for smartphones, wearables, and televisions.

- The integration of micro-LED technology in automotive displays, including heads-up displays and in-cabin entertainment systems, is contributing significantly to market expansion.

- High production costs of micro-LED technology, including complex manufacturing processes, remain a key restraint, limiting its widespread adoption, especially in cost-sensitive markets.

- The complexity of designing advanced display driver ASICs to support micro-LED displays poses a challenge, impacting development timelines and increasing R&D expenses.

- North America and Asia Pacific dominate the market, with North America benefiting from a strong presence of semiconductor companies and Asia Pacific experiencing rapid growth due to booming electronics sectors and government support.

- Europe is adopting micro-LED in automotive displays, while Latin America is seeing steady growth in consumer electronics and digital signage, presenting emerging opportunities in these regions.

Market Drivers:

Increased Demand for High-Quality, Energy-Efficient Displays

One of the primary drivers of the Global Micro-LED & Advanced Display Driver ASIC Market is the increasing demand for high-quality, energy-efficient displays. Micro-LED technology offers improved brightness, contrast, and color saturation, making it ideal for applications such as televisions, smart devices, and automotive displays. This shift towards micro-LED displays is pushing manufacturers to develop advanced display driver ASICs that can handle the intricate demands of micro-LED technology, such as pixel-level brightness control and precise color calibration.

Growing Adoption in Consumer Electronics and High-Tech Devices

The growing adoption of micro-LED displays in consumer electronics and other high-tech devices is also a significant factor in the market’s expansion. With consumers increasingly prioritizing advanced display technology for their electronic devices, the demand for displays that provide better picture quality and energy efficiency is rising. Micro-LED’s potential to offer these features makes it a preferred choice, and as its implementation in smart TVs, smartphones, and wearables increases, it directly boosts the need for display driver ASICs.

- For example, VueReal, utilizing its proprietary MicroSolid Printing™ platform, has reported yield rates above 99.97%in micro-LED die transfer for high-density displays. The company’s reference design kits enable commercial partners to develop products with pixel sizes as small as 5μm, allowing for pixel densities exceeding 5,000ppi in consumer electronics such as AR glasses and next-gen smartwatches.

Rising Demand for Higher-Resolution Displays

Another key market driver is the push for higher-resolution displays across various industries. With the growing trend of ultra-high-definition and 4K displays, advanced display driver ASICs are needed to support the greater number of pixels required for these displays. Micro-LEDs, which are inherently more efficient in achieving higher resolutions than traditional LED or OLED technologies, are being integrated into these high-end displays. Consequently, the demand for ASICs capable of handling the advanced processing requirements for such displays has surged.

- For example, Micro-LED driver ASICs are now designed to support 8K and even 16K resolutiondisplays, requiring parallel data processing and high-bandwidth (multi-gigabit per second) transmission interfaces.

Micro-LED Adoption in Automotive Displays

The increasing use of micro-LED technology in automotive displays also plays a crucial role in driving the market. As automotive manufacturers focus on integrating cutting-edge displays into vehicles, such as heads-up displays, in-cabin entertainment systems, and advanced instrument clusters, the need for advanced display driver ASICs that can handle these high-performance micro-LED systems is growing. This trend is expected to continue as the automotive sector adopts more high-tech features in vehicles.

Market Trends:

Miniaturization and Compact Design

One significant trend in the Global Micro-LED & Advanced Display Driver ASIC Market is the growing focus on miniaturization and compact design. As devices become increasingly smaller and more portable, the need for compact and power-efficient display drivers has intensified. Micro-LEDs, with their small pixel sizes, fit well within this trend, and manufacturers are focusing on designing ASICs that are not only powerful but also space-efficient to meet the needs of portable devices such as wearables and handheld electronics.

Flexible and Bendable Displays

A rising trend in the market is the shift towards flexible and bendable displays. As the demand for foldable smartphones and other flexible devices increases, micro-LED technology is emerging as an ideal solution due to its inherent flexibility and durability. This trend is prompting semiconductor companies to develop advanced display driver ASICs capable of functioning effectively in these flexible applications, creating a new segment within the micro-LED and display driver market.

- For example, AUO Corporationshowcased a portable 3-inch foldable Micro-LED display at SID Display Week 2024, representing one of the largest and most advanced flexible Micro-LEDs brought to market.

Focus on Sustainability and Energy Efficiency

The rise in demand for sustainable and eco-friendly technologies is also influencing the Global Micro-LED & Advanced Display Driver ASIC Market. Micro-LEDs consume less power than traditional LED and OLED displays, making them an attractive choice for consumers and industries focused on reducing energy consumption. Display driver ASIC manufacturers are increasingly prioritizing the design of energy-efficient, environmentally friendly components to meet the growing demand for sustainable products across various markets, including consumer electronics and automotive.

Integration of Artificial Intelligence (AI) in Displays

Another key trend shaping the market is the integration of artificial intelligence (AI) into display technologies. AI-powered display driver ASICs are becoming more common, as these chips help optimize display performance by adjusting brightness, color accuracy, and power consumption based on real-time environmental factors. As AI technology continues to evolve, it is expected to play a larger role in enhancing micro-LED displays, further driving the demand for advanced display driver ASICs.

- For example, Hyperlume’s use of Micro-LEDs for optical communication has achieved “orders of magnitude” lower power use for data transfer compared to traditional interconnects, with sub-pJ/bit energy efficiency and multi-terabit/mm² density metrics, made possible by direct CMOS-compatible integration of the Micro-LED optical engine with ASIC packaging.

Market Challenges Analysis:

High Production Costs

The primary challenge facing the Global Micro-LED & Advanced Display Driver ASIC Market is the high cost of production associated with micro-LED technology. While micro-LED displays offer numerous benefits, such as higher resolution and greater energy efficiency, they are costly to manufacture compared to traditional LED or OLED displays. The complexity of micro-LED assembly and the need for advanced manufacturing techniques contribute to the higher costs, which can hinder widespread adoption, particularly in cost-sensitive markets.

Technological Complexity in ASIC Design

Another challenge is the technological complexity involved in developing advanced display driver ASICs for micro-LEDs. As micro-LED displays require precise control over each pixel, the ASICs used in these displays must be capable of handling intricate tasks such as real-time brightness adjustment and color accuracy. Designing ASICs that meet these stringent requirements while maintaining efficiency and reliability poses a significant technical hurdle for manufacturers. This complexity often results in longer development cycles and higher research and development costs.

Market Opportunities:

Opportunities in the Automotive Sector

The Global Micro-LED & Advanced Display Driver ASIC Market presents significant opportunities in the automotive sector. As automotive manufacturers increasingly incorporate micro-LED displays into vehicle dashboards, infotainment systems, and heads-up displays, there is a growing demand for advanced display driver ASICs capable of supporting these high-performance systems. The automotive industry’s shift towards incorporating cutting-edge display technologies presents a lucrative market for micro-LED driver ASICs.

Expansion in Wearable Devices

The expansion of micro-LED technology into wearable devices also presents a promising opportunity. With the growing consumer demand for wearables such as smartwatches and fitness trackers, micro-LED displays are gaining traction due to their compact design and energy efficiency. Display driver ASICs that can support these applications, enabling smaller, more efficient devices with high-quality displays, represent a key opportunity for manufacturers in the market.

Market Segmentation Analysis:

The Global Micro-LED & Advanced Display Driver ASIC Market is experiencing significant growth, driven by technological advancements in display technologies and increasing demand across various applications.

By display technology, with micro-LED leading due to its superior brightness, color accuracy, and energy efficiency. Mini-LED follows closely, offering enhanced contrast ratios and being adopted in high-end televisions and monitors. OLED/AMOLED displays remain popular for their flexibility and rich color representation, especially in smartphones and wearable devices. LCD technology continues to dominate in mass-market applications due to its cost-effectiveness and widespread use in various consumer electronics.

- For example, according to Apple’s Pro Display XDR technical specifications, the 32-inch display utilizes a 576-zone, full-array Mini-LED backlight system, achieves 1,600 nits peak brightness (full screen) for HDR content, 1,000,000:1 contrast ratio, and 10-bit color depth.

By application segments show diverse growth patterns. Smartphones and tablets represent the largest portion of the market, as consumers demand better display quality and power efficiency. Televisions and monitors are also expanding rapidly, driven by the adoption of ultra-high-definition and micro-LED displays for premium products. The wearables segment is gaining momentum, fueled by increasing demand for smartwatches and fitness trackers with advanced display features. Automotive displays are another fast-growing segment, with micro-LED technology being integrated into dashboard displays, heads-up displays, and in-vehicle entertainment systems. Digital signage, particularly in retail and outdoor advertising, is increasingly incorporating micro-LEDs due to their durability and brightness. Industrial and medical displays are adopting advanced display technologies for better image clarity and reliability, especially in critical applications like medical imaging and control panels.

- For example, BMW Vision Neue Klasse concept (2025) describes a next-generation curved display “designed from the ground up specifically for Micro-LED technology,” featuring high contrast, crystal-clear graphics, and superior sunlight legibility.

Segmentation:

By Display Technology Segments:

- Micro-LED

- Mini-LED

- OLED/AMOLED

- LCD

By Application Segments:

- Smartphones & Tablets

- Televisions & Monitors

- Wearables

- Automotive Displays

- Digital Signage

- Industrial & Medical Displays

By Region Segments:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Micro-LED & Advanced Display Driver ASIC Market size was valued at USD 171.91 million in 2018 to USD 510.29 million in 2024 and is projected to reach USD 2,233.03 million by 2032, growing at a CAGR of 20.3% during the forecast period. The region is witnessing significant advancements in micro-LED technology, primarily driven by the presence of key players and robust demand for high-performance displays in consumer electronics and automotive sectors. North America dominates the market with a substantial market share of approximately 28%, due to the widespread adoption of micro-LED displays in devices such as televisions, smart devices, and high-tech automotive displays. The growth is also fueled by investments from major companies focused on developing advanced display driver ASICs to support the growing adoption of micro-LED technology.

Europe

The Europe Global Micro-LED & Advanced Display Driver ASIC Market size was valued at USD 118.10 million in 2018 to USD 337.73 million in 2024 and is projected to reach USD 1,345.87 million by 2032, growing at a CAGR of 18.9% during the forecast period. Europe’s market growth is driven by the increasing demand for micro-LED displays in automotive applications, particularly for in-cabin displays, infotainment systems, and heads-up displays. The region holds a market share of around 17%, with countries such as Germany and the United Kingdom leading the charge. Europe is also heavily investing in sustainability and energy-efficient display technologies, further accelerating the need for advanced display driver ASICs. As the European market emphasizes technological innovation and energy efficiency, it has become a significant player in the Global Micro-LED & Advanced Display Driver ASIC Market.

Asia Pacific

The Asia Pacific Global Micro-LED & Advanced Display Driver ASIC Market size was valued at USD 255.67 million in 2018 to USD 800.21 million in 2024 and is projected to reach USD 3,704.21 million by 2032, growing at a CAGR of 21.1% during the forecast period. The region is poised to experience the highest growth due to the rapid adoption of micro-LED displays in consumer electronics, especially in countries like China, Japan, and South Korea. Asia Pacific’s dominance, with a market share of approximately 40%, is attributed to the booming electronics manufacturing sector, with a large number of companies focusing on the development and deployment of micro-LED technology. The demand for micro-LED in televisions, smartphones, and wearables, coupled with government support for high-tech innovations, drives the need for display driver ASICs in the region.

Latin America

The Latin America Global Micro-LED & Advanced Display Driver ASIC Market size was valued at USD 28.26 million in 2018 to USD 84.16 million in 2024 and is projected to reach USD 324.59 million by 2032, growing at a CAGR of 18.4% during the forecast period. While the Latin American market is smaller compared to other regions, it is witnessing steady growth driven by increased interest in micro-LED technology for consumer electronics, particularly televisions and digital signage. Latin America holds a market share of approximately 5%, with the growing middle-class population and rising disposable income contributing to the demand for high-definition displays. Additionally, Latin American countries are increasingly adopting smart city initiatives, further driving the need for advanced display solutions in public and commercial spaces.

Middle East

The Middle East Global Micro-LED & Advanced Display Driver ASIC Market size was valued at USD 16.29 million in 2018 to USD 44.79 million in 2024 and is projected to reach USD 163.73 million by 2032, growing at a CAGR of 17.6% during the forecast period. The Middle East market is growing at a moderate pace due to its increasing adoption of high-end display technologies in sectors such as retail, automotive, and entertainment. The region holds a market share of approximately 3%, with countries like the UAE and Saudi Arabia investing heavily in smart city projects that incorporate advanced display technologies such as micro-LEDs in public infrastructure and digital signage. The region is also focusing on enhancing consumer electronics offerings with premium display solutions.

Africa

The Africa Global Micro-LED & Advanced Display Driver ASIC Market size was valued at USD 8.05 million in 2018 to USD 27.21 million in 2024 and is projected to reach USD 91.21 million by 2032, growing at a CAGR of 16.3% during the forecast period. The African market for micro-LED and advanced display driver ASICs is in its early stages but is expected to grow steadily, driven by rising adoption of consumer electronics and increasing infrastructure development. Africa holds a market share of approximately 2%, with a focus on urbanization and smart city projects, creating demand for energy-efficient and high-performance display technologies. As more emphasis is placed on consumer electronics, particularly smartphones and TVs, Africa is poised to experience steady growth in the micro-LED display market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Texas Instruments (TI)

- STMicroelectronics

- Samsung

- Novatek Microelectronics

- SiliconCore

- BOE HC SemiTek

- Jocoj

- TOPCO

- Finemad Electronics

- Focuslight

Competitive Analysis:

The competitive landscape of the Global Micro-LED & Advanced Display Driver ASIC Market is characterized by the presence of several key players such as Texas Instruments, Analog Devices, and Broadcom, among others. These companies focus on developing high-performance, energy-efficient ASIC solutions tailored for micro-LED displays. Competition is intense as players aim to differentiate their products through innovation in design and technology, offering improved display quality, enhanced power efficiency, and smaller form factors. Strategic partnerships and mergers and acquisitions are commonly observed as companies seek to enhance their technological capabilities and expand their market reach. The need for cost-effective solutions, alongside the rise in demand for premium displays in consumer electronics, automotive, and other industries, intensifies the competitive dynamics. Companies that can provide scalable, reliable, and energy-efficient solutions are well-positioned to lead the market in the long term.

Recent Developments:

- In May 2025, Samsung Electronics announced a strategic partnership with BAFTA, becoming BAFTA’s first Official Screen Partner. Coinciding with the reveal of its highly-anticipated 2025 lineup of TVs, projectors, and soundbars, this partnership aligns Samsung with leading names in the creative arts and underscores its leadership in advanced display innovation.

Market Concentration & Characteristics:

The Global Micro-LED & Advanced Display Driver ASIC Market is moderately concentrated, with a few dominant players controlling a significant portion of the market share. Large semiconductor companies such as Texas Instruments and Broadcom lead the market, owing to their extensive research and development capabilities and established customer bases. The market is characterized by rapid technological advancements, with players continuously focusing on optimizing power efficiency and enhancing display quality. As micro-LED technology continues to mature, companies are increasingly investing in product innovation to meet the rising demand for high-definition, energy-efficient displays across consumer electronics, automotive, and other sectors. The market also sees growing competition from smaller players that offer specialized solutions targeting specific industry needs.

Report Coverage:

The research report offers an in-depth analysis based on Display Technology and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Micro-LED & Advanced Display Driver ASIC Market will continue its strong growth, during the forecast period.

- Technological advancements will drive innovations in display quality, including better contrast ratios, thinner panels, and reduced power consumption.

- The growing demand for micro-LEDs in high-end consumer electronics, such as televisions and smartphones, will increase the need for specialized display driver ASICs.

- Adoption of micro-LEDs in automotive applications will significantly boost market demand for display driver solutions.

- As energy efficiency becomes a key consumer preference, the need for energy-efficient advanced display driver ASICs will rise.

- The shift towards flexible, foldable, and bendable displays will create new opportunities for ASIC manufacturers.

- AI-driven display technologies will become more integrated, driving demand for advanced display driver ASICs with AI capabilities.

- North America and Asia-Pacific will continue to lead the market, with substantial investments from key semiconductor companies.

- The European market will grow due to the rising adoption of micro-LED technology in automotive and wearable devices.

- Smaller players with specialized solutions will also gain traction in niche markets, increasing competition and innovation.