Market Overview

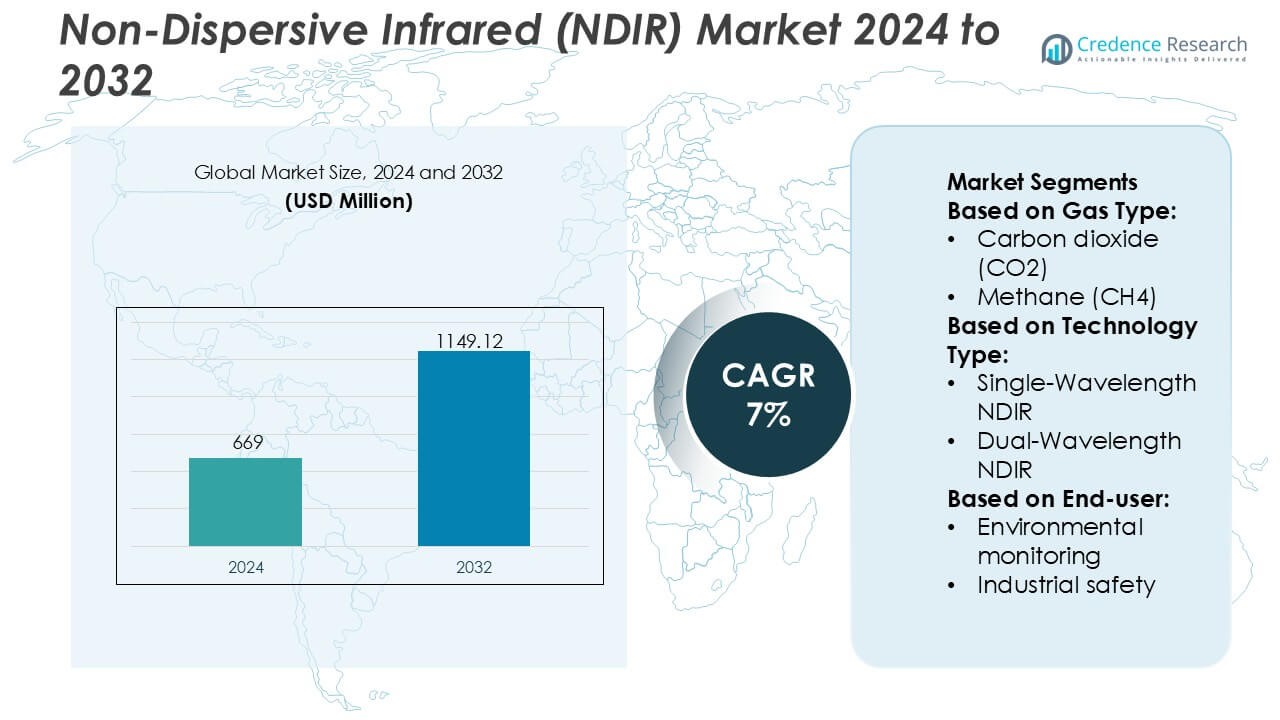

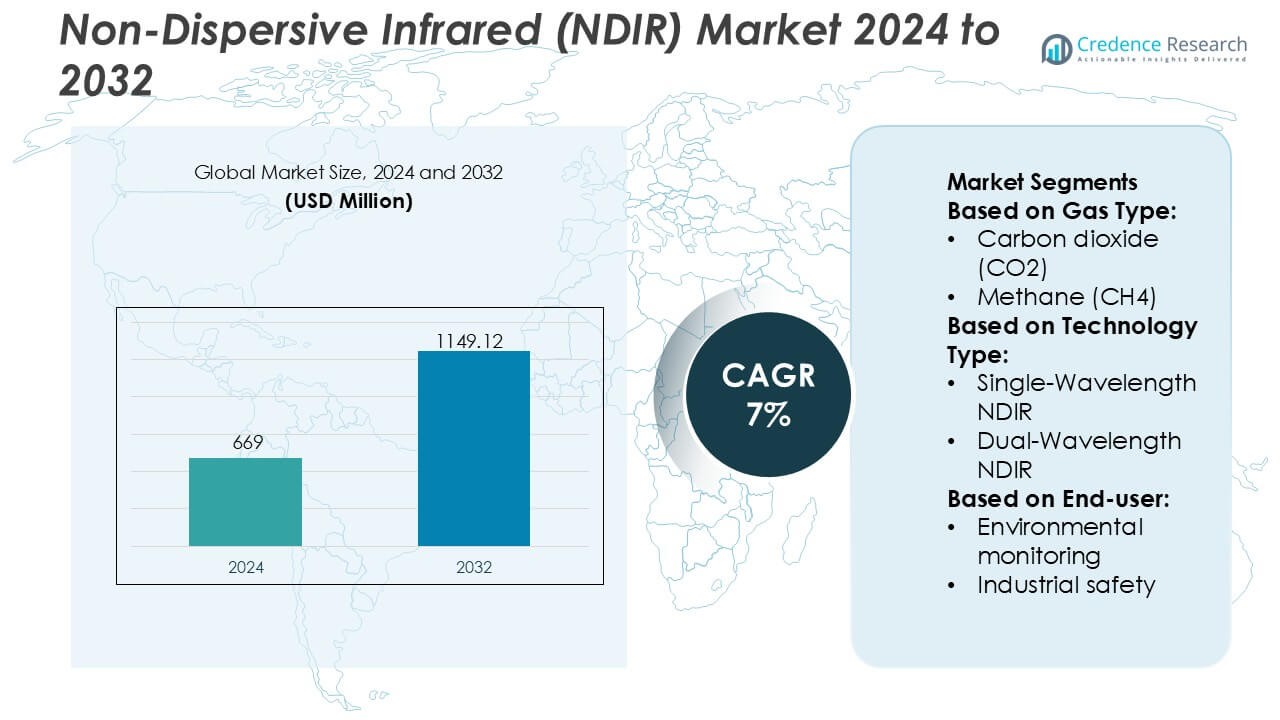

Non-Dispersive Infrared (NDIR) Market size was valued USD 669 million in 2024 and is anticipated to reach USD 1149.12 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-Dispersive Infrared (NDIR) Market Size 2024 |

USD 669 Million |

| Non-Dispersive Infrared (NDIR) Market, CAGR |

7% |

| Non-Dispersive Infrared (NDIR) Market Size 2032 |

USD 1149.12 Million |

The Non-Dispersive Infrared (NDIR) market is led by a group of established players with strong capabilities in infrared optics, sensor integration, and advanced signal processing, enabling them to address diverse applications across industrial safety, environmental monitoring, automotive emissions, and medical diagnostics. These companies compete through continuous innovation, focusing on sensor accuracy, long-term stability, miniaturization, and compatibility with digital and IoT-enabled systems. Strategic partnerships with OEMs and system integrators further strengthen their market presence and application reach. Regionally, North America leads the NDIR market with an exact 38% share, driven by stringent environmental regulations, advanced industrial automation, strong R&D ecosystems, and early adoption of high-performance gas sensing technologies across regulated industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Non-Dispersive Infrared (NDIR) market was valued at USD 669 million in 2024 and is projected to reach USD 1,149.12 million by 2032, expanding at a CAGR of 7% during the forecast period, supported by broad adoption across safety-critical and regulated industries.

- Rising demand for accurate and stable gas monitoring in industrial safety, environmental surveillance, automotive emissions control, and medical diagnostics remains the primary market driver, with carbon dioxide monitoring representing the dominant gas segment due to widespread regulatory and process-control requirements.

- Ongoing trends include sensor miniaturization, low-power designs, and integration with IoT and digital monitoring platforms, enabling real-time data analytics and remote system management across smart factories and infrastructure.

- The competitive landscape is shaped by innovation-led strategies, strong R&D investment, and partnerships with OEMs, while high initial sensor costs and performance sensitivity in harsh environments act as key market restraints.

- Regionally, North America leads with an exact 38% share, followed by Europe and Asia-Pacific, while industrial safety and environmental monitoring together account for the largest segment share due to strict compliance mandates.

Market Segmentation Analysis:

By Gas Type

The NDIR market by gas type is led by carbon dioxide (CO₂) sensors, which hold the dominant share at approximately 46% of total demand. This leadership reflects widespread deployment across indoor air quality systems, HVAC controls, green building management, and industrial process monitoring, where stable, selective CO₂ detection is critical. Growing regulatory focus on ventilation efficiency, carbon capture utilization, and emissions tracking continues to reinforce adoption. Methane (CH₄) follows as a high-growth segment driven by leak detection in oil and gas operations, while carbon monoxide and refrigerant gas sensors maintain steady demand in safety-critical and compliance-driven applications.

- For instance, Lynred supports high-precision CO₂ and hydrocarbon detection using its uncooled and cooled infrared detector technologies operating in the 3–5 µm and 8–12 µm spectral bands, aligned with the 4.26 µm CO₂ absorption line.

By Technology Type

Among technology types, single-wavelength NDIR systems account for the largest share at around 52%, supported by their cost efficiency, compact design, and suitability for high-volume deployments. These systems dominate HVAC, indoor air quality, and portable monitoring devices where target gas environments remain stable. Strong demand from building automation and consumer-grade sensing platforms sustains volume leadership. Dual-wavelength NDIR gains traction in industrial safety and automotive emissions due to improved baseline correction, while multi-wavelength NDIR adoption accelerates in advanced process analytics where multi-gas discrimination and higher accuracy justify premium system costs.

- For instance, Texas Instruments Incorporated supports single- and multi-wavelength NDIR system development through its DLP® technology, including the DLP2010NIR digital micromirror device featuring a 0.2-inch diagonal micromirror array with 854 × 480 resolution and micromirrors measuring 5.4 µm.

By End-user

The environmental monitoring segment leads NDIR adoption with an estimated 39% market share, driven by continuous air quality surveillance, emissions reporting, and climate-related monitoring initiatives. Government mandates, smart city programs, and industrial compliance requirements fuel sustained sensor deployment across fixed and distributed networks. Industrial safety represents a strong secondary segment, benefiting from real-time toxic and combustible gas detection needs. Food and beverage processing and medical diagnostics show rising uptake due to non-contact measurement advantages, while automotive emissions monitoring expands steadily alongside stricter on-road and off-road emissions control standards.

Key Growth Drivers

Expanding Demand for Gas Monitoring Across Industrial and Environmental Applications

Rising regulatory scrutiny on air quality, workplace safety, and emissions monitoring continues to drive adoption of NDIR sensors. Industries such as oil and gas, chemicals, power generation, and manufacturing increasingly deploy fixed and portable gas analyzers to ensure compliance with safety standards and environmental norms. NDIR technology offers high selectivity, long-term stability, and minimal calibration requirements, making it well suited for continuous monitoring of critical gases. Growing investments in environmental monitoring infrastructure further strengthen demand across both developed and emerging economies.

- For instance, Honeywell International Inc. has expanded industrial and environmental monitoring through its XNX™ Universal Transmitter and Searchline Excel™ Plus systems, which integrate infrared gas sensing capable of detecting hydrocarbon gases over path lengths up to 120 m.

Increasing Adoption in Automotive and Mobility Applications

The automotive sector remains a significant growth driver for the NDIR market, supported by tightening emission regulations and the transition toward advanced engine management systems. NDIR sensors play a critical role in exhaust gas analysis, cabin air quality monitoring, and battery thermal management in electric and hybrid vehicles. Their ability to deliver accurate, real-time measurements under harsh operating conditions supports compliance with emission standards while improving fuel efficiency and passenger safety. Expanding vehicle production and rising integration of smart sensing technologies continue to accelerate market uptake.

- For instance, Excelitas Technologies provides automotive-qualified infrared emitters and detectors designed for NDIR (Non-Dispersive Infrared) gas sensing. These components meet the rigorous AEC-Q and TS16949 standards required for vehicle cabin air quality monitoring and emission testing.

Technological Advancements Improving Sensor Performance and Cost Efficiency

Continuous innovation in optics, infrared sources, detectors, and signal processing enhances the performance and commercial viability of NDIR sensors. Miniaturization, improved optical path designs, and integration with digital interfaces reduce power consumption and overall system costs. These advances enable broader deployment in compact devices, IoT-enabled platforms, and cost-sensitive applications. Improved accuracy, faster response times, and longer operational lifespans strengthen the value proposition of NDIR technology, encouraging adoption across new end-user segments and supporting sustained market growth.

Key Trends & Opportunities

Integration of NDIR Sensors with IoT and Smart Monitoring Platforms

A key trend shaping the NDIR market involves integration with IoT ecosystems and cloud-based analytics platforms. Connected NDIR sensors enable remote monitoring, predictive maintenance, and real-time data visualization across industrial and environmental networks. This integration supports proactive decision-making, reduces downtime, and enhances regulatory reporting efficiency. Growing adoption of smart factories, smart buildings, and digital environmental monitoring systems creates new opportunities for NDIR suppliers to deliver value-added, data-driven solutions beyond standalone sensing hardware.

- For instance, P13243 series consists of high-speed InAsSb (Indium Antimonide) photovoltaic detectors, not thermopiles. These are lead-free, environmentally friendly quantum sensors designed to replace older PbSe (Lead Selenide) detectors for gas sensing.

Rising Opportunities in Healthcare and Food Safety Applications

NDIR technology increasingly gains traction in healthcare diagnostics and food and beverage processing due to its non-invasive measurement capability and high accuracy. Applications such as medical breath analysis, anesthesia monitoring, fermentation control, and modified-atmosphere packaging benefit from reliable gas detection without cross-sensitivity issues. Rising emphasis on patient safety, quality control, and regulatory compliance expands the addressable market. These emerging applications offer attractive growth opportunities, particularly for compact and application-specific NDIR sensor designs.

- For instance, Murata’s NDIR CO₂ sensors achieve accurate detection even at atmospheric CO₂ concentrations below 400 ppm through a dual-beam optical system that separates measurement and reference channels to reduce drift and baseline errors.

Key Challenges

High Initial Cost Compared to Alternative Sensing Technologies

Despite performance advantages, NDIR sensors often carry higher upfront costs than electrochemical or semiconductor-based alternatives. This cost differential can limit adoption in highly price-sensitive applications or low-volume deployments. Components such as infrared sources, optical filters, and precision detectors contribute to higher manufacturing expenses. While long-term stability and reduced maintenance offset lifecycle costs, budget constraints in certain end-user segments remain a barrier, particularly in developing markets and consumer-grade applications.

Performance Limitations in Complex or Harsh Operating Environments

NDIR sensors may face challenges in environments with high humidity, dust, vibration, or rapidly fluctuating temperatures. Optical contamination, condensation, and signal drift can affect measurement accuracy if not properly managed through system design. Additionally, detection limits for certain low-concentration gases may require advanced configurations, increasing complexity. Addressing these limitations demands robust packaging, compensation algorithms, and periodic validation, which can increase system complexity and slow adoption in demanding field conditions.

Regional Analysis

North America

North America leads the Non-Dispersive Infrared (NDIR) market with an exact 38% share, supported by stringent environmental regulations, advanced industrial safety standards, and early adoption of sensing technologies. Strong demand originates from environmental monitoring, oil and gas operations, automotive emissions testing, and healthcare diagnostics. The presence of established sensor manufacturers, robust R&D ecosystems, and widespread integration of IoT-based monitoring platforms strengthens regional dominance. Continuous investments in smart infrastructure, industrial automation, and regulatory compliance programs further reinforce demand for high-accuracy, low-maintenance NDIR gas sensing solutions across the United States and Canada.

Europe

Europe holds an exact 27% share of the global NDIR market, driven by strict emission control directives, workplace safety regulations, and sustainability initiatives. Countries across Western and Northern Europe actively deploy NDIR sensors in industrial safety systems, building automation, automotive testing, and environmental monitoring networks. Strong emphasis on decarbonization, indoor air quality, and industrial digitization accelerates sensor adoption. The region benefits from strong collaboration between research institutions and sensor manufacturers, supporting continuous innovation in optical design and miniaturization. Regulatory harmonization across the European Union further sustains steady regional demand.

Asia-Pacific

Asia-Pacific accounts for an exact 24% share of the NDIR market and represents the fastest-growing regional landscape. Rapid industrialization, expanding manufacturing bases, and rising environmental awareness drive strong adoption across China, Japan, South Korea, and India. Governments increasingly invest in air quality monitoring, industrial safety, and smart city infrastructure, creating large-scale deployment opportunities. Growth in automotive production, electronics manufacturing, and food processing further boosts demand for reliable gas sensing solutions. Cost-effective manufacturing capabilities and rising local sensor production also enhance market penetration across both industrial and emerging consumer applications.

Latin America

Latin America captures an exact 6% share of the global NDIR market, supported by gradual improvements in industrial safety standards and environmental monitoring initiatives. Demand primarily arises from oil and gas operations, mining activities, and food and beverage processing industries. Governments increasingly focus on emissions compliance and workplace safety, encouraging adoption of stable and low-maintenance gas sensing technologies. Although budget constraints limit large-scale deployments, growing awareness of air quality and safety regulations supports steady market expansion. Brazil and Mexico remain key contributors due to their industrial scale and regulatory progress.

Middle East & Africa

The Middle East & Africa region holds an exact 5% share of the NDIR market, driven mainly by oil and gas, petrochemical, and power generation sectors. Harsh operating environments increase the need for durable, non-consumable gas sensing technologies, positioning NDIR sensors as a reliable solution. Environmental monitoring initiatives and industrial safety regulations continue to strengthen, particularly in Gulf Cooperation Council countries. While adoption remains moderate compared to mature regions, infrastructure development, industrial diversification, and rising investments in environmental compliance gradually expand regional demand for NDIR-based gas monitoring systems.

Market Segmentations:

By Gas Type:

- Carbon dioxide (CO2)

- Methane (CH4)

By Technology Type:

- Single-Wavelength NDIR

- Dual-Wavelength NDIR

By End-user:

- Environmental monitoring

- Industrial safety

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Non-Dispersive Infrared (NDIR) market players such as Lynred, Texas Instruments Incorporated, Honeywell International Inc., Excelitas Technologies Corp., Hamamatsu Photonics K.K., Teledyne Technologies Incorporated, Murata Manufacturing Co., Ltd., Raytheon Technologies Corporation, NXP Semiconductors N.V., and FLIR Systems, Inc. The Non-Dispersive Infrared (NDIR) market exhibits a competitive landscape characterized by strong emphasis on technological differentiation, product reliability, and application-specific performance. Market participants compete on sensor accuracy, long-term stability, response time, and resistance to environmental interference, particularly in demanding industrial and outdoor settings. Continuous investments in optical design, infrared source efficiency, and advanced signal processing support improvements in sensitivity and cost efficiency. Companies increasingly focus on miniaturized, low-power sensors compatible with digital and IoT-based monitoring systems. Strategic collaboration with OEMs and system integrators enhances market reach and accelerates deployment across environmental monitoring, automotive emissions, industrial safety, and healthcare applications.

Key Player Analysis

- Lynred

- Texas Instruments Incorporated

- Honeywell International Inc.

- Excelitas Technologies Corp.

- Hamamatsu Photonics K.K.

- Teledyne Technologies Incorporated

- Murata Manufacturing Co., Ltd.

- Raytheon Technologies Corporation

- NXP Semiconductors N.V.

- FLIR Systems, Inc.

Recent Developments

- In December 2024, Sensidyne launched the SensAlert IR fixed-point infrared gas detector a rugged device using dual-wavelength NDIR technology for precise detection of combustible hydrocarbons in harsh, hazardous environments like oil & gas and chemical plants, offering reliability, low maintenance (no routine calibration needed), and resilience against sensor poisoning and etching, even in low-oxygen (anaerobic) conditions.

- In May 2024, Servomex announced the SERVOTOUGH SpectraExact 2500F photometric analyzer specifically for performing accurate liquid water measurements in corrosive, hazardous, and flammable environments. By using non-dispersive infrared technology in single-beam dual-wavelength mode, the SpectraExact 2500F achieves stable performance and increased sensitivity levels.

- In May 2023, Yokogawa Electric Corporation launched the IR800G (rack), IR810G (wall/panel), and IR810S (explosion-proof) NDIR gas analyzers as part of their OpreX Analyzers lineup, designed for precise, low-concentration greenhouse gas (GHG) monitoring (CO2, CO, CH4, NO, SO2) with features like active zero-drift correction and automatic blowback for improved accuracy and reduced maintenance in Continuous Emission Monitoring Systems (CEMS).

Report Coverage

The research report offers an in-depth analysis based on Gas Type, Technology Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- NDIR sensor adoption will expand steadily across environmental monitoring, industrial safety, and emission control applications.

- Continuous miniaturization will enable wider integration of NDIR sensors into portable, wearable, and embedded devices.

- Advances in infrared sources and detectors will improve sensitivity, stability, and operational lifespan.

- Integration with IoT platforms and cloud-based analytics will strengthen real-time monitoring and predictive maintenance capabilities.

- Automotive applications will grow with increasing focus on emission compliance, cabin air quality, and electric vehicle systems.

- Healthcare and medical diagnostics will create new demand for non-invasive gas analysis solutions.

- Food and beverage processing will increase reliance on NDIR sensors for quality control and process optimization.

- Cost optimization through scalable manufacturing will improve adoption in price-sensitive and emerging markets.

- Regulatory emphasis on air quality and workplace safety will continue to support long-term market expansion.

- Application-specific customization will differentiate suppliers and strengthen competitive positioning.