Market Overview:

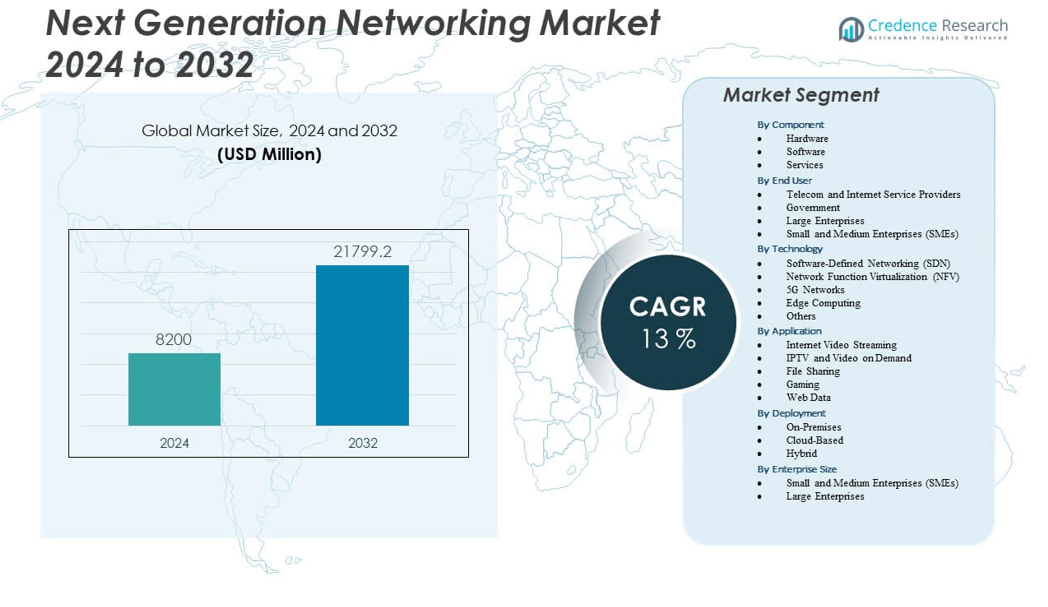

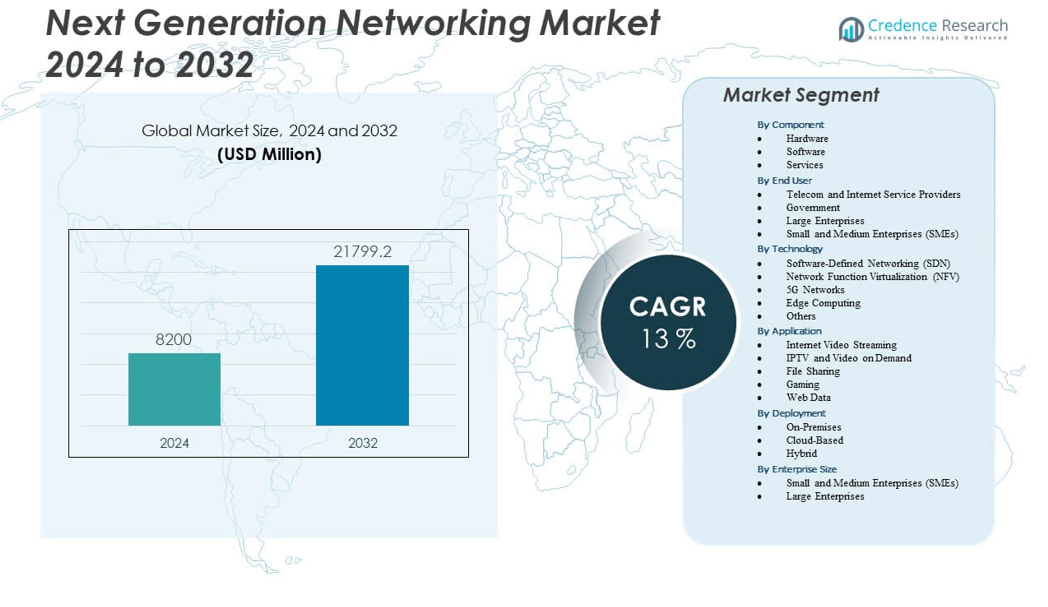

The Next Generation Networking Market is projected to grow from USD 8,200 million in 2024 to an estimated USD 21,799.2 million by 2032, with a compound annual growth rate (CAGR) of 13% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Next Generation Networking Market Size 2024 |

USD 8,200 million |

| Next Generation Networking Market, CAGR |

13% |

| Next Generation Networking Market Size 2032 |

USD 21,799.2 million |

The growth of the Next Generation Networking Market is driven by rising demand for high-speed connectivity, increasing adoption of cloud-based services, and the proliferation of IoT devices that require seamless and scalable networks. Businesses are investing in advanced networking solutions to enhance efficiency, security, and data management capabilities. The shift towards 5G deployment and the growing emphasis on software-defined networking and network function virtualization further accelerate market expansion. Additionally, enterprises are prioritizing automation, real-time analytics, and reduced latency, which positions next-generation networking as a core enabler of digital transformation across industries.

Geographically, North America leads the market due to strong adoption of advanced technologies, robust infrastructure, and the presence of major networking solution providers. Europe follows with significant investments in 5G and digital innovation, while Asia-Pacific emerges as the fastest-growing region, driven by rapid industrialization, smart city projects, and government-backed digitalization initiatives. Countries like China, India, and Japan are spearheading adoption due to expanding internet penetration and rising demand for enterprise-grade connectivity. Meanwhile, regions in Latin America and the Middle East are steadily embracing next-generation networking, fueled by modernization efforts and increasing investments in telecom infrastructure.

Market Insights:

- The Next Generation Networking Market is projected to grow from USD 8,200 million in 2024 to USD 21,799.2 million by 2032, registering a CAGR of 13%.

- Rising demand for high-speed connectivity and scalable network solutions fuels strong adoption across enterprises and service providers.

- Expansion of 5G infrastructure and integration of SDN and NFV technologies drive efficiency and agility in network operations.

- Growing concerns around cybersecurity and compliance create restraints, requiring advanced security frameworks in deployments.

- North America leads the market with the largest share, supported by advanced infrastructure and strong presence of key players.

- Europe demonstrates steady growth with emphasis on regulatory alignment, data protection, and large-scale 5G rollouts.

- Asia-Pacific emerges as the fastest-growing region, driven by digitalization initiatives, expanding IoT adoption, and rapid industrial growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Demand for High-Speed and Reliable Network Infrastructure

The Next Generation Networking Market is propelled by the strong demand for fast and reliable network infrastructure that supports seamless communication. Enterprises across industries adopt next-generation networking to handle surging data traffic and digital workloads. It provides enhanced bandwidth, lower latency, and improved network resilience. Telecom operators and enterprises rely on it to support advanced applications such as video conferencing and digital collaboration. Cloud computing accelerates this demand by pushing organizations to modernize networks. The growing need for scalable connectivity creates opportunities for providers. Governments encourage investments in digital infrastructure. This environment reinforces the growth trajectory of the sector.

Growing Adoption of Software-Defined Networking and Virtualization Technologies

The market experiences robust growth through the rising use of software-defined networking (SDN) and network function virtualization (NFV). These solutions offer flexibility, scalability, and reduced hardware dependence. Enterprises implement them to optimize resources and lower operational costs. It empowers organizations to manage complex network operations with centralized control. Rapid digitalization accelerates their adoption across industries. Businesses use SDN to meet fluctuating demand while ensuring efficiency. Service providers deploy NFV to enhance service agility and reduce deployment cycles. This transition to programmable networks strengthens the competitive position of the market.

- For example, VMware highlights the adoption of its SDN platform, VMware NSX, across global enterprise environments, emphasizing its role in delivering efficient, scalable, and secure network virtualization solutions.

Expansion of Internet of Things and Smart Connected Ecosystems

The Next Generation Networking Market benefits from the expansion of IoT and smart connected systems. Businesses implement advanced networks to connect billions of devices reliably. It supports machine-to-machine communication across industries such as healthcare, automotive, and manufacturing. Enhanced connectivity enables real-time monitoring, predictive maintenance, and intelligent operations. Governments invest in smart cities that require resilient networking solutions. Enterprises adopt next-generation networking to handle increasing IoT-driven traffic. The ecosystem encourages innovation by creating new use cases and applications. This expansion broadens the scope and utility of modern networks.

- For example, Siemens has connected approximately 1.3 million devices and assets through its MindSphere platform across industrial environments, showcasing its scalability and established adoption.

Rising Emphasis on Network Security and Data Protection Standards

Growing concerns about cybersecurity and data protection fuel demand for secure next-generation networks. The Next Generation Networking Market integrates advanced encryption, authentication, and monitoring systems. It addresses the rising volume of cyber threats targeting enterprises and governments. Organizations seek robust solutions to secure sensitive financial and personal data. Service providers differentiate offerings by embedding advanced security features. Businesses recognize that secure networking underpins trust in digital services. Regulators strengthen compliance requirements, compelling enterprises to upgrade systems. This trend consolidates the role of next-generation networking in safeguarding digital ecosystems.

Market Trends

Integration of Artificial Intelligence and Machine Learning into Network Management

The Next Generation Networking Market advances through the integration of AI and ML into network operations. Automated tools predict traffic patterns and optimize resource allocation. It reduces manual intervention and enhances decision-making. Enterprises apply AI-driven analytics for real-time performance monitoring. Machine learning algorithms improve detection of anomalies and outages. Telecom operators use predictive tools to minimize downtime. AI-driven orchestration improves agility and efficiency. The integration fosters smarter networks that align with enterprise transformation strategies.

- For example, in early trials of Cisco AI Network Analytics, organizations observed up to a 75 percent reduction in flagged incidents, underscoring its ability to streamline alert management and improve network efficiency.

Transition Toward Cloud-Native and Edge-Based Architectures

Organizations focus on cloud-native and edge-based models to boost efficiency and flexibility. The Next Generation Networking Market benefits from this transition as enterprises move workloads closer to users. It lowers latency and enhances user experiences. Edge computing supports real-time analytics for industries like healthcare and manufacturing. Cloud-native frameworks provide scalability and resilience. Businesses adopt hybrid models that combine cloud and edge for seamless operations. Telecom providers invest in edge infrastructure to improve service delivery. This architectural shift transforms traditional networking into dynamic ecosystems.

- For example, Equinix maintains a network of approximately 260 data centers worldwide, delivering lower latency and improved performance for enterprise applications through its strategically localized infrastructure.

Growth in Open Standards and Interoperability Across Networking Solutions

The industry witnesses rising adoption of open standards to ensure interoperability among networking systems. The Next Generation Networking Market expands as vendors collaborate on unified frameworks. It simplifies integration across multi-vendor environments. Enterprises demand flexibility that open standards provide. Interoperability reduces dependency on proprietary systems. Service providers use it to accelerate innovation and reduce costs. Standardized protocols enhance efficiency across networks. The trend enables seamless adoption of emerging technologies in diverse settings.

Rising Role of Automation and Orchestration in Next-Generation Networks

Automation shapes the future of enterprise and telecom networks. The Next Generation Networking Market grows with the deployment of orchestration tools. It streamlines repetitive tasks and ensures operational efficiency. Automated provisioning accelerates service delivery. Orchestration integrates multiple functions into cohesive systems. Businesses rely on automation to lower costs and boost productivity. It supports self-healing capabilities that improve resilience. Automated solutions align with the growing need for agility in digital enterprises.

Market Challenges Analysis

High Implementation Costs and Complexity in Network Transformation Projects

The Next Generation Networking Market faces challenges from the significant investment required for deployment. It demands new infrastructure, skilled professionals, and integration with legacy systems. Small and medium enterprises struggle with capital-intensive upgrades. Complexity arises during migration to advanced platforms. Service providers often encounter delays in large-scale rollouts. Businesses face risks of downtime during transitions. Lack of standardized implementation practices adds to difficulties. These challenges slow down adoption in cost-sensitive regions.

Rising Cybersecurity Risks and Compliance Requirements Across Industries

Cybersecurity remains a persistent obstacle for the adoption of advanced networking solutions. The Next Generation Networking Market experiences growing threats targeting evolving infrastructures. It exposes enterprises to data breaches and financial risks. Meeting strict compliance standards complicates deployment. Businesses must integrate robust security frameworks with every network layer. Service providers face pressure to guarantee resilience against sophisticated attacks. Increased regulatory scrutiny heightens operational demands. These factors create barriers to adoption and raise implementation costs.

Market Opportunities

Expansion of 5G Infrastructure and Emerging Smart City Initiatives

The Next Generation Networking Market gains opportunities from the rapid rollout of 5G and smart cities. It supports ultra-low latency and high-capacity networks that empower advanced use cases. Governments invest heavily in infrastructure upgrades. Enterprises embrace 5G to enable immersive applications such as AR and VR. Smart city initiatives rely on resilient networks to connect utilities and services. These developments generate demand for advanced networking solutions. Service providers gain new revenue streams through innovative offerings. This creates long-term growth potential for the industry.

Increasing Enterprise Focus on Digital Transformation and Industry 4.0 Adoption

Enterprises expand digital transformation strategies that depend on next-generation networking. The Next Generation Networking Market benefits from the alignment with Industry 4.0. It empowers manufacturers, healthcare providers, and logistics firms with intelligent systems. Advanced networks support automation and data-driven decision-making. Businesses invest in upgrading to remain competitive. Cloud adoption and IoT integration accelerate demand for networking solutions. Industry 4.0 frameworks require reliable and scalable connectivity. These opportunities reinforce the market’s central role in enabling innovation.

Market Segmentation Analysis:

By component, the Next Generation Networking Market demonstrates strong growth across its component categories, with hardware such as switches, routers, gateways, servers, and security devices forming the backbone of deployments. Software solutions, including Software-Defined Networking, Network Function Virtualization, and AI-based network management, gain prominence due to their ability to optimize resources and provide agility. Services such as deployment, consulting, integration, and managed services play a crucial role in supporting enterprises with tailored solutions and ensuring smooth transitions toward modernized infrastructure.

- For example, Arista Networks has installed over 100 million Ethernet ports globally, demonstrating its leadership in high-throughput networking. VMware’s NSX platform delivers comprehensive SDN and NFV capabilities with broad adoption in enterprise environments.

By end user, telecom and internet service providers represent a dominant share, driven by demand for high-speed connectivity and network modernization. Government agencies adopt advanced solutions to strengthen public infrastructure and enhance security. Large enterprises invest in scalable and resilient systems to support digital transformation, while small and medium enterprises adopt flexible and cost-effective models to remain competitive in fast-changing markets.

By technology, the market advances with Software-Defined Networking and Network Function Virtualization reshaping management frameworks, while 5G networks and edge computing expand adoption across industries.

By applications such as internet video streaming, IPTV and video on demand, file sharing, gaming, and web data highlight the growing demand for reliable and low-latency solutions.

- For example, Netflix utilizes AWS cloud infrastructure leveraging multiple regions and CloudFront’s global edge locations to ensure seamless, low-latency streaming. It also employs its own Open Connect CDN within ISPs and IXPs to cache content closer to viewers, reducing network congestion and improving performance.

By deployment models diversify between on-premises, cloud-based, and hybrid approaches, reflecting enterprise requirements for scalability and control.

By enterprise size, small and medium enterprises adopt modular solutions to balance cost and efficiency, while large enterprises implement next-generation networks at scale to support mission-critical operations and future growth strategies.

Segmentation:

By Component

- Hardware (Switches, Routers, Gateways, Servers, Security Devices)

- Software (Software-Defined Networking, Network Function Virtualization, AI-based Network Management)

- Services (Deployment, Consulting, Integration, Managed Services)

By End User

- Telecom and Internet Service Providers

- Government

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Technology

- Software-Defined Networking (SDN)

- Network Function Virtualization (NFV)

- 5G Networks

- Edge Computing

- Others

By Application

- Internet Video Streaming

- IPTV and Video on Demand

- File Sharing

- Gaming

- Web Data

By Deployment

- On-Premises

- Cloud-Based

- Hybrid

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Next Generation Networking Market, accounting for 35%. The region benefits from advanced infrastructure, early adoption of innovative technologies, and strong presence of leading networking solution providers. Enterprises invest heavily in digital transformation strategies supported by next-generation networks. It is driven by the expansion of 5G, rapid cloud adoption, and growing demand for secure, high-speed connectivity across industries. Government initiatives that promote advanced communication technologies further strengthen growth. The robust ecosystem in the United States and Canada continues to reinforce leadership in the global landscape.

Europe secures 27% of the market, supported by significant investments in digital infrastructure and innovation. Countries such as Germany, the United Kingdom, and France prioritize 5G rollouts and smart city projects that require resilient networking solutions. Enterprises across the region implement SDN and NFV technologies to reduce dependency on hardware and improve agility. It experiences rising demand from large enterprises and public sector projects aimed at boosting connectivity. The European Union’s regulatory frameworks and emphasis on data protection encourage adoption of secure, next-generation systems. Growing partnerships among telecom operators and technology providers fuel ongoing transformation.

Asia-Pacific captures 25% of the Next Generation Networking Market and emerges as the fastest-growing regional segment. Strong economic growth, rapid industrialization, and expanding internet penetration drive adoption. Countries such as China, India, and Japan invest in large-scale 5G deployments and edge computing to support massive data traffic. It benefits from government-backed digitalization initiatives and rising demand from SMEs seeking cost-effective solutions. The region’s competitive telecom sector accelerates investments in advanced infrastructure. Latin America accounts for 7%, while the Middle East and Africa collectively hold 6%, with both regions witnessing steady growth from telecom modernization projects and enterprise digital adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- IBM Corporation

- Samsung Electronics

- NEC Corporation

- Nokia Corporation

- Ericsson

- Juniper Networks

- VMware Inc.

- Oracle Corporation

- Citrix Systems Inc.

- F5 Networks Inc.

- Ciena Corporation

Competitive Analysis:

The Next Generation Networking Market is highly competitive, with global players focusing on innovation, scalability, and advanced service portfolios. Cisco Systems, Huawei, Nokia, Ericsson, and Juniper Networks dominate hardware and infrastructure, while VMware, Citrix, and Oracle strengthen software and virtualization offerings. It witnesses growing emphasis on 5G, edge computing, and AI-based management tools, pushing companies to expand R&D and strategic collaborations. IBM and Samsung focus on integrated digital solutions, while F5 Networks and Ciena enhance application delivery and optical networking capabilities. Partnerships, acquisitions, and new product launches remain core strategies. The competitive landscape reflects strong global rivalry balanced with regional players entering niche segments.

Recent Developments:

- In June 2025, CommScope Ruckus launched its Wi-Fi 7 Hospitality Portfolio, including the H670 wall AP and R370 AP models. These AI-driven Wi-Fi 7 solutions are tailored for the hospitality industry, enabling enhanced guest Wi-Fi experiences and IoT connectivity across luxury and budget hotels, marking a significant advancement in hospitality networking technology.

- In June 2025, Cisco Systems introduced a new generation of network hardware at Cisco Live 2025, including five Secure Routers (8100, 8200, 8300, 8400, and 8500) designed for AI-driven branch operations with native SD-WAN, SASE integration, and post-quantum security offering up to three times the throughput of previous models.

- By July 2025, Arista Networks launched Wi-Fi 7 Access Points (C-400 and O-435 models) for both indoor and rugged outdoor environments, enhancing enterprise network capabilities. Concurrently, Arista acquired Broadcom’s VeloCloud SD-WAN unit, boosting its multi-access (Wi-Fi 7 + 5G) and cloud-managed networking portfolio for AI and IoT use cases.

Market Concentration & Characteristics:

The Next Generation Networking Market demonstrates moderate to high concentration, with a few leading companies holding significant shares. It is defined by continuous technological advancement, strong demand for high-speed and secure networks, and rapid adoption across industries. Global leaders set industry benchmarks through large-scale deployments, while emerging firms introduce specialized solutions that target niche requirements. The market shows characteristics of high R&D intensity, regulatory alignment, and strong reliance on strategic alliances. It continues to evolve with a blend of established dominance and innovative disruption.

Report Coverage:

The research report offers an in-depth analysis based on Component, End User, Technology, Application, Deployment and Enterprise Size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of 5G infrastructure will enable low-latency applications, creating new opportunities across industries.

- Integration of AI and machine learning in network management will enhance automation and predictive analytics.

- Edge computing adoption will accelerate to support real-time data processing and decentralized connectivity models.

- Enterprises will prioritize network security frameworks to address evolving cyber threats and regulatory requirements.

- Cloud-native architectures will gain momentum as organizations seek flexible, scalable, and cost-efficient deployment models.

- Growth of IoT ecosystems will increase demand for resilient, high-capacity networks capable of handling large device volumes.

- Telecom operators will invest in next-generation solutions to modernize legacy systems and improve service delivery.

- Strategic collaborations between technology providers and enterprises will drive innovation and faster adoption cycles.

- Virtualization technologies such as SDN and NFV will continue to transform resource allocation and reduce hardware reliance.

- Regional markets will witness varied adoption, with advanced economies leading in innovation and emerging economies driving scale.