Market Overview

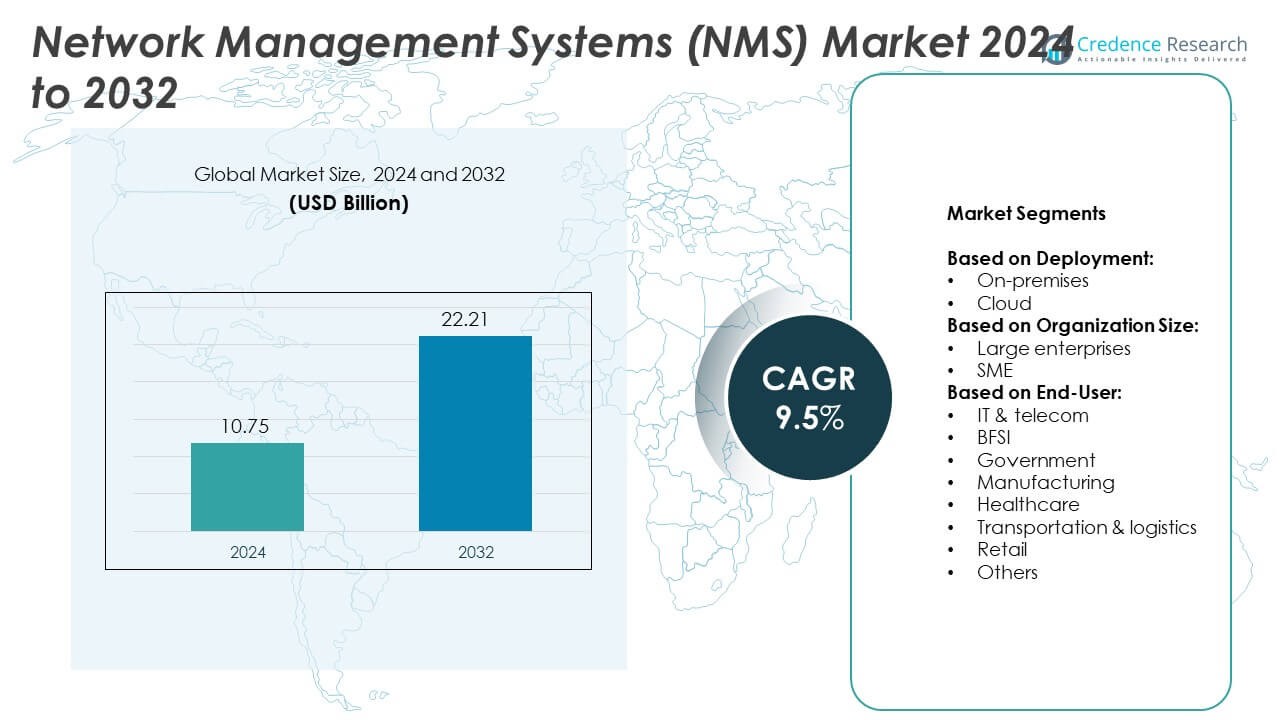

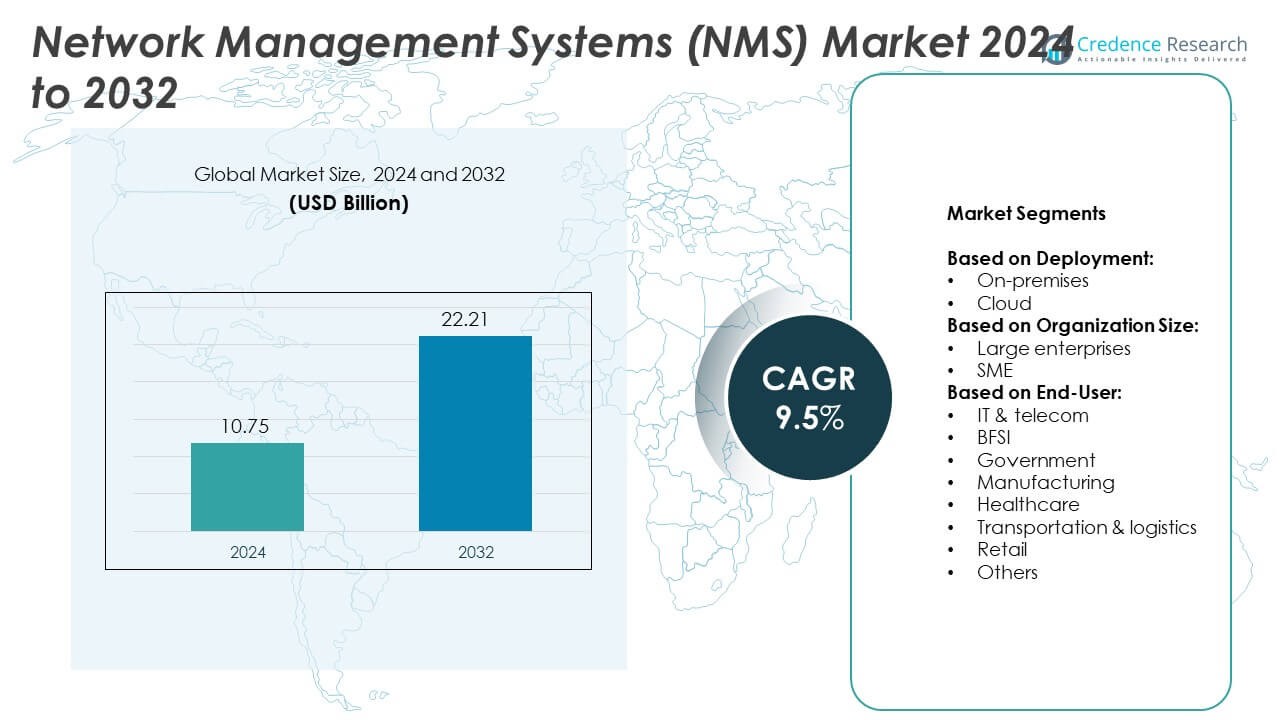

Network Management Systems (NMS) Market size was valued at USD 10.75 Billion in 2024 and is anticipated to reach USD 22.21 Billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Network Management Systems (NMS) Market Size 2024 |

USD 10.75 Billion |

| Network Management Systems (NMS) Market, CAGR |

9.5% |

| Network Management Systems (NMS) Market Size 2032 |

USD 22.21 Billion |

The Network Management Systems (NMS) market grows due to increasing network complexity, cloud adoption, and demand for centralized visibility. Enterprises seek tools that automate fault detection, optimize bandwidth, and ensure compliance. Rising deployment of IoT devices and 5G infrastructure drives demand for scalable, real-time monitoring solutions. AI integration, predictive analytics, and zero-touch provisioning shape key market trends. Vendors focus on automation, cybersecurity integration, and cloud-native platforms to support hybrid environments and reduce operational risk.

North America leads the Network Management Systems (NMS) market due to strong digital infrastructure and early technology adoption across telecom, healthcare, and BFSI sectors. Europe follows with increasing demand from government and industrial segments, supported by strict data compliance laws. Asia Pacific shows rapid growth driven by 5G rollout, cloud expansion, and digital transformation in emerging economies. Key players active across these regions include Cisco Systems, Huawei Technologies, IBM, and Juniper Networks, offering scalable, cloud-based, and AI-enabled NMS solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Network Management Systems (NMS) market was valued at USD 10.75 Billion in 2024 and is projected to reach USD 22.21 Billion by 2032, growing at a CAGR of 9.5%.

- Rising network complexity, increasing IoT adoption, and demand for centralized monitoring are key drivers of market growth.

- AI integration, cloud-native platforms, and predictive analytics are emerging as major trends in next-generation NMS solutions.

- Leading companies focus on automation, SDN support, and cybersecurity integration to strengthen their competitive position.

- High deployment costs, integration challenges with legacy systems, and skilled workforce shortages act as major restraints.

- North America dominates the market, supported by robust digital infrastructure and early cloud adoption; Asia Pacific shows fastest growth with 5G and enterprise digitization.

- Vendors prioritize modular designs, multi-vendor compatibility, and managed service models to expand reach across SMEs and large enterprises.

Market Drivers

Rising Demand for Centralized Network Visibility Across Expanding Enterprise Infrastructure

The Network Management Systems (NMS) market is driven by enterprises expanding their network infrastructure across hybrid environments. Organizations require unified visibility to monitor routers, switches, firewalls, and wireless components in real time. It enables IT teams to detect faults, identify bottlenecks, and maintain consistent service levels. Increasing reliance on digital tools, SaaS applications, and remote access further amplifies the need for centralized control. NMS platforms offer dashboards, alerts, and historical performance logs for better network reliability. It ensures rapid response to disruptions while reducing downtime and operational risk.

- For instance, Cisco’s network management platform, now known as Catalyst Center (formerly DNA Center), provides a dashboard for monitoring, securing, and managing networks, including wired and wireless devices. The platform is used by numerous large enterprises, with customer case studies demonstrating its use in complex environments, such as at a large hospital system and for managing campus and branch networks. The company has a long history of high adoption in large enterprises, including within the Fortune 500.

Rapid Growth in IoT Devices and Connected Endpoints Requires Scalable Monitoring Solutions

IoT proliferation creates complex, multi-endpoint environments that demand advanced monitoring capabilities. The Network Management Systems (NMS) market supports organizations by offering tools that scale with expanding device footprints. It helps track connectivity, latency, and device performance across geographically dispersed assets. Enterprises in manufacturing, logistics, and utilities integrate NMS to secure machine-to-machine communications. Rising threat surfaces from unsecured IoT endpoints increase the value of real-time anomaly detection. It strengthens endpoint control and minimizes data loss through proactive alerts and diagnostic tools.

- For instance, The industrial software market experienced over 12% growth in 2024, with IoT Analytics noting that AI became a top technology topic.

Need for Enhanced Cybersecurity and Network Compliance Reinforces System Adoption

Rising cyberattacks on enterprise networks highlight the need for secure and compliant network operations. The Network Management Systems (NMS) market supports policy enforcement, access control, and threat detection from a central interface. It helps detect unauthorized access, unusual traffic flows, or rogue devices before breaches escalate. Regulatory mandates in finance, healthcare, and telecom demand full audit trails and compliance-ready reporting. NMS tools simplify documentation, automate compliance tasks, and reduce legal exposure. It plays a critical role in securing digital infrastructure without overloading internal IT teams.

Cloud Migration and SDN Adoption Drive Demand for Agile, Software-Based Network Management

Shift toward cloud-first strategies and software-defined networking (SDN) demands flexible, software-centric monitoring solutions. The Network Management Systems (NMS) market enables dynamic configuration, virtualization management, and seamless integration with APIs. It aligns with evolving enterprise needs, supporting hybrid and multi-cloud environments with scalable controls. Cloud-native NMS platforms offer remote access, faster deployment, and lower maintenance overhead. These platforms adapt quickly to changing workloads, enabling real-time response to performance shifts. It supports business continuity and system agility in volatile digital environments.

Market Trends

Rising Shift Toward AI-Powered Network Analytics and Predictive Maintenance Capabilities

The Network Management Systems (NMS) market is witnessing strong adoption of AI and machine learning for advanced network analytics. AI enables predictive maintenance by analyzing historical data to identify early signs of equipment failure or performance issues. It helps IT teams prioritize fixes before disruptions occur. Vendors integrate anomaly detection, pattern recognition, and automated root cause analysis into core NMS offerings. These features reduce manual workload and improve resolution times. It enhances network resilience and operational efficiency across complex architectures.

- For instance, VMware’s NSX platform (formerly NSX-T), which is part of the VMware Cloud Foundation (VCF) offering, provides a scalable and secure software-defined networking solution. It enables dynamic configuration and microsegmentation for modern applications, with one high-end NSX Edge Virtual Machine (EVM) supporting a maximum throughput of approximately 20 Gbps.

Increased Focus on Automation and Zero-Touch Provisioning Across Multi-Vendor Environments

Growing enterprise reliance on automation drives the integration of zero-touch provisioning and configuration management in NMS platforms. The Network Management Systems (NMS) market supports this trend by offering orchestration features across devices from different vendors. It helps streamline onboarding, firmware updates, and policy deployment without manual intervention. These tools minimize human error and shorten network rollout timelines. Enterprises gain more agility while maintaining control over compliance and security standards. It supports consistent performance across heterogeneous network environments.

- For instance, according to Nokia documentation, ZTP enables the automatic configuration of network nodes with minimal manual intervention. In 2023, Nokia’s network business saw a surge in demand, particularly driven by 5G rollouts in India.

Growing Adoption of Cloud-Native and SaaS-Based Network Management Platforms

Cloud-native architectures are reshaping how enterprises deploy and scale their NMS tools. The Network Management Systems (NMS) market sees rapid migration from legacy on-premise tools to SaaS models. It improves accessibility, flexibility, and ease of integration with cloud services. SaaS-based NMS platforms offer continuous updates, faster deployments, and reduced infrastructure cost. Remote teams benefit from centralized control panels and API-driven configuration. It supports decentralized IT operations and hybrid workforce models.

Integration of NMS with Cybersecurity Frameworks and Zero Trust Architectures

Network management increasingly intersects with cybersecurity to form unified visibility and control layers. The Network Management Systems (NMS) market reflects this by embedding threat intelligence, access control, and behavior analytics. It supports integration with SIEM, SOAR, and endpoint protection systems. Enterprises adopt NMS to enforce Zero Trust principles across devices, users, and applications. This trend strengthens perimeter defense without adding monitoring silos. It enables more comprehensive risk management and policy enforcement.

Market Challenges Analysis

Complexity in Managing Heterogeneous Networks Across Legacy and Modern Infrastructure

Enterprises often struggle to manage hybrid networks that combine legacy systems with modern cloud and SDN infrastructure. The Network Management Systems (NMS) market faces a challenge in offering seamless interoperability across diverse hardware, protocols, and platforms. It becomes difficult to apply consistent monitoring rules, automate processes, and maintain real-time visibility. Many NMS tools require extensive customization to handle proprietary configurations or outdated firmware. This increases setup time, training needs, and operational costs. It limits scalability and slows down digital transformation efforts in large enterprises.

Shortage of Skilled IT Professionals and Rising Complexity in Cyber Threat Detection

A growing talent gap in network engineering and security operations impacts the effective use of NMS platforms. The Network Management Systems (NMS) market must address the challenge of simplifying interfaces without reducing functionality. It becomes harder for teams to configure advanced alert settings, analyze logs, and apply threat detection protocols. Cyber threats continue to evolve faster than traditional NMS capabilities. Smaller firms without dedicated security teams struggle to respond to threats despite having tools in place. It creates vulnerabilities in critical systems and undermines trust in automation.

Market Opportunities

Expansion of 5G and Edge Infrastructure Unlocks Demand for Distributed Network Management Tools

The rollout of 5G and edge computing opens new growth avenues for NMS vendors. The Network Management Systems (NMS) market benefits from rising demand for tools that support low-latency, high-bandwidth, and decentralized infrastructure. It must monitor cell sites, edge servers, and micro data centers in real time. Enterprises deploying private 5G networks seek NMS platforms that enable dynamic bandwidth allocation and remote diagnostics. These systems improve service continuity while reducing site visits and maintenance overhead. It allows telecom operators and industrial users to scale networks efficiently across urban and remote areas.

Growing Need for Compliance Management in Regulated Sectors Boosts Market Penetration

Stricter compliance mandates in healthcare, finance, and utilities create strong demand for integrated monitoring and audit-ready reporting. The Network Management Systems (NMS) market can expand by providing tools that ensure data integrity, access traceability, and SLA enforcement. It supports compliance with standards like HIPAA, GDPR, and PCI-DSS by centralizing logs, alerts, and system changes. Vendors offering pre-configured compliance templates gain a competitive edge in regulated markets. Real-time policy validation reduces audit risks and strengthens governance frameworks. It empowers IT teams to meet legal requirements without manual effort.

Market Segmentation Analysis:

By Deployment:

The Network Management Systems (NMS) market divides into on-premises and cloud segments. On-premises solutions hold strong demand among large enterprises with strict data control policies. These systems offer deeper customization and integration with legacy infrastructure. However, the cloud segment shows faster growth due to its scalability, remote accessibility, and cost efficiency. It supports dynamic updates and centralized dashboards across distributed networks. Cloud-based NMS platforms gain momentum among companies with hybrid and multi-cloud environments.

- For instance, SolarWinds is a leading provider of IT management software, including both on-premises and SaaS solutions for network monitoring. The company transitioned towards a subscription-first model in 2023, reporting $234.2 million in subscription. As of December 2024, SolarWinds had over 300,000 customers worldwide across all its product offerings, though not necessarily for a single SaaS NMS.

By Organization Size:

Large enterprises represent a significant share due to complex networks and critical uptime requirements. They adopt NMS to streamline device monitoring, automate processes, and support regulatory needs. It enables large IT teams to manage infrastructure at scale with advanced analytics and reporting features. Small and medium enterprises (SMEs) adopt simplified, subscription-based NMS platforms with limited customization. These firms focus on affordability, ease of deployment, and low operational overhead. The SME segment grows as more businesses digitize operations and expand remote work setups.

- For instance, The Palo Alto Networks SASE platform leverages AI and extensive threat data to prevent cyberattacks, including stopping billions of threats daily. Instead of focusing on a specific number of connections, the company highlights the platform’s performance, such as its 99.999% uptime SLA, and customer testimonials that emphasize its ability to handle remote access at scale

By End-User:

IT and telecom remain leading end-users, driven by the need for real-time fault detection and bandwidth optimization. The BFSI sector uses NMS to ensure secure data transmission, uptime, and compliance across financial networks. Government agencies adopt these tools to maintain surveillance systems, citizen services, and infrastructure uptime. Manufacturing firms use NMS for uninterrupted production and machine connectivity. Healthcare providers deploy it to secure connected medical devices and patient data. In transportation and logistics, NMS platforms monitor vehicle tracking systems and warehouse connectivity. Retail chains adopt it to manage POS systems, store Wi-Fi networks, and supply chain links. Other sectors include education, utilities, and energy providers using NMS to support expanding digital infrastructure.

Segments:

Based on Deployment:

Based on Organization Size:

Based on End-User:

- IT & telecom

- BFSI

- Government

- Manufacturing

- Healthcare

- Transportation & logistics

- Retail

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share in the Network Management Systems (NMS) market, accounting for 38.6% of the global revenue in 2024. The region benefits from strong digital infrastructure, a high concentration of telecom operators, and early adoption of cloud-native solutions. The presence of major NMS vendors and technology innovators supports continuous upgrades and product enhancements. Enterprises across sectors such as BFSI, healthcare, and IT deploy NMS platforms to manage multi-location networks and ensure regulatory compliance. The rise of remote work, 5G rollouts, and hybrid IT environments has further increased the reliance on centralized network monitoring tools. Cloud-based NMS solutions are gaining popularity in the U.S. and Canada due to their scalability and integration with existing DevOps workflows. It strengthens enterprise agility and reduces downtime through real-time diagnostics and predictive alerts.

Europe

Europe accounts for 26.1% of the global Network Management Systems (NMS) market, with steady demand from telecom operators, government institutions, and industrial manufacturers. Strict regulatory frameworks like GDPR and the NIS Directive require secure, traceable, and auditable network operations. Enterprises in countries like Germany, France, and the UK actively invest in tools that support compliance reporting and data sovereignty. Manufacturing and automotive sectors deploy NMS to monitor factory networks, robotics systems, and logistics chains. Digital transformation across public and private sectors has driven investments in unified monitoring systems. The shift toward software-defined infrastructure and the adoption of AI-powered analytics are shaping the evolution of NMS platforms in this region. It improves operational resilience and supports European enterprises’ push for efficiency and cybersecurity readiness.

Asia Pacific

Asia Pacific holds a 21.4% share of the global Network Management Systems (NMS) market and is the fastest-growing regional segment. Countries like China, India, Japan, and South Korea invest heavily in 5G infrastructure, smart cities, and digital enterprise platforms. Large-scale network deployments by telecom operators and cloud service providers drive demand for scalable monitoring solutions. Small and mid-sized businesses in Southeast Asia adopt cloud-based NMS platforms due to low upfront costs and quick setup. Government-backed digitization programs, combined with rising cyber threats, push both public and private entities to prioritize network visibility and security. The growing number of data centers and edge computing nodes across the region further expands the market scope. It enables real-time monitoring across geographically dispersed infrastructure while reducing response time to network anomalies.

Latin America

Latin America contributes 8.1% to the global Network Management Systems (NMS) market, supported by growing investments in telecom upgrades and enterprise IT modernization. Brazil, Mexico, and Argentina lead regional adoption, focusing on infrastructure reliability and cybersecurity. Enterprises deploy NMS platforms to improve connectivity, reduce outages, and enable policy-driven network control. Adoption is driven by sectors like banking, public services, and logistics that require reliable network uptime for digital operations. Cloud-based offerings gain traction among mid-sized firms that need budget-friendly solutions. The rise of smart retail, healthcare digitalization, and cross-border e-commerce expands demand for real-time monitoring capabilities. It helps businesses maintain secure, fast, and scalable network environments in emerging urban centers.

Middle East & Africa

Middle East & Africa holds a 5.8% share of the global Network Management Systems (NMS) market, with momentum building in GCC countries and parts of North Africa. Governments in the UAE, Saudi Arabia, and South Africa are investing in digital transformation initiatives, smart cities, and secure data infrastructure. Telecom operators and public utilities deploy NMS to maintain network availability and regulatory compliance. Enterprises across sectors like oil and gas, education, and healthcare seek tools that monitor infrastructure in real time, especially in remote or high-risk environments. Local challenges such as limited IT skills and high latency in rural regions create opportunities for managed NMS services. It improves monitoring reach and system control across infrastructure-constrained environments.

Key Player Analysis

- Juniper Networks

- Alcatel

- BMC Software

- Riverbed Technology

- HPE Aruba

- Broadcom

- Nokia Corporation

- Cisco Systems

- Check Point Software Technologies Ltd.

- Huawei Technologies

- IBM

- Hewlett Packard Enterprise (HPE)

Competitive Analysis

The Network Management Systems (NMS) market features strong competition among key players including Juniper Networks, Alcatel, BMC Software, Riverbed Technology, HPE Aruba, Broadcom, Nokia Corporation, Cisco Systems, Check Point Software Technologies Ltd., Huawei Technologies, IBM, and Hewlett Packard Enterprise (HPE). These companies focus on scalable, AI-integrated, and cloud-native solutions to support enterprise-wide network visibility, automation, and threat detection. Most vendors expand their offerings with SDN support, real-time analytics, and centralized control features. Cloud-based deployments gain momentum, prompting legacy providers to upgrade their software portfolios to match evolving hybrid infrastructure demands. Integration with cybersecurity tools, compliance modules, and IoT monitoring further differentiates their product lines. Strategic acquisitions, R&D investments, and global service delivery help them compete across enterprise, telecom, and government sectors. Companies strengthen customer retention through modular platforms, remote diagnostics, and support for multi-vendor ecosystems. With rising demand for predictive maintenance and zero-touch provisioning, leading vendors focus on automation, ease of deployment, and cross-platform operability to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In 2025, Juniper Networks completed acquisition by Hewlett Packard Enterprise (HPE), aiming to integrate Juniper’s networking with HPE’s AI infrastructure and hybrid cloud stack, including expanding into data center, firewalls, and routers. The deal took over 18 months to close.

- In 2025, Cisco unveiled a secure network architecture designed for campus, branch, and industrial networks. The solution offers unified management, AI‑optimized devices, and embedded security features.

- In 2025, Huawei unveiled upgraded Xinghe Intelligent Network products in Asia Pacific that embed AI capabilities and published technical standards for financial data center networks.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Organization Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-native NMS platforms will continue to gain traction across hybrid and multi-cloud environments.

- AI and machine learning will play a larger role in predictive network analytics and anomaly detection.

- Demand for NMS tools will grow with 5G deployment and edge infrastructure expansion.

- Enterprises will prioritize integrated NMS platforms with built-in security and compliance features.

- Automation and zero-touch provisioning will become standard features in advanced NMS solutions.

- SME adoption will rise due to the availability of affordable, subscription-based cloud NMS offerings.

- Integration with SDN and network virtualization tools will increase across enterprise networks.

- NMS vendors will focus on improving scalability and interoperability for large, distributed networks.

- Industry-specific NMS solutions will emerge to meet unique compliance and performance needs.

- Managed NMS services will grow in regions with limited in-house IT and network management resources.