Market Overview

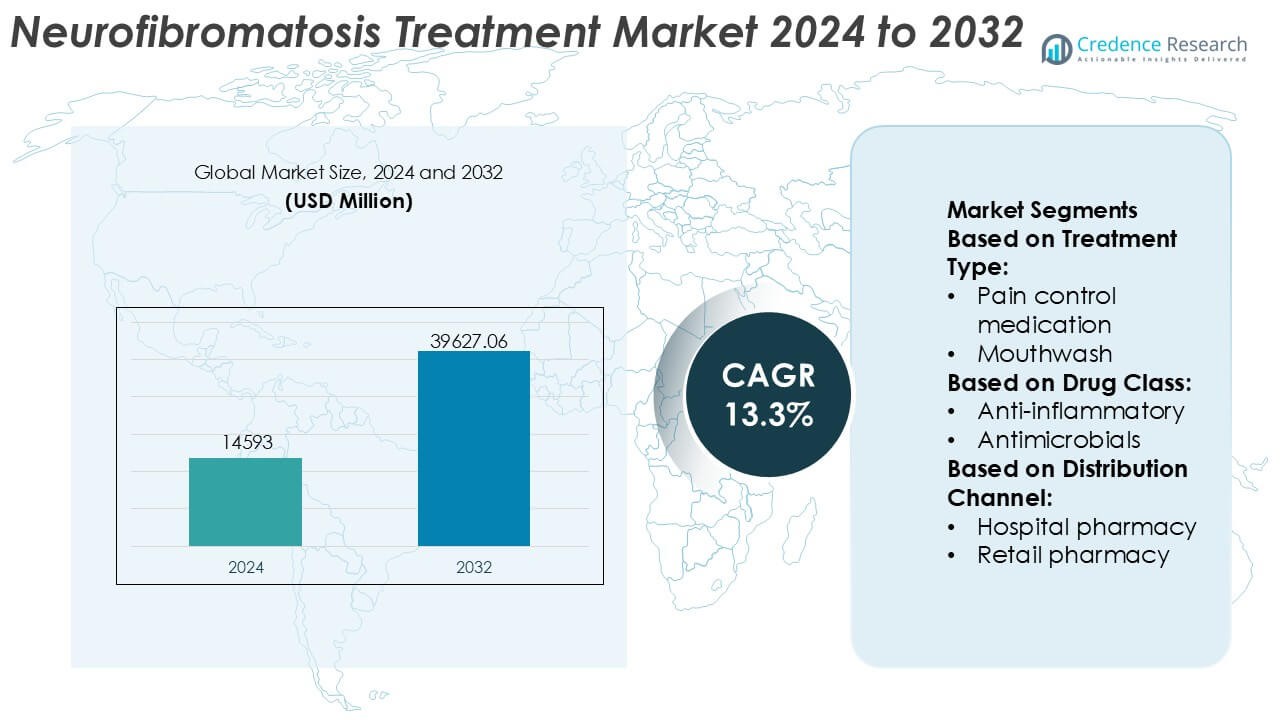

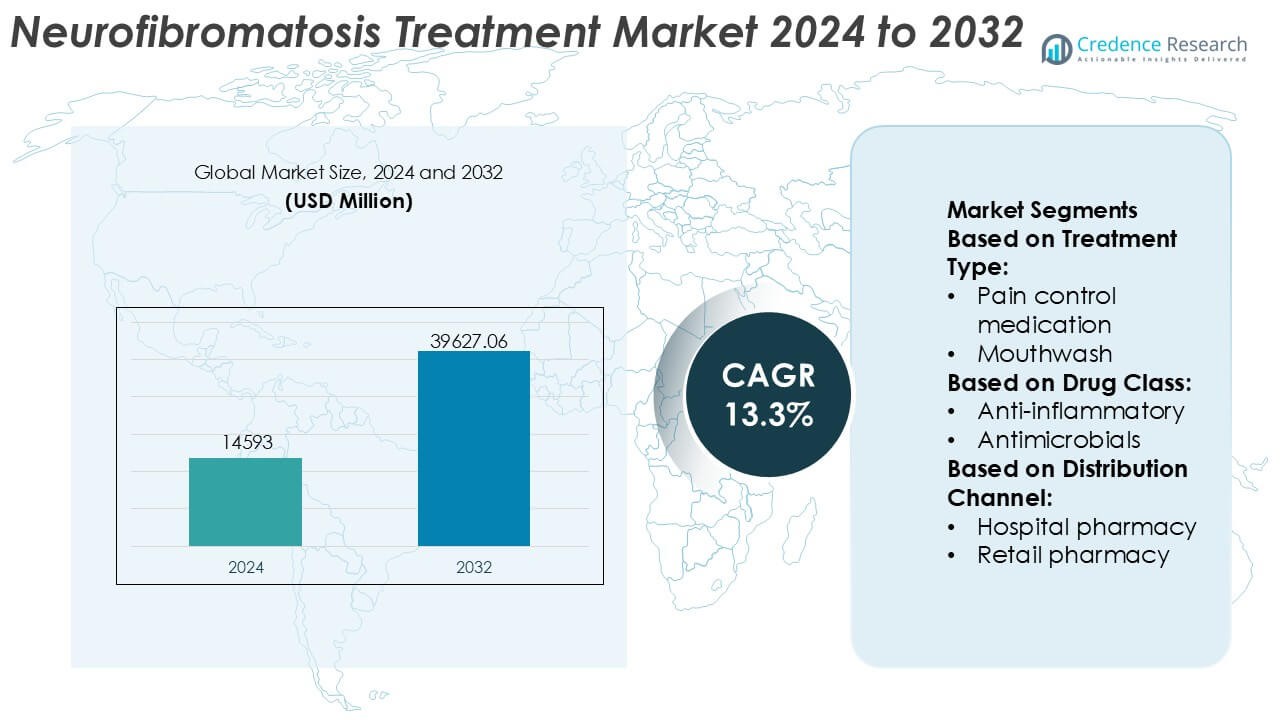

Neurofibromatosis Treatment Market size was valued USD 14593 million in 2024 and is anticipated to reach USD 39627.06 million by 2032, at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neurofibromatosis Treatment Market Size 2024 |

USD 14593 Million |

| Neurofibromatosis Treatment Market, CAGR |

13.3% |

| Neurofibromatosis Treatment Market Size 2032 |

USD 39627.06 Million |

The Neurofibromatosis Treatment Market is shaped by a concentrated group of established pharmaceutical and specialty therapy providers that compete through targeted drug development, orphan disease expertise, and strong clinical pipelines. Leading players focus on advancing precision therapies, expanding approved indications, and strengthening post-approval evidence to support long-term adoption. Strategic collaborations with research institutions and patient advocacy organizations further enhance competitive positioning and accelerate innovation. Regionally, North America dominates the market with an exact 41% share, supported by advanced healthcare infrastructure, early adoption of novel therapies, robust reimbursement systems, and high disease awareness. Strong regulatory support for rare diseases and a high concentration of specialized treatment centers reinforce the region’s leadership. Overall, competition centers on clinical differentiation, regulatory execution, and sustained investment in rare genetic disorder management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Neurofibromatosis Treatment Market was valued at USD 14,593 million in 2024 and is projected to reach USD 39,627.06 million by 2032, expanding at a CAGR of 13.3%, driven by rising diagnosis rates and increasing availability of targeted therapies.

- Market growth is primarily driven by advances in precision medicine, wider adoption of MEK inhibitors, and strong regulatory incentives for orphan drugs addressing rare genetic disorders.

- Key market trends include expansion of clinical pipelines, increased use of genetic testing for early diagnosis, and growing reliance on real-world evidence to support long-term treatment outcomes.

- The competitive landscape remains concentrated, with established players focusing on indication expansion, lifecycle management, and strategic collaborations to strengthen clinical differentiation and global reach.

- Regionally, North America leads with an exact 41% market share, supported by advanced healthcare infrastructure, while targeted drug therapies represent the dominant treatment segment due to superior efficacy and specialist preference.

Market Segmentation Analysis:

By Treatment Type

By treatment type, pain control medication represents the dominant sub-segment in the Neurofibromatosis Treatment Market, accounting for an estimated 48–52% market share, driven by the high prevalence of chronic neuropathic pain and tumor-associated discomfort among patients. Clinicians rely on analgesics, anticonvulsants, and adjunct pain therapies to manage long-term symptoms and improve quality of life. Mouthwash formulations hold a smaller but relevant share due to their role in managing oral lesions and mucosal complications, particularly in advanced cases. Other treatment types, including supportive and symptom-specific therapies, complement core pain management strategies across care settings.

- For instance, Alma Lasers supports adjunct, non-pharmacological symptom management through its CO₂ and Er:YAG laser platforms used for cutaneous neurofibroma reduction, operating at a 10,600 nm CO₂ wavelength and a 2,940 nm Er:YAG wavelength, with pulse durations measured in microseconds and energy delivery calibrated in joules per pulse, enabling precise lesion ablation with controlled thermal depth to improve patient comfort and recovery outcomes.

By Drug Class

By drug class, anti-neoplastic drugs dominate the segment with an estimated 34–38% market share, reflecting their critical role in managing tumor growth associated with neurofibromatosis, particularly plexiform neurofibromas. Targeted therapies and chemotherapy agents form the backbone of disease-modifying treatment, supported by growing clinical adoption. Anti-inflammatory drugs maintain steady demand for symptom relief related to inflammation and pain, while antimicrobials, antifungals, and antibiotics address secondary infections and treatment-related complications. Other drug classes, including adjunct neurologic and supportive agents, contribute to comprehensive, multi-drug treatment regimens.

- For instance, Sun Pharmaceutical Industries Ltd. has advanced its oncology portfolio through the commercialization of everolimus tablets (generic Afinitor) in 2.5 mg, 5 mg, and 10 mg strengths. While these products were historically associated with its Halol manufacturing facility in Gujarat.

By Distribution Channel

By distribution channel, hospital pharmacies lead the market with an estimated 42–46% share, supported by the complex nature of neurofibromatosis treatment, frequent specialist involvement, and the need for controlled dispensing of high-cost or specialty drugs. Hospitals also serve as primary centers for diagnosis, oncology care, and long-term disease management. Retail pharmacies follow, driven by ongoing prescription refills for pain control and supportive medications. Online pharmacies represent a growing channel, supported by chronic therapy needs, home delivery convenience, and increasing adoption of digital prescription platforms.

Key Growth Drivers

Rising Prevalence of Neurofibromatosis and Improved Diagnosis

The increasing prevalence of neurofibromatosis (NF), particularly NF1, significantly drives demand for targeted treatment solutions. Advances in genetic testing, molecular diagnostics, and imaging technologies have improved early and accurate diagnosis, expanding the treated patient pool. Enhanced disease awareness among clinicians and patients further supports timely intervention. As healthcare systems adopt standardized diagnostic protocols, more individuals receive long-term pharmacological and surgical care, directly contributing to sustained market growth across both developed and emerging healthcare markets.

- For instance, BIOFRONTERA Inc. supports clinically confirmed lesion assessment and treatment through its photodynamic therapy platform combining Ameluz® (10% aminolevulinic acid hydrochloride gel) with the BF-RhodoLED® XL lamp, which emits narrow-band red light at 635 nm and delivers a standardized light dose of 37 J/cm² over a controlled illumination period, a system validated across multicenter clinical studies involving more than 1,200 treated patients, enabling reproducible lesion visualization and targeted treatment planning based on documented cellular fluorescence response.

Advancements in Targeted and Precision Therapies

Rapid progress in targeted therapies, including MEK inhibitors and molecularly targeted drugs, strongly accelerates market expansion. Regulatory approvals of novel agents addressing tumor growth and symptom management have shifted treatment paradigms away from purely surgical approaches. These therapies offer improved efficacy, reduced systemic toxicity, and better quality-of-life outcomes. Ongoing clinical trials exploring gene-based and pathway-specific treatments continue to strengthen the product pipeline, attracting pharmaceutical investments and expanding therapeutic options for neurofibromatosis patients.

- For instance, AstraZeneca and MSD (known as Merck & Co. in the U.S. and Canada) developed and commercialized selumetinib (Koselugo®), an oral MEK1/2 inhibitor formulated in 10 mg and 25 mg capsules.

Growing Healthcare Expenditure and Specialty Care Infrastructure

Rising global healthcare expenditure and the expansion of specialty neurology and oncology centers support the adoption of advanced neurofibromatosis treatments. Improved access to multidisciplinary care, including neurologists, geneticists, and oncologists, enhances treatment continuity and outcomes. Government initiatives supporting rare disease management and reimbursement frameworks further encourage therapy adoption. Increased funding for orphan drug development also stimulates innovation, enabling manufacturers to address unmet needs in neurofibromatosis management.

Key Trends & Opportunities

Expansion of Orphan Drug Development and Regulatory Incentives

The neurofibromatosis treatment market benefits from strong momentum in orphan drug development. Regulatory incentives such as fast-track approvals, extended market exclusivity, and tax benefits encourage pharmaceutical companies to invest in rare disease therapies. These policies reduce development risks while accelerating commercialization timelines. As a result, companies increasingly focus on innovative small molecules and biologics, creating significant growth opportunities and strengthening the competitive landscape in neurofibromatosis therapeutics.

- For instance, Hill Dermaceuticals, Inc. provides FDA-approved prescription solutions for chronic dermatologic symptoms through products such as Derma-Smoothe/FS®, which contains fluocinolone acetonide 0.01% in a vehicle of refined peanut oil. The refined oil is specially processed to be free of allergenic proteins, ensuring safety for patients with peanut sensitivities.

Increasing Focus on Non-Surgical and Long-Term Management Solutions

A growing trend toward non-surgical treatment approaches presents substantial market opportunities. Long-term pharmacological management, symptom control therapies, and supportive care solutions are gaining traction as alternatives to invasive procedures. This shift reflects patient preference for less invasive treatments and improved disease control. The trend also supports continuous therapy demand, increasing recurring revenue streams for drug manufacturers and fostering sustained market growth.

- For instance, Almirall, S.A. has advanced non-invasive dermatology-focused innovation through products such as Klisyri® (tirbanibulin) ointment formulated at 10 mg/g, delivered in single-use sachets with a defined once-daily application regimen over 5 consecutive days, supported by a targeted Src kinase and tubulin polymerization inhibition mechanism.

Emerging Opportunities in Pediatric and Early-Stage Treatment

Pediatric neurofibromatosis treatment represents a high-growth opportunity, driven by earlier diagnosis and proactive disease management strategies. Pharmaceutical companies increasingly target early-stage interventions to slow disease progression and reduce long-term complications. Development of child-friendly formulations and dosing regimens further enhances treatment adoption. This focus aligns with rising awareness of lifelong disease burden, positioning pediatric-focused therapies as a key future growth segment.

Key Challenges

High Treatment Costs and Limited Reimbursement Coverage

The high cost of targeted neurofibromatosis therapies poses a significant challenge to market expansion. Many advanced treatments require prolonged administration, increasing financial burden on patients and healthcare systems. Limited reimbursement coverage in several regions restricts access, particularly in low- and middle-income countries. These cost-related barriers may slow adoption rates and create disparities in treatment availability, despite growing clinical demand for effective therapies.

Limited Patient Pool and Clinical Trial Constraints

The rarity of neurofibromatosis restricts patient availability for large-scale clinical trials, complicating drug development and regulatory approval processes. Small sample sizes can delay evidence generation and increase development timelines. Additionally, disease heterogeneity complicates trial design and outcome measurement. These factors elevate development costs and risk, potentially limiting the number of new entrants and slowing overall innovation within the neurofibromatosis treatment market.

Regional Analysis

North America

North America leads the Neurofibromatosis Treatment Market with an estimated 41% market share, driven by advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of targeted therapies. The region benefits from a high diagnosis rate of neurofibromatosis type 1 and type 2 due to widespread genetic screening and specialist access. Robust clinical research activity and rapid uptake of FDA-approved therapies, including MEK inhibitors, support sustained treatment demand. Pharmaceutical companies prioritize North America for clinical trials and new product launches, while patient advocacy organizations improve disease awareness. High healthcare spending and established rare disease management programs further reinforce the region’s dominant position.

Europe

Europe accounts for approximately 28% of the Neurofibromatosis Treatment Market, supported by well-established public healthcare systems and increasing focus on rare disease management. Countries such as Germany, France, and the United Kingdom lead regional demand through specialized neurology centers and coordinated referral networks. Strong regulatory support under orphan drug frameworks accelerates access to innovative therapies. Growing awareness among clinicians and patients improves early diagnosis and treatment adherence. However, pricing controls and reimbursement variability across countries influence market penetration rates. Continued investment in cross-border research collaborations and centralized registries strengthens Europe’s role in advancing standardized care for neurofibromatosis patients.

Asia Pacific

Asia Pacific holds around 21% market share and represents the fastest-expanding regional segment in the Neurofibromatosis Treatment Market. Rising healthcare expenditure, improving diagnostic capabilities, and expanding access to specialty care drive growth across China, Japan, South Korea, and India. Governments increasingly prioritize rare diseases through national health policies and reimbursement pilots. Large patient populations and growing genetic testing infrastructure support market expansion. Pharmaceutical companies enhance regional presence through partnerships with local healthcare providers. Despite progress, uneven access to advanced therapies persists between urban and rural areas, creating opportunities for affordable treatment solutions and broader awareness initiatives.

Latin America

Latin America captures nearly 6% of the global market, supported by gradual improvements in healthcare infrastructure and increasing recognition of rare genetic disorders. Brazil and Mexico serve as key contributors due to expanding public health coverage and growing specialist networks. Diagnosis rates continue to improve through better access to imaging and genetic testing. However, limited availability of advanced targeted therapies and reimbursement constraints slow adoption. International pharmaceutical companies focus on selective market entry and compassionate use programs. Ongoing healthcare reforms and increased collaboration with global rare disease organizations are expected to enhance treatment access and market stability across the region.

Middle East & Africa

The Middle East & Africa region represents about 4% market share, reflecting developing healthcare systems and lower diagnosis rates for neurofibromatosis. Gulf Cooperation Council countries lead regional demand due to higher healthcare investment, availability of specialized hospitals, and medical tourism. In contrast, many African countries face challenges related to limited genetic testing, specialist shortages, and low disease awareness. Governments and non-profit organizations increasingly support rare disease initiatives and capacity building. Gradual expansion of tertiary care facilities and improved referral pathways are expected to support long-term growth, although access disparities remain a key constraint.

Market Segmentations:

By Treatment Type:

- Pain control medication

- Mouthwash

By Drug Class:

- Anti-inflammatory

- Antimicrobials

By Distribution Channel:

- Hospital pharmacy

- Retail pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Neurofibromatosis Treatment Market players such as Alma Lasers, Sun Pharmaceutical Industries Ltd., BIOFRONTERA Inc., Novartis AG, Hill Dermaceuticals, Inc., Almirall, S.A, 3M, Galderma, Ortho Dermatologics (Bausch Health Companies Inc.), and LEO Pharma A/S. The Neurofibromatosis Treatment Market demonstrates a moderately competitive landscape characterized by continuous innovation, strong emphasis on targeted therapies, and growing specialization in rare disease management. Market participants focus on expanding clinical pipelines, improving treatment efficacy, and enhancing safety profiles to address the complex and heterogeneous nature of neurofibromatosis. Strategic priorities include investment in research and development, advancement of precision medicine approaches, and optimization of regulatory pathways for orphan drugs. Companies strengthen market presence through collaborations with research institutions, patient advocacy groups, and healthcare providers to improve diagnosis rates and treatment adoption. Increasing attention to real-world evidence, long-term outcome studies, and patient support initiatives further shapes competitive positioning. Overall, competition centers on delivering differentiated, clinically validated solutions while navigating pricing pressures, reimbursement requirements, and evolving standards of care across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alma Lasers

- Sun Pharmaceutical Industries Ltd.

- BIOFRONTERA Inc.

- Novartis AG

- Hill Dermaceuticals, Inc.

- Almirall, S.A

- 3M

- Galderma

- Ortho Dermatologics (Bausch Health Companies Inc.)

- LEO Pharma A/S

Recent Developments

- In April 2025, GSK and South Korean firm ABL Bio announced a significant, multi-program licensing agreement to develop innovative treatments for neurodegenerative diseases, such as Alzheimer’s and Parkinson’s disease.

- In February 2025, Eli Lilly mentioned investments in obesity treatment, positioning itself as a leader alongside semaglutide manufacturer Novo Nordisk, thanks to its successful drug tirzepatide. In addition, the company plans to leverage its extensive pipeline of incretin therapies by exploring potential applications in neurology and immunology.

- In July 2024, Currax Pharmaceuticals announced the approval of a new manufacturing site for CONTRAVE/MYSIMBA in the EU and EEA, doubling production capacity to ensure continuous supply amid GLP-1 supply issues.

- In June 2024, Almirall, S.A. launched an expanded indication for Klisyri (tirbanibulin) to treat actinic keratosis in larger field areas of up to 100 cm². While Klisyri has been available in Europe since 2021, this specific 2024 expansion for larger treatment areas was approved by the U.S. Food and Drug Administration (FDA).

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Drug Class, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Targeted and pathway-specific therapies will gain wider clinical adoption, improving disease control and long-term outcomes.

- Precision medicine approaches will increasingly guide treatment selection based on genetic and molecular profiling.

- Ongoing clinical trials will expand indications and optimize dosing regimens for existing therapies.

- Early diagnosis rates will improve through broader access to genetic testing and specialist referral networks.

- Multidisciplinary care models will strengthen coordination between neurology, oncology, dermatology, and surgery.

- Patient support programs will expand to enhance adherence, monitoring, and quality of life.

- Regulatory incentives for orphan drugs will continue to encourage innovation and pipeline development.

- Real-world evidence will play a greater role in shaping treatment guidelines and reimbursement decisions.

- Emerging delivery technologies will improve treatment convenience and safety profiles.

- Global awareness initiatives will reduce diagnostic delays and support more consistent standards of care across regions.