Market Overview

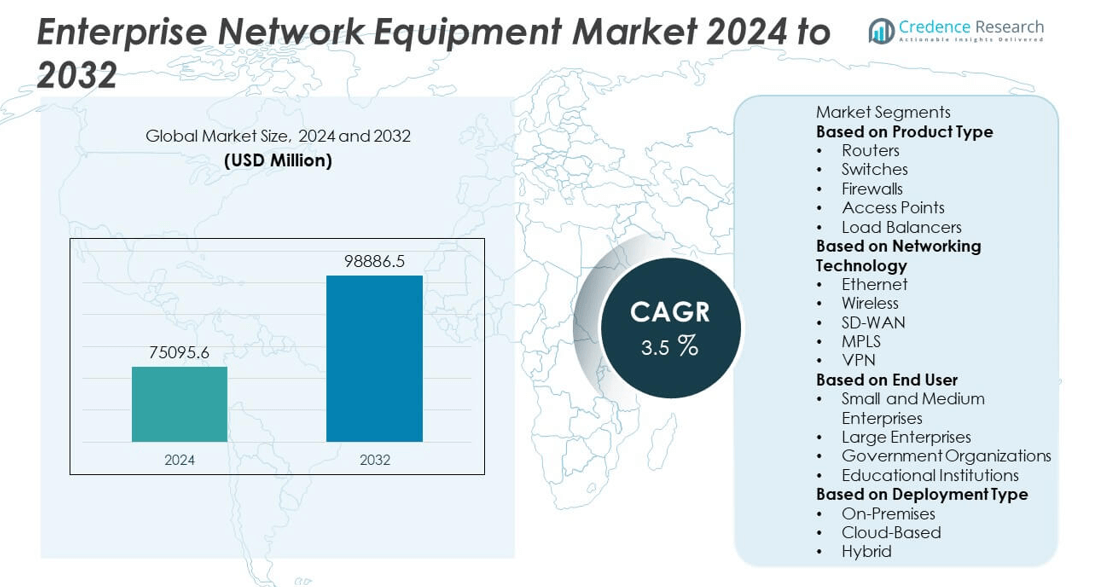

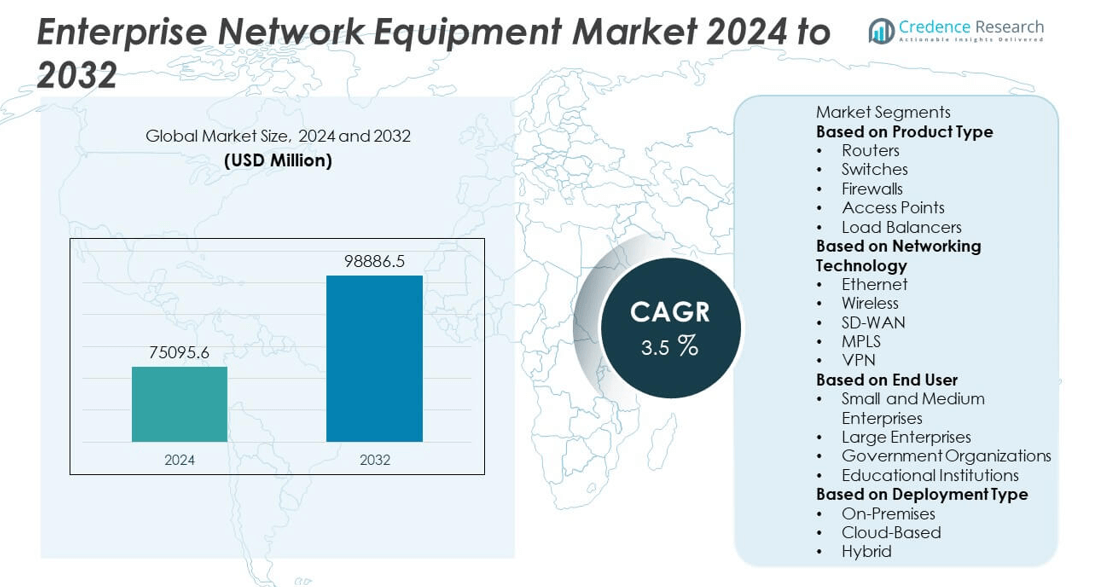

Enterprise Network Equipment Market was valued at USD 75,095.6 million in 2024 and is projected to reach USD 98,886.5 million by 2032, reflecting a compound annual growth rate (CAGR) of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Network Equipment Market Size 2024 |

USD 75,095.6 million |

| Enterprise Network Equipment Market, CAGR |

3.5% |

| Enterprise Network Equipment Market Size 2032 |

USD 98,886.5 million |

The Enterprise Network Equipment Market grows steadily, driven by the rising need for high-speed, reliable connectivity, expanding cloud adoption, and increasing IoT deployments across industries. Enterprises invest in advanced routers, switches, and security appliances to enhance performance, scalability, and threat protection. It benefits from trends such as the integration of AI and machine learning for network optimization.

The Enterprise Network Equipment Market spans key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each demonstrating distinct growth drivers. North America leads in technology adoption, supported by strong enterprise IT investments and advanced infrastructure. Europe focuses on secure, compliant networking solutions, driven by strict data protection regulations. Asia-Pacific experiences rapid expansion fueled by large-scale 5G rollouts, IoT adoption, and industrial automation. Latin America and the Middle East & Africa show potential through digital transformation initiatives and infrastructure upgrades. Prominent players shaping the market landscape include Cisco Systems, Juniper Networks, Hewlett Packard Enterprise, and Arista Networks. These companies compete by offering innovative, scalable, and secure networking solutions tailored to evolving enterprise needs, while investing in AI-driven management, virtualization capabilities.

Market Insights

- The Enterprise Network Equipment Market was valued at USD 75,095.6 million in 2024 and is projected to reach USD 98,886.5 million by 2032, at a CAGR of 3.5% during the forecast period.

- The market growth is supported by rising demand for high-speed, reliable connectivity, expanding cloud adoption, and the increasing integration of IoT devices across multiple industries.

- Key trends include the integration of AI and machine learning for automated network optimization, the transition toward software-defined networking and virtualization, and the expansion of edge computing to enable low-latency applications.

- Competition is intense, with major players such as Cisco Systems, Hewlett Packard Enterprise, Arista Networks, and Juniper Networks focusing on innovation, scalability, and security to strengthen market positions.

- High capital investment requirements, rapid technological changes, and complex integration processes act as restraints, especially for small and medium-sized enterprises.

- North America dominates due to advanced infrastructure and early adoption of emerging technologies, while Europe focuses on secure and compliant networking, and Asia-Pacific shows the fastest growth driven by 5G deployments and industrial automation.

- Vendors align strategies with sustainability goals by offering energy-efficient equipment and smart power management features, creating opportunities in environmentally conscious markets and supporting long-term cost savings for enterprises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Speed and Reliable Connectivity Across Enterprises

The Enterprise Network Equipment Market experiences strong growth due to the need for high-speed, low-latency connectivity in modern enterprises. Organizations depend on advanced networking hardware to support data-intensive applications, video conferencing, and cloud-based platforms. It benefits from the shift toward gigabit and multi-gigabit networks to handle increasing traffic volumes. Enterprises seek equipment with improved bandwidth management and quality of service capabilities to ensure seamless operations. Network hardware that delivers stability and scalability gains preference in competitive markets. Vendors invest in innovation to meet the performance expectations of various industries.

- For instance, Juniper Networks’ T1600 core router delivers 800 Gb/s full-duplex throughput and supports 1.6 Tbit/s half-duplex throughput, enabling robust, high-capacity network backbones.

Expanding Adoption of Cloud Services and Hybrid IT Architectures

Cloud migration drives significant demand for advanced network infrastructure in the Enterprise Network Equipment Market. Enterprises require solutions that integrate on-premise systems with public and private cloud environments. It increases the demand for switches, routers, and security appliances capable of handling hybrid workloads. Secure and efficient data transfer between cloud resources and enterprise networks remains a priority. The shift to hybrid IT models requires adaptable network designs that maintain performance across diverse environments. Providers offer products with advanced virtualization support and cloud management features to address these needs.

- For instance, Juniper’s ACX7100 and ACX7509 routers include weighted fair queuing (WFQ), priority queuing, and traffic-shaping and policing functions to manage hybrid traffic classes effectively.

Growing Internet of Things (IoT) Deployments Across Industries

The Enterprise Network Equipment Market gains momentum from widespread IoT adoption in sectors such as manufacturing, healthcare, and logistics. It creates demand for robust network infrastructure capable of supporting thousands of connected devices. Enterprises prioritize equipment that ensures secure device onboarding, low-latency communication, and reliable data flow. IoT-specific network management features, such as traffic segmentation and edge computing support, gain traction. The increasing complexity of IoT ecosystems drives the need for high-capacity switches and wireless solutions. Vendors respond with products designed for industrial-grade reliability and scalability.

Rising Focus on Network Security and Threat Mitigation

Security concerns remain a central driver for the Enterprise Network Equipment Market. It pushes enterprises to adopt equipment with integrated threat detection, encryption, and access control mechanisms. Network hardware that offers real-time monitoring and automated threat response gains higher acceptance. Compliance with data protection regulations reinforces the demand for secure network designs. Enterprises require solutions that defend against sophisticated cyberattacks targeting both core and edge infrastructure. Vendors enhance their offerings with AI-driven analytics and zero-trust architecture support to address evolving threats.

Market Trends

Integration of Artificial Intelligence and Machine Learning for Network Optimization

The Enterprise Network Equipment Market witnesses a growing trend toward embedding AI and ML capabilities into network infrastructure. Enterprises deploy intelligent systems that enable automated traffic management, predictive maintenance, and performance optimization. It helps reduce downtime by identifying potential faults before they impact operations. AI-driven analytics enhance decision-making by providing real-time insights into network usage patterns. Vendors focus on developing self-healing networks that adapt to changing conditions without manual intervention. The adoption of AI-enabled equipment increases operational efficiency and reduces the total cost of ownership for enterprises.

- For instance, Juniper’s Mist AIOps platform has eliminated 90 percent of wireless network trouble tickets and has provisioned over 4,000 access points in a single deployment day.

Shift Toward Software-Defined Networking and Network Function Virtualization

A clear trend in the Enterprise Network Equipment Market is the transition from hardware-centric designs to software-driven architectures. It enables enterprises to manage networks with greater flexibility, scalability, and control. SDN and NFV allow centralized configuration, reducing reliance on proprietary hardware and enabling faster deployment of new services. This shift supports cost-effective scaling to meet dynamic workload demands. Vendors offer solutions that integrate with existing systems while supporting virtualization standards. Enterprises benefit from reduced complexity and improved agility in network operations.

- For instance, Cisco DNA Center’s Plug-and-Play workflows support zero-touch provisioning across large-scale deployments, while Juniper’s Mist Wired Assurance automates switch onboarding within minutes and surfaces per-port metrics for precise policy enforcement.

Expansion of Edge Computing Infrastructure to Support Emerging Applications

Edge computing deployment continues to influence the Enterprise Network Equipment Market significantly. It drives demand for equipment that processes data closer to its source, reducing latency and improving application performance. Enterprises in sectors like manufacturing, retail, and healthcare invest in edge-ready switches, routers, and security appliances. This trend supports use cases such as real-time analytics, AR/VR applications, and autonomous systems. Vendors design compact, energy-efficient equipment to meet the needs of distributed edge environments. The growth of 5G networks further accelerates the integration of edge capabilities into enterprise infrastructure.

Increased Focus on Sustainable and Energy-Efficient Network Solutions

Sustainability goals shape purchasing decisions in the Enterprise Network Equipment Market. It encourages enterprises to select products with lower energy consumption, recyclable materials, and efficient cooling mechanisms. Green networking initiatives align with regulatory requirements and corporate responsibility objectives. Vendors invest in developing energy-optimized switches and routers that reduce operational costs. The adoption of smart power management features becomes a standard expectation. Energy efficiency not only addresses environmental concerns but also enhances the long-term economic value of network investments.

Market Challenges Analysis

High Capital Investment Requirements and Cost Pressures on Enterprises

The Enterprise Network Equipment Market faces the challenge of significant upfront costs for advanced networking infrastructure. It requires enterprises to allocate substantial budgets for high-performance switches, routers, security appliances, and software platforms. Smaller organizations often delay upgrades due to limited capital, which slows adoption rates. Rapid technology evolution shortens product life cycles, forcing frequent reinvestment. Maintenance and training expenses add to the overall financial burden. Vendors must balance innovation with affordability to retain competitiveness in price-sensitive segments.

Complex Integration and Security Risks in Evolving Network Environments

Integrating new network equipment into existing infrastructure remains a persistent challenge for the Enterprise Network Equipment Market. It often involves compatibility issues, lengthy deployment timelines, and operational disruptions. The growing complexity of hybrid and multi-cloud architectures increases the risk of configuration errors. Cybersecurity threats intensify as networks expand to accommodate IoT devices, remote workforces, and edge computing nodes. Enterprises require robust security features without compromising performance, yet implementing these measures demands specialized expertise. Vendors need to provide flexible, interoperable solutions that address integration hurdles while ensuring advanced threat protection.

Market Opportunities

Rising Adoption of 5G and Advanced Wireless Technologies

The Enterprise Network Equipment Market presents strong opportunities through the expansion of 5G infrastructure and next-generation wireless networks. It enables enterprises to deploy high-speed, low-latency connectivity solutions for mission-critical applications. Industries such as manufacturing, transportation, and healthcare can leverage 5G-enabled equipment to enhance automation, remote operations, and real-time data analytics. Vendors have the opportunity to develop specialized switches, routers, and access points optimized for 5G environments. The growth of private 5G networks opens new revenue streams in enterprise-specific deployments. Integration of advanced wireless technologies into core and edge infrastructure creates potential for long-term contracts and recurring service models.

Growing Demand for Cloud-Managed and AI-Driven Networking Solutions

Cloud-managed platforms create significant growth prospects for the Enterprise Network Equipment Market. It supports enterprises in simplifying network management, improving scalability, and enabling centralized control. AI-driven analytics embedded in equipment provide predictive insights, automated troubleshooting, and optimized resource allocation. Enterprises increasingly seek solutions that combine security, performance, and agility in a single platform. Vendors offering cloud-native and AI-enabled products can cater to the evolving needs of hybrid work environments. The ability to deliver subscription-based models and managed services further expands market penetration opportunities.

Market Segmentation Analysis:

By Product Type

The Enterprise Network Equipment Market segments by product type into routers, switches, wireless access points, network security appliances, and network management software. Routers and switches hold a strong position due to their critical role in managing data flow and enabling connectivity across enterprise environments. Wireless access points gain increasing adoption with the expansion of mobile devices and remote workforces. Network security appliances see rising demand due to heightened cyber threats and regulatory compliance requirements. Network management software grows steadily as enterprises seek centralized monitoring, configuration control, and performance optimization. It creates opportunities for vendors offering integrated hardware and software solutions that improve operational efficiency.

- For instance, Juniper’s T1600 core router achieves 1.6 Tbit/s capacity (800 Gbit/s full-duplex) with forwarding of 1.92 billion packets per second, enabling high-performance backbone networks.

By Networking Technology

The Enterprise Network Equipment Market divides by networking technology into wired and wireless solutions. Wired networking retains dominance in environments where stability, security, and high throughput are critical, such as data centers and large corporate offices. Wireless networking registers faster growth, driven by the need for flexibility, mobility, and ease of deployment. It benefits from advancements in Wi-Fi 6, Wi-Fi 6E, and upcoming Wi-Fi 7 technologies, which offer higher speeds and lower latency. Enterprises adopt hybrid networking models that combine the reliability of wired systems with the convenience of wireless connectivity. Vendors focus on interoperability between these technologies to meet diverse operational requirements.

- For instance, Aruba’s 550 Series Wi-Fi 6 access points handle up to 1.5 Gbps wireless throughput and support 256 clients per radio, enabling high-density deployment.

By End-User

The Enterprise Network Equipment Market categorizes end-users into IT and telecom, banking and financial services (BFSI), healthcare, manufacturing, government, retail, and others. IT and telecom lead the segment due to continuous infrastructure upgrades and high bandwidth requirements. BFSI prioritizes secure, low-latency networks to support digital transactions and regulatory compliance. Healthcare invests in reliable connectivity to enable telemedicine, electronic health records, and IoT-based patient monitoring. Manufacturing adopts advanced networking to support automation, robotics, and smart factory initiatives. Government agencies focus on secure communication networks for public services and defense applications. Retail leverages network infrastructure for omnichannel operations and real-time inventory management. It offers growth opportunities across sectors seeking to modernize infrastructure and enhance operational resilience.

Segments:

Based on Product Type

- Routers

- Switches

- Firewalls

- Access Points

- Load Balancers

Based on Networking Technology

- Ethernet

- Wireless

- SD-WAN

- MPLS

- VPN

Based on End User

- Small and Medium Enterprises

- Large Enterprises

- Government Organizations

- Educational Institutions

Based on Deployment Type

- On-Premises

- Cloud-Based

- Hybrid

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share in the Enterprise Network Equipment Market, accounting for approximately 38% of global revenue in 2024. Strong technological infrastructure, high penetration of advanced networking solutions, and early adoption of innovations such as AI-driven network management support the region’s leadership. The United States dominates within the region due to its concentration of large enterprises, data centers, and cloud service providers. It benefits from ongoing investments in 5G infrastructure, cybersecurity solutions, and edge computing deployments. Canada contributes to growth with expanding IT services and government initiatives promoting digital transformation. Vendors in North America focus on developing high-performance, secure, and scalable networking solutions to address enterprise demands for hybrid work and IoT integration.

Europe

Europe captures around 27% of the Enterprise Network Equipment Market, supported by mature IT infrastructure and strong demand for secure networking in regulated industries such as BFSI and healthcare. Germany, the United Kingdom, and France lead adoption, driven by industrial automation, smart manufacturing, and cloud migration. It gains momentum from EU-wide digital transformation initiatives and investments in 5G and fiber-optic networks. Enterprises in Europe place high importance on compliance with GDPR and other data protection regulations, which fuels demand for integrated security features in networking equipment. The region also sees rising adoption of sustainable and energy-efficient network solutions aligned with environmental regulations. Vendors target European enterprises with products that balance performance, compliance, and environmental responsibility.

Asia-Pacific

Asia-Pacific accounts for approximately 24% of the Enterprise Network Equipment Market and exhibits the fastest growth rate among all regions. Rapid economic development, expanding digital infrastructure, and increasing enterprise IT budgets drive adoption in countries such as China, Japan, India, and South Korea. It benefits from large-scale 5G rollouts, widespread IoT deployments, and strong demand for cloud computing services. The manufacturing sector in the region accelerates investment in industrial networking for automation and smart factory projects. Governments in countries like India and China support initiatives for digital transformation and cybersecurity resilience. Vendors in Asia-Pacific focus on delivering cost-effective yet advanced networking solutions tailored to diverse market needs, from large-scale enterprises to small and medium-sized businesses.

Latin America

Latin America holds about 6% of the Enterprise Network Equipment Market, with growth primarily driven by Brazil, Mexico, and Argentina. The region experiences rising adoption of cloud services, e-commerce platforms, and mobile connectivity solutions. It faces challenges such as uneven infrastructure development and budget constraints among enterprises. However, ongoing investments in data centers and fiber-optic networks create opportunities for vendors. Enterprises in sectors like banking, retail, and telecommunications increasingly seek reliable and secure networking equipment to support digital services. Vendors focusing on competitive pricing and localized support gain an advantage in this cost-sensitive market.

Middle East & Africa

The Middle East & Africa region represents roughly 5% of the Enterprise Network Equipment Market, supported by growing investments in smart city projects, digital government services, and modernized enterprise infrastructure. The United Arab Emirates, Saudi Arabia, and South Africa lead adoption with initiatives in 5G, cloud computing, and IoT integration. It benefits from a strong push toward diversifying economies and developing technology hubs. Limited infrastructure in some parts of the region presents challenges, but the demand for secure and scalable networks is rising. Vendors targeting this region prioritize solutions that combine advanced performance with resilience in challenging environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Enterprise Network Equipment Market is defined by the presence of global leaders including Cisco Systems, Hewlett Packard Enterprise, Arista Networks, Juniper Networks, Dell Technologies, Nokia, TP-Link, Extreme Networks, ZTE Corporation, and MikroTik. These companies compete on innovation, product performance, scalability, and security capabilities to capture a larger customer base. Cisco Systems maintains a dominant position through its extensive portfolio of networking hardware, software, and integrated security solutions. Hewlett Packard Enterprise focuses on intelligent edge solutions and cloud-managed networking. Arista Networks leads in high-performance data center and cloud networking, while Juniper Networks emphasizes AI-driven automation and security integration. Dell Technologies leverages its broad IT infrastructure expertise to deliver end-to-end networking solutions, and Nokia strengthens its position with advanced IP networking and 5G-ready products. TP-Link and MikroTik cater to cost-sensitive segments with competitive pricing and reliable performance, while Extreme Networks and ZTE Corporation expand their portfolios with innovative, software-driven architectures. Strategic partnerships, mergers, and continuous R&D investments remain central to sustaining competitive advantage in this dynamic market.

Recent Developments

- In June 2025, Nokia integrated 5th Gen AMD EPYC processors into its Cloud Platform for improved performance and energy efficiency.

- In March 2025, Nokia launched 5G.MIL initiatives with Lockheed Martin and Verizon and showcased optical networking innovations at MWC.

- In February 2025, MikroTik added new storage-related features in RouterOS for devices supporting external storage such as RB1100, X86, and CHR platforms.

Market Concentration & Characteristics

The Enterprise Network Equipment Market demonstrates a moderate to high level of concentration, with a few dominant players controlling significant market share through extensive portfolios, global reach, and strong brand recognition. It features a competitive mix of multinational corporations and specialized vendors, each focusing on innovation, scalability, and security to differentiate their offerings. The market is characterized by rapid technological evolution, with trends such as software-defined networking, AI-driven automation, and cloud-managed infrastructure shaping product development. It demands consistent investment in research and development to address evolving enterprise requirements for speed, reliability, and secure connectivity. Vendors compete on performance, interoperability, and service quality, while strategic partnerships and acquisitions remain central to strengthening market positioning. It also benefits from recurring revenue models through managed services and subscription-based solutions, creating long-term client relationships. The market structure favors companies that can adapt quickly to emerging networking standards and deliver integrated solutions that align with hybrid and multi-cloud strategies.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Networking Technology, End-User, Deployment Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of AI-driven network management solutions.

- Cloud-managed networking will expand across enterprises of all sizes.

- Demand for high-speed connectivity will drive upgrades to advanced Ethernet and optical systems.

- 5G integration will enhance enterprise network capabilities and performance.

- Security-focused network designs will gain priority in procurement decisions.

- Edge computing deployments will increase demand for distributed networking solutions.

- Software-defined networking will become a standard approach in enterprise infrastructure.

- Energy-efficient and sustainable network equipment will see higher adoption.

- Vendors will focus on delivering more interoperable and scalable solutions.

- Strategic partnerships will strengthen product innovation and market reach.