| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| N-(Phosphonomethyl) Glycine Market Size 2024 |

USD 6,991.63 million |

| N-(Phosphonomethyl) Glycine Market, CAGR |

4.24% |

| N-(Phosphonomethyl) Glycine Market Size 2032 |

USD 9,986.34 million |

Market Overview:

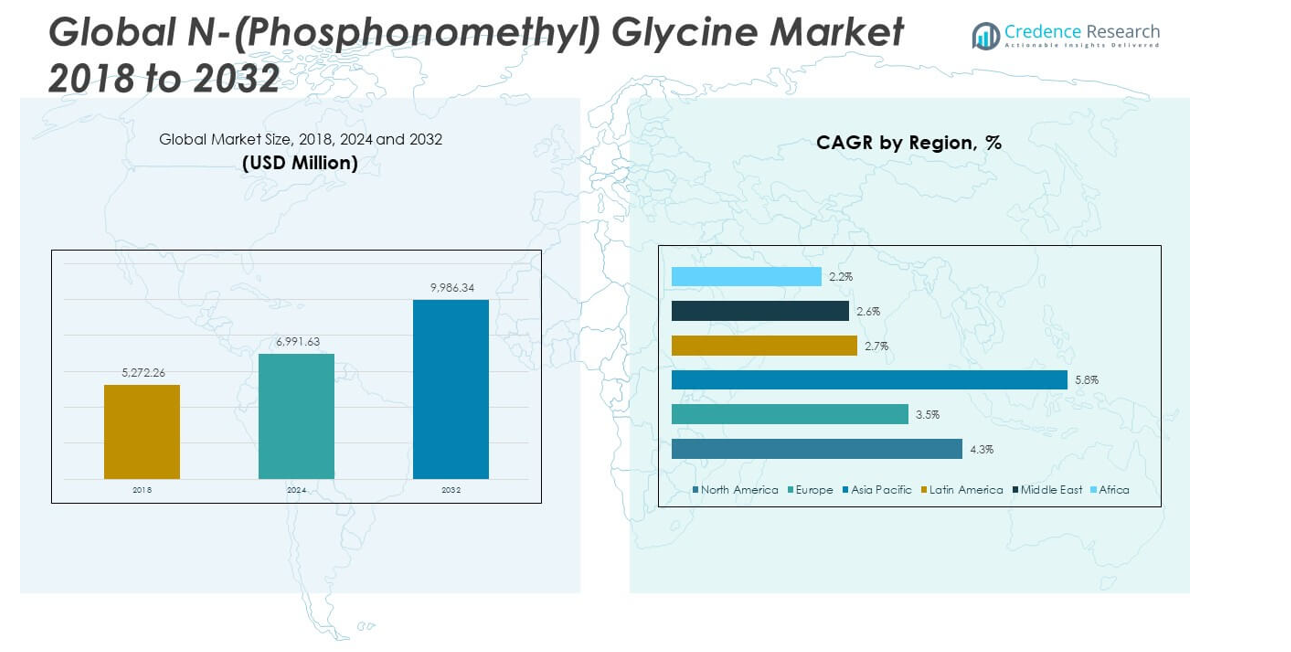

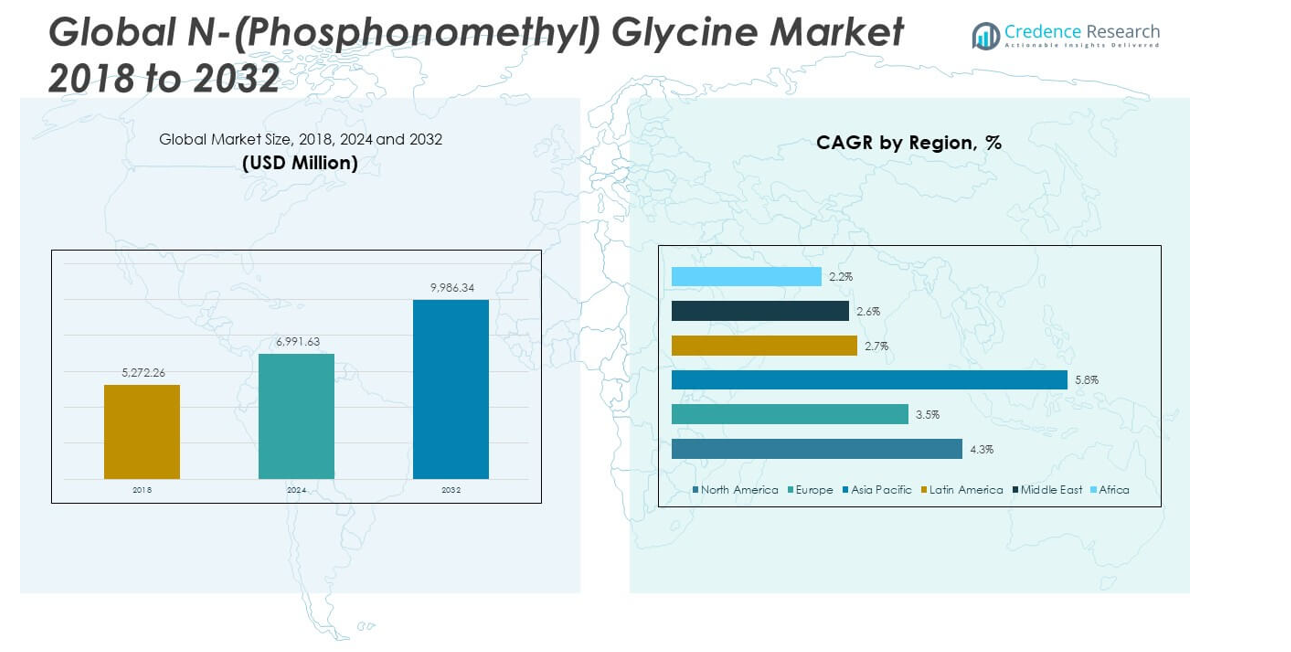

The Global N-(Phosphonomethyl) Glycine Market size was valued at USD 5,272.26 million in 2018 to USD 6,991.63 million in 2024 and is anticipated to reach USD 9,986.34 million by 2032, at a CAGR of 4.24% during the forecast period.

The primary driver of the N-(Phosphonomethyl) Glycine market is the escalating demand for herbicides in agriculture, propelled by the need for higher crop yields to meet the food demands of a growing global population. Glyphosate, a key ingredient in many herbicides, plays a crucial role in modern agriculture by effectively managing weeds and ensuring higher crop yields. Additionally, the adoption of genetically modified (GM) crops resistant to glyphosate is contributing to market growth. These herbicide-tolerant crop hybrids are designed to withstand the application of non-selective herbicides like glyphosate, facilitating more efficient weed control. Furthermore, glyphosate’s cost-effectiveness and environmental benefits compared to mechanical tillage technologies are enhancing its appeal among farmers.

Regionally, the N-(Phosphonomethyl) Glycine market exhibits diverse dynamics. North America remains a significant market, driven by the widespread adoption of herbicide-tolerant GM crops and advanced agricultural practices. The U.S. and Canada are notable consumers, focusing on precision agriculture and digital agronomy services to optimize glyphosate application. In Latin America, countries like Brazil and Argentina maintain robust consumption due to large-scale soybean and maize cultivation, with glyphosate being integral to their weed management strategies. The Asia-Pacific region is experiencing rapid growth, particularly in East Asia, where government support for conservation tillage and the widespread planting of glyphosate-tolerant GMO soy and corn are driving market expansion. Conversely, Europe faces regulatory challenges concerning glyphosate use, which may impact market growth in the region.

Market Insights:

- The Global N-(Phosphonomethyl) Glycine Market was valued at USD 5,272.26 million in 2018 and is expected to reach USD 9,986.34 million by 2032, with a CAGR of 4.24% during the forecast period.

- The primary driver of the market is the increasing demand for effective herbicides to meet the growing food demands of the global population, with glyphosate playing a crucial role in weed control.

- The adoption of genetically modified (GM) crops, especially those resistant to glyphosate, has significantly boosted the market, making herbicide applications more efficient and environmentally sustainable.

- Advances in agricultural practices, including precision farming and reduced tillage practices, are optimizing the use of N-(Phosphonomethyl) Glycine, further enhancing its demand.

- Government policies and regulatory support in regions like North America and Latin America have played a significant role in encouraging the use of glyphosate-based herbicides for improving agricultural productivity.

- The Global N-(Phosphonomethyl) Glycine Market faces regulatory challenges, especially with growing concerns over glyphosate’s safety, leading to stricter regulations and bans in certain markets, particularly Europe.

- Increasing competition from alternative weed control solutions, including mechanical, biological, and thermal methods, poses a challenge to the long-term dominance of glyphosate in weed management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Herbicides in Agriculture

The primary driver of growth in the Global N-(Phosphonomethyl) Glycine Market is the rising demand for effective herbicides in agriculture. Farmers face increasing pressure to maximize crop yields to meet the food demands of a growing global population. N-(Phosphonomethyl) Glycine, commonly known as glyphosate, is one of the most widely used herbicides in crop protection due to its effectiveness in controlling a broad range of weeds. The herbicide’s cost-effectiveness compared to alternative weed management techniques further strengthens its adoption. Glyphosate’s ability to improve productivity while reducing the need for labor-intensive manual weeding makes it an attractive option for large-scale farming operations.

Adoption of Genetically Modified Crops

The adoption of genetically modified (GM) crops resistant to N-(Phosphonomethyl) Glycine has significantly boosted the market. These crops, particularly glyphosate-tolerant varieties of soybeans, corn, and cotton, have made herbicide applications more efficient and environmentally sustainable. The ability to use glyphosate in combination with these crops allows farmers to reduce weed competition without harming the crops. The growing acreage of GM crops globally, especially in regions like North America and Latin America, continues to drive demand for glyphosate-based products. The increasing prevalence of GM crops in key agricultural markets has solidified the position of N-(Phosphonomethyl) Glycine as a vital tool in modern agriculture.

Advances in Agricultural Practices

Advancements in agricultural practices are another significant factor driving the growth of the N-(Phosphonomethyl) Glycine market. Precision farming techniques and the adoption of digital agronomy are optimizing the use of herbicides, including glyphosate. These innovations enable farmers to apply the chemical more efficiently, reducing overuse and minimizing environmental impact. Additionally, reduced tillage practices, which have gained popularity in response to sustainability concerns, rely heavily on herbicides like glyphosate to manage weeds without disturbing the soil. The rise in sustainable farming practices has bolstered the demand for herbicides as part of an integrated approach to crop management.

- For instance, John Deere’s See & Spray technology demonstrated an average herbicide savings of 59% on corn, soybean, and cotton fields across the U.S. during the 2024 growing season, according to an official John Deere press release. Independent studies, including one from Iowa State University, reported up to 76% product savings in test fields.

Government Policies and Regulatory Support

Government policies and regulatory support also play a critical role in the growth of the N-(Phosphonomethyl) Glycine Market. In several countries, particularly in North America and Latin America, government-backed initiatives to enhance agricultural productivity have led to widespread adoption of glyphosate. Additionally, many governments provide subsidies or incentives to promote the use of advanced herbicides and GM crops to ensure food security. While regulatory scrutiny over the safety of glyphosate has intensified, its continued approval in major agricultural regions supports its use. As policymakers seek to balance crop protection with environmental sustainability, glyphosate remains a key component of modern agricultural practices, ensuring its place in the market for the foreseeable future.

- For instance, the U.S. Department of Agriculture (USDA) reported that federal conservation programs, such as the Conservation Stewardship Program, encourage the adoption of reduced tillage and cover cropping, practices that often rely on glyphosate for effective weed management.

Market Trends:

Shift Towards Sustainable and Precision Agriculture

A key trend in the Global N-(Phosphonomethyl) Glycine Market is the increasing focus on sustainable and precision agriculture practices. With growing concerns about environmental impact and resource conservation, farmers are adopting more efficient methods to reduce chemical usage while maintaining high crop yields. Precision farming, which uses technology to monitor and manage the application of herbicides, is helping to optimize glyphosate use. This approach not only reduces overuse but also enhances environmental sustainability by ensuring that the herbicide is applied only where necessary. As the demand for sustainable agricultural solutions rises, precision agriculture is becoming a critical driver for the continued growth of the market.

- For example, Bayer has committed to reducing the environmental impact per hectare of its global crop protection portfolio by 30% by 2030, using a methodology that accounts for both product volume and environmental profile.

Regulatory Challenges and Safety Concerns

Regulatory challenges and safety concerns surrounding N-(Phosphonomethyl) Glycine are shaping market trends. Over the past few years, concerns about the potential health risks of glyphosate, including its possible link to cancer, have led to stricter regulatory scrutiny in several regions. Some countries have implemented bans or restrictions on its use, particularly in Europe. Despite these challenges, glyphosate remains widely used due to its proven effectiveness in weed control. The ongoing research and development efforts to improve glyphosate’s safety profile are helping maintain its market position. Regulatory trends are forcing companies to innovate and improve the safety and efficacy of glyphosate formulations to comply with evolving standards.

Growing Adoption of Glyphosate-Resistant Crops

The increasing adoption of glyphosate-resistant crops continues to shape the Global N-(Phosphonomethyl) Glycine Market. Genetically modified (GM) crops, particularly those that are resistant to glyphosate, have become a cornerstone of modern agriculture. These crops, which include soybean, corn, and cotton, allow for more effective and efficient herbicide application without harming the crops. The trend of expanding glyphosate-resistant crop adoption, especially in key markets like North America, Brazil, and Argentina, is boosting the demand for glyphosate. As the acreage of GM crops continues to rise, the reliance on N-(Phosphonomethyl) Glycine will also grow, driving further market expansion.

- For instance, in Brazil, more than 90% of farmers have adopted glyphosate-resistant soybean and corn varieties, fundamentally changing weed management practices and reducing costs.

Technological Advancements in Glyphosate Formulations

Technological advancements in glyphosate formulations are another significant trend impacting the market. New formulations are being developed to enhance the efficacy, stability, and environmental impact of glyphosate products. Innovations such as the development of glyphosate-based herbicides with improved surfactants, reduced toxicity, and better shelf life are making it a more attractive option for farmers. These advancements are also addressing safety concerns by reducing the potential for non-target impacts and improving the overall environmental footprint of herbicide use. The ongoing research into novel formulations is expected to support the continued dominance of N-(Phosphonomethyl) Glycine in the herbicide market.

Market Challenges Analysis:

Regulatory Scrutiny and Safety Concerns

One of the significant challenges faced by the Global N-(Phosphonomethyl) Glycine Market is the increasing regulatory scrutiny surrounding glyphosate’s safety. Over the years, concerns about the potential health risks, including its possible carcinogenic effects, have led to growing calls for stricter regulations and bans, particularly in European markets. Regulatory bodies in various countries are closely examining the safety of glyphosate, leading to restrictions in some regions. These heightened regulatory pressures create uncertainty for market players, as they face the risk of stricter compliance requirements and potential product bans. The need for continuous testing, safety reassessment, and the introduction of new regulations can result in increased operational costs and complexity for companies involved in the production and distribution of N-(Phosphonomethyl) Glycine.

Competition from Alternative Weed Control Solutions

Another challenge to the Global N-(Phosphonomethyl) Glycine Market is the growing competition from alternative weed control solutions. While glyphosate has been widely used for decades, there is a shift towards exploring non-chemical weed control methods, including mechanical, biological, and thermal options. The demand for organic farming and eco-friendly solutions is pushing the development of these alternatives. In addition, the rise in herbicide-resistant weed populations is prompting farmers to seek alternative herbicides and more integrated pest management strategies. As these alternatives gain traction in the market, they may reduce the dependence on glyphosate, posing a challenge to the continued growth and market share of N-(Phosphonomethyl) Glycine. This trend could impact the long-term sustainability of glyphosate’s dominance in weed management.

Market Opportunities:

Expansion in Emerging Markets

A significant opportunity for growth in the Global N-(Phosphonomethyl) Glycine Market lies in the expansion of glyphosate use in emerging markets. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid agricultural development, where glyphosate-based herbicides are increasingly being adopted for efficient weed management. The growing demand for higher crop yields to support rising populations in these regions presents an opportunity for glyphosate manufacturers to expand their market presence. As the agricultural industry in these markets modernizes, the need for effective and cost-efficient herbicides like N-(Phosphonomethyl) Glycine will continue to rise, driving future demand.

Advancements in Glyphosate Formulation Innovation

Another opportunity for the Global N-(Phosphonomethyl) Glycine Market lies in the ongoing innovation of glyphosate formulations. Advances in technology can lead to the development of more effective, environmentally friendly, and safer glyphosate-based products. New formulations with reduced toxicity and improved environmental profiles can address growing concerns about sustainability while maintaining the herbicide’s efficiency. By enhancing the appeal of glyphosate among environmentally-conscious consumers and regulators, these innovations can open up new markets and strengthen its position in agricultural systems worldwide. These advancements will drive continued demand for N-(Phosphonomethyl) Glycine in the coming years.

Market Segmentation Analysis:

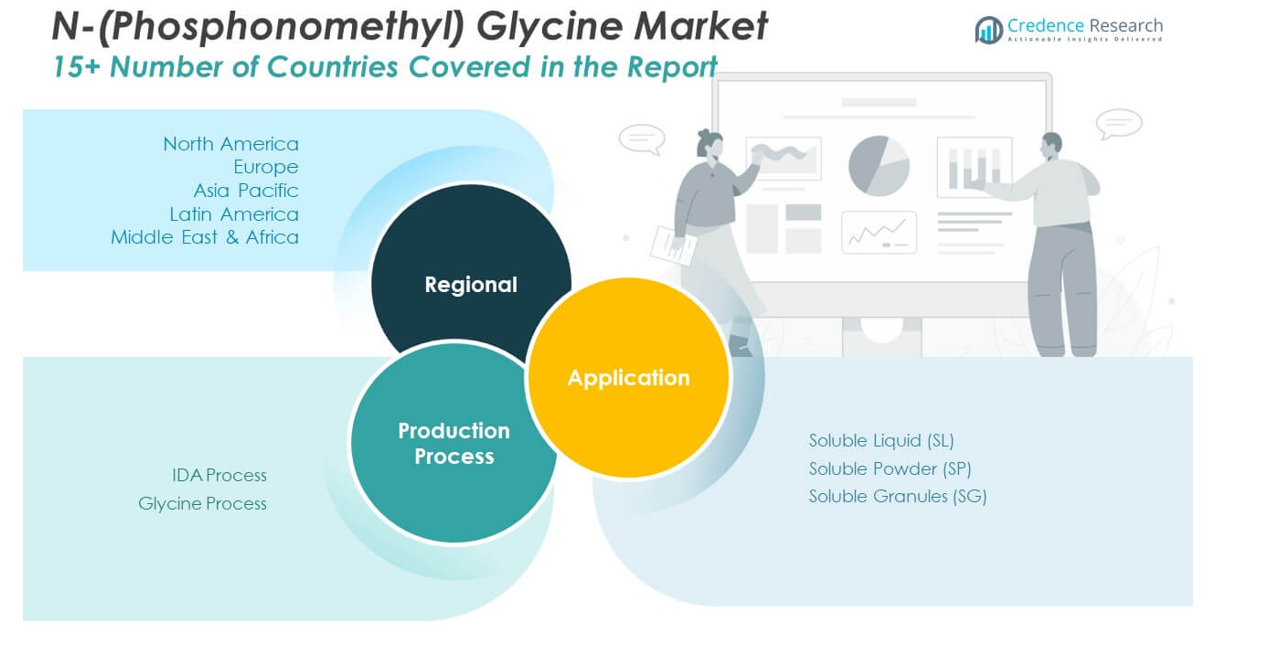

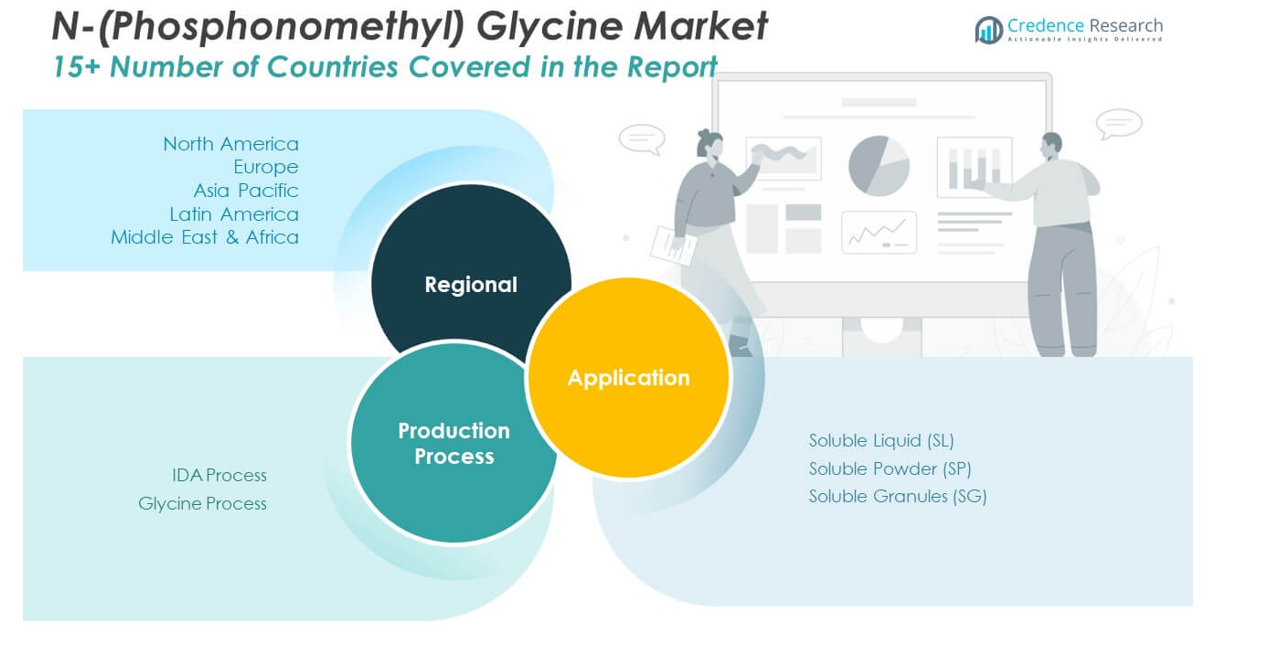

The Global N-(Phosphonomethyl) Glycine Market is segmented by application and production process.

By application segment, the market is divided into Soluble Liquid (SL), Soluble Powder (SP), and Soluble Granules (SG). Soluble Liquid (SL) holds a significant share due to its ease of application and effectiveness in weed management across various crop types. Soluble Powder (SP) is commonly used in regions requiring high precision in herbicide delivery, while Soluble Granules (SG) are preferred for large-scale agricultural operations due to their long shelf life and easy handling.

- For instance, Bayer’s Roundup Speed 540 SL contains 540 g/L of glyphosate acid equivalent, representing one of the highest-concentration soluble liquid herbicide formulations offered by the company. This high-strength formulation ensures rapid translocation within plants and provides broad-spectrum weed control across diverse cropping systems. Soluble Powder (SP) herbicide variants, though less common, are increasingly utilized in precision agriculture applications for their ease of dosing, storage stability, and accurate field deployment.

By production process segment is categorized into the IDA Process and Glycine Process. The IDA (Isopropylamine) Process is widely adopted for its cost-effectiveness and efficiency in producing high-purity N-(Phosphonomethyl) Glycine. The Glycine Process, although more complex, allows for better control over the quality of the final product and is favored for specialized formulations. Both processes cater to the diverse needs of the market, depending on the required production scale and desired quality of the herbicide.

- For instance, Sichuan Hebang Biotechnology Co., Ltd. employs the glycine route for glyphosate production, a process widely recognized for yielding high-purity outputs suitable for meeting stringent international quality standards. While specific purity levels may vary by formulation, glycine-based synthesis is known to achieve glyphosate content exceeding 95%, with controlled secondary amine levels to align with EU regulatory requirements.

Segmentation:

By Application:

- Soluble Liquid (SL)

- Soluble Powder (SP)

- Soluble Granules (SG)

By Production Process:

- IDA Process

- Glycine Process

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America N-(Phosphonomethyl) Glycine Market size was valued at USD 2,101.31 million in 2018 to USD 2,754.88 million in 2024 and is anticipated to reach USD 3,946.85 million by 2032, at a CAGR of 4.30% during the forecast period. North America holds a significant share in the Global N-(Phosphonomethyl) Glycine Market, driven by its robust agricultural sector. The United States, in particular, accounts for a large portion of the demand, with glyphosate being widely used in both crop production and land management. The increasing adoption of genetically modified crops that are resistant to glyphosate has further supported the market’s expansion. Additionally, the region benefits from a strong regulatory framework that ensures the safety and efficiency of glyphosate use in agriculture. The growing demand for sustainable farming practices and precision agriculture continues to drive innovation in herbicide application.

Europe

The Europe N-(Phosphonomethyl) Glycine Market size was valued at USD 1,553.21 million in 2018 to USD 1,988.23 million in 2024 and is anticipated to reach USD 2,680.06 million by 2032, at a CAGR of 3.50% during the forecast period. Europe represents a significant market but faces more regulatory challenges compared to other regions. Stricter regulations surrounding the use of glyphosate, particularly in countries like France and Germany, have slowed growth. However, glyphosate remains a key herbicide, particularly in the agriculture-intensive regions of Eastern Europe. Despite regulatory constraints, the market continues to grow, driven by the need for effective weed control in cereal crops, oilseeds, and vegetables. The increasing shift toward sustainable farming practices is pushing for innovations that align with environmental safety standards.

Asia Pacific

The Asia Pacific N-(Phosphonomethyl) Glycine Market size was valued at USD 1,046.86 million in 2018 to USD 1,501.07 million in 2024 and is anticipated to reach USD 2,420.04 million by 2032, at a CAGR of 5.80% during the forecast period. Asia Pacific is expected to experience the fastest growth in the N-(Phosphonomethyl) Glycine market. The region’s vast agricultural landscape, especially in countries like China and India, is a primary factor contributing to the growing demand for glyphosate-based herbicides. Glyphosate’s role in enhancing productivity and managing weed resistance in crops such as rice, wheat, and cotton is pivotal. The rising adoption of genetically modified crops resistant to glyphosate is further propelling market growth. Strong government support for agriculture and the expansion of sustainable farming practices in the region also contribute to this growth.

Latin America

The Latin America N-(Phosphonomethyl) Glycine Market size was valued at USD 260.71 million in 2018 to USD 341.63 million in 2024 and is anticipated to reach USD 434.43 million by 2032, at a CAGR of 2.70% during the forecast period. Latin America remains a key market for glyphosate, primarily due to the large-scale cultivation of crops like soybeans, maize, and cotton in countries like Brazil and Argentina. Glyphosate’s widespread use for weed control in these regions has driven the market’s steady growth. The region also benefits from increasing adoption of glyphosate-resistant crops and advanced farming techniques, which enhance the efficiency of herbicide use. While facing some regulatory scrutiny, glyphosate’s cost-effectiveness and efficacy continue to make it a preferred choice for farmers in the region.

Middle East

The Middle East N-(Phosphonomethyl) Glycine Market size was valued at USD 192.17 million in 2018 to USD 238.02 million in 2024 and is anticipated to reach USD 300.02 million by 2032, at a CAGR of 2.60% during the forecast period. The Middle East, with its arid climate and agricultural challenges, sees a growing need for efficient weed control solutions, which drives demand for glyphosate-based herbicides. Countries like Saudi Arabia and the UAE, which are investing in improving agricultural productivity through technology and enhanced farming practices, are major consumers of glyphosate. The market benefits from increasing awareness of modern agricultural practices, as well as the adoption of genetically modified crops. However, the growth rate in the region is slower compared to other regions due to limited agricultural land and a focus on other agricultural inputs.

Africa

The Africa N-(Phosphonomethyl) Glycine Market size was valued at USD 117.99 million in 2018 to USD 167.81 million in 2024 and is anticipated to reach USD 204.93 million by 2032, at a CAGR of 2.20% during the forecast period. In Africa, glyphosate use is on the rise, particularly in countries like South Africa, Egypt, and Nigeria, where agricultural practices are evolving to meet the demands of a growing population. The use of glyphosate in staple crops such as maize and sorghum is becoming increasingly common. The market is supported by government initiatives aimed at improving agricultural efficiency and sustainability. However, growth in the region is slower compared to other regions due to economic challenges, limited access to advanced farming technologies, and lower levels of glyphosate adoption across smallholder farms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Monsanto

- Zhejiang Jinfanda Biochemical

- Fuhua Tongda Agrochemical

- Wynca

- Nantong Jiangshan Agrochemical & Chemical

- Good Harvest-Weien

- Sunvic Chemical

- Jiangsu Yangnong Chemical

- Hubei Sanonda

- Rainbow Chemical

Competitive Analysis:

The Global N-(Phosphonomethyl) Glycine Market is highly competitive, with several major players dominating the landscape. Leading manufacturers include Bayer CropScience, Corteva Agriscience, and Syngenta, which hold substantial market shares through their well-established glyphosate-based product portfolios. These companies leverage their extensive distribution networks, robust R&D capabilities, and strong brand recognition to maintain a competitive edge. The market is also characterized by a high level of innovation, with companies continuously working on improving the safety, efficiency, and environmental sustainability of glyphosate formulations. Smaller players focus on niche markets or developing localized solutions to cater to specific regional needs. Regulatory challenges and public perception of glyphosate’s safety play a crucial role in shaping the competitive environment, prompting companies to adapt their strategies. With increasing demand for sustainable agriculture, competition will intensify, requiring industry players to innovate and navigate regulatory landscapes effectively to secure long-term market positioning.

Recent Developments:

- In March 2025, Bayer CropScience introduced Vyconic™ soybeans at the Commodity Classic in Denver, Colorado.This new trait technology enables soybeans to tolerate five different herbicides, including glyphosate, offering farmers enhanced flexibility in weed management.The launch underscores Bayer’s commitment to advancing weed control solutions in agriculture.

- In June 2024, Interoceanic Corporation announced the acquisition of Bonus Crop Fertilizer, a move aimed at expanding its portfolio in the agricultural sector.This acquisition enhances Interoceanic’s capabilities in providing comprehensive crop nutrition solutions, complementing its existing product offerings.

Market Concentration & Characteristics:

The Global N-(Phosphonomethyl) Glycine Market exhibits moderate concentration, with a few large players such as Bayer CropScience, Corteva Agriscience, and Syngenta commanding a significant portion of the market share. These companies dominate through extensive research and development, strong distribution channels, and established brand recognition. The market is characterized by intense competition, particularly in the development of advanced herbicide formulations and the adaptation to evolving regulatory requirements. Smaller regional players and niche manufacturers focus on specialized markets or localized herbicide solutions. The market also experiences innovation in product formulations aimed at enhancing environmental safety and reducing toxicity. While the major players maintain substantial control, regional players contribute to market diversity and cater to specific agricultural needs. With the increasing emphasis on sustainable agricultural practices, companies are under pressure to innovate while adhering to stricter regulatory standards.

Report Coverage:

The research report offers an in-depth analysis based on application and production process. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global N-(Phosphonomethyl) Glycine market is expected to experience steady growth in the coming years, driven by increasing demand for herbicides in agriculture.

- The growing adoption of genetically modified crops resistant to glyphosate will continue to support market expansion, particularly in key agricultural regions.

- As sustainable agricultural practices gain traction, the use of glyphosate is likely to shift towards more efficient and eco-friendly applications, aligning with environmental goals.

- Regulatory challenges, particularly around health concerns and product safety, could influence the market, potentially leading to stricter guidelines and market fluctuations.

- The rise of generic glyphosate formulations is expected to put downward pressure on prices, providing more affordable alternatives to traditional branded products.

- Innovations in glyphosate formulations, focusing on improving safety, efficacy, and environmental impact, are set to enhance the product’s competitiveness in the market.

- Consumer demand for organic and non-GMO products may impact glyphosate usage, with farmers adjusting their practices to meet these preferences.

- Emerging markets with expanding agricultural sectors offer significant growth opportunities, creating new demand for glyphosate-based herbicides.

- Collaborations and strategic partnerships between key players are likely to spur innovation, strengthen market positions, and drive market share.

- The development of alternative weed control technologies could shape the future of herbicide use, potentially reducing long-term dependence on glyphosate.