Market Overview

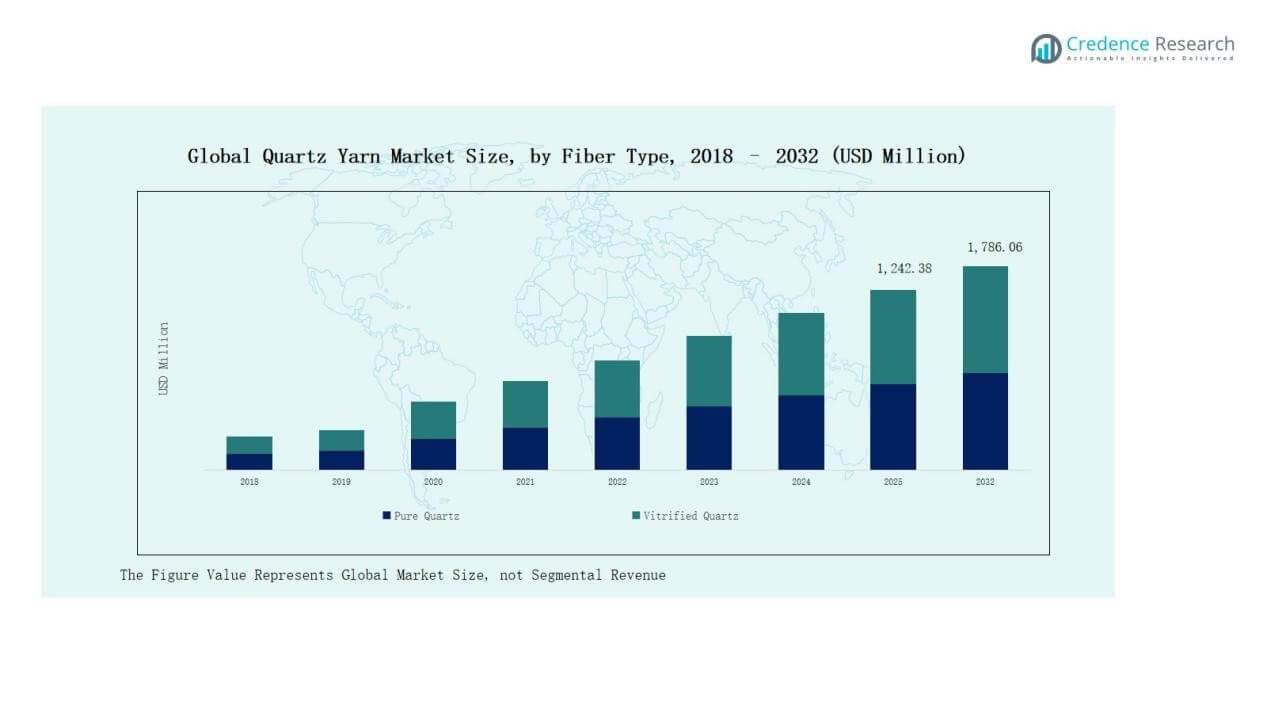

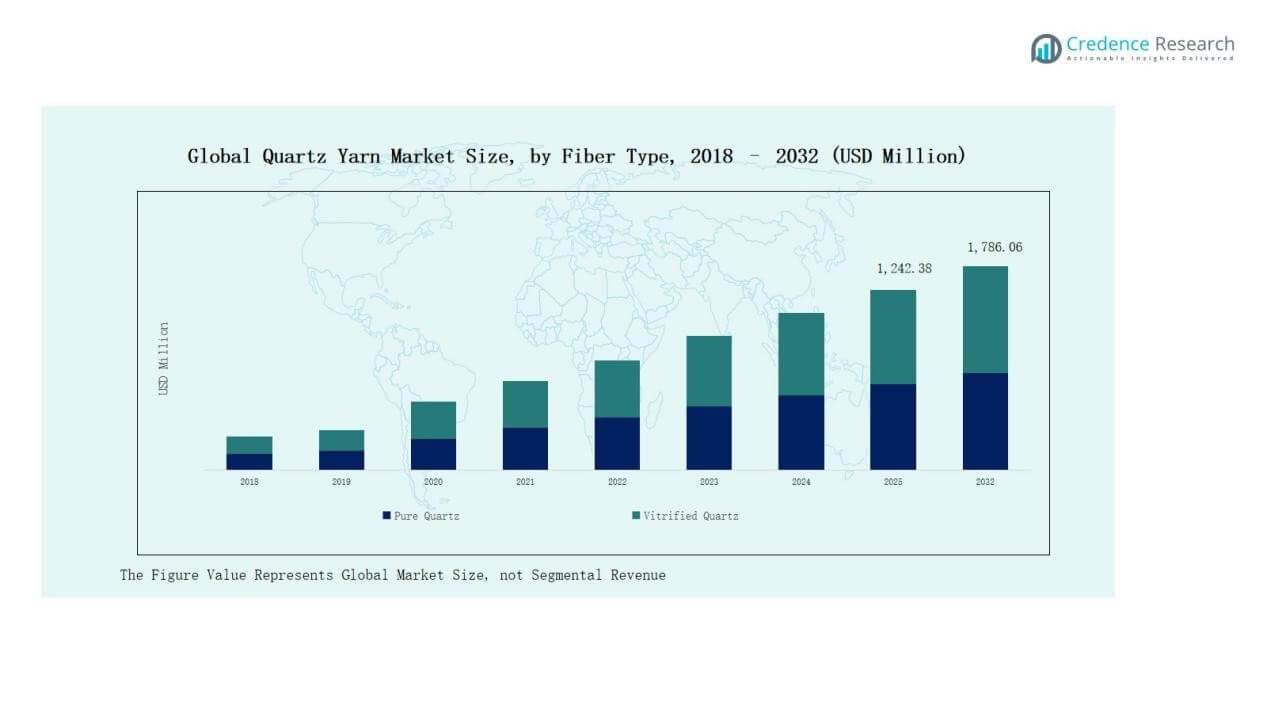

Quartz Yarn Market size was valued at USD 1,020.00 million in 2018, reached USD 1,186.77 million in 2024, and is anticipated to reach USD 1,786.06 million by 2032, at a CAGR of 5.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Yarn Market Size 2024 |

USD 1,186.77 Million |

| Quartz Yarn Market, CAGR |

5.32% |

| Quartz Yarn Market Size 2032 |

USD 1,786.06 Million |

The Quartz Yarn Market is shaped by prominent players including Saint-Gobain, Owens Corning, 3M Company, Nitto Boseki Co., Ltd., Nippon Electric Glass Co., Ltd., Hexcel Corporation, Jushi Group Co., Ltd., and Asahi Glass Co., Ltd. These companies strengthen their positions through advanced product portfolios, strategic collaborations, and investments in high-purity quartz materials to serve aerospace, automotive, and chemical processing industries. Among regions, Asia Pacific leads the market with a 32% share in 2024, supported by strong manufacturing capacity, growing aerospace projects, and expanding automotive and electronics industries. This leadership reflects the region’s robust industrial base and export potential.

Market Insights

Market Insights

- The Quartz Yarn Market grew from USD 1,020.00 million in 2018 to USD 1,186.77 million in 2024 and is expected to reach USD 1,786.06 million by 2032 at 5.32% CAGR.

- Asia Pacific leads with 32% share in 2024, followed by North America at 28% and Europe at 26%, while Latin America and Middle East & Africa hold 7% each.

- By fiber type, pure quartz dominates with 62% share in 2024 due to superior purity, dielectric strength, and thermal stability, while vitrified quartz accounts for 38%.

- By yarn type, filament yarn holds 68% share in 2024, led by multifilament for flexibility and durability, while spun yarn represents 32% with broader blending applications.

- By end-use industry, aerospace and defense lead with 34% share in 2024, followed by automotive at 22%, chemical processing at 18%, construction at 15%, and oil & gas at 11%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Fiber Type

The pure quartz segment dominates the Quartz Yarn Market, holding nearly 62% share in 2024. Its leadership stems from superior thermal stability, high purity, and excellent dielectric strength, making it indispensable in aerospace, defense, and semiconductor applications. Vitrified quartz, with a 38% share, grows steadily due to its cost efficiency and adaptability in construction and chemical processing. Rising demand for high-performance materials in advanced industries continues to reinforce the strong position of pure quartz yarn globally.

For instance, Saint-Gobain’s Quartzel yarn reports SiO₂ content above 99.95%, a dielectric constant of 3.74 and dielectric loss of 0.0002 at 10 GHz, with insulating integrity up to 1050 °C and ablative behavior above 1600 °C. These metrics support use in radomes and high-temperature insulation.

By Yarn Type

The filament yarn segment leads the market with about 68% share in 2024, driven by its superior tensile strength, uniformity, and suitability for high-tech applications. Within this, multifilament yarn accounts for a larger portion than monofilament, as it enhances flexibility and durability in composite reinforcement and insulation. Spun yarn, with 32% share, remains relevant in applications requiring cost efficiency and broader material blending. The growing adoption of quartz composites in aerospace and electronics boosts the filament yarn segment.

For instance, Toray Industries introduced a new high-strength carbon fiber multifilament yarn tailored for aerospace structural composites, offering improved fatigue resistance.

By End-Use Industry

The aerospace and defense industry dominates the Quartz Yarn Market with a 34% share in 2024, attributed to stringent performance standards and high demand for heat-resistant, lightweight materials. Automotive follows with 22% share, leveraging quartz yarn in high-temperature insulation and composite reinforcement. Chemical processing holds 18% share, construction accounts for 15%, and oil & gas represents 11%. Increased spending on aerospace composites, combined with rising lightweight vehicle production, continues to strengthen the leadership of aerospace and defense applications.

Key Growth Drivers

Rising Aerospace and Defense Applications

The aerospace and defense sector drives major growth in the Quartz Yarn Market. Demand for lightweight, high-strength, and thermally stable materials in aircraft components, rocket casings, and defense equipment is rising sharply. Quartz yarn’s exceptional dielectric and thermal resistance properties make it indispensable for advanced composites and insulation. Increasing investments in space exploration and military modernization programs worldwide further reinforce this demand, establishing aerospace and defense as the largest revenue-generating industry for quartz yarn manufacturers.

For instance, Northrop Grumman integrated quartz yarn-reinforced composites into solid rocket motor casings for its missile and space launch systems to improve structural performance under high pressure and heat.

Expanding Use in Automotive Lightweighting

Automotive manufacturers increasingly adopt quartz yarn to achieve vehicle lightweighting and fuel efficiency targets. High thermal resistance, low thermal expansion, and durability make it suitable for insulation, composites, and sealing threads in electric vehicles and high-performance engines. Stringent emission norms and the rapid growth of the EV sector amplify adoption. Automakers integrate quartz yarn into advanced composite components, supporting safer, more efficient, and environmentally sustainable vehicle design. This transition significantly boosts overall market expansion in the mobility sector.

Growth in Chemical Processing and Industrial Applications

Quartz yarn’s resistance to high temperatures, corrosion, and harsh chemicals positions it as a vital material in industrial environments. The chemical processing industry increasingly relies on it for filtration, sealing, and composite reinforcement solutions. Expanding demand for durable and safe materials in processing plants and refineries enhances adoption. Rising investments in industrial infrastructure, especially in emerging economies, provide new avenues for growth. As industries focus on longer lifecycle and reduced downtime, quartz yarn secures a critical role in operations.

For instance, CYC Quartz Fiber Yarn (SiO₂ > 99.95%) operates reliably at ≥ 1100 °C and resists acid and alkali attack.

Key Trends & Opportunities

Key Trends & Opportunities

Rising Adoption of Quartz Composites

A notable trend is the rapid expansion of quartz composites in advanced industries. Quartz yarn reinforced composites deliver high tensile strength, thermal stability, and resistance to extreme environments, making them suitable for aerospace, automotive, and oil & gas applications. Growing R&D efforts to enhance mechanical performance and reduce costs accelerate adoption. With sustainability gaining prominence, composites integrating quartz yarn offer extended durability and recyclability, positioning them as a preferred choice across multiple industries and boosting long-term market opportunities.

For instance, NASA’s Artemis program incorporated quartz fiber-based composites into thermal protection systems for its spacecraft, highlighting their capability to endure harsh space environments

Expansion in Emerging Economies

Emerging economies in Asia Pacific, Latin America, and the Middle East create significant growth opportunities for quartz yarn suppliers. Rising infrastructure development, growing aerospace projects, and automotive manufacturing expansion in these regions drive higher adoption. Local governments emphasize advanced materials for energy efficiency and industrial safety, supporting broader usage. Expanding chemical and construction sectors in China, India, and Brazil further accelerate demand. Companies investing in local production and partnerships benefit from reduced costs and increased market accessibility.

For instance, Heraeus Quartz announced the strengthening of its production facility in China to cater to the rising demand from electronics and semiconductor industries.

Key Challenges

High Production Costs

A major challenge in the Quartz Yarn Market is its high production cost. Manufacturing involves energy-intensive processes, advanced purification methods, and precision engineering, making the material more expensive than substitutes. These costs limit adoption in cost-sensitive industries like construction and automotive in developing regions. Price volatility in raw materials such as high-purity quartz also adds uncertainty. To overcome this barrier, producers must focus on process optimization, scale economies, and innovations that reduce energy and material consumption.

Limited Awareness in End-Use Industries

Despite strong performance benefits, awareness of quartz yarn remains limited outside specialized sectors like aerospace and defense. Industries such as construction and automotive often rely on conventional glass fibers or ceramics due to familiarity and lower cost. This knowledge gap restricts penetration into broader markets. Manufacturers face the challenge of educating customers, highlighting long-term benefits, and demonstrating cost-effectiveness through case studies. Stronger marketing and technical collaborations with end-users are needed to increase adoption across new industry verticals.

Competition from Alternative Materials

The presence of alternative high-performance materials creates competitive pressure in the market. Ceramic fibers, carbon fibers, and aramid fibers offer thermal and mechanical properties that overlap with quartz yarn applications, often at lower costs or broader availability. In industries prioritizing cost efficiency, these substitutes limit quartz yarn adoption. Continuous innovation and differentiation are required to sustain competitiveness. Producers must emphasize unique advantages such as higher purity, superior dielectric strength, and longer lifecycle performance to retain their market share.

Regional Analysis

North America

North America holds 28% share of the Quartz Yarn Market in 2024. The region benefits from strong aerospace and defense investments, particularly in the United States. Demand for high-performance materials in military aircraft, satellites, and space exploration projects drives growth. The automotive sector further supports adoption through lightweighting initiatives and electric vehicle production. Canada and Mexico contribute with growing industrial and construction applications. It maintains a competitive edge through advanced R&D and strong presence of leading composite manufacturers.

Europe

Europe accounts for 26% share of the Quartz Yarn Market in 2024. The region emphasizes high-quality aerospace production, chemical processing, and renewable energy infrastructure. Germany leads with strong demand from its automotive and aerospace sectors, while France and the UK remain key markets for defense and industrial applications. Construction industries in Southern Europe support additional consumption. It benefits from strict regulatory standards that encourage adoption of advanced and durable materials. Market expansion is reinforced by leading glass and composites companies.

Asia Pacific

Asia Pacific dominates the Quartz Yarn Market with 32% share in 2024. China drives regional growth with high investments in aerospace, automotive, and electronics manufacturing. Japan and South Korea contribute significantly through advanced material development and defense projects. India and Southeast Asia provide additional growth through infrastructure expansion and chemical processing industries. Rising industrialization and government-backed programs in renewable energy strengthen demand. It remains the most dynamic region due to large-scale manufacturing capacity and expanding export potential.

Latin America

Latin America represents 7% share of the Quartz Yarn Market in 2024. Brazil leads demand, supported by its automotive, oil and gas, and construction sectors. Argentina contributes through industrial and chemical applications. Expanding energy projects and infrastructure development create additional opportunities. Adoption remains slower compared to developed regions due to high material costs. It benefits from increasing partnerships with global suppliers that aim to tap into regional demand. Market growth depends on steady industrial modernization and rising safety standards.

Middle East & Africa

The Middle East & Africa together hold 7% share of the Quartz Yarn Market in 2024. The Middle East drives growth through oil and gas applications, particularly in GCC countries. Investments in aerospace and defense also support demand in Turkey and Israel. Africa contributes with construction and industrial activities, led by South Africa and Egypt. Adoption is still limited due to infrastructure and cost barriers. It gains momentum from government-backed projects and increasing need for advanced filtration and insulation solutions.

Market Segmentations:

Market Segmentations:

By Fiber Type

- Pure Quartz

- Vitrified Quartz

By Yarn Type

- Filament Yarn

- Monofilament

- Multifilament

- Spun Yarn

By End-Use Industry

- Aerospace & Defense

- Automotive

- Chemical Processing

- Construction

- Oil & Gas

By Application

- Composite Reinforcement

- Filtration

- Insulation

- Sealing Threads

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Quartz Yarn Market is moderately consolidated, with a mix of global corporations and regional players competing for market share. Leading companies such as Saint-Gobain, Nitto Boseki Co., Ltd., Owens Corning, 3M Company, and Nippon Electric Glass Co., Ltd. dominate through strong product portfolios, advanced R&D, and long-term supply partnerships in aerospace, defense, and automotive sectors. Asian manufacturers, including Jushi Group Co., Ltd. and Jiangsu Hengli Group, strengthen their positions by leveraging cost-effective production and expanding exports. European players like Asahi Glass Co., Ltd. and PPG Industries focus on high-purity grades and advanced composites to address demanding end-use industries. Competition is centered on product performance, thermal stability, and chemical resistance, with companies investing in innovation to maintain differentiation. Strategic collaborations, acquisitions, and capacity expansions are common tactics to secure leadership and strengthen supply chain resilience across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Saint-Gobain

- HLPPL

- Nitto Boseki Co., Ltd.

- JPS Composite Materials

- Shandong Glassfiber Factory

- 3M Company

- Asahi Glass Co., Ltd.

- Owens Corning

- PPG Industries

- Hexcel Corporation

- Nippon Electric Glass Co., Ltd.

- AGY Holding Corp.

- Jushi Group Co., Ltd.

- Jiangsu Hengli Group

- Zibo Hengyuxin New Material Technology Co., Ltd.

- Jiangsu Hengyi Group Co., Ltd.

Recent Developments

- In September 2025, the Competition Commission of India approved the acquisition of the entire shareholding of IPM Inc. and OC NL Invest Cooperatief U.A. in Owens-Corning (India) Pvt. Ltd. by Triumph Composites Pvt. Ltd. and Quartz Fibre Private Limited.

- In June 2025, Heraeus Covantics introduced a large-format Fluosil® preform for fused silica applications, strengthening its high-purity quartz and fused silica processing capabilities.

- In August 2025, Rock West Composites completed a radome prototype using quartz-reinforced epoxy, highlighting growing aerospace applications for quartz yarn and fabrics.

- In February 2024, Saint-Gobain Advanced Ceramic Composites expanded its oxide fibers program, reinforcing its strategic focus on advanced silica and quartz fiber technologies.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Yarn Type, End Use Industry, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in aerospace and defense due to advanced composite adoption.

- Automotive manufacturers will increasingly use quartz yarn for lightweight and thermal-resistant components.

- Chemical processing industries will expand applications in filtration and sealing solutions.

- Construction sector adoption will grow with rising focus on durable insulation materials.

- Oil and gas industry will integrate quartz yarn in high-temperature and corrosive environments.

- Asia Pacific will strengthen its lead with large-scale production and export capacity.

- North America will sustain growth through defense investments and space exploration projects.

- Europe will focus on high-performance composites supported by strict quality standards.

- Companies will emphasize process innovation to lower production costs and expand reach.

- Strategic collaborations and capacity expansions will shape long-term competitiveness in the market.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: