Market Overview

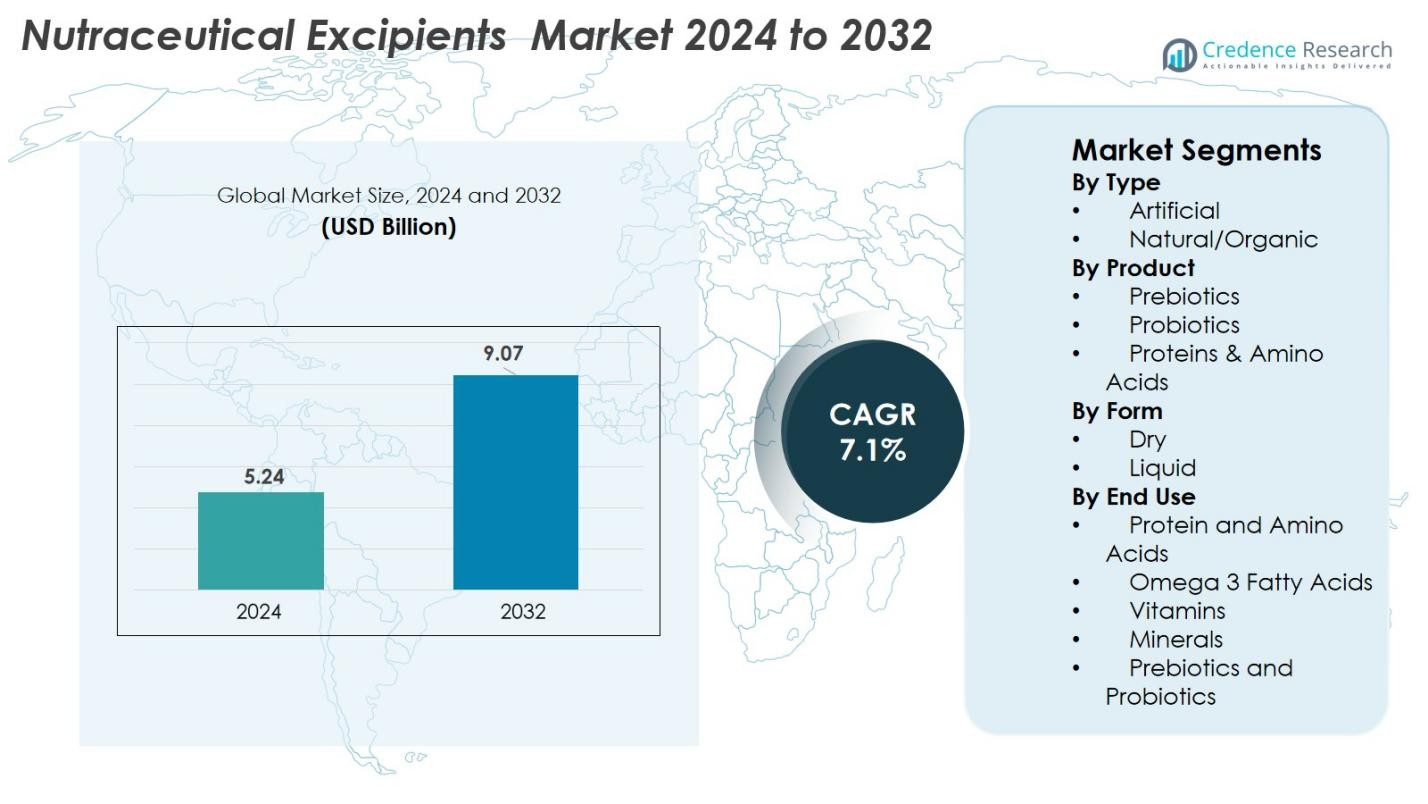

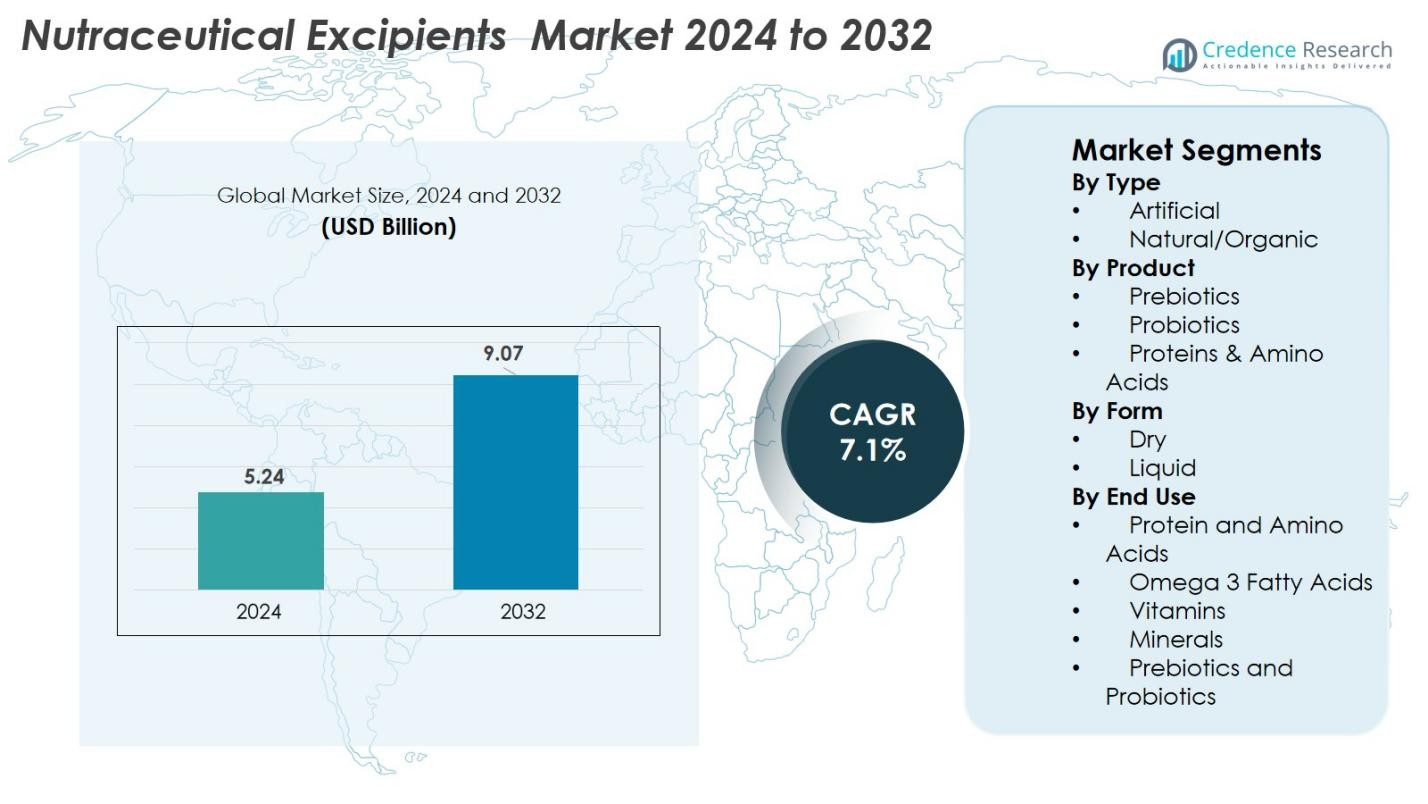

Nutraceutical Excipients Market size was valued at USD 5.24 Billion in 2024 and is anticipated to reach USD 9.07 Billion by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nutraceutical Excipients Market Size 2024 |

USD 5.24 Billion |

| Nutraceutical Excipients Market, CAGR |

7.1% |

| Nutraceutical Excipients Market Size 2032 |

USD 9.07 Billion |

Nutraceutical Excipients Market continues to expand rapidly, driven by strong demand for clean-label supplements and advanced formulation technologies. Leading players such as Shin-Etsu Chemical Co. Ltd., Roquette Frères, Kerry Group PLC, Associated British Foods, MEGGLE Group Wasser, Fuji Chemical Industries Co. Ltd., Gattefossé, Pharmatrans Sanaq AG, Pioma Chemicals, and Ingredion Plc strengthen market growth through innovation in natural, organic, and multifunctional excipients. North America leads the global landscape with a 36% share, supported by a mature supplement industry and high consumer health awareness. Europe follows with 29%, driven by strict regulatory standards and strong demand for plant-based excipients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nutraceutical Excipients market was valued at USD 5.24 Billion in 2024 and is projected to reach USD 9.07 Billion by 2032, registering a CAGR of 7.1% during the forecast period.

- Growing demand for functional foods, dietary supplements, and clean-label formulations acts as a key driver, with natural/organic excipients leading the type segment with a 62% share due to rising preference for plant-based and non-GMO ingredients.

- Market trends highlight increased adoption of advanced excipients that enhance solubility, bioavailability, and controlled release, driven by innovation in microencapsulation and plant-derived ingredients.

- Key players focus on expanding portfolios and manufacturing capacities, with strong activity from Shin-Etsu Chemical, Roquette Frères, Kerry Group, MEGGLE, and Ingredion as companies compete through R&D and partnerships.

- Regionally, North America holds a 36% share, followed by Europe at 29% and Asia Pacific at 25%, reflecting strong supplement demand, regulatory frameworks, and rising health awareness across major consumer markets.

Market Segmentation Analysis

By Type

The Nutraceutical Excipients market by type is led by the Natural/Organic segment, commanding 62% share in 2024, driven by rising consumer preference for clean-label formulations, plant-derived additives, and minimally processed ingredients. Manufacturers increasingly adopt natural binders, fillers, and stabilizers to meet stringent regulatory expectations and align with sustainability goals. The Artificial segment, while still relevant for cost-efficient formulations, sees slower growth as brands focus on product transparency, allergen-free profiles, and bio-based excipients to enhance digestibility and compatibility in functional foods, dietary supplements, and sports nutrition applications.

- For Instance, Roquette supplies a broad portfolio of plant-based fillers, diluents and binders for nutraceuticals enabling formulation of solid dosage forms (tablets/capsules) using natural cellulose- or starch-derived excipients rather than synthetic binders.

By Product

Within the product category, Proteins & Amino Acids dominate the market with a 48% share, supported by their widespread use as stabilizers, texture enhancers, and bioactive carriers in nutraceutical formulations. Growth is fueled by rising protein-enriched dietary supplements, fortified beverages, and functional foods targeting muscle health, weight management, and active lifestyles. Prebiotics and Probiotics segments also expand steadily due to growing consumer awareness of gut health, but proteins remain the leading choice due to their multifunctional properties and compatibility across a wide range of nutraceutical delivery formats.

- For instance, Arla Foods Ingredients’ Lacprodan® whey protein isolates are widely used in ready-to-mix supplements and medical nutrition due to their high solubility and heat stability, enabling clear-beverage and fortified-drink applications.

By Form

By form, the Dry segment holds a commanding 71% share, driven by its superior stability, longer shelf life, and ease of incorporation into tablets, capsules, and powder-based supplements. Dry excipients offer better flowability, compressibility, and formulation versatility, making them preferred by manufacturers for large-scale nutraceutical production. The Liquid segment gains traction in specialized applications such as syrups, emulsions, and liquid-filled capsules, but its adoption remains lower due to shorter stability windows and higher storage costs, keeping the dry form as the dominant format across global markets.

Key Growth Drivers

Rising Demand for Functional Foods and Dietary Supplements

The growing global shift toward preventive healthcare significantly drives the demand for nutraceutical excipients. Consumers increasingly seek functional foods, fortified beverages, and dietary supplements to support immunity, digestive wellness, cognitive health, and active aging. This trend accelerates the need for high-performance excipients that enhance bioavailability, stability, and controlled release of active ingredients. Manufacturers rely on advanced binders, fillers, disintegrants, and coating agents to improve formulation efficiency and ensure consistent product performance. Additionally, the rising prevalence of lifestyle disorders such as obesity, diabetes, and cardiovascular diseases pushes consumers toward supplement-based nutrition. E-commerce expansion boosts access to nutraceutical products, indirectly increasing excipient consumption. As brands diversify into gummies, effervescent tablets, chewables, high-protein blends, and plant-based nutrition formats, the need for versatile, multifunctional excipients grows rapidly. This demand creates strong growth momentum across both emerging and developed markets.

- For instance, Lonza’s Capsugel® Vcaps Plus plant-based capsules are documented to improve moisture protection and stability for probiotic and herbal nutraceutical formulations, supporting the clean-label shift.

Expansion of Clean-Label and Natural Ingredient Preferences

The shift toward clean-label formulations remains a powerful driver for the nutraceutical excipients market. Consumers increasingly prioritize natural, organic, allergen-free, and non-GMO ingredients, pushing formulators to replace synthetic additives with bio-based alternatives. Natural excipients derived from plant fibers, starches, gums, cellulose, and fermentation-based ingredients gain widespread adoption due to better biocompatibility, sustainability, and low toxicity. Stricter global regulations—including FDA, EFSA, and regional clean-label standards—encourage manufacturers to improve formulation transparency and minimize artificial components. This transition supports innovation in natural binders, sweeteners, flavor carriers, stabilizers, and flow agents suitable for tablets, capsules, powders, and functional beverages. As major brands reposition themselves around wellness and purity, the market experiences strong growth in naturally sourced excipients. The trend extends into vegan, organic, halal, and kosher-certified products, further broadening the demand across nutraceutical applications worldwide.

- For instance, Ingredion’s NOVATION® functional native starches are clean-label certified and widely used in nutraceutical powders and beverages as natural thickeners and stabilizers, replacing modified starches.

Technological Advancements in Excipient Functionality

Continuous innovation in formulation technologies significantly strengthens market expansion, with manufacturers investing in high-performance excipients that enhance solubility, absorption, taste masking, and stability of nutraceutical actives. The rise of microencapsulation, nanotechnology, spray-drying, and controlled-release systems boosts the adoption of advanced excipients designed for targeted delivery and improved bioavailability of key nutrients such as omega-3s, probiotics, amino acids, botanical extracts, and minerals. These technologies enable manufacturers to create differentiated products that withstand heat, moisture, and oxidative degradation. Growing demand for gummy supplements, effervescent tablets, liquid-filled capsules, and high-nutrient powders further accelerates innovation in functional carriers, emulsifiers, and disintegrants. In addition, automated manufacturing and continuous processing systems enhance excipient performance consistency. As brands compete on product efficacy and convenience, technologically advanced excipients play a critical role in enabling premium nutraceutical formulations.

Key Trends & Opportunities

Growth of Personalized Nutrition and Customized Formulations

The rise of personalized nutrition represents a major opportunity for the nutraceutical excipients market. Consumers increasingly seek tailor-made supplements aligned with genetic profiles, metabolic responses, lifestyle metrics, and specific health goals. This shift creates demand for specialized excipients that allow flexible dosing, targeted delivery, and modular formulation structures. Technologies such as 3D-printed supplements, customizable powder blends, and personalized sachets require highly adaptable excipients to support stability, flowability, and precise nutrient release. Digital health platforms, wearables, and AI-based nutrition assessment tools fuel the adoption of personalized nutraceuticals, expanding opportunities for premium excipients. As brands focus on micro-segmenting consumer needs—such as cognitive health, gut microbiome balance, hormonal wellness, and stress management—the use of advanced carriers, sustained-release agents, and natural stabilizers increases significantly. This trend opens sustained innovation avenues for functional, high-performance excipients.

- For instance, Nestlé Health Science’s Persona Nutrition platform delivers personalized daily supplement packs, relying on flow-optimized excipients to maintain capsule stability and uniformity across hundreds of ingredient combinations.

Rapid Expansion of Plant-Based and Vegan Nutraceuticals

The accelerating shift toward plant-based nutrition presents substantial opportunities in the nutraceutical excipients industry. Consumers increasingly adopt vegan and plant-forward lifestyles driven by health awareness, sustainability concerns, and ethical preferences. This trend stimulates demand for plant-derived excipients such as starches, gums, pectins, cellulose derivatives, rice flour, and fermentation-based ingredients. Manufacturers leverage vegan-certified binders, sweeteners, and coating agents to create clean, allergen-free nutraceutical formulations free from gelatin, lactose, and other animal-derived components. Plant-based protein supplements, botanical extracts, herbal blends, and gut-health products represent rapidly expanding application areas that rely heavily on natural excipients. As global brands introduce vegan tablets, gummies, and capsules, the opportunity for innovative, plant-sourced excipient solutions expands across functional foods, dietary supplements, and wellness beverages.

- For instance, Roquette’s LYCOAT® pregelatinized pea starch is used as a plant-derived binder and film-forming agent in vegan tablets and gummies, replacing animal-derived gelatin.

Key Challenges

Regulatory Complexity and Quality Compliance Requirements

The nutraceutical excipients market faces growing regulatory challenges due to variations in global standards governing ingredient safety, purity, labeling, and functional claims. Agencies such as the FDA, EFSA, and regional authorities impose strict guidelines on excipient identity, manufacturing processes, contamination control, and allowable usage levels. Achieving compliance across multiple jurisdictions increases operational complexity and cost for manufacturers. Frequent updates to clean-label expectations, allergen declarations, and contaminant thresholds (such as heavy metals or microbial limits) create additional burdens. Smaller manufacturers often struggle with documentation, traceability requirements, and GMP adherence. The regulatory distinction between pharmaceutical and nutraceutical excipients further complicates approvals, slowing product innovation and launch timelines. Ensuring consistent global compliance remains a significant barrier for market expansion.

High Production Costs and Raw Material Price Volatility

The industry faces cost pressures due to fluctuations in raw material prices, particularly natural ingredients derived from plant fibers, gums, starches, or fermentation processes. Demand for organic and sustainably sourced materials further increases procurement costs. Energy-intensive manufacturing processes such as spray-drying, microencapsulation, and granulation add to operational expenses. Supply chain disruptions—driven by climate impacts, geopolitical instability, and logistics constraints—cause unpredictable cost variations, affecting profit margins for excipient producers. Manufacturers must also invest in advanced quality testing, specialized production equipment, and regulatory compliance measures, escalating overall costs. These financial constraints pose a significant challenge, especially for companies trying to scale natural, high-performance excipient production across global markets.

Regional Analysis

North America

North America leads the Nutraceutical Excipients market with a 36% share, supported by strong consumer demand for dietary supplements, functional foods, and clean-label nutrition products. The region benefits from advanced manufacturing capabilities, strict regulatory oversight, and a high adoption rate of innovative excipients for controlled release and enhanced bioavailability. Rising health awareness, an aging population, and expanding protein and probiotic supplement categories further strengthen market growth. Major players invest in natural, allergen-free, and non-GMO excipient development, while e-commerce channels accelerate product accessibility across the United States and Canada.

Europe

Europe accounts for 29% of the market, driven by stringent regulatory standards, rising demand for organic and natural excipients, and widespread consumer preference for clean-label nutraceuticals. The region’s mature dietary supplement industry accelerates adoption of advanced binders, fillers, and disintegrants in tablets, capsules, and powder formulations. Countries such as Germany, the U.K., France, and Italy lead due to strong innovation in plant-based nutrition and functional food products. Sustainability-focused initiatives and compliance with EFSA guidelines promote high-quality excipient production, supporting ongoing growth across diverse nutraceutical applications.

Asia Pacific

Asia Pacific holds a rapidly expanding 25% share, driven by booming nutraceutical consumption in China, India, Japan, and South Korea. Rising disposable income, growing awareness of preventive healthcare, and increasing demand for fortified foods and herbal supplements fuel market expansion. The region’s strong production base for plant-derived and fermentation-based excipients supports cost-effective manufacturing. Rapid urbanization and lifestyle-related health concerns also increase reliance on protein supplements, probiotics, and functional beverages. Global manufacturers continue to invest in the region due to favorable regulatory reforms and strong growth potential across developing economies.

Latin America

Latin America represents an emerging 6% share of the Nutraceutical Excipients market, supported by growing consumer interest in immunity-boosting supplements, herbal products, and fortified nutrition. Countries such as Brazil, Mexico, and Argentina show rising adoption of excipients in tablets, capsules, and functional beverages driven by increasing health awareness and expansion of regional manufacturing capabilities. Demand for natural and plant-based excipients is accelerating as consumers shift toward cleaner formulations. However, regulatory inconsistency and economic fluctuations create challenges for manufacturers entering the market, although long-term growth remains promising.

Middle East & Africa

The Middle East & Africa region contributes 4% to the global market, with growth driven by rising health consciousness, expanding urban populations, and increased demand for dietary supplements addressing immunity, energy, and general wellness. Markets such as the UAE, Saudi Arabia, and South Africa lead adoption due to stronger retail infrastructure and higher purchasing power. The region sees growing interest in natural excipients for herbal and halal-certified nutraceuticals. Despite limited local manufacturing and regulatory complexity slowing expansion, increasing investments in healthcare and nutrition continue to create opportunities for market penetration.

Market Segmentations

By Type

- Artificial

- Natural/Organic

By Product

- Prebiotics

- Probiotics

- Proteins & Amino Acids

By Form

By End Use

- Protein and Amino Acids

- Omega 3 Fatty Acids

- Vitamins

- Minerals

- Prebiotics and Probiotics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Nutraceutical Excipients market features a diverse and innovation-driven competitive landscape, with global and regional players focusing on advanced formulation technologies, clean-label solutions, and bio-based ingredient development. Leading companies such as Shin-Etsu Chemical Co. Ltd., Roquette Frères, Kerry Group PLC, Associated British Foods, MEGGLE Group Wasser, Fuji Chemical Industries Co. Ltd., Gattefossé, Pharmatrans Sanaq AG, Pioma Chemicals, and Ingredion Plc actively expand their portfolios to meet rising demand for natural, organic, and multifunctional excipients. These players invest heavily in R&D to enhance solubility, stability, taste masking, and controlled-release properties while strengthening their presence in high-growth segments such as protein supplements, probiotics, gummies, and functional beverages. Strategic partnerships, capacity expansions, and acquisitions remain central to gaining market share, improving supply chain efficiency, and addressing evolving regulatory requirements across global nutraceutical markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Chemical Industries Co Ltd

- Gattefosse

- Roquette Freres

- Shin-Etsu Chemical Co Ltd

- PharmatransSanaq AG

- MEGGLE Group Wasser

- Ingredion Plc

- Kerry Group PLC

- Pioma Chemicals

- Associated British Foods

Recent Developments

- In February 2024, Ingredion Incorporated, United States launched NOVATION® Indulge2940 functional native starch, a clean-label texturizer that supports gelling and improved mouthfeel in plant-based and supplement applications.

- In October 2023, Roquette launched three new excipient grades for moisture-sensitive active ingredients aimed at improving stability and performance of pharmaceutical and nutraceutical formulations.

- In September 2022, Roquette Frères completed the acquisition of Crest Cellulose, an Indian excipient manufacturer strengthening Roquette’s global plant-based excipient supply capacity

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Form, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as consumers increasingly prioritize preventive healthcare and nutrition-focused lifestyles.

- Demand for natural, organic, and clean-label excipients will continue to rise across supplements and functional foods.

- Advancements in controlled-release, taste-masking, and bioavailability-enhancing technologies will shape future formulation strategies.

- Personalized nutrition will drive the need for adaptable excipients suitable for custom dosing and targeted delivery.

- Plant-based and vegan product expansion will accelerate adoption of botanical and fermentation-derived excipients.

- Global regulatory harmonization efforts will push manufacturers to enhance quality, transparency, and compliance.

- Innovation in gummies, effervescent tablets, and liquid-filled capsules will create new opportunities for functional excipients.

- Partnerships between nutraceutical brands and excipient suppliers will increase to support rapid product development.

- Digital health and e-commerce growth will boost consumption of supplement formats requiring advanced excipient functionality.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will offer strong expansion opportunities for manufacturers.