Market Overview

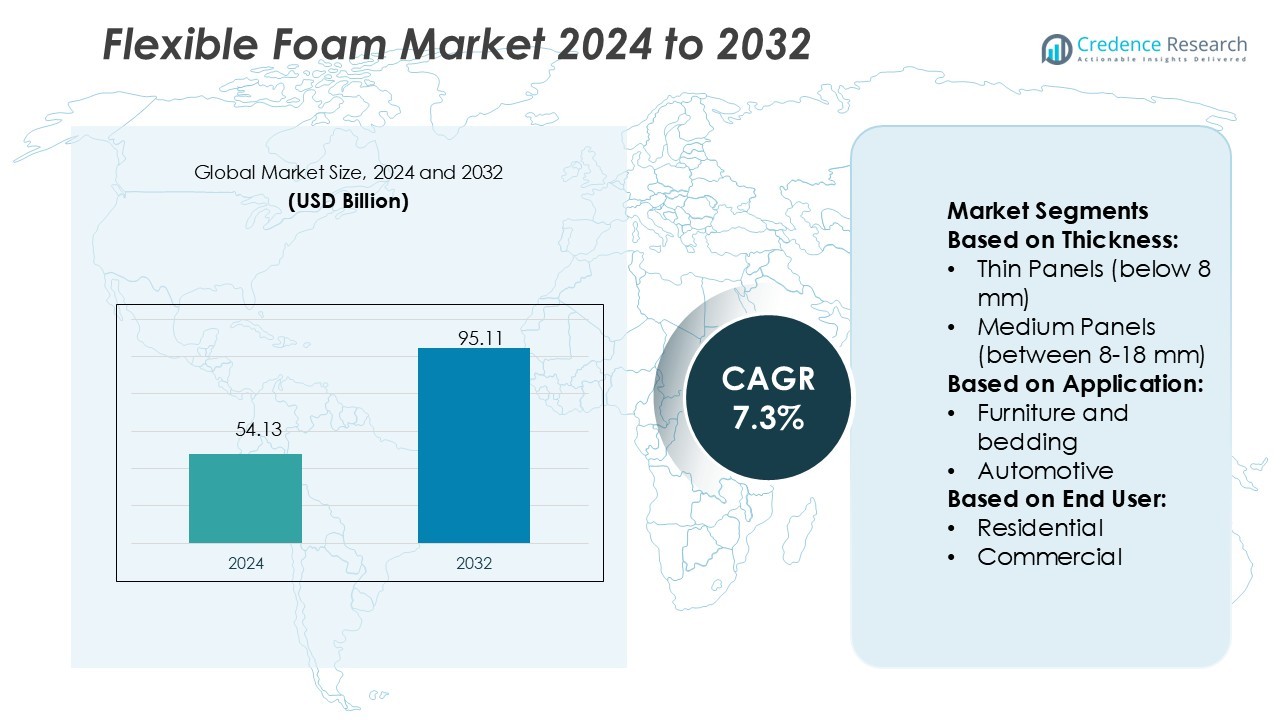

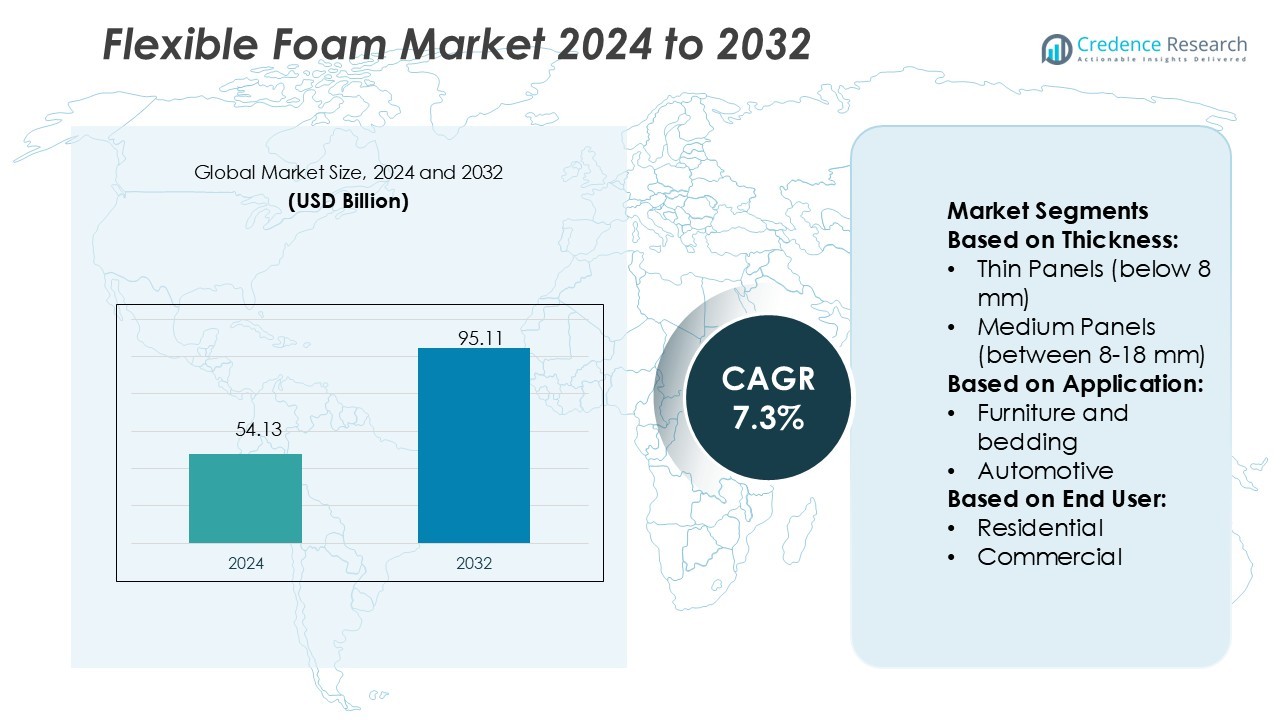

Flexible Foam Market size was valued USD 54.13 billion in 2024 and is anticipated to reach USD 95.11 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Foam Market Size 2024 |

USD 54.13 Billion |

| Flexible Foam Market, CAGR |

7.3% |

| Flexible Foam Market Size 2032 |

USD 95.11 Billion |

The flexible foam market is shaped by leading players such as BASF, Covestro, Dow, Huntsman, Recticel, Foamco, Foam Creations, Heubach, Poly Labs, and General Plastics, each focusing on innovation, sustainability, and tailored applications across industries. These companies invest in advanced polyurethane formulations, lightweight designs, and eco-friendly solutions to meet rising demand in furniture, automotive, construction, and packaging sectors. Among global regions, Asia Pacific leads the market with a 32% share, supported by rapid urbanization, strong automotive production, and expanding consumer demand for comfort-driven products. This dominance highlights the region’s role as the key growth hub for flexible foam.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Flexible Foam Market size was valued at USD 54.13 billion in 2024 and is expected to reach USD 95.11 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Market growth is driven by rising demand from furniture and bedding, which hold the largest application share at 39%, supported by consumer preference for comfort and lifestyle-focused products.

- Sustainability trends are reshaping the industry, with companies investing in eco-friendly, recyclable, and bio-based foam formulations to align with regulatory standards and consumer expectations.

- Competitive intensity remains high, as leading players such as BASF, Covestro, Dow, Huntsman, and Recticel expand production capacity, innovate lightweight polyurethane foams, and form strategic partnerships to strengthen market positions.

- Regionally, Asia Pacific dominates with 32% share, supported by rapid urbanization, industrial expansion, and automotive production, while North America and Europe follow with strong adoption in green building, premium furniture, and automotive comfort solutions.

Market Segmentation Analysis:

By Thickness

In the flexible foam market, medium panels between 8–18 mm hold the largest share at 46%. Their dominance stems from balanced performance, offering both durability and cushioning for a wide range of applications. These panels are widely used in furniture, automotive interiors, and construction insulation, where comfort and resilience are critical. Demand continues to grow as manufacturers emphasize ergonomic designs and energy efficiency. The ability of medium panels to deliver cost-effective production while ensuring long-lasting performance makes them the preferred thickness segment across industries.

- For instance, Recticel produces high-performance polyurethane (PUR) and polyisocyanurate (PIR) insulation, which can achieve thermal conductivity values as low as 0.022 W/m·K.

By Application

Furniture and bedding lead the market with a 39% share, driven by rising demand for comfort-focused consumer products. Flexible foam is essential in mattresses, sofas, and cushions due to its softness and resilience. The growth of the home furnishing sector, coupled with lifestyle shifts toward premium comfort, strengthens this segment’s position. Technological advances in foam density and breathable materials enhance product quality. As consumer focus on wellness and rest intensifies, the furniture and bedding application continues to dominate, supported by both residential and commercial demand.

- For instance, Saint-Gobain’s Norseal PS-V0 micro-cellular polyurethane foam achieves UL94 V-0 rating in thicknesses from 3.5 mm up to 12 mm, and when compressed by 30 % it remains airtight up to 10 kPa (1.5 psi).

By End User

The residential segment dominates with a 42% share, reflecting strong consumer reliance on flexible foam in daily-use products. Mattresses, seating, and home furnishings remain the largest contributors, boosted by urbanization and higher disposable incomes. Expanding housing projects and the trend of interior modernization further support this segment. Consumers increasingly prefer flexible foam-based solutions for comfort and energy efficiency. This preference, along with continuous innovation in home furniture and bedding, secures the residential sector’s lead over commercial and industrial applications in the market.

Key Growth Drivers

Expanding Demand in Furniture and Bedding

The growing furniture and bedding sector is a primary driver of the flexible foam market. Rising consumer preference for comfort-oriented products such as mattresses, sofas, and cushions increases foam adoption. Medium-density foams are in high demand due to their resilience, lightweight structure, and ergonomic benefits. Urbanization and expanding housing projects further boost consumption, while premium lifestyle trends encourage innovation in breathable and high-performance foam materials. Continuous product improvements and focus on quality reinforce furniture and bedding as the largest growth catalyst for flexible foam applications.

- For instance, Armacell’s ArmaComfort NR-P combines polyurethane (PU) foam with mass loading to provide acoustic insulation. The product is rated with a weighted sound absorption coefficient of 0.25 (H) for its 12 mm thick variant, according to ISO 354 and EN ISO 11654.

Automotive Industry Growth and Comfort Needs

The automotive industry drives significant demand for flexible foam, particularly in seating, headrests, and insulation. Rising vehicle production and consumer preference for enhanced comfort and noise reduction accelerate foam usage. Lightweight foams help automakers meet fuel efficiency and emission standards by reducing vehicle weight. Electric vehicle adoption further strengthens this driver, as thermal and acoustic management become essential. Innovations in flame-retardant and recyclable foams also align with industry sustainability goals. The shift toward advanced mobility solutions ensures steady growth of foam demand across global automotive markets.

- For instance, Dow’s STYROFOAM™ Highload XPS insulation delivers compressive strengths of 40, 60, and 100 psi (275, 415, 690 kPa) while maintaining R-value of 5.0 per inch.

Construction and Insulation Applications

Flexible foam demand in construction is rising due to its insulation, soundproofing, and energy efficiency benefits. Foams provide effective thermal and acoustic barriers, supporting modern building codes and sustainability goals. Growing infrastructure projects in both residential and commercial sectors fuel market growth. Increased awareness of green buildings and energy conservation enhances foam adoption in insulation materials. Manufacturers are developing high-durability, fire-resistant foams to meet stringent safety regulations. The combination of urban expansion and regulatory emphasis positions construction and insulation as a strong growth driver for the flexible foam market.

Key Trends & Opportunities

Sustainability and Eco-Friendly Foam Development

The shift toward sustainable materials is reshaping the flexible foam market. Manufacturers are investing in bio-based and recyclable foam alternatives to reduce environmental impact. Consumer awareness of eco-friendly products and regulatory restrictions on petrochemical-based materials drive this trend. Innovations in plant-based foams and closed-loop recycling systems create new growth opportunities. Companies adopting circular economy models are gaining competitive advantages, particularly in regions with strict environmental laws. The transition to sustainable foam solutions strengthens long-term market growth while addressing global environmental concerns.

- For instance, Huntsman’s ACOUSTIFLEX® VEF BIO system incorporates up to 20 % bio-based content while still achieving the same acoustic attenuation magnitude as their standard VEF foams (< 500 Hz).

Technological Innovation in Foam Manufacturing

Advancements in foam production technologies open opportunities for product diversification and performance enhancement. Innovations in microcellular foams, flame-retardant formulations, and high-resilience foams improve comfort, safety, and durability. Automation and precision engineering in manufacturing processes enhance efficiency and reduce production costs. Emerging smart foams with adaptive properties also expand potential applications in healthcare and automotive sectors. These innovations help companies differentiate offerings and meet evolving consumer demands. Technology-driven product development positions manufacturers to capitalize on future opportunities in both developed and emerging markets.

- For instance, Covestro leads chemical innovation with CO₂-based rigid polyurethane foam precursors. In its latest R&D, up to 20 % of petroleum feedstock is replaced by CO₂-derived intermediates, and prototype insulation boards built from CO₂-based polyols matched conventional foam’s thermal and mechanical benchmarks.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of petrochemical-based raw materials such as polyurethane limit stable production costs. Dependence on crude oil markets exposes foam manufacturers to unpredictable price swings, affecting profitability. Sudden cost increases challenge small and mid-sized producers, reducing competitiveness. The volatility also creates uncertainty in long-term supply contracts with end users. While companies explore bio-based alternatives, large-scale adoption remains limited due to higher costs. Addressing raw material volatility through strategic sourcing and technological alternatives is critical for sustaining growth in the flexible foam market.

Environmental and Regulatory Pressures

Stringent environmental regulations regarding petrochemical usage, emissions, and recycling challenge foam manufacturers. Compliance with sustainability standards demands significant investments in R&D and process modifications. Non-compliance risks penalties, brand damage, and reduced access to environmentally conscious markets. Rising restrictions on single-use plastics and landfill waste increase pressure to innovate eco-friendly foam solutions. Manufacturers face difficulties balancing regulatory compliance with cost efficiency, especially in price-sensitive markets. Developing sustainable formulations and strengthening recycling systems are essential to overcoming regulatory challenges in the flexible foam market.

Regional Analysis

North America

America holds a 27% share of the flexible foam market, driven by strong demand from furniture, bedding, and automotive industries. The U.S. leads the region with high adoption in premium mattresses and energy-efficient construction materials. Expanding e-commerce also fuels packaging applications, while automakers increasingly use lightweight foams for comfort and compliance with fuel standards. Growing awareness of eco-friendly and recyclable foam solutions supports market expansion. The presence of established manufacturers and technological innovation further strengthen North America’s position, making it one of the most mature and competitive regional markets for flexible foam.

Europe

Europe accounts for 25% of the flexible foam market, supported by stringent regulations promoting sustainability and recycling. Countries like Germany, France, and the UK dominate demand, particularly in automotive seating, bedding, and green building insulation. Strong focus on circular economy principles accelerates the adoption of bio-based and recyclable foams. The region also benefits from advanced manufacturing technologies and consumer preference for high-quality, durable products. Packaging applications are gaining traction due to sustainability-driven shifts away from plastics. Europe’s regulatory landscape and consumer awareness ensure steady growth, keeping the region at the forefront of sustainable foam innovation.

Asia Pacific

Asia Pacific leads the flexible foam market with a 32% share, driven by rapid urbanization, industrial growth, and rising disposable incomes. China and India dominate demand for bedding, furniture, and construction insulation products. Expanding automotive manufacturing hubs in China, Japan, and South Korea further fuel foam consumption in seating and interior applications. Growing middle-class populations demand premium comfort and lifestyle products, boosting residential use. The region also experiences strong growth in packaging applications through e-commerce expansion. Low-cost manufacturing, coupled with increasing innovation in foam technologies, positions Asia Pacific as the fastest-growing and most dynamic market.

Latin America

Latin America represents 9% of the global flexible foam market, with Brazil and Mexico serving as key contributors. Growing construction activities and rising furniture demand drive foam adoption in the region. Automotive manufacturing in Mexico also fuels usage, particularly in seating and insulation applications. Increasing consumer preference for cost-effective and durable products supports residential demand, while e-commerce packaging shows steady growth. Challenges include economic volatility and slower adoption of advanced foam technologies compared to developed regions. However, rising investments in manufacturing capacity and urban infrastructure provide growth opportunities for flexible foam producers in Latin America.

Middle East & Africa

The Middle East & Africa account for 7% of the flexible foam market, supported by demand in construction, furniture, and bedding sectors. Rapid urbanization, infrastructure development, and housing projects drive adoption, particularly in Gulf countries like the UAE and Saudi Arabia. The automotive industry also contributes, with lightweight foams used for seating and interiors. Rising awareness of comfort-focused products boosts residential demand, while packaging applications gain importance in expanding retail sectors. Although the region faces supply chain and cost challenges, growing investments in modern infrastructure and consumer lifestyles support steady long-term growth for flexible foam products.

Market Segmentations:

By Thickness:

- Thin Panels (below 8 mm)

- Medium Panels (between 8-18 mm)

By Application:

- Furniture and bedding

- Automotive

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flexible foam market features key players including Recticel, Foam Creations, BASF, Heubach, Poly Labs, Huntsman, Dow, Foamco, Covestro, and General Plastics. The flexible foam market is defined by continuous innovation, sustainability initiatives, and strong regional presence. Companies are increasingly investing in research and development to create advanced foam solutions with improved durability, lightweight properties, and recyclability. The market sees intense competition as players focus on cost efficiency, product diversification, and compliance with evolving environmental regulations. Strategic partnerships, mergers, and capacity expansions are common approaches to strengthen market positions and extend global reach. Growing demand in furniture, automotive, and construction applications ensures that competition remains centered on delivering high-performance, eco-friendly foam solutions to meet diverse customer needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Recticel

- Foam Creations

- BASF

- Heubach

- Poly Labs

- Huntsman

- Dow

- Foamco

- Covestro

- General Plastics

Recent Developments

- In December 2024, Dow introduced Voranol WK5750 polyether polyol, ideal for viscoelastic, hypersoft, and specialty slabstock foam used in mattresses, furniture, and automotive seating.

- In September 2024, BASF and Future Foam began commercial production of flexible foam for the bedding industry using 100% domestically sourced Biomass Balance (BMB) Lupranate T 80 toluene diisocyanate (TDI). This TDI is produced at BASF’s Verbund site in Geismar, Louisiana. This milestone underscores both companies’ commitment to sustainability.

- In April 2024, Huntsman automotive experts added new lightweight, durable polyurethane foam technologies to their battery solutions portfolio. These technologies are designed for potting and fixing cells in electric vehicle (EV) batteries and can also be used as moldable encapsulants in battery modules or packs.

- In March 2024, Seawise Innovative Packaging launched Styrofoam, an alternative form of packaging that is designed to replace extensively used EPS foam. The new packaging is designed to be a cost-effective solution for companies trying to reduce the use of plastics in their supply chain.

Report Coverage

The research report offers an in-depth analysis based on Thickness, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand from furniture and bedding applications.

- Automotive adoption of lightweight foams will expand to support comfort and fuel efficiency.

- Construction will drive growth as energy-efficient insulation materials gain wider usage.

- Packaging applications will rise with the continued expansion of global e-commerce.

- Sustainability will remain central, with bio-based and recyclable foams gaining strong traction.

- Technological advances will lead to high-performance foams with improved resilience and durability.

- Healthcare and sanitary products will offer new growth opportunities for specialized foams.

- Regional demand in Asia Pacific will strengthen due to rapid urbanization and industrialization.

- Strategic partnerships and mergers will increase as companies aim for global competitiveness.

- Regulatory compliance and circular economy adoption will shape long-term industry direction.