Market Overview:

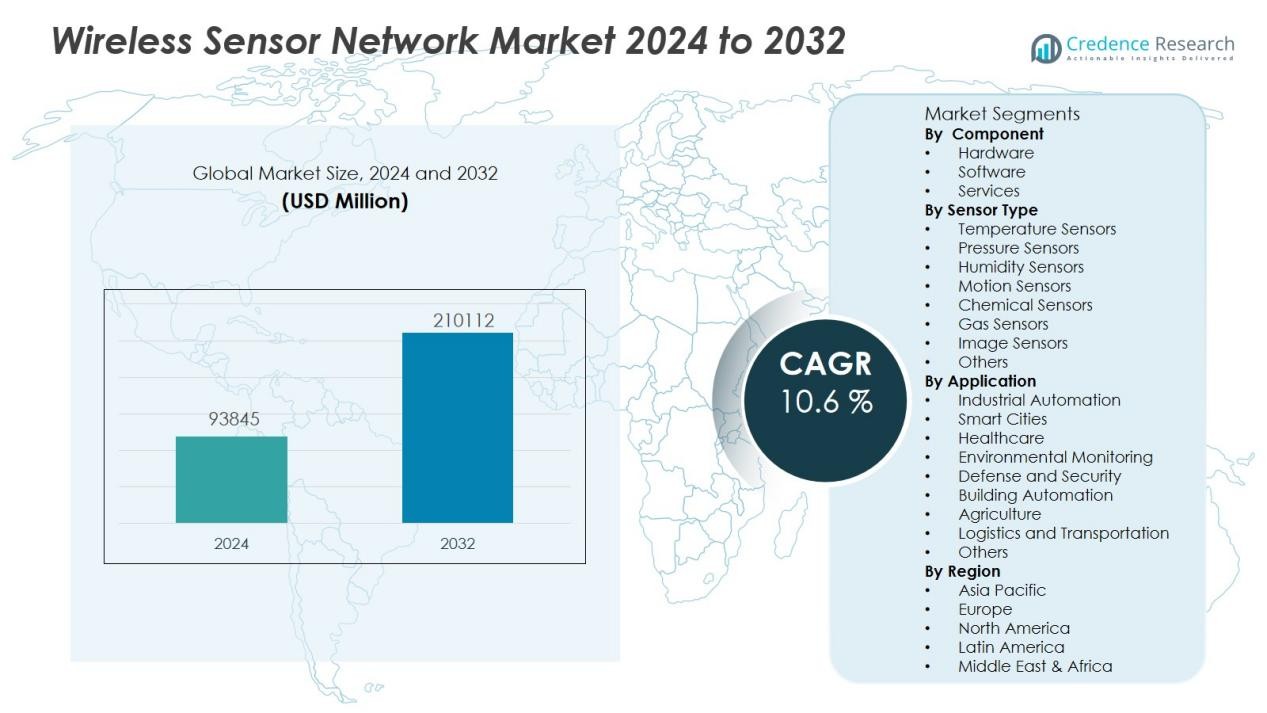

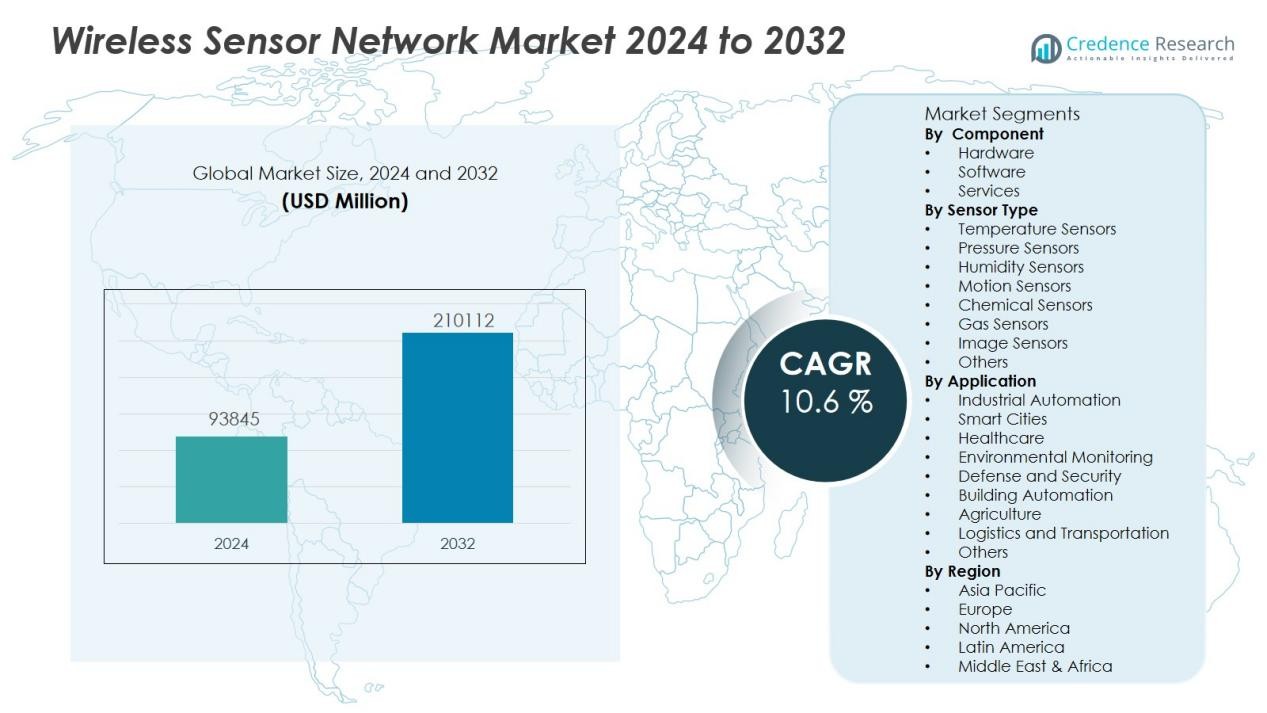

The Wireless sensor network market size was valued at USD 93845 million in 2024 and is anticipated to reach USD 210112 million by 2032, at a CAGR of 10.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless sensor network market Size 2024 |

USD 93845 Million |

| Wireless sensor network market , CAGR |

110.6 % |

| Wireless sensor network market Size 2032 |

USD 210112 Million |

Key drivers fueling the wireless sensor network market include the increasing demand for real-time data analytics, growing investments in smart infrastructure, and the rising focus on energy-efficient monitoring solutions. Enterprises leverage wireless sensor networks to enhance operational efficiency, enable predictive maintenance, and improve decision-making through continuous data collection and analysis. The evolution of low-power wireless technologies, coupled with declining sensor costs, accelerates the deployment of scalable sensor networks across new and existing applications.

Regionally, North America holds the largest share of the wireless sensor network market, supported by early adoption of advanced technologies, robust R&D initiatives, and a well-established IoT ecosystem. Asia-Pacific follows closely, driven by rapid urbanization, expanding manufacturing activities, and increased government investments in smart city and industrial automation projects. Europe demonstrates steady growth, while emerging markets in Latin America and the Middle East & Africa show rising potential as digital transformation initiatives gain momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The wireless sensor network market size reached USD 93,845 million in 2024 and is forecast to achieve USD 210,112 million by 2032, growing at a CAGR of 10.6% during the period.

- Rising demand for real-time data analytics and smart infrastructure propels adoption across sectors including building automation, environmental monitoring, and intelligent transportation.

- Advancements in low-power wireless technologies and scalable protocols enable cost-effective, large-scale deployments with extended device lifespan and minimal maintenance.

- Declining sensor costs and increased IoT integration make extensive sensor arrays feasible, enhancing asset tracking, predictive maintenance, and centralized data management.

- Government initiatives and smart city investments accelerate adoption by supporting public safety, energy efficiency, and urban management through advanced monitoring projects.

- Security vulnerabilities, data privacy concerns, and limited power resources present challenges, requiring robust encryption, authentication, and power-efficient designs to ensure network reliability.

- North America leads market share due to early technology adoption and strong R&D, while Asia-Pacific exhibits the fastest growth supported by urbanization, digital infrastructure, and proactive government policies.

Market Drivers:

Rising Demand for Real-Time Data and Smart Infrastructure:

The surge in demand for real-time data acquisition and analysis fuels significant growth in the wireless sensor network market. Organizations across industries require instant, accurate information to monitor operations, ensure safety, and optimize performance. Wireless sensor networks deliver seamless connectivity and flexibility, enabling efficient data collection from remote or challenging environments. This real-time capability supports smart infrastructure development in areas such as building automation, environmental monitoring, and intelligent transportation systems.

- For instance, Cisco implemented its Aironet Active Sensors in a smart building, enabling real-time simulation and analysis across up to 40 access points per floor, with each sensor testing up to 5 APs per cycle for comprehensive, rapid data collection and monitoring coverage.

Advancements in Low-Power and Scalable Wireless Technologies:

Continued innovation in low-power wireless protocols and scalable architectures drives broader adoption of wireless sensor networks. Modern sensors utilize technologies such as Zigbee, LoRa, and Bluetooth Low Energy, reducing energy consumption and extending device lifespan. These advances enable cost-effective deployment of large-scale networks with minimal maintenance. The availability of scalable, reliable connectivity supports diverse applications, from precision agriculture to large industrial plants.

- For instance, Semtech’s SX1262 LoRa transceiver achieves sleep currents as low as 0.1 µA while still supporting receive sensitivity of +22 dBm and 4.2 mA receive current, allowing wide-area sensor nodes to remain in the field for more than seven years on two AA batteries.

Declining Sensor Costs and Widespread IoT Integration:

Falling costs of sensor hardware and increasing integration with the Internet of Things (IoT) ecosystem accelerate market expansion. It becomes feasible for organizations to deploy extensive sensor arrays without substantial capital investment. Wireless sensor networks now form the backbone of IoT-enabled environments, allowing for seamless interoperability and centralized data management. Organizations benefit from improved asset tracking, predictive maintenance, and optimized supply chain operations.

Government Initiatives and Investments in Smart Cities:

Government-led initiatives and investments in smart city infrastructure create strong momentum for the wireless sensor network market. Authorities prioritize projects that enhance public safety, energy efficiency, and urban management through advanced monitoring solutions. Funding and policy support for smart grids, water management, and intelligent transportation boost adoption rates. These initiatives establish a favorable regulatory landscape and open new opportunities for technology providers and system integrators.

Market Trends:

Integration of Artificial Intelligence and Edge Computing in Sensor Networks:

Artificial intelligence and edge computing now play a pivotal role in transforming the wireless sensor network market. Companies integrate AI-driven analytics directly into sensor nodes, enabling real-time data processing and rapid decision-making at the edge. This shift minimizes latency, conserves bandwidth, and enhances system reliability by reducing dependency on centralized cloud infrastructure. The trend supports advanced applications such as anomaly detection, predictive maintenance, and autonomous operation in industrial, healthcare, and smart city environments. AI-powered networks provide actionable insights from complex data streams, improving efficiency and response times. The wireless sensor network market benefits from the seamless fusion of connectivity, computation, and intelligence at every network layer.

- For instance, Bosch’s XDK110 programmable sensor node incorporates onboard AI and edge computing to execute vibration analysis at a 2,000 Hz sampling rate, delivering anomaly alerts in as little as 10 ms from data capture.

Expansion of IoT Ecosystems and Adoption of Next-Generation Connectivity Standards:

IoT ecosystem expansion and the adoption of next-generation connectivity standards drive major changes in wireless sensor networks. Organizations deploy massive numbers of sensors across smart factories, logistics hubs, and environmental monitoring sites, relying on robust, standardized protocols for interoperability. The emergence of 5G, Wi-Fi 6, and LPWAN technologies supports high-density, low-latency communication, enabling new applications that require real-time, high-volume data transmission. The market experiences growing demand for interoperable, secure, and scalable network solutions to support diverse IoT use cases. It continues to evolve with industry standards and multi-protocol architectures, positioning wireless sensor networks as the backbone for digital transformation across sectors.

- For instance, Wi-Fi 6 routers manufactured by Cisco and Silicon Labs can now support 50 or more IoT end-devices per access point—more than double compared to previous Wi-Fi generations—while reducing device power consumption by approximately 20% through advanced Target Wake Time (TWT) scheduling.

Market Challenges Analysis:

Security Vulnerabilities and Data Privacy Concerns Limit Widespread Adoption:

Security vulnerabilities and data privacy concerns present ongoing challenges for the wireless sensor network market. Organizations deploying large-scale sensor networks must address risks related to unauthorized access, data breaches, and malicious attacks. The wireless and distributed nature of these networks makes them susceptible to interception and tampering. It requires robust encryption, authentication protocols, and continuous monitoring to safeguard sensitive information. Regulatory requirements around data privacy add another layer of complexity, demanding strict compliance measures. The market faces increased scrutiny from both end users and regulatory bodies to ensure trustworthy and resilient solutions.

Limited Power Resources and Maintenance Constraints Hinder Performance:

Limited power resources and maintenance constraints remain significant obstacles to optimal network performance. Battery-operated sensor nodes often experience reduced operational lifespans in harsh or remote environments, driving the need for frequent replacements or servicing. It places operational and financial strain on organizations managing extensive networks. Power-efficient designs and energy-harvesting solutions address some of these concerns, but technical barriers persist. The challenge intensifies in applications requiring real-time, continuous data collection and low-latency communication. These limitations slow deployment rates and impact the scalability of wireless sensor network solutions.

Market Opportunities:

Expansion of Smart Infrastructure and Industrial Automation Drives New Deployments:

The expansion of smart infrastructure and industrial automation presents significant growth opportunities for the wireless sensor network market. Smart cities, intelligent buildings, and connected factories require extensive sensor deployments to support automation, safety, and resource optimization. The market responds with customized solutions for diverse applications such as traffic management, structural health monitoring, and energy management. It enables municipalities and enterprises to gather actionable insights and enhance operational efficiency. The increasing focus on sustainability and cost savings further accelerates sensor network adoption. These trends create a fertile environment for innovation and value creation across public and private sectors.

Emerging Applications in Healthcare, Agriculture, and Environmental Monitoring Unlock Growth Potential:

Emerging applications in healthcare, agriculture, and environmental monitoring unlock new avenues for the wireless sensor network market. Healthcare providers use sensor networks to support patient monitoring, remote diagnostics, and hospital asset tracking, improving quality of care and resource utilization. In agriculture, precision farming and smart irrigation benefit from real-time environmental data, boosting productivity and reducing resource waste. Environmental monitoring applications leverage sensor networks to track air and water quality, detect hazards, and respond swiftly to ecological changes. It enables organizations to address pressing global challenges while opening new revenue streams for technology providers. These opportunities position wireless sensor networks at the center of next-generation digital ecosystems.

Market Segmentation Analysis:

By Component:

The wireless sensor network market includes segments such as hardware, software, and services. Hardware dominates revenue, driven by strong demand for sensor nodes, gateways, and communication modules. Continuous innovation in low-power chips and energy-efficient components supports widespread deployment. The software segment grows steadily, offering network management, security, and analytics solutions that optimize performance and scalability. Services, including consulting, integration, and maintenance, support clients throughout the deployment and lifecycle of sensor networks.

- For instance, Texas Instruments produces hundreds of millions of advanced analog and embedded processing chips daily at its Sherman, Texas facilities, each site offering 1.3 million square feet of clean room space for manufacturing.

By Sensor Type:

It encompasses a variety of sensor types, including temperature, pressure, humidity, motion, and chemical sensors. Temperature and humidity sensors hold significant shares due to their critical roles in environmental monitoring, industrial automation, and building management. Motion sensors find strong adoption in security, surveillance, and smart home applications. Chemical and pressure sensors serve specialized sectors such as healthcare, oil and gas, and water quality management, reflecting the expanding versatility of wireless sensor networks.

- For instance, Texas Instruments’ TMP117 digital temperature sensor achieves an exceptional ±0.1°C accuracy from –20°C to 50°C with zero calibration required during manufacturing, making it one of the most accurate single-chip temperature sensors available for industrial and medical applications.

By Application:

The market serves a wide range of applications, including industrial automation, smart cities, healthcare, environmental monitoring, and defense. Industrial automation remains the leading application, leveraging wireless sensor networks for predictive maintenance, process control, and asset management. Smart city initiatives drive adoption for infrastructure monitoring, traffic management, and energy optimization. Healthcare and environmental monitoring continue to emerge as high-growth segments, driven by increasing requirements for real-time data and remote sensing capabilities.

Segmentations:

By Component:

- Hardware

- Software

- Services

By Sensor Type:

- Temperature Sensors

- Pressure Sensors

- Humidity Sensors

- Motion Sensors

- Chemical Sensors

- Gas Sensors

- Image Sensors

- Others

By Application:

- Industrial Automation

- Smart Cities

- Healthcare

- Environmental Monitoring

- Defense and Security

- Building Automation

- Agriculture

- Logistics and Transportation

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds the largest portion of the wireless sensor network market, capturing 38% of global revenue in 2024. The region maintains its leadership through early technology adoption, strong investments in research and development, and a well-established IoT ecosystem. U.S. enterprises integrate wireless sensor networks into smart infrastructure, industrial automation, and advanced healthcare applications. It benefits from the presence of leading technology firms and government initiatives supporting smart city projects. High digital readiness and robust cybersecurity standards further drive adoption. Market participants find significant opportunities in scaling existing deployments and entering new verticals within the region.

Asia-Pacific :

Asia-Pacific commands a 29% share of the wireless sensor network market in 2024, showing the fastest growth trajectory among all regions. Major economies such as China, Japan, and India invest heavily in smart manufacturing, intelligent transportation, and digital infrastructure. The region’s expanding middle class, urbanization trends, and supportive government policies stimulate sensor network deployment across urban and rural settings. It attracts significant foreign direct investment and fosters technology partnerships to accelerate digital transformation. Rapid advancements in telecommunications and low-cost sensor production contribute to widespread accessibility. Asia-Pacific remains a hotspot for innovation and mass adoption.

Europe :

Europe holds a 21% share of the wireless sensor network market, supported by robust regulatory frameworks and a strong focus on sustainability. The European Union’s smart city programs, energy efficiency targets, and environmental monitoring mandates drive continued demand for wireless sensor networks. Key countries including Germany, the United Kingdom, and France lead in deploying advanced sensor solutions for smart buildings, transportation, and environmental management. It benefits from a collaborative innovation ecosystem that integrates academic, public, and private sector expertise. The push for green technologies and data privacy compliance positions Europe for ongoing expansion in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- PARKER HANNIFIN CORP

- HONEYWELL INTERNATIONAL INC.

- Bosch Sensortec GmbH

- Cisco Systems, Inc.

- Texas Instruments Incorporated

- NXP Semiconductors

- Huawei Technologies Co., Ltd.

- TE Connectivity

- ABB

- Advantech Co., Ltd.

Competitive Analysis:

The wireless sensor network market features robust competition, shaped by established global leaders and specialized technology innovators. Key players such as PARKER HANNIFIN CORP, HONEYWELL INTERNATIONAL INC., Bosch Sensortec GmbH, Cisco Systems, Inc., Texas Instruments Incorporated, NXP Semiconductors, and Huawei Technologies Co., Ltd. drive innovation through extensive R&D, strong product portfolios, and a focus on scalable, secure network solutions. It remains highly dynamic, with companies introducing new technologies to address evolving industry needs in automation, smart infrastructure, and IoT applications. Partnerships, acquisitions, and geographic expansion are common strategies to strengthen market position and diversify offerings. Continuous investments in low-power design, AI integration, and edge computing characterize the leading competitors’ approach, ensuring adaptability in a rapidly evolving environment. The market’s competitive landscape encourages both established and emerging firms to deliver advanced, customized solutions for diverse application areas.

Recent Developments:

- In January 2025, Cisco introduced AI Defense, a cybersecurity tool designed to safeguard enterprises against the misuse of AI tools and associated cyberthreats.

- In May, 2025, Huawei introduced the HUAWEI WATCH 5, WATCH FIT 4 series, FreeBuds 6, and MatePad Pro 12.2-inch at a product launch event in Berlin previous conversation.

Market Concentration & Characteristics:

The wireless sensor network market features moderate concentration, with several global and regional players contributing to its dynamic competitive landscape. Major technology firms such as Cisco Systems, Texas Instruments, Siemens, and Huawei hold significant market positions through ongoing innovation, broad product portfolios, and strong customer relationships. It is characterized by rapid technological advancements, frequent new product introductions, and continuous integration of IoT, AI, and edge computing capabilities. The market supports a diverse range of applications, from industrial automation and smart infrastructure to healthcare and environmental monitoring. Strategic partnerships, mergers, and investments further define the competitive environment, encouraging both established leaders and emerging companies to pursue growth opportunities.

Report Coverage:

The research report offers an in-depth analysis based on Component, Sensor Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Wireless sensor networks will see broader integration in smart cities, driving intelligent infrastructure management and urban mobility solutions.

- Industrial automation will increasingly depend on wireless sensor networks for real-time monitoring, predictive maintenance, and safety improvements.

- AI and machine learning capabilities will embed deeper into sensor nodes, enhancing data analytics and enabling autonomous decision-making.

- Expansion into healthcare will accelerate, with networks supporting advanced patient monitoring, diagnostics, and hospital asset tracking.

- Edge computing adoption will reduce latency, strengthen data security, and enable local data processing across large-scale sensor deployments.

- Adoption of energy-harvesting technologies will extend device lifespans and reduce the need for frequent maintenance or battery replacements.

- New connectivity standards, such as 5G and LPWAN, will unlock high-density, low-latency sensor networks for mission-critical applications.

- Environmental monitoring and disaster management systems will rely on wireless sensor networks for real-time data to support rapid response.

- Regulatory focus on data privacy and cybersecurity will lead to improved security protocols and robust compliance practices within the market.

- Emerging markets in Latin America, the Middle East, and Africa will demonstrate rising adoption, creating new growth avenues for technology providers.